4Q'23 FINANCIAL RESULTS January 23, 2024 Exhibit 99.3

2 Cautionary Statement Regarding Forward-Looking Statements The following slides are part of a presentation by Synchrony Financial in connection with reporting quarterly financial results. No representation is made that the information in these slides is complete. For additional information, see the earnings release and financial supplement included as exhibits to our Current Report on Form 8-K filed today and available on our website (www.synchronyfinancial.com) and the SEC's website (www.sec.gov). All references to net earnings and net income are intended to have the same meaning. All comparisons are for the fourth quarter of 2023 compared to the fourth quarter of 2022, unless otherwise noted. This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as "expects," "intends," "anticipates," "plans," "believes," "seeks," "targets," "outlook," "estimates," "will," "should," "may" or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward- looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our revenue in a small number of partners, and promotion and support of our products by our partners; cyber-attacks or other security breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the Consumer Financial Protection Bureau’s (the “CFPB”) proposed rule on credit card late fees, if adopted; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions, dispositions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislative and regulatory developments and the impact of the CFPB’s regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti- terrorism financing laws. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in our public filings, including under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed on February 9, 2023. You should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Disclaimers

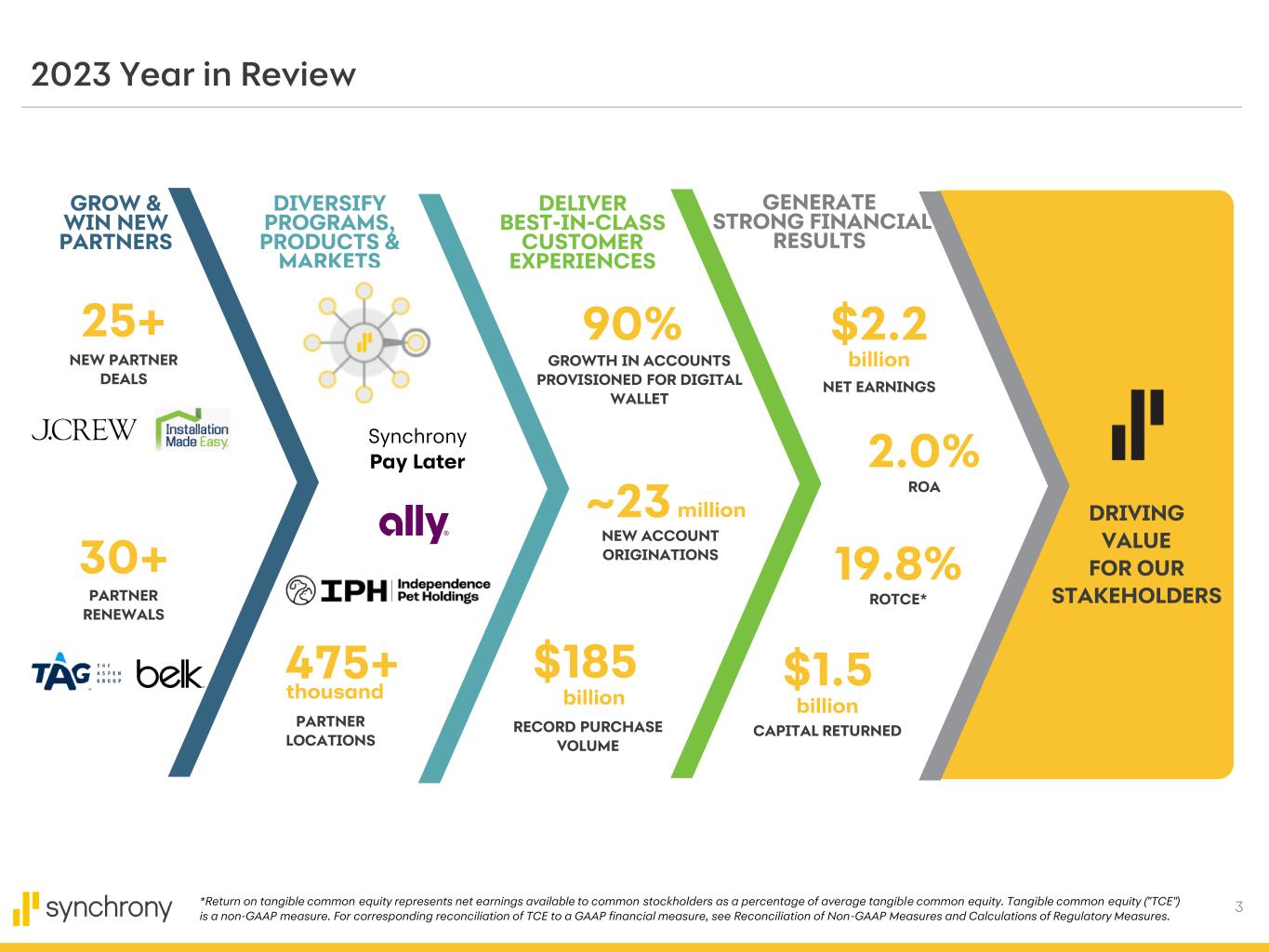

3 2023 Year in Review GENERATE STRONG FINANCIAL RESULTS DIVERSIFY PROGRAMS, PRODUCTS & MARKETS GROW & WIN NEW PARTNERS DELIVER BEST-IN-CLASS CUSTOMER EXPERIENCES 25+ NEW PARTNER DEALS ~23 NEW ACCOUNT ORIGINATIONS30+ PARTNER RENEWALS ROTCE* ROA NET EARNINGS $185 RECORD PURCHASE VOLUME CAPITAL RETURNED DRIVING VALUE FOR OUR STAKEHOLDERS *Return on tangible common equity represents net earnings available to common stockholders as a percentage of average tangible common equity. Tangible common equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. 475+ million billion $2.2 billion 2.0% 19.8% $1.5 billion 90% GROWTH IN ACCOUNTS PROVISIONED FOR DIGITAL WALLET PARTNER LOCATIONS thousand Synchrony Pay Later

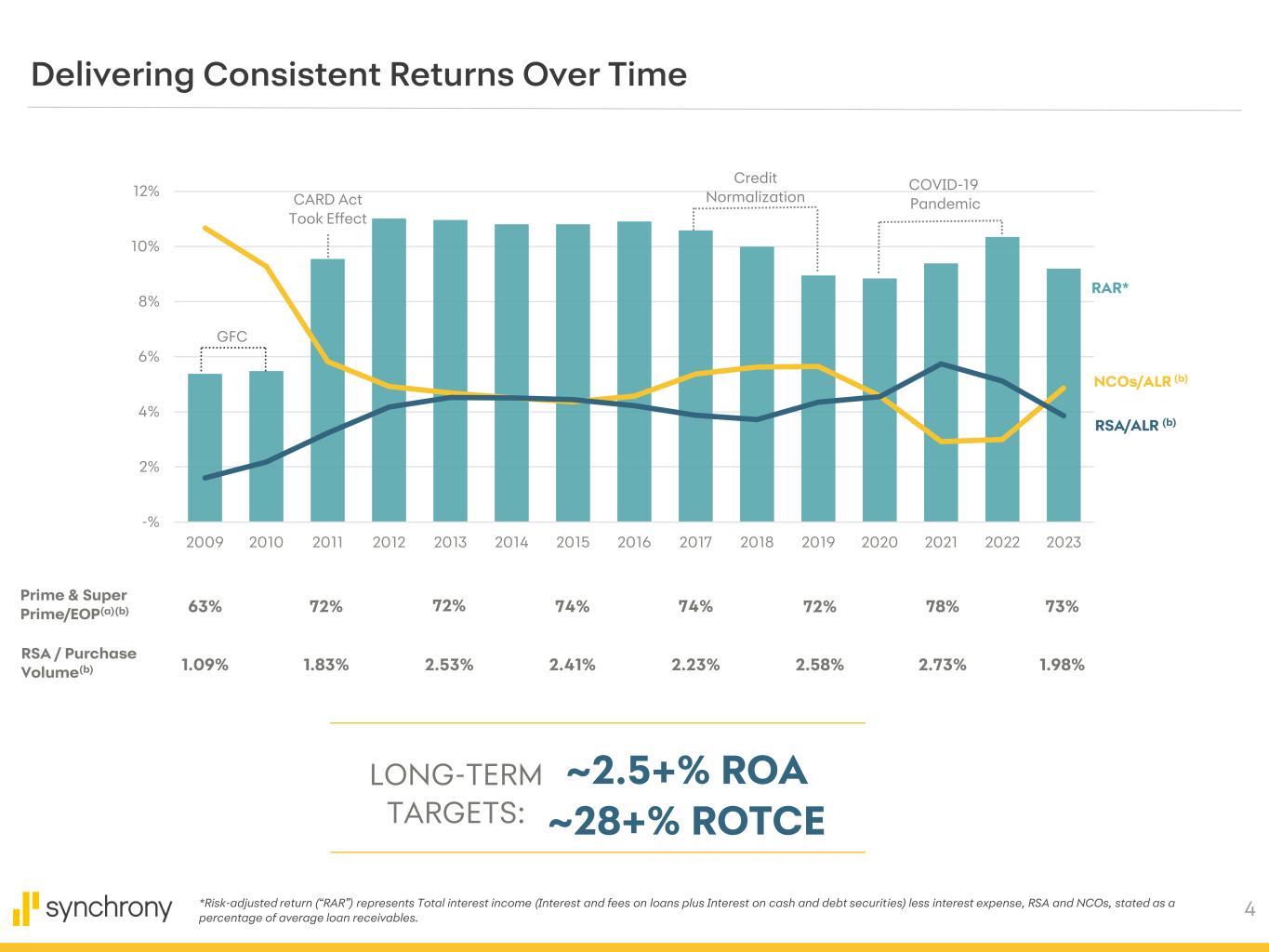

4 -% 2% 4% 6% 8% 10% 12% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 ~2.5+% ROA ~28+% ROTCE RSA / Purchase Volume(b) Prime & Super Prime/EOP(a)(b) 74% 72% 78%72% 72% 74%63% 73% 1.09% 1.83% 2.53% 2.41% 2.23% 2.58% 2.73% 1.98% RAR* RSA/ALR (b) NCOs/ALR (b) LONG-TERM TARGETS: GFC CARD Act Took Effect Credit Normalization COVID-19 Pandemic *Risk-adjusted return (“RAR”) represents Total interest income (Interest and fees on loans plus Interest on cash and debt securities) less interest expense, RSA and NCOs, stated as a percentage of average loan receivables. Delivering Consistent Returns Over Time

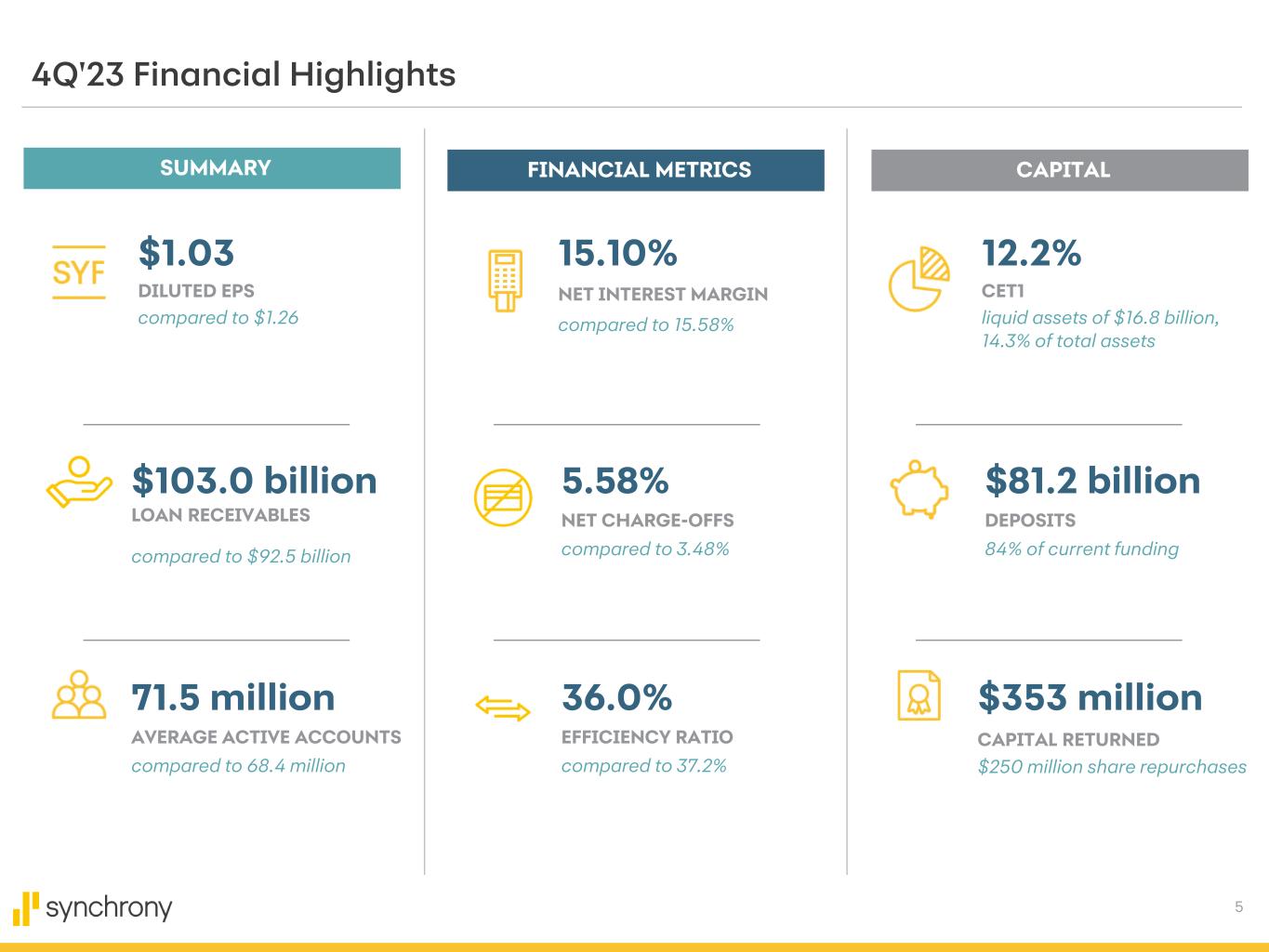

5 $1.03 DILUTED EPS compared to $1.26 15.10% NET INTEREST MARGIN compared to 15.58% 12.2% CET1 liquid assets of $16.8 billion, 14.3% of total assets SUMMARY FINANCIAL METRICS CAPITAL 4Q'23 Financial Highlights $103.0 billion LOAN RECEIVABLES compared to $92.5 billion $81.2 billion DEPOSITS 84% of current funding 5.58% NET CHARGE-OFFS compared to 3.48% 71.5 million AVERAGE ACTIVE ACCOUNTS compared to 68.4 million $353 million CAPITAL RETURNED $250 million share repurchases 36.0% EFFICIENCY RATIO compared to 37.2%

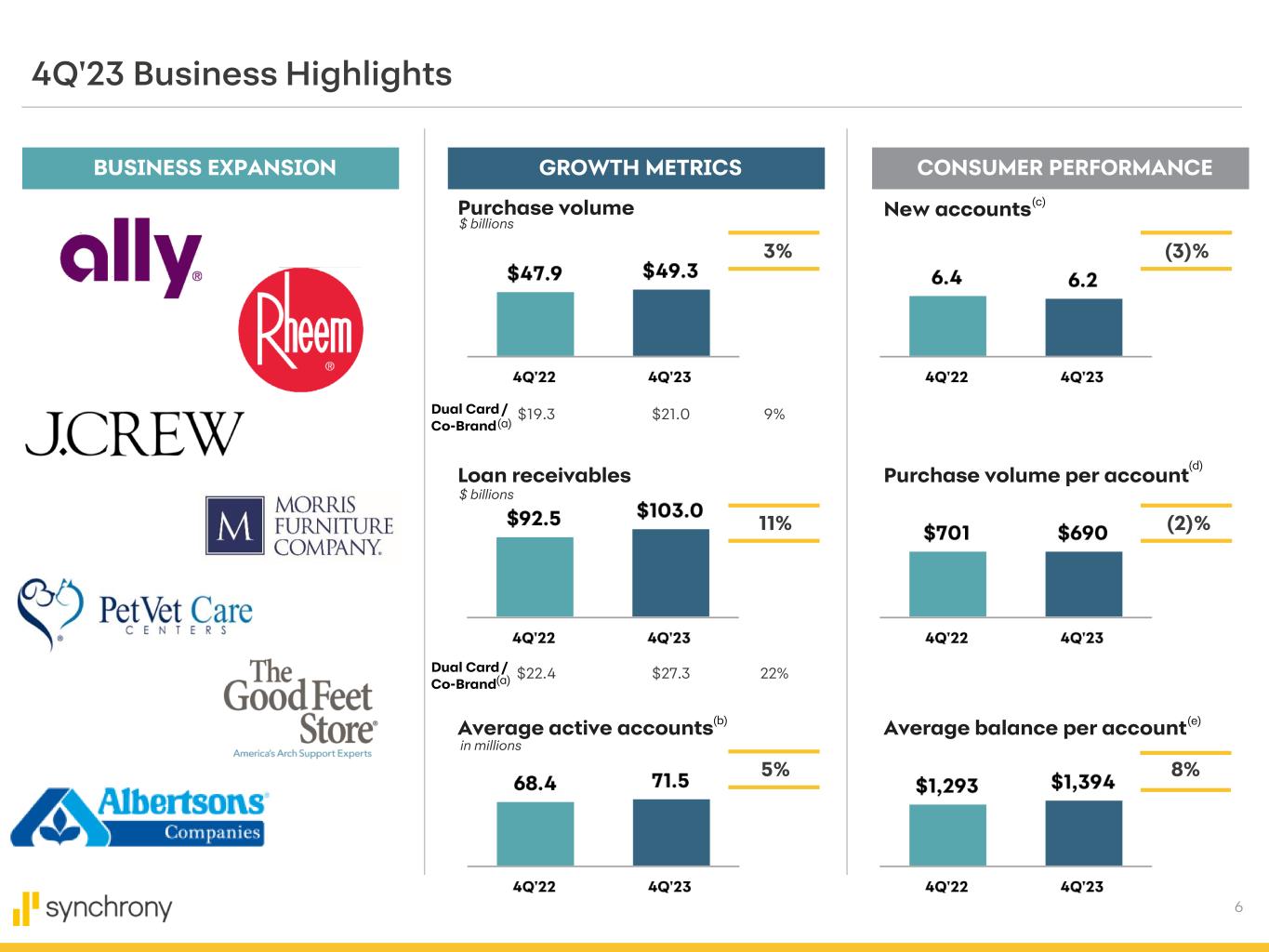

6 11% 8% Dual Card / Co-Brand BUSINESS EXPANSION CONSUMER PERFORMANCE (3)% (2)% New accounts Average balance per account (c) (e) GROWTH METRICS 3% 5% Purchase volume Average active accounts $22.4 Loan receivables Dual Card / Co-Brand in millions $19.3 9%$21.0 $ billions $27.3 $ billions 4Q'23 Business Highlights 22% Purchase volume per account (a) (a) (d) (b)

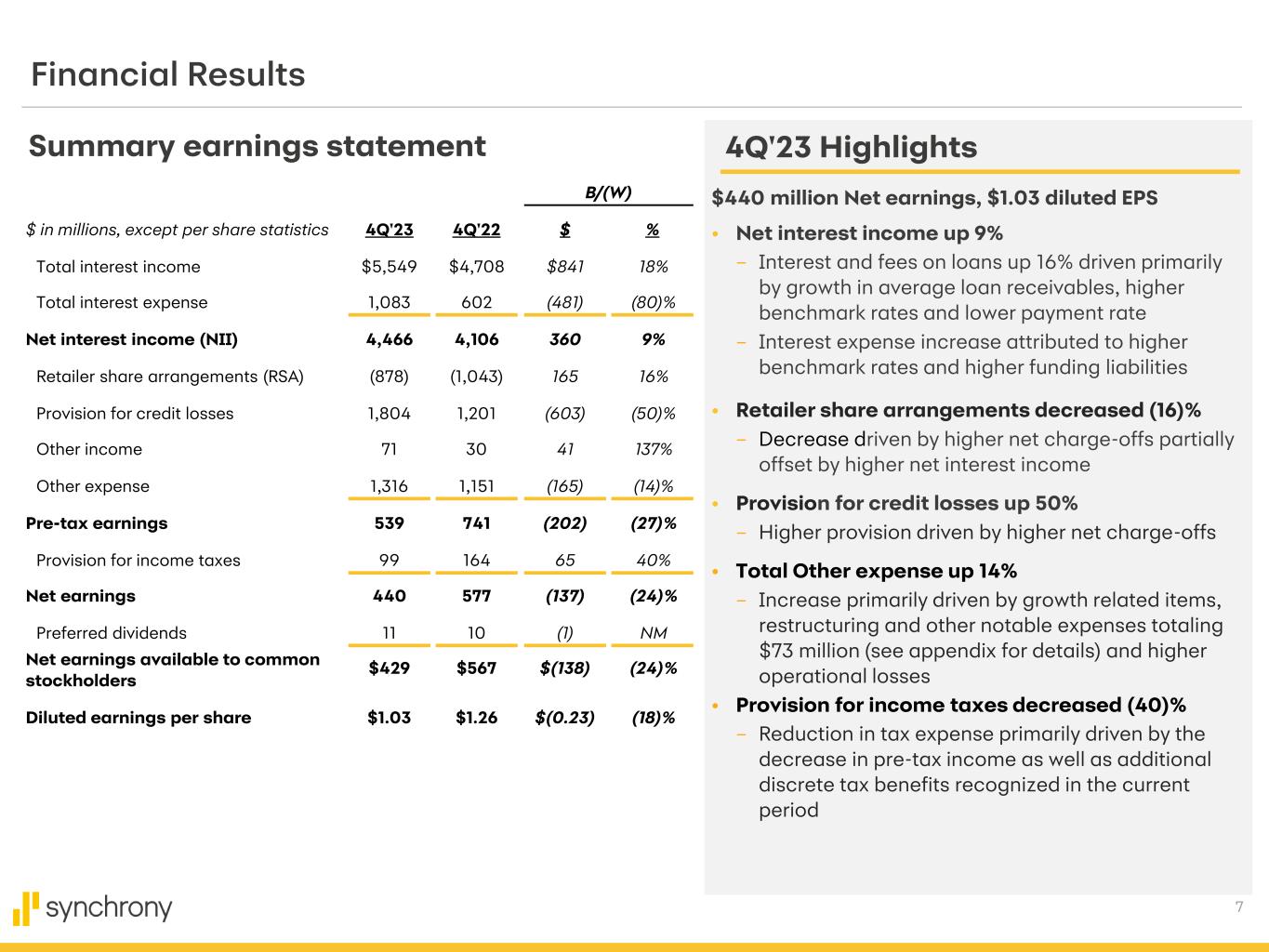

7 B/(W) $ in millions, except per share statistics 4Q'23 4Q'22 $ % Total interest income $5,549 $4,708 $841 18% Total interest expense 1,083 602 (481) (80)% Net interest income (NII) 4,466 4,106 360 9% Retailer share arrangements (RSA) (878) (1,043) 165 16% Provision for credit losses 1,804 1,201 (603) (50)% Other income 71 30 41 137% Other expense 1,316 1,151 (165) (14)% Pre-tax earnings 539 741 (202) (27)% Provision for income taxes 99 164 65 40% Net earnings 440 577 (137) (24)% Preferred dividends 11 10 (1) NM Net earnings available to common stockholders $429 $567 $(138) (24)% Diluted earnings per share $1.03 $1.26 $(0.23) (18)% Summary earnings statement Financial Results 4Q'23 Highlights $440 million Net earnings, $1.03 diluted EPS • Net interest income up 9% – Interest and fees on loans up 16% driven primarily by growth in average loan receivables, higher benchmark rates and lower payment rate – Interest expense increase attributed to higher benchmark rates and higher funding liabilities • Retailer share arrangements decreased (16)% – Decrease driven by higher net charge-offs partially offset by higher net interest income • Provision for credit losses up 50% – Higher provision driven by higher net charge-offs • Total Other expense up 14% – Increase primarily driven by growth related items, restructuring and other notable expenses totaling $73 million (see appendix for details) and higher operational losses • Provision for income taxes decreased (40)% – Reduction in tax expense primarily driven by the decrease in pre-tax income as well as additional discrete tax benefits recognized in the current period

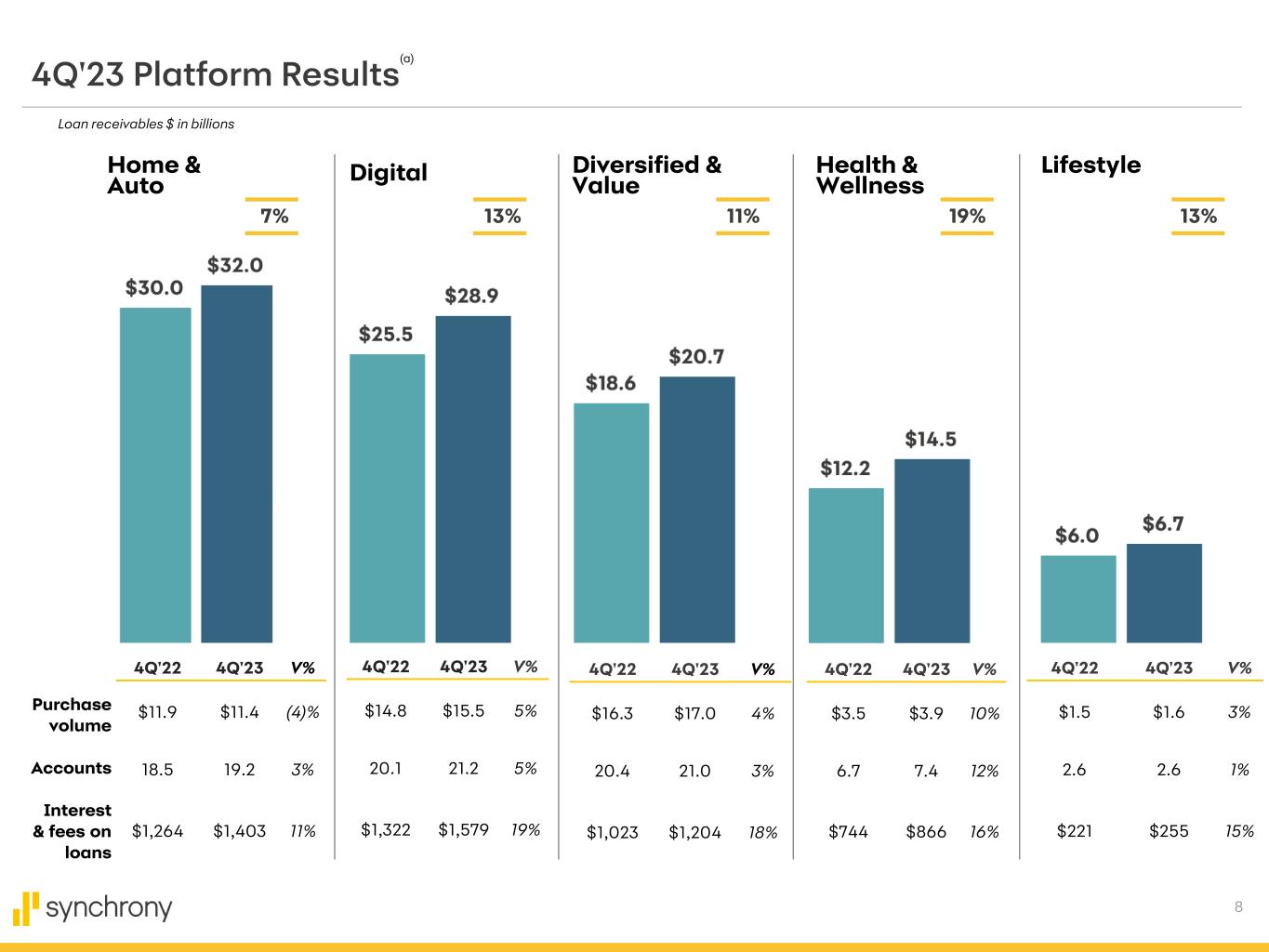

8 13%19%11%13%7% 4Q'23 Platform Results Home & Auto Digital Diversified & Value Health & Wellness Lifestyle 4Q'22 4Q'23 V% $11.9 $11.4 (4)% 18.5 19.2 3% $1,264 $1,403 11% 4Q'22 4Q'23 V% $14.8 $15.5 5% 20.1 21.2 5% $1,322 $1,579 19% 4Q'22 4Q'23 V% $16.3 $17.0 4% 20.4 21.0 3% $1,023 $1,204 18% 4Q'22 4Q'23 V% $3.5 $3.9 10% 6.7 7.4 12% $744 $866 16% 4Q'22 4Q'23 V% $1.5 $1.6 3% 2.6 2.6 1% $221 $255 15% Loan receivables $ in billions Purchase volume Accounts Interest & fees on loans (a)

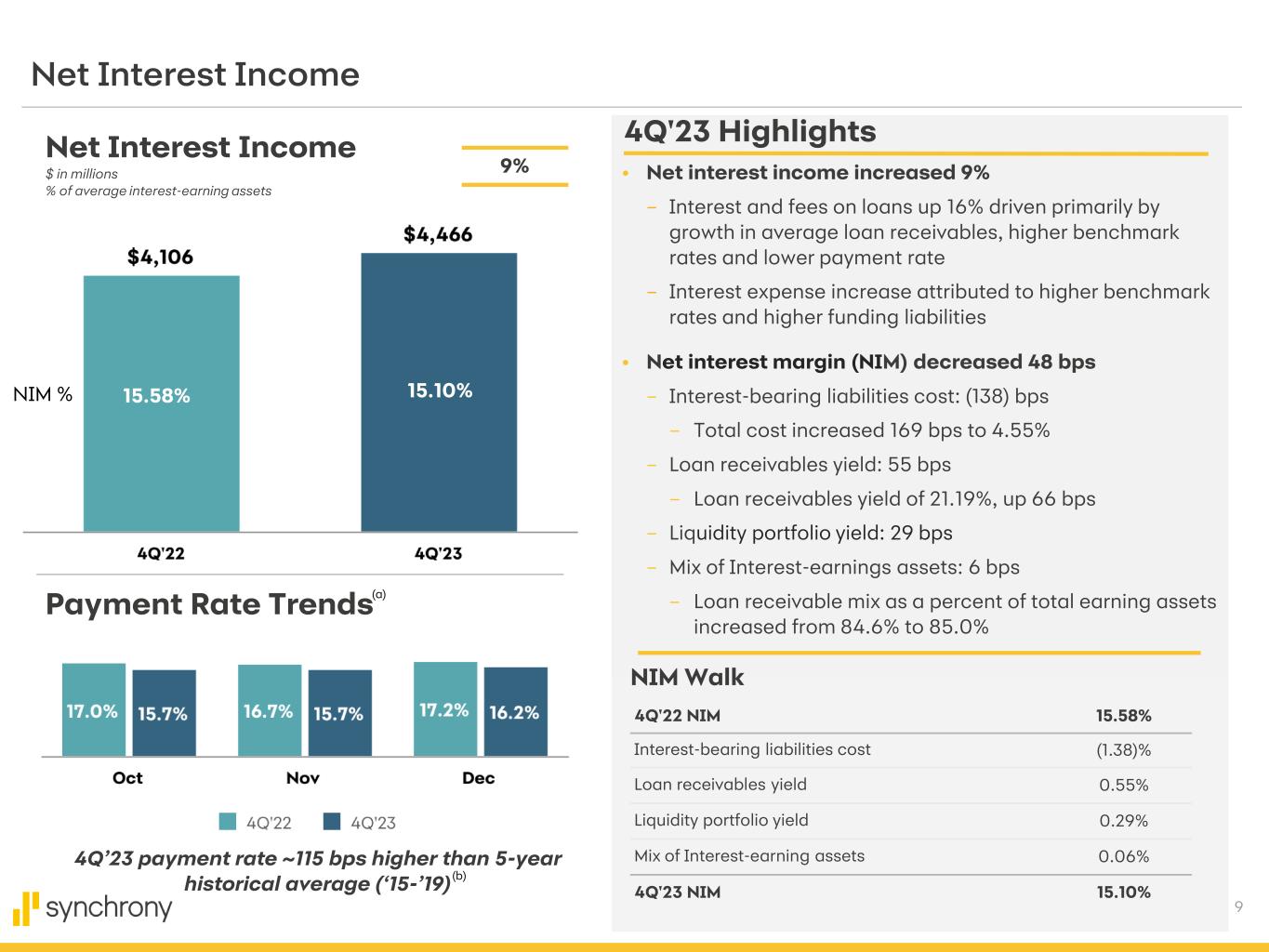

9 4Q’23 payment rate ~115 bps higher than 5-year historical average (‘15-’19) Payment Rate Trends Net Interest Income Net Interest Income $ in millions % of average interest-earning assets NIM Walk 9% 4Q'22 NIM 15.58% Interest-bearing liabilities cost (1.38)% Loan receivables yield 0.55% Liquidity portfolio yield 0.29% Mix of Interest-earning assets 0.06% 4Q'23 NIM 15.10% 4Q'23 Highlights (a) (b) • Net interest income increased 9% – Interest and fees on loans up 16% driven primarily by growth in average loan receivables, higher benchmark rates and lower payment rate – Interest expense increase attributed to higher benchmark rates and higher funding liabilities • Net interest margin (NIM) decreased 48 bps – Interest-bearing liabilities cost: (138) bps – Total cost increased 169 bps to 4.55% – Loan receivables yield: 55 bps – Loan receivables yield of 21.19%, up 66 bps – Liquidity portfolio yield: 29 bps – Mix of Interest-earnings assets: 6 bps – Loan receivable mix as a percent of total earning assets increased from 84.6% to 85.0% 15.58% 15.10%NIM %

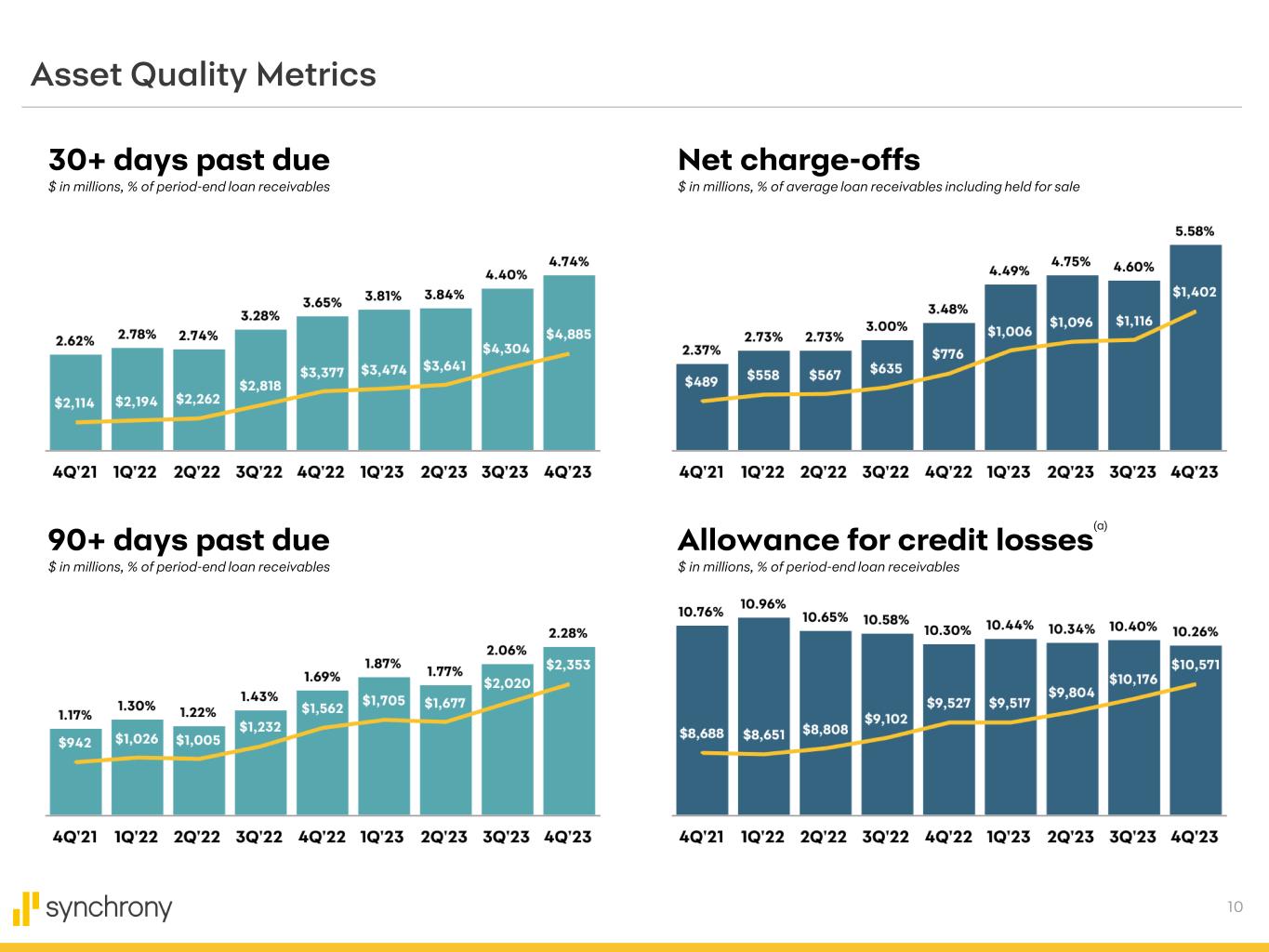

10 Asset Quality Metrics Allowance for credit losses $ in millions, % of period-end loan receivables Net charge-offs $ in millions, % of average loan receivables including held for sale 30+ days past due $ in millions, % of period-end loan receivables 90+ days past due $ in millions, % of period-end loan receivables (a)

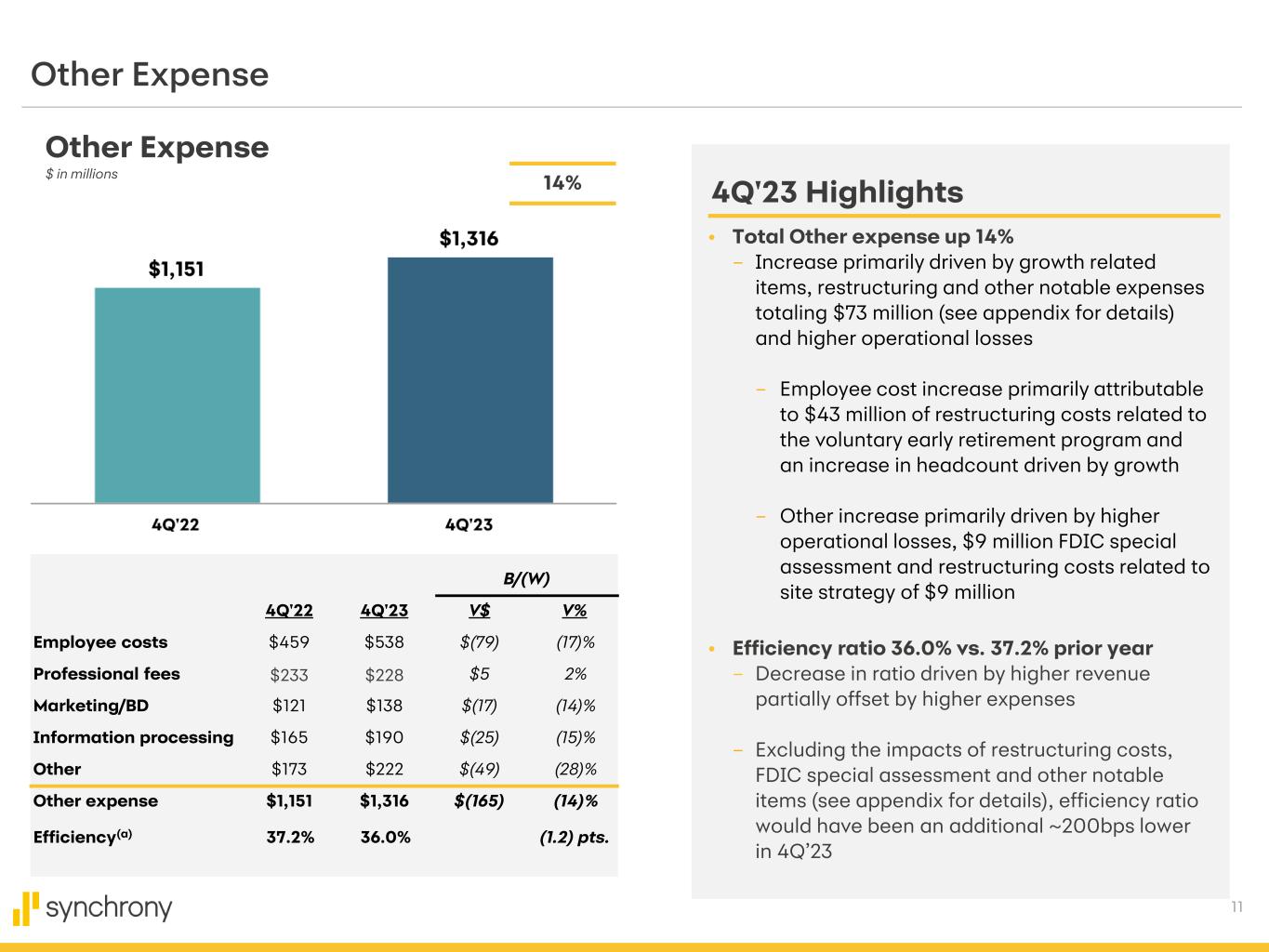

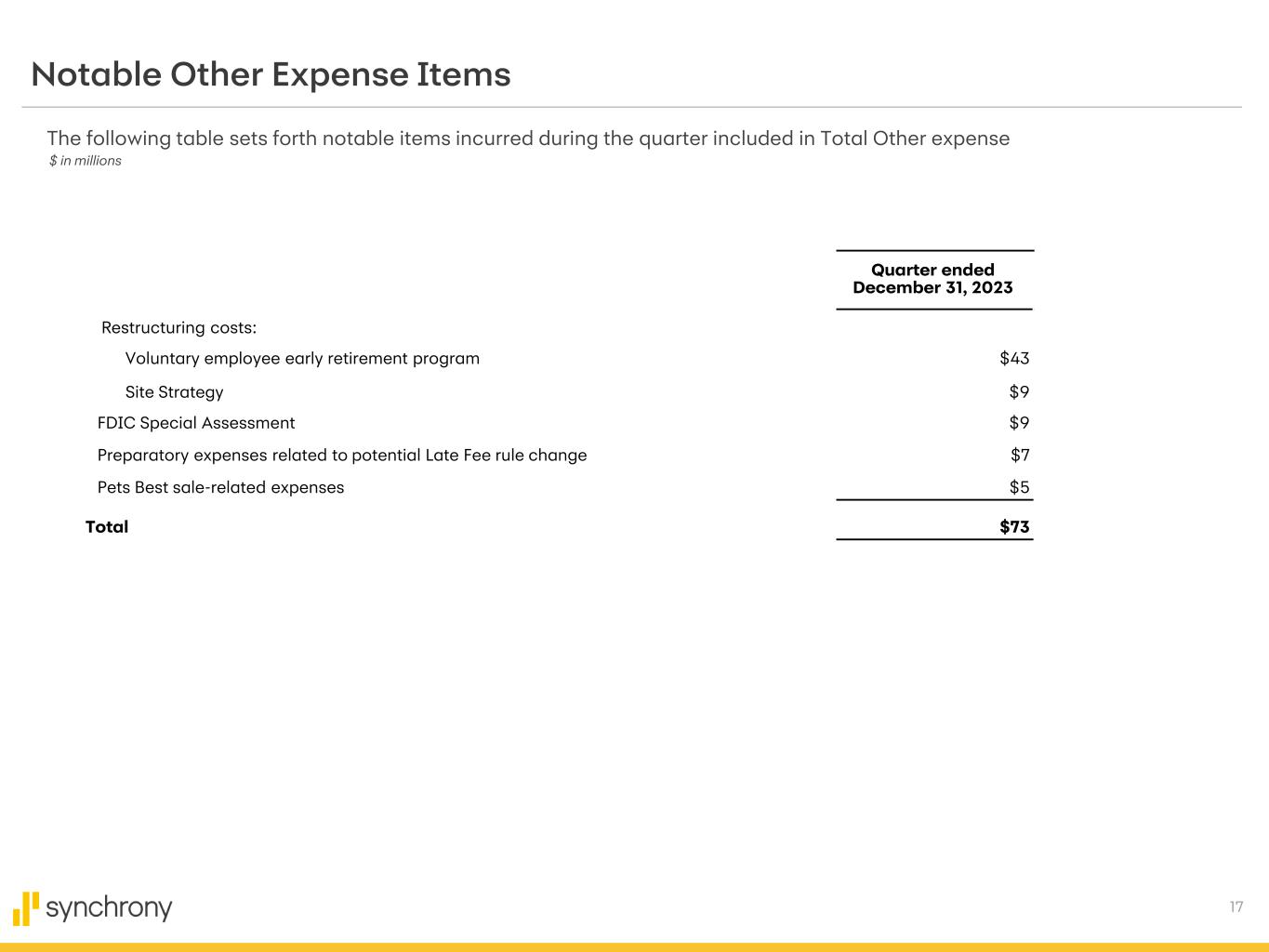

11 B/(W) 4Q'22 4Q'23 V$ V% Employee costs $459 $538 $(79) (17)% Professional fees $233 $228 $5 2% Marketing/BD $121 $138 $(17) (14)% Information processing $165 $190 $(25) (15)% Other $173 $222 $(49) (28)% Other expense $1,151 $1,316 $(165) (14)% Efficiency(a) 37.2% 36.0% (1.2) pts. Other Expense Other Expense $ in millions 4Q'23 Highlights14% • Total Other expense up 14% – Increase primarily driven by growth related items, restructuring and other notable expenses totaling $73 million (see appendix for details) and higher operational losses – Employee cost increase primarily attributable to $43 million of restructuring costs related to the voluntary early retirement program and an increase in headcount driven by growth – Other increase primarily driven by higher operational losses, $9 million FDIC special assessment and restructuring costs related to site strategy of $9 million • Efficiency ratio 36.0% vs. 37.2% prior year – Decrease in ratio driven by higher revenue partially offset by higher expenses – Excluding the impacts of restructuring costs, FDIC special assessment and other notable items (see appendix for details), efficiency ratio would have been an additional ~200bps lower in 4Q’23

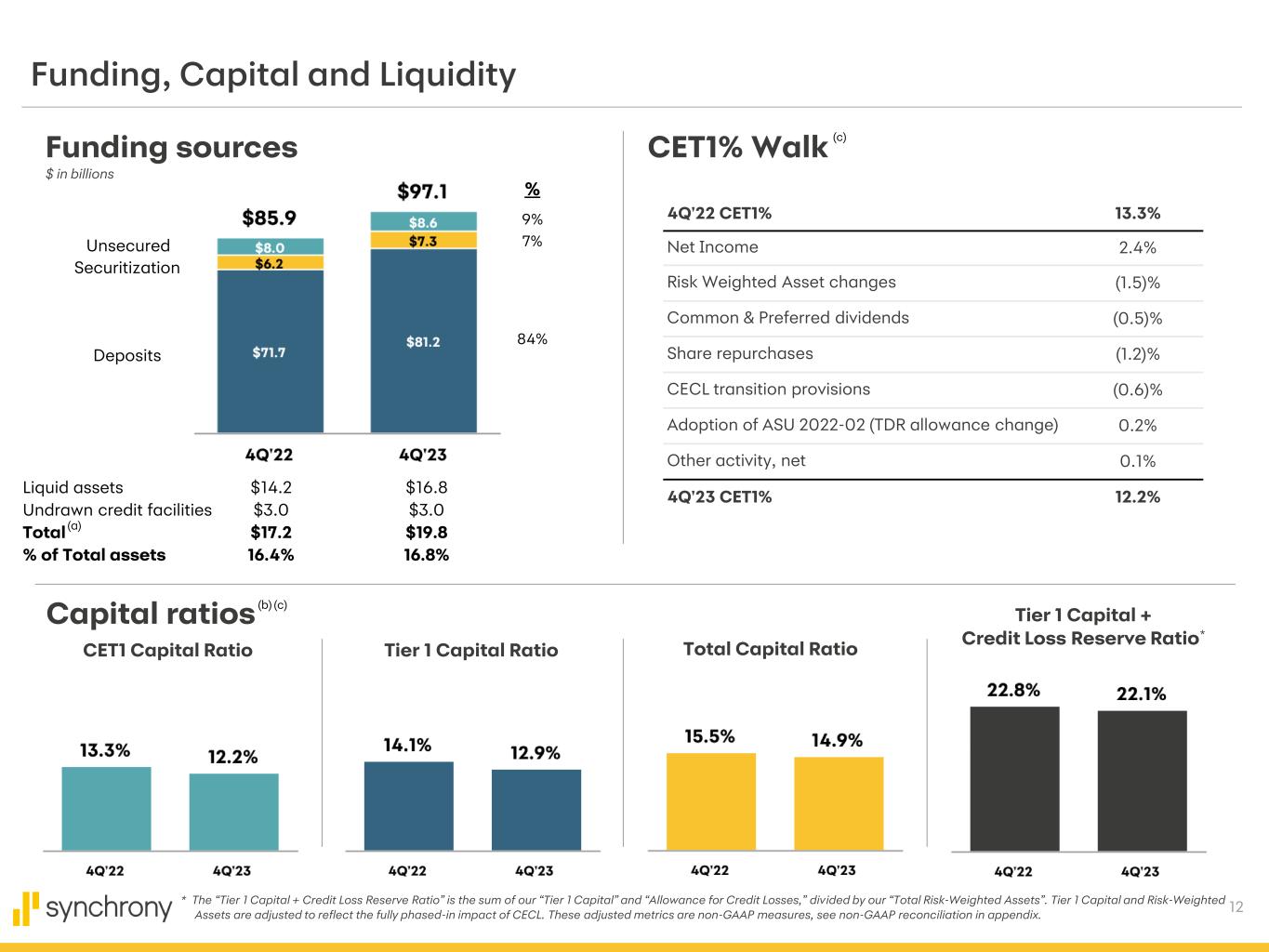

12 Tier 1 Capital + Credit Loss Reserve Ratio* Capital ratios Funding, Capital and Liquidity Funding sources $ in billions % 9% 7% CET1% Walk CET1 Capital Ratio Tier 1 Capital Ratio Total Capital Ratio * The “Tier 1 Capital + Credit Loss Reserve Ratio” is the sum of our “Tier 1 Capital” and “Allowance for Credit Losses,” divided by our “Total Risk-Weighted Assets”. Tier 1 Capital and Risk-Weighted Assets are adjusted to reflect the fully phased-in impact of CECL. These adjusted metrics are non-GAAP measures, see non-GAAP reconciliation in appendix. Unsecured Securitization Deposits Liquid assets $14.2 $16.8 Undrawn credit facilities $3.0 $3.0 Total $17.2 $19.8 % of Total assets 16.4% 16.8% (b) (c) 84% 4Q'22 CET1% 13.3% Net Income 2.4% Risk Weighted Asset changes (1.5)% Common & Preferred dividends (0.5)% Share repurchases (1.2)% CECL transition provisions (0.6)% Adoption of ASU 2022-02 (TDR allowance change) 0.2% Other activity, net 0.1% 4Q'23 CET1% 12.2% (c) (a)

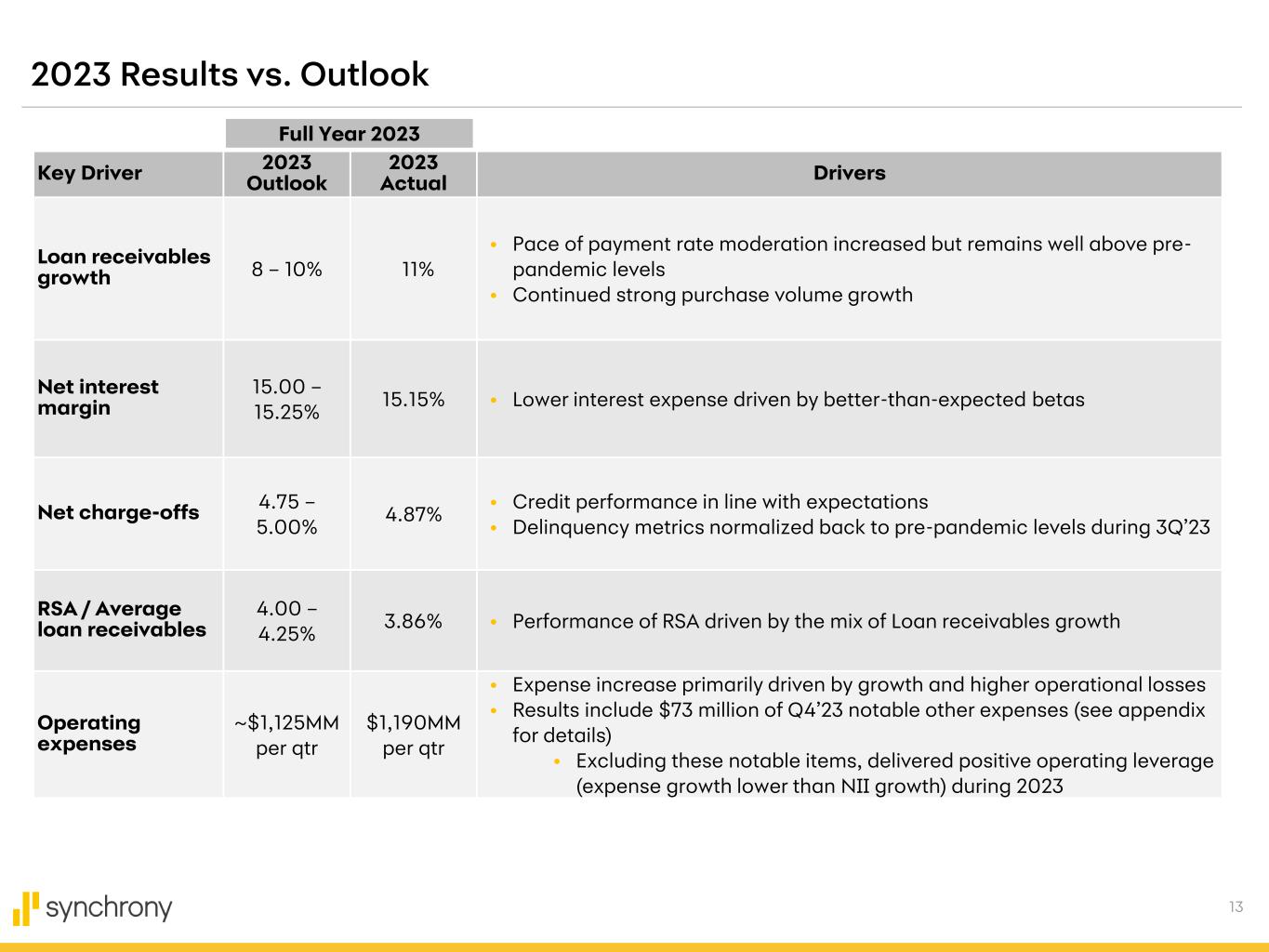

13 2023 Results vs. Outlook Key Driver 2023 Outlook 2023 Actual Drivers Loan receivables growth 8 – 10% 11% • Pace of payment rate moderation increased but remains well above pre- pandemic levels • Continued strong purchase volume growth Net interest margin 15.00 – 15.25% 15.15% • Lower interest expense driven by better-than-expected betas Net charge-offs 4.75 – 5.00% 4.87% • Credit performance in line with expectations • Delinquency metrics normalized back to pre-pandemic levels during 3Q’23 RSA / Average loan receivables 4.00 – 4.25% 3.86% • Performance of RSA driven by the mix of Loan receivables growth Operating expenses ~$1,125MM per qtr $1,190MM per qtr • Expense increase primarily driven by growth and higher operational losses • Results include $73 million of Q4’23 notable other expenses (see appendix for details) • Excluding these notable items, delivered positive operating leverage (expense growth lower than NII growth) during 2023 Full Year 2023

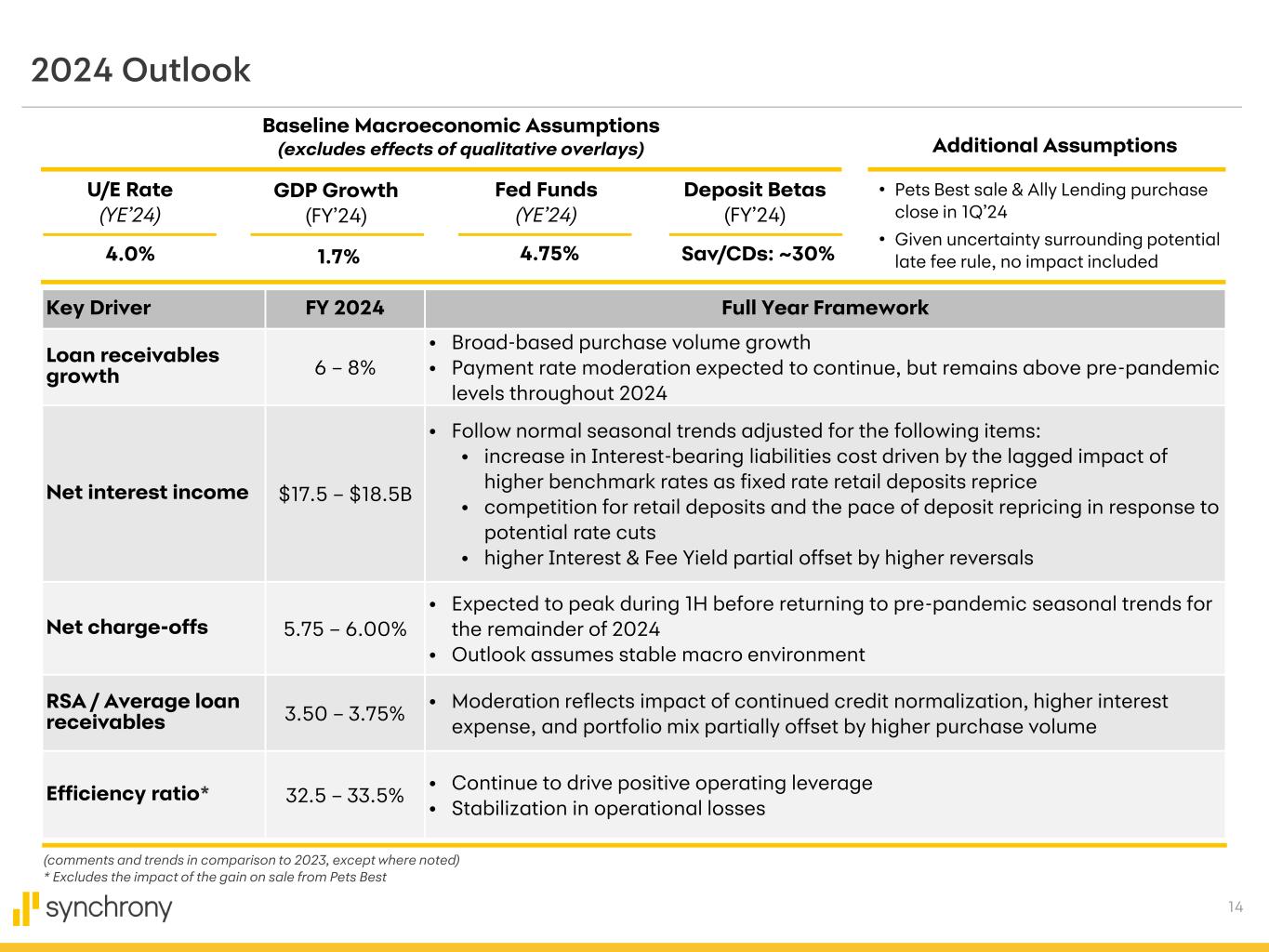

14 2024 Outlook Key Driver FY 2024 Full Year Framework Loan receivables growth 6 – 8% • Broad-based purchase volume growth • Payment rate moderation expected to continue, but remains above pre-pandemic levels throughout 2024 Net interest income $17.5 – $18.5B • Follow normal seasonal trends adjusted for the following items: • increase in Interest-bearing liabilities cost driven by the lagged impact of higher benchmark rates as fixed rate retail deposits reprice • competition for retail deposits and the pace of deposit repricing in response to potential rate cuts • higher Interest & Fee Yield partial offset by higher reversals Net charge-offs 5.75 – 6.00% • Expected to peak during 1H before returning to pre-pandemic seasonal trends for the remainder of 2024 • Outlook assumes stable macro environment RSA / Average loan receivables 3.50 – 3.75% • Moderation reflects impact of continued credit normalization, higher interest expense, and portfolio mix partially offset by higher purchase volume Efficiency ratio* 32.5 – 33.5% • Continue to drive positive operating leverage • Stabilization in operational losses (comments and trends in comparison to 2023, except where noted) * Excludes the impact of the gain on sale from Pets Best Baseline Macroeconomic Assumptions (excludes effects of qualitative overlays) U/E Rate (YE’24) Fed Funds (YE’24) Deposit Betas (FY’24) 4.0% 4.75% Sav/CDs: ~30% Additional Assumptions • Pets Best sale & Ally Lending purchase close in 1Q’24 • Given uncertainty surrounding potential late fee rule, no impact included GDP Growth (FY’24) 1.7%

15 All amounts and metrics included in this presentation are as of, or for the three months ended, December 31, 2023, unless otherwise stated. Delivering Consistent Returns Over Time a. Classification of Prime & Super Prime refers to VantageScore credit scores of 651 or higher for 2019-2023 and FICO scores of 661 or higher for periods prior to 2019. b. RSA/ALR refers to Retailer share arrangements as a percentage of Average loan receivables; NCO/ALR refers to Net charge-offs as a percentage of Average loan receivables; Prime & Super Prime/EOP refers to Prime & Super Prime Loan receivables as a percentage of total period-end Loan receivables; RSA/Purchase volume refers to Retailer share arrangements as a percentage of Purchase volume. 4Q'23 Business Highlights a. Dual Card / Co-Brand metrics are consumer only and include in-partner and out-of-partner activity. b. Average active accounts are credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. c. New accounts represent accounts that were approved in the respective period, in millions. d. Purchase volume per account is calculated as total Purchase volume divided by Average active accounts, in $. e. Average balance per account is calculated as the Average loan receivables divided by Average active accounts, in $. Platform Results a. Accounts represent Average active accounts in millions. Purchase volume $ in billions and Interest and fees on loans $ in millions. Net Interest Income: a. Payment rate is calculated as customer payments divided by beginning of period loan receivables. b. Historical payment rate excludes portfolios sold in 2019 and 2022. Asset Quality: a. Allowance for credit losses reflects the adoption of ASU 2022-22, “Financial Instruments - Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures” on January 1, 2023, which included a $294 million reduction to the allowance for credit losses upon adoption. Other Expense a. Efficiency ratio is calculated as Total Other expense divided by sum of Net interest income plus Other income less Retailer share arrangements (RSA). Funding, Capital and Liquidity a. Excludes available borrowing capacity related to unencumbered assets. b. Capital ratios reflect the phase-in of an estimate of CECL’s effect on regulatory capital over a three-year transitional period beginning in the first quarter of 2022, with effects fully phased-in beginning in the first quarter of 2025. CET1, Tier 1, and Total Capital Ratio are presented on a Transition basis and capital ratios for 2023 and 2022 reflect 50% and 25%, respectively, of the phase-in of CECL effects. c. Prior period amounts have been recast to reflect the change in presentation of contract costs related to our retailer partner agreements on our Statement of Financial Condition. See Exhibit 99.2 Financial Data Supplement of the Company for the quarter ended December 31, 2023, Statements of Financial Position for additional information. Footnotes

17 Notable Other Expense Items Quarter ended December 31, 2023 Restructuring costs: Voluntary employee early retirement program $43 Site Strategy $9 FDIC Special Assessment $9 Preparatory expenses related to potential Late Fee rule change $7 Pets Best sale-related expenses $5 Total $73 The following table sets forth notable items incurred during the quarter included in Total Other expense $ in millions

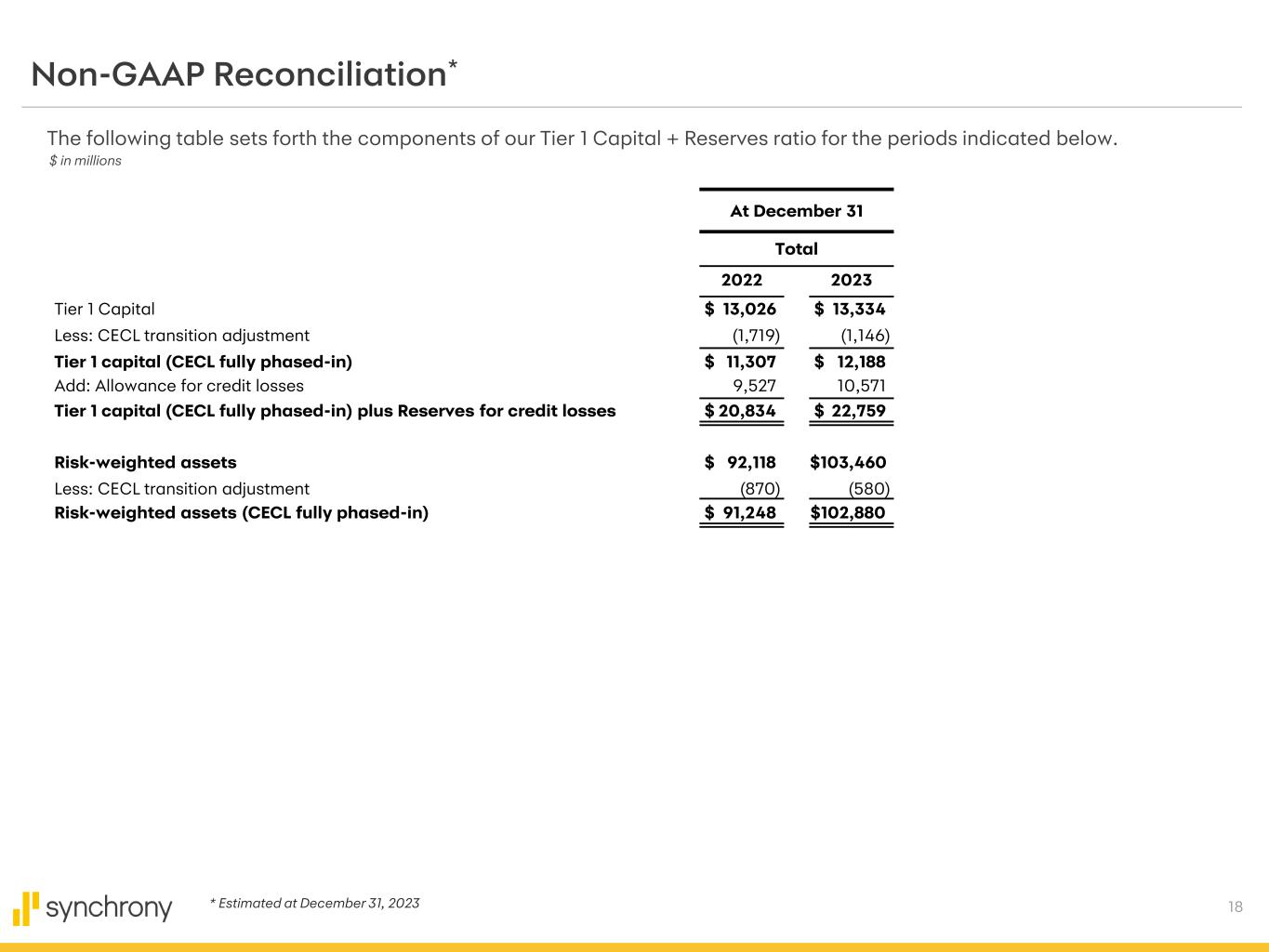

18 Non-GAAP Reconciliation* The following table sets forth the components of our Tier 1 Capital + Reserves ratio for the periods indicated below. $ in millions At December 31 Total 2022 2023 Tier 1 Capital $ 13,026 $ 13,334 Less: CECL transition adjustment (1,719) (1,146) Tier 1 capital (CECL fully phased-in) $ 11,307 $ 12,188 Add: Allowance for credit losses 9,527 10,571 Tier 1 capital (CECL fully phased-in) plus Reserves for credit losses $ 20,834 $ 22,759 Risk-weighted assets $ 92,118 $103,460 Less: CECL transition adjustment (870) (580) Risk-weighted assets (CECL fully phased-in) $ 91,248 $102,880 * Estimated at December 31, 2023

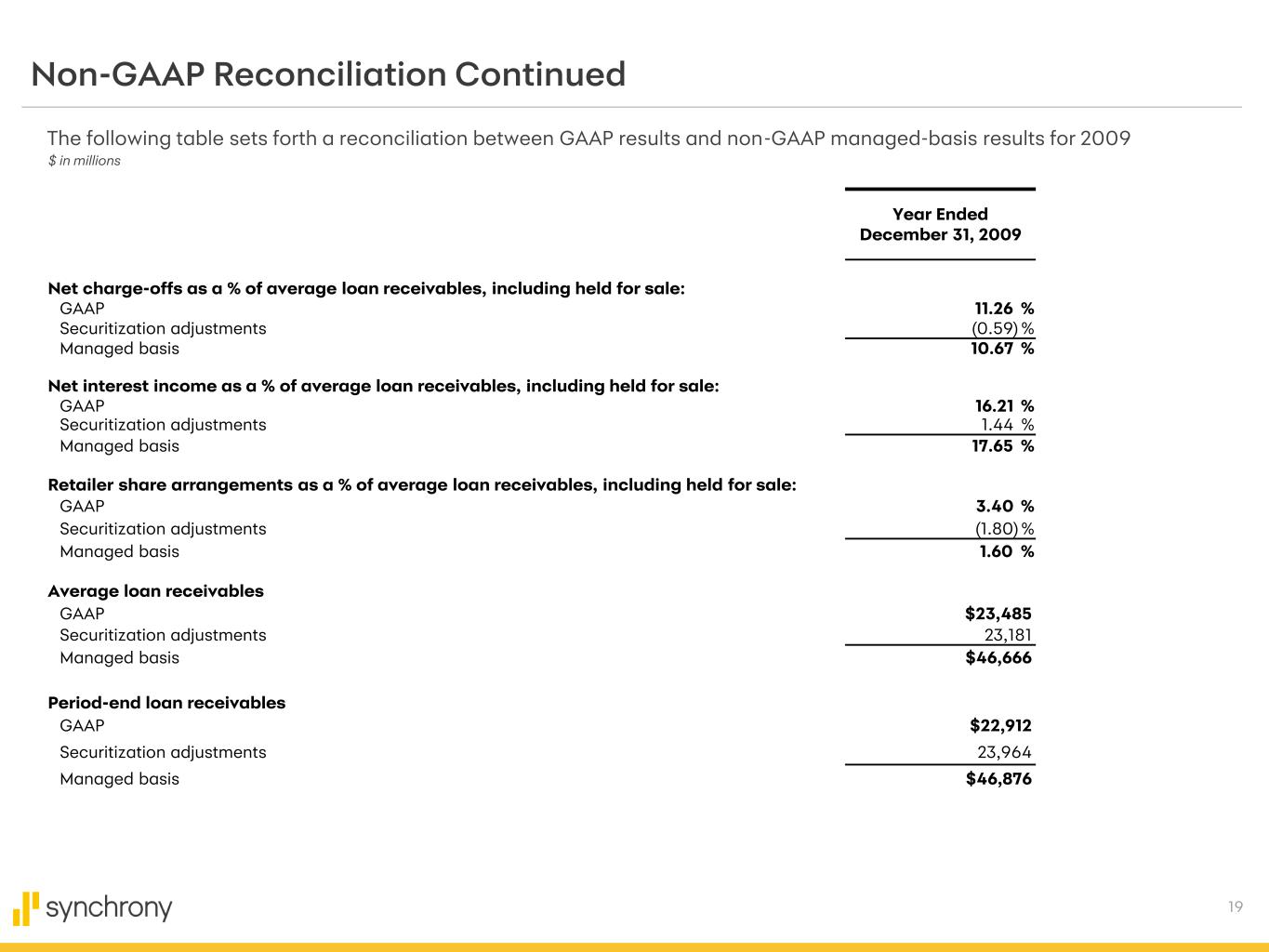

19 Non-GAAP Reconciliation Continued The following table sets forth a reconciliation between GAAP results and non-GAAP managed-basis results for 2009 $ in millions Year Ended December 31, 2009 Net charge-offs as a % of average loan receivables, including held for sale: GAAP 11.26 % Securitization adjustments (0.59) % Managed basis 10.67 % Net interest income as a % of average loan receivables, including held for sale: GAAP 16.21 % Securitization adjustments 1.44 % Managed basis 17.65 % Retailer share arrangements as a % of average loan receivables, including held for sale: GAAP 3.40 % Securitization adjustments (1.80) % Managed basis 1.60 % Average loan receivables GAAP $23,485 Securitization adjustments 23,181 Managed basis $46,666 Period-end loan receivables GAAP $22,912 Securitization adjustments 23,964 Managed basis $46,876