1 Exhibit 99.1

Synchrony Investor Day 2021

3 Cautionary Statement Regarding Forward-Looking Statements This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as "expects," "intends," "anticipates," "plans," "believes," "seeks," "targets," "outlook," "estimates," "will," "should," "may" or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated, including the future impacts of the novel coronavirus - icult to predict; retaining existing partners and attracting new partners, concentration of our revenue in a small number of partners, and promotion and support of our products by our partners; cyber-attacks or other security breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third-parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall - t of the Consumer Financial Protection hat limit our ability to pay dividends and repurchase our tion security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary Ris Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed on February 11, 2021. You should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. This presentation contains various statistical and other data relating to current and future market sizes and growth opportuniti which Synchrony operates. These data were sourced from third parties and also Synchrony internal analysis and involve a number of assumptions and estimates. Although we believe the information sourced from third parties to be reliable, we have not independently verified such information and cannot guarantee its accuracy or completeness. -in" capital measures, which are not prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The reconciliations of such measures to the most directly comparable GAAP measures are included at the end of this presentation. Disclaimers

4 Brian Doubles President & Chief Executive Officer

5 1932 We Have Built a Differentiated Business 2014 $933B purchase volume $78B loan receivables 65MM+ active accounts 29 U.S. patents Company founded 2021+ IPO, listed on NYSE Built on 89 years of experience and innovation, powered by bold moves in the past seven years. Since IPO1

6 130+ new partners 160+ existing partnership expansions 4 acquisitions Since IPO

7 EOP RECEIVABLESPURCHASE VOLUME NET INTEREST INCOME $71B $139B 2010 2020 2.0X $45B $82B 2010 2020 1.8X $8B $14B 2010 2020 1.9X

8 -Adjusted Returns 10.1% 14.9% 16.7% 16.9% 16.9% 17.0% 16.8% 16.1% 15.5% 15.5% 15.3% 9.9% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Direct Peers RISK-ADJUSTED YIELD (RAY) Peers 10-Year Historical Average RAY of 15.6% 1

9 Delivering Value for All Stakeholders, ADDITIONALLY, SYNCHRONY: One of the Board of Directors of any company in the Fortune 200 on the 2019 Fortune list of Best Places to Work for Diversity Ranked #5 of our 16,500 employees are members of one or more of our eight Diversity Networks More than 10,000 Most Diverse

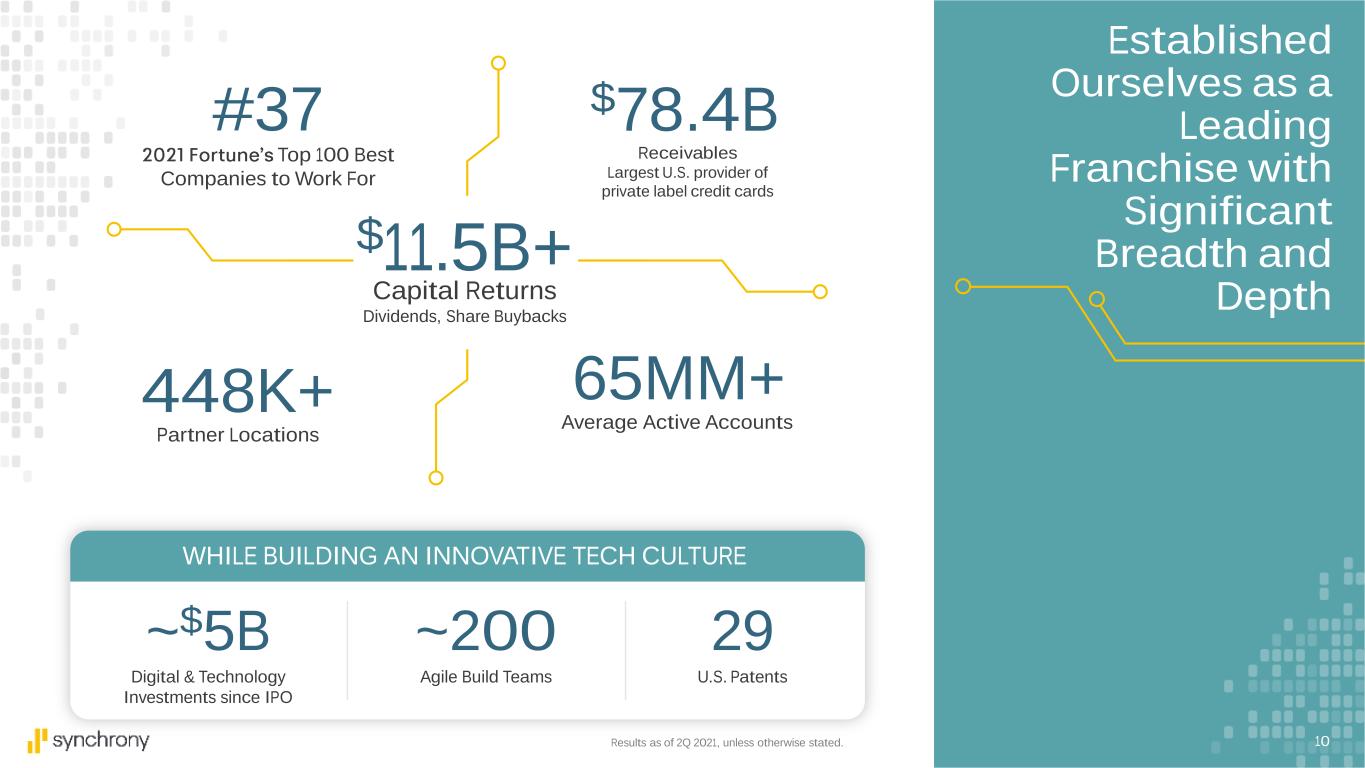

10 $11.5B+ Capital Returns Dividends, Share Buybacks #37 Top 100 Best Companies to Work For $78.4B Receivables Largest U.S. provider of private label credit cards 65MM+ Average Active Accounts Partner Locations 448K+ WHILE BUILDING AN INNOVATIVE TECH CULTURE ~200 Agile Build Teams 29 U.S. Patents ~$5B Digital & Technology Investments since IPO Results as of 2Q 2021, unless otherwise stated. Established Ourselves as a Leading Franchise with Significant Breadth and Depth

11 Synchrony enables commerce by delivering the leading financial ecosystem that connects our partners and our customers through world-class technology, products, and capabilities

12 Significant Opportunity in the Markets We Serve $5T Relevant Market

13 Digital Sample partners Platforms are Aligned to Power Growth Growth Tech Ops Credit Health & Wellness Home & Auto LifestyleDiversified & Value POWERED BY OUR SCALABLE FUNCTIONS:

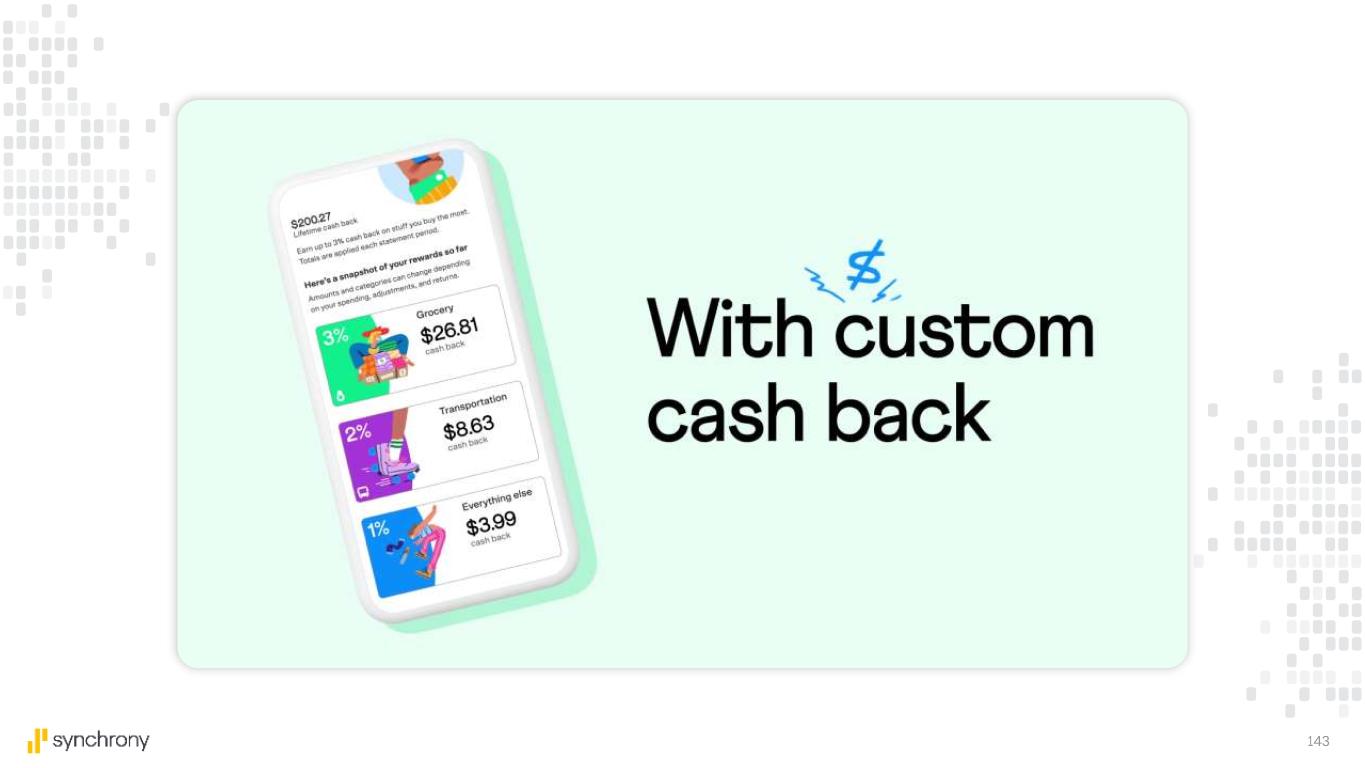

14 Partners and Customers are at the Forefront of Every Product & Service We Offer Customer Choice Purchasing Power Frictionless, Digital CX Value Prop Experience & Trust Seamless Customer Journey APPLY USE SERVICEENGAGE Multi-product Suite Digital Bank BNPL/Installments Growth Adjacencies PLCC DUAL CARD CO-BRAND SECURED NETWORK SYNCHRONY MC PET INSURANCE HEALTH SYSTEMS GIFTNOW INSTALLMENTS & LEASING INSTALLMENTS & BNPL SYNCHRONY NETWORKS & MARKETPLACE SECURED Revolving Commercial BUSINESS REVOLVING CREDIT INVOICE-BASED HIGH YIELD SAVINGS CD IRA MONEY MARKET

15

16 TECHNOLOGY ANALYTICS DATA PRODUCTS Align with Partner and Customer Choice CUSTOMER EXPERIENCE Leading Financial Ecosystem of Products & Capabilities

17 Enabling Partner and Customer Choice CUSTOMER DATA & INSIGHTS ALIGN TO BEST PRODUCT & VALUE PROPOSITION OPTIMIZED PRODUCT OFFERING Brand Affinity Ticket Size Credit History Transaction Intent SetPay/BNPL Co- Promotional Offers Right Product, Right Time, Right Purchase

18 Seamless Customer Experiences through Our Proprietary Products, Strategic Investments and Acquisitions AGILE INVESTMENT TECH INVESTMENTCLOUDINNOVATION STATION PROPRIETARY PRODUCTS & CAPABILITIES BUILD developer SyPI Attribute Data Share Synchrony Enterprise Data Lake ENGAGE 100 API ENDPOINTS Synchrony Plug-In ACQUISITIONS STRATEGIC INVESTMENTS & PARTNERSHIPS

19 WE DELIVEROUR STRATEGY DRIVING VALUE FOR OUR STAKEHOLDERS Solidifying Our Position as a Leading Financial Ecosystem Sustainable Growth Attractive Risk-Adjusted Returns Diversify our Programs, Products & Markets Grow & Win New Partners Deliver Best-in-Class Customer Experiences STRONG FOUNDATION Broad & Deep Partnerships Large Customer Base Proprietary Data & Advanced Analytics Dynamic Digital Platform Mutually Aligned Outcomes Compelling Value Propositions Customized Suite of Products & Services Unique Industry Expertise & Insights

20 Beto Casellas Health & Wellness CEO Curtis Howse Home & Auto CEO Tom Quindlen Diversified & Value and Lifestyle CEO Bart Schaller Digital CEO Michael Bopp Chief Growth Officer Carol Juel Chief Technology & Operating Officer Brian Doubles President & CEO Henry Greig Chief Credit & Capital Management Officer Brian Wenzel Sr. Chief Financial Officer Discussion

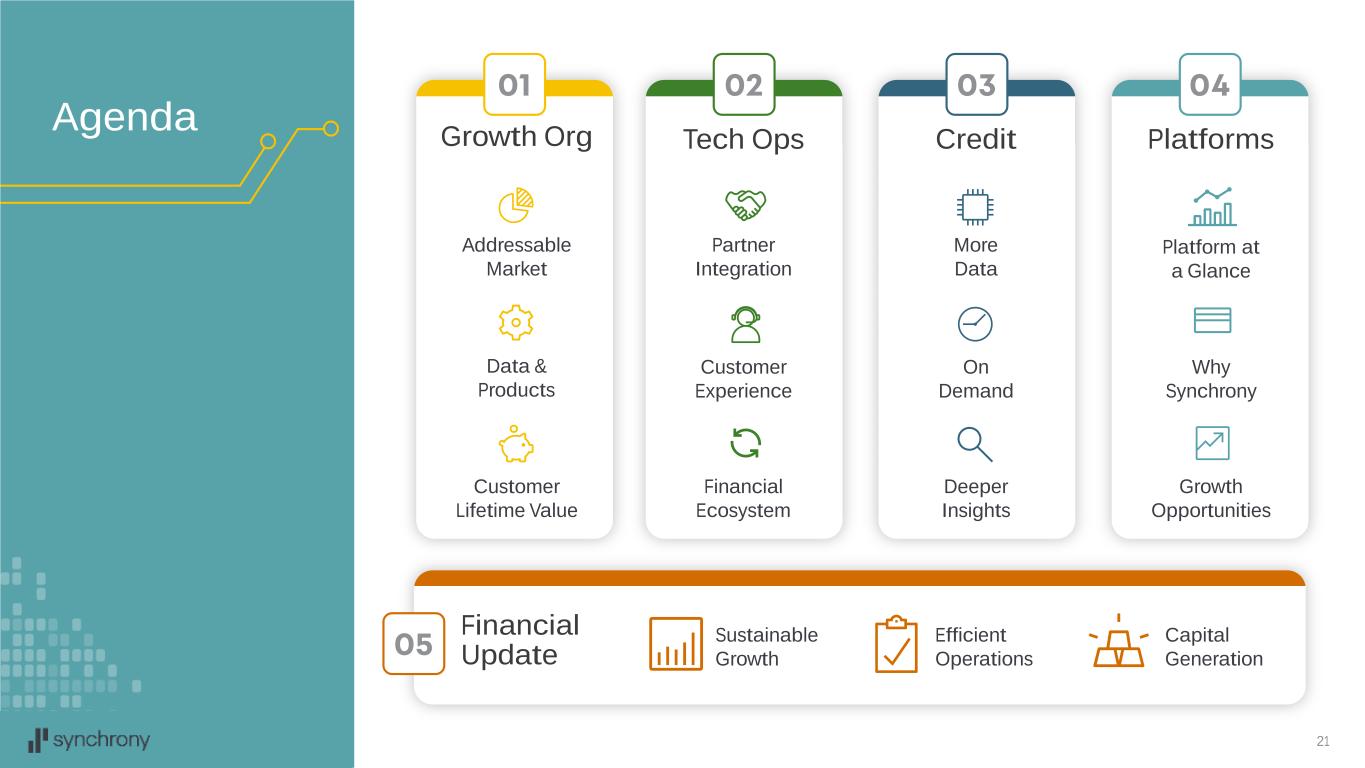

21 Agenda Addressable Market Growth Org Data & Products Customer Lifetime Value Financial Update Sustainable Growth Capital Generation Efficient Operations Partner Integration Tech Ops Customer Experience Financial Ecosystem More Data Credit On Demand Deeper Insights Platform at a Glance Platforms Why Synchrony Growth Opportunities

22 Mike Bopp EVP & Chief Growth Officer

23 INSIGHTS Leverage unique access to data to drive program performance PRODUCT OPTIMIZATION Comprehensive offering to provide best solution to customer EXPERIENCE Exceptional customer experience with a digital first lensSCALE Largest Cardholder Base Vast Partner Network Synchrony is Well-Positioned for Growth

24 Significant Customer Scale #2 65MM+ Average Active Accounts1 #1 60MM Cardholders1 Among top U.S. consumer credit card issuers

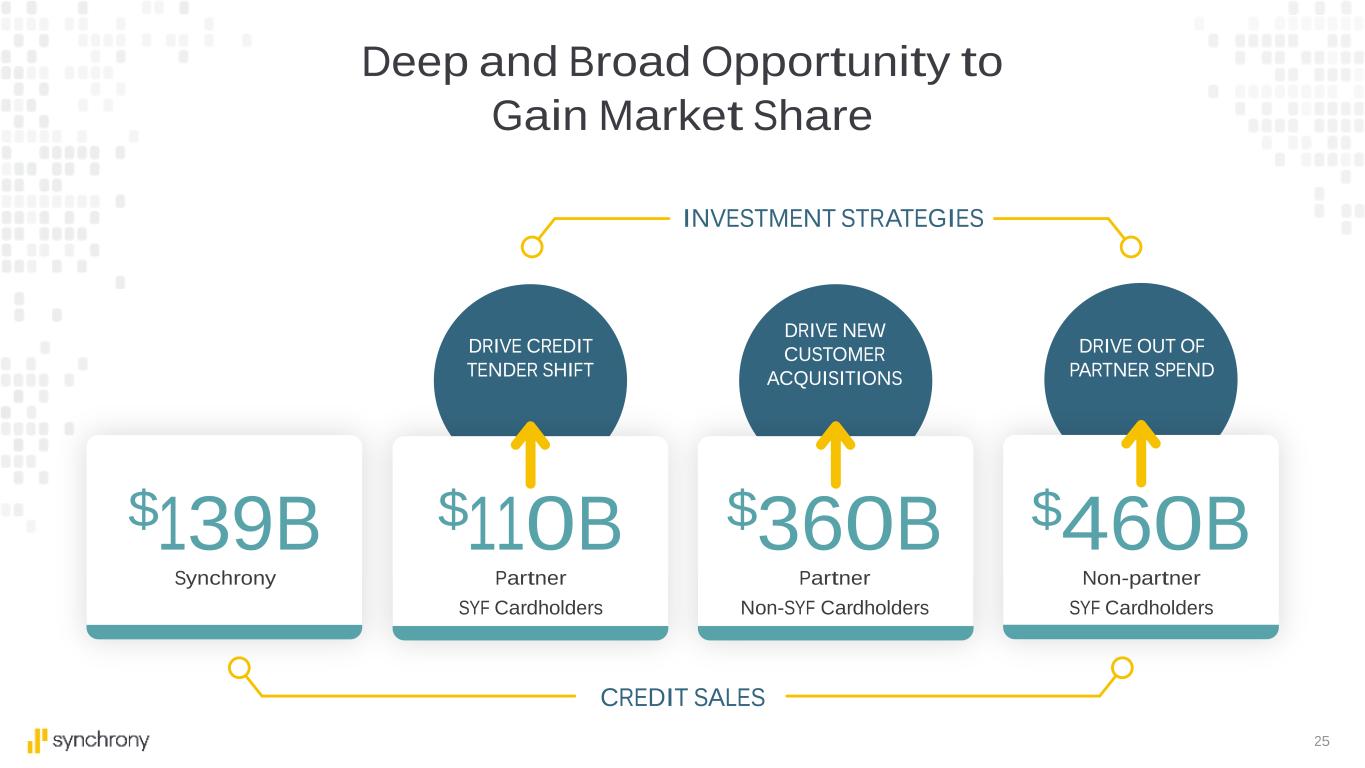

25 Synchrony $139B Partner $110B SYF Cardholders Partner $360B Non-SYF Cardholders Non-partner $460B SYF Cardholders DRIVE NEW CUSTOMER ACQUISITIONS DRIVE OUT OF PARTNER SPEND DRIVE CREDIT TENDER SHIFT CREDIT SALES INVESTMENT STRATEGIES Deep and Broad Opportunity to Gain Market Share

26 Customer Scale is Activated Through Our Partner Marketplaces MYSYNCHRONY CARECREDIT 180MM 118K 1MM visits partner locations 100MM 250K 18MM visits provider locations provider viewsreferrals

27 2Q '17 2Q '21 REPEAT SALES IN SYNCHRONY NETWORKS1 43% 52% 1.6x 1.9x 2.0x BNPL PLCC CareCredit PLCC H&A PLCC AVERAGE MONTHLY SALES PER ACTIVE VS. BNPL2 1.5x HOME & Auto PLCC Leveraging Our Network Effect to Drive Sales to Our Partners CareCredit PLCC Other SYF PLCC

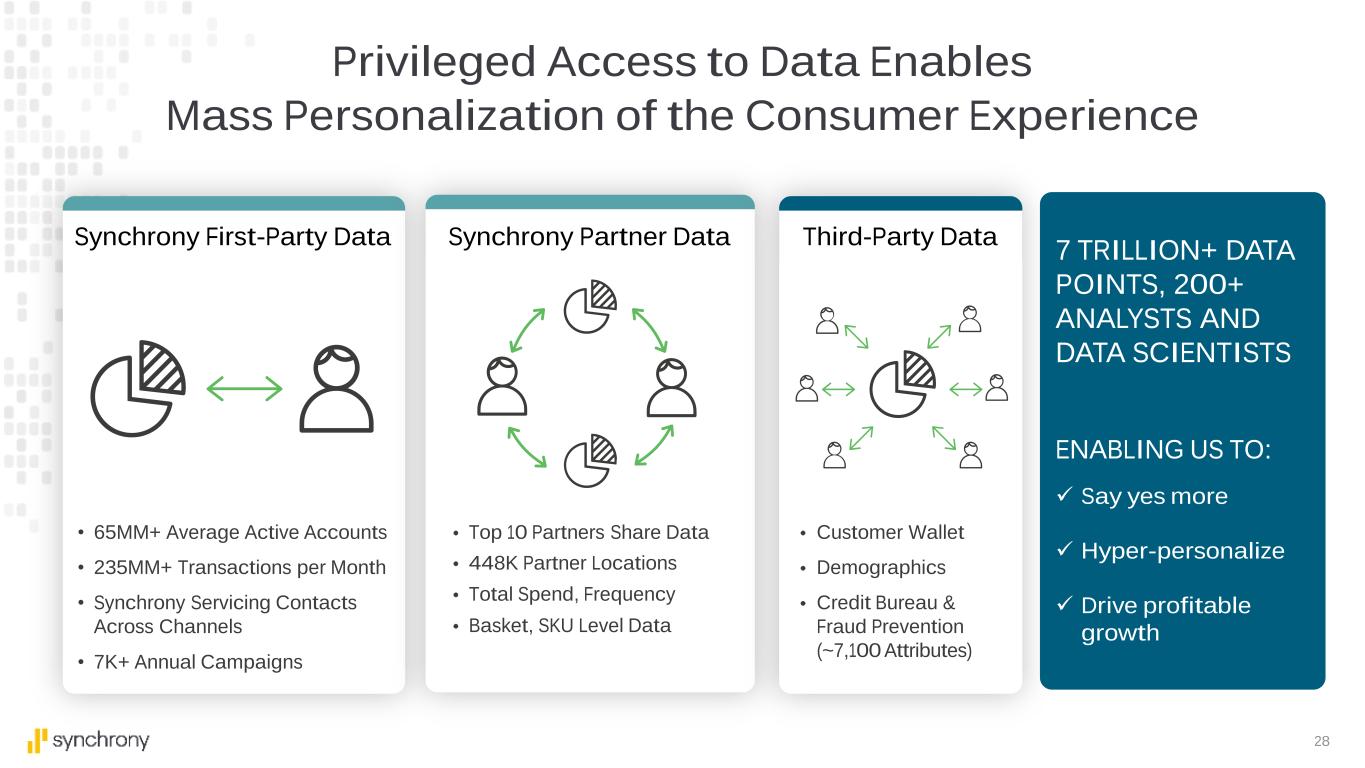

28 Synchrony First-Party Data Synchrony Partner Data • 65MM+ Average Active Accounts • 235MM+ Transactions per Month • Synchrony Servicing Contacts Across Channels • 7K+ Annual Campaigns Top 10 Partners Share Data 448K Partner Locations Total Spend, Frequency Basket, SKU Level Data 7 TRILLION+ DATA POINTS, 200+ ANALYSTS AND DATA SCIENTISTS ENABLING US TO: ✓ Say yes more ✓ Hyper-personalize ✓ Drive profitable growth Third-Party Data Customer Wallet Demographics Credit Bureau & Fraud Prevention (~7,100 Attributes) Privileged Access to Data Enables Mass Personalization of the Consumer Experience

29 CREDIT LINE OPTIMIZATION Average Credit Line Assignment +20 to 30% Post-Data Share Pre-Data Share PURCHASE VOLUME INCREASE Average Month 1 Sales/New Account Post-Data Share Pre-Data Share +15 to 20% Data-Sharing Ecosystem Drives Growth and Expands Access Across Our Partner Network Improved credit line best consumers Increase in initial consumer spending 512 data elements of Synchrony active accounts1 and growing! ~75% covering

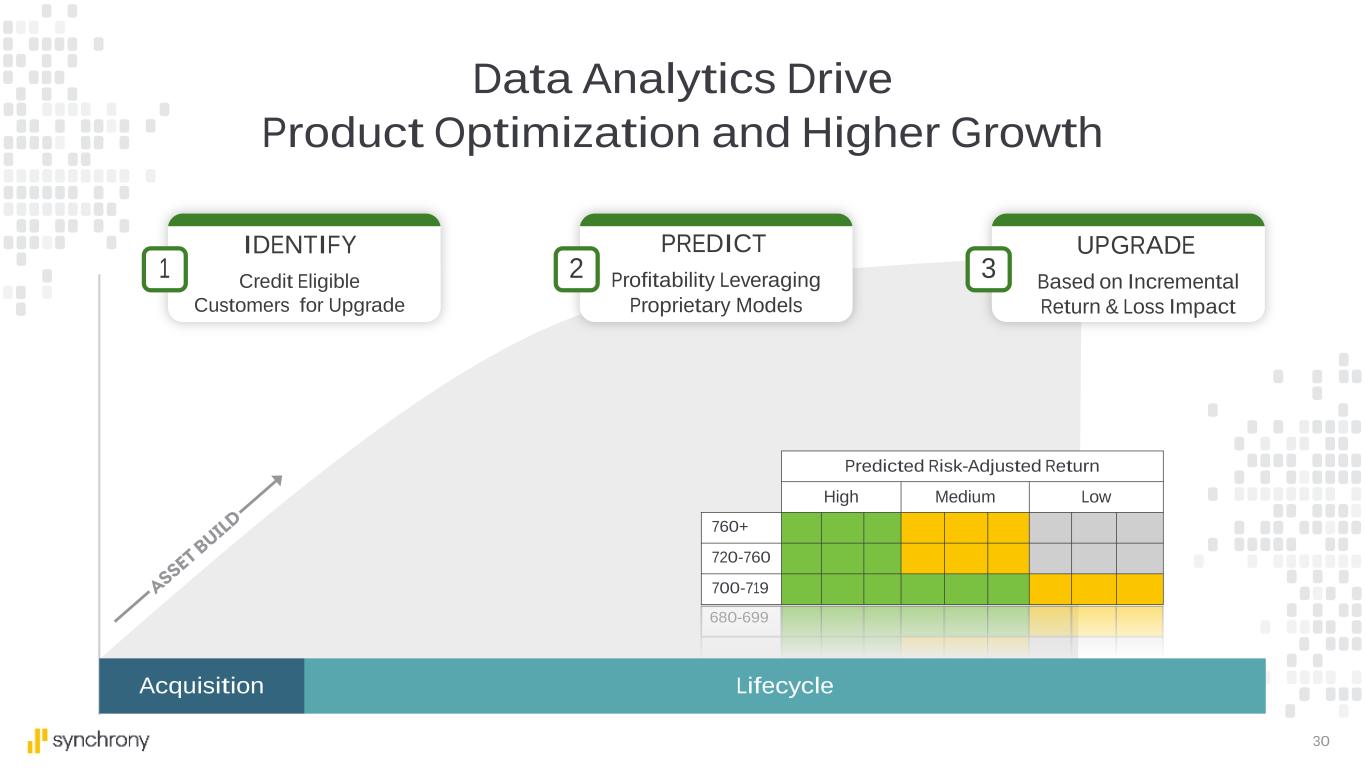

30 Data Analytics Drive Product Optimization and Higher Growth Predicted Risk-Adjusted Return High Medium Low 760+ 720-760 700-719 680-699 Acquisition 2 PREDICT Profitability Leveraging Proprietary Models Lifecycle 1 IDENTIFY Credit Eligible Customers for Upgrade 3 UPGRADE Based on Incremental Return & Loss Impact

31 -12 -9 -6 -3 0 3 6 9 12 15 18 21 RISK-ADJUSTED RETURN1 per account/per month UPGRADED CONTROL SYF Top 6 Issuers LIFETIME VALUE1 ~1.6X CONTROL UPGRADED Journey to Drive Lifetime Value 98% increase in sales increase in balances 78% Post-Upgrade (Move from PLCC to Dual Card) Delta Driven By:

32 QR CODE INSTALLMENTS & BNPL GIFTNOW HEALTH SYSTEMS PET INSURANCE Revolving PAYMENT INTEGRATIONS SECURED Installments Growth Adjacencies POSCLIENT WALLET 3RD-PARTY WALLET APIS PLCC DUAL CARD CO-BRAND SECURED NETWORK SYNCHRONY MC COMMON PLATFORMS Comprehensive Product Set Powered by Scalable Tech Business BUSINESS REVOLVING COMMERCIAL ACCOUNT DIGITAL ACQUISITIONS NATIVE PLUG-IN DIGITAL SERVICING DIGITAL MARKETINGREWARDS INSTALLMENTS & LEASING

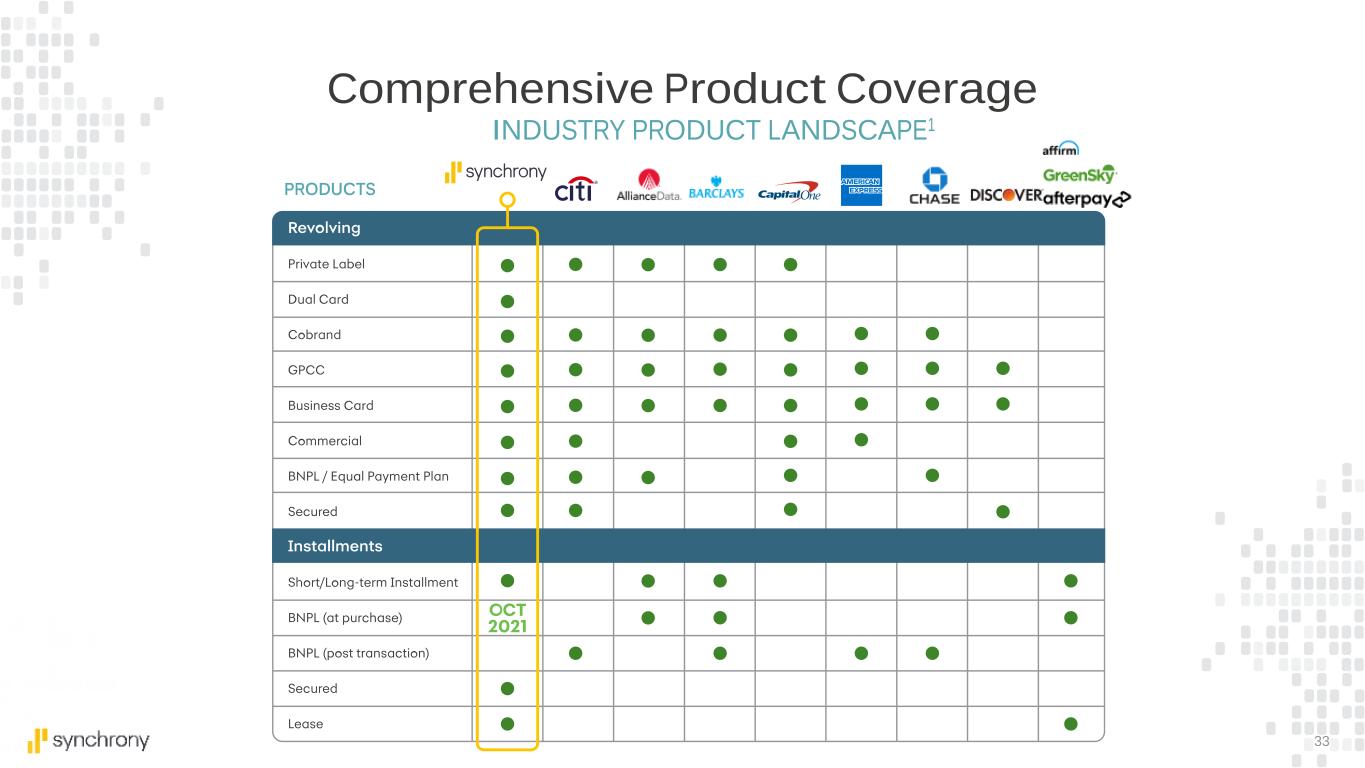

33 Comprehensive Product Coverage INDUSTRY PRODUCT LANDSCAPE1 PRODUCTS

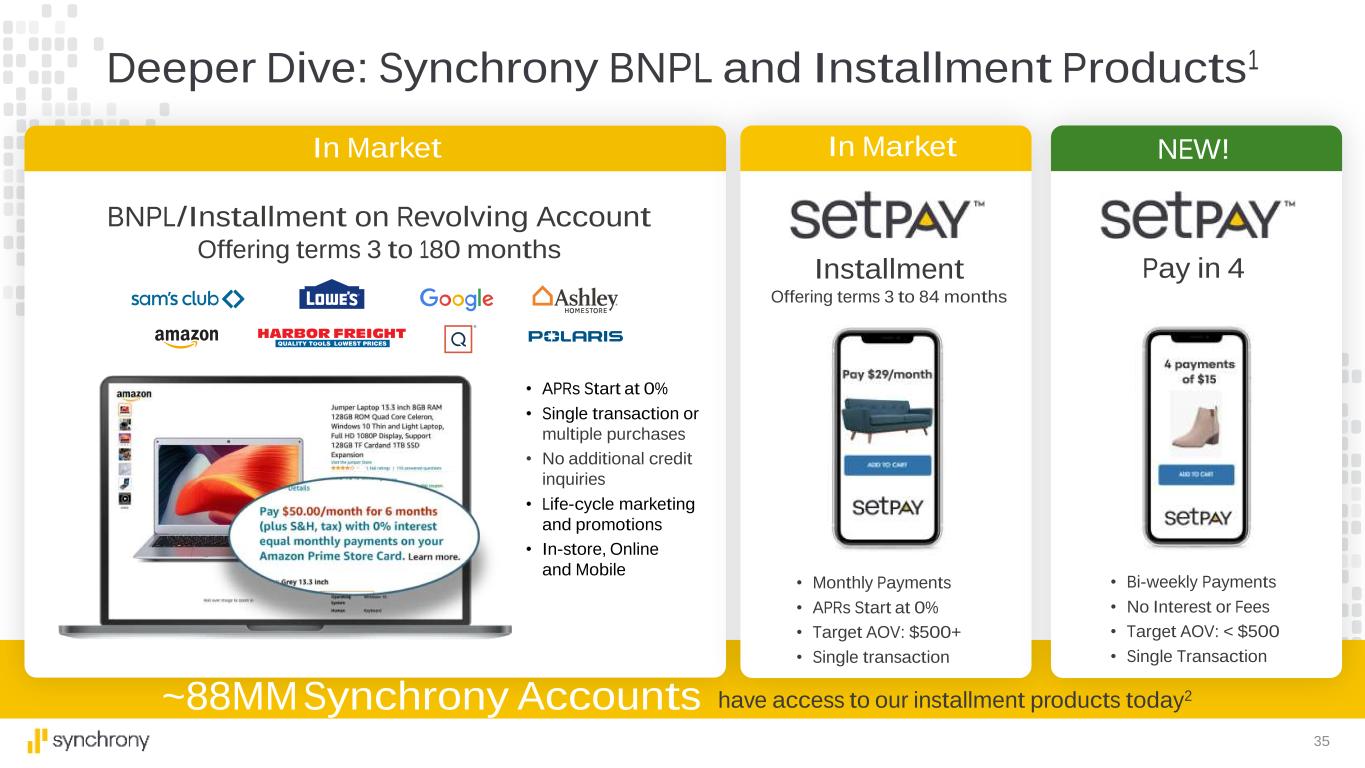

34 • APRs start at 0% • Single transaction or multiple purchases • No additional credit inquiries • Lifecycle marketing and promotions • In store, online and mobile BNPL/Installment on Revolving Account Offering terms 3 to 180 months In Market Deeper Dive: Synchrony BNPL and Installment Products1 Amazon Harbor Freight Google

35 BNPL/Installment on Revolving Account Offering terms 3 to 180 months In Market • APRs Start at 0% • Single transaction or multiple purchases • No additional credit inquiries • Life-cycle marketing and promotions • In-store, Online and Mobile In Market Installment Offering terms 3 to 84 months • Monthly Payments • APRs Start at 0% • Target AOV: $500+ • Single transaction Pay in 4 NEW! • Bi-weekly Payments • No Interest or Fees • Target AOV: < $500 • Single Transaction ~88MM Synchrony Accounts have access to our installment products today2 Deeper Dive: Synchrony BNPL and Installment Products1

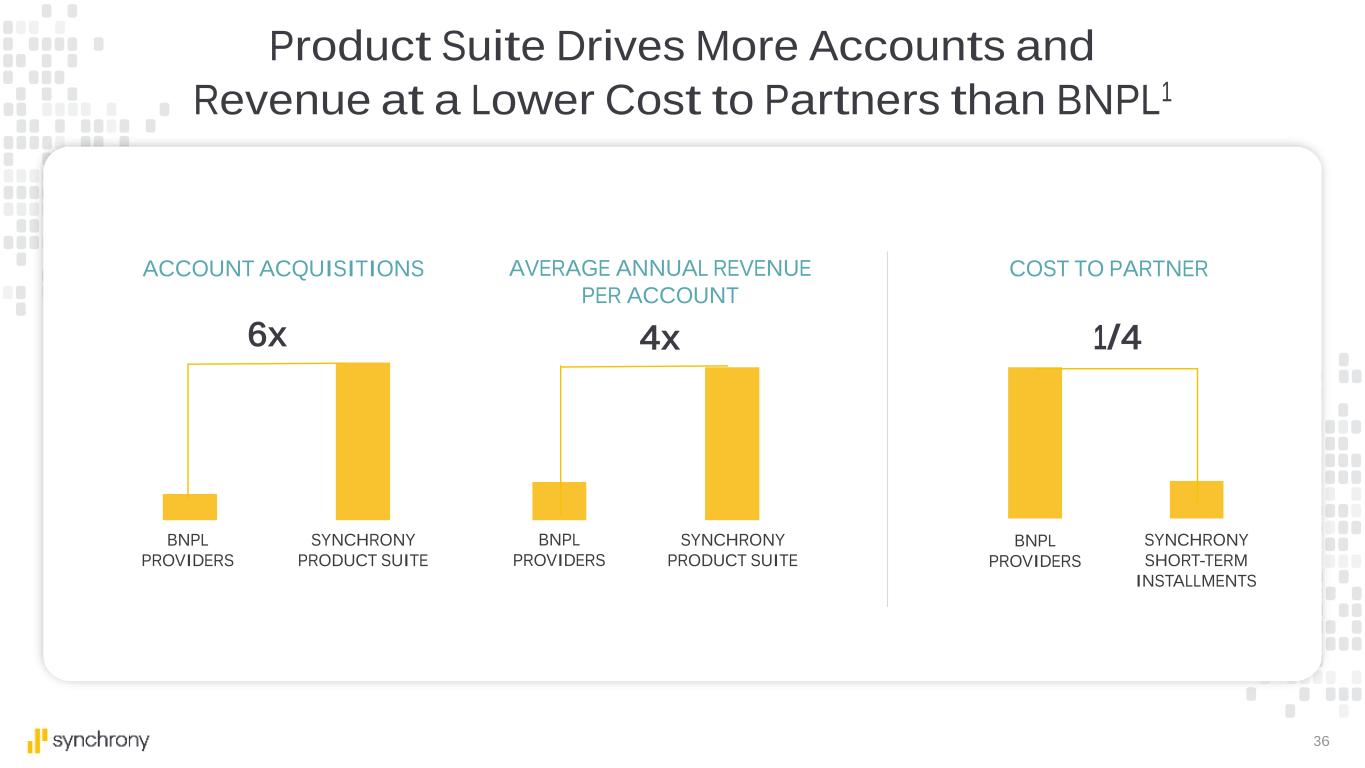

36 1/4 COST TO PARTNERACCOUNT ACQUISITIONS AVERAGE ANNUAL REVENUE PER ACCOUNT 6x 4x SYNCHRONY PRODUCT SUITE SYNCHRONY PRODUCT SUITE SYNCHRONY SHORT-TERM INSTALLMENTS Product Suite Drives More Accounts and Revenue at a Lower Cost to Partners than BNPL1 BNPL PROVIDERS BNPL PROVIDERS BNPL PROVIDERS

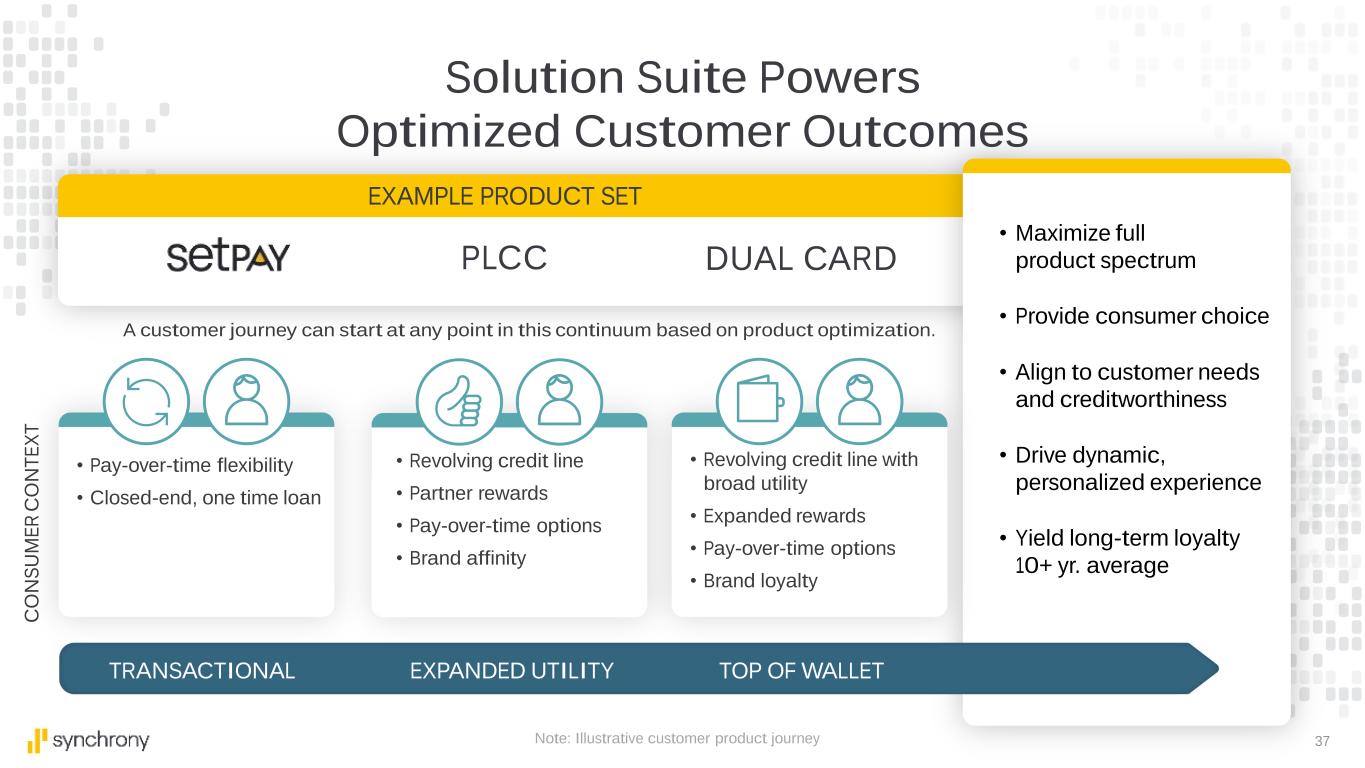

37Note: Illustrative customer product journey • Pay-over-time flexibility • Closed-end, one time loan PLCC • Revolving credit line • Partner rewards • Pay-over-time options • Brand affinity DUAL CARD • Maximize full product spectrum • Provide consumer choice • Align to customer needs and creditworthiness • Drive dynamic, personalized experience • Yield long-term loyalty 10+ yr. average EXPANDED UTILITYTRANSACTIONAL TOP OF WALLET EXAMPLE PRODUCT SET C O N S U M E R C O N T E X T Solution Suite Powers Optimized Customer Outcomes A customer journey can start at any point in this continuum based on product optimization. • Revolving credit line with broad utility • Expanded rewards • Pay-over-time options • Brand loyalty

38 The Power of Choice Experience Driven Built to Evolve Seamlessly Connecting Our Partners to Customers and Products Higher Conversion | More Sales | Loyal, Engaged Consumers | Less Effort for Partners | More Tools and Resources to Drive Growth | Financing Options to Meet Every Consumer Need

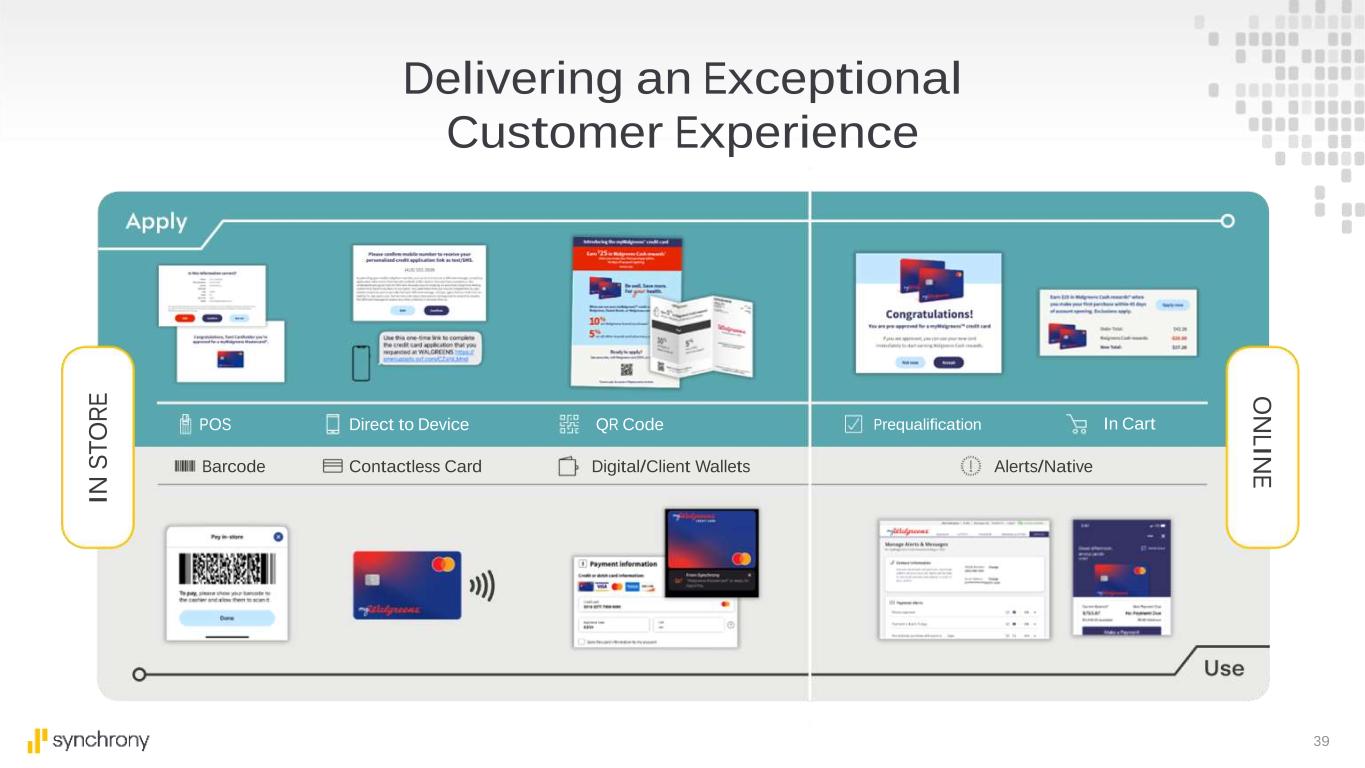

39 O N LIN E QR CodePOS Direct to Device Prequalification In Cart Barcode Contactless Card Digital/Client Wallets Alerts/Native IN S T O R E Delivering an Exceptional Customer Experience

40 Unmatched customer scale and vast partner base Privileged access to data and investments in data ecosystem Comprehensive product offering and exceptional experience, optimized for each customer

41 Carol Juel Chief Technology & Operating Officer

42 Dynamic, scalable technology a key differentiator that empowers success

43 Our Investments Power Innovation Products & Capabilities Foundational IPO & Transformation Pre-IPO 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 APIsCloud Artificial IntelligenceData Lake Data Centers & Infrastructure Cyber Data Centers & Infrastructure Cyber Digital & Native Data Centers & Infrastructure Cyber Digital & Native APIsCloud Artificial IntelligenceData Lake Legacy MobileeCommerce eCommerce + Advanced Cyber BNPL & Installment

44 Reaching more partners Providing more options to customers Translating data into action

45

46 Digital & Native Data Centers & Infrastructure CyberAPIsCloud P WERED BY Partner Technology Investment Home Improvement Contractor Auto Shop Powersports Dealer Veterinary Clinic Health Systems Physical Retail eTailer Flexible Technology Powers Partner Integration, Regardless of Size or Tech Sophistication

47

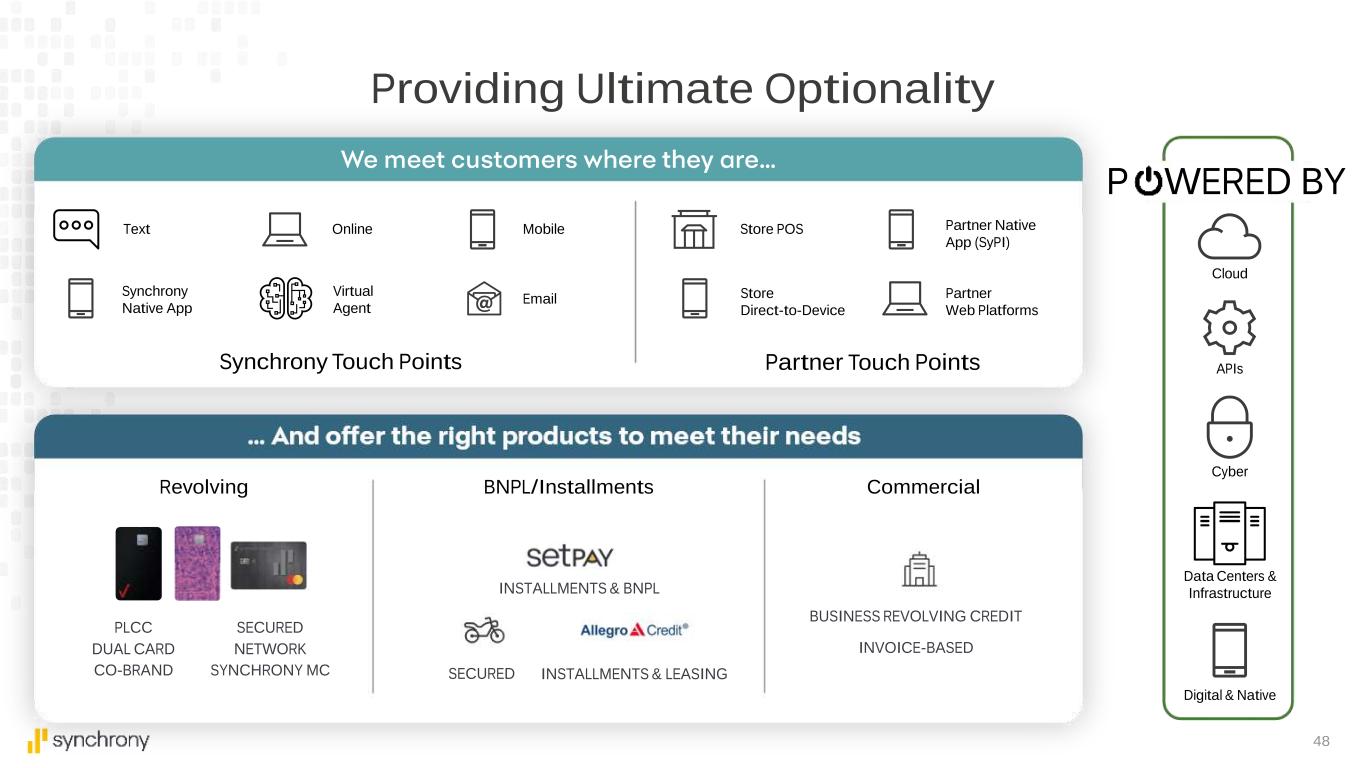

48 Providing Ultimate Optionality P WERED BY Digital & Native Data Centers & Infrastructure Cyber APIs Cloud Partner Touch PointsSynchrony Touch Points Store Direct-to-Device Partner Web Platforms Email Virtual Agent Synchrony Native App Store POS Partner Native App (SyPI) Text Online Mobile PLCC DUAL CARD CO-BRAND INSTALLMENTS & LEASING INSTALLMENTS & BNPL SECURED BUSINESS REVOLVING CREDIT INVOICE-BASED SECURED NETWORK SYNCHRONY MC Revolving BNPL/Installments Commercial

49

50 Partner Touch PointsSynchrony Touch Points Store Direct-to-Device Partner Web Platforms Email Virtual Agent Synchrony Native App Store POS Partner Native App (SyPI) Text Online Mobile Revolving BNPL/Installments Commercial PLCC DUAL CARD CO-BRAND INSTALLMENTS & LEASING INSTALLMENTS & BNPL SECURED BUSINESS REVOLVING CREDIT INVOICE-BASED SECURED NETWORK SYNCHRONY MC KEY Demonstrated in video Not in video, but Not currently

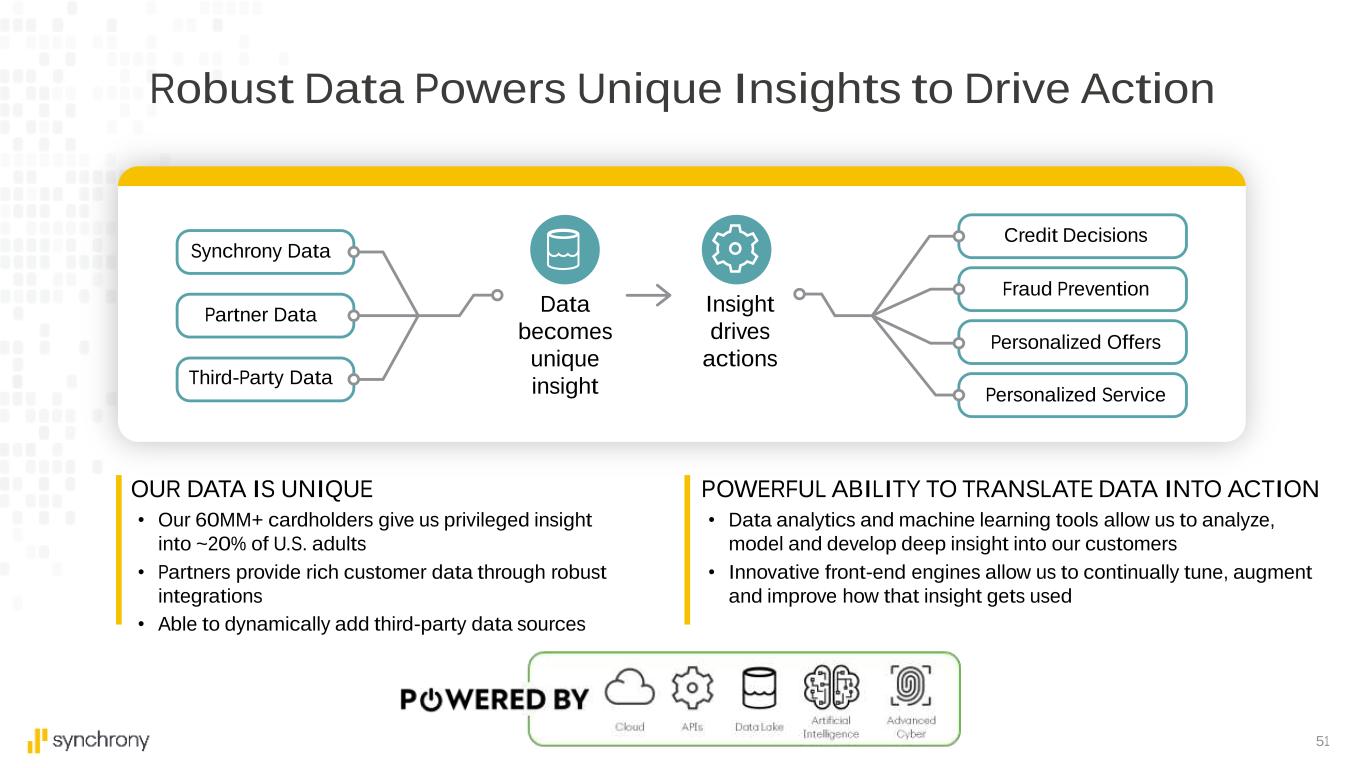

51 Advanced Cyber Artificial Intelligence Data LakeAPIsCloud P WERED BY OUR DATA IS UNIQUE • Our 60MM+ cardholders give us privileged insight into ~20% of U.S. adults • Partners provide rich customer data through robust integrations • Able to dynamically add third-party data sources POWERFUL ABILITY TO TRANSLATE DATA INTO ACTION • Data analytics and machine learning tools allow us to analyze, model and develop deep insight into our customers • Innovative front-end engines allow us to continually tune, augment and improve how that insight gets used Robust Data Powers Unique Insights to Drive Action Data becomes unique insight Insight drives actions Synchrony Data Partner Data Third-Party Data Credit Decisions Fraud Prevention Personalized Offers Personalized Service

52

53 Reaching more partners, no matter where they are on their technology journey. Providing more options to customers, from products to touchpoints. Translating data to swift action and delivering insight to maximum point of impact.

54 Henry Greig EVP Chief Credit & Capital Management Officer

55 Synchrony Credit Strategy

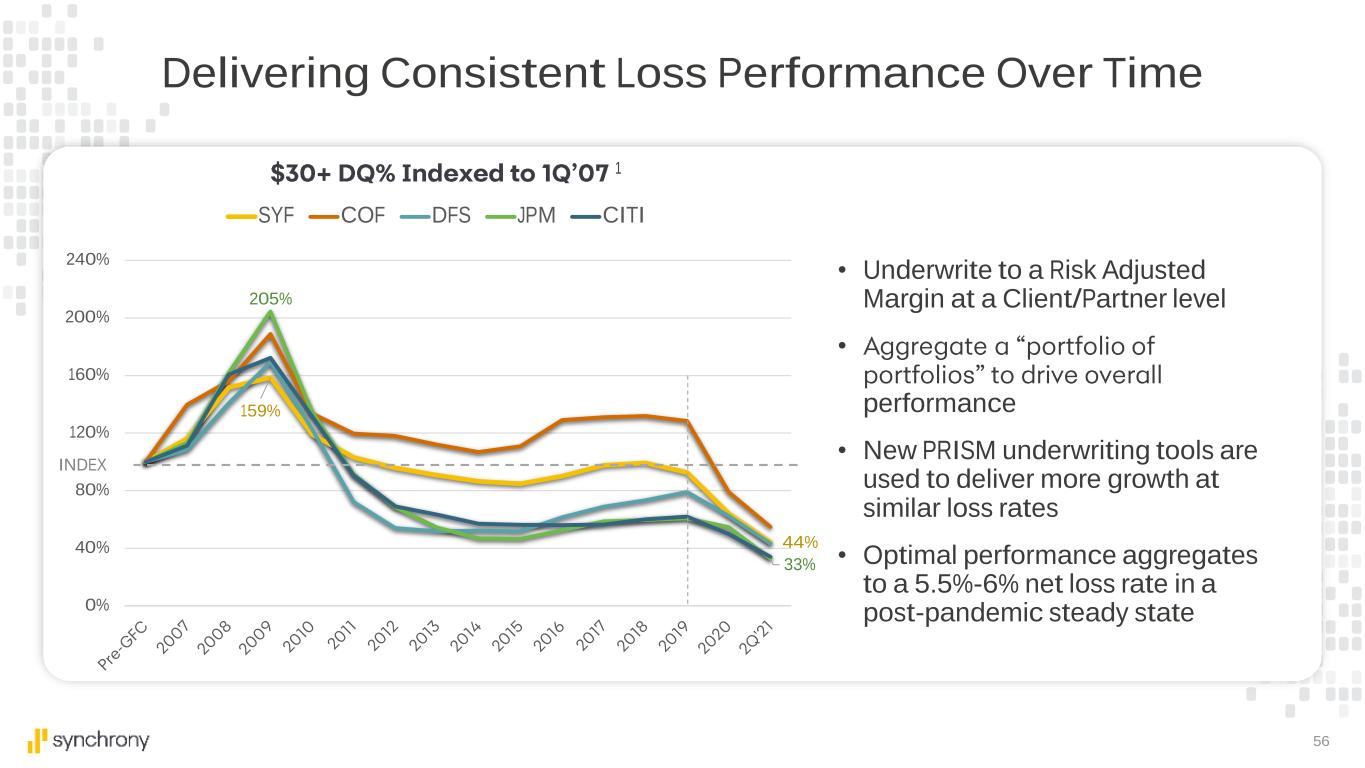

56 Delivering Consistent Loss Performance Over Time • Underwrite to a Risk Adjusted Margin at a Client/Partner level • performance • New PRISM underwriting tools are used to deliver more growth at similar loss rates • Optimal performance aggregates to a 5.5%-6% net loss rate in a post-pandemic steady state 159% 44% 205% 33% 0% 40% 80% 120% 160% 200% 240% 1 SYF COF DFS JPM CITI INDEX

57

58 Revolutionizing credit underwriting with a customer-centric approach to streamline customer experiences, proactively reward customers with higher lines, protect customers and drive sales for our partners. Streamlined Customer Experiences Credit Lines That Meet Customer Needs Continuous Learning. Continuous Enhancements More Approvals with Higher Sales and Lower Losses for our Partners and our Company

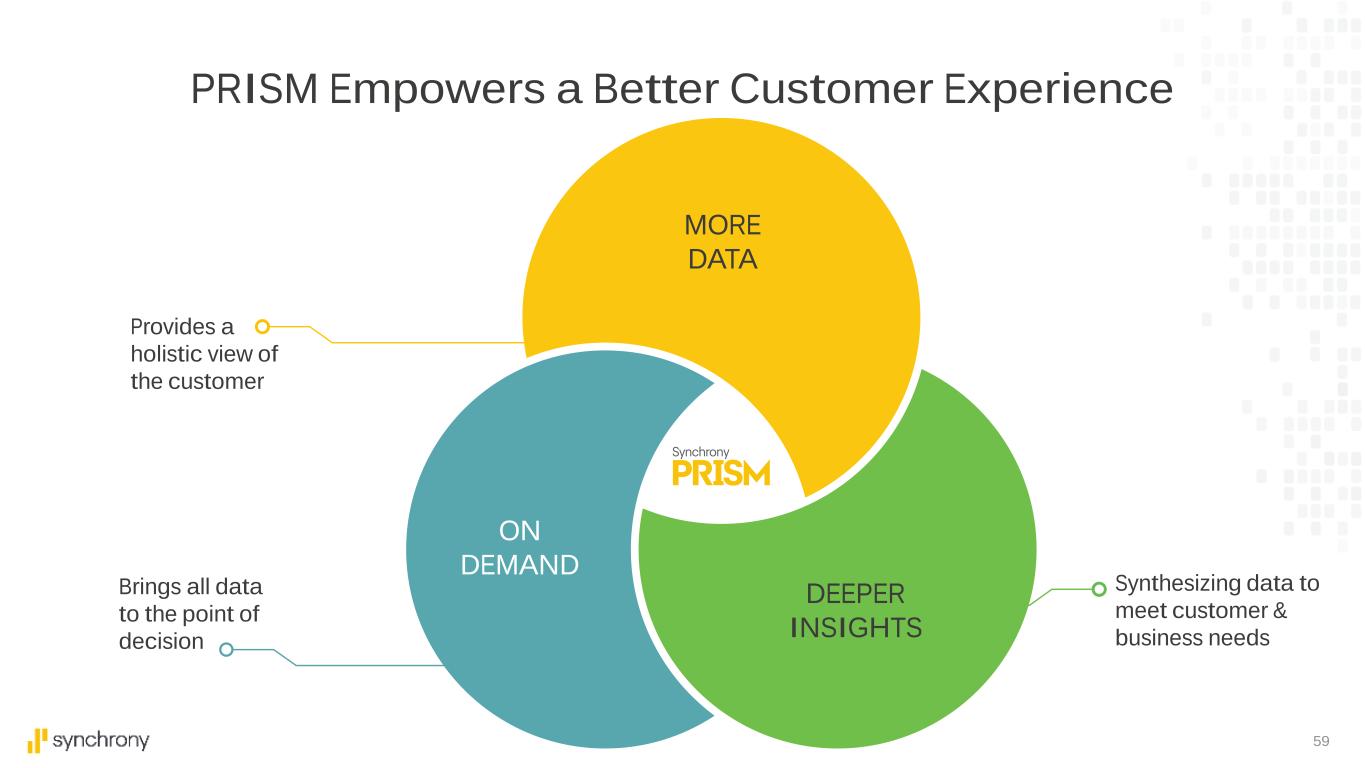

59 Brings all data to the point of decision Provides a holistic view of the customer PRISM Empowers a Better Customer Experience Synthesizing data to meet customer & business needs MORE DATA DEEPER INSIGHTS ON DEMAND

60 Harnessing Years of Customer Data and Client Relationships PERSONAL PROFILES Core Bureau Trended Data • Payment/Delinquency History • Inquiries/Time on File • Revolving Balances/Lines Synchrony Data • 100MM+1 customers and billions of transactions • Multiple accounts and touchpoints Client Specific Data • Highlights customer engagement (i.e., frequency, spend) • Proprietary at the Client level Alternative Data • Utility Data • Digital Footprint/Identity • Income Assets/Cash Flow • Payday Loan REAL-TIME DEPLOY OF CREDIT DECISIONS More Sources of Data Added Every Day

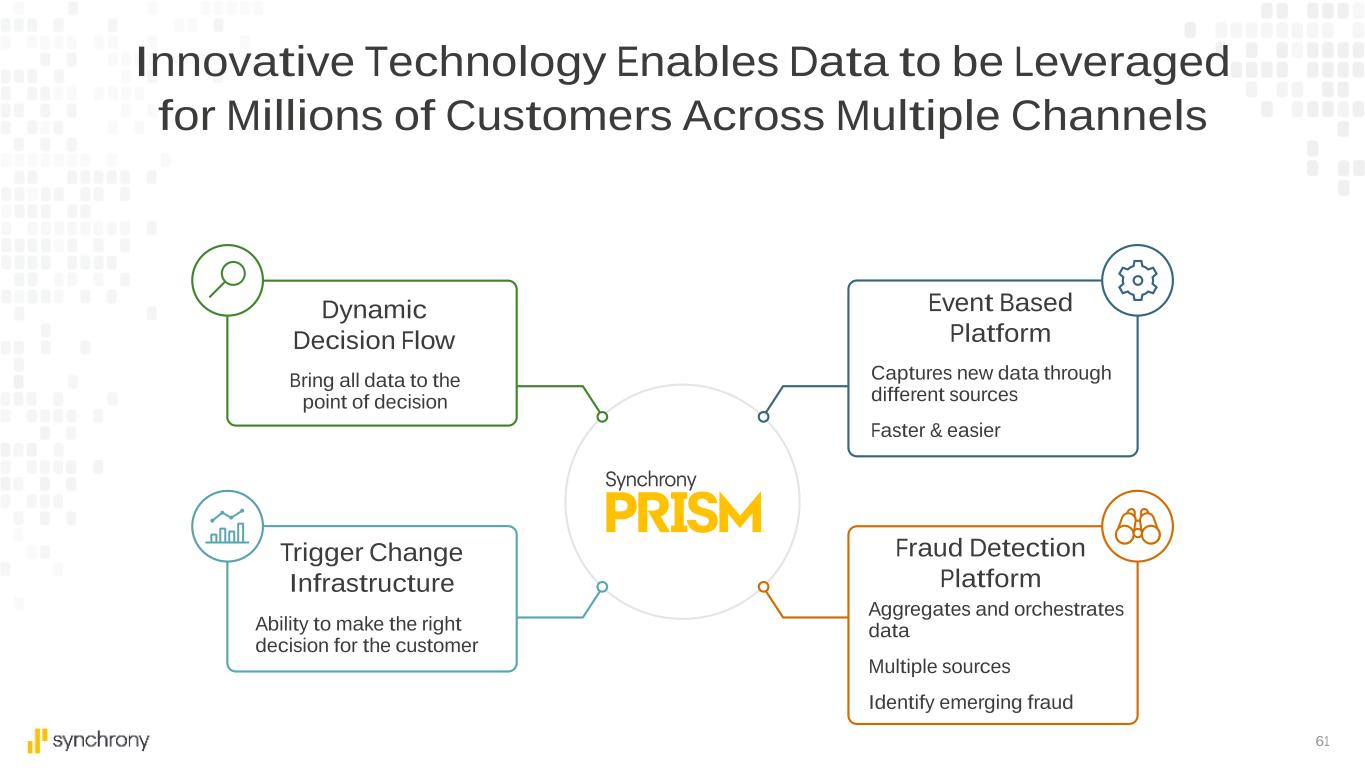

61 Innovative Technology Enables Data to be Leveraged for Millions of Customers Across Multiple Channels Event Based Platform Fraud Detection Platform Trigger Change Infrastructure Dynamic Decision Flow Bring all data to the point of decision Ability to make the right decision for the customer Captures new data through different sources Faster & easier Aggregates and orchestrates data Multiple sources Identify emerging fraud

62 Distilling Massive Amounts of Data Down to Critical Customer Behavior ALERTS PLATFORM • Customized alerts • Detect anomalous behavior and trends Ability to implement new strategies faster SPECIFIC PROPRIETARY SCORES Leveraging our unique data assets FRAUD ANALYTIC SOLUTIONS • Leverage data from multiple sources • Machine learning solutions

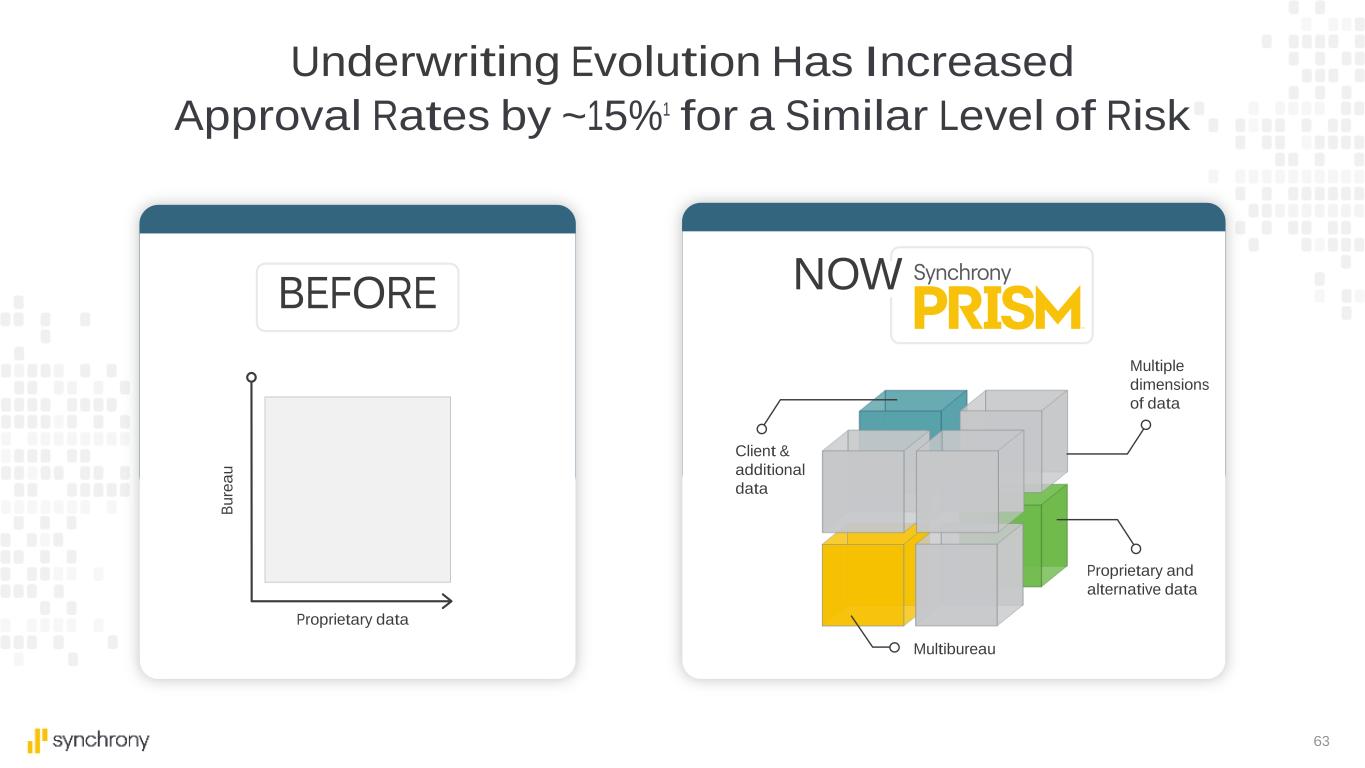

63 Underwriting Evolution Has Increased Approval Rates by ~15%1 for a Similar Level of Risk BEFORE NOW Client & additional data Multiple dimensions of data Proprietary and alternative data Multibureau Proprietary data B u re a u

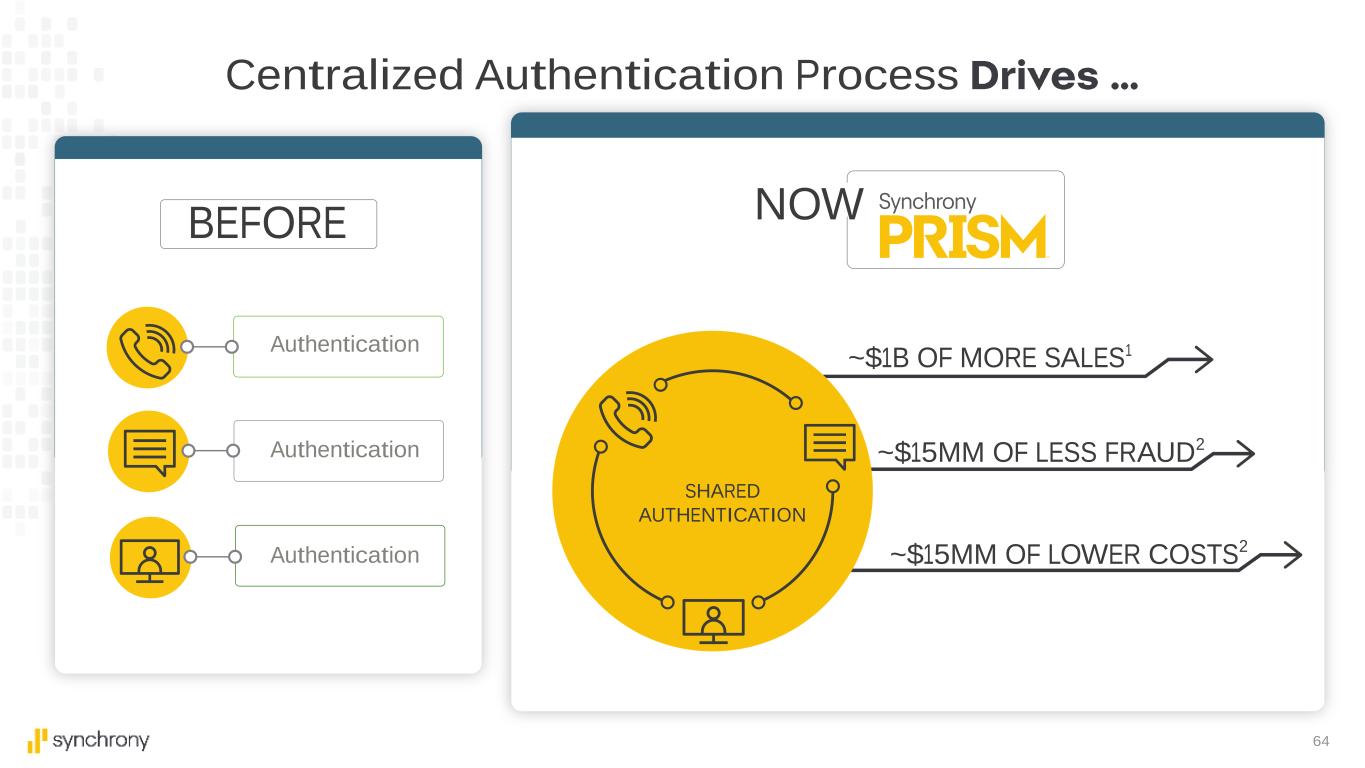

64 Centralized Authentication Process Authentication Authentication Authentication SHARED AUTHENTICATION ~$1B OF MORE SALES1 ~$15MM OF LESS FRAUD2 ~$15MM OF LOWER COSTS2 NOWBEFORE

65 Holistic Customer Management Yields Incremental Sales with Lower Risk Account Decision Account Decision Account Decision 30% Greater Sales1 50% Lower Fraud2 NOW Decision BEFORE

66 P ro d u c ts & C a p a b il it ie s Credit Wor thiness (R isk) SuperprimeSubprime BNPL / Installment Secured Card Dual Card Private Label Credit Spectrum Underwriting is Tailored to the Product and the Customer

67 Utilizing a customer-centric approach to underwriting to create a more dynamic and holistic view of our customer Leveraging a broad spectrum of data to yield powerful, proprietary insights and enable greater predictive precision PRISM powers better outcomes for our partners & customers enabling greater growth without incremental risk

68 Beto Casellas EVP & CEO Health & Wellness

69 Health & Wellness Platform provides comprehensive healthcare financing and payment solutions, through a network of providers and partners, for those seeking health and wellness care for themselves, their families and their pets.

70 Purchase volume $10.0 Billion EOP loan receivables $9.6 Billion Interest and fees $2.3 Billion Avg. active accounts 6.0 Million Results as of FY2020 Leading Healthcare and Pet Care Financing Provider with Scale and Expertise

71 Proven History of Strength and Experience 1987 1998 2004 2010 2017 Dental Ophthalmology Cosmetic Optometry Retail Pharmacies 2019 Pets Best Acquisition 2021 Walgreens Cobranded Mastercard 1994 2001 2009 2016 2018 2019 2021 Veterinary Audiology Ambulatory Surgical Centers Expanded into additional HC specialties Integration with Payment Systems Health Systems Allegro Acquisition 30+ YEARS EXPERIENCE in patient healthcare financing $110B+ FINANCED in care since inception 15+ YEARS EXPERIENCE in pet health insurance

72 Products Healthcare Pet Wellness Flexible Financing Solutions Support Leading Brands Partners

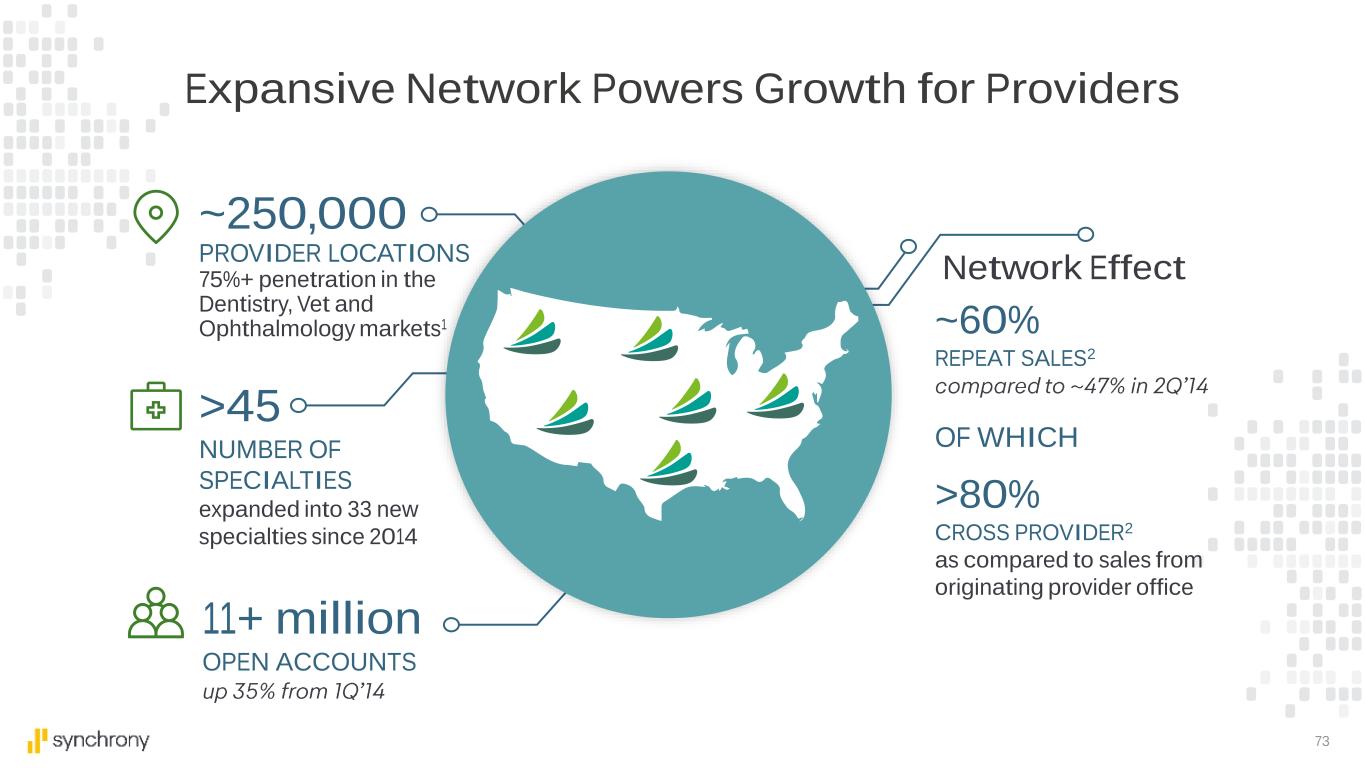

73 Expansive Network Powers Growth for Providers ~250,000 PROVIDER LOCATIONS 75%+ penetration in the Dentistry, Vet and Ophthalmology markets1 >45 NUMBER OF SPECIALTIES expanded into 33 new specialties since 2014 11+ million OPEN ACCOUNTS ~60% REPEAT SALES2 Network Effect >80% CROSS PROVIDER2 as compared to sales from originating provider office OF WHICH

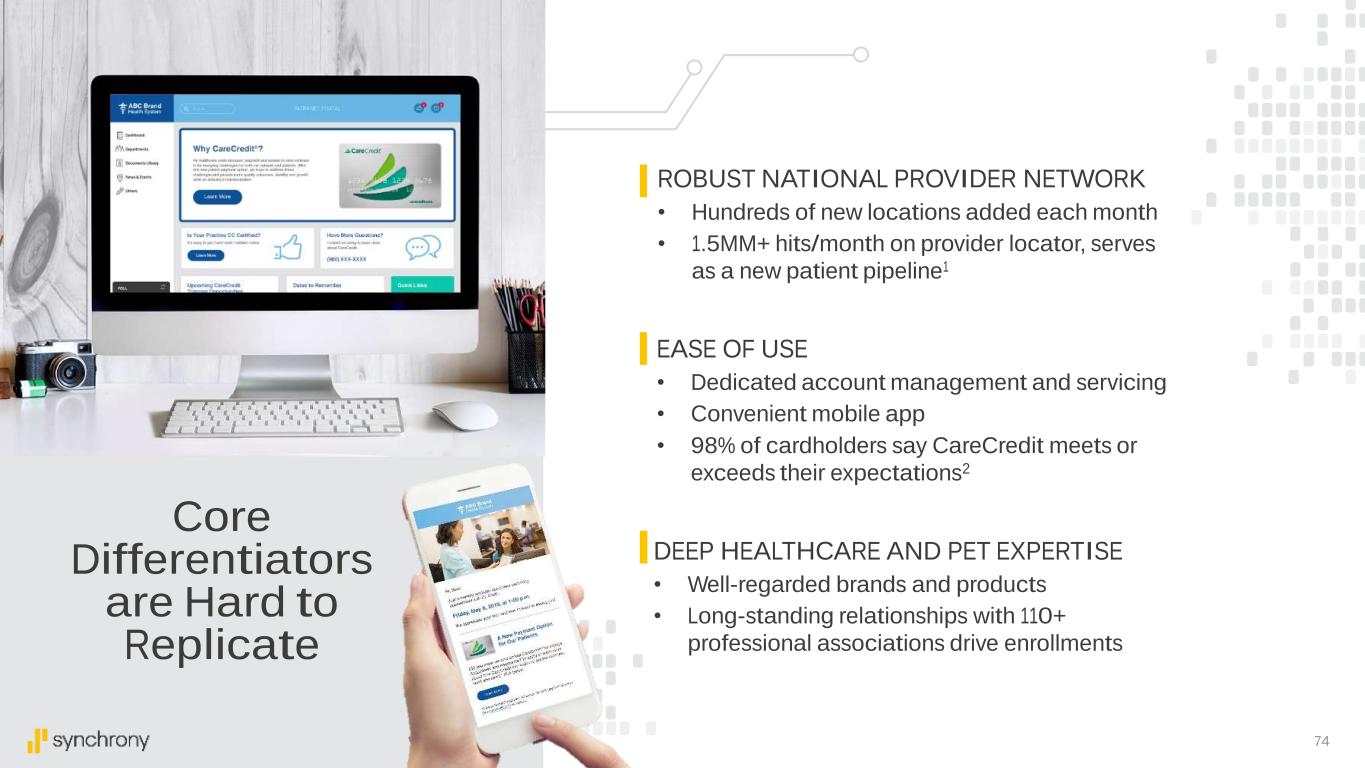

74 ROBUST NATIONAL PROVIDER NETWORK • Hundreds of new locations added each month • 1.5MM+ hits/month on provider locator, serves as a new patient pipeline1 EASE OF USE • Dedicated account management and servicing • Convenient mobile app • 98% of cardholders say CareCredit meets or exceeds their expectations2 DEEP HEALTHCARE AND PET EXPERTISE • Well-regarded brands and products • Long-standing relationships with 110+ professional associations drive enrollments Core Differentiators are Hard to Replicate

75 Custom Link sheet explains the benefits, how it works and step-by-step instructions to create links for the practice The Little Curby Pocket Pal is a pocket-size guide for quick reference. QR sticker on back for quick access. Curbside Digital Guide for the consumer and a simple prequalification and mobile transaction experience Innovative Solutions Simplify Applications and Payments Veterinary example

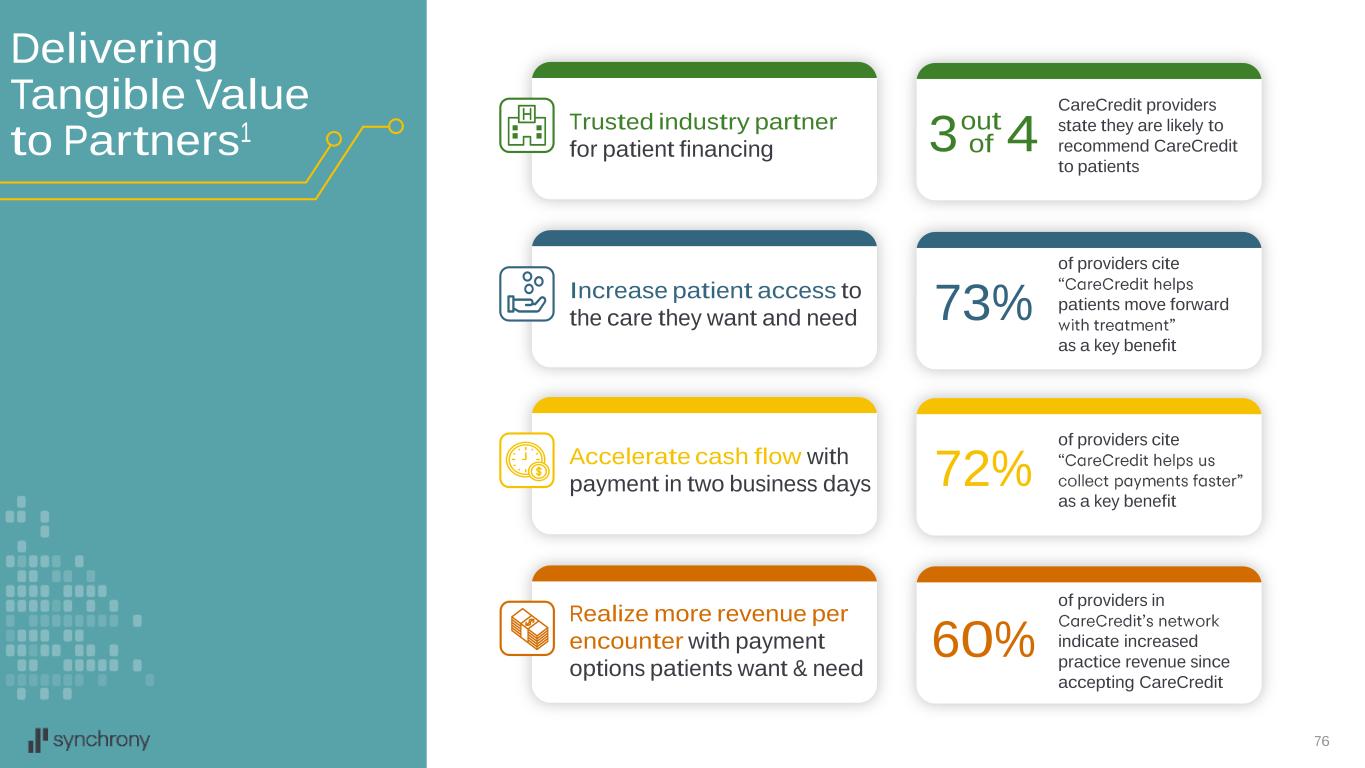

76 Delivering Tangible Value to Partners1 of providers cite patients move forward as a key benefit of providers in indicate increased practice revenue since accepting CareCredit of providers cite as a key benefit Increase patient access to the care they want and need Realize more revenue per encounter with payment options patients want & need Accelerate cash flow with payment in two business days Trusted industry partner for patient financing CareCredit providers state they are likely to recommend CareCredit to patients 73% 60% 72% 3 4out of

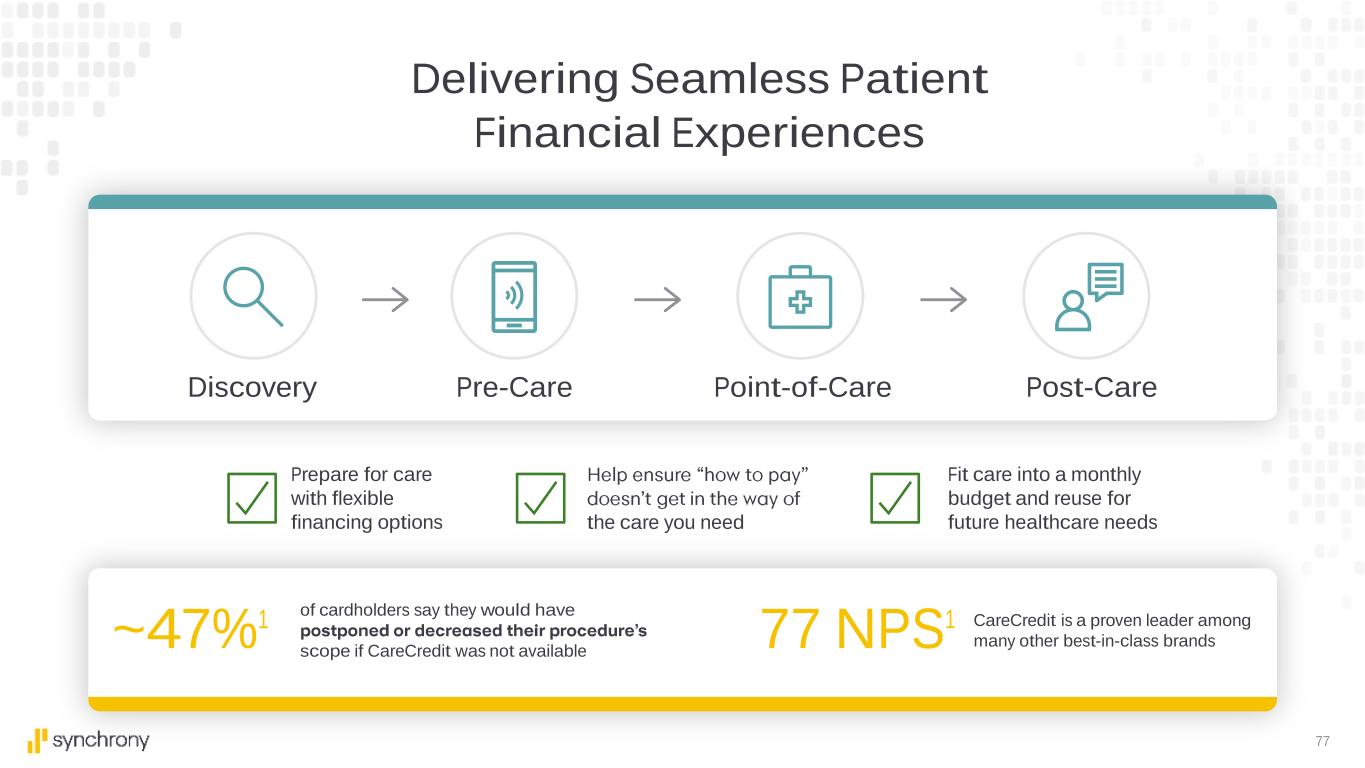

77 Delivering Seamless Patient Financial Experiences ~47%1 Prepare for care with flexible financing options the care you need Fit care into a monthly budget and reuse for future healthcare needs 77 NPS1 Discovery Pre-Care Point-of-Care Post-Care of cardholders say they would have scope if CareCredit was not available CareCredit is a proven leader among many other best-in-class brands

78 ~$405B Health OOP Expenditures ~$100B Pet Expenditures ~$200B Wellness Expenditures Market Overview Enhance product offerings to grow core medical and wellness Access health systems and practice management systems More points of access to healthcare services Core Growth Expansion Continue to unlock growth opportunities in Dental, Veterinary and Specialty Markets Simplify customer and provider experience Enhance consumer directed capabilities Continue integration of Pets Best insurance offering capturing payment synergies Grow presence in pet insurance market Expand into adjacent pet products, services and retail Considerable Growth Opportunity Epic and MyChart are trademarks of Epic Systems Corporation.

79

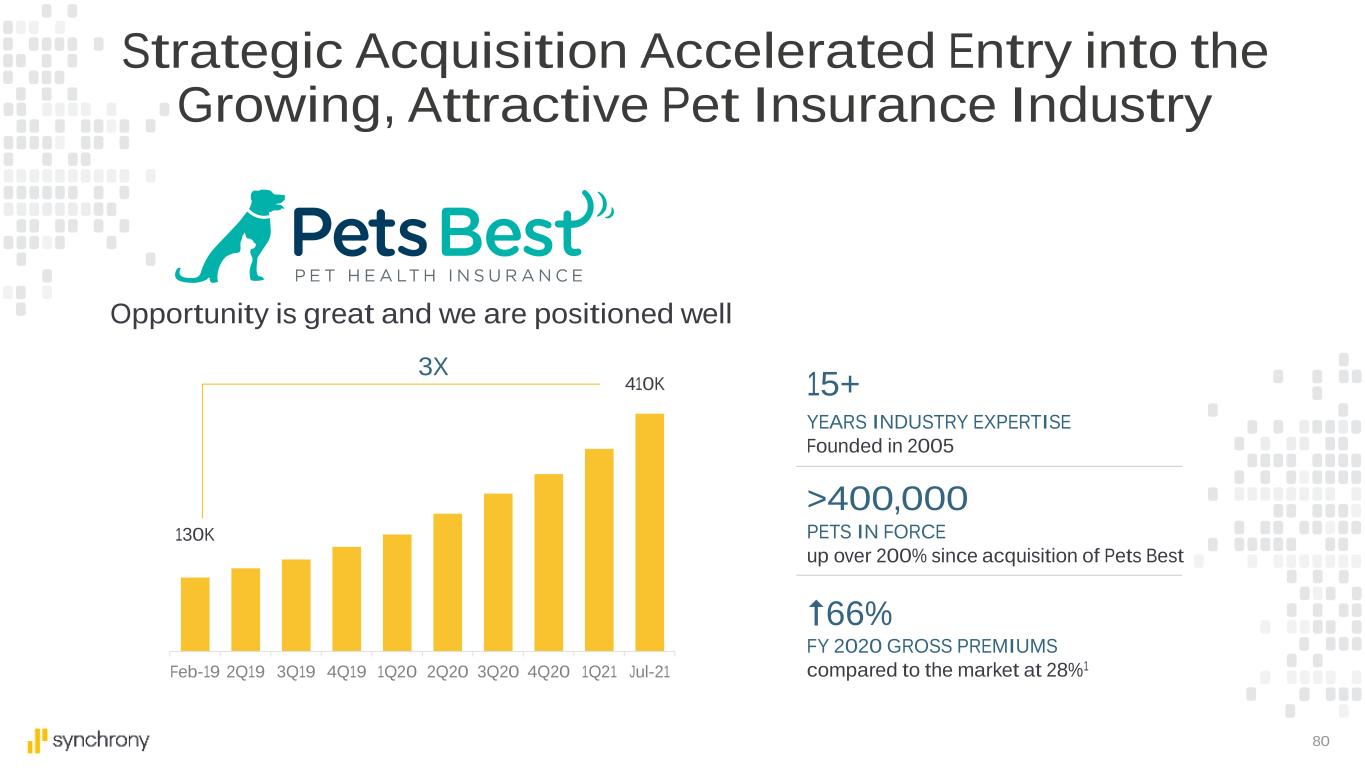

80 Strategic Acquisition Accelerated Entry into the Growing, Attractive Pet Insurance Industry >400,000 PETS IN FORCE up over 200% since acquisition of Pets Best 66% FY 2020 GROSS PREMIUMS compared to the market at 28%1 Opportunity is great and we are positioned well Feb-19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Jul-21 3X 130K 410K 15+ YEARS INDUSTRY EXPERTISE Founded in 2005

81

82 A leader in healthcare and pet care financing with well-regarded brands Broad distribution, significant scale and expertise power compelling outcomes Considerable opportunities for core growth and expansion through adjacencies

83 Curtis Howse EVP & CEO, Home & Auto

84 Home & Auto Platform works with partners to offer flexible financing options to customers, whether they want to realize their dreams or need value and utility to stay on the go

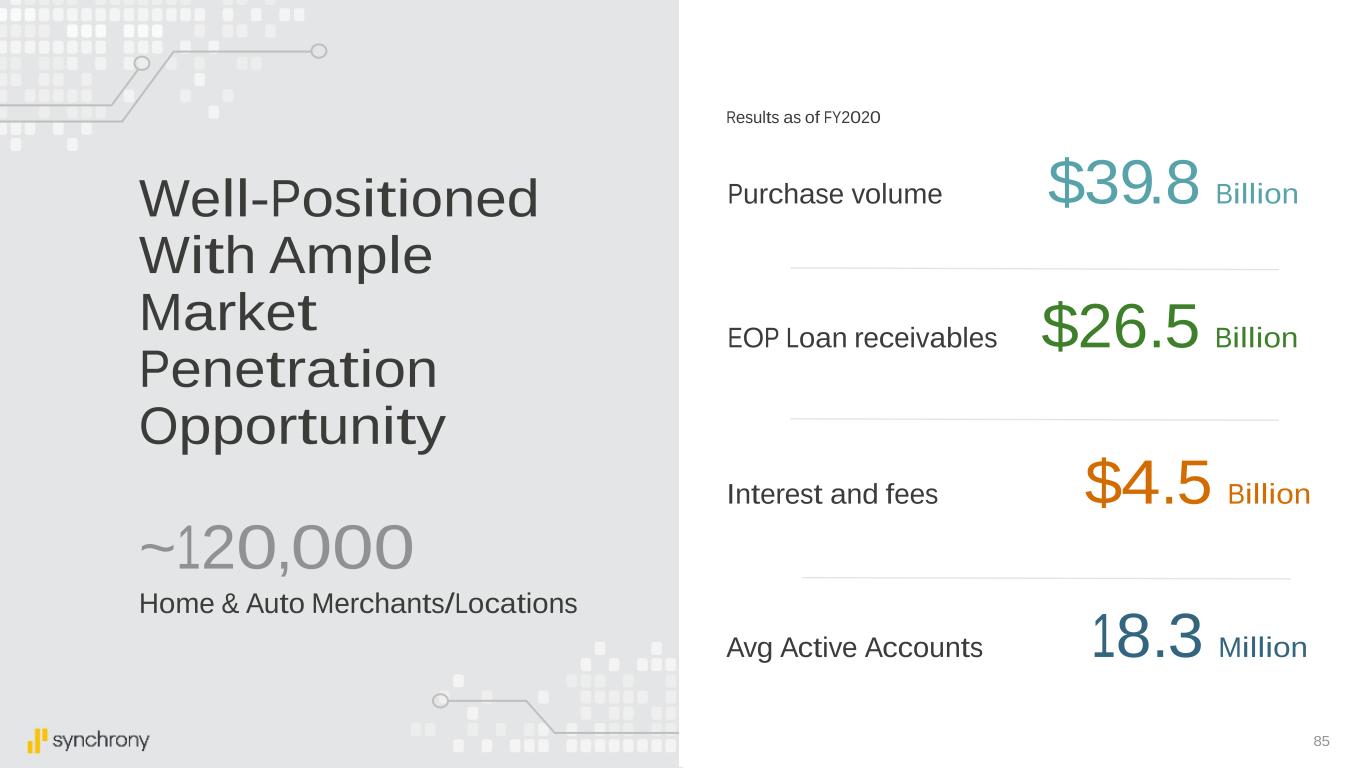

85 Purchase volume $39.8 Billion EOP Loan receivables $26.5 Billion Interest and fees $4.5 Billion Avg Active Accounts 18.3 Million Results as of FY2020 ~120,000 Home & Auto Merchants/Locations Well-Positioned With Ample Market Penetration Opportunity

86 Expertise across range of partners and merchants Data & Analytics drive loyalty, repeat sales & cross shop Seamless dealer / merchant onboarding Value For Partners Value For Customers In business since 1930s $20B Promotional Financing3 ~60% Repeat Sales1 New Merchant Sign-up2 <30 mins Deep Domain Expertise Drives Value Flexible buying options for wide range of needs Increased purchasing power and utility Frictionless customer experience

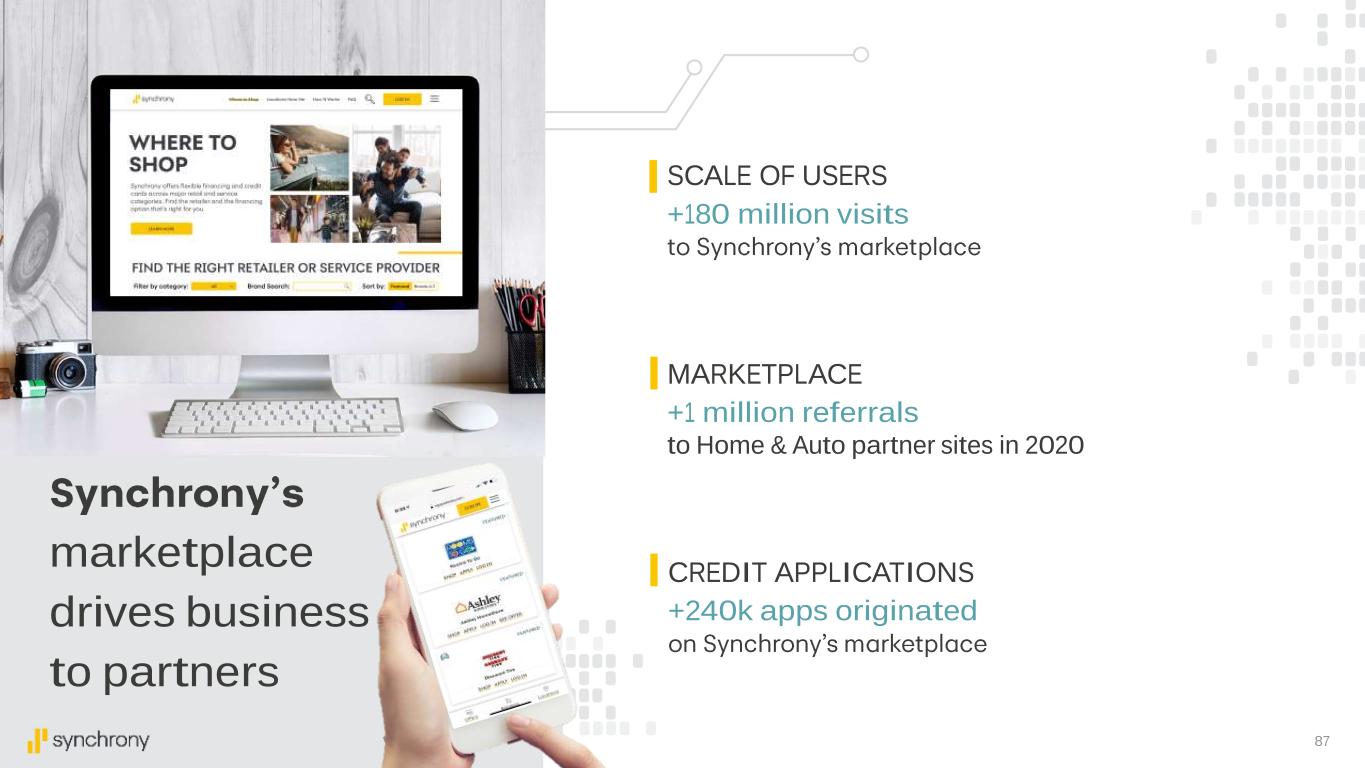

87 MARKETPLACE +1 million referrals to Home & Auto partner sites in 2020 CREDIT APPLICATIONS +240k apps originated SCALE OF USERS +180 million visits marketplace drives business to partners

88 ~$1.9T Home & Auto ~$0.6T Home ~$1.3T Auto Market Overview Continue to increase Partner engagement and drive into network Broaden Home & Auto network acceptance Drive repeat purchase and cross shop behavior Core Growth Networks Adjacencies Leverage data & analytics to drive increased penetration Expand our product set & simplify experiences Support Partner initiatives Add new Partners in relevant Verticals Expand commercial offerings Evolve with customer trends including in areas such as smart home, auto insurance, ride share and EV charging Significant Growth Opportunities

89 Furnishing & Decor Home Improvement Appliances & Electronics Mattress & Bedding Strong partnerships across leading brands in home industry 30+ years AVERAGE LENGTH OF RELATIONSHIP WITH TOP 20 PARTNERS $35 Billion CREDIT SALES2 ~60% OF SALES ARE REPEAT PURCHASES1 Home Vertical is Well-Diversified with Considerable Runway Diversified spend across all home categories

90 • ~2/3rds of home improvement projects are DIY1 • Financing products empower customers to choose what is best Home Improvement Do It Yourself (DIY) + Do It For Me (DIFM) Home Vertical is Deep and Positioned to Win PARTNERS Furniture, Décor & Appliances • Our partners continue to grow and open new stores • Relationships with buying groups give us access to 1,000s of individual merchants through one channel

91 +50K Independent Merchants & Contractors1 Enrolled Across the U.S. in 2020 ~8,000 Strong Shift to Digital in the Do It For Me space as partners custom dealer application links enhancing customer privacy and overall experience +500bps Approval rate lift on D2D applications3 +60% Increase in Mobile applications2 +40% Increase in applications across ALL Digital Channels2 DEALERS, CONTRACTORS & ORIGINAL EQUIPMENT MANUFACTURERS (OEMs) Home Vertical is Deep and Positioned to Win

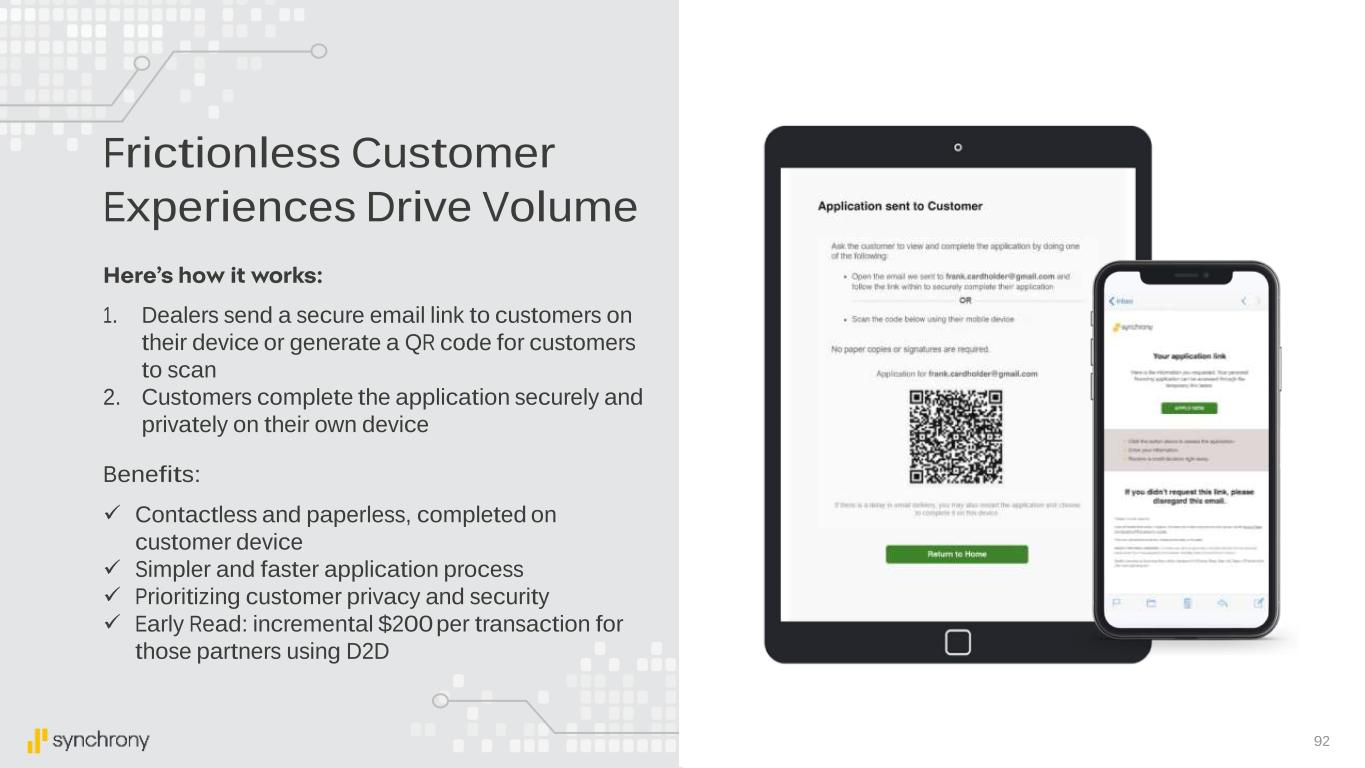

92 P L E A S E V I E W I N S L I D E S H O W P R E S E N T A T I O N M O D E . Frictionless Customer Experiences Drive Volume Benefits: 1. Dealers send a secure email link to customers on their device or generate a QR code for customers to scan 2. Customers complete the application securely and privately on their own device ✓ Contactless and paperless, completed on customer device ✓ Simpler and faster application process ✓ Prioritizing customer privacy and security ✓ Early Read: incremental $200 per transaction for those partners using D2D

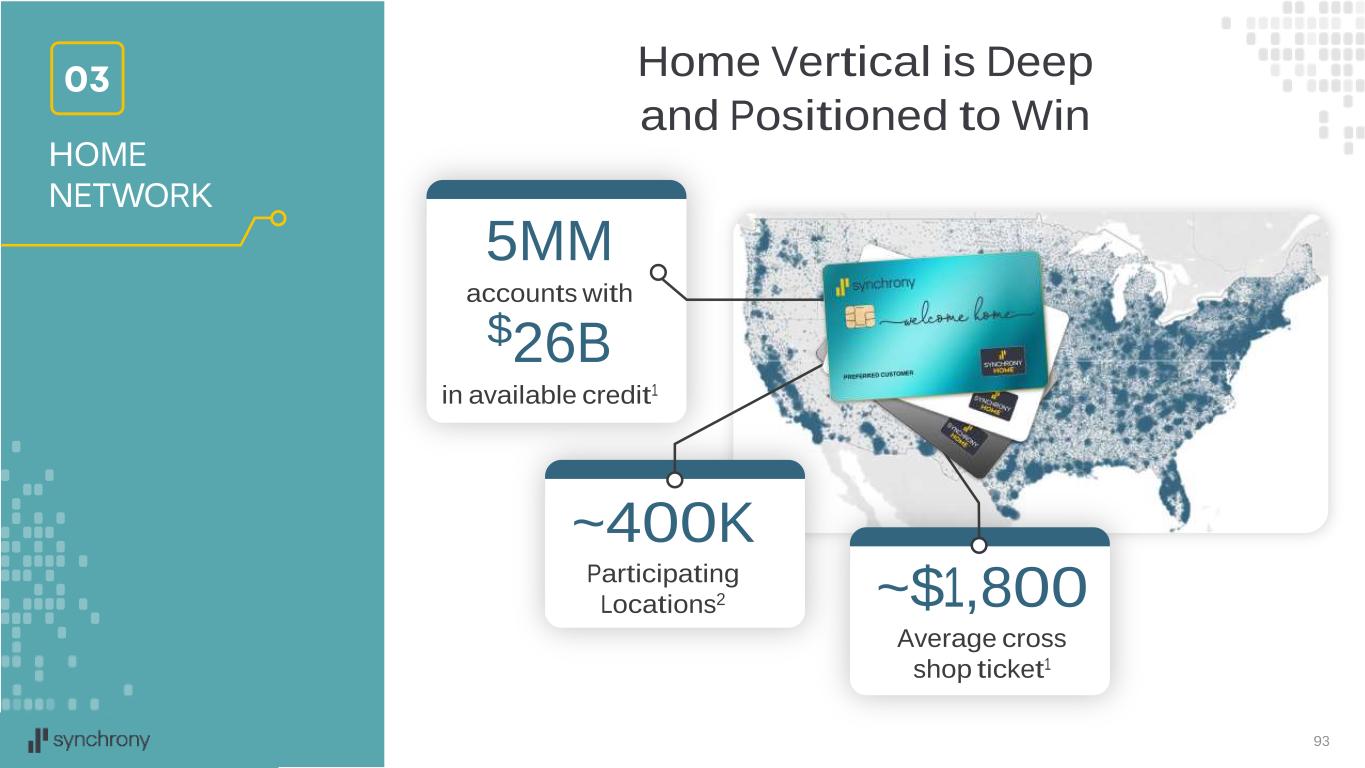

93 HOME NETWORK 5MM accounts with $26B in available credit1 ~$1,800 Average cross shop ticket1 ~400K Participating Locations2 Home Vertical is Deep and Positioned to Win

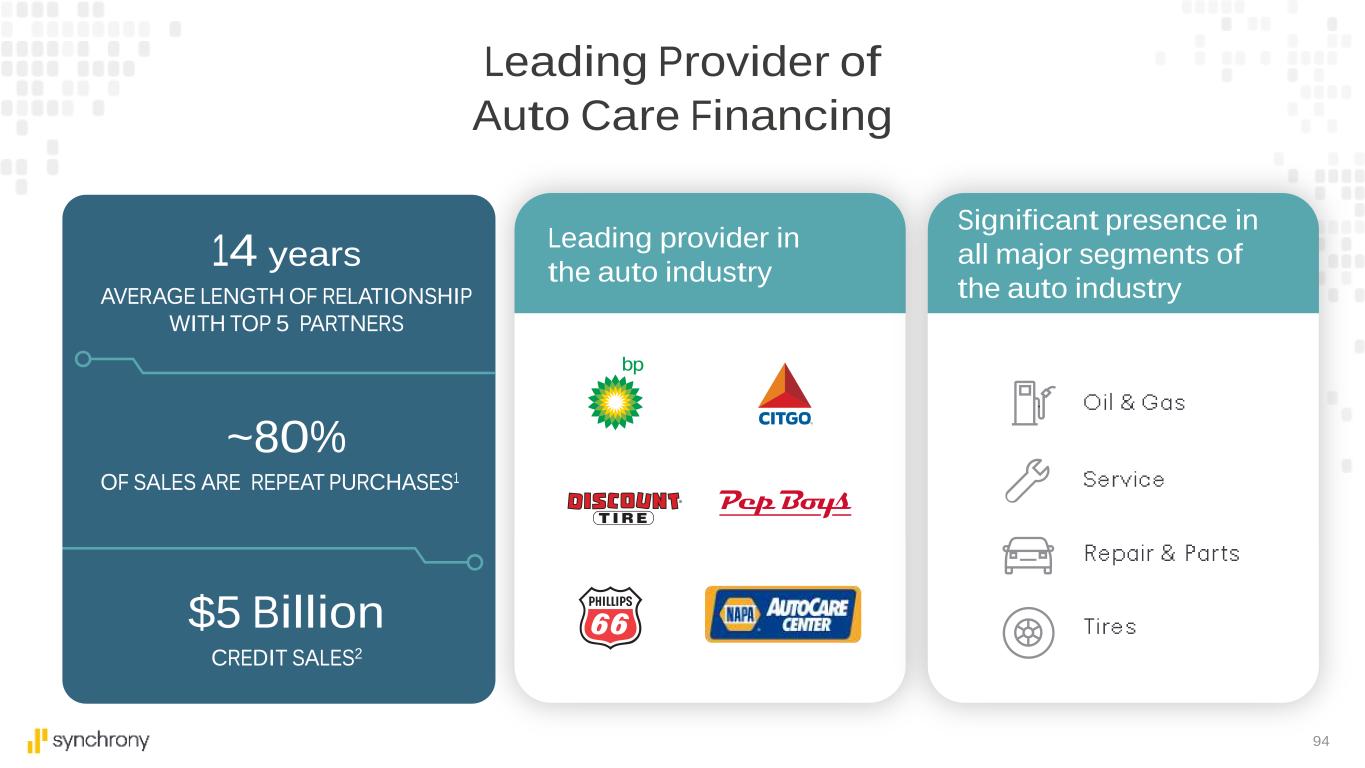

94 Leading provider in the auto industry Significant presence in all major segments of the auto industry Leading Provider of Auto Care Financing 14 years AVERAGE LENGTH OF RELATIONSHIP WITH TOP 5 PARTNERS $5 Billion CREDIT SALES2 ~80% OF SALES ARE REPEAT PURCHASES1

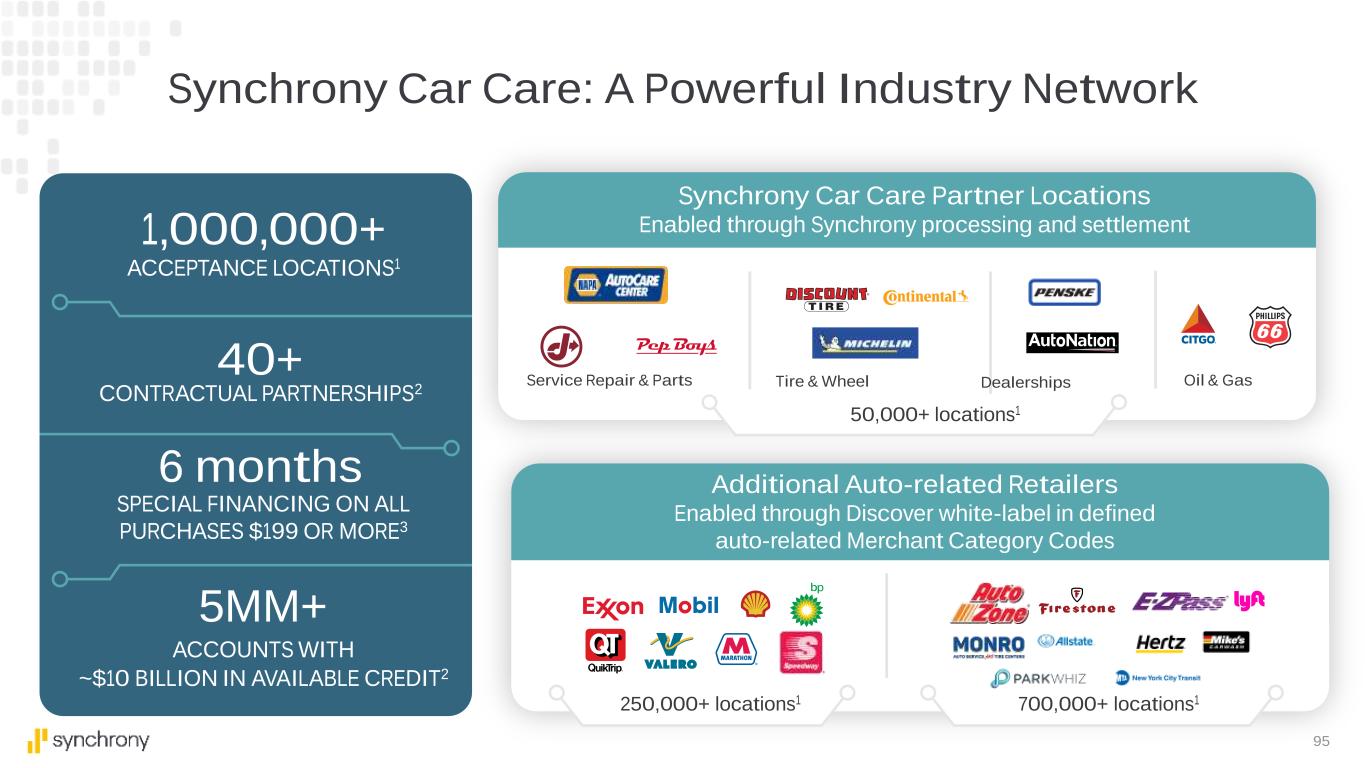

95 SPECIAL FINANCING ON ALL PURCHASES $199 OR MORE3 6 months CONTRACTUAL PARTNERSHIPS2 5MM+ ACCOUNTS WITH ~$10 BILLION IN AVAILABLE CREDIT2 1,000,000+ ACCEPTANCE LOCATIONS1 Synchrony Car Care Partner Locations Enabled through Synchrony processing and settlement 50,000+ locations1 Additional Auto-related Retailers Enabled through Discover white-label in defined auto-related Merchant Category Codes 250,000+ locations1 700,000+ locations1 Service Repair & Parts Tire & Wheel Dealerships Oil & Gas Synchrony Car Care: A Powerful Industry Network 40+

96 Power of the Network P L E A S E V I E W I N S L I D E S H O W P R E S E N T A T I O N M O D E .

97 Well-positioned to capitalize on market growth by leveraging our deep domain expertise Investing to win with partners and customers through a seamless and frictionless experience Utilizing data, products and capabilities to adapt to a changing world

98 Tom Quindlen EVP & CEO Diversified & Value and Lifestyle

99 Diversified & Value Platform helps large retail partners deliver everyday value to consumers shopping for daily needs or important life moments, whether shopping in store or digitally

100 Purchase volume $38.0 Billion EOP Loan receivables $15.8 Billion Interest and fees $3.5 Billion Avg. Active Accounts 18.0 Million Results as of FY2020 Reaching Millions of Customers and Generating Significant Volume

101 10 years 21 years 15 years 16 years ~$100B total retailer sales across ~5,000 locations and Digital properties1 Synchrony products drive 55 million transactions per month with ~25% digital sales2 Partners are Scaled, Omnichannel Leaders that Drive Frequent Purchases from Loyal Customers 27 years

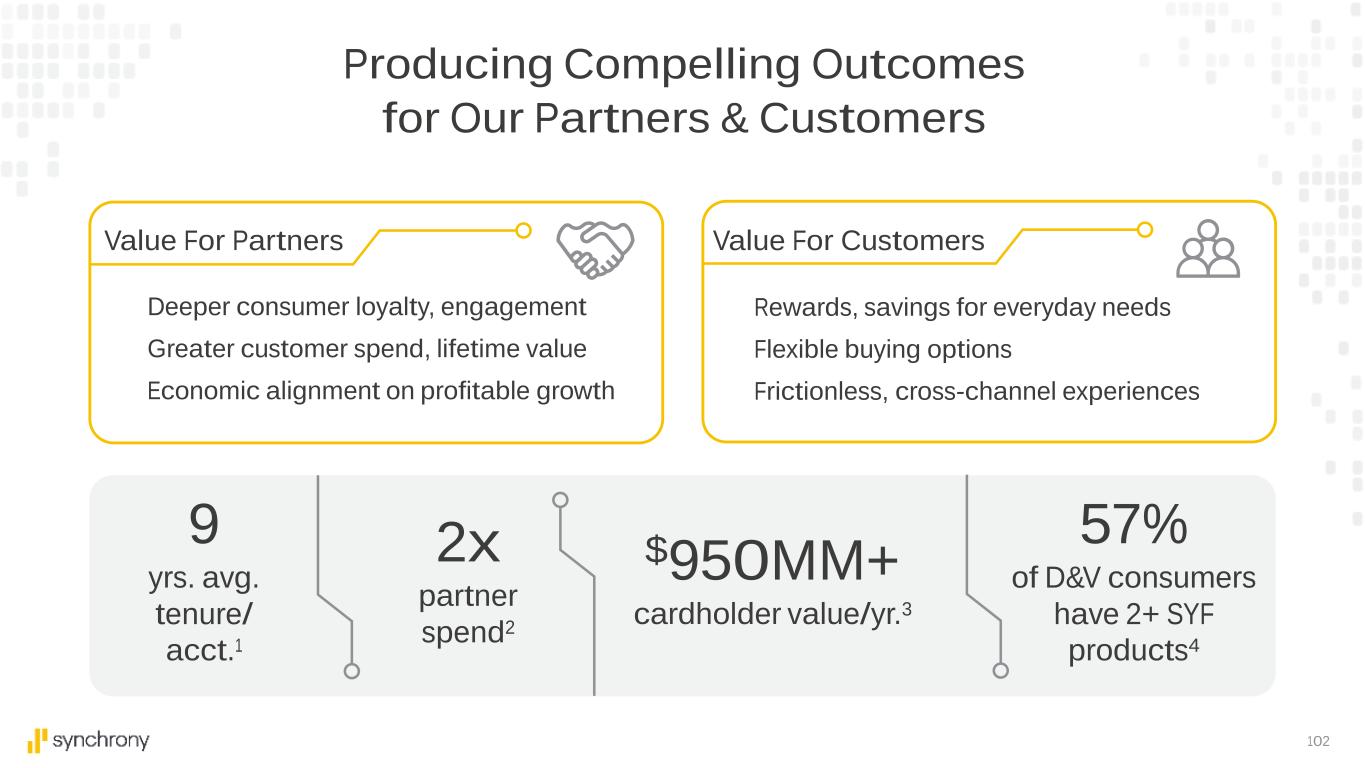

102 Deeper consumer loyalty, engagement Greater customer spend, lifetime value Economic alignment on profitable growth Value For Partners Value For Customers Rewards, savings for everyday needs Flexible buying options Frictionless, cross-channel experiences 9 yrs. avg. tenure/ acct.1 57% of D&V consumers have 2+ SYF products4 2x partner spend2 $950MM+ cardholder value/yr.3 Producing Compelling Outcomes for Our Partners & Customers

103 A Leader in a Large Market with Room to Grow Large partners drive majority of volume with approx. half on credit today1 Expected stable growth post-Covid, category outperformers In-Brand Sales Grow with partners + expand penetration World Sales Supplement in-partner sales with strong value props + loyalty New Clients Add partners with attractive risk-adjusted returns Strong in-partner and world sales MARKET HIGHLIGHTS ~$750B D&V Market ~$100B Current Partner Sales D&V Platform GROWTH DRIVERS

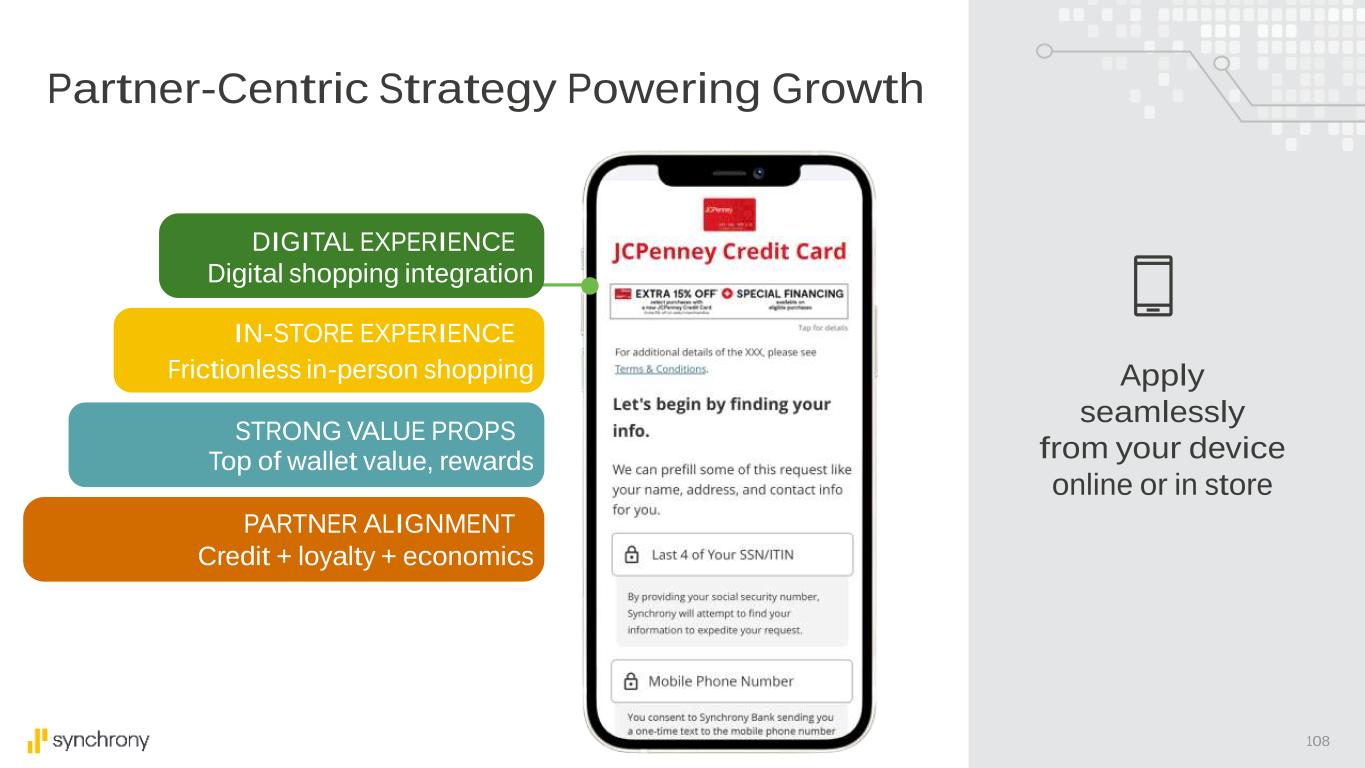

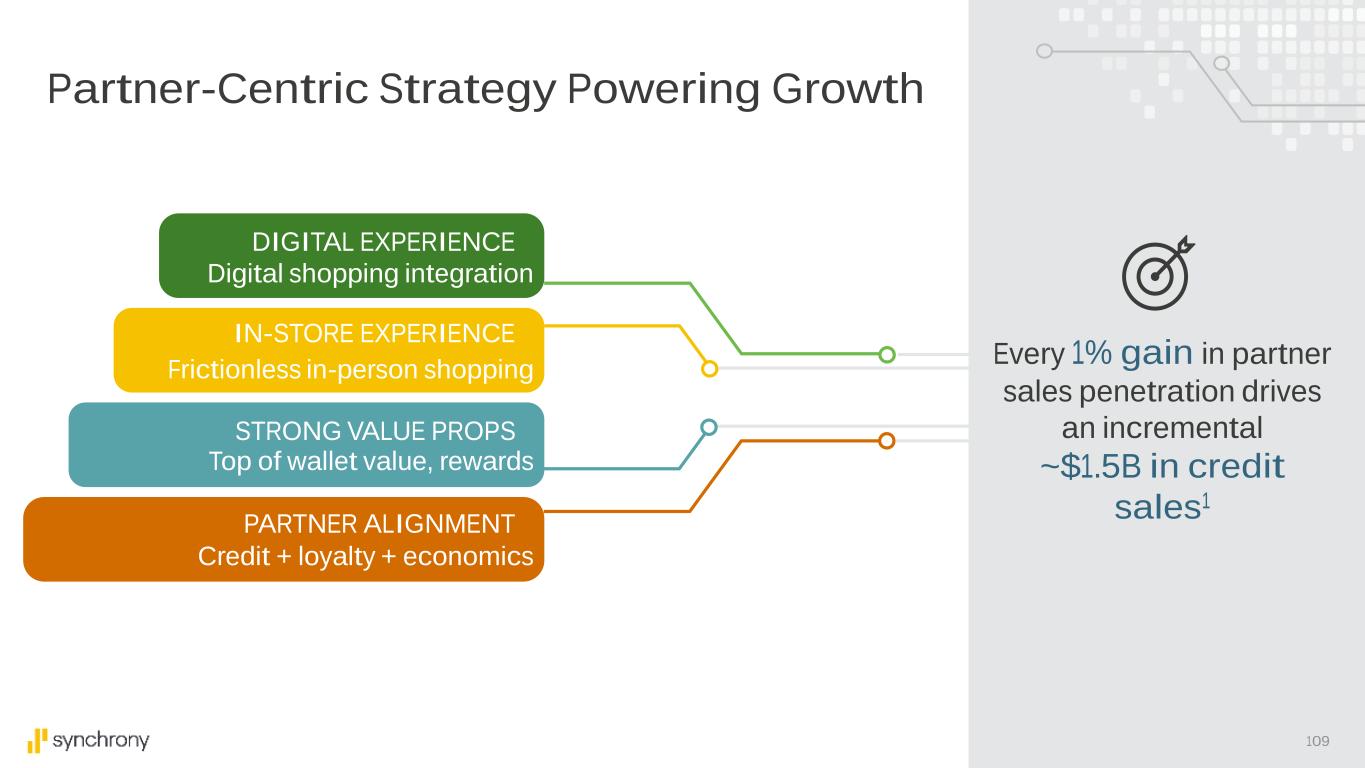

104 Every 1% gain in partner sales penetration drives an incremental ~$1.5B in credit sales1 PARTNER ALIGNMENT Credit + loyalty + economics STRONG VALUE PROPS Top of wallet value, rewards DIGITAL EXPERIENCE Digital shopping integration IN-STORE EXPERIENCE Frictionless in-person shopping Partner-Centric Strategy Powering Growth

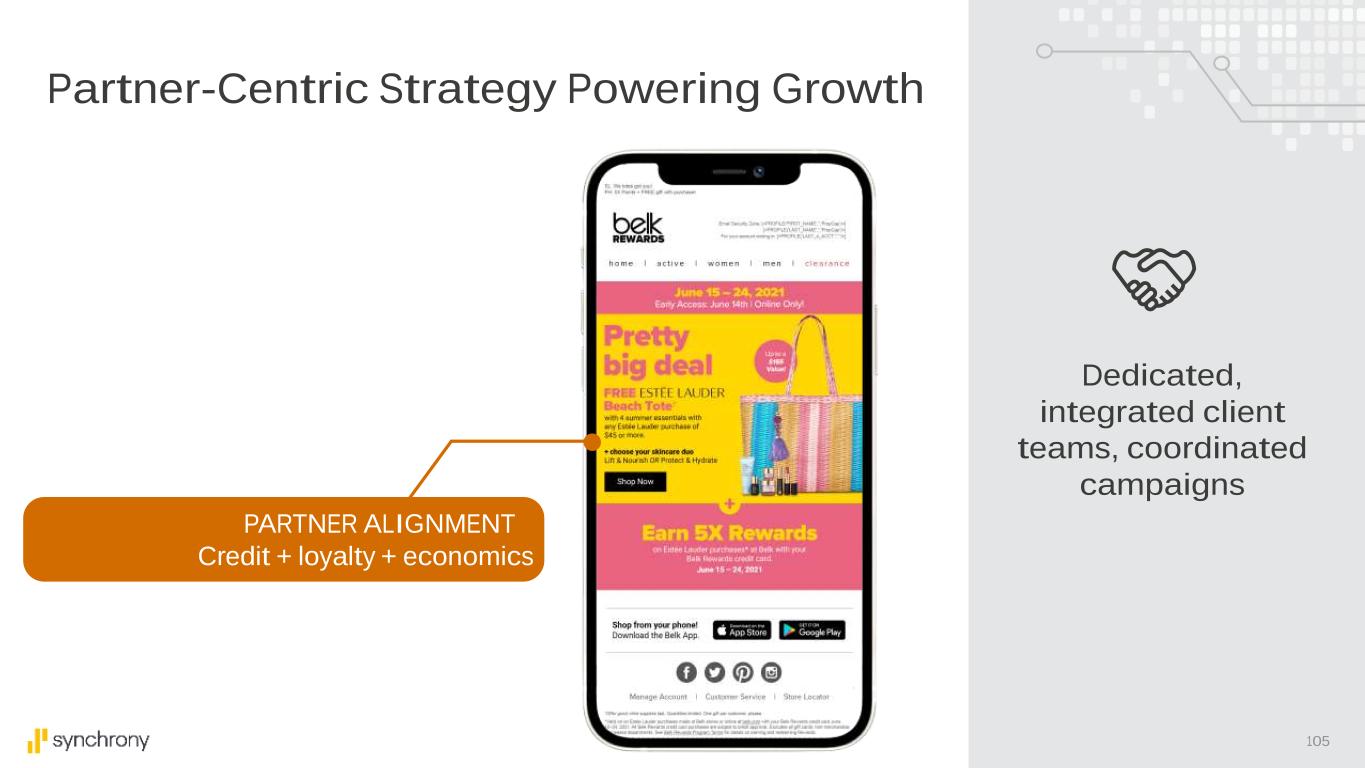

105 PARTNER ALIGNMENT Credit + loyalty + economics Dedicated, integrated client teams, coordinated campaigns Partner-Centric Strategy Powering Growth

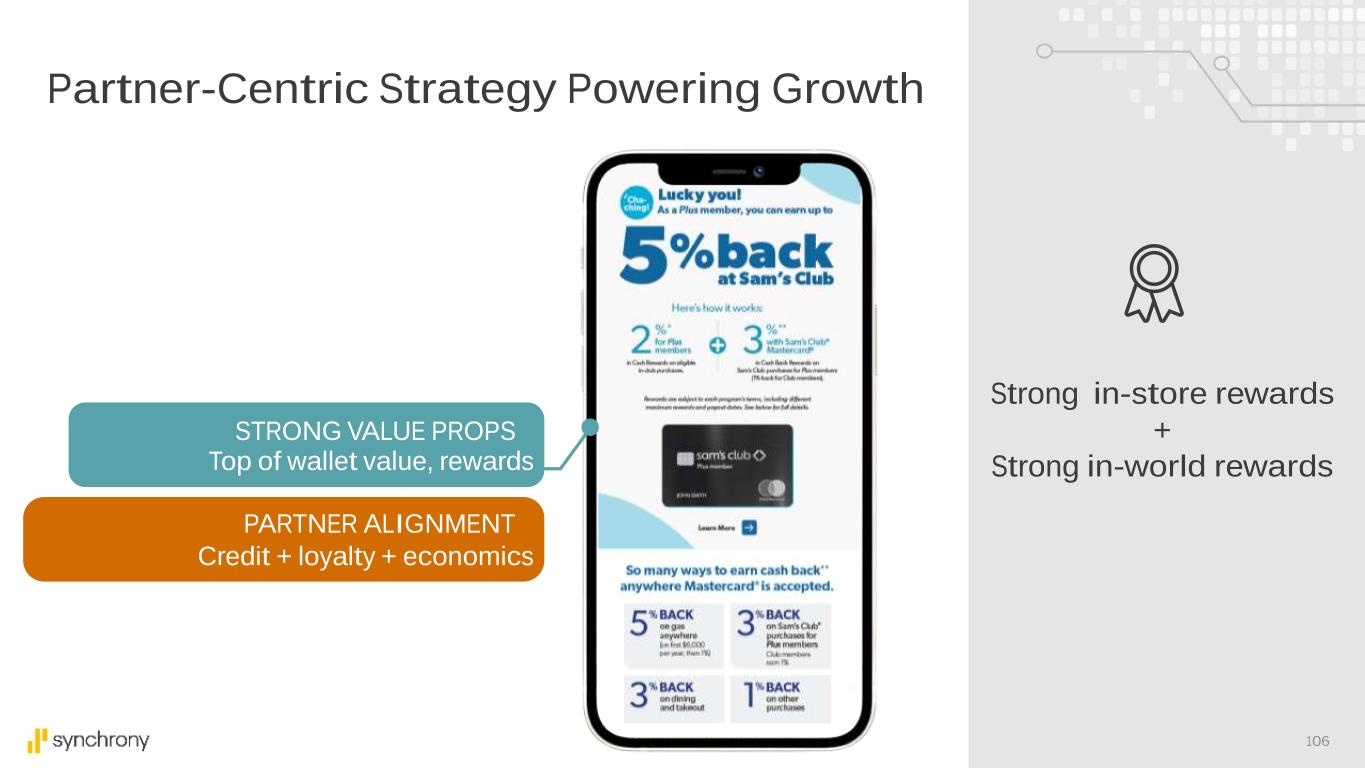

106 Strong in-store rewards + Strong in-world rewards PARTNER ALIGNMENT Credit + loyalty + economics STRONG VALUE PROPS Top of wallet value, rewards Partner-Centric Strategy Powering Growth

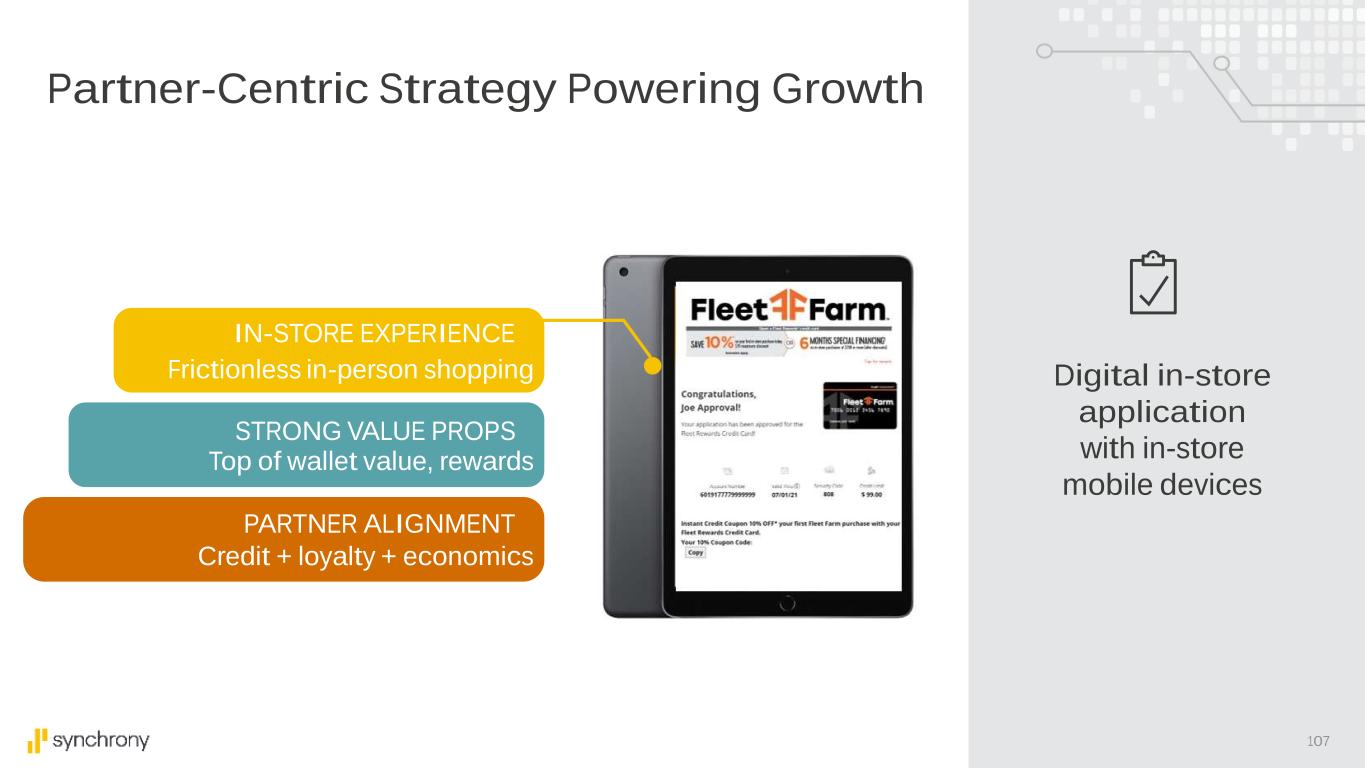

107 Digital in-store application with in-store mobile devices PARTNER ALIGNMENT Credit + loyalty + economics STRONG VALUE PROPS Top of wallet value, rewards IN-STORE EXPERIENCE Frictionless in-person shopping Partner-Centric Strategy Powering Growth

108 Apply seamlessly from your device online or in store PARTNER ALIGNMENT Credit + loyalty + economics STRONG VALUE PROPS Top of wallet value, rewards DIGITAL EXPERIENCE Digital shopping integration IN-STORE EXPERIENCE Frictionless in-person shopping Partner-Centric Strategy Powering Growth

109 Every 1% gain in partner sales penetration drives an incremental ~$1.5B in credit sales1 PARTNER ALIGNMENT Credit + loyalty + economics STRONG VALUE PROPS Top of wallet value, rewards DIGITAL EXPERIENCE Digital shopping integration IN-STORE EXPERIENCE Frictionless in-person shopping Partner-Centric Strategy Powering Growth

110 Use card in store Use card in world Use certificates faster TJX Digital Certificates driving greater in-store engagement Get rewarded faster Accessible through TJX app, email and TJX website More return trips to TJX stores Time to rewards earn / redemption Consumer choice in how she redeems certificates Creating Digital Experiences that Drive Loyalty

111 TJX is the leading off-price apparel and home fashions retailer in the U.S. and worldwide, and I am happy to say that Synchrony has been a trusted partner of ours since Recently, we have worked with Synchrony to further enhance our TJX Rewards loyalty program and delivery of our digital rewards to cardholders We work together and engage at all levels of the program, we share similar company cultures, and we truly see Synchrony as an extension of the TJX team Ernie Herrman CEO and President | The TJX Companies, Inc.

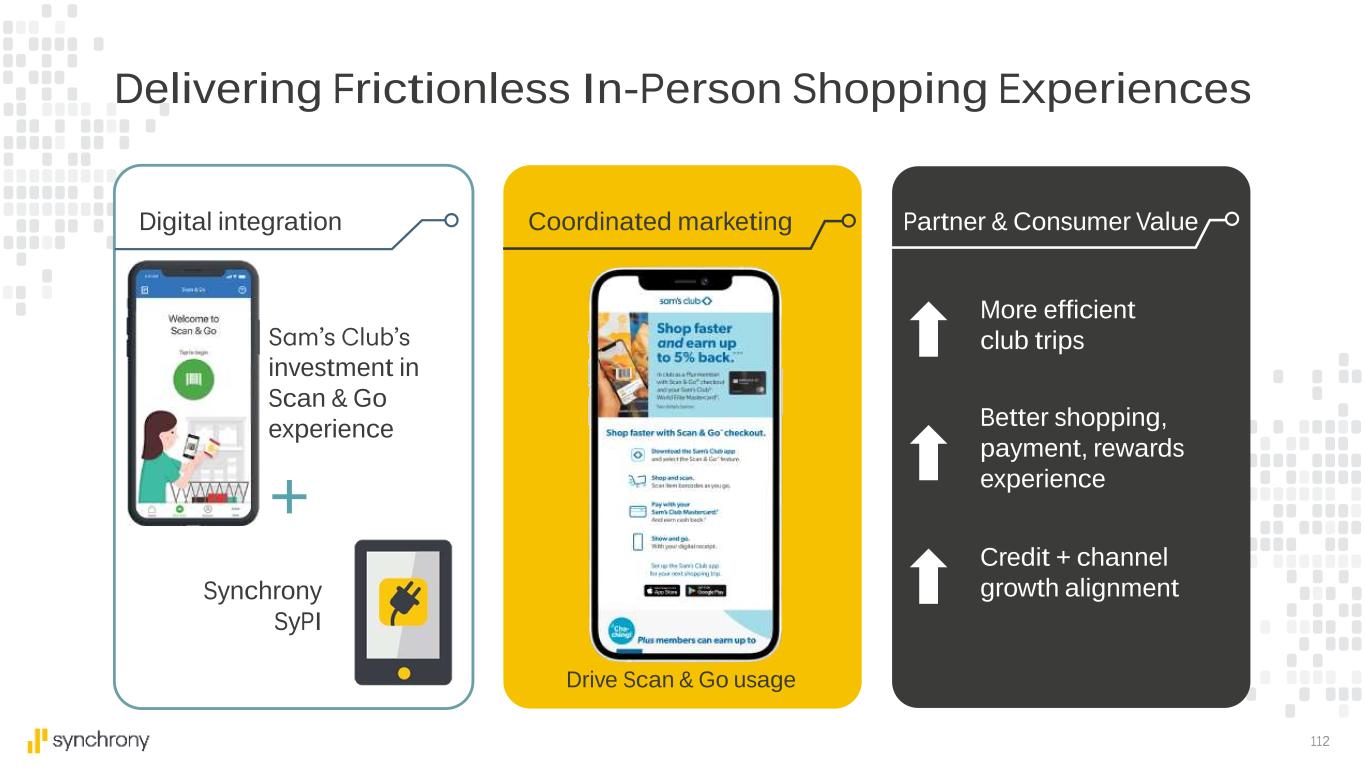

112 Better shopping, payment, rewards experience Credit + channel growth alignment More efficient club trips investment in Scan & Go experience + Synchrony SyPI Drive Scan & Go usage Delivering Frictionless In-Person Shopping Experiences Digital integration Partner & Consumer ValueCoordinated marketing

113 A market leader in scaled retail, with opportunity to enhance penetration Delivering everyday value and loyal customers, driving greater spend at our partners Powering top of wallet products and customer experiences to fuel organic growth and partner wins

114 Tom Quindlen EVP & CEO Diversified & Value and Lifestyle

115 Our Lifestyle Platform partners with a diverse set of merchants to extend the passion for their brands and products to the customer, offering seamless financing while building a relationship grounded in special experiences across multiple generations.

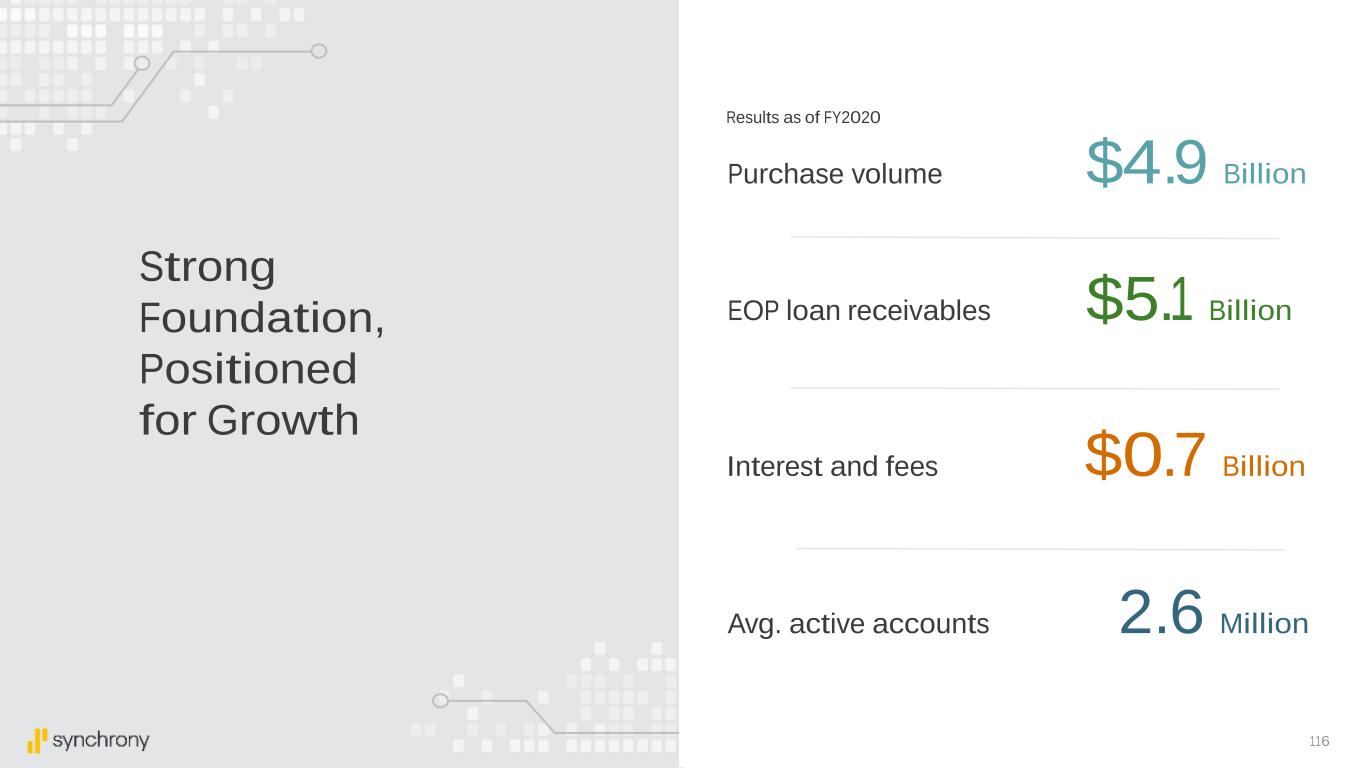

116 Avg. active accounts 2.6 Million Purchase volume $4.9 Billion EOP loan receivables $5.1 Billion Interest and fees $0.7 Billion Results as of FY2020 Strong Foundation, Positioned for Growth

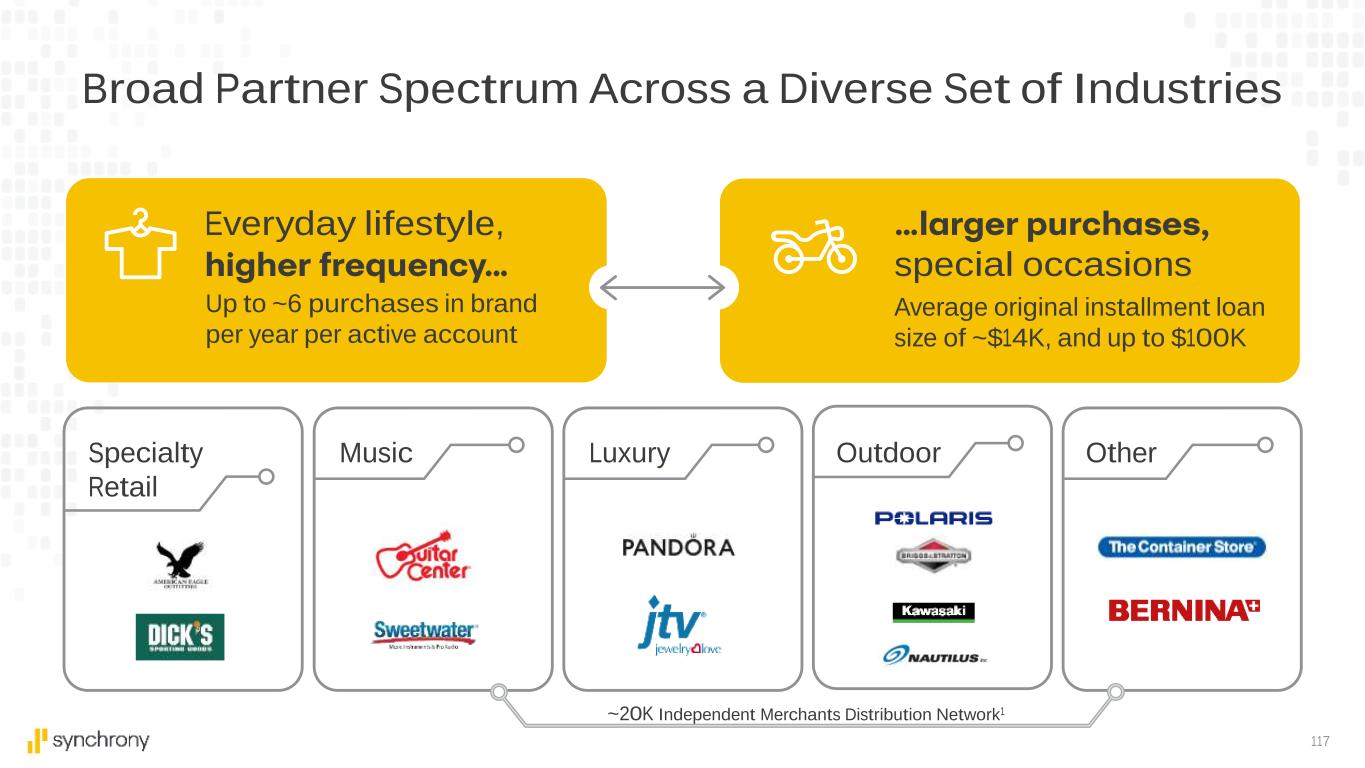

117 Specialty Retail Music Outdoor special occasions Everyday lifestyle, Up to ~6 purchases in brand per year per active account Other Average original installment loan size of ~$14K, and up to $100K Luxury ~20K Independent Merchants Distribution Network1 Broad Partner Spectrum Across a Diverse Set of Industries

118 30-minute dealer onboarding process1 Self-service tech tools Integrating with major e-commerce platforms Data & Analytics enables Personalization for partners & dealer base Multi-channel engagement for a comprehensive path to purchase Seamless Integration and best in-class Merchant Service and Solutions Extensive Product set empowers customer choice Through customer outreach, we have found that ~40% of the sales would not have happened if not for our financing options2 On average, Lifestyle consumers hold 2+ Synchrony accounts Powering Scalable Solutions for Our Partners and Customers Prequal Direct to DevicemPOS Engage Loyalty Prescreen Premium Products Text to Apply d A p p ly dBuy Fraud Detection

119 Large, highly fragmented verticals No single retailer accounts for >4% of sales Serving a Large and Fragmented Market ~$400B Relevant to Synchrony Significant portion of sales run on credit Up to ~75% of industry sales are financed in select verticals2 ~$5B1 Synchrony Sales SYNCHRONY LEADS WITH SIMPLICITY Differentiating through products, capabilities and services consumers and partners need Partner of leaders in Music, Apparel, Sporting Goods + Current Partner Sales

120 Market Overview >20 national retailers with $1B+ in revenues2 Within Existing Base Win New Partners Expand Dealer Network 1 incremental application per month per dealer/store generates ~$150MM1 in Sales Volume ~20K existing Partner Dealers >2K locations added annually3 Significant Growth Opportunities ~$400B Lifestyle Verticals Consumer Spending

121 Leveraging Differentiators to Solidify Leadership Position Manufacturer/OEM Across Dealers Speed Flexibility Multi-product Multi-channel Dealer Sales Conversion Consumer Access to Passions

122

123 Deep expertise in national specialty retail, serving iconic retailers Leveraging powerful network effect enabled by broad reach across manufacturers and dealers Cutting-edge customer experiences with multi-channel, multi-product optionality

124 Bart Schaller EVP & CEO Digital

125 Digital Platform enables our digital-first partners to deepen consumer engagement by embedding payment solutions, leading value and rewards, and personalized offers within seamless experiences and extending digital relationships into in-person commerce

126 $35.9 Billion $20.4 Billion $3.8 Billion 16.6 Million Results as of FY2020 Purchase volume EOP loan receivables Interest and fees Avg. active accounts 16 years Avg. PayPal, eBay, QVC, Amazon Long-standing partners 52 purchases 1 Avg. per active account per year Highly engaged customers Highly Engaged Customers, Partnerships That Span Decades

127 Diverse Range of Leading Digital Commerce Brands, Products, and Channels DIVERSE PARTNERS MULTIPLE CHANNELS INTEGRATED PRODUCTS Payments Marketplaces Digital-first Brands & Merchants Mobile/Native App Web Live/On-air Voice/Telesales In person/ Point-of-Sale Embedded Payments Cross-shop Enabled PLCC Cobrands Fixed & 0% Promotions Equal Pay & Installments Virtual Cards/e-Wallets

128 $650B Total Partner Opportunity ~20% E-comm CAGR 2017-201 Market Overview Expanded product and offer choice Partner Growth Product Expansion Clear Path to Expand Growth In-Person Spend retail, travel, dining, etc. Equal Pay & Installments Fixed & 0% Promotions Embedded PLCC Leading digital brands Large consumer bases New Partners & Consumers 65MM users2 95MM wireless connections2 Virtual & Physical Cobrands Grow with partners & increase share through: ✓Deeper integrations and capability enhancements ✓Personalized messaging and offers ✓Constantly evolving consumer experiences

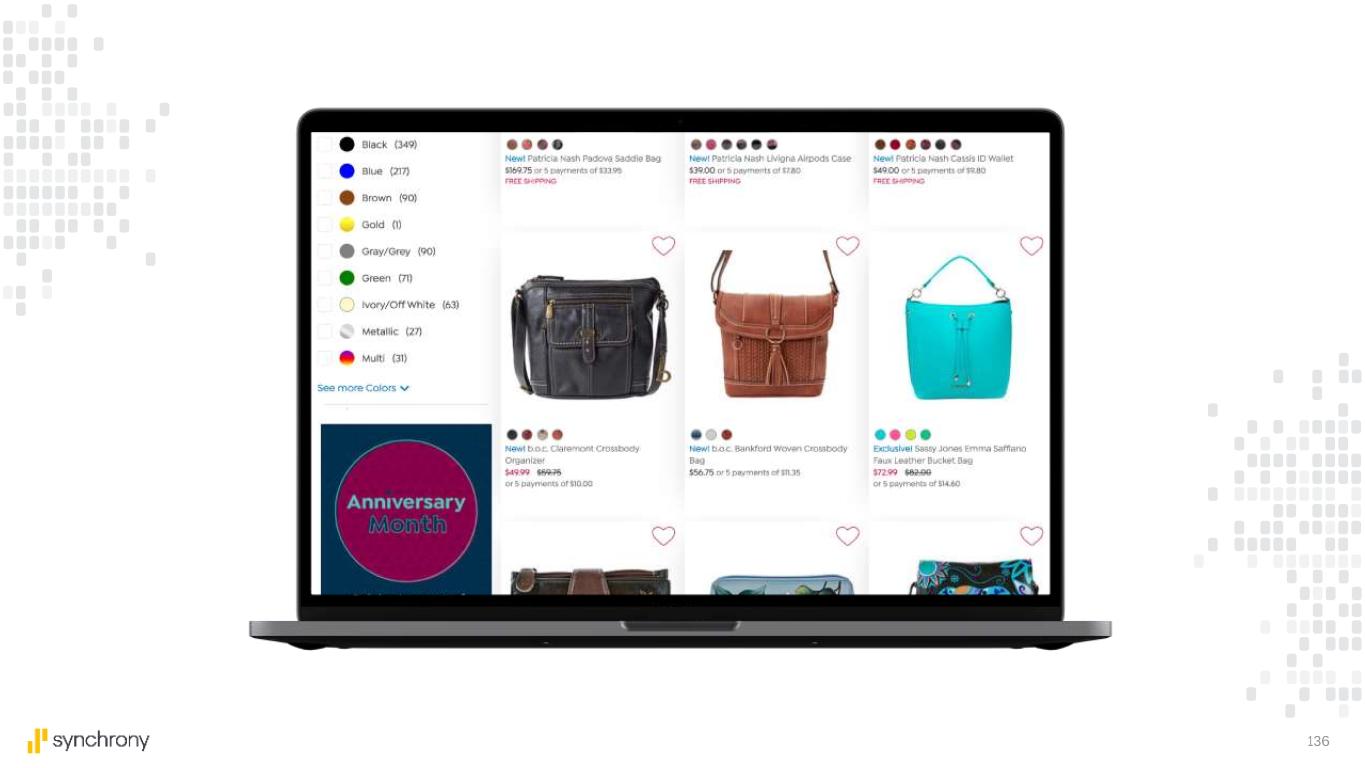

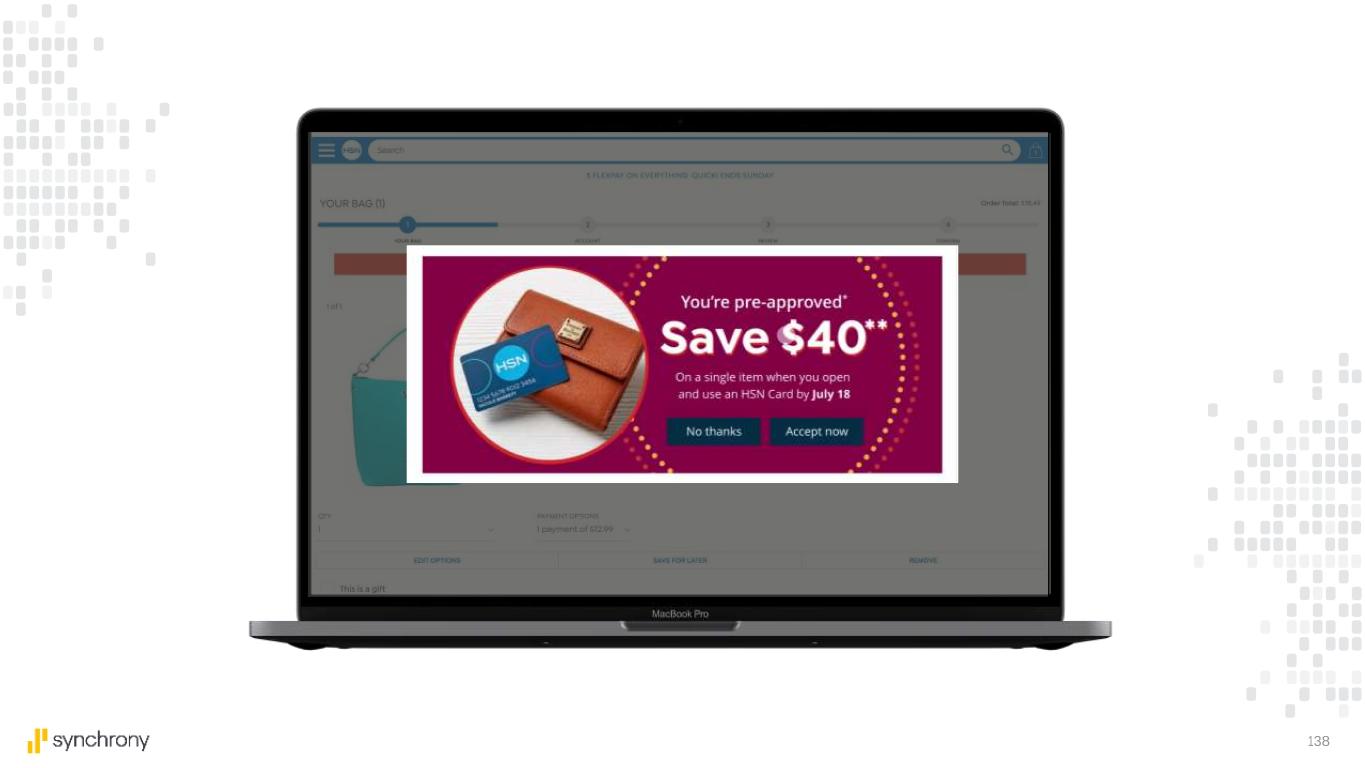

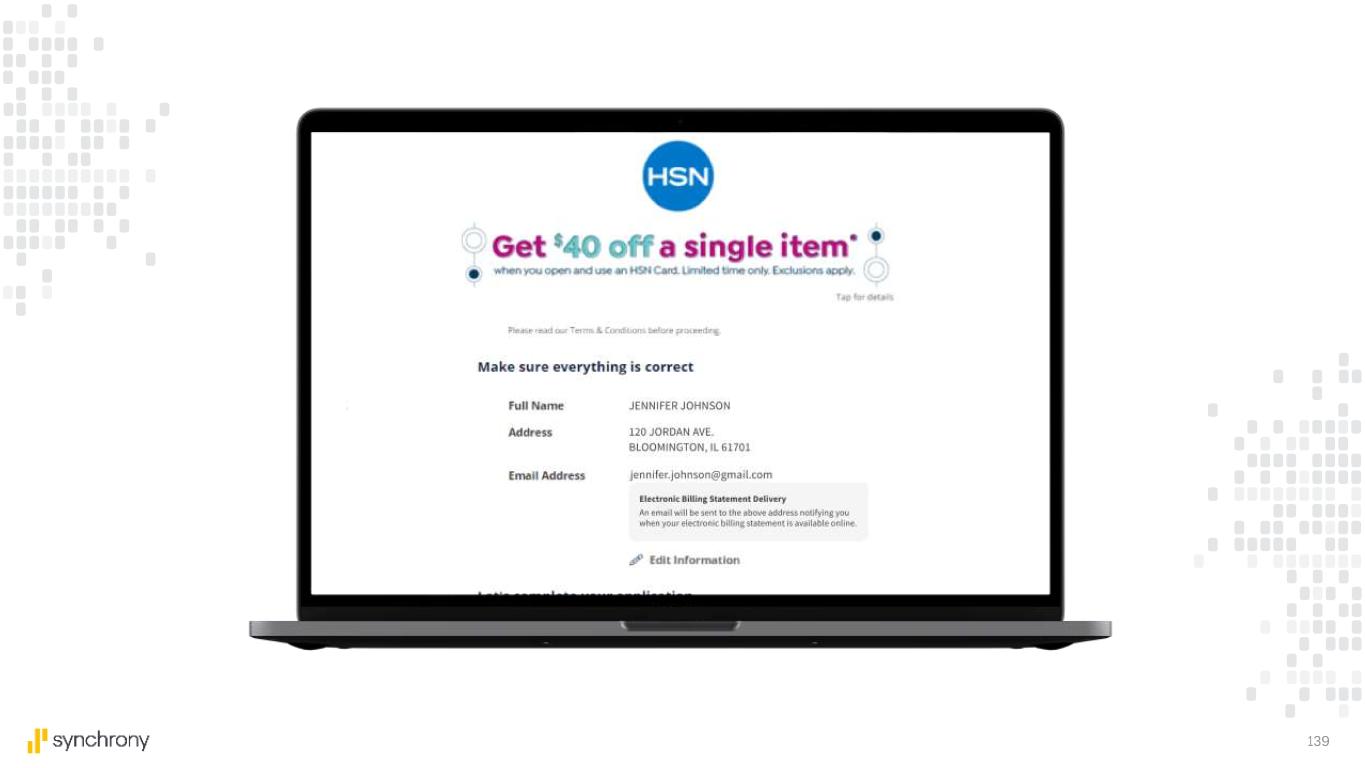

129 Seamlessly Integrating and Delivering Personalized, Intuitive Experiences Engage Apply Use Service Intuitive application and provisioning Personalized engagement and activation Dynamic rewards, effortless payments, consumer control Partner-native servicing

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146 Seamlessly Integrating and Delivering Personalized, Intuitive Experiences Engage Apply Use Service Intuitive application and provisioning Personalized engagement and activation Dynamic rewards, effortless payments, consumer control Partner-native servicing Embedded within digital partner environments, leveraging core Synchrony tech stack

147 Deeper Integration & Constantly Evolving User Experiences Alexa Skill Mobile Servicing App Expanded Products & Offers to Meet Customer Needs Cart-Based Promotional Financing New Channels (e.g. Amazon Pay) Prime 5% Prime Card Prime Bonus2007 20210% APR Equal Pay Integrated Checkout & Redemption Evolving with Our Partners to Meet Changing Customer Expectations 5%

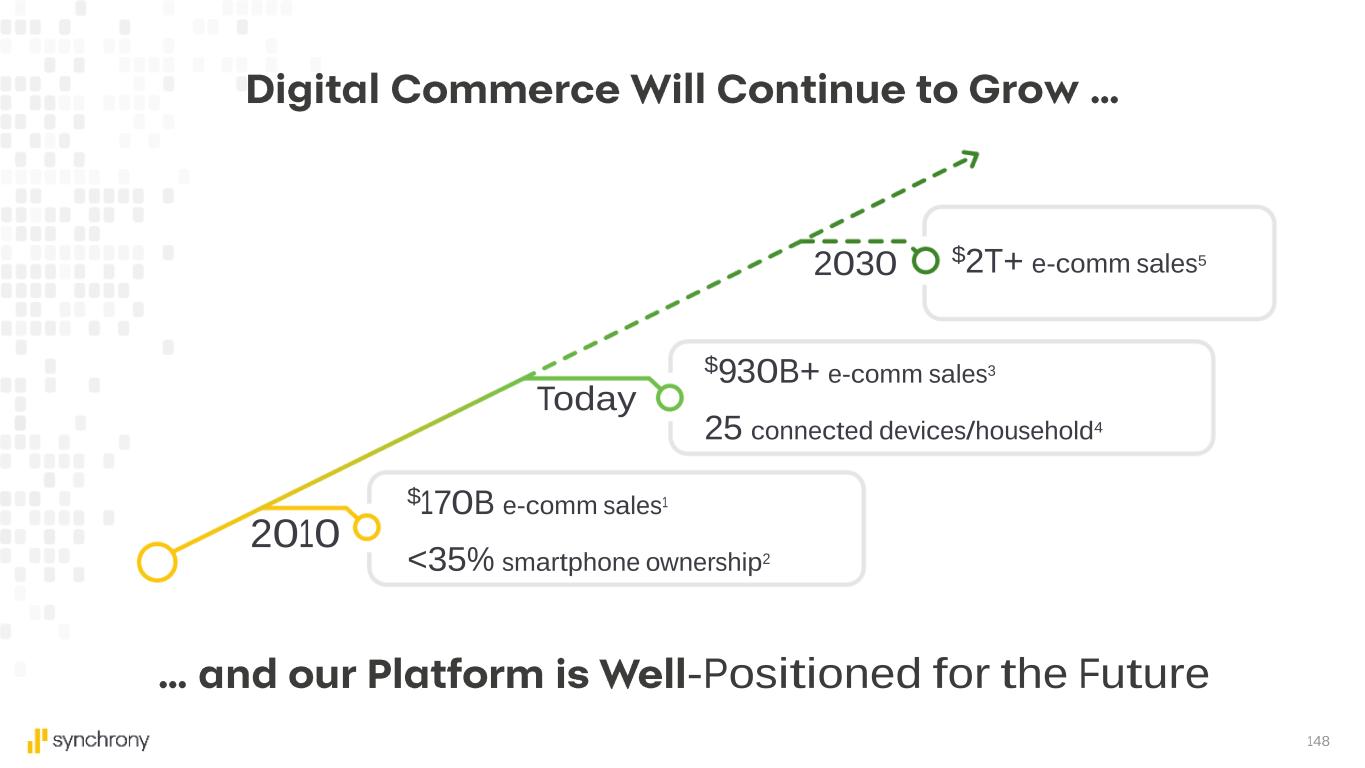

148 2010 $170B e-comm sales1 <35% smartphone ownership2 Today $930B+ e-comm sales3 25 connected devices/household4 2030 $2T+ e-comm sales5 -Positioned for the Future

149 Developing seamless and intuitive integrations within complex digital partner environments Leveraging data to deliver real-time, personalized offers, experiences and decisions Innovating and collaborating with partners to meet evolving customer and business needs

150 Brian Wenzel Sr. EVP & Chief Financial Officer

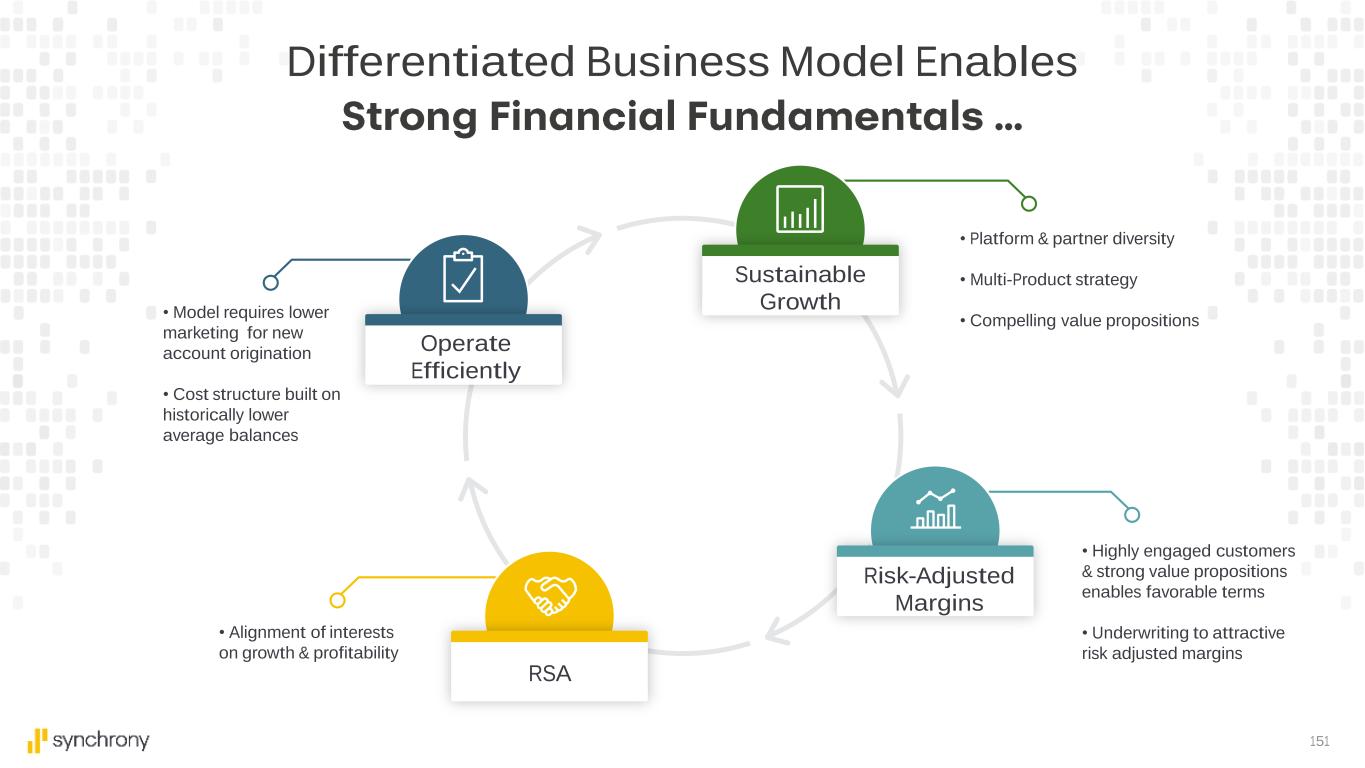

151 • Model requires lower marketing for new account origination • Cost structure built on historically lower average balances • Platform & partner diversity • Multi-Product strategy • Compelling value propositions • Highly engaged customers & strong value propositions enables favorable terms • Underwriting to attractive risk adjusted margins • Alignment of interests on growth & profitability Differentiated Business Model Enables Sustainable Growth Risk-Adjusted Margins RSA Operate Efficiently

152 Strength in Customer Relationships and Powers Our Strong Foundation Power of Partner Model 65+ MillionActive Accounts 448,000+Partner Locations ~2 Billion (FY 2019) Transactions 55%Digital Applications Average New Accounts per year1 ~25 Million Average Length of Credit Card Relationship2 10+ Years ~2Products per Bank Customer >40%Bank Customers Who Have Credit Products

153 EOP RECEIVABLESPURCHASE VOLUME NET INTEREST INCOME $71B $139B 2010 2020 2.0X $45B $82B 2010 2020 1.8X $8B $14B 2010 2020 1.9X

154 $61B $87B 2014 2019 $11B $17B 2014 2019 $103B $149B 2014 2019 +8% CAGR +4% CAGR Synchrony Direct Peers +7% CAGR +5% CAGR Synchrony Direct Peers +8% CAGR +8% CAGR Synchrony Direct Peers -Pandemic) EOP ReceivablesPurchase Volume Net Interest Income

155 ~$350+ Lifetime Value of an Account3 Co-Brand2Synchrony1 Industry2 >2X >4X • Acquiring a highly engaged customer • Powering greater utilization and value through our multi-product strategy & compelling value propositions • Yields 15-20x lifetime value per account >~$18$aX$ >2x >4x Cost To Acquire Partner Model Powers Low-Cost,

156 13.2% 13.3% 21.1% Broader Peers Direct Peers Synchrony Interest & Fee Yield 3.7% 3.4% 5.6% Net Charge-Offs All comparisons based on FY2019 Broader Peers Direct Peers Synchrony 9.5% 9.9% 15.5% Risk-Adjusted Yield (RAY) Broader Peers Direct Peers Synchrony -Adjusted Margins >560 bps

157 • Underwrite to a Risk- Adjusted Margin at the Partner/Channel Level • performance • Enhanced data and PRISM underwriting tools should deliver increased growth at similar loss profile Delivering Consistent Loss Performance Over Time 159% 44% 205% 33% 0% 40% 80% 120% 160% 200% 240% 1 SYF COF DFS JPM CITI INDEX

158 • Refined underwriting as we entered pandemic • Offered payment deferrals to standard payment plans • Monitoring longer term • Began adjustments to underwriting starting in late Effectively Managing Our Portfolio Through the Pandemic1 8% 8% 7% 6% 6% 5% 4% 20% 21% 19% 18% 17% 18% 16% 72% 71% 74% 76% 77% 77% 80% 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 Low Medium High

159 Retailer Share Agreements (RSAs) Designed to Align Growth & Profitability ~75% ~25% RSA Payout Types Sharing Arrangements Volume Total RSA is a factor of Growth and Financial Performance Primary Sharing Arrangements ensure profitability focus Secondary Volume drives our focus on growth General RSA Components1 • Aligns interests of the parties • Leads to stronger and long-lasting relationships • Designed to provide upside participation for partners, and provide downside protection to SYF Net Interest & Fee Yield Provision for Loan Losses Expenses Interchange and Royalty %

160 Retailer Share Agreement Variations 100% 50%50% 1.5% 2.5% Total Program Return Synchrony Share of Return Retailer Share of Return 2.75% 1.25% 4.0% Total Program Return Allocation 100% 25% 75% 2.0% 2.0% Total Program Return 2.50% 1.50% 4.0% Lo w e r T h re s h o ld s H ig h e r T h re s h o ld s Program Return SYF 69% of Program Return SYF 63% of Program Return • RSAs vary based on program • Designed to achieve approximately same ROA, risk dependent • Hurdle rates and sharing percentages dependent upon retailer risk tolerance • Two key factors in RSA movement • Growth in average assets applied for the hurdle • Underlying financial performance (Yield & NCOs) The Fundamental RSA Construct Remains Intact

161 100% 50%50% 1.5% 2.5% Total Program Return SYF Share of Return Retailer Share of Return 2.75% 1.25% 4.0% Total Program Return Allocation 100% 25% 75% 2.0% 2.0% Total Program Return 2.50% 1.50% 4.0% Lo w e r T h re s h o ld s H ig h e r T h re s h o ld s Program Return SYF: 69% of Program Return SYF: 63% of Program Return 2.63% 1.87% 2.13% 0.37% 3.00% 1.50% 2.00% 0.50% SYF: 58% of Program Return SYF: 80% of Program Return SYF: 67% of Program Return SYF: 85% of Program Return + 50 bps (No Asset Change) (150) bps (No Asset Change) Program Return Examples Impact to RSA is More Sensitive in Dynamic Times

162 33.5% 31.9% 51.7% 53.0% 1 22015 2019 Direct PeersSYF Industry Leading Efficiency Ratio Our Core Differentiators and Diligent Focus Power Our Efficiency Drive Core Productivity Initiatives Heritage of Operating Low Avg. Bal. Accts Efficient Marketing Spend Fund Strategic Investments Expense Management Tenets +21 pts

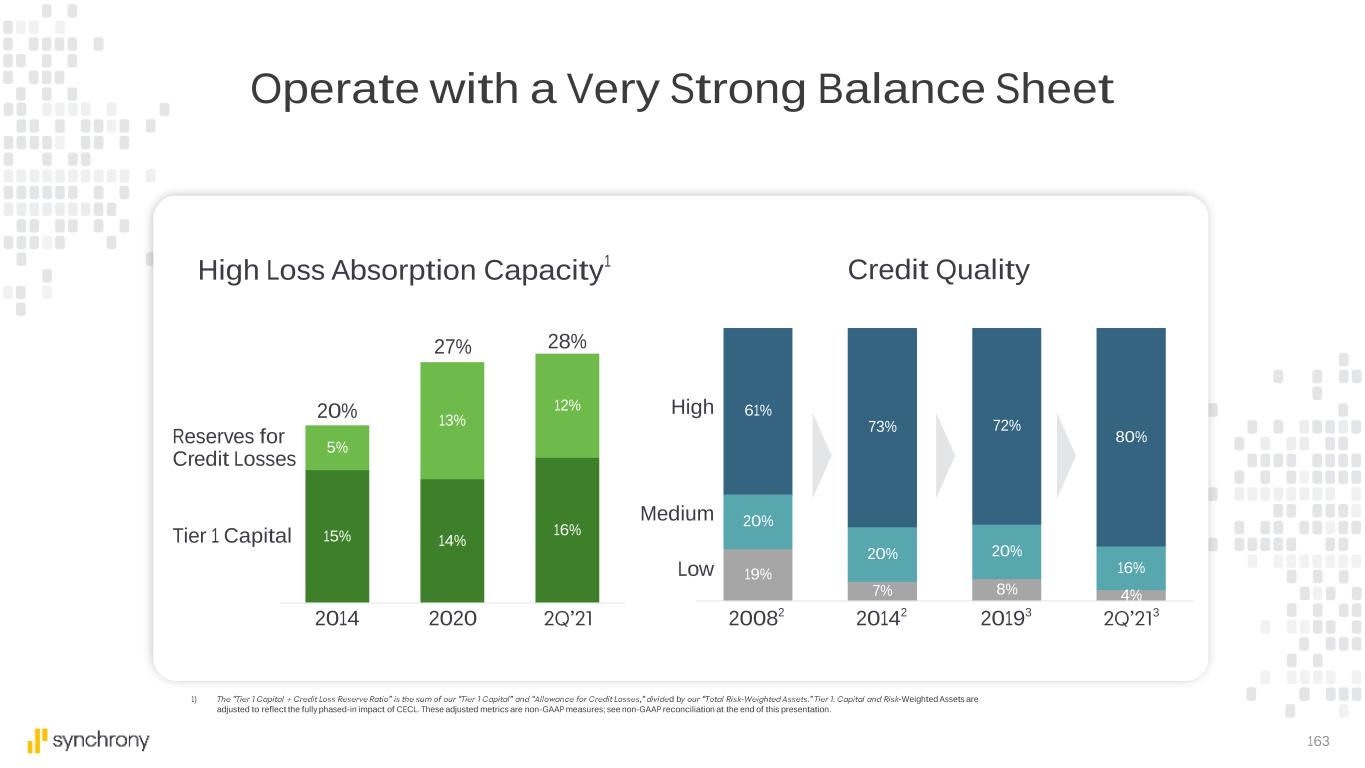

163 19% 7% 8% 4% 20% 20% 20% 16% 61% 73% 72% 80% 20082 High 2019320142 Medium Low 15% 14% 16% 5% 13% 12%20% 27% 2014 2020 Tier 1 Capital Reserves for Credit Losses High Loss Absorption Capacity1 Credit Quality 3 28% Operate with a Very Strong Balance Sheet 1) d b - -Weighted Assets are adjusted to reflect the fully phased-in impact of CECL. These adjusted metrics are non-GAAP measures; see non-GAAP reconciliation at the end of this presentation.

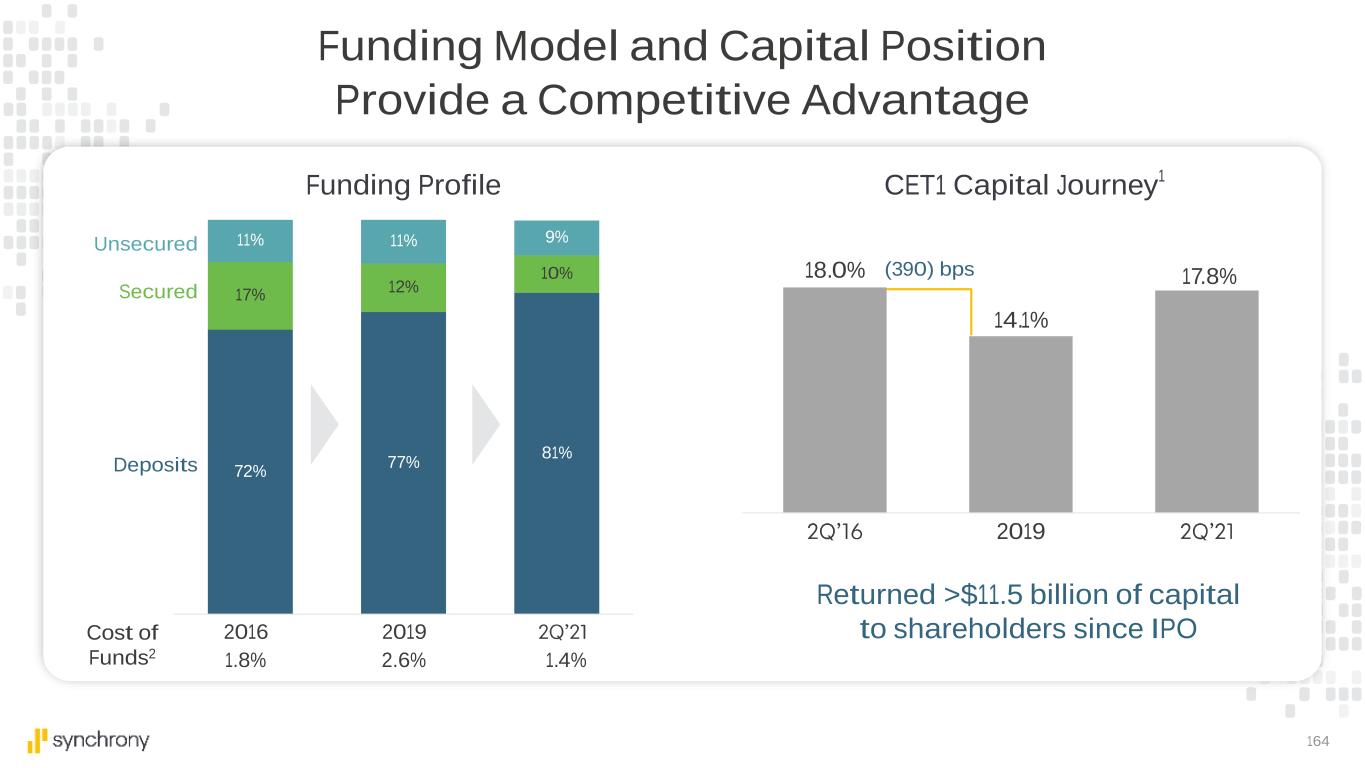

164 72% 77% 81% 17% 12% 10% 11% 11% 9% 20192016 Deposits Unsecured Secured CET1 Capital Journey1 1.8% 2.6% 1.4% Cost of Funds2 18.0% 2019 14.1% 17.8% Funding Profile Returned >$11.5 billion of capital to shareholders since IPO Funding Model and Capital Position Provide a Competitive Advantage (390) bps

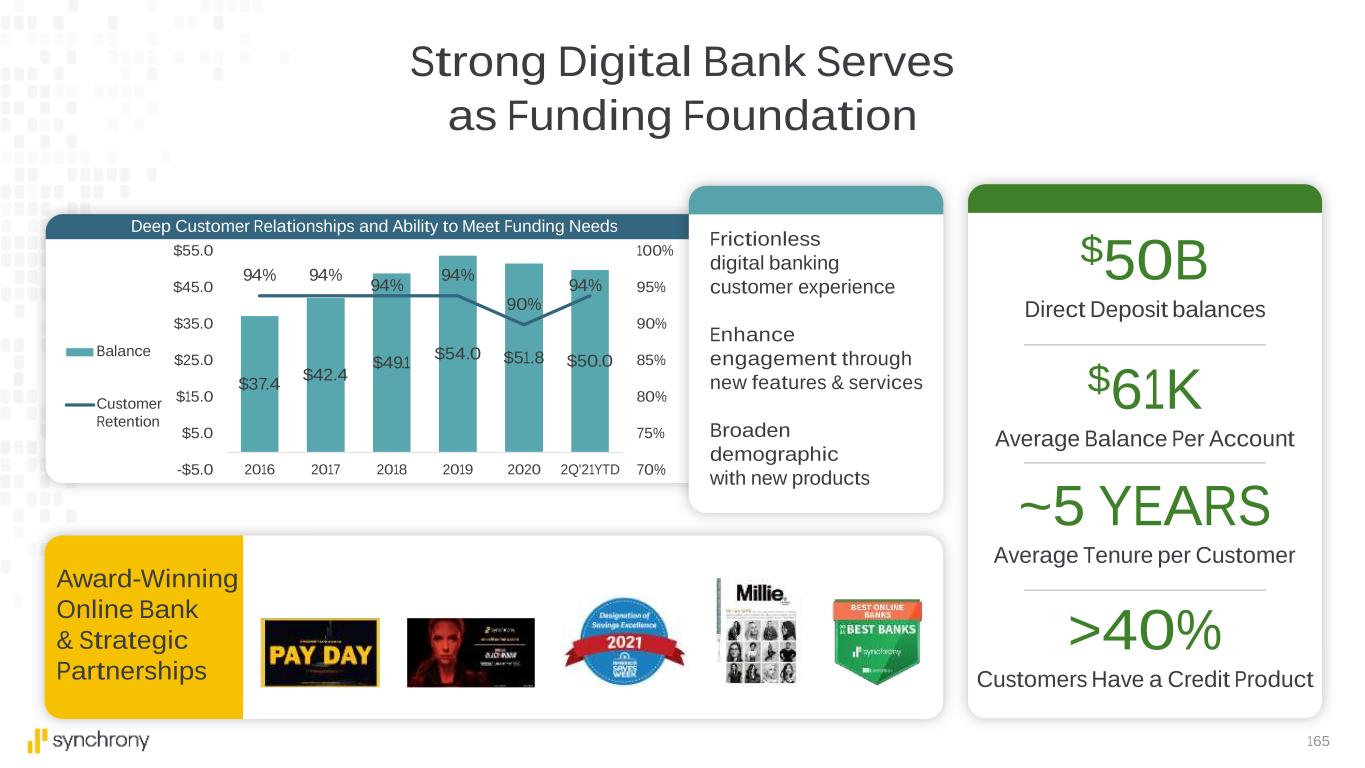

165 $37.4 $42.4 $49.1 $54.0 $51.8 $50.0 94% 94% 94% 94% 90% 94% 70% 75% 80% 85% 90% 95% 100% -$5.0 $5.0 $15.0 $25.0 $35.0 $45.0 $55.0 2016 2017 2018 2019 2020 2Q'21YTD Balance Customer Retention $61K Average Balance Per Account >40% Customers Have a Credit Product $50B Direct Deposit balances ~5 YEARS Average Tenure per Customer Deep Customer Relationships and Ability to Meet Funding Needs Award-Winning Online Bank & Strategic Partnerships Frictionless digital banking customer experience Enhance engagement through new features & services Broaden demographic with new products Strong Digital Bank Serves as Funding Foundation

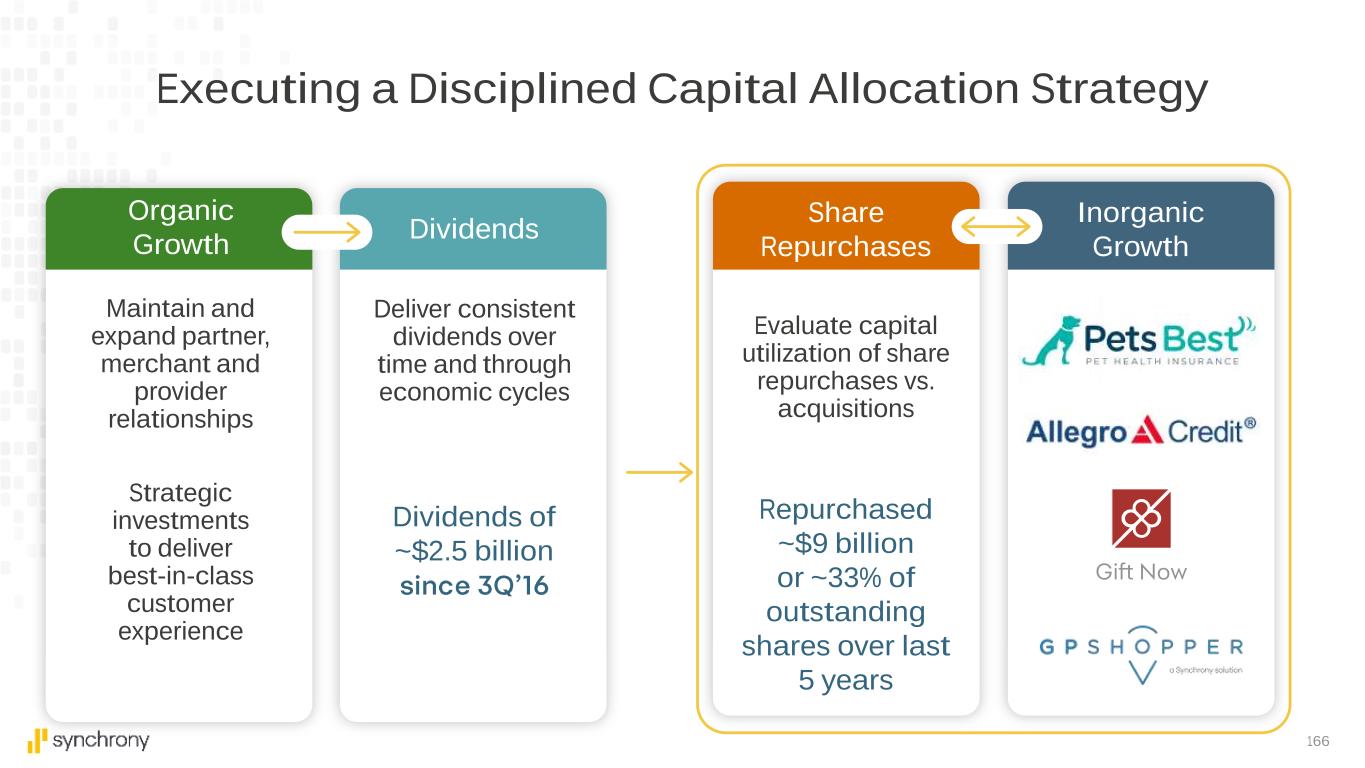

166 Executing a Disciplined Capital Allocation Strategy Maintain and expand partner, merchant and provider relationships Strategic investments to deliver best-in-class customer experience Deliver consistent dividends over time and through economic cycles Dividends of ~$2.5 billion Organic Growth Dividends Share Repurchases Inorganic Growth Repurchased ~$9 billion or ~33% of outstanding shares over last 5 years Evaluate capital utilization of share repurchases vs. acquisitions

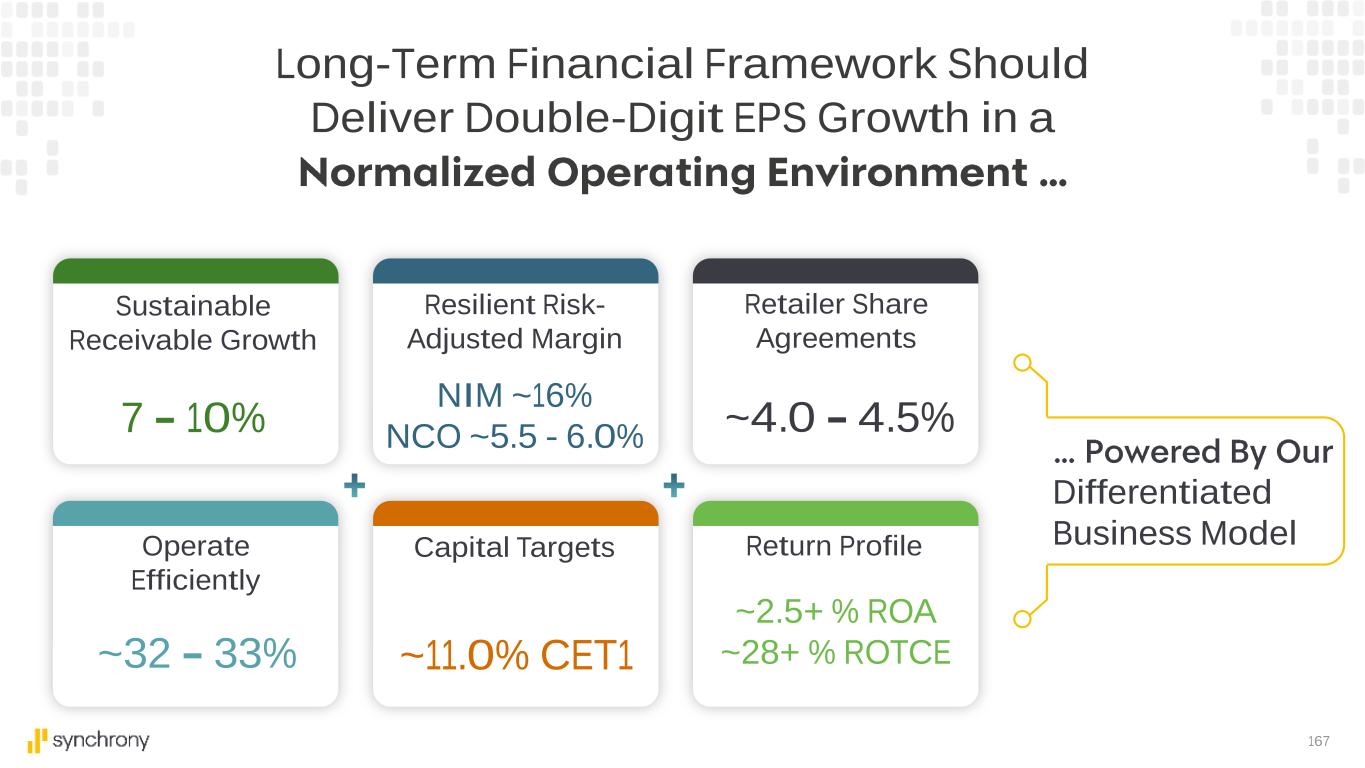

167 Sustainable Receivable Growth Operate Efficiently Resilient Risk- Adjusted Margin Retailer Share Agreements Differentiated Business Model 7 10% NIM ~16% NCO ~5.5 - 6.0% ~4.0 4.5% ~32 33% Long-Term Financial Framework Should Deliver Double-Digit EPS Growth in a Capital Targets ~11.0% CET1 Return Profile ~2.5+ % ROA ~28+ % ROTCE

168 • Improvement in operating performance is partially offset by higher RSA •Mid-teens Purchase volume growth •Continued elevated payment rate •Modest improvement • Improved ALR %, yield increase and lower NCOs•Continued strength in credit performance and delinquencies • Further decline in NCOs Continued Growth Net Interest Margin Net Charge Offs RSAs

169 Diversification & multi-product strategy delivers sustainable growth Portfolio has resilient risk-adjusted yields driven by compelling value propositions RSA aligns mutual interests around growth and financial performance Business model delivers high returns and significant capital generation

170 Brian Doubles President & Chief Executive Officer

171 Diversified business with deep reach gives us tremendous addressable market opportunity Combination of our multi-product suite and innovative digital capabilities enables us to engage and serve more partners and more customers empowering them with greater choice Well-positioned to generate sustainable growth, attractive returns and significant capital over the long term

172 Synchrony enables commerce by delivering the leading financial ecosystem that connects our partners and our customers through world-class technology, products, and capabilities Life. Powered by Synchrony.

173 End Notes KEY TERMS Capital One Financial Corporation Credit Card Business, Domestic Card; Discover Financial Services Credit Card; and American Express Company Global Consumer Services Group, U.S. except for references to Net Interest Income and Efficiency Ratio, where Discover data represents total company information. JPMorgan Chase & Co. Consumer & Community Banking, Credit Card; Citigroup Global Consumer Banking, North America - Citi Retail Services; Bank of America Corporation Consumer Banking Segment, Credit Card; and Wells Fargo & Company Consumer Credit Card - vables less net charge offs as a percentage of average loan receivables average basis by interest and fees on loans for the year ended December 31, 2020, for those partners or for all partners participating in a program, based on the date each partner relationship or program, as applicable, started.

174 End Notes POWERFUL FINANCIAL ECOSYSTEM We Have Built a Differentiated Business and a Strong Track Record of Success 1) Total purchase volume and patents for period 3Q 2014 through to 2Q 2021; Loans Receivable and Active Accounts as of 2Q 2021. At Attractive Risk-Adjusted Returns 1) Direct peer information for year-ended December 31, 2019

175 End Notes DATA & PRODUCTS POWERING GROWTH Significant Customer Scale sis Leveraging Our Network Effect to Drive Sales to Our Partners 1) Synchrony networks are: CareCredit (Health & Wellness Platform); HOME (Home and Auto Platform); and Car Care (Home and Auto Platform). d on 2021 monthly sales data. Data Sharing Ecosystem Drives Growth and Expands Access Across Our Partner Network 1) Excludes Health & Wellness Platform. 1) Estimated value based upon performance tracking from upgrade targeting campaigns utilizing Synchrony-built proprietary models. Comprehensive Product Coverage home, auto and personal loans. Source: competitor press releases, websites and, marketing materials. Deeper Dive: Synchrony BNPL and Installment Products 1) Installments include equal pay no interest promos. 2) Number of open and purchase eligible accounts with installment product capability access available as of June 2021. Product Suite Drives More Customers and Revenue at a Lower Cost to partners than BNPL 1) Ratios based upon Synchrony internal analysis. Synchrony cost to partner estimated based on short- three Pure-Play BNPL Issuers AfterPay, Quadpay and Sezzle, sourced from public company filings and press releases.

176 End Notes TECHNOLOGY: POWERING THE FUTURE No end notes for this section

177 End Notes THE POWER OF PRISM Delivering Consistent Loss Performance Over Time 1) Peer delinquency information represents applicable U.S. Credit Card business units, sourced from company public filings. Harnessing Years of Customer Data and Client Relationships 1) Include active and inactive accounts as of June 30, 2021. Underwriting Evolution Has Increased Approval Rates by ~15% for a Similar Level of Risk 1) Estimated incremental sales for the year ended December 31, 2021 2) Estimated benefit for the year ended December 31, 2021 Holistic Customer Management Yields Incremental Sales with Lower Risk 1) Based upon Synchrony internal analysis 2) Based upon transactional fraud expense incurred for the month ended June 30, 2021 compared to prior year period.

178 End Notes HEALTH & WELLNESS PLATFORM Expansive Network Powers Growth for Providers 1) As of July 2021, based on provider locations and Health & Wellness industry research. 2) As of quarter ending June 30, 2021; excludes Dual Card/Co-Brand, installment and commercial portfolios Core Differentiators are Hard to Replicate 1) Omniture web report for the year ended December 31, 2020. 2) Source: Q3 2020 Cardholder Engagement Study by Chadwick Martin Bailey. Delivering Tangible Value to Partners 1) Source: CareCredit provider satisfaction survey, June 2021. Delivering Seamless Patient Financial Experiences - Net Promoter Score Strategic Acquisition Accelerated Entry into the Growing, Attractive Pet Insurance Industry 1) Source: North American Pet Health Insurance Association (NAPHIA) 2020.

179 End Notes HOME & AUTO PLATFORM Deep Domain Expertise Drives Value 1) For the quarter ended June 30, 2021; excludes Dual Card/Co-Brand, installment and commercial portfolios 2) Time between dealer accepting terms and being approved 3) For the year ended December 31, 2020 Home Vertical is Well-Diversified with Considerable Runway 1) For the quarter ended June 30, 2021; excludes Dual Card/Co-Brand, installment and commercial portfolios 2) For the year ended December 31, 2020 Home Vertical is Deep and Positioned to Win - Partners 1) Source: Home Improvement Research Institute Home Vertical is Deep and Positioned to Win Dealers, Contractors & Original Equipment Manufacturers (OEMs) 1) As of June 30, 2021 2) For six months ended June 30, 2021 compared to prior year period 3) As compared to non-D2D applications for eight weeks ended August 21, 2021 Home Vertical is Deep and Positioned to Win Home Network 1) As of June 30, 2021 2) As of December 31, 2020 Leading Provider of Auto Care Financing 1) For the quarter ending June 30, 2021; excludes Dual Card/Co-Brand, installment and commercial portfolios 2) For the year ended December 31, 2020 Synchrony Car Care: A Powerful Industry Network 1) As of December 31, 2020 2) As of June 30, 2021 3) Excluding gas purchases

180 End Notes DIVERSIFIED & VALUE PLATFORM Partners are Scaled, Omnichannel Leaders that Drive Frequent Purchases from Loyal Customers 1) US data, per latest available public filings 2) Digital sales percentage for six months ended December 31, 2020 Producing Compelling Outcomes for Our Partners & Customers 1) Per active account, platform average, June 2021 2) Average cardholder vs. non-cardholder/non-loyalty consumer, representative portfolios 3) Estimated value of rewards and other discounts earned by cardholders annually 4) As of June 2021 A Leader in a Large Market with Room to Grow 1) Based upon Synchrony internal analysis Partner-Centric Strategy Powering Growth 1) Internal estimate based on transactional data; includes in-partner and world sales

181 End Notes LIFESTYLE PLATFORM Broad Partner Spectrum Across a Diverse Set of Industries 1) As of June 2021 Powering Scalable Solutions for Our Partners and Customers 1) Time between dealer accepting terms and being approved Serving a Large and Fragmented Market 1) For the year ended December 31, 2020 2) Based upon Synchrony internal analysis Significant Growth Opportunities 1) Synchrony internal analysis, based on conversion rates and average ticket sizes 2) Non- 3) Average dealer locations/storefronts added since Jan 2019, per year

182 End Notes DIGITAL PLATFORM Highly Engaged Customers, Partnerships That Span Decades 1) Based on annualized 2021 data Clear Path to Expand Growth 1) Source: U.S. Census 2) Source: public filings and company websites Digital Commerce Will Continue to Grow 1) U.S. Census Adj. Retail Sales 2) Among U.S. adults, source: Pew Research 3) eMarketer estimate for 2021 total e-comm sales 4) Across 14 device categories including laptops, smartphones, video streaming devices, game consolers, fitness equipment, etc., source: Deloitte 2021 Connectivity and Mobile Trends 5) Estimate, assuming e-comm continues to grow 9% or more annually through 2030

183 End Notes POWERFUL FINANCIAL PERFORMANCE and Powers Our Strong Foundation 1) Based on average new accounts per year from 2014-2020 2) Based on average life of account for total open accounts as of July 2021 Partner Model Powers Low- 1) Based on Synchrony internal analysis, representative of large retail partner. Costs to acquire excludes offer/rewards costs. 2) Source: Argus 3) Lifetime value representative of large retail partner account and is based on a vintage 10-year estimate of Net Finance Charges + Net Late Fees + Interchange Loyalty Cost Net Losses. Delivering Consistent Loss Performance Over Time 1) Peer delinquency information represents applicable U.S. Credit Card business units, sourced from company public filings. Effectively Managing Our Portfolio Through the Pandemic 1) Data is based on VantageScore credit scores available for our customers in each period, weighted by balance, as a % of period-end receivables. There are certain customer accounts for which a VantageScore credit score is not available where we use alternative sources to assess their credit and predict behavior. Scores >651 - Retailer Share Agreements (RSAs) Designed to Align Growth & Profitability 1) Each Retailer Share Agreement is different. Levels and payouts vary, but in general these metrics are used in program calculations. Operate with a Very Strong Balance Sheet 1) See footnote on slide for non-GAAP metric 2) Data prior to 2019 is based on FICO scores available for our customers in each period, weighted by balance, as a % of period-end receivables. If FICO score was not available credit bureau-based scores were mapped to a FICO equivalent. If neither score was available, the - each period, weighted by balance, as a % of period-end receivables. There are certain customer accounts for which a VantageScore credit score is not available where we use alternative sources to assess their credit and predict behavior. If neither score was available, the account - Funding Model and Capital Position Provide a Competitive Advantage two years in accordance with the interim final rule issued by U.S. banking agencies in March -in methodology, prior to CECL implementation. 2) Cost of funds are for years ended December 31, 2016 and 2019, and three months ended June 30, 2021

Non-GAAP Reconciliation The following table sets forth the components of our Tier 1 Capital + Reserves ratio for the periods indicated below. 2014 2020 2021 Tier 1 Capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,277 $13,525 $14,671 Less: CECL transition adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . - (2,686) (2,376) Tier 1 capital (CECL fully phased-in). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,277 $10,839 $12,295 Add: Allowance for credit losses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,236 10,265 9,023 Tier 1 capital (CECL fully phased-in) plus Reserves for credit losses. . . . . . $12,513 $21,104 $21,318 Risk-weighted assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $64,162 $80,561 $78,281 Less: CECL transition adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . - (2,477) (2,166) Risk-weighted assets (CECL fully phased-in). . . . . . . . . . . . . . . . . . . . . . . . . . . $64,162 $78,084 $76,115 At Dec 31 At Jun 30