DEF 14AFALSE0001601712iso4217:USD00016017122024-01-012024-12-310001601712syf:Mr.DoublesMember2024-01-012024-12-310001601712syf:Mr.DoublesMember2023-01-012023-12-3100016017122023-01-012023-12-310001601712syf:Mr.DoublesMember2022-01-012022-12-3100016017122022-01-012022-12-310001601712syf:Mr.DoublesMember2021-01-012021-12-310001601712syf:Ms.KeaneMember2021-01-012021-12-3100016017122021-01-012021-12-310001601712syf:Ms.KeaneMember2020-01-012020-12-3100016017122020-01-012020-12-31000160171212024-01-012024-12-31000160171222024-01-012024-12-31000160171232024-01-012024-12-31000160171242024-01-012024-12-31000160171252024-01-012024-12-310001601712ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001601712ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2024-01-012024-12-310001601712ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:YearEndFairValueOfEquityAwardsGrantedInCoveredYearThatAreOutstandingAndUnvestedRSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:ChangeInFairValueAsOfVestingDateOfPriorYearEquityAwardsVestedInCoveredYearRSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedRSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTableRSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:YearEndFairValueOfEquityAwardsGrantedInCoveredYearThatAreOutstandingAndUnvestedPSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:ChangeInFairValueAsOfVestingDateOfPriorYearEquityAwardsVestedInCoveredYearPSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedPSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTablePSUsMemberecd:PeoMember2024-01-012024-12-310001601712syf:YearEndFairValueOfEquityAwardsGrantedInCoveredYearThatAreOutstandingAndUnvestedSOsMemberecd:PeoMember2024-01-012024-12-310001601712syf:ChangeInFairValueAsOfVestingDateOfPriorYearEquityAwardsVestedInCoveredYearSOsMemberecd:PeoMember2024-01-012024-12-310001601712syf:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedSOsMemberecd:PeoMember2024-01-012024-12-310001601712syf:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTableSOsMemberecd:PeoMember2024-01-012024-12-310001601712ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001601712ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001601712ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001601712syf:YearEndFairValueOfEquityAwardsGrantedInCoveredYearThatAreOutstandingAndUnvestedRSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:ChangeInFairValueAsOfVestingDateOfPriorYearEquityAwardsVestedInCoveredYearRSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedRSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTableRSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:YearEndFairValueOfEquityAwardsGrantedInCoveredYearThatAreOutstandingAndUnvestedPSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:ChangeInFairValueAsOfVestingDateOfPriorYearEquityAwardsVestedInCoveredYearPSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedPSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTablePSUsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:YearEndFairValueOfEquityAwardsGrantedInCoveredYearThatAreOutstandingAndUnvestedSOsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:ChangeInFairValueAsOfVestingDateOfPriorYearEquityAwardsVestedInCoveredYearSOsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedSOsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712syf:EquityAwardsAdjustmentsExcludingValueReportedInTheCompensationTableSOsMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001601712ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

________________________

| | | | | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant o |

Check the appropriate box:

| | | | | |

o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

SYNCHRONY FINANCIAL

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | | | | | | | | | | |

| | | |

Notice of 2025 Annual Meeting of Stockholders Dear Stockholders: You are invited to attend Synchrony Financial’s 2025 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 17, 2025 at 9:00 a.m., Eastern Time, for the following purposes: •To elect the 11 directors named in the proxy statement for the coming year; •To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2025; •To approve our named executive officers’ compensation in an advisory vote; and •To consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting. The meeting will be held virtually to provide expanded access, improved communication and cost savings for our stockholders and Synchrony Financial. Hosting a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location. Our virtual meeting is designed to afford all attendees the same rights and opportunities to participate as they would at an in-person meeting. During the live Q&A session of the meeting we will answer questions as they come in, and we commit to publishing each relevant question received following the meeting. The live webcast will be available to stockholders and the general public at the time of the meeting, and a replay of the meeting will be made publicly available on the company’s website. The website address for the virtual meeting is: www.virtualshareholdermeeting.com/SYF2025. To participate in the meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials. The meeting will begin promptly at 9:00 a.m., Eastern Time. Online check-in will begin at 8:45 a.m., Eastern Time, and we recommend that you allow for time to complete the online check-in procedure. You are eligible to vote if you were a stockholder of record at the close of business on April 22, 2025. Proxy materials are being mailed or made available to stockholders on or about April 25, 2025. Whether or not you plan to attend the meeting, please submit your proxy by mail, internet or telephone to ensure that your shares are represented at the meeting. Sincerely, Jonathan S. Mothner Executive Vice President, Chief Risk and Legal Officer April 25, 2025 | | | Proxy Logistics at a Glance DATE June 17, 2025 TIME 9:00 a.m., Eastern Time VIRTUAL MEETING WEBSITE ADDRESS www.virtualshareholder meeting.com/SYF2025 RECORD DATE April 22, 2025 IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE 2025 ANNUAL MEETING TO BE HELD ON JUNE 17, 2025 Our proxy materials relating to our Annual Meeting (notice, proxy statement and annual report) are available at www.proxyvote.com. |

2025 ANNUAL MEETING AND PROXY STATEMENT / 1

2 / 2025 ANNUAL MEETING AND PROXY STATEMENT

2025 ANNUAL MEETING AND PROXY STATEMENT / 3

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | Proxy Summary | | |

| | This summary highlights certain information in this proxy statement in connection with our 2025 Annual Meeting of Stockholders (the “Annual Meeting”). As it is only a summary and does not contain all of the information you should consider, please review the complete proxy statement before you vote. In this proxy statement, references to the “Company,” “Synchrony,” “we,” “us” and “our” are to Synchrony Financial. For answers to frequently asked questions regarding the Annual Meeting, please refer to pages 77 - 79 of this proxy statement. Proxy materials are being mailed or made available to stockholders on or about April 25, 2025. | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | Logistics | | | | Voting | | |

| | | | | | | | | | | |

| | | | DATE June 17, 2025 | | | | | BY MAIL You may date, sign and promptly return your proxy card by mail in a postage prepaid envelope (such proxy card must be received by June 16, 2025). | | |

| | | | | | | | | | |

| | | | TIME 9:00 a.m., Eastern Time | | | | | | |

| | | | | | | | | |

| | | | | | | BY TELEPHONE You may use the toll-free telephone number shown on your Notice of Internet Availability of Proxy Materials (the “Notice”) or proxy card up until 11:59 p.m., Eastern Time, on June 16, 2025. | | |

| | | | | | | | | |

| | | | VIRTUAL MEETING WEBSITE ADDRESS www.virtualshareholdermeeting.com/SYF2025 | | | | | |

| | | | | | | | | |

| | | | RECORD DATE April 22, 2025 | | | | | | | |

| | | | | | | BY THE INTERNET In Advance You may vote online by visiting the internet website address indicated on your Notice or proxy card or scan the QR code included on your Notice or proxy card with your mobile device, and follow the on-screen instructions until 11:59 p.m., Eastern Time, on June 16, 2025. At the Annual Meeting You may attend the virtual Annual Meeting by visiting this internet website address: www.virtualshareholdermeeting.com/SYF2025. | | |

| | | | | | | | | |

| | | Eligibility to Vote You are eligible to vote if you were a stockholder of record at the close of business on April 22, 2025. | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Agenda | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Election of 11 directors named in this proxy statement Voting standard: Majority of votes cast BOARD RECOMMENDATION FOR | | | | Ratify the selection of KPMG LLP as our independent registered public accounting firm for 2025 Voting standard: Majority of votes cast BOARD RECOMMENDATION FOR | | | | Advisory approval of our named executive officers’ compensation Voting standard: Majority of votes cast, Page Reference — 37 BOARD RECOMMENDATION FOR | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

4 / 2025 ANNUAL MEETING AND PROXY STATEMENT

Synchrony Financial is a premier consumer financial services company delivering one of the industry's most complete digitally-enabled product suites. We provide our partners and consumers with a diverse set of financing solutions and innovative digital capabilities to address their specific needs and deliver seamless, omnichannel experiences. Our offerings include private label, dual, co-brand and general purpose credit cards, as well as short- and long-term installment loans and consumer banking products.

In 2024, we continued to focus on growing and deepening our partnership relationships, diversifying the markets we serve and expanding our digital presence while delivering strong financial results and driving progress toward our long-term financial targets.

2024 Financial and Business Highlights

| | | | | | | | |

| | |

| $3.5B | | net earnings |

| 2.9% | | return on assets |

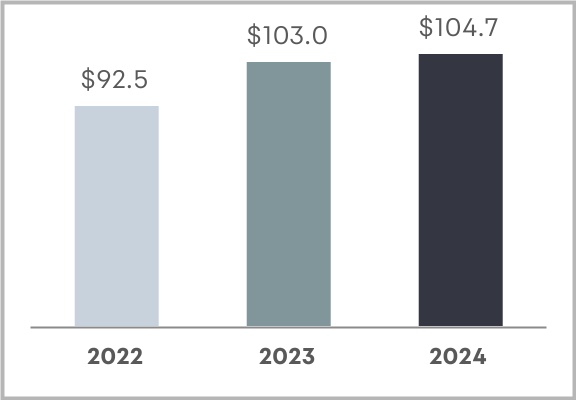

| $104.7B | | loan receivables |

| $1.4B | | capital returned to stockholders |

| | | | | | | | | | | |

| | | |

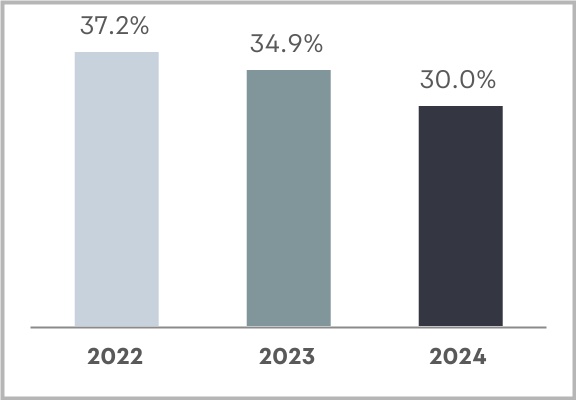

| 30.0% | | efficiency ratio |

| 90+ | | new or renewed partnerships |

| 70.9M | | average active accounts |

| $182.2B | | purchase volume (second highest level) |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| Sold Pets Best | | Acquired Ally Lending | |

| | | | |

At Synchrony, being a responsible corporate citizen is deeply ingrained into our culture, and we see it as both the right thing to do and strategically sound. In 2024, our employees devoted their time, energy and compassion to various volunteer efforts. We also partnered with local nonprofit organizations, providing the resources and support they need to improve the lives of those they serve.

2024 Community Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| over | 24K | total employee volunteer hours | | |

~$20M | donated to over 300 charitable organizations | |

| | that includes | | | | | | | |

| | ~$4.7M | in matching gifts | & | more than | $7.5M | donated for Education as an Equalizer program grants |

| | | | | | | | | | | |

| | | | | | | | | | | |

And since our IPO in 2014, there have been |

| | | | | | | | | | | | | | | | | |

| | | | | |

| more than | 125K | employee volunteer hours |

over | $100M | in donations, including more than | $25M | in matching gifts |

| |

2025 ANNUAL MEETING AND PROXY STATEMENT / 5

Our over 20,000 full-time employees are essential to our financial performance and ability to deliver on our strategic objectives. In 2024, we expanded the depth of commercial expertise on our executive leadership team with the appointments of Maran Nalluswami as EVP, Chief Strategy and Business Development Officer, Courtney Gentleman as EVP & CEO, Diversified & Value, and Darrell Owens as EVP & CEO, Lifestyle. We also continued to invest in our employees through development and training programs that are available to all employees at all levels of the organization.

2024 Training and Development Highlights

| | | | | | | | | | | | | | |

| | | | |

over | 100 | | employees selected for our Skills Training for Evolving Professional Program | |

over | 350 | | vice-president level employees participated in Impact Sessions globally | |

| | | | |

| Across our entire employee population | |

| | | | | | | | | | | |

| | | |

| over | 655K | |

| courses completed | |

| | | |

| | | | | | | | |

| | |

| 32 |

| average course completions per employee |

| | |

| | | | | | | | |

| | |

| 20 |

| average hours of training per employee |

| | |

Finally, the board of directors of the Company (the “Board of Directors” or “Board”) plays an integral role in guiding our strategic direction, promoting a culture of trust and accountability, and maintaining strong corporate governance practices designed to serve the needs and interests of the Company, its stockholders, employees and other stakeholders. In October 2024, Daniel Colao joined the Board, adding to the Board’s expertise in financial services and consumer lending, as well as strategic planning and risk oversight and management.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Synchrony Board by the Numbers | |

| | | | | | | | | | | | |

| 10 | of | 11 | | 5 | directors | | 7 | years | | 64 | |

| directors are independent | | added since 2019

| | average tenure

| | average age

| |

| | | | | | | | | | | | |

6 / 2025 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | |

Corporate Governance |

We believe that strong corporate governance is integral to building long-term value for our stockholders and enabling effective Board oversight. We are committed to governance policies and practices that serve the interests of the Company and its stockholders. The Board monitors emerging issues in the governance community and regularly reviews our governance practices to evaluate evolving best practices and stockholder feedback. |

A few of our corporate governance best practices include:

Board Leadership Structure

Our Board is led by Jeffrey Naylor, our non-executive chair of the Board (“Chair”). Mr. Naylor assumed this role in April 2023 after serving as Lead Independent Director since April 2021, and has served as an independent director on our Board since 2014.

Our Board, led by the Nominating and Corporate Governance Committee, annually reviews the Board’s leadership structure and has determined to re-elect Mr. Naylor as non-executive Chair. We continue to believe that having an independent director serve as the non-executive Chair of the Board is in the best interests of our stockholders and is the appropriate leadership structure for the Company at this time. The separation of roles allows our Chair to focus on the organization and effectiveness of the Board. At the same time, it allows our President and Chief Executive Officer (“CEO”) to focus on executing our strategy and managing our operations, performance and risks.

Board’s Role in Strategy

The Board actively oversees the Company’s strategic direction and the performance of our business and management. On an annual basis, the Board conducts an intensive, multi-day review of the Company’s short-, medium- and long-term strategic plan, taking into consideration economic, consumer, technology, regulatory and other significant trends and changes, as well as other developments in the industry impacting our business. The Board’s input is then incorporated into the strategic plan and the plan is presented for approval at the subsequent Board meeting. The output of these meetings provides the strategic context for the Board’s discussions at its meetings throughout the next year, including regular updates and feedback from the Board on the Company’s progress on its strategic plan and deep dives on developments in important areas such as credit, cybersecurity and new and developing technologies. In addition, the Board regularly discusses and reviews feedback on strategy from our stockholders and other stakeholders, and often engages with internal and external experts and advisors to ensure our strategy reflects the latest competitive and regulatory landscape.

The Company continues to leverage its proprietary data and analytics, our lending expertise and innovative digital capabilities with the aim of providing a seamless customer experience and compelling value propositions. The Board will oversee the plan to continue to expand access to credit and invest in digital innovations to provide financial solutions that foster deeper customer relationships while also driving loyalty and sales for our partners, providers and small and mid-sized businesses.

2025 ANNUAL MEETING AND PROXY STATEMENT / 7

| | | | | | | | | | | | | | |

Expanding Access to Credit |

Providing access to financial solutions that help build credit, encourage savings, and create real life opportunities is at the core of what we do. The Project REACh program was launched by the Office of the Comptroller of the Currency (OCC) to reduce specific barriers that prevent full, equal and fair participation in the U.S. economy. Since 2022, Synchrony has utilized bank and deposit account data made available through Project REACh to extend credit to the “credit invisible” population, which according to economists comprises more than 10% of our population who are unseen by our financial system because they lack a usable credit score, limiting their access to loans, credit cards and home ownership. Over 50% of new account holders to whom we offered credit utilizing Project REACh data migrated to a 651+ Vantage score within 12 months. Through this program, Synchrony is using bank and deposit account data, combined with our advanced underwriting techniques, to approve tens of thousands of people for their first credit card, helping to improve financial inclusion for traditionally underserved populations. Recognizing that inclusion starts with meeting consumers where they shop, we have integrated financial inclusion initiatives with some of our partners, potentially helping a parent finance their back-to-school shopping, getting a consumer back on the road faster through financing new tires, or helping a family pay over time for an unexpected pet illness. Outside of Project REACh data, Synchrony continues to utilize data sets not traditionally included in credit bureau data to enhance our underwriting overall and to improve access to financial markets for all. For example, Synchrony has launched a program to allow credit challenged and credit invisible customers to opt into providing more details about their cash flow by linking their checking and savings account information from the privacy of their own device. The power of Synchrony PRISM, our proprietary credit tools, allows us to rapidly ingest the additional information, along with other non-traditional data sets, to create a more holistic view of creditworthiness. |

Board’s Role in Risk Oversight

We manage enterprise risk using an integrated framework that includes Board-level oversight, administration by a group of cross-functional management committees, and day-to-day implementation by a dedicated risk management team led by the Chief Risk Officer (“CRO”), a role currently held by our Chief Risk and Legal Officer. The CRO functionally reports to the chair of our Board’s Risk Committee. The Board (with input from the Risk Committee) is responsible for approving the Company’s enterprise-wide risk appetite statement and framework, as well as certain other risk management policies, and oversees the Company’s strategic plan and enterprise-wide risk management program.

The Board regularly devotes time during its meetings to review and discuss the most significant risks facing the Company and management’s responses to those risks. During these discussions, the President and CEO, the Chief Financial Officer (“CFO”), the CRO, the Deputy General Counsel and other members of senior management present management’s assessment of risks, a description of the most significant risks facing the Company, along with any mitigating factors and plans or practices in place to address and monitor those risks. The Board has also delegated certain of its risk oversight responsibilities to its committees.

8 / 2025 ANNUAL MEETING AND PROXY STATEMENT

The following illustration provides an overview of our committee-focused governance structure, at both the Board and management committee-level, for the Company's risk management program.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Board delegates certain of its risk oversight responsibilities to its committees. The Risk Committee of the Board has responsibility for the oversight of the risk management program, and the four other board committees have oversight roles with respect to risk management within their respective oversight areas. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Risk Committee | | Audit Committee | | Management Development and Compensation Committee | | Nominating and Corporate Governance Committee | | Technology Committee | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Several management committees and subcommittees have important roles and responsibilities in administering the risk management program, including: | | This committee-focused governance structure provides a forum through which risk expertise is applied cross-functionally to all major decisions, including development of policies, processes and controls used by the CRO and risk management team to execute our enterprise risk management philosophy. | | | The enterprise risk management philosophy is to ensure that all relevant risks are appropriately identified, measured, monitored and controlled. At Synchrony, risk management is organized around eight major risk categories: | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Enterprise Risk Management Committee | | | Credit Risk | | Market Risk | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Management Committee | | | Liquidity Risk | | Operational Risk | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset and Liability Management Committee | | | Compliance Risk | | Legal Risk | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Management Committee | | | Strategic Risk | | Reputational Risk | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The CRO manages our risk management team and is responsible for establishing and implementing standards for the identification, management, measurement, monitoring and reporting of risk on an enterprise-wide basis. The CRO regularly reports to the Board of Directors and the Risk Committee on risk management matters. The approach in executing our enterprise risk management philosophy focuses on leveraging risk expertise to drive enterprise risk management using a strong governance framework structure, a comprehensive enterprise risk assessment program and an effective risk appetite framework.

2025 ANNUAL MEETING AND PROXY STATEMENT / 9

Responsibility for risk management flows to individuals and entities throughout our Company, including the Board, various Board and management committees and senior management. The corporate culture and values, in conjunction with the risk management accountability incorporated into the integrated Enterprise Risk Government Framework, which includes the committee-focused governance structure described above and three distinct “Lines of Defense” (as illustrated below), has facilitated, and is expected to continue to facilitate, the evolution of an effective risk presence across the Company.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| First Line of Defense | | Second Line of Defense | | Third Line of Defense | |

| | | | | | |

| | | | | | |

| •Comprises business areas whose day-to-day activities involve decision-making and associated risk-taking for the Company

•Responsible for identifying, assessing, managing and controlling that risk, and for mitigating our overall risk exposure

•Formulates strategy and operates within the risk appetite and risk governance framework | | •Also known as the independent risk management organization

•Provides oversight of first line risk-taking and management

•Assists in determining risk capacity, risk appetite, and the strategies, policies and structure for managing risks

•Owns the risk governance framework

| | •Comprises Internal Audit

•Provides independent and objective assurance to senior management and to the Board and Audit Committee that first and second line risk management and internal control systems and its governance processes are well-designed and working as intended | |

| | | | | | |

Additionally, our compliance program is a key component of our overall risk governance framework. Our compliance team, which is part of our risk management organization, provides oversight and supervision by identifying regulations with which Synchrony must comply, assessing risks associated with non-compliance, developing policies and training, and monitoring risk through assessments, testing and reporting. This team is led by our Chief Compliance Officer, who reports to our CRO. Our compliance function includes personnel aligned to business processes, as well as fair lending, preventing unfair, deceptive or abusive acts or practices (“UDAAP”), responsible marketing and our sales platforms. The compliance team also leads our Ombuds program and provides oversight of the consumer complaints program.

The compliance function also leads our compliance training program, through which all employees (including part-time employees) and our Board receive training on our code of conduct, which covers a broad range of topics, including data security; fair dealing; UDAAP and illegal discrimination; anti-money laundering and sanctions; and anti-bribery and anti-corruption. And all employees with roles that may directly or indirectly impact our customers, as well as our Board, receive additional targeted training, including an overview of banking laws and regulations; more in-depth content on fair lending, UDAAP and anti-money laundering and sanctions; and modules on fair debt collection practices. This population of employees—which constitutes nearly all of our employees—is required to refresh their training in these areas annually. Our compliance training program offers further support in the form of functional training, detailed procedures and job aids, and regular communications to reinforce key compliance topics.

Fair dealing extends to our suppliers’ employees, too. We assign them courses based on the type of work they perform for the Company and their level of interaction with Synchrony customers. Most supplier employees in the training program complete similar courses on fair lending, UDAAP and other banking laws on the same timetable as our own employees.

10 / 2025 ANNUAL MEETING AND PROXY STATEMENT

Board Oversight of Cybersecurity and Technology

The protection and security of financial and personal information of our consumers is one of the Company’s highest priorities. To that end, we have an extensive cybersecurity oversight framework in place, which includes oversight of cybersecurity risk. Our information security team, led by a Chief Information Security Officer or functional equivalent (“CISO”), in collaboration with our Risk Committee and our executive leadership team, closely monitors our information security program, including our strategy, and information security policies and practices. The CISO role reports directly to our Chief Technology and Operating Officer and on a dotted line basis to our CRO. The Risk Committee receives reports and briefings on our information security and enterprise risk management programs at least quarterly, including the results of any external audits, examinations and evaluations, as well as maturity assessments of our information security program, at least one of these sessions is held jointly with the Audit Committee. The Board also receives reports on cybersecurity and the Company ensures the Board includes members with cybersecurity experience. The information security program includes administrative, technical and physical safeguards and is designed to provide an appropriate level of protection to maintain the confidentiality, integrity, and availability of our Company’s, our clients’ and our customers’ information. This includes protecting against known and evolving threats to the security or integrity of customer records and information, and against unauthorized access, compromise or loss of customer records or information. For more information regarding our cybersecurity risk management strategy and governance, please see “Item 1C. Cybersecurity” in our Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (“SEC”) on February 7, 2025.

A key part of our strategic focus is the continued development of innovative, efficient and flexible technology to deliver products and services that meet the needs of our partners and customers and enables us to operate our business efficiently. The integration of our technology with our partners is at the core of our value proposition, enabling us to anticipate and deliver the experiences and tools our partners and consumers want, while reducing fraud and enhancing customer service. Recognizing the importance of technology and innovation to our future success, and in order to better leverage the Board’s technology expertise, we have a committee of the Board devoted exclusively to technology and innovation. The Technology Committee reviews and advises the Board on major strategies and other subjects relating to the Company’s approach to technology-related innovation, the technology development process and existing and emerging technologies, including generative artificial intelligence. The Chair of the Technology Committee is Art Coviello, a leader in the technology industry and former Executive Vice President of EMC Corporation and Executive Chairman of RSA Security, Inc.

| | | | | | | | | | | | | | |

Our Responsible and Secure Approach to Innovation |

Information security and maintaining the privacy of consumer data are top priorities at Synchrony. We strive to maintain the confidentiality, integrity and availability of our clients’ and customers’ information across services and to deliver innovative products and capabilities that drive value for our customers and partners. Access to and appropriate use of data is a critical component of our ability to do so. Our information security program is supported by regular training of information security employees as well as training and awareness activities for employees throughout the company. In 2024, we continued to enhance our Information Security Training and Awareness Program, strengthening our overall message via heightened awareness and targeted training—99.9% of in-scope Synchrony employees completed the annual Information Security Awareness training. We also conduct focused Security Awareness events, communications and exercises, including regularly scheduled phishing simulation campaigns for employees and contingent workers and cross-functional cybersecurity exercises with our executive leadership team. Awareness activities and themes run throughout the year, with a special focus on Cybersecurity Awareness Month in October. |

Board Focus on our People and Culture

Our Board delegates primary responsibility for oversight of our human capital management strategies to our Management Development and Compensation Committee. Additionally, the Nominating and Corporate Governance Committee engages regularly on topics related to promoting and sustaining our corporate culture, including through providing meaningful opportunities for employee and community engagement.

Since our IPO, the Board has consistently believed that sustainable, long-term stockholder value creation requires caring for our business, our customers, our partners, our employees, our communities and the environment. The Board supports management’s purposeful investments in our people to cultivate innovation and to attract, develop and retain the best talent while delivering great business results. We believe that our values-driven culture makes our business stronger, more innovative and more successful.

2025 ANNUAL MEETING AND PROXY STATEMENT / 11

| | | | | | | | | | | | | | |

| Building a Highly Skilled and Engaged Workforce |

We believe that maintaining a high-performing workforce requires investment in our employees at all levels, building a consistent pipeline of new talent and creating a work environment that encourages engagement and connection. We offer several programs and initiatives that are designed to provide pathways for permanent employment opportunities for new talent, as well as training and development resources for existing employees.

Business Leadership Program. The Synchrony Business Leadership Program (BLP) cultivates future leaders through various pathways, including full-time rotations, summer internships and immersive externships. While historical success has been measured primarily by employee retention, we now prioritize a holistic approach that encompasses the overall employee experience. We continue to refine the BLP to ensure it fully reflects our leadership expectations and organizational goals, and aligns seamlessly with Synchrony’s core values.

Skills Training for Evolving Professionals (STEP). The STEP Program cultivates leadership skills, talent and business acumen for our non-exempt associates in the United States, India and the Philippines. Successful participants may be eligible for promotions. The program consists of four distinct levels, with advancement to the final level based on performance demonstrated throughout the program.

Vice President Impact Sessions. In 2024, over 350 vice presidents from across the organization participated in sessions designed to engage with Synchrony's values and leadership expectations, while learning how to change perspective and elevate our culture. After a comprehensive self-review, participants were offered tailored programs to focus on intentional development, enhanced transparency and sustained behavioral change. |

We promote our culture through various means, including by sponsoring eight employee resource groups to help foster greater employee engagement and co-designing an employee experience that is built on trust, support and empowerment. We aim to foster a culture of open communication, active listening and collaboration. By actively seeking and incorporating employee feedback, through employee surveys, town halls, roundtables and other channels, we aim to create a workplace that supports and empowers our people to thrive. The Board receives updates on the results of these activities and other topics related to our talent strategy.

We believe that investments in our community also help fuel our culture. Our contributions extend beyond monetary donations; our employees devote their time, energy and compassion to volunteering and advocating for marginalized individuals who could use extra support. To make a broader impact, we partner with local nonprofit organizations, providing the resources and support they need to improve the lives of those they serve. The Nominating and Corporate Governance Committee oversees our community initiatives and partnerships, including our Education as an Equalizer program.

| | | | | | | | | | | | | | |

Education as an Equalizer |

Throughout our journey to find the best ways to serve our communities, we researched and engaged in conversations with our team. These efforts led us to a united conclusion: the key to making a lasting difference is through education. Recognized for its potential to open doors and transform lives, education stands as a beacon of hope. It addresses the persistent access and opportunity disparities that often fuel a relentless cycle of poverty. Synchrony and the Synchrony Foundation unveiled the Education as an Equalizer initiative in 2021. This ambitious five-year project seeks to uplift underserved communities through the power of education. With a commitment from the Synchrony Foundation of $20 million over five years to various academic institutions, skill-training programs and nonprofits striving to make an impact, we're not just dreaming of a better future, we're actively building it. The Synchrony Foundation has granted approximately $19 million toward this commitment which is emblematic of our unwavering dedication to bridging educational divides and nurturing prosperity within marginalized communities. |

12 / 2025 ANNUAL MEETING AND PROXY STATEMENT

CEO and Management Development and Succession Planning

The Board, with the assistance of the Management Development and Compensation Committee (“MDCC”), oversees the Company's strategies and policies for career development and progression, as well as succession planning for key executives and the CEO. At least annually, the Board conducts a comprehensive review of the Company's talent strategy. This includes a review of how the Company is developing its workforce to support its strategic goals, as well as future needs, with consideration to, among other items, the competitive and regulatory environment. This comprehensive review also incorporates a review of top talent with future potential to succeed members of our executive leadership team and CEO, as well as the strategy for developing those employees. See “Compensation Matters—Organization and Succession Review” for additional information regarding our development and succession planning processes. The Board also participates in informal meetings and activities with the Company's top performers and potential executive leadership successors to develop familiarity with these employees and assess their skills and attributes.

Board Refreshment

Under the leadership of our Nominating and Corporate Governance Committee, Synchrony’s Board of Directors and its committees routinely evaluate our Board and Board committee composition and leadership, as well as our latest updated skills matrix, see “Board of Directors Skills and Demographics” below. This established process helps to ensure that the Board has the requisite expertise to oversee Synchrony’s business today and as it evolves under our strategy for the future.

The Nominating and Corporate Governance Committee receives recommendations on potential director candidates from various sources, including professional search firms, other directors, members of management and stockholders. The Committee aims to source a broad pool of qualified candidates for all open director positions in furtherance of maintaining an appropriate mix of skills and expertise on the Board. When assessing potential director candidates, the Nominating and Corporate Governance Committee considers the attributes discussed under the heading “Qualifications of Directors” and will also consider, among other items, a candidate’s experience and expertise in areas that are relevant to the Company’s current and future strategy and objectives; their judgment and ability to constructively challenge management; and their commitment to support and represent the interests of the Company, its employees, stockholders and other stakeholders and devote the necessary amount of time and attention to the Company.

As a result, since 2019, we have added five new directors, adding experience in healthcare, digital, technology, the consumer sector, risk management and most recently financial services and consumer lending. As a group, our Board possesses expertise in areas directly relevant to our business and strategy—including accounting, consumer banking, credit cards, cybersecurity, government and regulatory affairs, healthcare, marketing, retail, risk management, digital and technology. We also recently rotated the chair of our Audit Committee.

As the Nominating and Corporate Governance Committee approaches future Board refreshment efforts, including to fill vacancies created by expected director retirements in the next five years, the Committee plans to actively seek out highly qualified candidates that complement and add to the skills and expertise represented on the Board. The Committee believes it is important for the Board to represent a mix of experiences, backgrounds and tenure, and is focused on maintaining a board comprising a broad range of professional and personal characteristics through its refreshment efforts.

Board and Committee Evaluation Process

On an annual basis, our Nominating and Corporate Governance Committee develops and oversees a self-evaluation process for the Board, its committees and individual directors. The process is intended to monitor and assess the Board’s performance and culture, and identify opportunities for improvement. Additionally, at least every third year, the Nominating and Corporate Governance Committee will engage an external firm to facilitate all or a portion of the evaluation. The results of and feedback from the annual evaluation are shared with the Board, the committees and individual directors, as applicable, and utilized to develop action items and takeaways to address over the following year (or a longer term if necessary).

In addition to the formal evaluation process, our directors, including our non-executive Chair, regularly engage with each other and members of management to share feedback on topics germane to the Board’s overall performance and effectiveness.

2025 ANNUAL MEETING AND PROXY STATEMENT / 13

Board Commitment to Stockholder Engagement

We continue to value our stockholders’ perspectives on our strategy and governance practices. We believe that maintaining a dialogue with our stockholders allows us to better understand and respond to their perspectives on matters of importance to them. Members of our management team, including our Chief Human Resources Officer, CRO, Director of Investor Relations, Senior Vice President, Total Rewards and Corporate Secretary, as well as, in certain instances members of our Board, participated in engagement meetings in 2024.

As part of our regular stockholder engagement in 2024, we engaged with investors on a variety of topics, including the regulatory environment, credit management, consumer health, business strategy, board composition, compensation practices, as well as corporate governance and environmental topics. In addition to our regular stockholder engagement, we also held meetings with investors following our 2024 Annual Meeting of Stockholders to discuss our Say-on-Pay vote, as well as other topics of interest to them. The feedback from those discussions and the actions we have taken to address the feedback we received from our stockholders is discussed in “Compensation Matters—Stockholder Engagement.”

| | | | | | | | | | | | | | |

OTHER GOVERNANCE HIGHLIGHTS INCLUDE: |

| | | | | | | | |

| 10 out of 11 directors are independent | |

| Experienced Board members with a broad range of skills and backgrounds | |

| Each of the Audit Committee, MDCC, Nominating and Corporate Governance Committee, Risk Committee and Technology Committee is comprised exclusively of independent directors | |

| Non-executive Chair of the Board | |

| Annual election of all directors | |

| Majority voting standard for directors in uncontested elections | |

| | | | | |

| Stockholder special meetings may be called upon the request of a majority of stockholders |

| Single-class voting structure (one share, one vote) |

| No stockholder rights plan |

| Stock ownership requirements for our executive officers and directors |

| Nominating and Corporate Governance Committee regularly reviews overall corporate governance framework |

| |

14 / 2025 ANNUAL MEETING AND PROXY STATEMENT

Board of Directors

We believe that our directors possess the highest personal and professional ethics, as well as deep industry knowledge and expertise, and are committed to representing the long-term interests of our stockholders. We deliberately and thoughtfully maintain a Board representing a wide-range of perspectives and experiences, which we believe is critical to effective corporate governance and to achieving our strategic goals. The composition of the Board reflects distinct and varied professional experience and personal characteristics.

Board of Directors Skills and Demographics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nominees | | | | | | | | | | | |

| | Financial Expert | ● | ● | ● | ● | ● | ● | ● | ● | ● | | ● |

| Risk Expert | | ● | | ● | ● | ● | ● | ● | ● | | |

| Financial Services Industry | | | ● | ● | | ● | ● | ● | ● | | |

| C-Suite Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Brand And Marketing | ● | | | | | | | | | ● | |

| Direct Consumer/Retailers | ● | ● | ● | | | | | ● | | ● | |

| Government/Regulatory | ● | | | ● | | ● | ● | | ● | | ● |

| Healthcare | ● | | | | | | | | | | ● |

| Human Capital/Compensation | ● | | | ● | | | ● | ● | | ● | ● |

| Strategic Planning | ● | ● | | ● | ● | ● | ● | ● | ● | ● | ● |

| Tech/Digital/Cyber | | ● | ● | | ● | | | | | | |

| Gender | | | | | | | | | | | | |

| Male | ● | ● | | ● | ● | ● | ● | ● | ● | | |

| Female | | | ● | | | | | | | ● | ● |

Ethnicity | | | | | | | | | | | |

| Black or African American | | ● | | | | | | | | ● | |

| Hispanic | ● | | | | | | | | | | |

| White/Caucasian | | | ● | ● | ● | ● | ● | ● | ● | | ● |

2025 ANNUAL MEETING AND PROXY STATEMENT / 15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Synchrony Board by the Numbers | |

| | | | | | | | | | | | |

| 10 | of | 11 | | 5 | directors | | 7 | years | | 64 | |

| directors are independent | | added since 2019

| | average tenure

| | average age

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Board Qualifications | | | | | | | | |

| | | | COMMITTEE MEMBERSHIP |

| NAME | AGE | DIRECTOR SINCE | INDEPENDENT | AUDIT | MDC | NCG | RISK | TECH |

Brian D. Doubles President and CEO of Synchrony Financial | 50 | 2021 | | | | | | |

Fernando Aguirre Former Chairman, President and CEO of Chiquita Brands International, Inc. | 67 | 2019 | | | ● | ● | | |

Paget L. Alves CEO and Chairman of Sorenson Communications | 70 | 2015 | | ● | | ● | | |

Kamila Chytil Former Chief Operating Officer of DentaQuest LLC | 45 | 2022 | | ● | | | | ● |

Daniel Colao Former CFO of GE Capital | 58 | 2024 | | ● | | | ● | |

Arthur W. Coviello, Jr. Former Executive Vice President of EMC Corporation; Former Executive Chairman of RSA Security, Inc. | 71 | 2015 | | | | | ● | ● |

Roy A. Guthrie Former CEO of Renovate America, Inc.; Former Executive Vice President and CFO of Discover Financial Services, Inc. | 71 | 2014 | | | | | ● | ● |

Jeffrey G. Naylor (Non-Executive Chair of the Board) Former CFO and Chief Administrative Officer of the TJX Companies, Inc. | 66 | 2014 | | ● | ● | | | |

P.W. “Bill” Parker Former Vice Chairman and Chief Risk Officer of U.S. Bancorp | 68 | 2020 | | | | ● | ● | |

Laurel J. Richie Former President of the Women’s National Basketball Association LLC | 66 | 2015 | | | ● | ● | | |

Ellen M. Zane Former President and CEO of Tufts Medical Center and Tufts Children’s Hospital | 73 | 2019 | | ● | ● | | | |

| ● Committee Chair ● Committee Member |

16 / 2025 ANNUAL MEETING AND PROXY STATEMENT

ITEM 1—ELECTION OF DIRECTORS

The Board consists of 11 directors: our President and CEO, Brian D. Doubles, and 10 directors who are “independent” under the listing standards of the New York Stock Exchange (“NYSE”) and our own independence standards set forth in our Governance Principles. The independent directors are Fernando Aguirre, Paget L. Alves, Kamila Chytil, Daniel Colao, Arthur W. Coviello, Jr., Roy A. Guthrie, Jeffrey G. Naylor, Bill Parker, Laurel J. Richie and Ellen M. Zane (together, the “Independent Directors”). Under our Bylaws, our directors will be elected annually by a majority of votes cast in uncontested elections. As discussed under “Committees of the Board of Directors” below, our Nominating and Corporate Governance Committee is responsible for recommending to our Board, for its approval, the director nominees to be presented for stockholder approval at each annual meeting.

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

Each of the 11 director nominees (the “Director Nominees”) listed on the following pages is currently a director of the Company.

The following biographies describe the individual qualifications that the Board considered in determining whether to recommend that the director be nominated for election at the Annual Meeting and the business experience of each Director Nominee.

If elected, each of the Director Nominees is expected to serve for a term of one year or until their successors are duly elected and qualified. The Board expects that each of the Director Nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the Director Nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute Director Nominees as the Board may nominate.

| | | | | | | | | | | |

| | | |

THE BOARD RECOMMENDS A VOTE FOR the election of the 11 directors named in this proxy statement. | | | |

| | | |

2025 ANNUAL MEETING AND PROXY STATEMENT / 17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Brian D. Doubles President and Chief Executive Officer | | Director Since 2021 | |

| | | | | | | | | | | | | |

| Age: 50 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Skills: | | |

| | | | | | | | | |

| | | | | | | | | | | | | |

| Financial Expert | | | Risk Expert | | Financial Services Industry | | | C-Suite Experience | | Government/Regulatory | Strategic Planning | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Mr. Doubles has extensive expertise in the retail finance business, and also possesses significant risk expertise. He also brings valuable perspectives to our Board as the Company's President and CEO. Mr. Doubles has also served as a member of the board of directors of Synchrony Bank (the “Bank”) since 2009. Mr. Doubles previously served as our Executive Vice President and CFO from February 2014 to April 2019. Prior to Synchrony’s founding, Mr. Doubles served in various roles of increasing responsibility and management at the General Electric Company (“GE”). Mr. Doubles is a member of the Business Roundtable and Bank Policy Institute. Mr. Doubles received a B.S. in Engineering from Michigan State University. | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | Fernando Aguirre | | | | | | | Director Since 2019 | | | |

| | | Age: 67 | Committees: MDC and NCG (Chair) | | Independent | | | |

| | |

| | | | | | | | |

| | | Skills: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Financial Expert | C-Suite Experience | Brand and Marketing | | Direct Consumer/Retailers | | Government/Regulatory | Healthcare | | Human Capital/Compensation | | Strategic Planning | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | | Mr. Aguirre brings significant knowledge and experience in the areas of leadership, strategy, digital marketing, branding and communications to the Board. He also has extensive experience as chair and CEO of a large publicly traded company and as a director of other publicly traded companies. Mr. Aguirre served as President and CEO of Chiquita Brands International, Inc. (January 2004 to October 2012) and also served as chair of the board (May 2004 to October 2012). Prior to that, Mr. Aguirre held various global marketing and management roles at Procter & Gamble (1980 to 2004). Mr. Aguirre currently serves on two other public company boards: CVS Health, an American healthcare company that owns CVS Pharmacy, CVS Caremark and Aetna; and Barry Callebaut, one of the world’s largest cocoa processors and chocolate manufacturers. He previously served on several other boards including Aetna, Inc., Coca-Cola Enterprises and Levi Strauss & Co. Mr. Aguirre is currently the Owner and CEO of the Erie SeaWolves Minor League Baseball team, the double AA affiliate of the Detroit Tigers. He also owns a minority stake in the Myrtle Beach Pelicans, a low A affiliate of the Chicago Cubs. A native of Mexico, Mr. Aguirre is a prominent figure in the Hispanic community, recognized as one of the 100 Influentials by Hispanic Business Magazine and honored with the Hispanic Heritage Leadership Award by the NFL. Mr. Aguirre received a B.S. from Southern Illinois University Edwardsville. | | | |

| | | | | | |

18 / 2025 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | Paget L. Alves | Director Since 2015 | | | |

| | | Age: 70 | Committees: Audit and NCG (Audit Committee Financial Expert) | | | Independent | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Skills: | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Financial Expert | | Risk Expert | | C-Suite Experience | | | Direct Consumer/Retailers | | | | Strategic Planning | | | Tech/Digital/Cyber | | | |

| | | | | | |

| | | | | | |

| | | Mr. Alves adds extensive executive management and leadership experience to the Board, including from leadership roles with technology companies. He also has an extensive background in sales, financial expertise and experience with strategic and business development, as well as with strategic corporate transactions, including mergers and acquisitions.

Mr. Alves has served as the CEO of Sorenson Communications, a privately held language services provider, since November 2024, and also serves as the Chairman of the Sorenson board. He previously held various positions at Sprint Corporation, a wireless and wireline communications services provider, including Chief Sales Officer (January 2012 to September 2013); President of the Business Markets Group (2009 to 2012); President, Sales and Distribution, (2008 to 2009); President, South Region (2006 to 2008); Senior Vice President, Enterprise Markets (2005 to 2006); and President, Strategic Markets (2003 to 2005). Prior to joining Sprint, Mr. Alves served as President and Chief Operating Officer of Centennial Communications Corporation (2000 to 2001), and as President and CEO of PointOne Telecommunications, Inc. Mr. Alves currently serves on one other public company board: Yum! Brands, Inc., a company that develops, operates, franchises and licenses a system of quick-service restaurants. In addition to Sorenson, Mr. Alves serves on the board of one other private company, Ariel Alternatives. He previously served on several other boards, including International Game Technology PLC, GTECH Holdings Corporation, Herman Miller, Inc. and International Game Technology Inc. Mr. Alves has been recognized by Savoy magazine as among Savoy’s Most Influential Black Corporate Directors three times, most recently in 2024. Mr. Alves received a B.S. in Industrial and Labor Relations and a J.D. from Cornell University. | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Kamila Chytil | | | | | Director Since 2022 | | | |

| | | Age: 45 | | Committees: Audit and Tech (Audit Committee Financial Expert) | | Independent | | | |

| | |

| |

| | | |

| | | Skills: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Financial Expert | | Financial Services Industry | | | C-Suite Experience | | Direct Consumer/Retailers | | Tech/Digital/Cyber | | | |

| | | | | | | | | | | | | | | |

| | | | | | |

| | | Ms. Chytil contributes her extensive background in consumer finance, technology and operations to the Board. She also possesses executive management and leadership experience. Ms. Chytil most recently served as the Chief Operating Officer of DentaQuest LLC, a private equity backed oral healthcare company, from March 2021 to December 2024. She previously served as the Chief Operating Officer of MoneyGram International, a public crossborder P2P payments and money transfer company (2019 to 2021); MoneyGram’s Chief Global Operations Officer (2016 to 2019); and as MoneyGram’s Senior Vice President of Key Partnerships and Payments (2015 to 2016). Prior to joining MoneyGram, Ms. Chytil held various positions of increasing responsibility at FIS, a Financial Technology (FinTech) corporation that offers a wide range of financial products and services, from 2004 to 2015. At FIS, she served in multiple risk management, analytics, and operational roles, including Senior Vice President and General Manager of Retail Payments, focusing on traditional financial services as well as retail and underbanked focused financial products. Prior to joining FIS, Ms. Chytil served as a Business Analyst at Danka Office Imaging Company (2003 to 2004), and an Account Manager at Capital One Financial Corporation (2000 to 2003). Ms. Chytil previously served as a board member for MoneyGram Foundation (2019 to 2021); MoneyGram Poland (2016 to 2021); and MoneyGram Payment Systems, Inc. (2017 to 2021). In 2020, Ms. Chytil contributed to multiple articles on digital transformation in Forbes FinTech. In 2016, she was voted Woman of the Year in Business, Poland; and in 2017, she was awarded the Dallas Business Journal 40 under 40 award and was chosen by PaymentSource as 1 of 25 Most Influential Women in Payments. Ms. Chytil earned a B.S. in International Business and Finance from the University of Tampa and an M.B.A. from the University of Florida. | | | |

| | | | | | | | | | | | | | | |

2025 ANNUAL MEETING AND PROXY STATEMENT / 19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Daniel Colao | | | | | | | | Director Since 2024 | | | |

| | | Age: 58 | Committees: Audit (Chair) and Risk (Audit Committee Financial Expert) | | Independent | | | |

| | |

|

| | | |

| | | Skills: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Financial Expert | Risk Expert | Financial Services Industry | | | C-Suite Experience | | Government/Regulatory | | Human Capital/Compensation | | Strategic Planning | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | | Mr. Colao brings to the Board deep expertise in financial services and consumer lending, as well as strategic planning, risk oversight and management. Mr. Colao most recently served as Chief Financial Officer and Executive Advisor of GE Capital, the former financial services division of General Electric, from 2017 until his retirement in June 2021. During his over 30-year career, Mr. Colao held various senior roles within financial services, including Global Financial Planning Leader of GE Capital (2011 to 2017); Chief Financial Officer, Chief Risk Officer and Executive Vice President of GE Asset Management (2008 to 2010); Managing Director and Global Chief Financial Officer of Lehman Brothers’ Investment Management and Bank & Mortgage Capital divisions (2007 to 2008); and Chief Financial Officer and Executive Vice President of GE Capital Aviation Services (2005 to 2007). Mr. Colao has also served as a member of the Board of Directors of the Bank since November 2024. Mr. Colao previously served on the Company's Board from February 2014 to November 2015 and currently serves on the advisory board of AX Partners, a privately-held capital markets solutions provider. Mr. Colao received a B.S. in Finance from Boston College. | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Arthur W. Coviello | | | | | Director Since 2015 | | | |

| | | Age: 71 | Committees: Risk and Tech (Chair) | | | Independent | | | |

| | |

|

| | | | | | | | | |

| | | Skills: | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Financial Expert | Risk Expert | | C-Suite Experience | | | Strategic Planning | | | Tech/Digital/Cyber | | | |

| | | | | | | | | | | | | | | |

| | | | | | |

| | | Mr. Coviello's significant professional experience, including as a former CEO of a publicly traded company, add valued perspective to the Board. He also has an accounting background and possesses extensive financial expertise, as well as considerable experience in technology and cybersecurity. Mr. Coviello has been an independent cybersecurity consultant since 2015 and has served as a Managing Partner of SYN Ventures, a venture capital firm specializing in investing in cybersecurity companies, since 2022. He previously served as Executive Vice President of EMC Corporation, an IT infrastructure company, and Executive Chairman of RSA Security, Inc. (“RSA”), the security division of EMC Corporation and a provider of security, risk and compliance solutions (2011 to 2015) and as Executive Vice President and President of RSA (2006 to 2011). Prior thereto, Mr. Coviello held various executive positions at RSA, including President and CEO (2000 to 2006), and President (1999 to 2000). Prior to RSA, he had extensive financial and operating management expertise in several technology companies. Mr. Coviello has also served as a member of the Board of Directors of the Bank since January 2017. Mr. Coviello serves on one other public company board: Tenable Holdings, Inc., a provider of cyber exposure solutions, which is a discipline for managing and measuring cyber security risk. He also serves on the boards of several private software companies: BreachRx, Inc., Conifers, Inc., Oomnitza, Inc., Phosphorous Security Inc and RegScale, Inc. Mr. Coviello previously served on the boards of directors of several public companies: Epiphany Technology Acquisition Corp., Mandiant, Inc., EnerNOC, Inc. and Gigamon, Inc. He received a B.B.A. in Accounting from the University of Massachusetts, Amherst. | | | |

| | | | | | |

20 / 2025 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Roy A. Guthrie | | | | | | | | Director Since 2014 | | | |

| | | Age: 71 | Committees: Risk (Chair) and Tech | | Independent | | | |

| | |

| |

| | | | | | | | | |

| | | Skills: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Financial Expert | Risk Expert | | Financial Services Industry | | C-Suite Experience | | Government/Regulatory | | Human Capital/Compensation | | Strategic Planning | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | | Mr. Guthrie brings to the Board significant leadership experience, including as the former CFO of two publicly traded companies and a director of other publicly traded companies. He also has an accounting background, significant financial expertise and risk management experience. Mr. Guthrie has extensive experience in consumer finance (including the private-label credit card industry), including more than 30 years of experience in finance and/or operating roles. Mr. Guthrie most recently served as CEO of Renovate America, Inc., a privately owned financial services company (2017 to 2018). Mr. Guthrie served as Executive Vice President (2005 to 2012), and as CFO (2005 to 2011) of Discover Financial Services, Inc., a direct banking and payments company. He previously served as President and CEO of various businesses of Citigroup Inc., including CitiFinancial International (2000 to 2004) and CitiCapital (2000 to 2001). Prior to joining Citigroup, Mr. Guthrie served in various roles of increasing responsibility at Associates First Capital Corporation (1978-2000). Mr. Guthrie has also served as a member of the Board of Directors of the Bank since July 2014. Mr. Guthrie serves on two other public company boards: Mr. Cooper Group, Inc., an originator and servicer of real estate mortgage loans; and OneMain Holdings, Inc., a financial services company. He previously served on the boards of directors of Cascade Acquisition Corporation, LifeLock, Inc., and Garrison Capital Inc. During his tenure with Discover Financial Services, Inc., he also served on the board of directors of Discover Bank. Mr. Guthrie received a B.A. in Economics from Hanover College and an M.B.A. from Drake University. | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Jeffrey G. Naylor | | Director Since 2014, Non-Executive Chair Since 2023 | | | |

| | | Age: 66 | Committees: Audit and MDC (Audit Committee Financial Expert) | | Independent | | | |

| | |

| |

| | | |

| | | Skills: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Financial Expert | Risk Expert | Financial Services Industry | | C-Suite Experience | | Direct Consumer/Retailers | | | Human Capital/Compensation | | Strategic Planning | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | | Mr. Naylor brings to the Board executive management and leadership experience, including as CFO of a publicly traded company and as a director of other publicly traded companies, extensive financial expertise and accounting experience, as well as considerable experience in the retail and consumer goods industries accumulated over the course of 25 years.

Prior to his appointment as non-executive Chair, Mr. Naylor served as Lead Independent Director of the Board (2021 to 2023). Mr. Naylor served as Senior Corporate Advisor of the TJX Companies, Inc., a retail company of apparel and home fashions (2013 to 2014). Mr. Naylor served as Senior Executive Vice President and CAO of the TJX Companies, Inc. (2012 to 2013); Senior Executive Vice President, Chief Financial and Administrative Officer (2009 to 2012); Senior Executive Vice President, Chief Administrative and Business Development Officer (2007 to 2009); Senior Executive Vice President, Chief Financial and Administrative Officer (2006 to 2007); and CFO (2004 to 2006). Prior to joining TJX, Mr. Naylor served as Senior Vice President and CFO of Big Lots, Inc. (2001 to 2004); Senior Vice President, Chief Financial and Administrative Officer of Dade Behring, Inc. (2000 to 2001); and Vice President, Controller of The Limited, Inc. (1998 to 2000). Mr. Naylor has also served as a member of the Board of Directors of the Bank since July 2014. Mr. Naylor serves on two other public company boards: Dollar Tree, Inc., an operator of discount variety stores; and Wayfair, Inc., an e-commerce retailer of home furnishings and decor. Mr. Naylor received a B.A. in Economics and Political Science from Northwestern University and an M.B.A. from the J.L. Kellogg Graduate School of Management. | | | |

| | | | | | |

2025 ANNUAL MEETING AND PROXY STATEMENT / 21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | P.W. “Bill” Parker | | | Director Since 2020 | | | |

| | | Age: 68 | Committees: NCG and Risk | | | Independent | | | |

| | |

| | | |

| | | | | | | | | | | | |

| | | Skills: | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | Financial Expert | Risk Expert | | | Financial Services Industry | | | C-Suite Experience | | | Government/ Regulatory | | Strategic Planning | | | |

| | | | | | |

| | | | | | |

| | | Mr. Parker brings leadership experience, an extensive background in risk management and deep expertise in credit to the Board.

Mr. Parker most recently served as Vice Chairman and Chief Risk Officer of U.S. Bancorp (2013 to 2018); Executive Vice President and Chief Credit Officer (2007 to 2013); Executive Vice President of Credit Portfolio Management of U.S. Bancorp (2005 to 2007); and Senior Vice President of Credit Portfolio Management (2002 to 2005). Mr. Parker currently serves on the board of directors of S&P Global Ratings, a fully owned division of S&P Global Inc. He previously served on the board of directors of U.S. Bank National Association (2011 to 2018). Mr. Parker also serves on the boards of the following charitable organizations: Hazelden Betty Ford Foundation, Summit Academy OIC, Friends of the Lake Vermilion Trail and American Indian College Fund, and is also a member of the capital campaign committee of CommonBond Communities, a nonprofit organization that provides affordable housing options in the Upper Midwest. Mr. Parker received a B.A. from Amherst College and an M.B.A. from the Tuck School of Business at Dartmouth. | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | Laurel J. Richie | | | | Director Since 2015 | | | |

| | | Age: 66 | | Committees: MDC (Chair) and NCG | | Independent | | | |

| | |

| |

| | | | | | | |

| | | Skills: | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | C-Suite Experience | | Brand and Marketing | | Direct Consumer/Retailers | | Human Capital/Compensation | | Strategic Planning | | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | Ms. Richie’s executive management and leadership experience and her considerable experience as a director of other public companies, as well as in communications and marketing add valuable perspective to the Board.

Ms. Richie served as President of the Women’s National Basketball Association LLC, a professional sports league (2011 to 2015). Ms. Richie served as a brand consultant for Teach For America (2016 to 2018), and as Chief Marketing Officer of Girl Scouts of the United States of America (2008 to 2011). She held various positions at Ogilvy & Mather (1984 to 2008), including Senior Partner and Executive Group Director and member of the agency’s Operating and Diversity Advisory Boards. Ms. Richie is currently engaged by several Fortune 100 companies to advise c-suite executives on matters of personal leadership and corporate culture. Ms. Richie has also served as a member of the Board of Directors of the Bank since April 2021. Ms. Richie serves on two other public company boards: Bright Horizons, a provider of high-quality education and childcare; and Hasbro, a global toy and game company whose mission is to entertain and connect fans through storytelling and play. She also serves as an independent director at SeatGeek, a closely held private corporation. Ms. Richie has been recognized as one of the 25 Most Influential Women in Business by The Network Journal, one of the Most Influential African Americans in Sports by Black Enterprise, and one of the Most Influential Black Corporate Directors by Savoy magazine. She is the recipient of numerous awards including Sports Business Journal’s Game Changer Award and Ebony magazine’s Outstanding Women in Marketing and Communications Award. Ms. Richie received a B.A. in Policy Studies from Dartmouth College. Ms. Richie is a former Trustee of the Naismith Basketball Hall of Fame and her alma mater where she served as Chair of the Board from 2017 to 2021. | | | |

| | | | | | |

22 / 2025 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | Ellen M. Zane | | | Director Since 2019 | | | |

| | | Age: 73 | Committees: Audit and MDC (Audit Committee Financial Expert) | Independent | | | |

| | |

| |

|

| | | |

| | | Skills: | | | | | | | | |

| | | | | | | | | | | |

| | | Financial Expert | C-Suite Experience | Government/Regulatory | Healthcare | Human Capital/Compensation | Strategic Planning | | | |

| | | | | | | | | | | |

| | | | | | |

| | | Ms. Zane brings to the Board executive experience in the healthcare industry, including as the CEO of a large medical center, in addition to her financial expertise and substantial experience as a director at other public companies.