0001601712false2024FYhttp://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#IncomeTaxExpenseBenefithttp://fasb.org/us-gaap/2024#IncomeTaxExpenseBenefithttp://fasb.org/us-gaap/2024#IncomeTaxExpenseBenefithttp://fasb.org/us-gaap/2024#IncomeTaxExpenseBenefithttp://fasb.org/us-gaap/2024#IncomeTaxExpenseBenefithttp://fasb.org/us-gaap/2024#IncomeTaxExpenseBenefit1434421415411435392436322iso4217:USDxbrli:sharesiso4217:USDxbrli:sharessyf:paymentxbrli:puresyf:executivesyf:approachsyf:securitysyf:contractsyf:sales_platformsyf:segment00016017122024-01-012024-12-310001601712us-gaap:CommonStockMember2024-01-012024-12-310001601712us-gaap:SeriesAPreferredStockMember2024-01-012024-12-310001601712us-gaap:SeriesBPreferredStockMember2024-01-012024-12-3100016017122024-06-3000016017122025-01-3100016017122024-12-3100016017122023-01-012023-12-3100016017122022-01-012022-12-310001601712us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-01-012024-12-310001601712us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310001601712us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310001601712syf:SynchronySegmentMember2024-01-012024-12-310001601712syf:SynchronySegmentMember2023-01-012023-12-310001601712syf:SynchronySegmentMember2022-01-012022-12-3100016017122023-12-310001601712syf:UnsecuritizedLoansHeldforInvestmentMember2024-12-310001601712syf:UnsecuritizedLoansHeldforInvestmentMember2023-12-310001601712us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:PreferredStockMember2021-12-310001601712us-gaap:CommonStockMember2021-12-310001601712us-gaap:AdditionalPaidInCapitalMember2021-12-310001601712us-gaap:RetainedEarningsMember2021-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001601712us-gaap:TreasuryStockCommonMember2021-12-3100016017122021-12-310001601712us-gaap:RetainedEarningsMember2022-01-012022-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001601712us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001601712us-gaap:CommonStockMember2022-01-012022-12-310001601712us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001601712us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001601712us-gaap:PreferredStockMember2022-12-310001601712us-gaap:CommonStockMember2022-12-310001601712us-gaap:AdditionalPaidInCapitalMember2022-12-310001601712us-gaap:RetainedEarningsMember2022-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001601712us-gaap:TreasuryStockCommonMember2022-12-3100016017122022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:PreferredStockMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommonStockMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AdditionalPaidInCapitalMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:TreasuryStockCommonMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712us-gaap:RetainedEarningsMember2023-01-012023-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001601712us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001601712us-gaap:CommonStockMember2023-01-012023-12-310001601712us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001601712us-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001601712us-gaap:PreferredStockMember2023-12-310001601712us-gaap:CommonStockMember2023-12-310001601712us-gaap:AdditionalPaidInCapitalMember2023-12-310001601712us-gaap:RetainedEarningsMember2023-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001601712us-gaap:TreasuryStockCommonMember2023-12-310001601712us-gaap:RetainedEarningsMember2024-01-012024-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001601712us-gaap:PreferredStockMember2024-01-012024-12-310001601712us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001601712us-gaap:CommonStockMember2024-01-012024-12-310001601712us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001601712us-gaap:RetainedEarningsMemberus-gaap:SeriesAPreferredStockMember2024-01-012024-12-310001601712us-gaap:RetainedEarningsMemberus-gaap:SeriesBPreferredStockMember2024-01-012024-12-310001601712us-gaap:PreferredStockMember2024-12-310001601712us-gaap:CommonStockMember2024-12-310001601712us-gaap:AdditionalPaidInCapitalMember2024-12-310001601712us-gaap:RetainedEarningsMember2024-12-310001601712us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001601712us-gaap:TreasuryStockCommonMember2024-12-310001601712srt:MaximumMember2024-01-012024-12-310001601712syf:UnsecuredConsumerandSecuredbyCollateralMember2024-12-310001601712us-gaap:UncollateralizedMember2024-12-310001601712syf:UnsecuredConsumerinBankruptcyMember2024-12-310001601712syf:CreditCardReceivableDeceasedAccountHoldersMember2024-12-310001601712us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001601712us-gaap:CreditCardReceivablesMember2024-01-012024-12-310001601712syf:NonCreditCardLoanMember2024-01-012024-12-310001601712syf:AllyLendingMember2024-03-012024-03-010001601712syf:BusinessAcquisitionInitialValuesMembersyf:AllyLendingMember2024-03-010001601712syf:AllyLendingMember2024-03-010001601712syf:BusinessAcquisitionInitialValuesMembersyf:AllyLendingMember2024-03-012024-03-010001601712syf:AllyLendingMember2024-01-012024-12-310001601712syf:IndependencePetHoldingsInc.Membersyf:PetsBestMember2024-03-052024-03-310001601712syf:PetsBestMembersyf:IndependencePetHoldingsInc.Membersyf:SynchronyFinancialMember2024-03-052024-03-310001601712syf:PetsBestMember2024-03-052024-03-310001601712syf:IndependencePetHoldingsInc.Member2024-03-050001601712syf:IndependencePetHoldingsInc.Member2024-12-310001601712us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-12-310001601712us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001601712us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001601712us-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001601712us-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310001601712us-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001601712us-gaap:AssetBackedSecuritiesMember2024-12-310001601712us-gaap:AssetBackedSecuritiesMember2023-12-310001601712us-gaap:OtherDebtSecuritiesMember2024-12-310001601712us-gaap:OtherDebtSecuritiesMember2023-12-310001601712us-gaap:CreditCardReceivablesMember2024-12-310001601712us-gaap:CreditCardReceivablesMember2023-12-310001601712us-gaap:ConsumerLoanMember2024-12-310001601712us-gaap:ConsumerLoanMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMember2023-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2024-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2023-12-310001601712syf:FederalReserveDiscountWindowMember2024-12-310001601712syf:FederalReserveDiscountWindowMember2023-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CreditCardReceivablesMember2023-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerLoanMember2023-12-310001601712us-gaap:ConsumerLoanMember2024-01-012024-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMember2024-01-012024-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:UnallocatedFinancingReceivablesMember2023-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2024-01-012024-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2023-12-310001601712us-gaap:CreditCardReceivablesMember2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:CreditCardReceivablesMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CreditCardReceivablesMember2022-12-310001601712us-gaap:CreditCardReceivablesMember2023-01-012023-12-310001601712us-gaap:ConsumerLoanMember2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ConsumerLoanMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ConsumerLoanMember2022-12-310001601712us-gaap:ConsumerLoanMember2023-01-012023-12-310001601712us-gaap:CommercialPortfolioSegmentMember2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001601712us-gaap:CommercialPortfolioSegmentMember2023-01-012023-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:UnallocatedFinancingReceivablesMemberus-gaap:AccountingStandardsUpdate202202Member2022-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:UnallocatedFinancingReceivablesMember2022-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2023-01-012023-12-310001601712srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2022-12-310001601712us-gaap:CreditCardReceivablesMember2021-12-310001601712us-gaap:CreditCardReceivablesMember2022-01-012022-12-310001601712us-gaap:ConsumerLoanMember2021-12-310001601712us-gaap:ConsumerLoanMember2022-01-012022-12-310001601712us-gaap:CommercialPortfolioSegmentMember2021-12-310001601712us-gaap:CommercialPortfolioSegmentMember2022-01-012022-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2021-12-310001601712us-gaap:UnallocatedFinancingReceivablesMember2022-01-012022-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712us-gaap:CreditCardReceivablesMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712us-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2024-12-310001601712us-gaap:ConsumerLoanMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712us-gaap:ConsumerLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712us-gaap:ConsumerLoanMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712us-gaap:ConsumerLoanMembersyf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2024-12-310001601712syf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712us-gaap:FinancialAssetPastDueMember2024-12-310001601712syf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2024-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712us-gaap:CreditCardReceivablesMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712us-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2023-12-310001601712us-gaap:ConsumerLoanMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712us-gaap:ConsumerLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712us-gaap:ConsumerLoanMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712us-gaap:ConsumerLoanMembersyf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2023-12-310001601712syf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712us-gaap:FinancialAssetPastDueMember2023-12-310001601712syf:FinancialAssetEqualToOrGreaterThan90DaysPastDueAndAccruingMember2023-12-310001601712us-gaap:CreditCardReceivablesMembersyf:SixHundredAndFiftyOneOrHigherMember2024-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FiveHundredAndNinetyOneToSixHundredAndFiftyMember2024-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FiveHundredAndNinetyOrLessMember2024-12-310001601712us-gaap:CreditCardReceivablesMembersyf:SixHundredAndFiftyOneOrHigherMember2023-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FiveHundredAndNinetyOneToSixHundredAndFiftyMember2023-12-310001601712us-gaap:CreditCardReceivablesMembersyf:FiveHundredAndNinetyOrLessMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:SixHundredAndFiftyOneOrHigherMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FiveHundredAndNinetyOneToSixHundredAndFiftyMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FiveHundredAndNinetyOrLessMember2024-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:SixHundredAndFiftyOneOrHigherMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FiveHundredAndNinetyOneToSixHundredAndFiftyMember2023-12-310001601712us-gaap:CommercialPortfolioSegmentMembersyf:FiveHundredAndNinetyOrLessMember2023-12-310001601712syf:ModificationDateAmountMembersyf:LongTermModificationMemberus-gaap:CreditCardReceivablesMember2024-01-012024-12-310001601712syf:ModificationDateAmountMembersyf:LongTermModificationMemberus-gaap:CreditCardReceivablesMember2023-01-012023-12-310001601712syf:ModificationDateAmountMembersyf:LongTermModificationMemberus-gaap:ConsumerLoanMember2024-01-012024-12-310001601712syf:ModificationDateAmountMembersyf:LongTermModificationMemberus-gaap:ConsumerLoanMember2023-01-012023-12-310001601712syf:ModificationDateAmountMembersyf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMember2024-01-012024-12-310001601712syf:ModificationDateAmountMembersyf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-12-310001601712syf:ModificationDateAmountMembersyf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMember2024-01-012024-12-310001601712syf:ModificationDateAmountMembersyf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMember2023-01-012023-12-310001601712syf:ModificationDateAmountMembersyf:ShortTermModificationMemberus-gaap:ConsumerLoanMember2024-01-012024-12-310001601712syf:ModificationDateAmountMembersyf:ShortTermModificationMemberus-gaap:ConsumerLoanMember2023-01-012023-12-310001601712syf:ModificationDateAmountMembersyf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMember2024-01-012024-12-310001601712syf:ModificationDateAmountMembersyf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-12-310001601712syf:ModificationDateAmountMember2024-01-012024-12-310001601712syf:ModificationDateAmountMember2023-01-012023-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMembersyf:FinancingReceivables30to89DaysPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2024-12-310001601712us-gaap:FinancialAssetNotPastDueMember2024-12-310001601712us-gaap:FinancialAssetNotPastDueMember2024-01-012024-12-310001601712syf:FinancingReceivables30to89DaysPastDueMember2024-01-012024-12-310001601712us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-01-012024-12-310001601712us-gaap:FinancialAssetPastDueMember2024-01-012024-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712syf:LongTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CreditCardReceivablesMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:ConsumerLoanMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMembersyf:FinancingReceivables30to89DaysPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-12-310001601712syf:ShortTermModificationMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2023-12-310001601712us-gaap:FinancialAssetNotPastDueMember2023-12-310001601712us-gaap:FinancialAssetNotPastDueMember2023-01-012023-12-310001601712syf:FinancingReceivables30to89DaysPastDueMember2023-01-012023-12-310001601712us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-01-012023-12-310001601712us-gaap:FinancialAssetPastDueMember2023-01-012023-12-310001601712us-gaap:OtherAssetsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:OtherAssetsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712syf:InvestmentsFundingCommitmentMember2024-12-310001601712us-gaap:ComputerSoftwareIntangibleAssetMember2024-12-310001601712us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001601712us-gaap:OtherIntangibleAssetsMember2024-12-310001601712us-gaap:OtherIntangibleAssetsMember2023-12-310001601712syf:FiniteLivedIntangibleAssetsExcludingCustomerContractsMemberus-gaap:OtherExpenseMember2024-01-012024-12-310001601712syf:FiniteLivedIntangibleAssetsExcludingCustomerContractsMemberus-gaap:OtherExpenseMember2023-01-012023-12-310001601712syf:FiniteLivedIntangibleAssetsExcludingCustomerContractsMemberus-gaap:OtherExpenseMember2022-01-012022-12-310001601712syf:FixedSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MinimumMember2024-12-310001601712syf:FixedSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MaximumMember2024-12-310001601712syf:FixedSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712syf:FixedSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712syf:FloatingSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MinimumMember2024-12-310001601712syf:FloatingSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MaximumMember2024-12-310001601712syf:FloatingSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712syf:FloatingSecuritizedBorrowingsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712syf:FixedSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMembersrt:MinimumMember2024-12-310001601712syf:FixedSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMembersrt:MaximumMember2024-12-310001601712syf:FixedSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2024-12-310001601712syf:FixedSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2023-12-310001601712syf:FixedToFloatingSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2024-12-310001601712syf:FixedToFloatingSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2023-12-310001601712syf:FixedSeniorUnsecuredNotesMembersrt:SubsidiariesMemberus-gaap:SeniorNotesMembersrt:MinimumMember2024-12-310001601712syf:FixedSeniorUnsecuredNotesMembersrt:SubsidiariesMemberus-gaap:SeniorNotesMembersrt:MaximumMember2024-12-310001601712syf:FixedSeniorUnsecuredNotesMembersrt:SubsidiariesMemberus-gaap:SeniorNotesMember2024-12-310001601712syf:FixedSeniorUnsecuredNotesMembersrt:SubsidiariesMemberus-gaap:SeniorNotesMember2023-12-310001601712us-gaap:SeniorNotesMember2024-12-310001601712us-gaap:SeniorNotesMember2023-12-310001601712syf:FixedSubordinatedUnsecuredNotesMemberus-gaap:SeniorSubordinatedNotesMembersrt:MinimumMember2024-12-310001601712syf:FixedSubordinatedUnsecuredNotesMemberus-gaap:SeniorSubordinatedNotesMember2024-12-310001601712syf:FixedSubordinatedUnsecuredNotesMemberus-gaap:SeniorSubordinatedNotesMember2023-12-310001601712syf:SeniorAndSubordinatedNotesMember2024-12-310001601712syf:SeniorAndSubordinatedNotesMember2023-12-310001601712syf:CommittedCapacityMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712syf:UncommittedCapacityMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712syf:CommittedCapacityMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2024-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001601712us-gaap:FairValueMeasurementsRecurringMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2023-12-310001601712us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherDebtSecuritiesMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001601712us-gaap:FairValueMeasurementsRecurringMember2023-12-310001601712us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001601712us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310001601712us-gaap:FairValueInputsLevel1Member2024-12-310001601712us-gaap:FairValueInputsLevel2Member2024-12-310001601712us-gaap:FairValueInputsLevel3Member2024-12-310001601712us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-310001601712us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-12-310001601712us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMember2024-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2024-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:SeniorNotesMember2024-12-310001601712us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001601712us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001601712us-gaap:FairValueInputsLevel1Member2023-12-310001601712us-gaap:FairValueInputsLevel2Member2023-12-310001601712us-gaap:FairValueInputsLevel3Member2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001601712us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001601712us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001601712us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001601712us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMember2023-12-310001601712us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2023-12-310001601712us-gaap:FairValueInputsLevel3Memberus-gaap:SeniorNotesMember2023-12-310001601712syf:BaselIIIMember2024-12-310001601712syf:BaselIIIMember2023-12-310001601712syf:BaselIIIMembersrt:SubsidiariesMember2024-12-310001601712syf:BaselIIIMembersrt:SubsidiariesMember2023-12-310001601712us-gaap:OtherLiabilitiesMembersrt:AffiliatedEntityMember2024-12-310001601712us-gaap:OtherLiabilitiesMembersrt:AffiliatedEntityMember2023-12-310001601712us-gaap:SeriesAPreferredStockMember2024-12-310001601712us-gaap:SeriesAPreferredStockMember2023-12-310001601712us-gaap:SeriesBPreferredStockMember2024-12-310001601712us-gaap:SeriesBPreferredStockMember2023-12-310001601712syf:January2021ShareRepurchaseProgramMember2024-12-310001601712syf:A2014LongTermIncentivePlanMemberDomain2024-12-310001601712syf:A2014LongTermIncentivePlanMemberDomainus-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2024-01-012024-12-310001601712us-gaap:PerformanceSharesMember2024-01-012024-12-310001601712us-gaap:PerformanceSharesMembersrt:MinimumMember2024-01-012024-12-310001601712us-gaap:PerformanceSharesMembersrt:MaximumMember2024-01-012024-12-310001601712us-gaap:EmployeeStockOptionMembersyf:A2014LongTermIncentivePlanMemberDomain2024-12-310001601712us-gaap:RestrictedStockMembersyf:A2014LongTermIncentivePlanMemberDomain2024-12-310001601712us-gaap:RestrictedStockUnitsRSUMembersyf:A2014LongTermIncentivePlanMemberDomain2024-12-310001601712us-gaap:PerformanceSharesMembersyf:A2014LongTermIncentivePlanMemberDomain2024-12-310001601712syf:A2014LongTermIncentivePlanMemberDomain2024-01-012024-12-310001601712srt:SubsidiariesMember2024-12-310001601712srt:ParentCompanyMember2024-01-012024-12-310001601712srt:ParentCompanyMember2023-01-012023-12-310001601712srt:ParentCompanyMember2022-01-012022-12-310001601712srt:ParentCompanyMember2024-12-310001601712srt:ParentCompanyMember2023-12-310001601712us-gaap:RelatedPartyMembersrt:ParentCompanyMember2024-12-310001601712us-gaap:RelatedPartyMembersrt:ParentCompanyMember2023-12-310001601712srt:ParentCompanyMemberus-gaap:SeniorNotesMember2024-12-310001601712srt:ParentCompanyMemberus-gaap:SeniorNotesMember2023-12-310001601712srt:ParentCompanyMember2022-12-310001601712srt:ParentCompanyMember2021-12-3100016017122024-10-012024-12-310001601712syf:AlbertoCasellasMember2024-10-012024-12-310001601712syf:AlbertoCasellasMember2024-12-310001601712syf:BrianDoublesMember2024-10-012024-12-310001601712syf:BrianDoublesMember2024-12-310001601712syf:CourtneyGentlemenMember2024-10-012024-12-310001601712syf:CourtneyGentlemenMember2024-12-310001601712syf:CurtisHowseMember2024-10-012024-12-310001601712syf:CurtisHowseMember2024-12-310001601712syf:CarolJuelMember2024-10-012024-12-310001601712syf:CarolJuelMember2024-12-310001601712syf:DarrellOwensMember2024-10-012024-12-310001601712syf:DarrellOwensMember2024-12-310001601712syf:BartSchallerMember2024-10-012024-12-310001601712syf:BartSchallerMember2024-12-310001601712syf:BrianWenzelMember2024-10-012024-12-310001601712syf:BrianWenzelMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024 OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

001-36560

(Commission File Number)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 51-0483352 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 777 Long Ridge Road | | |

| Stamford, | Connecticut | | 06902 |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code) (203) 585-2400

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the outstanding common equity of the registrant held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $18,645,501,294.

The number of shares of the registrant’s common stock, par value $0.001 per share, outstanding as of January 31, 2025 was 388,749,489.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant’s Annual Meeting of Stockholders, to be held June 17, 2025, is incorporated by reference into Part III to the extent described therein.

Synchrony Financial

Table of Contents

OUR ANNUAL REPORT ON FORM 10-K

To improve the readability of this document and better present both our financial results and how we manage our business, we present the content of our Annual Report on Form 10-K in the order listed in the table of contents below. See "Form 10-K Cross-Reference Index" on page 4 for a cross-reference index to the traditional U.S. Securities and Exchange Commission (SEC) Form 10-K format.

FORM 10-K CROSS REFERENCE INDEX

____________________________________________________________________________________________

| | | | | | | | |

Part I | | Page(s) |

| | |

| | |

| | |

| | |

| | |

Item 1B. | Unresolved Staff Comments | Not Applicable |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 4. | Mine Safety Disclosures | Not Applicable |

| | |

Part II | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | Not Applicable |

| | |

| | |

| | |

| | |

| | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | Not Applicable |

| | |

Part III | | |

| | |

Item 10. | Directors, Executive Officers and Corporate Governance | |

| | |

Item 11. | Executive Compensation | (b) |

| | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | (c) |

| | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | (d) |

| | |

Item 14. | Principal Accountant Fees and Services | (e) |

| | |

Part IV | | |

| | |

| | |

| | |

Item 16. | Form 10-K Summary | Not Applicable |

| | |

| | |

______________________

(a)Incorporated by reference to “Management,” “Election of Directors,” “Governance Principles,” “Code of Conduct” and “Committees of the Board of the Directors” in our definitive proxy statement for our 2025 Annual Meeting of Stockholders to be held on June 17, 2025, which will be filed within 120 days of the end our fiscal year ended December 31, 2024 (the “2025 Proxy Statement”).

(b)Incorporated by reference to “Compensation Discussion and Analysis,” “2024 Executive Compensation,” “Management Development and Compensation Committee Report” and “Management Development and Compensation Committee Interlocks and Insider Participation,” “CEO Pay Ratio” and “Policies and Practices related to the Grant of Certain Equity Awards Close in Time to the Release of Material Nonpublic Information” in the 2025 Proxy Statement.

(c)Incorporated by reference to “Beneficial Ownership” and “Equity Compensation Plan Information” in the 2025 Proxy Statement.

(d)Incorporated by reference to “Related Person Transactions,” “Election of Directors” and “Committees of the Board of Directors” in the 2025 Proxy Statement.

(e)Incorporated by reference to “Independent Auditor” in the 2025 Proxy Statement.

Certain Defined Terms

Except as the context may otherwise require in this report, references to:

•“we,” “us,” “our” and the “Company” are to SYNCHRONY FINANCIAL and its subsidiaries;

•“Synchrony” are to SYNCHRONY FINANCIAL only;

•the “Bank” are to Synchrony Bank (a subsidiary of Synchrony);

•the “Board of Directors” or “Board” are to Synchrony’s board of directors;

•"CECL" are to the impairment model known as the Current Expected Credit Loss model, which is based on expected credit losses; and

•“VantageScore” are to a credit score developed by the three major credit reporting agencies which is used as a means of evaluating the likelihood that credit users will pay their obligations.

We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which, in our business and in this report, we refer to as our “partners.” The terms of the programs all require cooperative efforts between us and our partners of varying natures and degrees to establish and operate the programs. Our use of the term “partners” to refer to these entities is not intended to, and does not, describe our legal relationship with them, imply that a legal partnership or other relationship exists between the parties or create any legal partnership or other relationship. Information with respect to partner “locations” in this report is given at December 31, 2024. “Open accounts” represents credit card or installment loan accounts that are not closed, blocked or more than 60 days delinquent.

Unless otherwise indicated, references to “loan receivables” do not include loan receivables held for sale.

For a description of certain other terms we use, including “active account” and “purchase volume,” see the notes to "Management’s Discussion and Analysis—Results of Operations—Other Financial and Statistical Data.” There is no standard industry definition for many of these terms, and other companies may define them differently than we do.

“Synchrony” and its logos and other trademarks referred to in this report, including CareCredit®, Quickscreen®, Dual Card™, Synchrony Car Care™ and SyPI™ belong to us. Solely for convenience, we refer to our trademarks in this report without the ™ and ® symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this report are the property of their respective owners.

On our website at https://investors.synchrony.com, we make available under the "Filings & Regulatory-SEC Filings" menu selection, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") as soon as reasonably practicable after such reports or amendments are electronically filed with, or furnished to, the SEC. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information that we file electronically with the SEC.

Industry and Market Data

This report contains various historical and projected financial information concerning our industry and market. Some of this information is from industry publications and other third-party sources, and other information is from our own data and market research that we commission. All of this information involves a variety of assumptions, limitations and methodologies and is inherently subject to uncertainties, and therefore you are cautioned not to give undue weight to it. Although we believe that those industry publications and other third-party sources are reliable, we have not independently verified the accuracy or completeness of any of the data from those publications or sources.

Cautionary Note Regarding Forward-Looking Statements:

Various statements in this Annual Report on Form 10-K may contain “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “outlook,” “estimates,” “will,” “should,” “may,” "aim," “focus,” “confident,” “trajectory,” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements.

Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions, including factors impacting consumer confidence and economic growth in the United States, and whether industry trends we have identified develop as anticipated; the impact of changes in the U.S. presidential administration and Congress on fiscal, monetary and regulatory policy; retaining existing partners and attracting new partners, concentration of our revenue in a small number of partners, and promotion and support of our products by our partners; cyber-attacks or other security incidents or breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the Consumer Financial Protection Bureau's ("CFPB") final rule on credit card late fees, including the timing for resolution and outcome of the litigation challenging the final rule, as well as changes to consumer behaviors in response to the final rule, if implemented, the product, pricing and policy changes that have been or will be implemented to mitigate the impacts of the final rule or the final rule not becoming effective; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates; effectiveness of our risk management processes and procedures; reliance on models which may be inaccurate or misinterpreted; our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market and susceptibility to market fluctuations and legislative and regulatory developments; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions, dispositions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third-parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation, regulatory actions and compliance issues; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and other legislative and regulatory developments and the impact of the CFPB's regulation of our business, including new requirements and constraints that Synchrony and the Bank are or will become subject to as a result of having $100 billion or more in total assets; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included in “Risk Factors Relating to Our Business” and “Risk Factors Relating to Regulation.” You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement, including under the heading "Business Trends and Conditions" below, speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law.

OUR BUSINESS

Our Company

____________________________________________________________________________________________

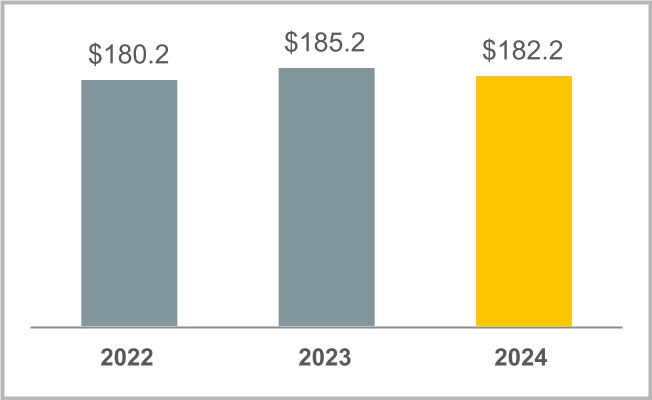

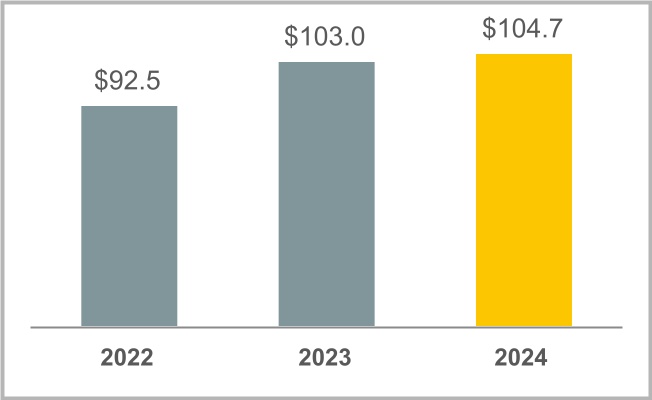

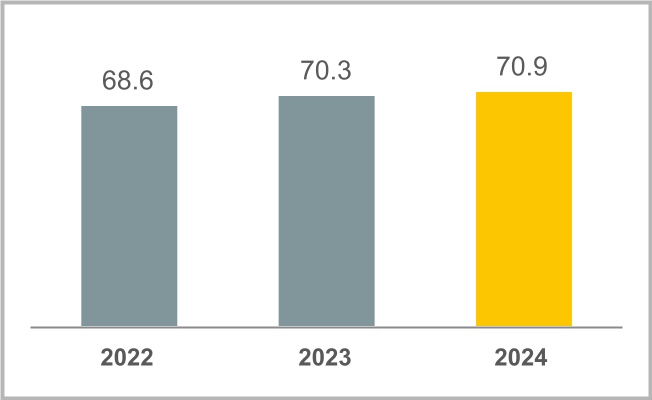

We are a premier consumer financial services company delivering one of the industry's most complete digitally-enabled product suites. Our experience, expertise and scale encompass a broad spectrum of industries, including digital, health and wellness, retail, telecommunications, home, auto, outdoor, pet and more. We have an established and diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” We connect our partners and consumers through our dynamic financial ecosystem and provide them with a diverse set of financing solutions and innovative digital capabilities to address their specific needs and deliver seamless, omnichannel experiences. We utilize a broad set of distribution channels, including mobile apps and websites, as well as online marketplaces and business management solutions like point-of-sale platforms. Our offerings include private label, dual, co-brand and general purpose credit cards, as well as short- and long-term installment loans and consumer banking products. During 2024, we financed $182.2 billion of purchase volume, and at December 31, 2024, we had $104.7 billion of loan receivables and 71.5 million active accounts.

Our business benefits from longstanding and collaborative relationships with our partners, including some of the nation’s leading retailers and manufacturers with well-known consumer brands, such as Lowe’s and Sam's Club and also leading digital partners, such as Amazon and PayPal. We believe our business model has been successful because it aligns our interests with those of our partners and provides substantial value to both our partners and our customers. Our partners promote our credit products because they generate increased sales and strengthen customer loyalty. Our customers benefit from instant access to credit, discounts, or other benefits such as cash back rewards, and promotional offers. We seek to differentiate ourselves through our deep industry expertise, our long history of consumer lending, our innovative digital capabilities and our diverse product suite. We have omnichannel (in-store, online and mobile) technology and marketing capabilities, which allow us to offer and deliver our credit products instantly to customers across multiple channels. We continue to invest in, and develop, our digital assets as we aim to ensure our partners are well positioned for the rapidly evolving environment. We have been able to demonstrate our digital capabilities by providing solutions that meet the needs of our partners and customers, with approximately 57% of our consumer revolving applications in 2024 processed through a digital channel.

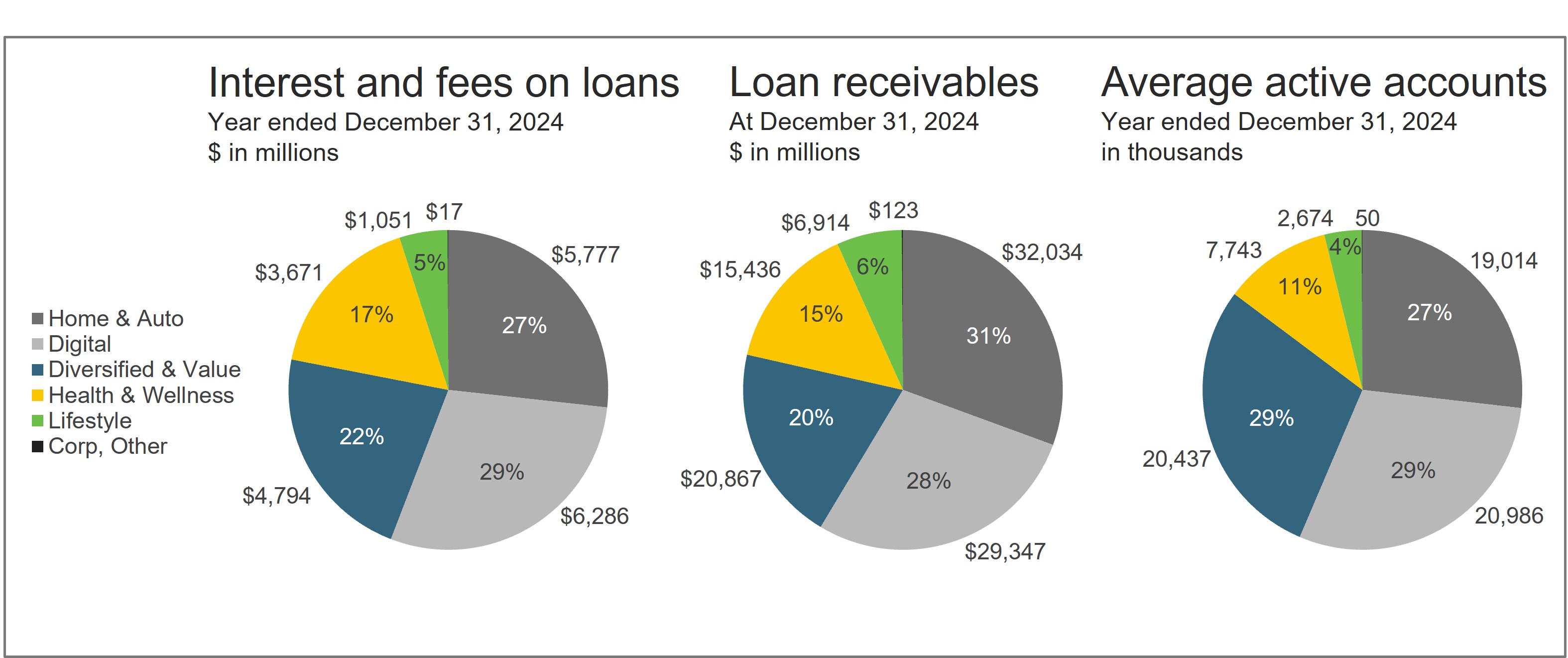

We conduct our operations through a single business segment. Profitability and expenses, including funding costs, credit losses and operating expenses, are managed for the business as a whole. Substantially all of our revenue generating activities are within the United States and are aligned through five sales platforms (Home & Auto, Digital, Diversified & Value, Health & Wellness and Lifestyle). Those platforms are organized by the types of partners we work with, and are measured on interest and fees on loans, loan receivables, active accounts and other sales metrics.

We offer our credit products primarily through our wholly-owned subsidiary, the Bank. In addition, through the Bank, we offer, directly to retail, affinity relationships and commercial customers, a range of deposit products insured by the Federal Deposit Insurance Corporation (“FDIC”), including certificates of deposit, individual retirement accounts (“IRAs”), money market accounts, savings accounts and sweep and affinity deposits. We also take deposits at the Bank through third-party securities brokerage firms that offer our FDIC-insured deposit products to their customers. Our deposit base has continued to serve as a source of stable and diversified low-cost funding for our credit activities. At December 31, 2024, we had $82.1 billion in deposits, which represented 84% of our total funding sources.

Our Sales Platforms

____________________________________________________________________________________________

We offer our credit products through five sales platforms: Home & Auto, Digital, Diversified & Value, Health & Wellness and Lifestyle.

Set forth below is a summary of certain information relating to our sales platforms:

Home & Auto

Our Home & Auto sales platform provides comprehensive payments and financing solutions with integrated in-store and digital experiences through a broad network of partners and merchants providing home and automotive merchandise and services, as well as our Synchrony Car Care network and Synchrony HOME credit card offering. In March 2024, we completed our acquisition of Ally Financial Inc.'s point-of-sale financing business ("Ally Lending"), which deepened our presence in the home improvement sector, including specialty areas such as roofing, HVAC and windows. Home & Auto accounted for $5.8 billion, or 27%, of our total interest and fees on loans for the year ended December 31, 2024.

Home & Auto Partners

Our Home & Auto sales platform partners include a wide range of key retailers in the home improvement, furniture, bedding, flooring, appliance and electronics industry, such as Ashley HomeStores LTD, Floor & Decor, Lowe's, and Mattress Firm, as well as automotive merchandise and services, such as Chevron and Discount Tire. In addition, we also have program agreements with manufacturers, buying groups and industry associations, such as Generac, Nationwide Marketing Group and the Home Furnishings Association.

At December 31, 2024, the length of our relationship with each of our five largest partners was over 10 years, and in the case of Lowe's, 45 years.

| | | | | | | | |

| 2024 Partner Agreements: |

| New partnerships: | • Bel Furniture | • The Carpet Guys |

• National Alliance Trade Merchants (NATM) |

|

| Program extensions: | • Associated Materials | • Generac |

• Big Sandy | • Jerome's Furniture |

• BrandsMart | • P.C. Richard & Son |

Digital

Our Digital sales platform provides comprehensive payments and financing solutions with integrated digital experiences through partners and merchants who primarily engage with their consumers through digital channels. We enable our partners to deepen consumer engagement by embedding payments and financing solutions, delivering compelling value and rewards, and providing personalized offers within seamless experiences. We also work with our partners to extend digital relationships to in-person commerce. In addition to our partner products, we also offer a Synchrony-branded general purpose credit card. Digital accounted for $6.3 billion, or 29%, of our total interest and fees on loans for the year ended December 31, 2024.

Digital Partners

Our Digital sales platform includes key partners delivering digital payment solutions, such as PayPal, including our Venmo program, online marketplaces, such as Amazon and eBay, and digital-first brands and merchants, such as Fanatics, the Qurate brands, and Verizon.

The Digital sales platform has strong alignment with its partners through both long-standing relationships as well as new programs such as our partnership with Virgin Red in 2024. At December 31, 2024, the length of our relationship with each of our three largest partners was over 10 years, and in the case of PayPal, 20 years. The Digital sales platform has highly engaged customers and aims to continue to drive penetration and everyday use by expanding products, channels, and deeper user experience integrations.

| | | | | | | | |

2024 Partner Agreements: |

| New partnerships: | • Virgin Red |

|

| Program extensions: | • Cathay Pacific | • Verizon |

• Newegg |

|

Diversified & Value

Our Diversified & Value sales platform provides comprehensive payments and financing solutions with integrated in-store and digital experiences through large retail partners who deliver everyday value to consumers shopping for daily needs or important life moments. Diversified & Value accounted for $4.8 billion, or 22%, of our total interest and fees on loans for the year ended December 31, 2024.

Diversified & Value Partners

Our Diversified & Value sales platform is comprised of five large retail partners: Belk, Fleet Farm, JCPenney, Sam's Club and TJX Companies, Inc. Through strong partner alignment, competitive value propositions, and embedding our products in the digital experience, we expect to continue to drive penetration and everyday use.

At December 31, 2024, the length of our relationship with each of these five partners was over 10 years, and in the case of Sam’s Club, 31 years.

| | | | | | | | |

2024 Partner Agreements: |

| Program extensions: | • JCPenney | • Sam's Club(1) |

_________________(1)Renewed in January 2025.

Health & Wellness

Our Health & Wellness sales platform provides comprehensive healthcare payments and financing solutions, through a network of providers and health related retail locations, for those seeking health and wellness care for themselves, their families and their pets, and includes our CareCredit brand, as well as partners such as Walgreens. Health & Wellness accounted for $3.7 billion, or 17%, of our total interest and fees on loans for the year ended December 31, 2024.

We offer customers a CareCredit-branded private label credit card that may be used across our network of CareCredit providers and our CareCredit Dual Card offering, access to installment loans at select providers and our Walgreens private label and Dual Card. In March 2024, we expanded our installment loan offering in health and wellness, including cosmetic, audiology and dentistry through our acquisition of Ally Lending.

In March 2024, we also sold Pets Best Insurance Services, LLC (“Pets Best”) for consideration comprising a combination of cash and an equity interest in Independence Pet Holdings, Inc.

Health & Wellness Partners

The vast majority of our partners are individual and small groups of independent healthcare providers, which includes networks of healthcare practitioners that provide planned medical, elective and other procedures that generally are not fully covered by insurance. The remainder are primarily national and regional healthcare providers, such as Aspen Dental and Mars Petcare and health-focused retailers, such as Rite Aid and Walgreens. In addition, we also have over 160 relationships with professional and other associations (including the American Dental Association and the American Veterinary Medical Association), manufacturers and buying groups, which endorse and promote our credit products to their members.

At December 31, 2024, we had a network of Health & Wellness providers and health-focused retailers that collectively have over 285,000 locations. Excluding our program agreement with Walgreens, no single Health & Wellness partner accounted for more than 0.6% of our total interest and fees on loans for the year ended December 31, 2024. Accounts originated in dental practices accounted for 50% of Health & Wellness interest and fees on loans for the year ended December 31, 2024.

We believe our ability to attract new partners is aided by being able to provide partners access to our existing CareCredit account holder base. During 2024 over 210,000 provider and retail locations either processed a CareCredit application or made a sale on a CareCredit credit card, and our CareCredit provider locator averaged over 1.9 million views per month during the year ended December 31, 2024.

| | | | | | | | |

2024 Partner Agreements: |

New partnerships: | • Bond Veterinary | • Pet Paradise |

• Lakefield Veterinary Group | • Western Veterinary |

• LaserAway |

|

| Extensions: | • Bosley | • LCA Vision |

• HearingLife | • SCI |

• Innovetive | • Suveto |

During the year ended December 31, 2024 we also launched the integration of our CareCredit credit card with Pets Best, which is part of Independence Pet Holdings, Inc., to enable direct insurance claim reimbursement for customers.

Lifestyle

Lifestyle provides comprehensive payments and financing solutions with integrated in-store and digital experiences through partners and merchants who offer merchandise in power sports, outdoor power equipment, and other industries such as sporting goods, apparel, jewelry and music. We create customized credit programs for national and regional retailers, manufacturers, and industry associations. Credit extended in this platform, other than for our apparel and sporting goods retail partners, is primarily promotional financing. With our large retail partners, we continue to drive penetration and everyday use through strong partner alignment, competitive value propositions, and embedding our products in the digital experience. Lifestyle accounted for $1.1 billion, or 5%, of our total interest and fees on loans for the year ended December 31, 2024.

Lifestyle Partners

Our Lifestyle sales platform partners include a wide range of key retailers in the apparel, specialty retail, outdoor, music and luxury industry, such as American Eagle, Dick's Sporting Goods, Guitar Center, Kawasaki, Pandora, Polaris, Suzuki and Sweetwater.

At December 31, 2024, the length of our relationship with each of our five largest partners was approximately 10 years or longer, and in the case of American Eagle, 28 years.

| | | | | | | | |

2024 Partner Agreements: |

| New partnerships: | • BRP | • Gibson |

| Program extensions: | • CF Moto | • EC Barton |

• Daniel's | • Reeds |

• Dick's Sporting Goods |

|

Corp, Other

Corp, Other includes activity and balances related to certain program agreements with retail partners and merchants that will not be renewed beyond their current expiration date and certain programs that were previously terminated, which are not managed within the five sales platforms discussed above. Corp, Other also includes amounts related to changes in the fair value of equity investments and realized gains or losses associated with the sale of businesses and investments.

Our Partner Agreements

____________________________________________________________________________________________

Revenue

Our revenue we earn from our agreements with our partners primarily consists of interest and fees on our loan receivables, and in our program agreements that contain promotional financing, includes “merchant discounts,” which are fees paid to us by our partners in almost all cases to compensate us for all or part of the foregone interest income associated with promotional financing. We offer promotional financing across all five of our sales platforms.

The types of promotional financing we offer includes deferred interest (interest accrues during a promotional period and becomes payable if the full purchase amount is not paid off during the promotional period), no interest (no interest on a promotional purchase) and reduced interest (interest is assessed monthly at a promotional interest rate during the promotional period). As a result, during the promotional period we do not generate interest income or generate it at a lower rate, although we continue to generate fee income relating to late fees on required minimum payments. For these promotional financing offerings, we generally partner with sellers of “big-ticket” products or services or large basket transactions (generally priced from $500 to $25,000+) to consumers where our financing products and industry expertise provide strong incremental value to our partners and their customers. In addition to our revolving products, we also offer secured installment loans for certain large purchases, primarily for power sports and outdoor power equipment, and also offer unsecured installment loans primarily in our Home & Auto and Health & Wellness sales platforms and also through our other installment products, such as our Synchrony Pay in 4 product for short-term loans. We also promote our programs to sellers through direct marketing activities such as industry trade publications, trade shows and sales efforts by dedicated internal and external sales teams, leveraging our existing partner network or through endorsements through manufacturers and industry associations. Our broad array of point-of-sale technologies and quick enrollment process allow us to quickly and effectively integrate new partners and providers.

Our five largest programs based upon interest and fees on loans for the year ended December 31, 2024, were Amazon, JCPenney, Lowe’s, PayPal and Sam’s Club. These programs accounted in aggregate for 54% of our total interest and fees on loans for the year ended December 31, 2024, and 51% of loan receivables at December 31, 2024. Our programs with Lowe's, PayPal, which includes our Venmo program, and Sam's Club, each accounted for more than 10% of our total interest and fees on loans for the year ended December 31, 2024. The length of our relationship with each of our five largest partners is over 17 years, and in the case of Lowe's, 45 years. During the year ended December 31, 2024 we extended our program agreement with JCPenney and in January 2025 we extended our program agreement with Sam's Club. The current expiration dates for program agreements with our five largest partners range from 2026 through 2034.

Other income related to our program agreements primarily consists of interchange fees, fees paid to us by customers who purchase our Payment Security product and other customer-related fees, such as paper statement fees, less costs incurred related to loyalty programs that we operate for a number of our partners. Interchange fees are earned when our Dual Card credit cards are used outside of our partners’ sales channels, and from transactions using our general purpose co-branded credit cards.

Program Agreements

Our private label credit cards, Dual Cards, co-branded credit card and installment programs for our retail and digital partners are typically governed by program agreements that are each negotiated separately with our partners. Although the terms of the agreements are partner-specific, and may be amended from time to time, under a typical program agreement, our partner agrees to support and promote the program to its customers, but we control credit criteria and issue products to customers who qualify under those criteria. We own the underlying accounts and all loan receivables generated under the program from the time of origination. Other key provisions in our program agreements include:

Term

Our program agreements typically have contract terms ranging from approximately three to ten years. Many program agreements have renewal clauses that provide for automatic renewal for one or more years until terminated by us or our partner. We typically seek to renew the program agreements well in advance of their termination dates. Some program agreements are subject to termination prior to the scheduled termination date by us or our partner for various reasons. See Termination below for additional information.

Exclusivity

Our program agreements are typically exclusive for the products we offer and limit our partners’ ability to originate or promote other private label or co-branded credit cards during the term of the agreement. The terms of our program agreements with national and regional retailers and manufacturers are typically similar to the terms of our program agreements in that we are the exclusive provider of financing for the products we offer, or in the case of some of our programs, may allow to have several primary lenders. Some program agreements, however, allow the merchant to use a second source lender after an application has been submitted to us and declined.

Retailer Share Arrangements

Most of our program agreements with large retail and certain other partners contain retailer share arrangements that provide for payments to our partner if the economic performance of the program exceeds a contractually-defined threshold. Economic performance for the purposes of these arrangements is typically measured based on agreed upon program revenues (including interest income and certain other income) less agreed upon program expenses (including interest expense, provision for credit losses, retailer payments and operating expenses). We may also provide other economic benefits to our partners such as royalties on purchase volume or payments for new accounts, in some cases instead of retailer share arrangements (for example, on our co-branded credit cards). All of these arrangements are intended to align our interests and provide an additional incentive to our partners to promote our credit products.

Certain program agreements set forth the program’s economic terms, including the merchant discount applicable to each promotional finance offering for credit card and installment loans. We typically do not pay fees to these partners pursuant to any retailer share arrangements, but in some cases we pay a sign-up fee to a partner or provide volume-based rebates on the merchant discount paid by the partner.

Other Economic Terms