UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2019

OR

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

001-36560

(Commission File Number)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 51-0483352 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

777 Long Ridge Road | | |

Stamford, Connecticut | | 06902 |

(Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code) (203) 585-2400

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ý | Accelerated filer | o |

| | | |

Non-accelerated filer | o | Smaller reporting company | o |

| | | |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of shares of the registrant’s common stock, par value $0.001 per share, outstanding as of April 22, 2019 was 689,316,399.

Synchrony Financial

|

| |

PART I - FINANCIAL INFORMATION | Page |

| |

| |

Item 1. Financial Statements: | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II - OTHER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Certain Defined Terms

Except as the context may otherwise require in this report, references to:

| |

• | “we,” “us,” “our” and the “Company” are to SYNCHRONY FINANCIAL and its subsidiaries; |

| |

• | “Synchrony” are to SYNCHRONY FINANCIAL only; |

| |

• | the “Bank” are to Synchrony Bank (a subsidiary of Synchrony); |

| |

• | the “Board of Directors” are to Synchrony's board of directors; |

| |

• | “GE” are to General Electric Company and its subsidiaries; |

| |

• | the “Tax Act” are to P.L. 115-97, commonly referred to as the Tax Cuts and Jobs Act, signed into law on December 22, 2017; and |

| |

• | “FICO” are to a credit score developed by Fair Isaac & Co., which is widely used as a means of evaluating the likelihood that credit users will pay their obligations. |

We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which, in our business and in this report, we refer to as our “partners.” The terms of the programs all require cooperative efforts between us and our partners of varying natures and degrees to establish and operate the programs. Our use of the term “partners” to refer to these entities is not intended to, and does not, describe our legal relationship with them, imply that a legal partnership or other relationship exists between the parties or create any legal partnership or other relationship. The “average length of our relationship” with respect to a specified group of partners or programs is measured on a weighted average basis by interest and fees on loans for the year ended December 31, 2018 for those partners or for all partners participating in a program, based on the date each partner relationship or program, as applicable, started.

Unless otherwise indicated, references to “loan receivables” do not include loan receivables held for sale.

For a description of certain other terms we use, including “active account” and “purchase volume,” see the notes to “Management’s Discussion and Analysis—Results of Operations—Other Financial and Statistical Data” in our Annual Report on Form 10-K for the year ended December 31, 2018 (our “2018 Form 10-K”). There is no standard industry definition for many of these terms, and other companies may define them differently than we do.

“Synchrony” and its logos and other trademarks referred to in this report, including CareCredit®, Quickscreen®, Dual Card™, Synchrony Car Care™ and SyPI™, belong to us. Solely for convenience, we refer to our trademarks in this report without the ™ and ® symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this report are the property of their respective owners.

On our website at www.synchronyfinancial.com, we make available under the "Investors-SEC Filings" menu selection, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such reports or amendments are electronically filed with, or furnished to, the SEC. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information that we file electronically with the SEC.

Cautionary Note Regarding Forward-Looking Statements:

Various statements in this Quarterly Report on Form 10-Q may contain “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “outlook,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements.

Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; cyber-attacks or other security breaches; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third-parties to provide various services that are important to our operations; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; a material indemnification obligation to GE under the Tax Sharing and Separation Agreement with GE if we cause the split-off from GE or certain preliminary transactions to fail to qualify for tax-free treatment or in the case of certain significant transfers of our stock following the split-off; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and other legislative and regulatory developments and the impact of the Consumer Financial Protection Bureau's (the “CFPB”) regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this report and in our public filings, including under the heading “Risk Factors Relating to Our Business” in our 2018 Form 10-K. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by the federal securities laws.

PART I. FINANCIAL INFORMATION

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated financial statements and related notes included elsewhere in this quarterly report and in our 2018 Form 10-K. The discussion below contains forward-looking statements that are based upon current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from these expectations. See “Cautionary Note Regarding Forward-Looking Statements.”

Introduction and Business Overview

____________________________________________________________________________________________

We are a premier consumer financial services company delivering customized financing programs across key industries including retail, health, auto, travel and home, along with award-winning consumer banking products. We provide a range of credit products through our financing programs which we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” For the three months ended March 31, 2019, we financed $32.5 billion of purchase volume, and had 77.1 million average active accounts, and at March 31, 2019, we had $80.4 billion of loan receivables.

We offer our credit products primarily through our wholly-owned subsidiary, the Bank. In addition, through the Bank, we offer, directly to retail and commercial customers, a range of deposit products insured by the Federal Deposit Insurance Corporation (“FDIC”), including certificates of deposit, individual retirement accounts (“IRAs”), money market accounts and savings accounts. We also take deposits at the Bank through third-party securities brokerage firms that offer our FDIC-insured deposit products to their customers. We have significantly expanded our online direct banking operations in recent years and our deposit base serves as a source of stable and diversified low cost funding for our credit activities. At March 31, 2019, we had $64.1 billion in deposits, which represented 75% of our total funding sources.

Our Sales Platforms

_________________________________________________________________

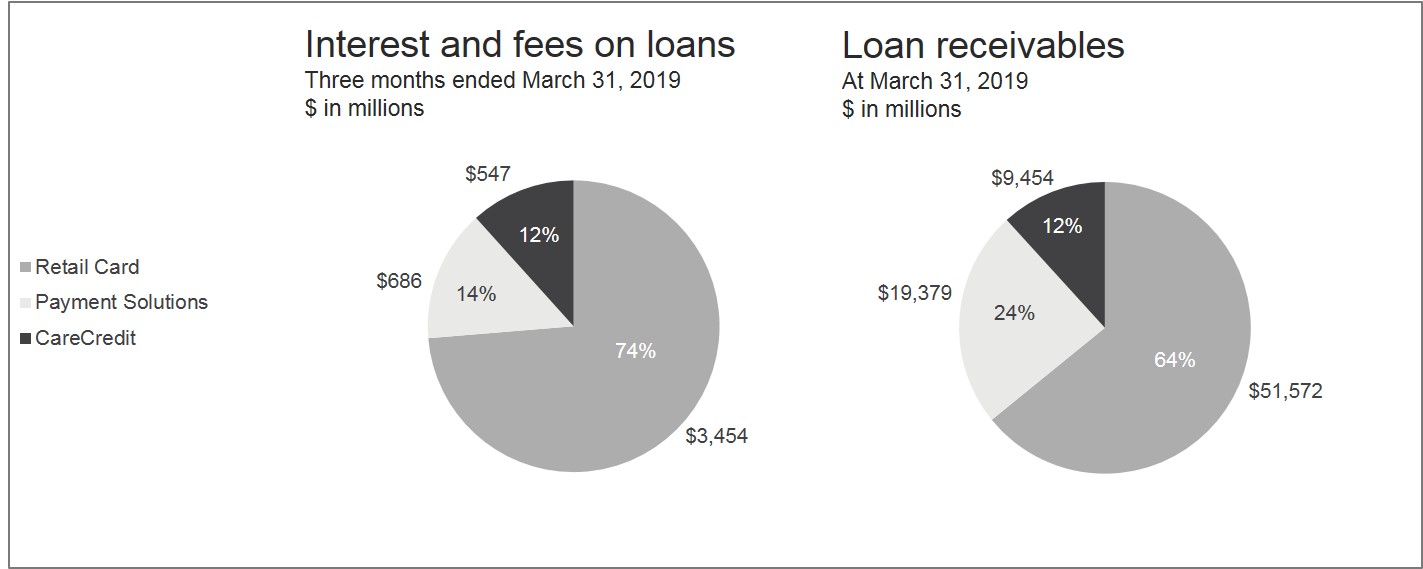

We conduct our operations through a single business segment. Profitability and expenses, including funding costs, loan losses and operating expenses, are managed for the business as a whole. Substantially all of our operations are within the United States. We offer our credit products through three sales platforms (Retail Card, Payment Solutions and CareCredit). Those platforms are organized by the types of products we offer and the partners we work with, and are measured on interest and fees on loans, loan receivables, active accounts and other sales metrics.

Beginning in the first quarter of 2019, our oil and gas retail credit programs, previously reported within our Retail Card sales platform, are now reported within our Payment Solutions sales platform. Payment Solutions now includes a broad range of automotive-related credit programs, comprising of these retail partners, our Synchrony Car Care program network and other automotive partners. We have recast all prior-period reported metrics for our Retail Card and Payment Solutions sales platforms to conform to the current-period presentation.

Retail Card

Retail Card is a leading provider of private label credit cards, and also provides Dual Cards, general purpose co-branded credit cards and small- and medium-sized business credit products. We offer one or more of these products primarily through 24 national and regional retailers with which we have ongoing program agreements. The average length of our relationship with these Retail Card partners is 22 years. Retail Card’s revenue primarily consists of interest and fees on our loan receivables. Other income primarily consists of interchange fees earned when our Dual Card or general purpose co-branded credit cards are used outside of our partners' sales channels and fees paid to us by customers who purchase our debt cancellation products, less loyalty program payments. In addition, the majority of our retailer share arrangements, which generally provide for payment to our partner if the economic performance of the program exceeds a contractually-defined threshold, are with partners in the Retail Card sales platform. Substantially all of the credit extended in this platform is on standard terms.

Payment Solutions

Payment Solutions is a leading provider of promotional financing for major consumer purchases, offering consumer choice for financing at the point of sale, including primarily private label credit cards, Dual Cards and installment loans. Payment Solutions offers these products through participating partners consisting of national and regional retailers, local merchants, manufacturers, buying groups and industry associations. Substantially all of the credit extended in this platform, other than for our oil and gas retail partners, is promotional financing. Payment Solutions’ revenue primarily consists of interest and fees on our loan receivables, including “merchant discounts,” which are fees paid to us by our partners in almost all cases to compensate us for all or part of foregone interest income associated with promotional financing.

CareCredit

CareCredit is a leading provider of promotional financing to consumers for health, veterinary and personal care procedures, services or products. We have a network of CareCredit providers and health-focused retailers, the vast majority of which are individual or small groups of independent healthcare providers, through which we offer a CareCredit branded private label credit card and our CareCredit Dual Card offering. Substantially all of the credit extended in this platform is promotional financing. CareCredit’s revenue primarily consists of interest and fees on our loan receivables, including merchant discounts.

Our Credit Products

____________________________________________________________________________________________

Through our platforms, we offer three principal types of credit products: credit cards, commercial credit products and consumer installment loans. We also offer a debt cancellation product.

The following table sets forth each credit product by type and indicates the percentage of our total loan receivables that are under standard terms only or pursuant to a promotional financing offer at March 31, 2019.

|

| | | | | | | | | | | |

| | | Promotional Offer | | |

Credit Product | Standard Terms Only | | Deferred Interest | | Other Promotional | | Total |

Credit cards | 62.9 | % | | 18.4 | % | | 14.8 | % | | 96.1 | % |

Commercial credit products | 1.6 |

| | — |

| | — |

| | 1.6 |

|

Consumer installment loans | — |

| | — |

| | 2.3 |

| | 2.3 |

|

Other | — |

| | — |

| | — |

| | — |

|

Total | 64.5 | % | | 18.4 | % | | 17.1 | % | | 100.0 | % |

Credit Cards

We typically offer the following principal types of credit cards:

| |

• | Private Label Credit Cards. Private label credit cards are partner-branded credit cards (e.g., Lowe’s or Amazon) or program-branded credit cards (e.g., Synchrony Car Care or CareCredit) that are used primarily for the purchase of goods and services from the partner or within the program network. In addition, in some cases, cardholders may be permitted to access their credit card accounts for cash advances. In Retail Card, credit under our private label credit cards typically is extended on standard terms only, and in Payment Solutions and CareCredit, credit under our private label credit cards typically is extended pursuant to a promotional financing offer. |

| |

• | Dual Cards and General Purpose Co-Brand Cards. Our patented Dual Cards are credit cards that function as private label credit cards when used to purchase goods and services from our partners, and as general purpose credit cards when used elsewhere. We also offer general purpose co-branded credit cards that do not function as private label cards. Credit extended under our Dual Cards and general purpose co-branded credit cards typically is extended under standard terms only. We offer either Dual Cards or general purpose co-branded credit cards across all of our sales platforms, spanning 21 ongoing credit partners and our CareCredit Dual Card. |

Commercial Credit Products

We offer private label cards and Dual Cards for commercial customers that are similar to our consumer offerings. We also offer a commercial pay-in-full accounts receivable product to a wide range of business customers. We offer our commercial credit products primarily through our Retail Card platform to the commercial customers of our Retail Card partners.

Installment Loans

In Payment Solutions, we originate installment loans to consumers (and a limited number of commercial customers) in the United States, primarily in the power products market (motorcycles, ATVs and lawn and garden). Installment loans are closed-end credit accounts where the customer pays down the outstanding balance in installments. Installment loans are assessed periodic finance charges using fixed interest rates.

Business Trends and Conditions

____________________________________________________________________________________________

We believe our business and results of operations will be impacted in the future by various trends and conditions. For a discussion of certain trends and conditions, see “Management's Discussion and Analysis of Financial Condition and Results of Operations—Business Trends and Conditions” in our 2018 Form 10-K. For a discussion of how certain trends and conditions impacted the three months ended March 31, 2019, see “—Results of Operations.”

Seasonality

____________________________________________________________________________________________

In our Retail Card and Payment Solutions platforms, we experience fluctuations in transaction volumes and the level of loan receivables as a result of higher seasonal consumer spending and payment patterns that typically result in an increase of loan receivables from August through a peak in late December, with reductions in loan receivables occurring over the first and second quarters of the following year as customers pay their balances down.

The seasonal impact to transaction volumes and the loan receivables balance typically results in fluctuations in our results of operations, delinquency metrics and the allowance for loan losses as a percentage of total loan receivables between quarterly periods.

In addition to the seasonal variance in loan receivables discussed above, we also experience a seasonal increase in delinquency rates and delinquent loan receivables balances during the third and fourth quarters of each year due to lower customer payment rates resulting in higher net charge-off rates in the first and second quarters. Our delinquency rates and delinquent loan receivables balances typically decrease during the subsequent first and second quarters as customers begin to pay down their loan balances and return to current status resulting in lower net charge-off rates in the third and fourth quarters. Because customers who were delinquent during the fourth quarter of a calendar year have a higher probability of returning to current status when compared to customers who are delinquent at the end of each of our interim reporting periods, we expect that a higher proportion of delinquent accounts outstanding at an interim period end will result in charge-offs, as compared to delinquent accounts outstanding at a year end. Consistent with this historical experience, we generally experience a higher allowance for loan losses as a percentage of total loan receivables at the end of an interim period, as compared to the end of a calendar year. In addition, despite improving credit metrics such as declining past due amounts, we may experience an increase in our allowance for loan losses at an interim period end compared to the prior year end, reflecting these same seasonal trends.

The seasonal trends discussed above are most evident between the fourth quarter and the first quarter of the following year. Loan receivables at March 31, 2019 decreased compared to December 31, 2018 in excess of amounts attributable to the reclassification of the Walmart portfolio to loan receivables held for sale. In addition, our allowance for loan losses as a percentage of total loan receivables increased to 7.39% at March 31, 2019, from 6.90% at December 31, 2018. Both of these changes reflect the effects of the seasonal trends. Past due balances declined to $4.0 billion at March 31, 2019 from $4.4 billion at December 31, 2018, primarily due to collections from customers that were previously delinquent. The increase in the allowance for loan losses as a percentage of loan receivables at March 31, 2019 compared to December 31, 2018, despite a decrease in our past due balances, primarily reflects these same seasonal trends.

Results of Operations

____________________________________________________________________________________________

Highlights for the Three Months Ended March 31, 2019

Below are highlights of our performance for the three months ended March 31, 2019 compared to the three months ended March 31, 2018, as applicable, except as otherwise noted.

| |

• | Net earnings increased 73.0% to $1,107 million for the three months ended March 31, 2019, driven by higher net interest income and a decrease in provision for loan losses, partially offset by increases in retailer share arrangements, other expense and provision for income taxes. |

| |

• | Loan receivables increased 3.3% to $80,405 million at March 31, 2019 compared to March 31, 2018, primarily driven by the PayPal Credit acquisition, higher purchase volume and average active account growth, partially offset by the reclassification of $8.1 billion of loan receivables associated with the Walmart portfolio to loan receivables held for sale. |

| |

• | Net interest income increased 10.0% to $4,226 million for the three months ended March 31, 2019, primarily due to higher average loan receivables growth, partially offset by increases in interest expense reflecting higher benchmark interest rates and growth. |

| |

• | Retailer share arrangements increased 32.5% to $954 million for the three months ended March 31, 2019, primarily due to lower reserve build, growth and improved performance of the programs in which we have retailer share arrangements. |

| |

• | Over-30 day loan delinquencies as a percentage of period-end loan receivables increased 40 basis points to 4.92% at March 31, 2019 primarily due to the impact of reclassification of the Walmart portfolio to loan receivables held for sale, and the net charge-off rate decreased 8 basis points to 6.06% for the three months ended March 31, 2019. |

| |

• | Provision for loan losses decreased by $503 million, or 36.9%, for the three months ended March 31, 2019, substantially due to a $522 million reserve release following the reclassification of the Walmart portfolio to loan receivables held for sale. Our allowance coverage ratio (allowance for loan losses as a percent of end of period loan receivables) remained relatively flat at 7.39% at March 31, 2019, as compared to 7.37% at March 31, 2018. |

| |

• | Other expense increased by $55 million, or 5.6%, for the three months ended March 31, 2019, primarily driven by the PayPal Credit acquisition and business growth. |

| |

• | At March 31, 2019, deposits represented 75% of our total funding sources. Total deposits remained relatively flat at $64.1 billion at March 31, 2019, compared to December 31, 2018. Growth in our direct deposits of 4.9% to $51.8 billion, was offset by lower brokered deposits. |

| |

• | During the three months ended March 31, 2019, we repurchased $966 million of our outstanding common stock, and declared and paid cash dividends of $0.21 per share, or $150 million. |

| |

• | In March 2019, we announced our acquisition of Pets Best and entry into the pet health insurance industry as a managing general agent. |

2019 Partner Agreements

| |

• | We expanded our Synchrony Car Care program acceptance network and we also extended our Payment Solutions program agreements with P.C. Richard & Son, Rheem and Suzuki. |

| |

• | We expanded our CareCredit network through our new partnership with Simplee. |

Summary Earnings

The following table sets forth our results of operations for the periods indicated.

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Interest income | $ | 4,786 |

| | $ | 4,244 |

|

Interest expense | 560 |

| | 402 |

|

Net interest income | 4,226 |

| | 3,842 |

|

Retailer share arrangements | (954 | ) | | (720 | ) |

Net interest income, after retailer share arrangements | 3,272 |

| | 3,122 |

|

Provision for loan losses | 859 |

| | 1,362 |

|

Net interest income, after retailer share arrangements and provision for loan losses | 2,413 |

| | 1,760 |

|

Other income | 92 |

| | 75 |

|

Other expense | 1,043 |

| | 988 |

|

Earnings before provision for income taxes | 1,462 |

| | 847 |

|

Provision for income taxes | 355 |

| | 207 |

|

Net earnings | $ | 1,107 |

| | $ | 640 |

|

Other Financial and Statistical Data

The following table sets forth certain other financial and statistical data for the periods indicated. |

| | | | | | | |

| At and for the |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Financial Position Data (Average): | | | |

Loan receivables, including held for sale | $ | 89,903 |

| | $ | 79,090 |

|

Total assets | $ | 105,299 |

| | $ | 95,707 |

|

Deposits | $ | 64,062 |

| | $ | 56,656 |

|

Borrowings | $ | 22,299 |

| | $ | 21,205 |

|

Total equity | $ | 14,790 |

| | $ | 14,276 |

|

Selected Performance Metrics: | | | |

Purchase volume(1)(2) | $ | 32,513 |

| | $ | 29,626 |

|

Retail Card | $ | 24,660 |

| | $ | 22,141 |

|

Payment Solutions | $ | 5,249 |

| | $ | 5,064 |

|

CareCredit | $ | 2,604 |

| | $ | 2,421 |

|

Average active accounts (in thousands)(2)(3) | 77,132 |

| | 71,323 |

|

Net interest margin(4) | 16.08 | % | | 16.05 | % |

Net charge-offs | $ | 1,344 |

| | $ | 1,198 |

|

Net charge-offs as a % of average loan receivables, including held for sale | 6.06 | % | | 6.14 | % |

Allowance coverage ratio(5) | 7.39 | % | | 7.37 | % |

Return on assets(6) | 4.3 | % | | 2.7 | % |

Return on equity(7) | 30.4 | % | | 18.2 | % |

Equity to assets(8) | 14.05 | % | | 14.92 | % |

Other expense as a % of average loan receivables, including held for sale | 4.71 | % | | 5.07 | % |

Efficiency ratio(9) | 31.0 | % | | 30.9 | % |

Effective income tax rate | 24.3 | % | | 24.4 | % |

Selected Period-End Data: | | | |

Loan receivables | $ | 80,405 |

| | $ | 77,853 |

|

Allowance for loan losses | $ | 5,942 |

| | $ | 5,738 |

|

30+ days past due as a % of period-end loan receivables(10) | 4.92 | % | | 4.52 | % |

90+ days past due as a % of period-end loan receivables(10) | 2.51 | % | | 2.28 | % |

Total active accounts (in thousands)(2)(3) | 74,812 |

| | 68,891 |

|

| |

(1) | Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. |

| |

(2) | Includes activity and accounts associated with loan receivables held for sale. |

| |

(3) | Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. |

| |

(4) | Net interest margin represents net interest income divided by average interest-earning assets. |

| |

(5) | Allowance coverage ratio represents allowance for loan losses divided by total period-end loan receivables. |

| |

(6) | Return on assets represents net earnings as a percentage of average total assets. |

| |

(7) | Return on equity represents net earnings as a percentage of average total equity. |

| |

(8) | Equity to assets represents average equity as a percentage of average total assets. |

| |

(9) | Efficiency ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income. |

| |

(10) | Based on customer statement-end balances extrapolated to the respective period-end date. |

Average Balance Sheet

The following tables set forth information for the periods indicated regarding average balance sheet data, which are used in the discussion of interest income, interest expense and net interest income that follows.

|

| | | | | | | | | | | | | | | | | | | | | |

| 2019 | | 2018 |

Three months ended March 31 ($ in millions) | Average Balance | | Interest Income / Expense | | Average Yield / Rate(1) | | Average Balance | | Interest Income/ Expense | | Average Yield / Rate(1) |

Assets | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | |

Interest-earning cash and equivalents(2) | $ | 11,033 |

| | $ | 65 |

| | 2.39 | % | | $ | 12,434 |

| | $ | 47 |

| | 1.53 | % |

Securities available for sale | 5,640 |

| | 34 |

| | 2.44 | % | | 5,584 |

| | 25 |

| | 1.82 | % |

Loan receivables(3): | | | | | | | | | | | |

Credit cards, including held for sale | 86,768 |

| | 4,611 |

| | 21.55 | % | | 76,181 |

| | 4,099 |

| | 21.82 | % |

Consumer installment loans | 1,844 |

| | 42 |

| | 9.24 | % | | 1,572 |

| | 36 |

| | 9.29 | % |

Commercial credit products | 1,252 |

| | 34 |

| | 11.01 | % | | 1,286 |

| | 36 |

| | 11.35 | % |

Other | 39 |

| | — |

| | — | % | | 51 |

| | 1 |

| | NM |

|

Total loan receivables | 89,903 |

| | 4,687 |

| | 21.14 | % | | 79,090 |

| | 4,172 |

| | 21.39 | % |

Total interest-earning assets | 106,576 |

| | 4,786 |

| | 18.21 | % | | 97,108 |

| | 4,244 |

| | 17.72 | % |

Non-interest-earning assets: | | | | | | | | | | | |

Cash and due from banks | 1,335 |

| | | | | | 1,197 |

| | | | |

Allowance for loan losses | (6,341 | ) | | | | | | (5,608 | ) | | | | |

Other assets | 3,729 |

| | | | | | 3,010 |

| | | | |

Total non-interest-earning assets | (1,277 | ) | | | | | | (1,401 | ) | | | | |

Total assets | $ | 105,299 |

| | | | | | $ | 95,707 |

| | | | |

Liabilities | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | |

Interest-bearing deposit accounts | $ | 63,776 |

| | $ | 375 |

| | 2.38 | % | | $ | 56,356 |

| | $ | 249 |

| | 1.79 | % |

Borrowings of consolidated securitization entities | 13,407 |

| | 100 |

| | 3.02 | % | | 12,410 |

| | 74 |

| | 2.42 | % |

Senior unsecured notes | 8,892 |

| | 85 |

| | 3.88 | % | | 8,795 |

| | 79 |

| | 3.64 | % |

Total interest-bearing liabilities | 86,075 |

| | 560 |

| | 2.64 | % | | 77,561 |

| | 402 |

| | 2.10 | % |

Non-interest-bearing liabilities: | | | | | | | | | | | |

Non-interest-bearing deposit accounts | 286 |

| | | | | | 300 |

| | | | |

Other liabilities | 4,148 |

| | | | | | 3,570 |

| | | | |

Total non-interest-bearing liabilities | 4,434 |

| | | | | | 3,870 |

| | | | |

Total liabilities | 90,509 |

| | | | | | 81,431 |

| | | | |

Equity | | | | | | | | | | | |

Total equity | 14,790 |

| | | | | | 14,276 |

| | | | |

Total liabilities and equity | $ | 105,299 |

| | | | | | $ | 95,707 |

| | | | |

Interest rate spread(4) | | | | | 15.57 | % | | | | | | 15.62 | % |

Net interest income | | | $ | 4,226 |

| | | | | | $ | 3,842 |

| | |

Net interest margin(5) | | | | | 16.08 | % | | | | | | 16.05 | % |

| |

(1) | Average yields/rates are based on total interest income/expense over average balances. |

| |

(2) | Includes average restricted cash balances of $989 million and $771 million for the three months ended March 31, 2019 and 2018, respectively. |

| |

(3) | Interest income on loan receivables includes fees on loans of $693 million and $644 million for the three months ended March 31, 2019 and 2018, respectively. |

| |

(4) | Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. |

| |

(5) | Net interest margin represents net interest income divided by average total interest-earning assets. |

For a summary description of the composition of our key line items included in our Statements of Earnings, see Management's Discussion and Analysis of Financial Condition and Results of Operations in our 2018 Form 10-K.

Interest Income

Interest income increased by $542 million, or 12.8%, for the three months ended March 31, 2019, driven primarily by growth in our average loan receivables.

Average interest-earning assets

|

| | | | | | | | | | | | | |

Three months ended March 31 ($ in millions) | 2019 | | % | | 2018 | | % |

Loan receivables, including held for sale | $ | 89,903 |

| | 84.4 | % | | $ | 79,090 |

| | 81.4 | % |

Liquidity portfolio and other | 16,673 |

| | 15.6 | % | | 18,018 |

| | 18.6 | % |

Total average interest-earning assets | $ | 106,576 |

| | 100.0 | % | | $ | 97,108 |

| | 100.0 | % |

The increase in average loan receivables of 13.7% for the three months ended March 31, 2019, was driven by the PayPal Credit acquisition, higher purchase volume and average active account growth. Purchase volume and average active accounts increased 9.7% and 8.1%, respectively, including the effects of the PayPal Credit acquisition.

Yield on average interest-earning assets

The yield on average interest-earning assets increased for the three months ended March 31, 2019, primarily due to an increase in the percentage of interest-earning assets attributable to loan receivables, partially offset by a decrease in the yield on our average loan receivables of 25 basis points to 21.14%. This decrease was primarily due to the impact of adding the PayPal Credit program.

Interest Expense

Interest expense increased by $158 million, or 39.3%, for the three months ended March 31, 2019, driven primarily by higher benchmark interest rates and growth. Our cost of funds increased to 2.64% for the three months ended March 31, 2019, compared to 2.10% for the three months ended March 31, 2018.

Average interest-bearing liabilities

|

| | | | | | | | | | | | | |

Three months ended March 31 ($ in millions) | 2019 | | % | | 2018 | | % |

Interest-bearing deposit accounts | $ | 63,776 |

| | 74.1 | % | | $ | 56,356 |

| | 72.7 | % |

Borrowings of consolidated securitization entities | 13,407 |

| | 15.6 | % | | 12,410 |

| | 16.0 | % |

Third-party debt | 8,892 |

| | 10.3 | % | | 8,795 |

| | 11.3 | % |

Total average interest-bearing liabilities | $ | 86,075 |

| | 100.0 | % | | $ | 77,561 |

| | 100.0 | % |

The increase in average interest-bearing liabilities for the three months ended March 31, 2019 was driven primarily by growth in our direct deposits.

Net Interest Income

Net interest income increased by $384 million, or 10.0%, for the three months ended March 31, 2019, driven primarily by higher average loan receivables, partially offset by increases in interest expense reflecting higher benchmark interest rates and growth.

Retailer Share Arrangements

Retailer share arrangements increased by $234 million, or 32.5%, for the three months ended March 31, 2019, primarily due to lower reserve build, growth and improved performance of the programs in which we have retailer share arrangements.

Provision for Loan Losses

Provision for loan losses decreased by $503 million, or 36.9%, for the three months ended March 31, 2019, substantially due to a $522 million reserve release following the reclassification of the Walmart portfolio to loan receivables held for sale on our Condensed Consolidated Statement of Financial Position. Our allowance coverage ratio remained relatively flat at 7.39% at March 31, 2019, as compared to 7.37% at March 31, 2018.

Other Income

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Interchange revenue | $ | 165 |

| | $ | 158 |

|

Debt cancellation fees | 68 |

| | 66 |

|

Loyalty programs | (167 | ) | | (155 | ) |

Other | 26 |

| | 6 |

|

Total other income | $ | 92 |

| | $ | 75 |

|

Other income increased by $17 million, or 22.7%, for the three months ended March 31, 2019, primarily due to a reduction in certain contingent consideration obligations and higher investment gains in the current quarter. The increase in interchange revenue was fully offset by higher loyalty costs.

Other Expense

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Employee costs | $ | 353 |

| | $ | 358 |

|

Professional fees | 232 |

| | 166 |

|

Marketing and business development | 123 |

| | 121 |

|

Information processing | 113 |

| | 104 |

|

Other | 222 |

| | 239 |

|

Total other expense | $ | 1,043 |

| | $ | 988 |

|

Other expense increased by $55 million, or 5.6%, for the three months ended March 31, 2019, primarily due to an increase in professional fees. The increase in professional fees was primarily due to interim servicing costs associated with acquired portfolios, including the PayPal Credit portfolio.

Provision for Income Taxes

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Effective tax rate | 24.3 | % | | 24.4 | % |

Provision for income taxes | $ | 355 |

| | $ | 207 |

|

The effective tax rate for the three months ended March 31, 2019 decreased slightly compared to the same period in the prior year. In each period, the effective tax rate differs from the applicable U.S. federal statutory rate primarily due to state income taxes.

Platform Analysis

As discussed above under “—Our Sales Platforms,” we offer our products through three sales platforms (Retail Card, Payment Solutions and CareCredit), which management measures based on their revenue-generating activities. The following is a discussion of certain supplemental information for the three months ended March 31, 2019, for each of our sales platforms.

Beginning in the first quarter of 2019, our oil and gas retail credit programs, previously reported within our Retail Card sales platform, are now reported within our Payment Solutions sales platform. We have recast all prior-period reported metrics for our Retail Card and Payment Solutions sales platforms to conform to the current-period presentation.

Retail Card

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Purchase volume | $ | 24,660 |

| | $ | 22,141 |

|

Period-end loan receivables | $ | 51,572 |

| | $ | 51,117 |

|

Average loan receivables, including held for sale | $ | 60,964 |

| | $ | 52,251 |

|

Average active accounts (in thousands) | 58,632 |

| | 53,463 |

|

| | | |

Interest and fees on loans | $ | 3,454 |

| | $ | 3,015 |

|

Retailer share arrangements | $ | (940 | ) | | $ | (708 | ) |

Other income | $ | 76 |

| | $ | 69 |

|

Retail Card interest and fees on loans increased by $439 million, or 14.6%, for the three months ended March 31, 2019. The increase was primarily the result of growth in average loan receivables.

Retailer share arrangements increased by $232 million, or 32.8%, for the three months ended March 31, 2019, primarily as a result of the factors discussed under the heading “Retailer Share Arrangements” above.

Other income increased by $7 million, or 10.1%, for the three months ended March 31, 2019, primarily as a result of the factors discussed under the heading “Other Income” above.

Payment Solutions

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Purchase volume | $ | 5,249 |

| | $ | 5,064 |

|

Period-end loan receivables | $ | 19,379 |

| | $ | 17,927 |

|

Average loan receivables | $ | 19,497 |

| | $ | 18,051 |

|

Average active accounts (in thousands) | 12,406 |

| | 12,009 |

|

| | | |

Interest and fees on loans | $ | 686 |

| | $ | 643 |

|

Retailer share arrangements | $ | (12 | ) | | $ | (10 | ) |

Other income | $ | 1 |

| | $ | (2 | ) |

Payment Solutions interest and fees on loans increased by $43 million, or 6.7%, for the three months ended March 31, 2019. The increase was primarily driven by growth in average loan receivables.

CareCredit

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Purchase volume | $ | 2,604 |

| | $ | 2,421 |

|

Period-end loan receivables | $ | 9,454 |

| | $ | 8,809 |

|

Average loan receivables | $ | 9,442 |

| | $ | 8,788 |

|

Average active accounts (in thousands) | 6,094 |

| | 5,851 |

|

| | | |

Interest and fees on loans | $ | 547 |

| | $ | 514 |

|

Retailer share arrangements | $ | (2 | ) | | $ | (2 | ) |

Other income | $ | 15 |

| | $ | 8 |

|

CareCredit interest and fees on loans increased by $33 million, or 6.4%, for the three months ended March 31, 2019. The increase was primarily driven by growth in average loan receivables.

Loan Receivables

____________________________________________________________________________________________

The following discussion provides supplemental information regarding our loan receivables portfolio.

Loan receivables are our largest category of assets and represent our primary source of revenue. The following table sets forth the composition of our loan receivables portfolio by product type at the dates indicated.

|

| | | | | | | | | | | | | |

($ in millions) | At March 31, 2019 | | (%) | | At December 31, 2018 | | (%) |

Loans | | | | | |

Credit cards | $ | 77,251 |

| | 96.1 | % | | $ | 89,994 |

| | 96.6 | % |

Consumer installment loans | 1,860 |

| | 2.3 |

| | 1,845 |

| | 2.0 |

|

Commercial credit products | 1,256 |

| | 1.6 |

| | 1,260 |

| | 1.4 |

|

Other | 38 |

| | — |

| | 40 |

| | — |

|

Total loans | $ | 80,405 |

| | 100.0 | % | | $ | 93,139 |

| | 100.0 | % |

Loan receivables decreased by $12.7 billion, or 13.7%, at March 31, 2019 compared to December 31, 2018, primarily driven by the reclassification of $8.1 billion of loan receivables associated with the Walmart portfolio to loan receivables held for sale and the seasonality of our business.

Loan receivables increased by $2.6 billion, or 3.3%, at March 31, 2019 compared to March 31, 2018, primarily driven by the PayPal Credit acquisition, higher purchase volume and average active account growth, partially offset by the reclassification of the Walmart portfolio to loan receivables held for sale.

Our loan receivables portfolio had the following geographic concentration at March 31, 2019.

|

| | | | | | | |

($ in millions) | | Loan Receivables Outstanding | | % of Total Loan Receivables Outstanding |

State | |

California | | $ | 8,565 |

| | 10.7 | % |

Texas | | $ | 7,982 |

| | 9.9 | % |

Florida | | $ | 6,767 |

| | 8.4 | % |

New York | | $ | 4,614 |

| | 5.7 | % |

Pennsylvania | | $ | 3,331 |

| | 4.1 | % |

Impaired Loans and Troubled Debt Restructurings

Our loss mitigation strategy is intended to minimize economic loss and at times can result in rate reductions, principal forgiveness, extensions or other actions, which may cause the related loan to be classified as a Troubled Debt Restructuring (“TDR”) and also be impaired. We use long-term modification programs for borrowers experiencing financial difficulty as a loss mitigation strategy to improve long-term collectability of the loans that are classified as TDRs. The long-term program involves changing the structure of the loan to a fixed payment loan with a maturity no longer than 60 months and reducing the interest rate on the loan. The long-term program does not normally provide for the forgiveness of unpaid principal, but may allow for the reversal of certain unpaid interest or fee assessments. We also make loan modifications for some customers who request financial assistance through external sources, such as a consumer credit counseling agency program. The loans that are modified typically receive a reduced interest rate but continue to be subject to the original minimum payment terms and do not normally include waiver of unpaid principal, interest or fees. The determination of whether these changes to the terms and conditions meet the TDR criteria includes our consideration of all relevant facts and circumstances.

Loans classified as TDRs are recorded at their present value with impairment measured as the difference between the loan balance and the discounted present value of cash flows expected to be collected, discounted at the original effective interest rate of the loan. Our allowance for loan losses on TDRs is generally measured based on the difference between the recorded loan receivable and the present value of the expected future cash flows.

Interest income from loans accounted for as TDRs is accounted for in the same manner as other accruing loans. We accrue interest on credit card balances until the accounts are charged-off in the period the accounts become 180 days past due. The following table presents the amount of loan receivables that are not accruing interest, loans that are 90 days or more past-due and still accruing interest, and earning TDRs for the periods presented.

|

| | | | | | | |

($ in millions) | At March 31, 2019 | | At December 31, 2018 |

Non-accrual loan receivables(1) | $ | 4 |

| | $ | 5 |

|

Loans contractually 90 days past-due and still accruing interest | 2,004 |

| | 2,116 |

|

Earning TDRs(2) | 920 |

| | 1,085 |

|

Non-accrual, past-due and restructured loan receivables | $ | 2,928 |

| | $ | 3,206 |

|

______________________

| |

(1) | Excludes purchase credit impaired (“PCI”) loan receivables. |

| |

(2) | At March 31, 2019 and December 31, 2018, balances exclude $144 million and $122 million, respectively, of TDRs which are included in loans contractually 90 days past-due and still accruing interest on the balance. See Note 4. Loan Receivables and Allowance for Loan Losses to our condensed consolidated financial statements for additional information on the financial effects of TDRs for the three months ended March 31, 2019 and 2018. |

|

| | | | | | | |

| Three months ended March 31, |

($ in millions) | 2019 | | 2018 |

Gross amount of interest income that would have been recorded in accordance with the original contractual terms | $ | 64 |

| | $ | 62 |

|

Interest income recognized | 11 |

| | 12 |

|

Total interest income foregone | $ | 53 |

| | $ | 50 |

|

Delinquencies

Over-30 day loan delinquencies as a percentage of period-end loan receivables increased to 4.92% at March 31, 2019 from 4.52% at March 31, 2018, and increased from 4.76% at December 31, 2018. These increases were driven by the reclassification of loan receivables related to the Walmart portfolio to loan receivables held for sale. The increase as compared to December 31, 2018 was partially offset by the seasonality of our business.

Net Charge-Offs

Net charge-offs consist of the unpaid principal balance of loans held for investment that we determine are uncollectible, net of recovered amounts. We exclude accrued and unpaid finance charges and fees and third-party fraud losses from charge-offs. Charged-off and recovered finance charges and fees are included in interest and fees on loans while third-party fraud losses are included in other expense. Charge-offs are recorded as a reduction to the allowance for loan losses and subsequent recoveries of previously charged-off amounts are credited to the allowance for loan losses. Costs incurred to recover charged-off loans are recorded as collection expense and included in other expense in our Condensed Consolidated Statements of Earnings.

The table below sets forth the ratio of net charge-offs to average loan receivables, including held for sale, for the periods indicated. |

| | | | | |

| Three months ended March 31, |

| 2019 | | 2018 |

Ratio of net charge-offs to average loan receivables, including held for sale | 6.06 | % | | 6.14 | % |

Allowance for Loan Losses

The allowance for loan losses totaled $5,942 million at March 31, 2019, compared with $6,427 million at December 31, 2018 and $5,738 million at March 31, 2018, representing our best estimate of probable losses inherent in the portfolio. Our allowance for loan losses as a percentage of total loan receivables increased to 7.39% at March 31, 2019, from 6.90% at December 31, 2018 and remained relatively flat compared to March 31, 2018. The increase from December 31, 2018 was primarily driven by the effects of the seasonality of our business. See "Business Trends and Conditions — Asset Quality" in our 2018 Form 10-K for discussion of the various factors that contribute to forecasted net charge-offs over the next twelve months.

The following tables provide changes in our allowance for loan losses for the periods presented: |

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Balance at January 1, 2019 |

| | Provision charged to operations |

| | Gross charge-offs |

| | Recoveries |

| | Balance at

March 31, 2019 |

|

| | | | | | | | | |

Credit cards | $ | 6,327 |

| | $ | 832 |

| | $ | (1,594 | ) | | $ | 275 |

| | $ | 5,840 |

|

Consumer installment loans | 44 |

| | 15 |

| | (17 | ) | | 5 |

| | 47 |

|

Commercial credit products | 55 |

| | 12 |

| | (14 | ) | | 1 |

| | 54 |

|

Other | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Total | $ | 6,427 |

| | $ | 859 |

| | $ | (1,625 | ) | | $ | 281 |

| | $ | 5,942 |

|

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Balance at

January 1, 2018 |

| | Provision charged to operations |

| | Gross charge-offs |

| | Recoveries |

| | Balance at

March 31, 2018 |

|

| | | | | | | | | |

Credit cards | $ | 5,483 |

| | $ | 1,334 |

| | $ | (1,372 | ) | | $ | 195 |

| | $ | 5,640 |

|

Consumer installment loans | 40 |

| | 16 |

| | (15 | ) | | 4 |

| | 45 |

|

Commercial credit products | 50 |

| | 12 |

| | (12 | ) | | 2 |

| | 52 |

|

Other | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Total | $ | 5,574 |

| | $ | 1,362 |

| | $ | (1,399 | ) | | $ | 201 |

| | $ | 5,738 |

|

Funding, Liquidity and Capital Resources

____________________________________________________________________________________________

We maintain a strong focus on liquidity and capital. Our funding, liquidity and capital policies are designed to ensure that our business has the liquidity and capital resources to support our daily operations, our business growth, our credit ratings and our regulatory and policy requirements, in a cost effective and prudent manner through expected and unexpected market environments.

Funding Sources

Our primary funding sources include cash from operations, deposits (direct and brokered deposits), securitized financings and third-party debt.

The following table summarizes information concerning our funding sources during the periods indicated: |

| | | | | | | | | | | | | | | | | | | |

| 2019 | | 2018 |

Three months ended March 31 ($ in millions) | Average Balance | | % | | Average Rate | | Average Balance | | % | | Average Rate |

Deposits(1) | $ | 63,776 |

| | 74.1 | % | | 2.4 | % | | $ | 56,356 |

| | 72.7 | % | | 1.8 | % |

Securitized financings | 13,407 |

| | 15.6 |

| | 3.0 |

| | 12,410 |

| | 16.0 |

| | 2.4 |

|

Senior unsecured notes | 8,892 |

| | 10.3 |

| | 3.9 |

| | 8,795 |

| | 11.3 |

| | 3.6 |

|

Total | $ | 86,075 |

| | 100.0 | % | | 2.6 | % | | $ | 77,561 |

| | 100.0 | % | | 2.1 | % |

______________________

| |

(1) | Excludes $286 million and $300 million average balance of non-interest-bearing deposits for the three months ended March 31, 2019 and 2018, respectively. Non-interest-bearing deposits comprise less than 10% of total deposits for the three months ended March 31, 2019 and 2018. |

Deposits

We obtain deposits directly from retail and commercial customers (“direct deposits”) or through third-party brokerage firms that offer our deposits to their customers (“brokered deposits”). At March 31, 2019, we had $51.8 billion in direct deposits and $12.3 billion in deposits originated through brokerage firms (including network deposit sweeps procured through a program arranger that channels brokerage account deposits to us). A key part of our liquidity plan and funding strategy is to continue to expand our direct deposits base as a source of stable and diversified low-cost funding.

Our direct deposits include a range of FDIC-insured deposit products, including certificates of deposit, IRAs, money market accounts and savings accounts.

Brokered deposits are primarily from retail customers of large brokerage firms. We have relationships with 11 brokers that offer our deposits through their networks. Our brokered deposits consist primarily of certificates of deposit that bear interest at a fixed rate and at March 31, 2019, had a weighted average remaining life of 2.4 years. These deposits generally are not subject to early withdrawal.

Our ability to attract deposits is sensitive to, among other things, the interest rates we pay, and therefore, we bear funding risk if we fail to pay higher rates, or interest rate risk if we are required to pay higher rates, to retain existing deposits or attract new deposits. To mitigate these risks, our funding strategy includes a range of deposit products, and we seek to maintain access to multiple other funding sources, such as securitized financings (including our undrawn committed capacity) and unsecured debt.

The following table summarizes certain information regarding our interest-bearing deposits by type (all of which constitute U.S. deposits) for the periods indicated:

|

| | | | | | | | | | | | | | | | | | | |

Three months ended March 31 ($ in millions) | 2019 | | 2018 |

Average Balance | | % of Total | | Average Rate | | Average Balance | | % of Total | | Average Rate |

Direct deposits: | | | | | | | | | | | |

Certificates of deposit (including IRA certificates of deposit) | $ | 31,822 |

| | 49.9 | % | | 2.4 | % | | $ | 26,025 |

| | 46.2 | % | | 1.7 | % |

Savings accounts (including money market accounts) | 18,389 |

| | 28.8 |

| | 2.2 |

| | 17,813 |

| | 31.6 |

| | 1.5 |

|

Brokered deposits | 13,565 |

| | 21.3 |

| | 2.7 |

| | 12,518 |

| | 22.2 |

| | 2.4 |

|

Total interest-bearing deposits | $ | 63,776 |

| | 100.0 | % | | 2.4 | % | | $ | 56,356 |

| | 100.0 | % | | 1.8 | % |

Our deposit liabilities provide funding with maturities ranging from one day to ten years. At March 31, 2019, the weighted average maturity of our interest-bearing time deposits was 1.2 years. See Note 7. Deposits to our condensed consolidated financial statements for more information on their maturities.

The following table summarizes deposits by contractual maturity at March 31, 2019.

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | 3 Months or Less | | Over 3 Months but within 6 Months | | Over 6 Months but within 12 Months | | Over 12 Months | | Total |

U.S. deposits (less than $100,000)(1) | $ | 10,123 |

| | $ | 2,737 |

| | $ | 5,448 |

| | $ | 9,476 |

| | $ | 27,784 |

|

U.S. deposits ($100,000 or more) | | | | | | | | | |

Direct deposits: | | | | | | | | | |

Certificates of deposit (including IRA certificates of deposit) | 2,518 |

| | 4,194 |

| | 8,927 |

| | 5,573 |

| | 21,212 |

|

Savings accounts (including money market accounts) | 13,410 |

| | — |

| | — |

| | — |

| | 13,410 |

|

Brokered deposits: | | | | | | | | | |

Sweep accounts | 1,654 |

| | — |

| | — |

| | — |

| | 1,654 |

|

Total | $ | 27,705 |

| | $ | 6,931 |

| | $ | 14,375 |

| | $ | 15,049 |

| | $ | 64,060 |

|

______________________

| |

(1) | Includes brokered certificates of deposit for which underlying individual deposit balances are assumed to be less than $100,000. |

Securitized Financings

We have been engaged in the securitization of our credit card receivables since 1997. We access the asset-backed securitization market using the Synchrony Credit Card Master Note Trust (“SYNCT”) and the Synchrony Card Issuance Trust (“SYNIT”) through which we issue asset-backed securities through both public transactions and private transactions funded by financial institutions and commercial paper conduits. In addition, we issue asset-backed securities in private transactions through the Synchrony Sales Finance Master Trust (“SFT”).

The following table summarizes expected contractual maturities of the investors’ interests in securitized financings, excluding debt premiums, discounts and issuance costs at March 31, 2019.

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Less Than One Year | | One Year Through Three Years | | After Three Through Five Years | | After Five Years | | Total |

Scheduled maturities of long-term borrowings—owed to securitization investors: | | | | | | | | | |

SYNCT(1) | $ | 2,153 |

| | $ | 3,485 |

| | $ | 1,591 |

| | $ | — |

| | $ | 7,229 |

|

SFT | 350 |

| | 1,525 |

| | — |

| | — |

| | 1,875 |

|

SYNIT(1) | — |

| | 3,000 |

| | — |

| | — |

| | 3,000 |

|

Total long-term borrowings—owed to securitization investors | $ | 2,503 |

| | $ | 8,010 |

| | $ | 1,591 |

| | $ | — |

| | $ | 12,104 |

|

| |

(1) | Excludes subordinated classes of SYNCT notes and SYNIT notes that we own. |

We retain exposure to the performance of trust assets through: (i) in the case of SYNCT, SFT and SYNIT, subordinated retained interests in the loan receivables transferred to the trust in excess of the principal amount of the notes for a given series to provide credit enhancement for a particular series, as well as a pari passu seller’s interest in each trust and (ii) in the case of SYNCT and SYNIT, subordinated classes of notes that we own.

All of our securitized financings include early repayment triggers, referred to as early amortization events, including events related to material breaches of representations, warranties or covenants, inability or failure of the Bank to transfer loan receivables to the trusts as required under the securitization documents, failure to make required payments or deposits pursuant to the securitization documents, and certain insolvency-related events with respect to the related securitization depositor, Synchrony (solely with respect to SYNCT) or the Bank. In addition, an early amortization event will occur with respect to a series if the excess spread as it relates to a particular series or for the trust, as applicable, falls below zero. Following an early amortization event, principal collections on the loan receivables in the applicable trust are applied to repay principal of the trust's asset-backed securities rather than being available on a revolving basis to fund the origination activities of our business. The occurrence of an early amortization event also would limit or terminate our ability to issue future series out of the trust in which the early amortization event occurred. No early amortization event has occurred with respect to any of the securitized financings in SYNCT, SFT or SYNIT.

The following table summarizes for each of our trusts the three-month rolling average excess spread at March 31, 2019.

|

| | | | | | | | | |

| Note Principal Balance ($ in millions) | | # of Series Outstanding | | Three-Month Rolling Average Excess Spread(1) |

SYNCT(2) | $ | 7,928 |

| | 12 |

| | ~14.1% to 15.5% |

|

SFT | $ | 1,875 |

| | 10 |

| | 12.8 | % |

SYNIT(2) | $ | 3,015 |

| | 5 |

| | ~14.9% to 15.9% |

|

______________________

| |

(1) | Represents the excess spread (generally calculated as interest income collected from the applicable pool of loan receivables less applicable net charge-offs, interest expense and servicing costs, divided by the aggregate principal amount of loan receivables in the applicable pool) for SFT or, in the case of SYNCT and SYNIT, a range of the excess spreads relating to the particular series issued within each trust and omitting any series that have not been outstanding for at least three full monthly periods, in each case calculated in accordance with the applicable trust or series documentation, for the three securitization monthly periods ended March 31, 2019. |

| |

(2) | Includes subordinated classes of SYNCT and SYNIT notes that we own. |

Third-Party Debt

Senior Unsecured Notes

The following table provides a summary of our outstanding senior unsecured notes at March 31, 2019, which includes $1.25 billion of senior unsecured notes issued during the three months ended March 31, 2019.

|

| | | | | | | | |

Issuance Date | | Interest Rate(1) | | Maturity | | Principal Amount Outstanding(2) |

($ in millions) | | | | | | |

Fixed rate senior unsecured notes: | | | | | | |

Synchrony Financial | | | | | | |

August 2014 | | 3.000% | | August 2019 | | $ | 1,100 |

|

August 2014 | | 3.750% | | August 2021 | | 750 |

|

August 2014 | | 4.250% | | August 2024 | | 1,250 |

|

February 2015 | | 2.700% | | February 2020 | | 750 |

|

July 2015 | | 4.500% | | July 2025 | | 1,000 |

|

August 2016 | | 3.700%

| | August 2026 | | 500 |

|

December 2017 | | 3.950% | | December 2027 | | 1,000 |

|

March 2019 | | 4.375% | | March 2024 | | 600 |

|

March 2019 | | 5.150% | | March 2029 | | 650 |

|

Synchrony Bank | | | | | | |

June 2017 | | 3.000% | | June 2022 | | 750 |

|

May 2018 | | 3.650% | | May 2021 | | 750 |

|

Total fixed rate senior unsecured notes | | | | | | $ | 9,100 |

|

| | | | | | |

Floating rate senior unsecured notes: | | | | | | |

Synchrony Financial | | | | | | |

February 2015 | | Three-month LIBOR plus 1.23% | | February 2020 | | $ | 250 |

|

Synchrony Bank | | | | | | |

January 2018 | | Three-month LIBOR plus 0.625% | | March 2020 | | 500 |

|

Total floating rate senior unsecured notes | | | | | | $ | 750 |

|

______________________

| |

(1) | Weighted average interest rate of all senior unsecured notes at March 31, 2019 was 3.79%. |

| |

(2) | The amounts shown exclude unamortized debt discount, premiums and issuance cost. |

Short-Term Borrowings

Except as described above, there were no material short-term borrowings for the periods presented.

Other

At March 31, 2019, we had more than $25.0 billion of unencumbered assets in the Bank available to be used to generate additional liquidity through secured borrowings or asset sales or to be pledged to the Federal Reserve Board for credit at the discount window.

Covenants

The indenture pursuant to which our senior unsecured notes have been issued includes various covenants. If we do not satisfy any of these covenants, the maturity of amounts outstanding thereunder may be accelerated and become payable. We were in compliance with all of these covenants at March 31, 2019.

At March 31, 2019, we were not in default under any of our credit facilities or senior unsecured notes.

Credit Ratings

Our borrowing costs and capacity in certain funding markets, including securitizations and senior and subordinated debt, may be affected by the credit ratings of the Company, the Bank and the ratings of our asset-backed securities.

The table below reflects our current credit ratings and outlooks:

|

| | | | |

| | S&P | | Fitch Ratings |

Synchrony Financial | | | | |

Senior unsecured debt | | BBB- | | BBB- |

Outlook for Synchrony Financial senior unsecured debt | | Stable | | Stable |

Synchrony Bank | | | | |

Senior unsecured debt | | BBB | | BBB- |

Outlook for Synchrony Bank senior unsecured debt | | Stable | | Stable |

| | | | |

In addition, certain of the asset-backed securities issued by SYNCT and SYNIT are rated by Fitch, S&P and/or Moody’s. A credit rating is not a recommendation to buy, sell or hold securities, may be subject to revision or withdrawal at any time by the assigning rating organization, and each rating should be evaluated independently of any other rating. Downgrades in these credit ratings could materially increase the cost of our funding from, and restrict our access to, the capital markets.

Liquidity

____________________________________________________________________________________________

We seek to ensure that we have adequate liquidity to sustain business operations, fund asset growth, satisfy debt obligations and to meet regulatory expectations under normal and stress conditions.

We maintain policies outlining the overall framework and general principles for managing liquidity risk across our business, which is the responsibility of our Asset and Liability Management Committee, a subcommittee of our Risk Committee. We employ a variety of metrics to monitor and manage liquidity. We perform regular liquidity stress testing and contingency planning as part of our liquidity management process. We evaluate a range of stress scenarios including Company specific and systemic events that could impact funding sources and our ability to meet liquidity needs.

We maintain a liquidity portfolio, which at March 31, 2019 had $17.4 billion of liquid assets, primarily consisting of cash and equivalents and short-term obligations of the U.S. Treasury, less cash in transit which is not considered to be liquid, compared to $14.8 billion of liquid assets at December 31, 2018. The increase in liquid assets was primarily due to the retention of excess cash flows from operations and the seasonality of our business, partially offset by the deployment of capital through the execution of our capital plan.

As additional sources of liquidity, at March 31, 2019, we had an aggregate of $5.6 billion of undrawn committed capacity on our securitized financings, subject to customary borrowing conditions, from private lenders under our securitization programs and $0.5 billion of undrawn committed capacity under our unsecured revolving credit facility with private lenders, and we had more than $25.0 billion of unencumbered assets in the Bank available to be used to generate additional liquidity through secured borrowings or asset sales or to be pledged to the Federal Reserve Board for credit at the discount window.

As a general matter, investments included in our liquidity portfolio are expected to be highly liquid, giving us the ability to readily convert them to cash. The level and composition of our liquidity portfolio may fluctuate based upon the level of expected maturities of our funding sources as well as operational requirements and market conditions.

We rely significantly on dividends and other distributions and payments from the Bank for liquidity; however, bank regulations, contractual restrictions and other factors limit the amount of dividends and other distributions and payments that the Bank may pay to us. For a discussion of regulatory restrictions on the Bank’s ability to pay dividends, see “Regulation—Risk Factors Relating to Regulation—We are subject to restrictions that limit our ability to pay dividends and repurchase our common stock; the Bank is subject to restrictions that limit its ability to pay dividends to us, which could limit our ability to pay dividends, repurchase our common stock or make payments on our indebtedness” and “Regulation—Regulation Relating to Our Business—Savings Association Regulation—Dividends and Stock Repurchases” in our 2018 Form 10-K.

Debt Securities

____________________________________________________________________________________________

The following discussion provides supplemental information regarding our debt securities portfolio. All of our debt securities are classified as available-for-sale at March 31, 2019 and December 31, 2018, and are held to meet our liquidity objectives and to comply with the Community Reinvestment Act. Debt securities classified as available-for-sale are reported in our Condensed Consolidated Statements of Financial Position at fair value.

The following table sets forth the amortized cost and fair value of our portfolio of debt securities at the dates indicated:

|

| | | | | | | | | | | | | | | |

| At March 31, 2019 | | At December 31, 2018 |

($ in millions) | Amortized Cost | | Estimated Fair Value | | Amortized Cost | | Estimated Fair Value |

U.S. government and federal agency | $ | 2,284 |

| | $ | 2,285 |

| | $ | 2,889 |

| | $ | 2,888 |

|

State and municipal | 48 |

| | 47 |

| | 50 |

| | 48 |

|

Residential mortgage-backed | 1,148 |

| | 1,123 |

| | 1,180 |

| | 1,139 |

|

Asset-backed | 2,049 |

| | 2,049 |

| | 1,988 |

| | 1,985 |

|

U.S. corporate debt | 2 |

| | 2 |

| | 2 |

| | 2 |

|

Total | $ | 5,531 |

| | $ | 5,506 |

| | $ | 6,109 |

| | $ | 6,062 |

|

Unrealized gains and losses, net of the related tax effects, on available-for-sale debt securities that are not other-than-temporarily impaired are excluded from earnings and are reported as a separate component of comprehensive income (loss) until realized. At March 31, 2019, our debt securities had gross unrealized gains of $4 million and gross unrealized losses of $29 million. At December 31, 2018, our debt securities had gross unrealized gains of $1 million and gross unrealized losses of $48 million.

Our debt securities portfolio had the following maturity distribution at March 31, 2019.

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Due in 1 Year or Less | | Due After 1 through 5 Years | | Due After 5 through 10 Years | | Due After 10 years | | Total |

U.S. government and federal agency | $ | 2,285 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 2,285 |

|

State and municipal | — |

| | 1 |

| | 4 |

| | 42 |

| | 47 |

|

Residential mortgage-backed | — |

| | — |

| | 150 |

| | 973 |

| | 1,123 |

|

Asset-backed | 1,583 |

| | 466 |

| | — |

| | — |

| | 2,049 |

|

U.S. corporate debt | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Total(1) | $ | 3,870 |

| | $ | 467 |

| | $ | 154 |

| | $ | 1,015 |

| | $ | 5,506 |

|

Weighted average yield(2) | 2.5 | % | | 2.7 | % | | 3.2 | % | | 2.9 | % | | 2.6 | % |

______________________

| |

(1) | Amounts stated represent estimated fair value. |

| |

(2) | Weighted average yield is calculated based on the amortized cost of each security. In calculating yield, no adjustment has been made with respect to any tax-exempt obligations. |

At March 31, 2019, we did not hold investments in any single issuer with an aggregate book value that exceeded 10% of equity, excluding obligations of the U.S. government.

Capital