1 Investor Presentation February 2023 Exhibit 99.1

2 Disclaimers Cautionary Statement Regarding Forward-Looking Statements This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “outlook,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated, including the future impacts of the novel coronavirus disease (“COVID-19”) outbreak and measures taken in response thereto for which future developments are highly uncertain and difficult to predict; retaining existing partners and attracting new partners, concentration of our revenue in a small number of partners, and promotion and support of our products by our partners; cyber-attacks or other security breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third-parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and other legislative and regulatory developments and the impact of the Consumer Financial Protection Bureau’s (the “CFPB”) regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and antiterrorism financing laws. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in our public filings, including under the heading “Risk Factors Relating to Our Business” and “Risk Factors Relating to Regulation” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed on February 9, 2023. You should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Statistical and Other Data This presentation contains various statistical and other data relating to current and future market sizes and growth opportunities for Synchrony’s business and the industries in which Synchrony operates. These data were sourced from third parties and also Synchrony internal analysis and involve a number of assumptions and estimates. Although we believe the information sourced from third parties to be reliable, we have not independently verified such information and cannot guarantee its accuracy or completeness. In addition, all reference to cardholders and applications are for consumer only. Non-GAAP Measures The information provided in this presentation includes measures which are not prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). For a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures, please see the appendix that follows.

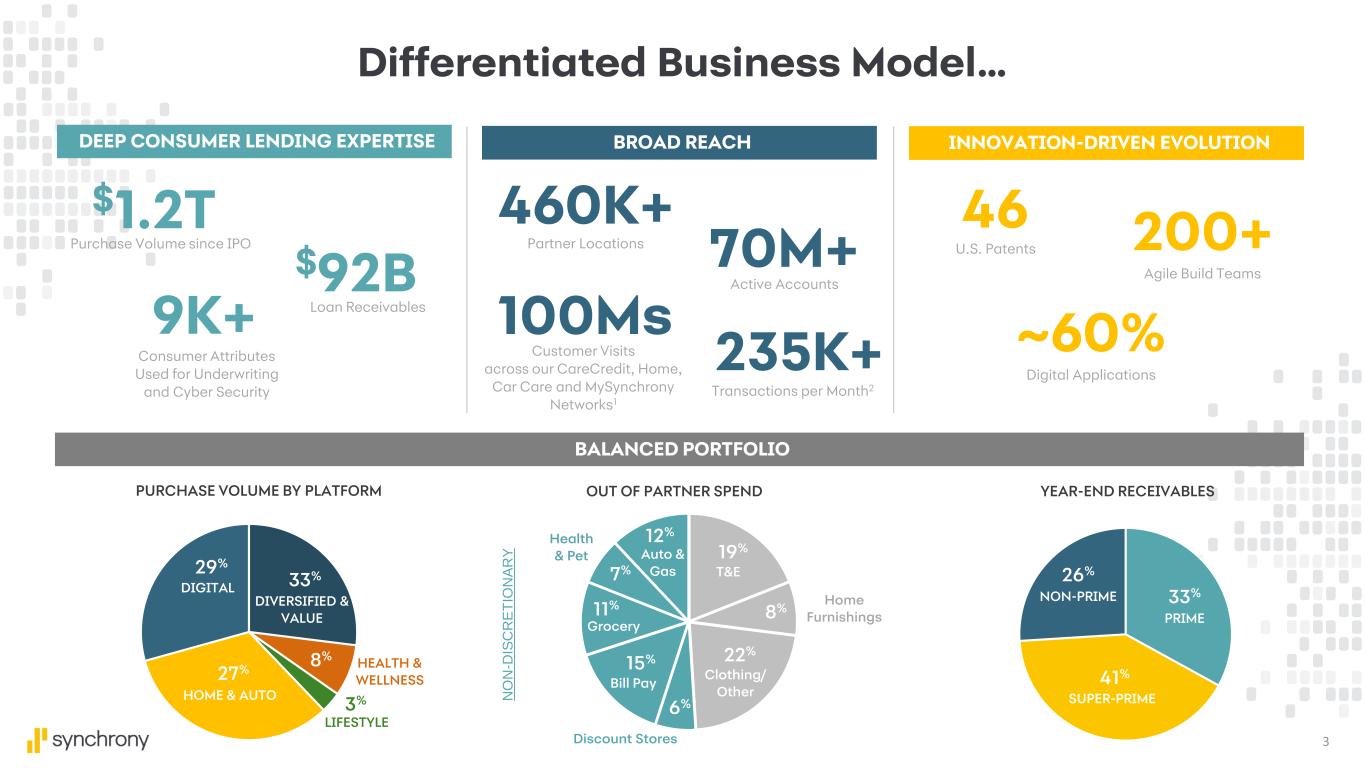

3 Differentiated Business Model… $1.2T Purchase Volume since IPO $92B Loan Receivables 70M+ Active Accounts 46 U.S. Patents 200+ Agile Build Teams Transactions per Month2 235K+ 100Ms Customer Visits across our CareCredit, Home, Car Care and MySynchrony Networks1 N O N -D IS C R E T IO N A R Y OUT OF PARTNER SPENDPURCHASE VOLUME BY PLATFORM Clothing/ Other T&E Home Furnishings Discount Stores Grocery Health & Pet Auto & Gas 19% 22% 12% 7% 11% 15% 6% 8% Bill Pay 33% 29% 3% 8% 27% DIGITAL DIVERSIFIED & VALUE HEALTH & WELLNESS LIFESTYLE DEEP CONSUMER LENDING EXPERTISE INNOVATION-DRIVEN EVOLUTIONBROAD REACH BALANCED PORTFOLIO HOME & AUTO 9K+ Consumer Attributes Used for Underwriting and Cyber Security 460K+ Partner Locations ~60% Digital Applications NON-PRIME 26% SUPER-PRIME 41% PRIME 33% YEAR-END RECEIVABLES

4 … Driving Strong Financial Results TIER 1 CAPITAL + CREDIT LOSS RESERVE RATIO* TANGIBLE BOOK VALUE PER SHARE (+46% vs 2Q20**) CET1 RATIO (vs ~11% target) 22%80%+ $22.2412.8% DEPOSIT FUNDED BALANCED GROWTH SINCE YEAR OF IPO 1 AT STRONG RISK-ADJUSTED RETURNS AVERAGE RISK-ADJUSTED RETURN2 ANNUAL GROWTH IN DILUTED EARNINGS PER SHARE ANNUAL GROWTH IN NET INTEREST INCOME 10%5% 10%4% ANNUAL GROWTH IN LOAN RECEIVABLES ** Tangible book value (TBV) is a non-GAAP measure, also referred to as Tangible common equity (TCE); see non-GAAP reconciliation at the end of this presentation * Reflects the sum of our “Tier 1 Capital” and “Allowance for Credit Losses,” divided by our “Total Risk-Weighted Assets”. Tier 1 Capital and Risk-Weighted Assets are adjusted to reflect the fully phased-in impact of CECL. These adjusted metrics are non-GAAP measures, see non-GAAP reconciliation in appendix. ROBUST FUNDING, CAPITAL AND LIQUIDITY

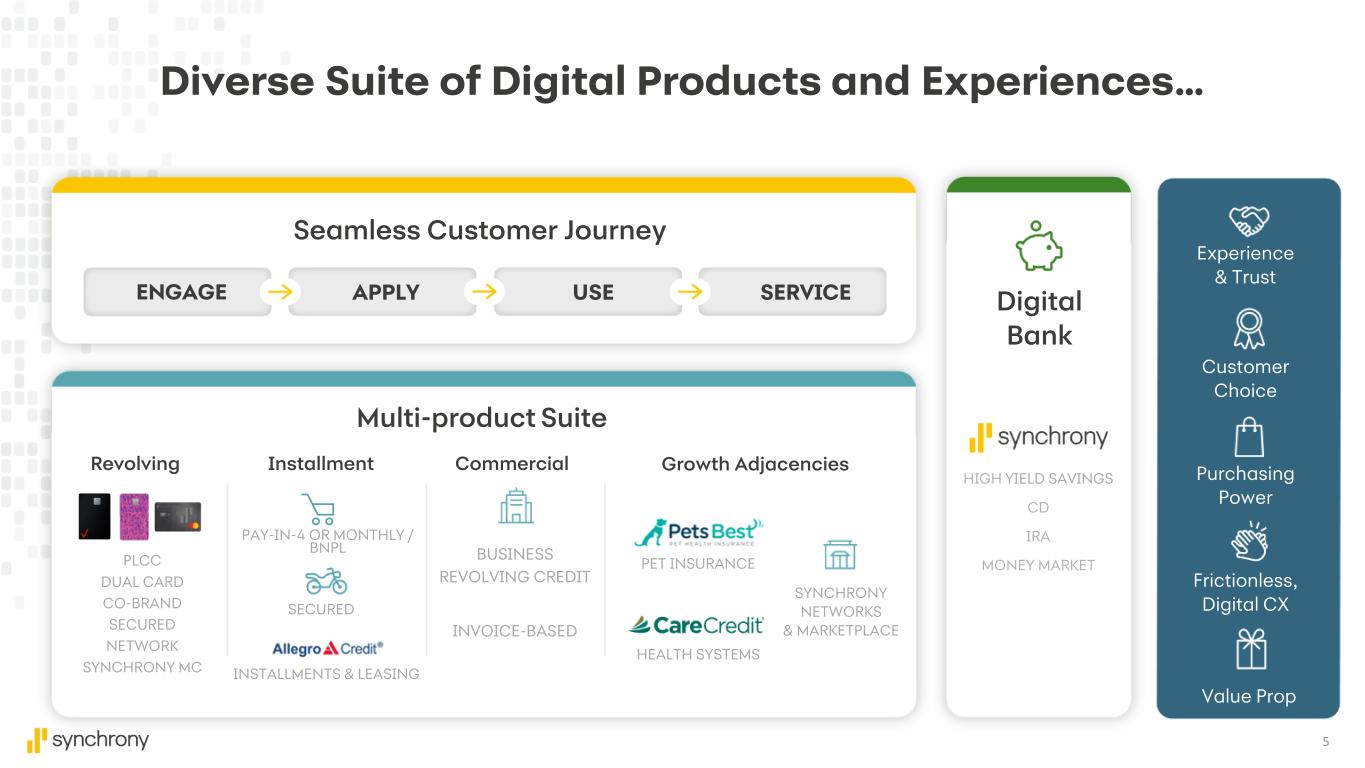

5 Diverse Suite of Digital Products and Experiences… Customer Choice Purchasing Power Frictionless, Digital CX Value Prop Experience & Trust Seamless Customer Journey APPLY USE SERVICEENGAGE Multi-product Suite Digital Bank Installment Growth Adjacencies PLCC DUAL CARD CO-BRAND SECURED NETWORK SYNCHRONY MC PET INSURANCE HEALTH SYSTEMS INSTALLMENTS & LEASING SECURED Revolving Commercial BUSINESS REVOLVING CREDIT INVOICE-BASED HIGH YIELD SAVINGS CD IRA MONEY MARKET PAY-IN-4 OR MONTHLY / BNPL SYNCHRONY NETWORKS & MARKETPLACE

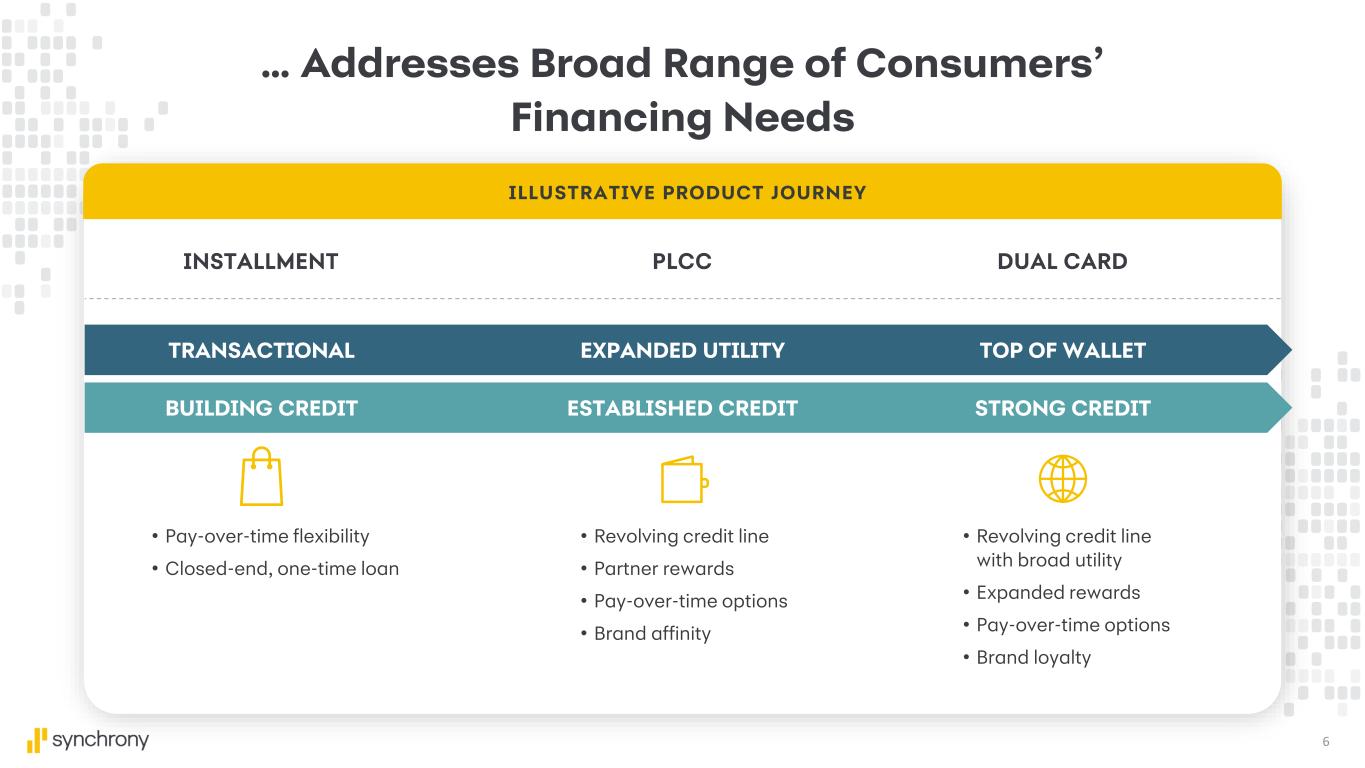

6 … Addresses Broad Range of Consumers’ Financing Needs ILLUSTRATIVE PRODUCT JOURNEY • Pay-over-time flexibility • Closed-end, one-time loan PLCC • Revolving credit line • Partner rewards • Pay-over-time options • Brand affinity DUAL CARD • Revolving credit line with broad utility • Expanded rewards • Pay-over-time options • Brand loyalty EXPANDED UTILITYTRANSACTIONAL TOP OF WALLET BUILDING CREDIT STRONG CREDITESTABLISHED CREDIT INSTALLMENT

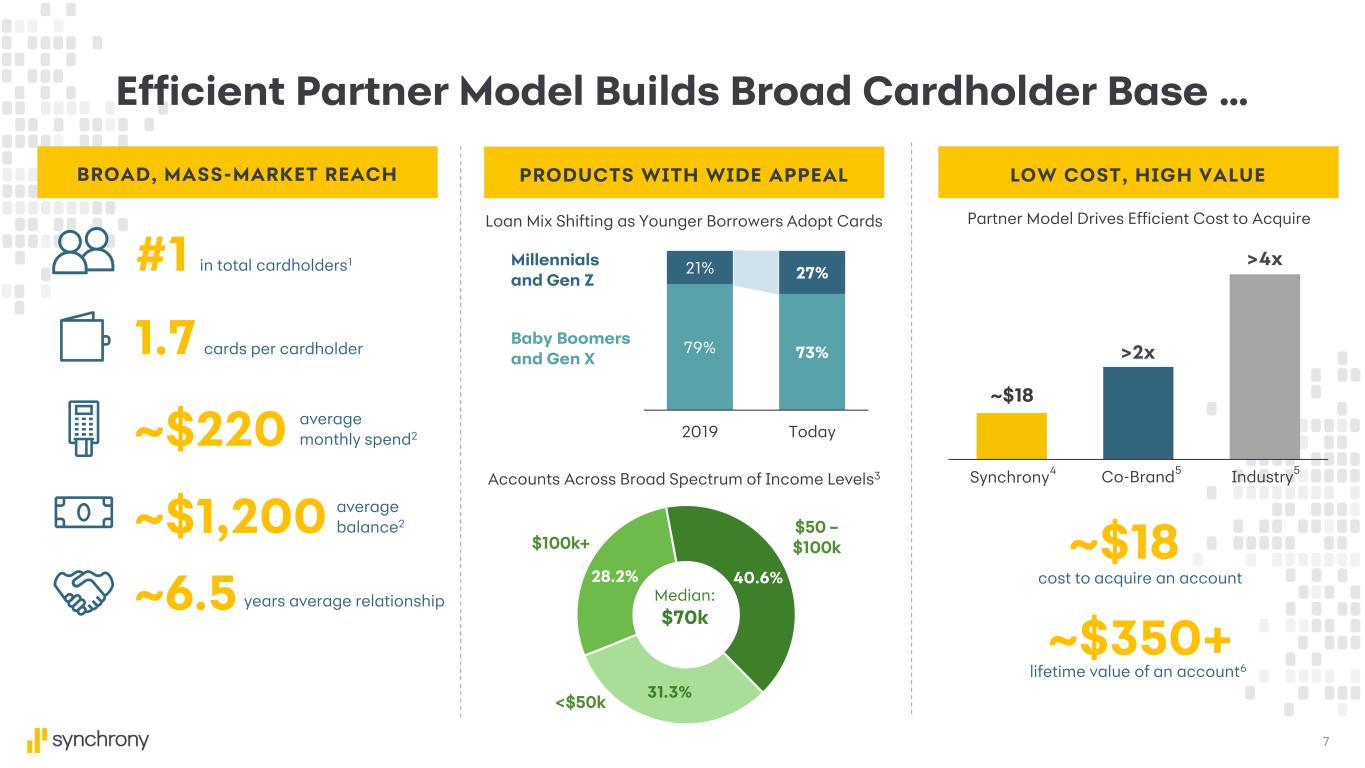

7 28.2% 40.6% 31.3% Efficient Partner Model Builds Broad Cardholder Base … BROAD, MASS-MARKET REACH #1 in total cardholders1 1.7 cards per cardholder 79% 73% 21% 27% 2019 Today PRODUCTS WITH WIDE APPEAL Millennials and Gen Z Baby Boomers and Gen X LOW COST, HIGH VALUE ~$1,200 ~6.5 ~$220 average monthly spend2 average balance2 Co-Brand5 Synchrony 4 Industry5 ~$18 >2x >4x ~$350+ lifetime value of an account6 years average relationship $50 – $100k Median: $70k ~$18 cost to acquire an account <$50k $100k+ Loan Mix Shifting as Younger Borrowers Adopt Cards Accounts Across Broad Spectrum of Income Levels3 Partner Model Drives Efficient Cost to Acquire

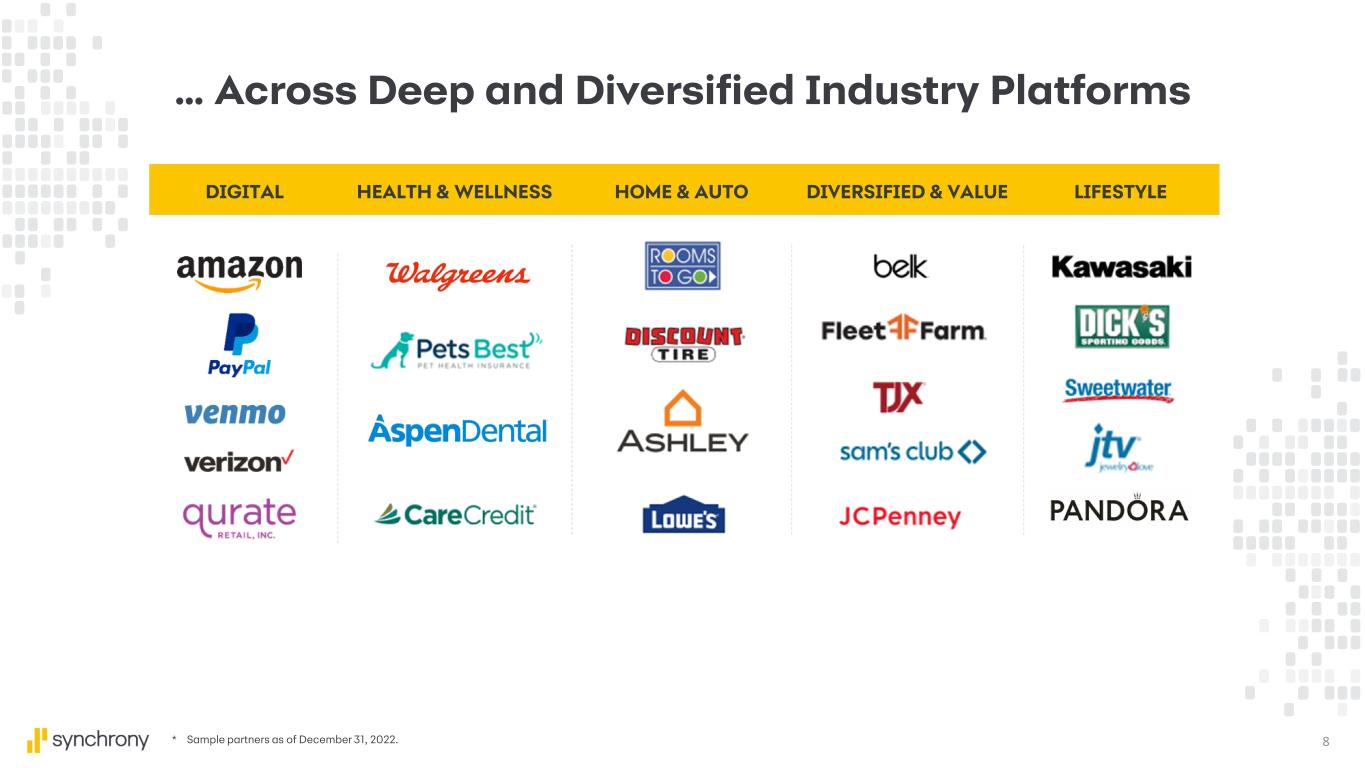

8 … Across Deep and Diversified Industry Platforms DIGITAL HEALTH & WELLNESS HOME & AUTO LIFESTYLEDIVERSIFIED & VALUE * Sample partners as of December 31, 2022.

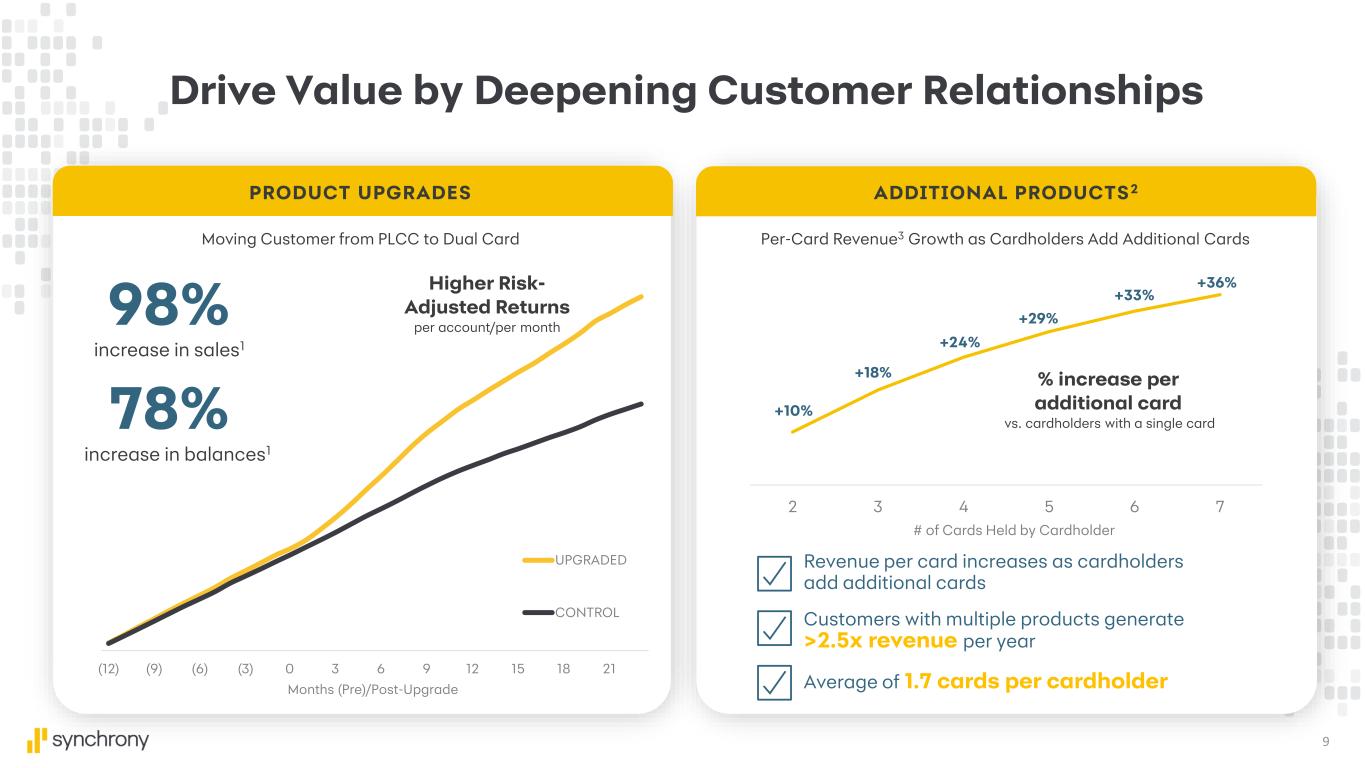

9 Drive Value by Deepening Customer Relationships PRODUCT UPGRADES (12) (9) (6) (3) 0 3 6 9 12 15 18 21 UPGRADED CONTROL 98% increase in sales1 increase in balances1 78% Moving Customer from PLCC to Dual Card Higher Risk- Adjusted Returns per account/per month ADDITIONAL PRODUCTS2 Months (Pre)/Post-Upgrade Per-Card Revenue3 Growth as Cardholders Add Additional Cards Revenue per card increases as cardholders add additional cards Customers with multiple products generate >2.5x revenue per year Average of 1.7 cards per cardholder 2 3 4 5 6 7 +10% +18% +24% +29% +33% +36% # of Cards Held by Cardholder % increase per additional card vs. cardholders with a single card

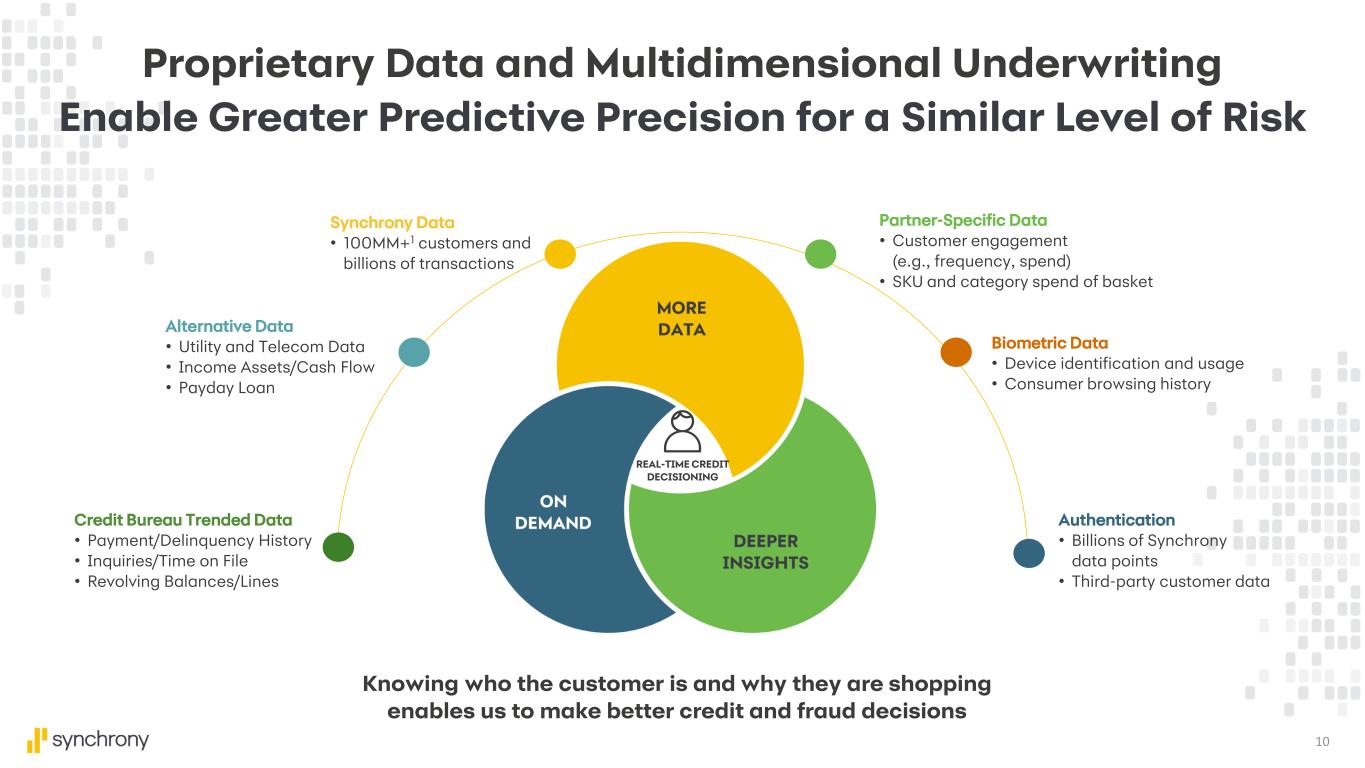

10 Proprietary Data and Multidimensional Underwriting Enable Greater Predictive Precision for a Similar Level of Risk Credit Bureau Trended Data • Payment/Delinquency History • Inquiries/Time on File • Revolving Balances/Lines Alternative Data • Utility and Telecom Data • Income Assets/Cash Flow • Payday Loan Synchrony Data • 100MM+1 customers and billions of transactions Partner-Specific Data • Customer engagement (e.g., frequency, spend) • SKU and category spend of basket Biometric Data • Device identification and usage • Consumer browsing history Authentication • Billions of Synchrony data points • Third-party customer data Knowing who the customer is and why they are shopping enables us to make better credit and fraud decisions REAL-TIME CREDIT DECISIONING

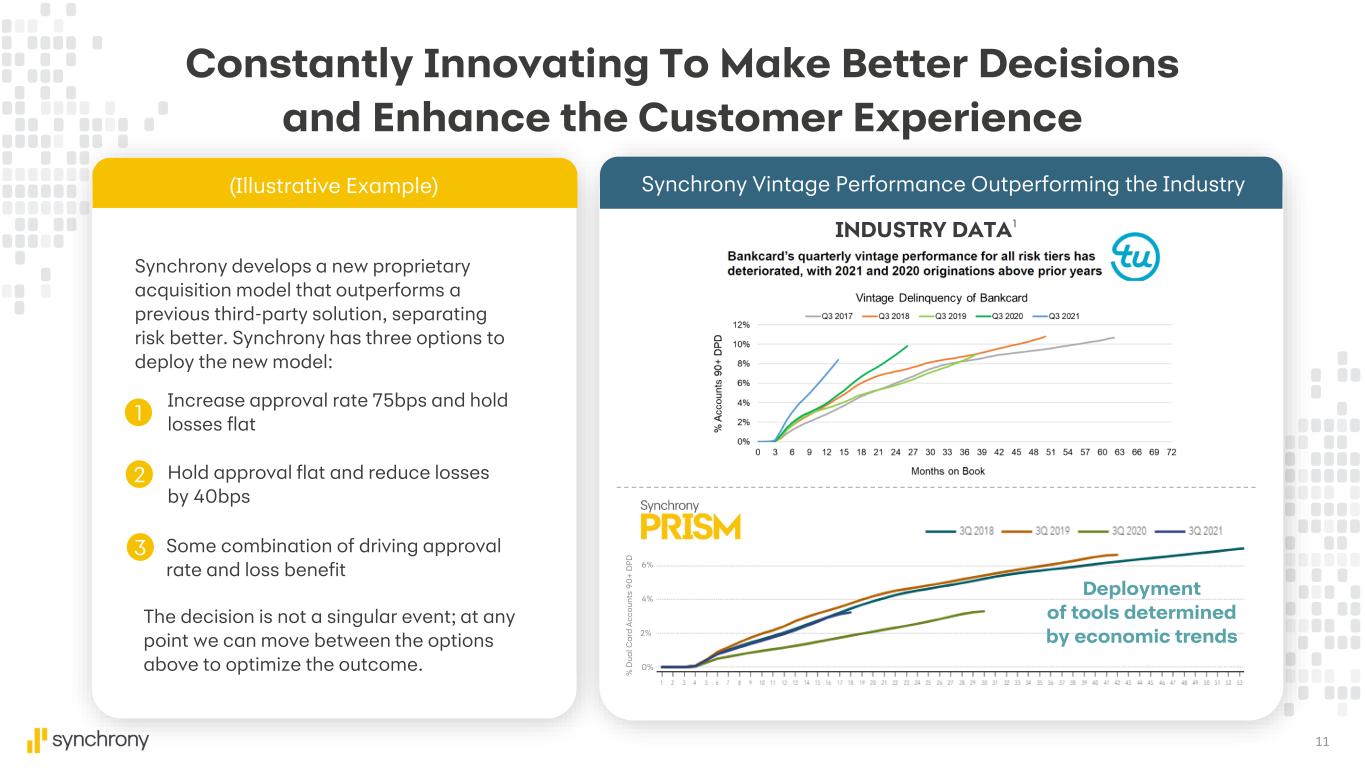

11 Constantly Innovating To Make Better Decisions and Enhance the Customer Experience Synchrony develops a new proprietary acquisition model that outperforms a previous third-party solution, separating risk better. Synchrony has three options to deploy the new model: 1 Increase approval rate 75bps and hold losses flat 2 Hold approval flat and reduce losses by 40bps The decision is not a singular event; at any point we can move between the options above to optimize the outcome. 3 Some combination of driving approval rate and loss benefit Synchrony Vintage Performance Outperforming the Industry INDUSTRY DATA1 (Illustrative Example) Deployment of tools determined by economic trends % D u a l C a rd A c c o u n ts 9 0 + D P D 6% 4% 2% 0%

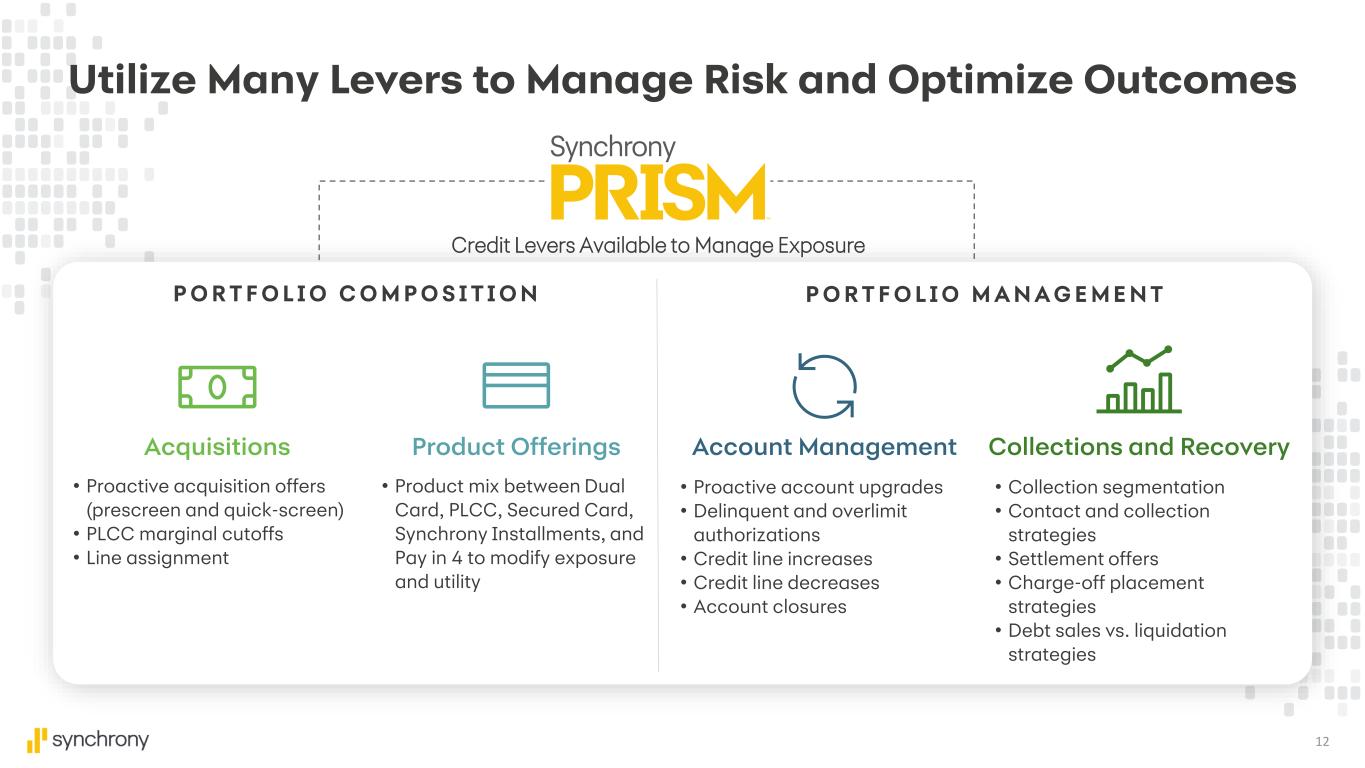

12 P O R T F O L I O C O M P O S I T I O N Utilize Many Levers to Manage Risk and Optimize Outcomes P O R T F O L I O M A N A G E M E N T Credit Levers Available to Manage Exposure • Proactive acquisition offers (prescreen and quick-screen) • PLCC marginal cutoffs • Line assignment • Product mix between Dual Card, PLCC, Secured Card, Synchrony Installments, and Pay in 4 to modify exposure and utility • Proactive account upgrades • Delinquent and overlimit authorizations • Credit line increases • Credit line decreases • Account closures • Collection segmentation • Contact and collection strategies • Settlement offers • Charge-off placement strategies • Debt sales vs. liquidation strategies Acquisitions Product Offerings Account Management Collections and Recovery

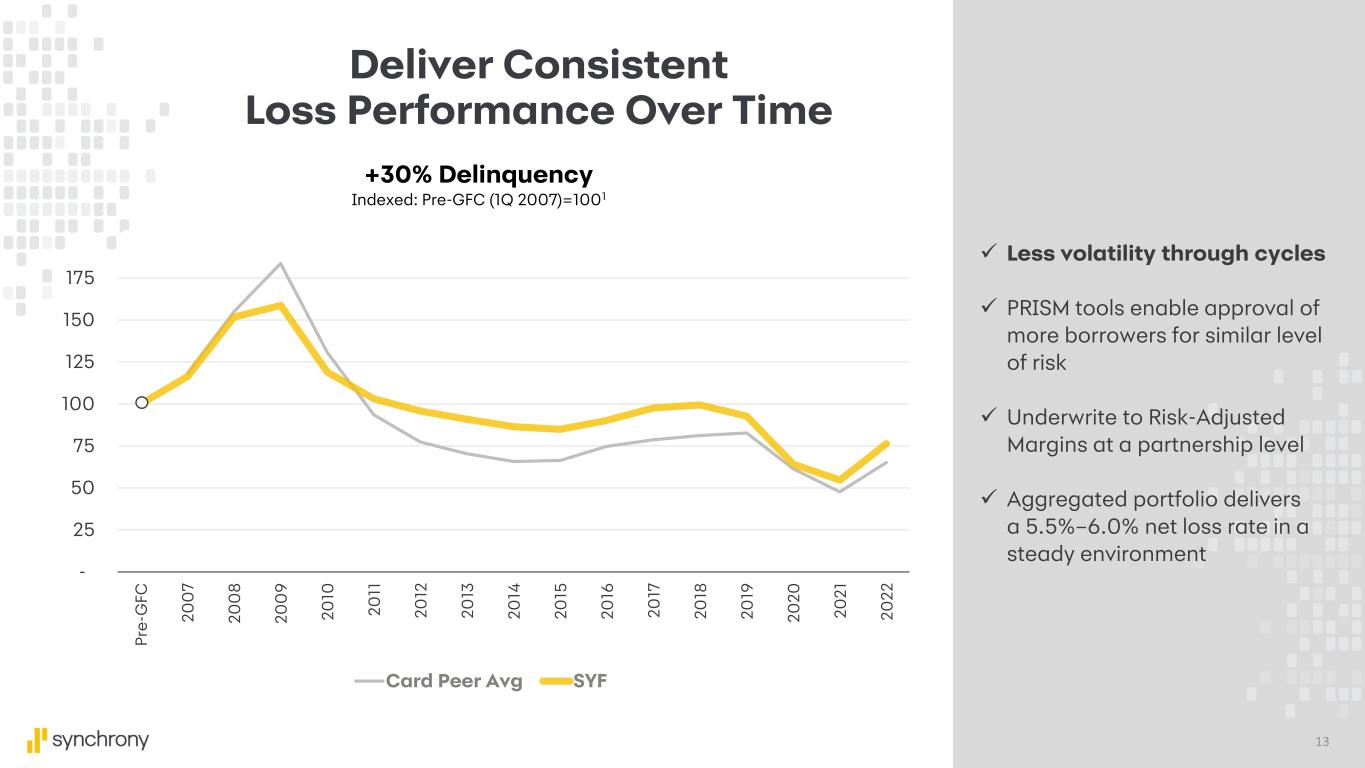

13 Deliver Consistent Loss Performance Over Time ✓ Less volatility through cycles ✓ PRISM tools enable approval of more borrowers for similar level of risk ✓ Underwrite to Risk-Adjusted Margins at a partnership level ✓ Aggregated portfolio delivers a 5.5%–6.0% net loss rate in a steady environment - 25 50 75 100 125 150 175 P re -G FC 2 0 0 7 2 0 0 8 2 0 0 9 2 0 10 2 0 11 2 0 12 2 0 13 2 0 14 2 0 15 2 0 16 2 0 17 2 0 18 2 0 19 2 0 2 0 2 0 2 1 2 0 2 2 +30% Delinquency Indexed: Pre-GFC (1Q 2007)=1001 Card Peer Avg SYF

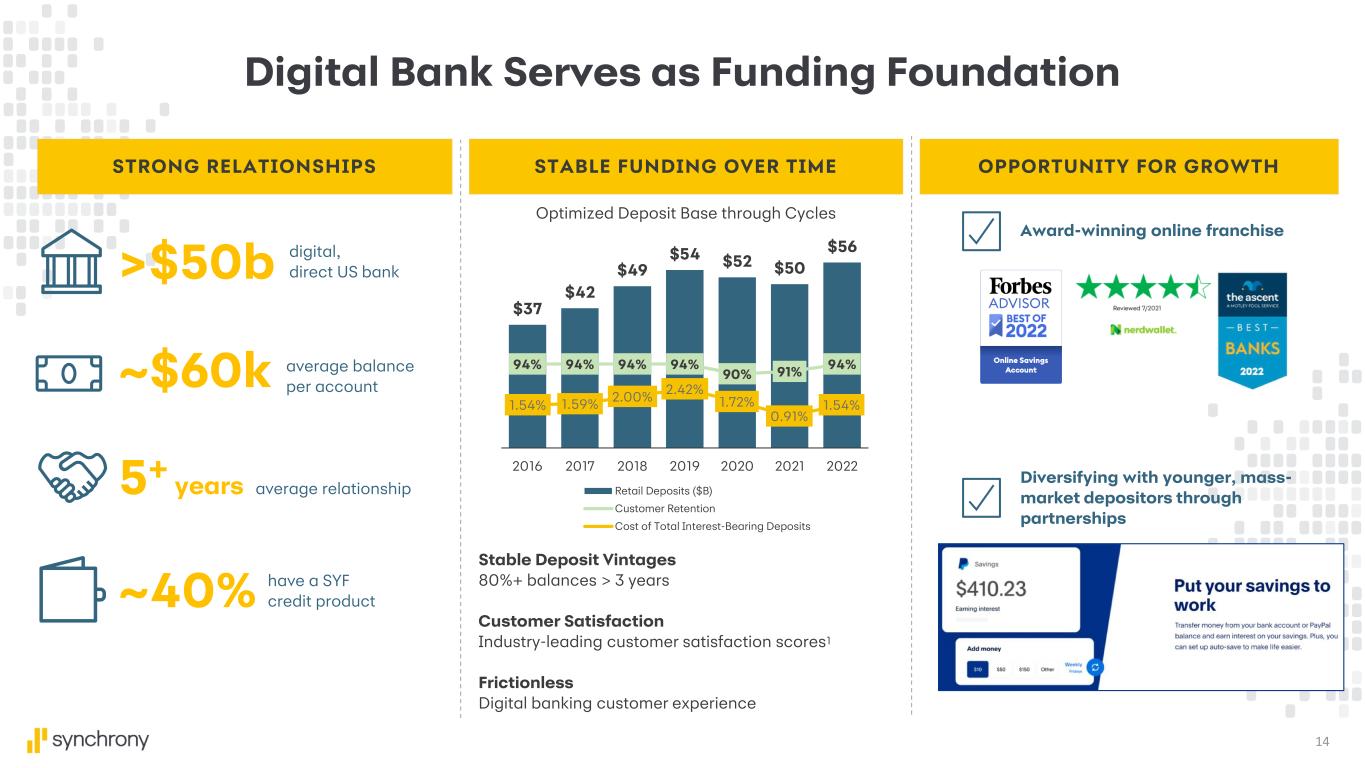

14 Digital Bank Serves as Funding Foundation STRONG RELATIONSHIPS STABLE FUNDING OVER TIME OPPORTUNITY FOR GROWTH ~$60k average balance per account Award-winning online franchise Diversifying with younger, mass- market depositors through partnerships ~40% 5+ years average relationship >$50b Stable Deposit Vintages 80%+ balances > 3 years Customer Satisfaction Industry-leading customer satisfaction scores1 Frictionless Digital banking customer experience $37 $42 $49 $54 $52 $50 $56 94% 94% 94% 94% 90% 91% 94% 60% 70% 80% 90% 100% 110% 120% 130% 140% $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2016 2017 2018 2019 2020 2021 2022 Retail Deposits ($B) Customer Retention Cost of Total Interest-Bearing Deposits 1.54% 1.59% 2.00% 2.42% 1.72% 0.91% 1.54% 0% 1% 1% 2% 2% 3% 3% digital, direct US bank have a SYF credit product Optimized Deposit Base through Cycles

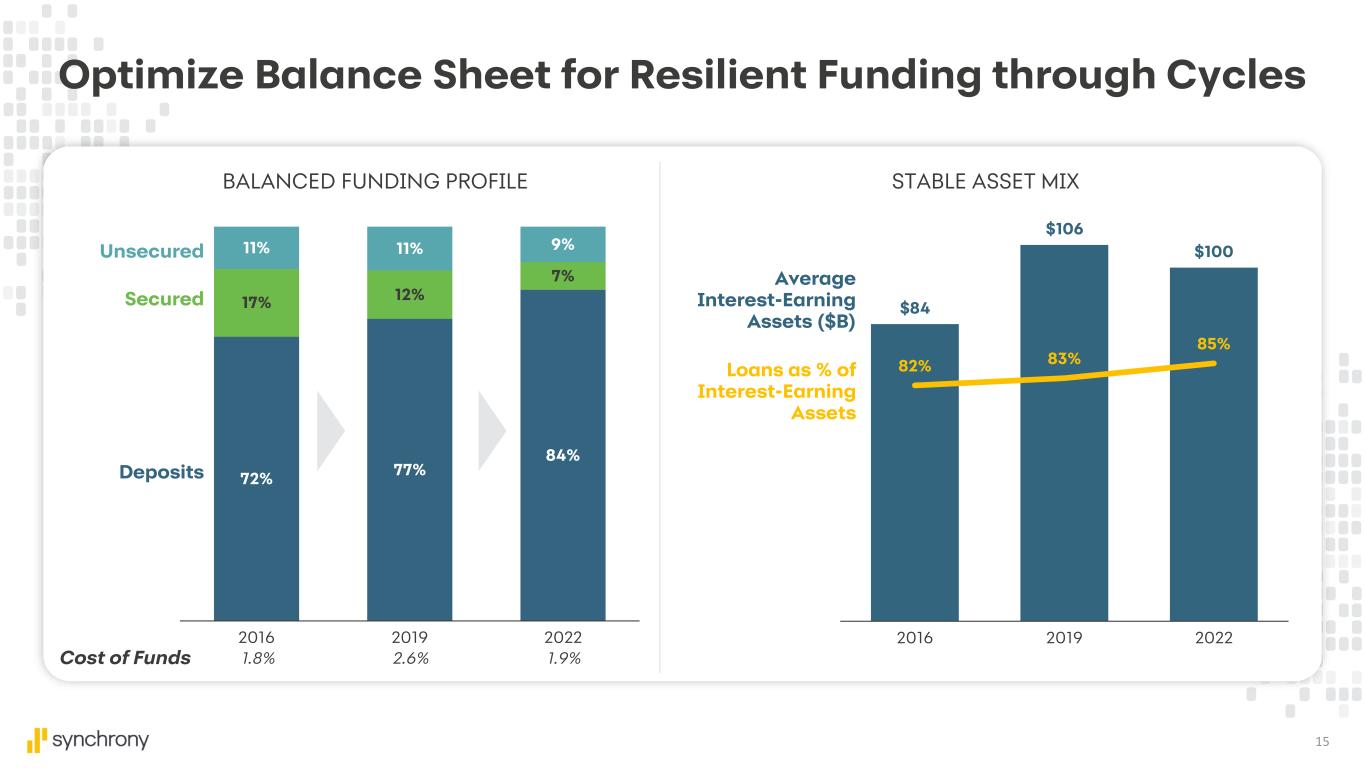

15 $84 $106 $100 82% 83% 85% 50% 60% 70% 80% 90% 100% 110% - 20,000.00 40,000.00 60,000.00 80,000.00 100,000.00 120,000.00 2016 2019 2022 Average Interest-Earning Assets ($B) Loans as % of Interest-Earning Assets STABLE ASSET MIX Optimize Balance Sheet for Resilient Funding through Cycles 72% 77% 84% 17% 12% 7% 11% 11% 9% 2016 2019 2022 Deposits Unsecured Secured 1.8% 2.6% 1.9%Cost of Funds BALANCED FUNDING PROFILE

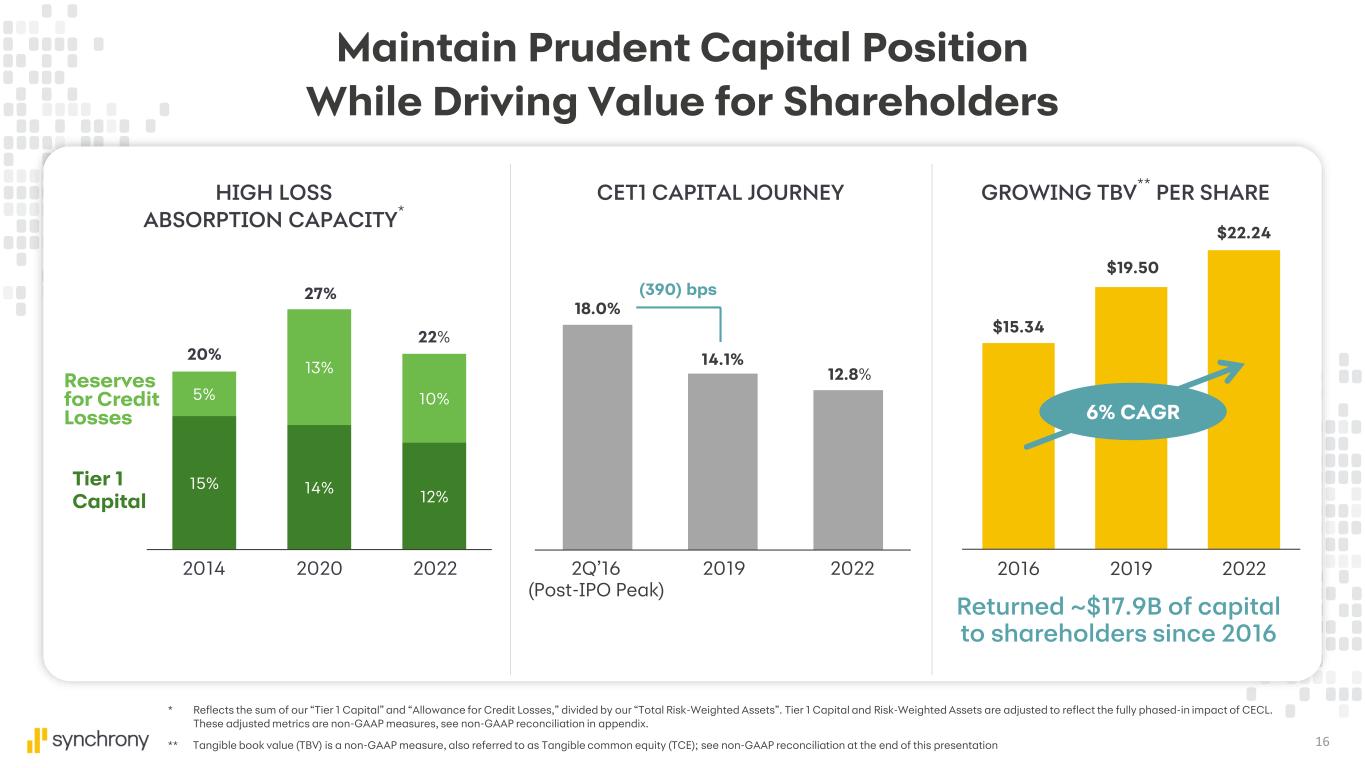

16 CET1 CAPITAL JOURNEY 18.0% 2Q’16 (Post-IPO Peak) 2019 14.1% 12.8% Returned ~$17.9B of capital to shareholders since 2016 Maintain Prudent Capital Position While Driving Value for Shareholders 2022 GROWING TBV ** PER SHARE 15% 14% 12% 5% 13% 10% 20% 27% 2014 2020 Tier 1 Capital Reserves for Credit Losses HIGH LOSS ABSORPTION CAPACITY * 2022 22% $15.34 $19.50 $22.24 2016 2019 2022 6% CAGR (390) bps ** Tangible book value (TBV) is a non-GAAP measure, also referred to as Tangible common equity (TCE); see non-GAAP reconciliation at the end of this presentation * Reflects the sum of our “Tier 1 Capital” and “Allowance for Credit Losses,” divided by our “Total Risk-Weighted Assets”. Tier 1 Capital and Risk-Weighted Assets are adjusted to reflect the fully phased-in impact of CECL. These adjusted metrics are non-GAAP measures, see non-GAAP reconciliation in appendix.

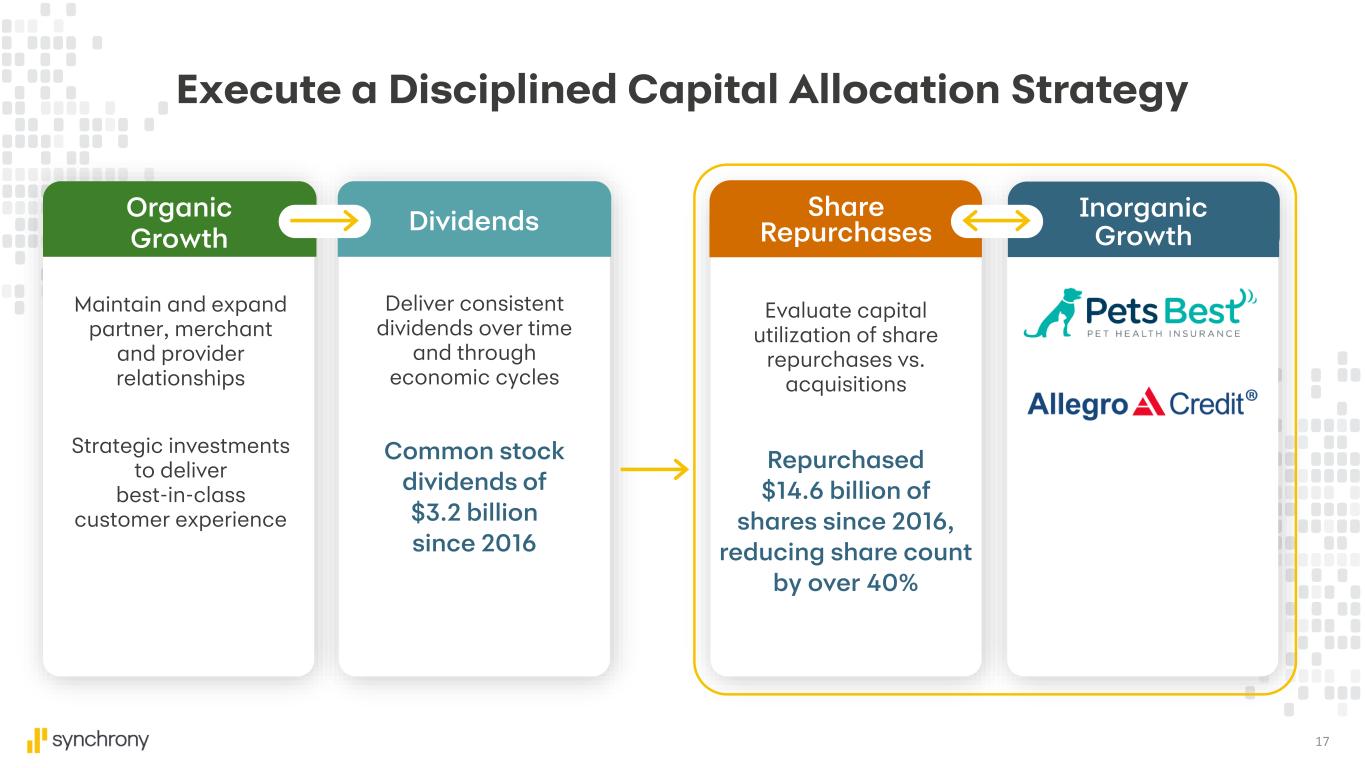

17 Maintain and expand partner, merchant and provider relationships Strategic investments to deliver best-in-class customer experience Deliver consistent dividends over time and through economic cycles Common stock dividends of $3.2 billion since 2016 Organic Growth Dividends Share Repurchases Inorganic Growth Repurchased $14.6 billion of shares since 2016, reducing share count by over 40% Evaluate capital utilization of share repurchases vs. acquisitions Execute a Disciplined Capital Allocation Strategy

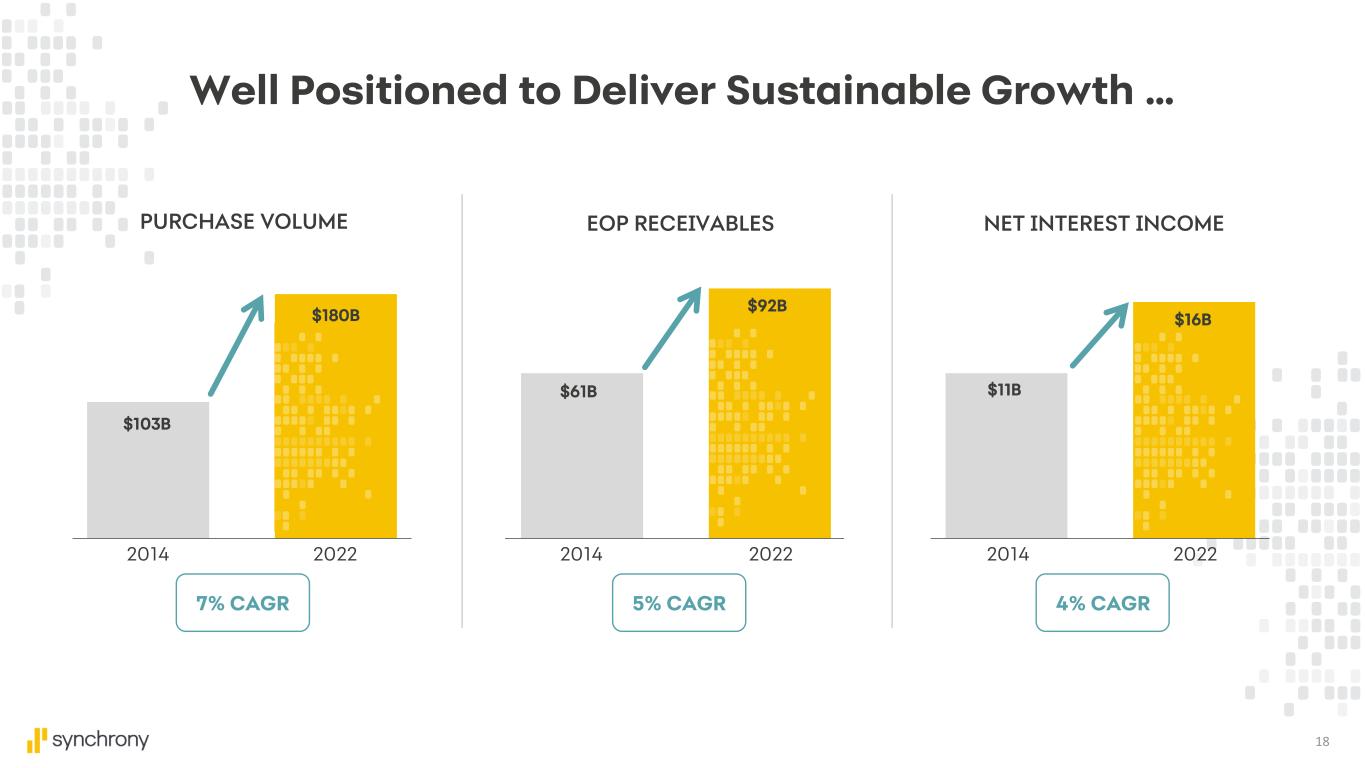

18 Well Positioned to Deliver Sustainable Growth … PURCHASE VOLUME EOP RECEIVABLES NET INTEREST INCOME 7% CAGR 5% CAGR 4% CAGR $180B $103B $92B $61B $16B $11B 2014 2022 2014 2022 2014 2022

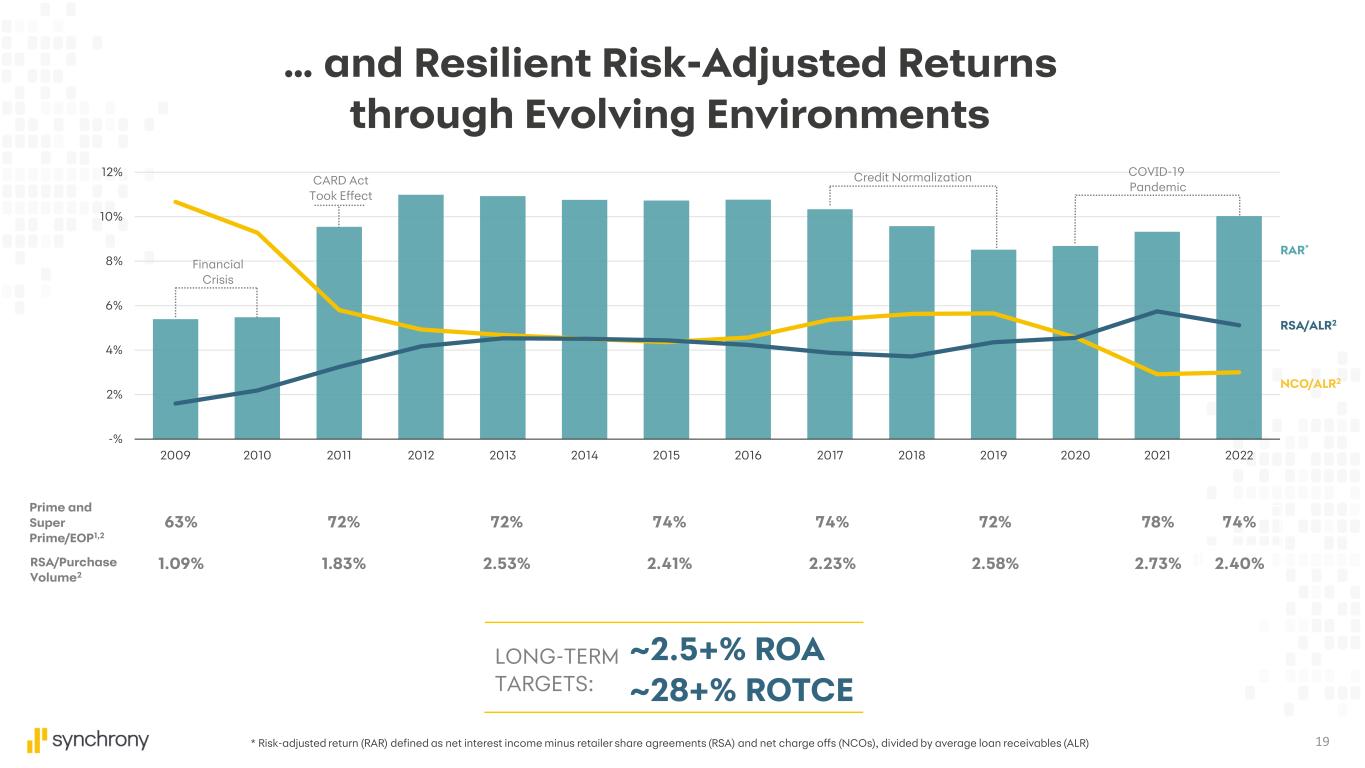

19 RSA/Purchase Volume2 Prime and Super Prime/EOP1,2 ~2.5+% ROA ~28+% ROTCE LONG-TERM TARGETS: … and Resilient Risk-Adjusted Returns through Evolving Environments * Risk-adjusted return (RAR) defined as net interest income minus retailer share agreements (RSA) and net charge offs (NCOs), divided by average loan receivables (ALR) -% 2% 4% 6% 8% 10% 12% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 RAR* RSA/ALR2 NCO/ALR2 Financial Crisis CARD Act Took Effect Credit Normalization COVID-19 Pandemic 63% 72% 72% 74% 74% 72% 78% 74% 1.09% 1.83% 2.53% 2.41% 2.23% 2.58% 2.73% 2.40%

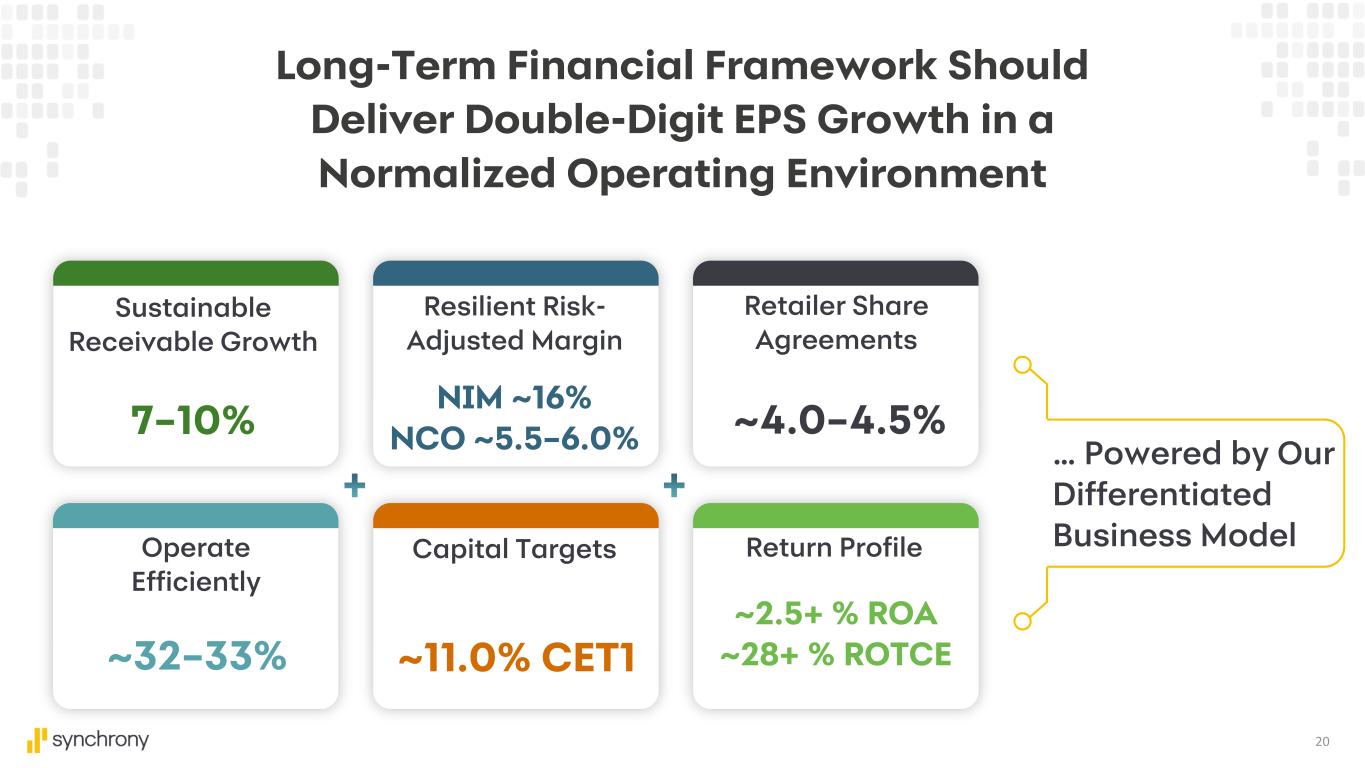

20 Sustainable Receivable Growth Operate Efficiently Resilient Risk- Adjusted Margin Retailer Share Agreements … Powered by Our Differentiated Business Model 7–10% NIM ~16% NCO ~5.5–6.0% ~4.0–4.5% ~32–33% Long-Term Financial Framework Should Deliver Double-Digit EPS Growth in a Normalized Operating Environment Capital Targets ~11.0% CET1 Return Profile ~2.5+ % ROA ~28+ % ROTCE

APPENDIX

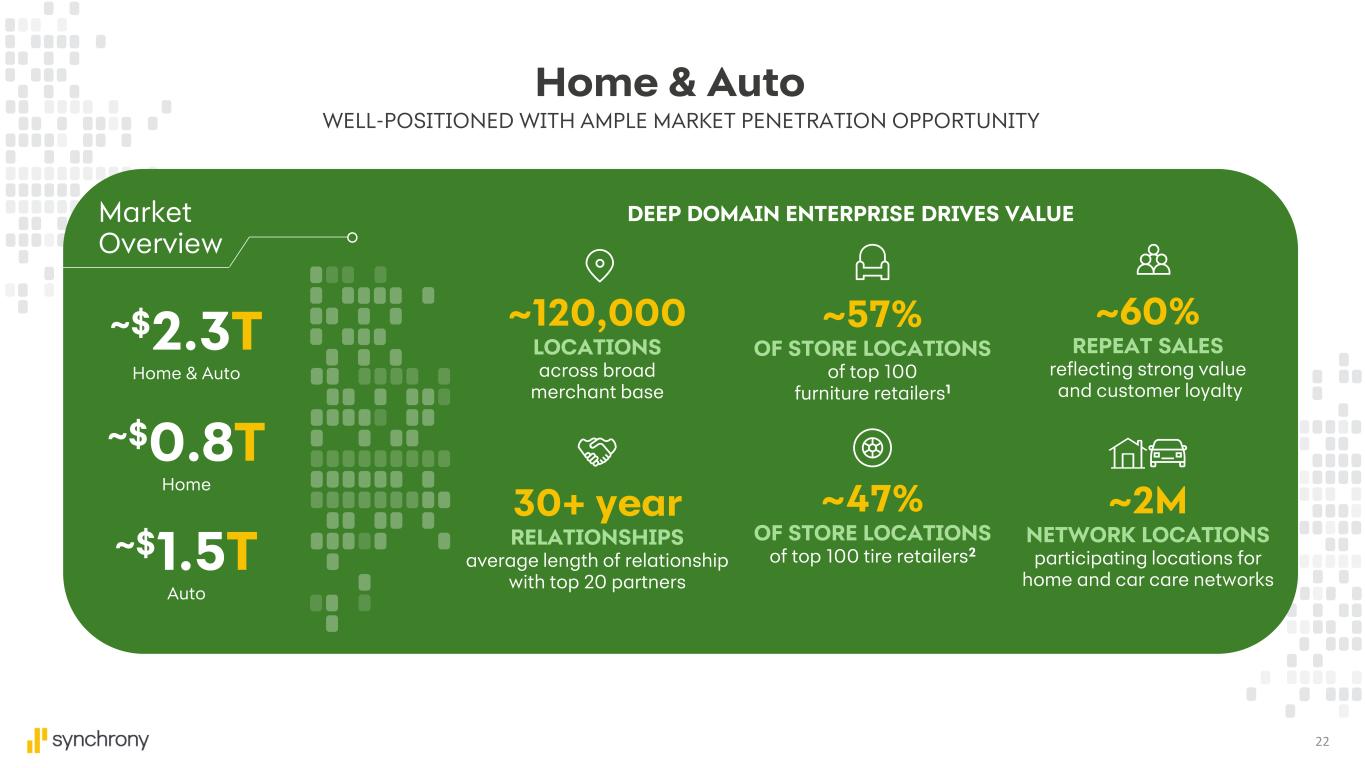

22 WELL-POSITIONED WITH AMPLE MARKET PENETRATION OPPORTUNITY Market Overview ~$2.3T Home & Auto ~$0.8T Home ~$1.5T Auto DEEP DOMAIN ENTERPRISE DRIVES VALUE ~60% REPEAT SALES reflecting strong value and customer loyalty ~2M NETWORK LOCATIONS participating locations for home and car care networks 30+ year RELATIONSHIPS average length of relationship with top 20 partners ~120,000 LOCATIONS across broad merchant base ~57% OF STORE LOCATIONS of top 100 furniture retailers1 ~47% OF STORE LOCATIONS of top 100 tire retailers2 Home & Auto

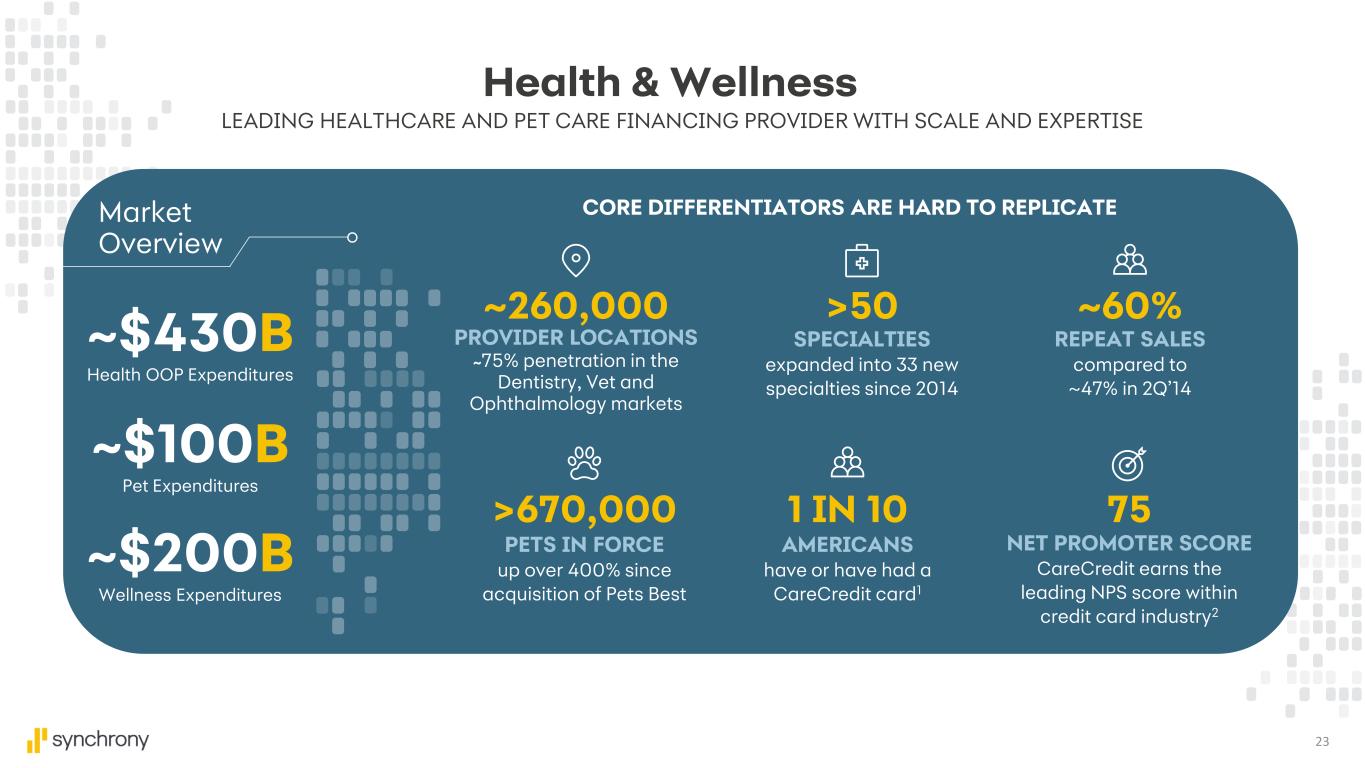

23 Market Overview LEADING HEALTHCARE AND PET CARE FINANCING PROVIDER WITH SCALE AND EXPERTISE ~$430B Health OOP Expenditures ~$100B Pet Expenditures ~$200B Wellness Expenditures PROVIDER LOCATIONS ~75% penetration in the Dentistry, Vet and Ophthalmology markets CORE DIFFERENTIATORS ARE HARD TO REPLICATE SPECIALTIES expanded into 33 new specialties since 2014 REPEAT SALES compared to ~47% in 2Q’14 ~260,000 >50 ~60% PETS IN FORCE up over 400% since acquisition of Pets Best AMERICANS have or have had a CareCredit card1 NET PROMOTER SCORE CareCredit earns the leading NPS score within credit card industry2 751 IN 10>670,000 Health & Wellness

24 >$900B D&V Market ~$125B Current Partner Sales1 DELIVER OMNICHANNEL EXPERIENCES AND EVERYDAY VALUE ACROSS SCALED RETAIL PARTNERS 9+ year CARDHOLDER TENURE on average across Diversified & Value POWER COMPELLING OUTCOMES FOR OUR PARTNERS AND CUSTOMERS 20+ year RELATIONSHIPS average length of relationship >50% WORLD SALES +500bps over last three years ~50% D&V CUSTOMERS2 have 2+ Synchrony products ~65 million TRANSACTIONS per month, +16% in 2022 >20% DIGITAL SALES as a percent of total D&V purchase volume Diversified & Value Market Overview

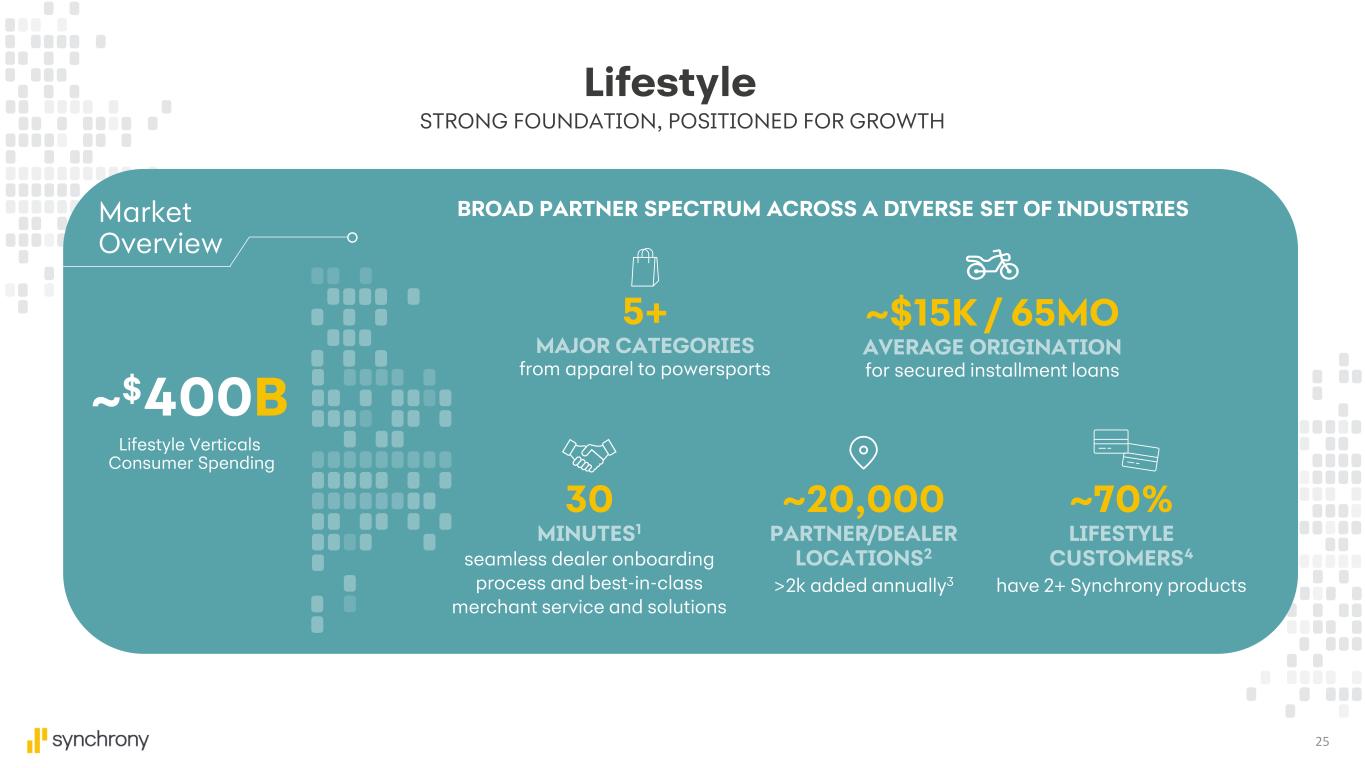

25 ~$400B Lifestyle Verticals Consumer Spending STRONG FOUNDATION, POSITIONED FOR GROWTH BROAD PARTNER SPECTRUM ACROSS A DIVERSE SET OF INDUSTRIES 5+ MAJOR CATEGORIES from apparel to powersports ~$15K / 65MO AVERAGE ORIGINATION for secured installment loans ~20,000 PARTNER/DEALER LOCATIONS2 >2k added annually3 ~70% LIFESTYLE CUSTOMERS4 have 2+ Synchrony products Lifestyle Market Overview 30 MINUTES1 seamless dealer onboarding process and best-in-class merchant service and solutions

26 >$700B Total Partner Opportunity ~21% E-Comm CAGR 2017–20211 HIGHLY ENGAGED CUSTOMERS, DEEPLY INTEGRATED PRODUCTS AND PARTNERSHIPS DRIVING SEAMLESS ENGAGEMENT WITH DIGITAL-FIRST BRANDS PRODUCTS & VAL PROPS SEAMLESSLY INTEGRATED ON PARTNER PLATFORMS Extended Promotions & Partner-Based Rewards Virtual and Physical Wallets & Cards >2 PRODUCTS PER CUSTOMER DIVERSE DIGITAL COMMERCE BRANDS 58 PURCHASES per active account per year STRONG ENGAGEMENT 90+ MILLION USERS at each of top four programs2 Digital Market Overview ~5 YEARS AVERAGE TENURE among digital customers3 ~5 YEARS YOUNGER than average Synchrony consumer

27 Footnotes All metrics are as of and for the period ending December 31, 2022 except where noted. Differentiated Business Model 1. As of December 2020. 2. As of June 2021. Driving Strong Financial Results 1. Reflects compound annual growth rates from 2014 to 2022; average risk-adjusted return reflects simple average of full-year results from 2014 to 2022. 2. Risk-adjusted return (RAR) defined as net interest income minus retailer share agreements (RSA) and net charge offs (NCOs), divided by average loan receivables (ALR). Efficient Partner Model Builds Broad Cardholder Base 1. Among top U.S. consumer credit card issuers as of November 2022. Source: Argus, internal analysis. 2. Among active accounts. 3. Self-reported income, August 2021 to July 2022. 4. Source: Internal analysis, 2021. Based on representative large retail partner. Cost to acquire excludes offer/reward costs. 5. Source: Argus, 2020. 6. Lifetime value representative of large retail partner account and is based on a vintage 10-year estimate of net finance charges + net late fees + interchange - loyalty costs - net losses. Source: Internal analysis, 2021. Drive Value by Deepening Customer Relationships 1. Estimated value based upon performance tracking from upgrade targeting campaigns utilizing Synchrony-built proprietary models. Source: Internal analysis, 2021. 2. Source: Internal analysis. 3. Per-card revenue reflects annual net finance charges and late fees. Proprietary Data and Multidimensional Underwriting 1. Includes active and inactive accounts as of June 30, 2021. Constantly Innovating to Make Better Decisions & Enhance the Customer Experience 1. Source: TransUnion, 90+ day delinquency rate by month. Deliver Consistent Loss Performance Over Time 1. “Card Peer Average” reflects average 30+ day delinquency rates at the following business units: Capital One Financial Corporation – Credit Card Business, Domestic Card; Discover Financial Services – Credit Card; Citigroup – Personal Banking & Wealth Management, U.S. Personal Banking, Branded Cards and Retail Services; JPMorgan Chase & Co – Consumer & Community Banking, Credit Card. Source: Company filings.

28 Footnotes Digital Bank Serves as Funding Foundation 1. Source: Internal analysis, October 2022. And Resilient Risk-Adjusted Returns through Cycles 1. Classification of Prime & Super Prime refers to VantageScore credit scores of 651 or higher for 2019-2022, and FICO scores of 661 or higher for periods prior to 2019. 2. RSA/ALR refers to Retail Share Arrangements as a percentage of Average Loan Receivables; NCO/ALR refers to Net Charge-Offs as a percentage of Average Loan Receivables; Prime & Super Prime /EOP refers to Prime & Super Prime loan receivables as a percentage of total Period-end Loan Receivables; RSA/Purchase Volume refers to Retailer Share Arrangements as a percentage of Purchase Volume. Appendix The “average length of our relationship” with respect to a specified group of partners or programs is measured on a weighted average basis by interest and fees on loans for the year ended December 31, 2022, for those partners or for all partners participating in a program, based on the date each partner relationship or program, as applicable, started. Home and Auto 1. Source: Furniture Today 2021 Top 100 (Released 5/23/2022). 2. Source: Modern Tire Dealer 100 Dealers (July 2022 Digital Edition). Health and Wellness 1. Source: Internal analysis, utilizing 2021 U.S. Census. 2. Source: Satmetrix 2021 Net Promoter Benchmark Study of U.S. Consumers, conducted January to March 2021. Diversified and Value 1. Source: Internal analysis, based on 2021 retail partner filings. 2. Consumer only. Lifestyle 1. Reflects time between dealer accepting terms and being approved. 2. Total partner/dealer locations as of June 2021. 3. Average dealer locations/storefronts added since January 2019, per year through June 30, 2021. 4. Consumer only. Digital 1. Source: U.S. Census. 2. Source: Partner public filings, 2021. 3. Consumer only.

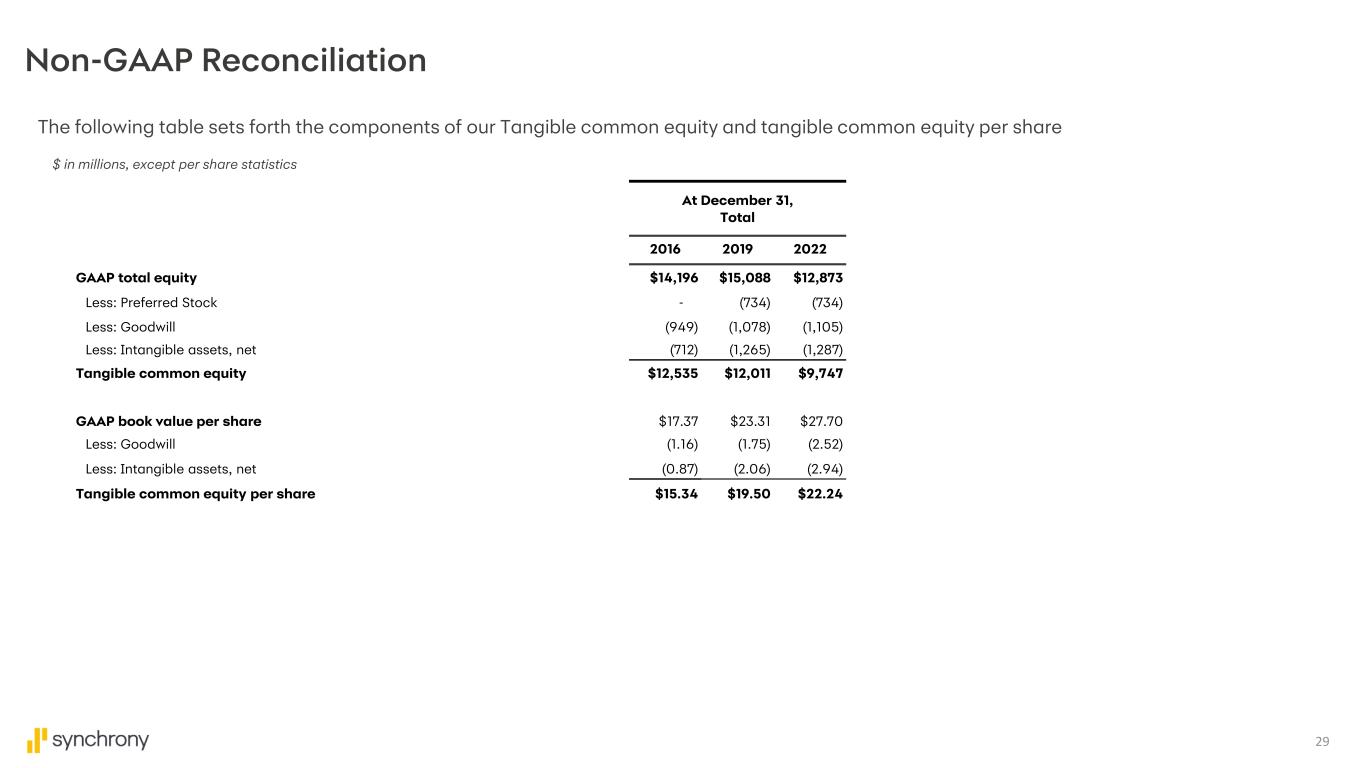

29 Non-GAAP Reconciliation The following table sets forth the components of our Tangible common equity and tangible common equity per share At December 31, Total 2016 2019 2022 GAAP total equity $14,196 $15,088 $12,873 Less: Preferred Stock - (734) (734) Less: Goodwill (949) (1,078) (1,105) Less: Intangible assets, net (712) (1,265) (1,287) Tangible common equity $12,535 $12,011 $9,747 GAAP book value per share $17.37 $23.31 $27.70 Less: Goodwill (1.16) (1.75) (2.52) Less: Intangible assets, net (0.87) (2.06) (2.94) Tangible common equity per share $15.34 $19.50 $22.24 $ in millions, except per share statistics

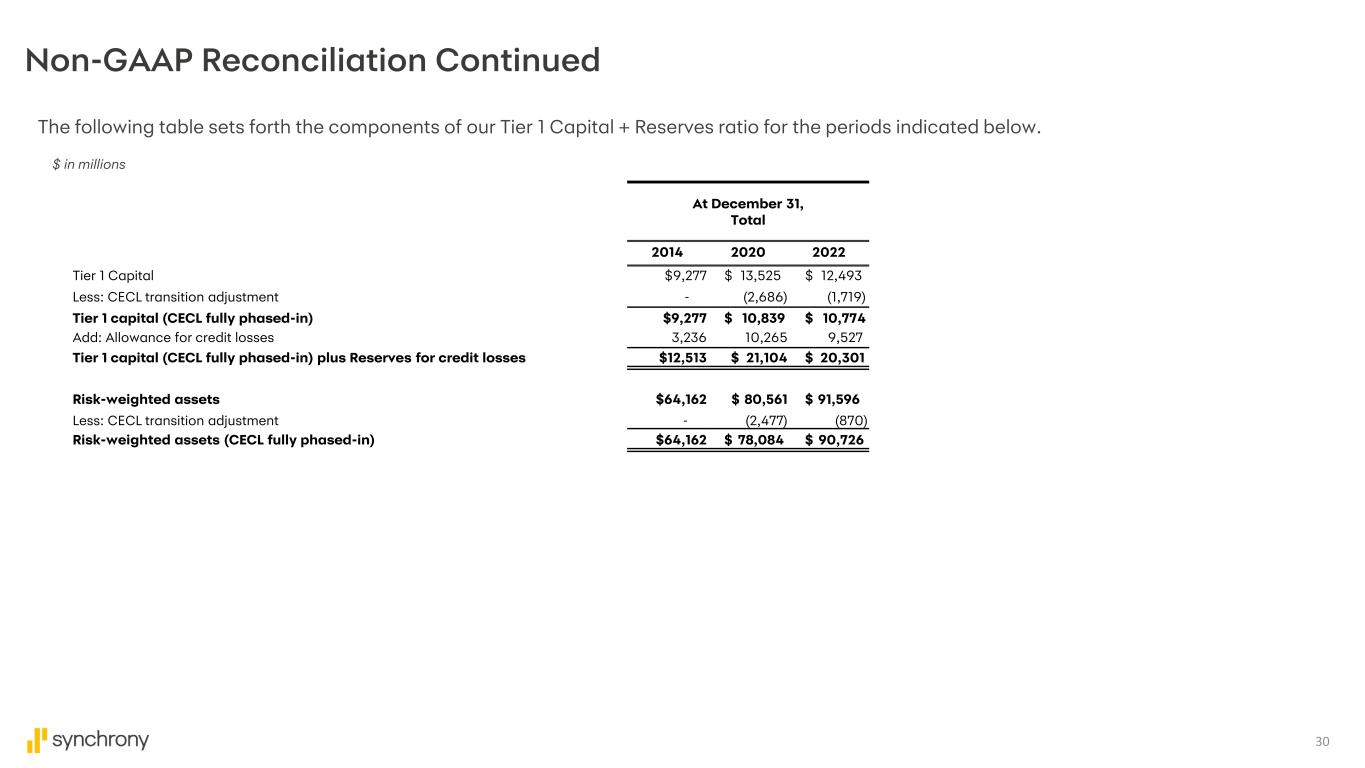

30 Non-GAAP Reconciliation Continued The following table sets forth the components of our Tier 1 Capital + Reserves ratio for the periods indicated below. $ in millions At December 31, Total 2014 2020 2022 Tier 1 Capital $9,277 $ 13,525 $ 12,493 Less: CECL transition adjustment - (2,686) (1,719) Tier 1 capital (CECL fully phased-in) $9,277 $ 10,839 $ 10,774 Add: Allowance for credit losses 3,236 10,265 9,527 Tier 1 capital (CECL fully phased-in) plus Reserves for credit losses $12,513 $ 21,104 $ 20,301 Risk-weighted assets $64,162 $ 80,561 $ 91,596 Less: CECL transition adjustment - (2,477) (870) Risk-weighted assets (CECL fully phased-in) $64,162 $ 78,084 $ 90,726

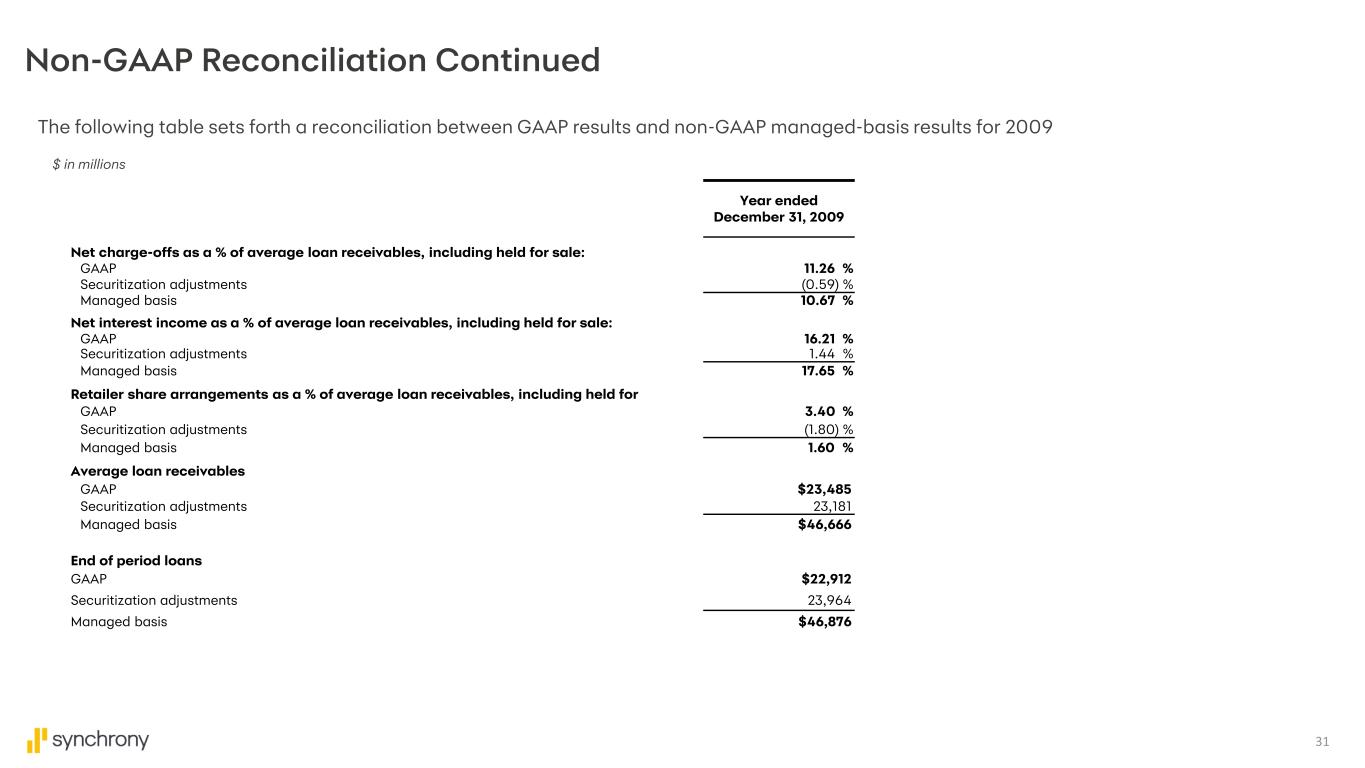

31 Non-GAAP Reconciliation Continued The following table sets forth a reconciliation between GAAP results and non-GAAP managed-basis results for 2009 $ in millions Year ended December 31, 2009 Net charge-offs as a % of average loan receivables, including held for sale: GAAP 11.26 % Securitization adjustments (0.59) % Managed basis 10.67 % Net interest income as a % of average loan receivables, including held for sale: GAAP 16.21 % Securitization adjustments 1.44 % Managed basis 17.65 % Retailer share arrangements as a % of average loan receivables, including held for GAAP 3.40 % Securitization adjustments (1.80) % Managed basis 1.60 % Average loan receivables GAAP $23,485 Securitization adjustments 23,181 Managed basis $46,666 End of period loans GAAP $22,912 Securitization adjustments 23,964 Managed basis $46,876