UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

OR

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

001-36560

(Commission File Number)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 51-0483352 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

777 Long Ridge Road | | |

Stamford, Connecticut | | 06902 |

(Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code) (203) 585-2400

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer | ý | Accelerated filer | o |

| | | |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

| | | |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of shares of the registrant’s common stock, par value $0.001 per share, outstanding as of July 24, 2017 was 795,335,232.

Synchrony Financial

|

| |

PART I - FINANCIAL INFORMATION | Page |

| |

| |

Item 1. Financial Statements: | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II - OTHER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Certain Defined Terms

Except as the context may otherwise require in this report, references to:

| |

• | “we,” “us,” “our” and the “Company” are to SYNCHRONY FINANCIAL and its subsidiaries; |

| |

• | “Synchrony” are to SYNCHRONY FINANCIAL only; |

| |

• | “GE” are to General Electric Company and its subsidiaries; |

| |

• | the “Bank” are to Synchrony Bank (a subsidiary of Synchrony); |

| |

• | the “Bank Term Loan” are to the term loan agreement, dated as of July 30, 2014, among Synchrony, as borrower, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders from time to time party thereto, as amended; |

| |

• | the “Board of Directors” are to Synchrony's board of directors; and |

| |

• | “FICO” score are to a credit score developed by Fair Isaac & Co., which is widely used as a means of evaluating the likelihood that credit users will pay their obligations. |

We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which, in our business and in this report, we refer to as our “partners.” The terms of the programs all require cooperative efforts between us and our partners of varying natures and degrees to establish and operate the programs. Our use of the term “partners” to refer to these entities is not intended to, and does not, describe our legal relationship with them, imply that a legal partnership or other relationship exists between the parties or create any legal partnership or other relationship. The “average length of our relationship” with respect to a specified group of partners or programs is measured on a weighted average basis by interest and fees on loans for the year ended December 31, 2016 for those partners or for all partners participating in a program, based on the date each partner relationship or program, as applicable, started.

Unless otherwise indicated, references to “loan receivables” do not include loan receivables held for sale.

For a description of certain other terms we use, including “active account” and “purchase volume,” see the notes to “Item 7. Management’s Discussion and Analysis—Other Financial and Statistical Data” in our Annual Report on Form 10-K for the year ended December 31, 2016 (our “2016 Form 10-K”). There is no standard industry definition for many of these terms, and other companies may define them differently than we do.

“Synchrony” and its logos and other trademarks referred to in this report, including CareCredit®, Dual Card™, eQuickscreen™, Quickscreen® and Synchrony Car Care™, belong to us. Solely for convenience, we refer to our trademarks in this report without the ™ and ® symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this report are the property of their respective owners.

On our website at www.synchronyfinancial.com, we make available under the "Investors-SEC Filings" menu selection, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such reports or amendments are electronically filed with, or furnished to, the SEC. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information that we file electronically with the SEC.

Cautionary Note Regarding Forward-Looking Statements:

Various statements in this Quarterly Report on Form 10-Q may contain “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “outlook,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements.

Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; cyber-attacks or other security breaches; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; failure of third parties to provide various services that are important to our operations; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; a material indemnification obligation to GE under the Tax Sharing and Separation Agreement with GE (the "TSSA") if we cause the split-off from GE or certain preliminary transactions to fail to qualify for tax-free treatment or in the case of certain significant transfers of our stock following the split-off; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and the impact of the Consumer Financial Protection Bureau's (the “CFPB”) regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this report and in our public filings, including under the heading “Risk Factors” in our 2016 Form 10-K. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by the federal securities laws.

PART I. FINANCIAL INFORMATION

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated financial statements and related notes included elsewhere in this quarterly report and in our 2016 Form 10-K. The discussion below contains forward-looking statements that are based upon current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from these expectations. See “Cautionary Note Regarding Forward-Looking Statements.”

Introduction and Business Overview

____________________________________________________________________________________________

We are one of the premier consumer financial services companies in the United States. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” For the three and six months ended June 30, 2017, we financed $33.5 billion and $62.4 billion of purchase volume and had 68.6 million and 69.3 million average active accounts, respectively and at June 30, 2017, we had $75.5 billion of loan receivables. For the three and six months ended June 30, 2017, we had net earnings of $496 million and $995 million, respectively, representing a return on assets of 2.2% for both periods.

We offer our credit products primarily through our wholly-owned subsidiary, Synchrony Bank (the "Bank"). In addition through the Bank, we offer, directly to retail and commercial customers, a range of deposit products insured by the Federal Deposit Insurance Corporation (“FDIC”), including certificates of deposit, individual retirement accounts (“IRAs”), money market accounts and savings accounts. We also take deposits at the Bank through third-party securities brokerage firms that offer our FDIC-insured deposit products to their customers. We have significantly expanded our online direct banking operations in recent years and our deposit base serves as a source of stable and diversified low cost funding for our credit activities. At June 30, 2017, we had $52.9 billion in deposits, which represented 72% of our total funding sources.

Our Sales Platforms

_________________________________________________________________

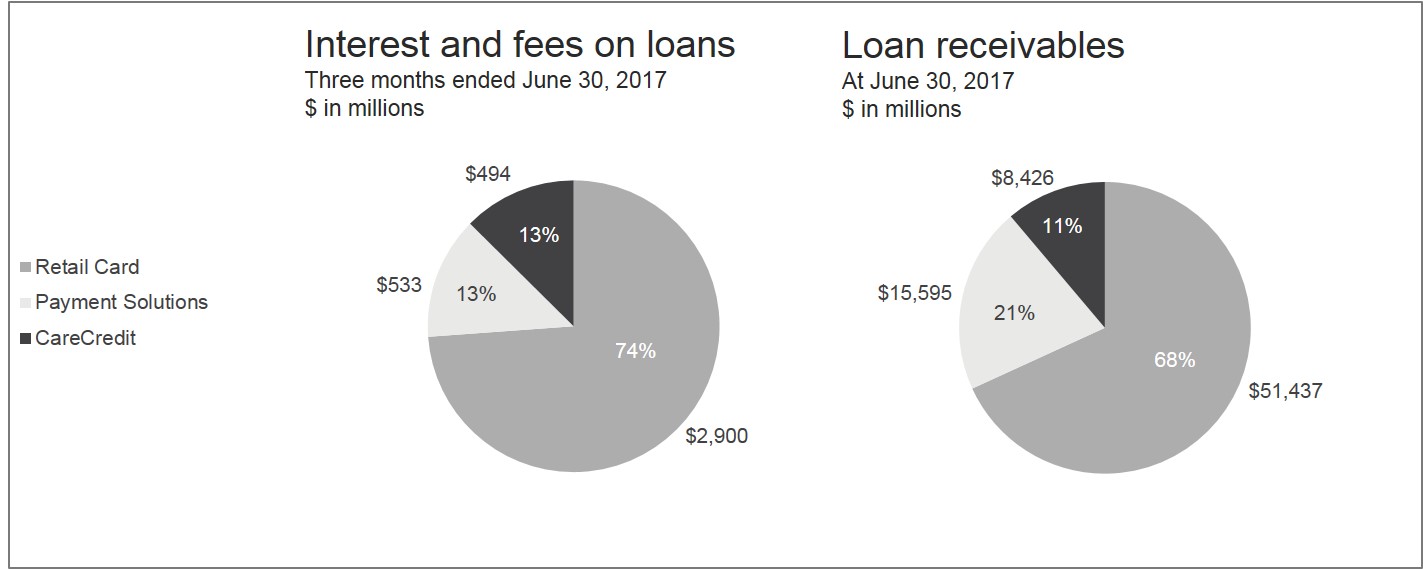

We conduct our operations through a single business segment. Profitability and expenses, including funding costs, loan losses and operating expenses, are managed for the business as a whole. Substantially all of our operations are within the United States. We offer our credit products through three sales platforms (Retail Card, Payment Solutions and CareCredit). Those platforms are organized by the types of products we offer and the partners we work with, and are measured on interest and fees on loans, loan receivables, new accounts and other sales metrics.

Retail Card

Retail Card is a leading provider of private label credit cards, and also provides Dual Cards, general purpose co-branded credit cards and small- and medium-sized business credit products. We offer one or more of these products primarily through 28 national and regional retailers with which we have ongoing program agreements. The average length of our relationship with these Retail Card partners is 19 years. Retail Card’s revenue primarily consists of interest and fees on our loan receivables. Other income primarily consists of interchange fees earned when our Dual Card or general purpose co-branded credit cards are used outside of our partners' sales channels and fees paid to us by customers who purchase our debt cancellation products, less loyalty program payments. In addition, the Retail Card sales platform includes the majority of our retailer share arrangements, which generally provide for payment to our partner if the economic performance of the program exceeds a contractually-defined threshold. Substantially all of the credit extended in this platform is on standard terms.

Payment Solutions

Payment Solutions is a leading provider of promotional financing for major consumer purchases, offering primarily private label credit cards and installment loans. Payment Solutions offers these products through participating partners consisting of national and regional retailers, local merchants, manufacturers, buying groups and industry associations. Substantially all of the credit extended in this platform is promotional financing. Payment Solutions’ revenue primarily consists of interest and fees on our loan receivables, including “merchant discounts,” which are fees paid to us by our partners in almost all cases to compensate us for all or part of foregone interest income associated with promotional financing.

CareCredit

CareCredit is a leading provider of promotional financing to consumers for health and personal care procedures, products or services. We have a network of CareCredit providers and health-focused retailers, the vast majority of which are individual or small groups of independent healthcare providers, through which we offer a CareCredit branded private label credit card. Substantially all of the credit extended in this platform is promotional financing. CareCredit’s revenue primarily consists of interest and fees on our loan receivables, including merchant discounts.

Our Credit Products

____________________________________________________________________________________________

Through our platforms, we offer three principal types of credit products: credit cards, commercial credit products and consumer installment loans. We also offer a debt cancellation product.

The following table sets forth each credit product by type and indicates the percentage of our total loan receivables that are under standard terms only or pursuant to a promotional financing offer at June 30, 2017.

|

| | | | | | | | | | | |

| | | Promotional Offer | | |

Credit Product | Standard Terms Only | | Deferred Interest | | Other Promotional | | Total |

Credit cards | 66.7 | % | | 16.2 | % | | 13.2 | % | | 96.1 | % |

Commercial credit products | 1.8 |

| | — |

| | — |

| | 1.8 |

|

Consumer installment loans | — |

| | — |

| | 2.0 |

| | 2.0 |

|

Other | 0.1 |

| | — |

| | — |

| | 0.1 |

|

Total | 68.6 | % | | 16.2 | % | | 15.2 | % | | 100.0 | % |

Credit Cards

We offer the following principal types of credit cards:

| |

• | Private Label Credit Cards. Private label credit cards are partner-branded credit cards (e.g., Lowe’s or Amazon) or program-branded credit cards (e.g., Synchrony Car Care or CareCredit) that are used primarily for the purchase of goods and services from the partner or within the program network. In addition, in some cases, cardholders may be permitted to access their credit card accounts for cash advances. In Retail Card, credit under our private label credit cards typically is extended on standard terms only, and in Payment Solutions and CareCredit, credit under our private label credit cards typically is extended pursuant to a promotional financing offer. |

| |

• | Dual Cards and General Purpose Co-Brand Cards. Our patented Dual Cards are credit cards that function as private label credit cards when used to purchase goods and services from our partners and as general purpose credit cards when used elsewhere. We also offer general purpose co-branded credit cards that do not function as private label cards. Credit extended under our Dual Cards and general purpose co-branded credit cards typically is extended under standard terms only. Currently, only our Retail Card platform offers Dual Cards and general purpose co-branded credit cards. At June 30, 2017, we offered these credit cards through 20 of our 28 ongoing Retail Card programs, of which the majority are Dual Cards. |

Commercial Credit Products

We offer private label cards and Dual Cards for commercial customers that are similar to our consumer offerings. We also offer a commercial pay-in-full accounts receivable product to a wide range of business customers. We offer our commercial credit products primarily through our Retail Card platform to the commercial customers of our Retail Card partners.

Installment Loans

In Payment Solutions, we originate installment loans to consumers (and a limited number of commercial customers) in the United States, primarily in the power products market (motorcycles, ATVs and lawn and garden). Installment loans are closed-end credit accounts where the customer pays down the outstanding balance in installments. Installment loans are assessed periodic finance charges using fixed interest rates.

Business Trends and Conditions

____________________________________________________________________________________________

We believe our business and results of operations will be impacted in the future by various trends and conditions. For a discussion of these trends and conditions, see “Management's Discussion and Analysis of Financial Condition and Results of Operations—Business Trends and Conditions” in our 2016 Form 10-K. For a discussion of how these trends and conditions impacted the three and six months ended June 30, 2017, see “—Results of Operations.”

Seasonality

____________________________________________________________________________________________

In our Retail Card and Payment Solutions platforms, we experience fluctuations in transaction volumes and the level of loan receivables as a result of higher seasonal consumer spending and payment patterns that typically result in an increase of loan receivables from August through a peak in late December, with reductions in loan receivables occurring over the first and second quarters of the following year as customers pay their balances down.

The seasonal impact to transaction volumes and the loan receivables balance typically results in fluctuations in our results of operations, delinquency metrics and the allowance for loan losses as a percentage of total loan receivables between quarterly periods.

In addition to the seasonal variance in loan receivables discussed above, we also experience a seasonal increase in delinquency rates and delinquent loan receivables balances during the third and fourth quarters of each year due to lower customer payment rates resulting in higher net charge-off rates in the first and second quarters. Our delinquency rates and delinquent loan receivables balances typically decrease during the subsequent first and second quarters as customers begin to pay down their loan balances and return to current status resulting in lower net charge-off rates in the third and fourth quarters. Because customers who were delinquent during the fourth quarter of a calendar year have a higher probability of returning to current status when compared to customers who are delinquent at the end of each of our interim reporting periods, we expect that a higher proportion of delinquent accounts outstanding at an interim period end will result in charge-offs, as compared to delinquent accounts outstanding at a year end. Consistent with this historical experience, we generally experience a higher allowance for loan losses as a percentage of total loan receivables at the end of an interim period, as compared to the end of a calendar year. In addition, despite improving credit metrics such as declining past due amounts, we may experience an increase in our allowance for loan losses at an interim period end compared to the prior year end, reflecting these same seasonal trends.

Results of Operations

____________________________________________________________________________________________

Highlights for the Three and Six Months Ended June 30, 2017

Below are highlights of our performance for the three and six months ended June 30, 2017 compared to the three and six months ended June 30, 2016, as applicable, except as otherwise noted.

| |

• | Net earnings increased 1.4% to $496 million for the three months ended June 30, 2017, driven by higher net interest income, partially offset by increases in provision for loan losses and other expense. Net earnings decreased 7.1% to $995 million for the six months ended June 30, 2017, driven by increases in provision for loan losses and other expense, partially offset by higher net interest income. |

| |

• | Loan receivables increased 10.5% to $75,458 million at June 30, 2017 compared to June 30, 2016, primarily driven by higher purchase volume and average active account growth. |

| |

• | Net interest income increased 13.2% to $3,637 million and 12.5% to $7,224 million for the three and six months ended June 30, 2017, respectively, primarily due to higher average loan receivables. |

| |

• | Retailer share arrangements remained relatively flat for the three and six months ended June 30, 2017, primarily as a result of growth and improved performance of the programs in which we have retailer share arrangements, largely offset by higher provision for loan losses and loyalty costs associated with these programs. |

| |

• | Over-30 day loan delinquencies as a percentage of period-end loan receivables increased 46 basis points to 4.25% at June 30, 2017 from 3.79% at June 30, 2016, and net charge-off rate increased 91 basis points to 5.42% and 74 basis points to 5.37% for the three and six months ended June 30, 2017, respectively. |

| |

• | Provision for loan losses increased by $305 million, or 29.9%, for the three months ended June 30, 2017, primarily due to higher net charge-offs and loan receivables growth. Provision for loan losses increased by $708 million, or 36.8%, for the six months ended June 30, 2017, primarily due to an increase in net charge-offs and higher loan loss reserve. Our allowance coverage ratio (allowance for loan losses as a percent of end of period loan receivables) increased to 6.63% at June 30, 2017, as compared to 5.70% at June 30, 2016. |

| |

• | Other expense increased by $72 million, or 8.6%, and $180 million, or 11.0%, for the three and six months ended June 30, 2017, respectively, primarily driven by business growth. |

| |

• | We continue to invest in our direct banking activities to grow our deposit base. Total deposits increased 1.6% to $52.9 billion at June 30, 2017, compared to December 31, 2016, driven primarily by growth in our direct deposits of 6.6% to $40.4 billion, partially offset by a reduction in our brokered deposits. |

| |

• | On May 18, 2017, the Board announced plans to increase our quarterly dividend to $0.15 per share commencing in the third quarter of 2017 and approval of a share repurchase program of up to $1.64 billion through June 30, 2018. During the six months ended June 30, 2017, we repurchased $676 million of our outstanding common stock, and declared and paid cash dividends of $0.26 per share, or $210 million. |

| |

• | During the six months ended June 30, 2017, we announced our acquisition of GPShopper, a developer of mobile applications that offers retailers and brands a full suite of commerce, engagement and analytical tools. |

New and Extended Partner Agreements during the six months ended June 30, 2017

| |

• | We extended our Retail Card program agreements with Belk and QVC, launched our new programs with Cathay Pacific, Nissan and Infiniti and announced our new partnership with zulily. |

| |

• | We launched our Synchrony Car Care program in our Payment Solutions sales platform and extended our program agreements with MEGA Group USA, City Furniture and Midas. |

| |

• | In our CareCredit sales platform, we acquired the Citi Health Card portfolio and renewed National Veterinary Associates in our network of providers. |

Summary Earnings

The following table sets forth our results of operations for the periods indicated.

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Interest income | $ | 3,970 |

| | $ | 3,515 |

| | $ | 7,883 |

| | $ | 7,035 |

|

Interest expense | 333 |

| | 303 |

| | 659 |

| | 614 |

|

Net interest income | 3,637 |

| | 3,212 |

| | 7,224 |

| | 6,421 |

|

Retailer share arrangements | (669 | ) | | (664 | ) | | (1,353 | ) | | (1,334 | ) |

Net interest income, after retailer share arrangements | 2,968 |

| | 2,548 |

| | 5,871 |

| | 5,087 |

|

Provision for loan losses | 1,326 |

| | 1,021 |

| | 2,632 |

| | 1,924 |

|

Net interest income, after retailer share arrangements and provision for loan losses | 1,642 |

| | 1,527 |

| | 3,239 |

| | 3,163 |

|

Other income | 57 |

| | 83 |

| | 150 |

| | 175 |

|

Other expense | 911 |

| | 839 |

| | 1,819 |

| | 1,639 |

|

Earnings before provision for income taxes | 788 |

| | 771 |

| | 1,570 |

| | 1,699 |

|

Provision for income taxes | 292 |

| | 282 |

| | 575 |

| | 628 |

|

Net earnings | $ | 496 |

| | $ | 489 |

| | $ | 995 |

| | $ | 1,071 |

|

Other Financial and Statistical Data

The following table sets forth certain other financial and statistical data for the periods indicated. |

| | | | | | | | | | | | | | | |

| At and for the | | At and for the |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Financial Position Data (Average): | | | | | | | |

Loan receivables, including held for sale | $ | 74,090 |

| | $ | 66,561 |

| | $ | 74,111 |

| | $ | 66,377 |

|

Total assets | $ | 89,394 |

| | $ | 81,413 |

| | $ | 89,431 |

| | $ | 81,962 |

|

Deposits | $ | 52,054 |

| | $ | 45,731 |

| | $ | 52,062 |

| | $ | 45,135 |

|

Borrowings | $ | 20,146 |

| | $ | 19,137 |

| | $ | 20,114 |

| | $ | 20,362 |

|

Total equity | $ | 14,442 |

| | $ | 13,543 |

| | $ | 14,383 |

| | $ | 13,236 |

|

Selected Performance Metrics: | | | | | | | |

Purchase volume(1) | $ | 33,476 |

| | $ | 31,507 |

| | $ | 62,356 |

| | $ | 58,484 |

|

Retail Card | $ | 27,101 |

| | $ | 25,411 |

| | $ | 50,053 |

| | $ | 46,961 |

|

Payment Solutions | $ | 3,930 |

| | $ | 3,903 |

| | $ | 7,616 |

| | $ | 7,295 |

|

CareCredit | $ | 2,445 |

| | $ | 2,193 |

| | $ | 4,687 |

| | $ | 4,228 |

|

Average active accounts (in thousands)(2) | 68,635 |

| | 65,531 |

| | 69,307 |

| | 65,996 |

|

Net interest margin(3) | 16.20 | % | | 15.94 | % | | 16.19 | % | | 15.89 | % |

Net charge-offs | $ | 1,001 |

| | $ | 747 |

| | $ | 1,975 |

| | $ | 1,527 |

|

Net charge-offs as a % of average loan receivables, including held for sale | 5.42 | % | | 4.51 | % | | 5.37 | % | | 4.63 | % |

Allowance coverage ratio(4) | 6.63 | % | | 5.70 | % | | 6.63 | % | | 5.70 | % |

Return on assets(5) | 2.2 | % | | 2.4 | % | | 2.2 | % | | 2.6 | % |

Return on equity(6) | 13.8 | % | | 14.5 | % | | 14.0 | % | | 16.3 | % |

Equity to assets(7) | 16.16 | % | | 16.63 | % | | 16.08 | % | | 16.15 | % |

Other expense as a % of average loan receivables, including held for sale | 4.93 | % | | 5.07 | % | | 4.95 | % | | 4.97 | % |

Efficiency ratio(8) | 30.1 | % | | 31.9 | % | | 30.2 | % | | 31.1 | % |

Effective income tax rate | 37.1 | % | | 36.6 | % | | 36.6 | % | | 37.0 | % |

Selected Period-End Data: | | | | | | | |

Loan receivables | $ | 75,458 |

| | $ | 68,282 |

| | $ | 75,458 |

| | $ | 68,282 |

|

Allowance for loan losses | $ | 5,001 |

| | $ | 3,894 |

| | $ | 5,001 |

| | $ | 3,894 |

|

30+ days past due as a % of period-end loan receivables(9) | 4.25 | % | | 3.79 | % | | 4.25 | % | | 3.79 | % |

90+ days past due as a % of period-end loan receivables(9) | 1.90 | % | | 1.67 | % | | 1.90 | % | | 1.67 | % |

Total active accounts (in thousands)(2) | 69,277 |

| | 66,491 |

| | 69,277 |

| | 66,491 |

|

| |

(1) | Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. Purchase volume includes activity related to our portfolios classified as held for sale. |

| |

(2) | Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. |

| |

(3) | Net interest margin represents net interest income divided by average interest-earning assets. |

| |

(4) | Allowance coverage ratio represents allowance for loan losses divided by total period-end loan receivables. |

| |

(5) | Return on assets represents net earnings as a percentage of average total assets. |

| |

(6) | Return on equity represents net earnings as a percentage of average total equity. |

| |

(7) | Equity to assets represents average equity as a percentage of average total assets. |

| |

(8) | Efficiency ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income. |

| |

(9) | Based on customer statement-end balances extrapolated to the respective period-end date. |

Average Balance Sheet

The following tables set forth information for the periods indicated regarding average balance sheet data, which are used in the discussion of interest income, interest expense and net interest income that follows.

|

| | | | | | | | | | | | | | | | | | | | | |

| 2017 | | 2016 |

Three months ended June 30 ($ in millions) | Average Balance | | Interest Income / Expense | | Average Yield / Rate(1) | | Average Balance | | Interest Income/ Expense | | Average Yield / Rate(1) |

Assets | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | |

Interest-earning cash and equivalents(2) | $ | 10,758 |

| | $ | 28 |

| | 1.04 | % | | $ | 11,623 |

| | $ | 14 |

| | 0.48 | % |

Securities available for sale | 5,195 |

| | 15 |

| | 1.16 | % | | 2,858 |

| | 7 |

| | 0.99 | % |

Loan receivables(3): | | | | | | | | | | | |

Credit cards, including held for sale | 71,206 |

| | 3,858 |

| | 21.73 | % | | 63,876 |

| | 3,432 |

| | 21.61 | % |

Consumer installment loans | 1,461 |

| | 34 |

| | 9.33 | % | | 1,233 |

| | 28 |

| | 9.13 | % |

Commercial credit products | 1,378 |

| | 34 |

| | 9.90 | % | | 1,388 |

| | 33 |

| | 9.56 | % |

Other | 45 |

| | 1 |

| | NM |

| | 64 |

| | 1 |

| | NM |

|

Total loan receivables | 74,090 |

| | 3,927 |

| | 21.26 | % | | 66,561 |

| | 3,494 |

| | 21.11 | % |

Total interest-earning assets | 90,043 |

| | 3,970 |

| | 17.68 | % | | 81,042 |

| | 3,515 |

| | 17.44 | % |

Non-interest-earning assets: | | | | | | | | | | | |

Cash and due from banks | 829 |

| | | | | | 895 |

| | | | |

Allowance for loan losses | (4,781 | ) | | | | | | (3,732 | ) | | | | |

Other assets | 3,303 |

| | | | | | 3,208 |

| | | | |

Total non-interest-earning assets | (649 | ) | | | | | | 371 |

| | | | |

Total assets | $ | 89,394 |

| | | | | | $ | 81,413 |

| | | | |

Liabilities | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | |

Interest-bearing deposit accounts | $ | 51,836 |

| | $ | 202 |

| | 1.56 | % | | $ | 45,523 |

| | $ | 179 |

| | 1.58 | % |

Borrowings of consolidated securitization entities | 12,213 |

| | 63 |

| | 2.07 | % | | 12,211 |

| | 59 |

| | 1.94 | % |

Bank term loan | — |

| | — |

| | — | % | | 65 |

| | 7 |

| | NM |

|

Senior unsecured notes | 7,933 |

| | 68 |

| | 3.44 | % | | 6,861 |

| | 58 |

| | 3.40 | % |

Total interest-bearing liabilities | 71,982 |

| | 333 |

| | 1.86 | % | | 64,660 |

| | 303 |

| | 1.88 | % |

Non-interest-bearing liabilities: | | | | | | | | | | | |

Non-interest-bearing deposit accounts | 218 |

| | | | | | 208 |

| | | | |

Other liabilities | 2,752 |

| | | | | | 3,002 |

| | | | |

Total non-interest-bearing liabilities | 2,970 |

| | | | | | 3,210 |

| | | | |

Total liabilities | 74,952 |

| | | | | | 67,870 |

| | | | |

Equity | | | | | | | | | | | |

Total equity | 14,442 |

| | | | | | 13,543 |

| | | | |

Total liabilities and equity | $ | 89,394 |

| | | | | | $ | 81,413 |

| | | | |

Interest rate spread(5) | | | | | 15.82 | % | | | | | | 15.56 | % |

Net interest income | | | $ | 3,637 |

| | | | | | $ | 3,212 |

| | |

Net interest margin(6) | | | | | 16.20 | % | | | | | | 15.94 | % |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| 2017 | | 2016 |

Six months ended June 30 ($ in millions) | Average Balance | | Interest Income / Expense | | Average Yield / Rate(1) | | Average Balance | | Interest Income/ Expense | | Average Yield / Rate(1) |

Assets | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | |

Interest-earning cash and equivalents(2) | $ | 10,656 |

| | $ | 49 |

| | 0.93 | % | | $ | 11,957 |

| | $ | 30 |

| | 0.50 | % |

Securities available for sale | 5,204 |

| | 30 |

| | 1.16 | % | | 2,918 |

| | 13 |

| | 0.90 | % |

Loan receivables(3): | | | | | | | | | | | |

Credit cards, including held for sale | 71,285 |

| | 7,669 |

| | 21.69 | % | | 63,781 |

| | 6,868 |

| | 21.65 | % |

Consumer installment loans | 1,425 |

| | 66 |

| | 9.34 | % | | 1,194 |

| | 55 |

| | 9.26 | % |

Commercial credit products | 1,348 |

| | 68 |

| | 10.17 | % | | 1,350 |

| | 68 |

| | 10.13 | % |

Other | 53 |

| | 1 |

| | 3.80 | % | | 52 |

| | 1 |

| | 3.87 | % |

Total loan receivables | 74,111 |

| | 7,804 |

| | 21.23 | % | | 66,377 |

| | 6,992 |

| | 21.18 | % |

Total interest-earning assets | 89,971 |

| | 7,883 |

| | 17.67 | % | | 81,252 |

| | 7,035 |

| | 17.41 | % |

Non-interest-earning assets: | | | | | | | | | | | |

Cash and due from banks | 816 |

| | | | | | 1,131 |

| | | | |

Allowance for loan losses | (4,595 | ) | | | | | | (3,661 | ) | | | | |

Other assets | 3,239 |

| | | | | | 3,240 |

| | | | |

Total non-interest-earning assets | (540 | ) | | | | | | 710 |

| | | | |

Total assets | $ | 89,431 |

| | | | | | $ | 81,962 |

| | | | |

Liabilities | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | |

Interest-bearing deposit accounts | $ | 51,833 |

| | $ | 396 |

| | 1.54 | % | | $ | 44,914 |

| | $ | 351 |

| | 1.57 | % |

Borrowings of consolidated securitization entities | 12,267 |

| | 128 |

| | 2.10 | % | | 12,535 |

| | 117 |

| | 1.88 | % |

Bank term loan(4) | — |

| | — |

| | — | % | | 1,118 |

| | 31 |

| | 5.58 | % |

Senior unsecured notes | 7,847 |

| | 135 |

| | 3.47 | % | | 6,709 |

| | 115 |

| | 3.45 | % |

Total interest-bearing liabilities | 71,947 |

| | 659 |

| | 1.85 | % | | 65,276 |

| | 614 |

| | 1.89 | % |

Non-interest-bearing liabilities: | | | | | | | | | | | |

Non-interest-bearing deposit accounts | 229 |

| | | | | | 221 |

| | | | |

Other liabilities | 2,872 |

| | | | | | 3,229 |

| | | | |

Total non-interest-bearing liabilities | 3,101 |

| | | | | | 3,450 |

| | | | |

Total liabilities | 75,048 |

| | | | | | 68,726 |

| | | | |

Equity | | | | | | | | | | | |

Total equity | 14,383 |

| | | | | | 13,236 |

| | | | |

Total liabilities and equity | $ | 89,431 |

| | | | | | $ | 81,962 |

| | | | |

Interest rate spread(5) | | | | | 15.82 | % | | | | | | 15.52 | % |

Net interest income | | | $ | 7,224 |

| | | | | | $ | 6,421 |

| | |

Net interest margin(6) | | | | | 16.19 | % | | | | | | 15.89 | % |

| |

(1) | Average yields/rates are based on total interest income/expense over average balances. |

| |

(2) | Includes average restricted cash balances of $464 million and $641 million for the three months ended June 30, 2017 and 2016, respectively and $578 million and $536 million for the six months ended June 30, 2017 and 2016, respectively. |

| |

(3) | Interest income on loan receivables includes fees on loans of $625 million and $570 million for the three months ended June 30, 2017 and 2016, respectively, and $1,253 million and $1,154 million for the six months ended June 30, 2017 and 2016 respectively. |

| |

(4) | The effective interest rates for the Bank term loan for the six months ended June 30, 2016 was 2.48%. The Bank term loan's effective rate excludes the impact of charges incurred in connection with prepayments of the loan. |

| |

(5) | Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. |

| |

(6) | Net interest margin represents net interest income divided by average total interest-earning assets. |

For a summary description of the composition of our key line items included in our Statements of Earnings, see Management's Discussion and Analysis of Financial Condition and Results of Operations in our 2016 Form 10-K.

Interest Income

Interest income increased by $455 million, or 12.9%, and by $848 million, or 12.1%, for the three and six months ended June 30, 2017, respectively, driven primarily by growth in our average loan receivables.

Average interest-earning assets

|

| | | | | | | | | | | | | |

Three months ended June 30 ($ in millions) | 2017 | | % | | 2016 | | % |

Loan receivables, including held for sale | $ | 74,090 |

| | 82.3 | % | | $ | 66,561 |

| | 82.1 | % |

Liquidity portfolio and other | 15,953 |

| | 17.7 | % | | 14,481 |

| | 17.9 | % |

Total average interest-earning assets | $ | 90,043 |

| | 100.0 | % | | $ | 81,042 |

| | 100.0 | % |

|

| | | | | | | | | | | | | |

Six months ended June 30 ($ in millions) | 2017 | | % | | 2016 | | % |

Loan receivables, including held for sale | $ | 74,111 |

| | 82.4 | % | | $ | 66,377 |

| | 81.7 | % |

Liquidity portfolio and other | 15,860 |

| | 17.6 | % | | 14,875 |

| | 18.3 | % |

Total average interest-earning assets | $ | 89,971 |

| | 100.0 | % | | $ | 81,252 |

| | 100.0 | % |

The increases in average loan receivables of 11.3% and 11.7% for the three and six months ended June 30, 2017, respectively, were driven primarily by higher purchase volume of 6.2% and 6.6% and average active account growth of 4.7% and 5.0%, respectively.

Average active accounts increased to 68.6 million and 69.3 million for the three and six months ended June 30, 2017, and the average balances per these active accounts increased 6.3% for both periods.

Yield on average interest-earning assets

The yield on average interest-earning assets increased for the three and six months ended June 30, 2017. The increase in the three months ended June 30, 2017 was primarily due to an increase in the yield on our average loan receivables of 15 basis points to 21.26%. The increase in yield was primarily driven by higher revolve rates as well as a higher benchmark interest rate.

The increase in the six months ended June 30, 2017 was primarily due to an increase in the percentage of average interest-earning assets attributable to loan receivables.

Interest Expense

Interest expense increased by $30 million, or 9.9%, and by $45 million, or 7.3%, for the three and six months ended June 30, 2017, respectively, driven primarily by the growth in our deposit liabilities. Our cost of funds decreased slightly to 1.86% and 1.85% for the three and six months ended June 30, 2017, respectively, compared to 1.88% and 1.89% for the three and six months ended June 30, 2016, primarily due to a more favorable funding mix as deposits were a larger proportion of our funding.

Average interest-bearing liabilities

|

| | | | | | | | | | | | | |

Three months ended June 30 ($ in millions) | 2017 | | % | | 2016 | | % |

Interest-bearing deposit accounts | $ | 51,836 |

| | 72.0 | % | | $ | 45,523 |

| | 70.4 | % |

Borrowings of consolidated securitization entities | 12,213 |

| | 17.0 | % | | 12,211 |

| | 18.9 | % |

Third-party debt | 7,933 |

| | 11.0 | % | | 6,926 |

| | 10.7 | % |

Total average interest-bearing liabilities | $ | 71,982 |

| | 100.0 | % | | $ | 64,660 |

| | 100.0 | % |

|

| | | | | | | | | | | | | |

Six months ended June 30 ($ in millions) | 2017 | | % | | 2016 | | % |

Interest-bearing deposit accounts | $ | 51,833 |

| | 72.0 | % | | $ | 44,914 |

| | 68.8 | % |

Borrowings of consolidated securitization entities | 12,267 |

| | 17.1 | % | | 12,535 |

| | 19.2 | % |

Third-party debt | 7,847 |

| | 10.9 | % | | 7,827 |

| | 12.0 | % |

Total average interest-bearing liabilities | $ | 71,947 |

| | 100.0 | % | | $ | 65,276 |

| | 100.0 | % |

The increase in average interest-bearing liabilities for the three and six months ended June 30, 2017 was driven primarily by growth in our direct deposits. The increase in the six months ended June 30, 2017 was partially offset by lower securitized financings.

Net Interest Income

Net interest income increased by $425 million, or 13.2%, and by $803 million, or 12.5%, for the three and six months ended June 30, 2017, primarily driven by higher average loan receivables.

Retailer Share Arrangements

Retailer share arrangements remained relatively flat for the three and six months ended June 30, 2017, driven primarily by the growth and improved performance of the programs in which we have retailer share arrangements, partially offset by higher provision for loan losses and loyalty costs associated with these programs.

Provision for Loan Losses

Provision for loan losses increased by $305 million, or 29.9%, for the three months ended June 30, 2017, primarily due to higher net charge-offs and loan receivables growth. Provision for loan losses increased by $708 million, or 36.8%, for the six months ended June 30, 2017, primarily due to an increase in net charge-offs and higher loan loss reserve.

Our allowance coverage ratio increased to 6.63% at June 30, 2017, as compared to 5.70% at June 30, 2016, reflecting the increase in forecasted losses inherent in our loan portfolio.

Other Income

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Interchange revenue | $ | 165 |

| | $ | 151 |

| | $ | 310 |

| | $ | 281 |

|

Debt cancellation fees | 68 |

| | 63 |

| | 136 |

| | 127 |

|

Loyalty programs | (206 | ) | | (135 | ) | | (343 | ) | | (245 | ) |

Other | 30 |

| | 4 |

| | 47 |

| | 12 |

|

Total other income | $ | 57 |

| | $ | 83 |

| | $ | 150 |

| | $ | 175 |

|

Other income decreased by $26 million, or 31.3%, and by $25 million, or 14.3%, for the three and six months ended June 30, 2017, respectively. These decreases were primarily due to higher loyalty costs, which included the impact from higher reward redemption rates we experienced in one of our programs. The increases in loyalty costs were partially offset by increased interchange revenue driven by increased purchase volume outside of our retail partners' sales channels and a pre-tax gain of $18 million associated with the sale of contractual relationships related to processing of general purpose card transactions for certain merchants.

Other Expense

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Employee costs | $ | 321 |

| | $ | 301 |

| | $ | 646 |

| | $ | 581 |

|

Professional fees | 158 |

| | 154 |

| | 309 |

| | 300 |

|

Marketing and business development | 124 |

| | 107 |

| | 218 |

| | 201 |

|

Information processing | 88 |

| | 81 |

| | 178 |

| | 163 |

|

Other | 220 |

| | 196 |

| | 468 |

| | 394 |

|

Total other expense | $ | 911 |

| | $ | 839 |

| | $ | 1,819 |

| | $ | 1,639 |

|

Other expense increased by $72 million, or 8.6%, and by $180 million, or 11.0%, for the three and six months ended June 30, 2017, respectively, primarily due to increases in employee costs, marketing and business development, information processing and other expenses.

The increases in employee costs were primarily due to new employees added to support the continued growth of the business and replacement of certain third-party services. Marketing and business development expense increased primarily due to strategic investments in our sales platforms, increased marketing on retail deposits and higher amortization expense associated with retail partner contract acquisitions and extensions. Information processing costs increased primarily due to higher information technology investment and higher transaction volume. The increases in "other" were primarily driven by higher operational losses and growth of the business.

Provision for Income Taxes

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Effective tax rate | 37.1 | % | | 36.6 | % | | 36.6 | % | | 37.0 | % |

Provision for income taxes | $ | 292 |

| | $ | 282 |

| | $ | 575 |

| | $ | 628 |

|

The effective tax rate for the three months ended June 30, 2017 increased compared to the same period in the prior year primarily due to the discrete impact of a research and development credit and an additional tax benefit reimbursable to GE, that were both recorded in the prior year. The effective tax rate for the six months ended June 30, 2017 decreased compared to the same period in the prior year primarily due to state-related discrete items recorded during the current year. In each period the effective tax rate differs from the U.S. federal statutory rate of 35% primarily due to state income taxes.

Platform Analysis

As discussed above under “—Our Sales Platforms,” we offer our products through three sales platforms (Retail Card, Payment Solutions and CareCredit), which management measures based on their revenue-generating activities. The following is a discussion of certain supplemental information for the three and six months ended June 30, 2017, for each of our sales platforms.

Retail Card

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Purchase volume | $ | 27,101 |

| | $ | 25,411 |

| | $ | 50,053 |

| | $ | 46,961 |

|

Period-end loan receivables | $ | 51,437 |

| | $ | 46,705 |

| | $ | 51,437 |

| | $ | 46,705 |

|

Average loan receivables, including held for sale | $ | 50,533 |

| | $ | 45,593 |

| | $ | 50,588 |

| | $ | 45,536 |

|

Average active accounts (in thousands) | 54,058 |

| | 52,314 |

| | 54,729 |

| | 52,798 |

|

| | | | | | | |

Interest and fees on loans | $ | 2,900 |

| | $ | 2,585 |

| | $ | 5,788 |

| | $ | 5,199 |

|

Retailer share arrangements | $ | (657 | ) | | $ | (656 | ) | | $ | (1,338 | ) | | $ | (1,317 | ) |

Other income | $ | 25 |

| | $ | 69 |

| | $ | 102 |

| | $ | 148 |

|

Retail Card interest and fees on loans increased by $315 million, or 12.2%, and by $589 million, or 11.3%, for the three and six months ended June 30, 2017, respectively. These increases were primarily the result of growth in average loan receivables.

Retailer share arrangements remained relatively flat, for the three and six months ended June 30, 2017, respectively, primarily as a result of the factors discussed under the heading “Retailer Share Arrangements” above.

Other income decreased by $44 million, or 63.8%, and by $46 million, or 31.1%, for the three and six months ended June 30, 2017, respectively, as a result of higher loyalty costs, partially offset by increased interchange revenue driven by increased purchase volume outside of our retail partners' sales channels.

Payment Solutions

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Purchase volume | $ | 3,930 |

| | $ | 3,903 |

| | $ | 7,616 |

| | $ | 7,295 |

|

Period-end loan receivables | $ | 15,595 |

| | $ | 13,997 |

| | $ | 15,595 |

| | $ | 13,997 |

|

Average loan receivables | $ | 15,338 |

| | $ | 13,554 |

| | $ | 15,381 |

| | $ | 13,492 |

|

Average active accounts (in thousands) | 9,031 |

| | 8,153 |

| | 9,061 |

| | 8,148 |

|

| | | | | | | |

Interest and fees on loans | $ | 533 |

| | $ | 467 |

| | $ | 1,048 |

| | $ | 924 |

|

Retailer share arrangements | $ | (9 | ) | | $ | (7 | ) | | $ | (10 | ) | | $ | (14 | ) |

Other income | $ | 6 |

| | $ | 3 |

| | $ | 10 |

| | $ | 7 |

|

Payment Solutions interest and fees on loans increased by $66 million, or 14.1%, and by $124 million, or 13.4%, for the three and six months ended June 30, 2017, respectively. These increases were primarily driven by growth in average loan receivables.

CareCredit

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Purchase volume | $ | 2,445 |

| | $ | 2,193 |

| | $ | 4,687 |

| | $ | 4,228 |

|

Period-end loan receivables | $ | 8,426 |

| | $ | 7,580 |

| | $ | 8,426 |

| | $ | 7,580 |

|

Average loan receivables | $ | 8,219 |

| | $ | 7,414 |

| | $ | 8,142 |

| | $ | 7,349 |

|

Average active accounts (in thousands) | 5,546 |

| | 5,064 |

| | 5,517 |

| | 5,050 |

|

| | | | | | | |

Interest and fees on loans | $ | 494 |

| | $ | 442 |

| | $ | 968 |

| | $ | 869 |

|

Retailer share arrangements | $ | (3 | ) | | $ | (1 | ) | | $ | (5 | ) | | $ | (3 | ) |

Other income | $ | 26 |

| | $ | 11 |

| | $ | 38 |

| | $ | 20 |

|

CareCredit interest and fees on loans increased by $52 million, or 11.8%, and by $99 million, or 11.4%, for the three and six months ended June 30, 2017, respectively. These increases were primarily driven by growth in average loan receivables.

Investment Securities

____________________________________________________________________________________________

The following discussion provides supplemental information regarding our investment securities portfolio. All of our investment securities are classified as available-for-sale at June 30, 2017 and December 31, 2016, and are held to meet our liquidity objectives and to comply with the Community Reinvestment Act. Investment securities classified as available-for-sale are reported in our Condensed Consolidated Statements of Financial Position at fair value.

The following table sets forth the amortized cost and fair value of our portfolio of investment securities at the dates indicated:

|

| | | | | | | | | | | | | | | |

| At June 30, 2017 | | At December 31, 2016 |

($ in millions) | Amortized Cost | | Estimated Fair Value | | Amortized Cost | | Estimated Fair Value |

Debt: | | | | | | | |

U.S. government and federal agency | $ | 2,576 |

| | $ | 2,576 |

| | $ | 3,676 |

| | $ | 3,676 |

|

State and municipal | 45 |

| | 44 |

| | 47 |

| | 46 |

|

Residential mortgage-backed | 1,384 |

| | 1,362 |

| | 1,400 |

| | 1,373 |

|

Equity | 15 |

| | 15 |

| | 15 |

| | 15 |

|

Total | $ | 4,020 |

| | $ | 3,997 |

| | $ | 5,138 |

| | $ | 5,110 |

|

Unrealized gains and losses, net of the related tax effects, on available-for-sale securities that are not other-than-temporarily impaired are excluded from earnings and are reported as a separate component of comprehensive income (loss) until realized. At June 30, 2017, our investment securities had gross unrealized gains of $4 million and gross unrealized losses of $27 million. At December 31, 2016, our investment securities had gross unrealized gains of $3 million and gross unrealized losses of $31 million.

Our investment securities portfolio had the following maturity distribution at June 30, 2017. Equity securities have been excluded from the table because they do not have a maturity.

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Due in 1 Year or Less | | Due After 1 through 5 Years | | Due After 5 through 10 Years | | Due After 10 years | | Total |

Debt: | | | | | | | | | |

U.S. government and federal agency | $ | 2,300 |

| | $ | 276 |

| | $ | — |

| | $ | — |

| | $ | 2,576 |

|

State and municipal | — |

| | — |

| | 2 |

| | 42 |

| | 44 |

|

Residential mortgage-backed | — |

| | — |

| | — |

| | 1,362 |

| | 1,362 |

|

Total(1) | $ | 2,300 |

| | $ | 276 |

| | $ | 2 |

| | $ | 1,404 |

| | $ | 3,982 |

|

Weighted average yield(2) | 0.9 | % | | 1.9 | % | | 3.4 | % | | 2.8 | % | | 1.6 | % |

______________________

| |

(1) | Amounts stated represent estimated fair value. |

| |

(2) | Weighted average yield is calculated based on the amortized cost of each security. In calculating yield, no adjustment has been made with respect to any tax-exempt obligations. |

At June 30, 2017, we did not hold investments in any single issuer with an aggregate book value that exceeded 10% of equity, excluding obligations of the U.S. government.

Loan Receivables

____________________________________________________________________________________________

The following discussion provides supplemental information regarding our loan receivables portfolio.

Loan receivables are our largest category of assets and represent our primary source of revenue. The following table sets forth the composition of our loan receivables portfolio by product type at the dates indicated.

|

| | | | | | | | | | | | | |

($ in millions) | At June 30, 2017 | | (%) | | At December 31, 2016 | | (%) |

Loans | | | | | |

Credit cards | $ | 72,492 |

| | 96.1 | % | | $ | 73,580 |

| | 96.4 | % |

Consumer installment loans | 1,514 |

| | 2.0 |

| | 1,384 |

| | 1.8 |

|

Commercial credit products | 1,386 |

| | 1.8 |

| | 1,333 |

| | 1.7 |

|

Other | 66 |

| | 0.1 |

| | 40 |

| | 0.1 |

|

Total loans | $ | 75,458 |

| | 100.0 | % | | $ | 76,337 |

| | 100.0 | % |

Loan receivables decreased by $879 million, or 1.2%, at June 30, 2017 compared to December 31, 2016, primarily driven by the seasonality of our business.

Loan receivables increased by $7,176 million, or 10.5%, at June 30, 2017 compared to June 30, 2016, primarily driven by higher purchase volume and average active account growth.

Our loan receivables portfolio had the following geographic concentration at June 30, 2017.

|

| | | | | | | |

($ in millions) | | Loan Receivables Outstanding | | % of Total Loan Receivables Outstanding |

State | |

Texas | | $ | 7,686 |

| | 10.2 | % |

California | | $ | 7,545 |

| | 10.0 | % |

Florida | | $ | 6,139 |

| | 8.1 | % |

New York | | $ | 4,208 |

| | 5.6 | % |

Pennsylvania | | $ | 3,213 |

| | 4.3 | % |

Impaired Loans and Troubled Debt Restructurings

Our loss mitigation strategy is intended to minimize economic loss and at times can result in rate reductions, principal forgiveness, extensions or other actions, which may cause the related loan to be classified as a Troubled Debt Restructuring (“TDR”) and also be impaired. We primarily use long-term (12 to 60 months) modification programs for borrowers experiencing financial difficulty as a loss mitigation strategy to improve long-term collectability of the loans that are classified as TDRs. The long-term program involves changing the structure of the loan to a fixed payment loan with a maturity no longer than 60 months and reducing the interest rate on the loan. The long-term program does not normally provide for the forgiveness of unpaid principal, but may allow for the reversal of certain unpaid interest or fee assessments. We also make loan modifications for some customers who request financial assistance through external sources, such as a consumer credit counseling agency program. The loans that are modified typically receive a reduced interest rate but continue to be subject to the original minimum payment terms and do not normally include waiver of unpaid principal, interest or fees. The determination of whether these changes to the terms and conditions meet the TDR criteria includes our consideration of all relevant facts and circumstances.

Loans classified as TDRs are recorded at their present value with impairment measured as the difference between the loan balance and the discounted present value of cash flows expected to be collected, discounted at the original effective interest rate of the loan.

Interest income from loans accounted for as TDRs is accounted for in the same manner as other accruing loans. We accrue interest on credit card balances until the accounts are charged-off in the period the accounts become 180 days past due. The following table presents the amount of loan receivables that are not accruing interest, loans that are 90 days or more past-due and still accruing interest, and earning TDRs for the periods presented.

|

| | | | | | | |

($ in millions) | At June 30, 2017 | | At December 31, 2016 |

Non-accrual loan receivables | $ | 2 |

| | $ | 4 |

|

Loans contractually 90 days past-due and still accruing interest | 1,433 |

| | 1,542 |

|

Earning TDRs(1) | 854 |

| | 802 |

|

Non-accrual, past-due and restructured loan receivables | $ | 2,289 |

| | $ | 2,348 |

|

______________________

| |

(1) | At June 30, 2017 and December 31, 2016, balances exclude $78 million and $66 million, respectively, of TDRs which are included in loans contractually 90 days past-due and still accruing interest on the balance. See Note 4. Loan Receivables and Allowance for Loan Losses to our condensed consolidated financial statements for additional information on the financial effects of TDRs for the three and six months ended June 30, 2017 and 2016. |

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

($ in millions) | 2017 | | 2016 | | 2017 | | 2016 |

Gross amount of interest income that would have been recorded in accordance with the original contractual terms | $ | 53 |

| | $ | 43 |

| | $ | 104 |

| | $ | 85 |

|

Interest income recognized | 11 |

| | 12 |

| | 23 |

| | 24 |

|

Total interest income foregone | $ | 42 |

| | $ | 31 |

| | $ | 81 |

| | $ | 61 |

|

Delinquencies

Over-30 day loan delinquencies as a percentage of period-end loan receivables increased to 4.25% at June 30, 2017 from 3.79% at June 30, 2016, and decreased from 4.32% at December 31, 2016. The 46 basis point increase compared to the same period in the prior year was primarily driven by the factors discussed in "Business Trends and Conditions — Stable Asset Quality" in our 2016 Form 10-K. The decrease as compared to December 31, 2016, was primarily driven by the seasonality of our business, partially offset by the various factors referenced above.

Net Charge-Offs

Net charge-offs consist of the unpaid principal balance of loans held for investment that we determine are uncollectible, net of recovered amounts. We exclude accrued and unpaid finance charges and fees and third-party fraud losses from charge-offs. Charged-off and recovered finance charges and fees are included in interest and fees on loans while third-party fraud losses are included in other expense. Charge-offs are recorded as a reduction to the allowance for loan losses and subsequent recoveries of previously charged-off amounts are credited to the allowance for loan losses. Costs incurred to recover charged-off loans are recorded as collection expense and included in other expense in our Condensed Consolidated Statements of Earnings.

The table below sets forth the ratio of net charge-offs to average loan receivables, including held for sale, for the periods indicated. |

| | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2017 | | 2016 | | 2017 | | 2016 |

Ratio of net charge-offs to average loan receivables, including held for sale | 5.42 | % | | 4.51 | % | | 5.37 | % | | 4.63 | % |

Allowance for Loan Losses

The allowance for loan losses totaled $5,001 million at June 30, 2017 compared with $4,344 million at December 31, 2016 and $3,894 million at June 30, 2016, representing our best estimate of probable losses inherent in the portfolio. Our allowance for loan losses as a percentage of total loan receivables increased to 6.63% at June 30, 2017, from 5.69% at December 31, 2016 and 5.70% at June 30, 2016, which reflects the increase in forecasted net charge-offs over the next twelve months. See "Business Trends and Conditions — Stable Asset Quality" in our 2016 Form 10-K for discussion of the various factors that contribute to forecasted net charge-offs over the next twelve months.

The following tables provide changes in our allowance for loan losses for the periods presented: |

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Balance at April 1, 2017 |

| | Provision charged to operations |

| | Gross charge-offs |

| | Recoveries |

| | Balance at

June 30, 2017 |

|

| | | | | | | | | |

Credit cards | $ | 4,585 |

| | $ | 1,301 |

| | $ | (1,194 | ) | | $ | 214 |

| | $ | 4,906 |

|

Consumer installment loans | 40 |

| | 1 |

| | (11 | ) | | 4 |

| | 34 |

|

Commercial credit products | 50 |

| | 24 |

| | (16 | ) | | 2 |

| | 60 |

|

Other | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Total | $ | 4,676 |

| | $ | 1,326 |

| | $ | (1,221 | ) | | $ | 220 |

| | $ | 5,001 |

|

|

| | | | | | | | | | | | | | | | | | | |

($ in millions) | Balance at April 1, 2016 |

| | Provision charged to operations |

| | Gross charge-offs |

| | Recoveries |

| | Balance at

June 30, 2016 |

|

| | | | | | | | | |

Credit cards | $ | 3,543 |

| | $ | 988 |

| | $ | (947 | ) | | $ | 216 |

| | $ | 3,800 |

|

Consumer installment loans | 31 |

| | 14 |

| | (9 | ) | | 3 |

| | 39 |

|

Commercial credit products | 44 |

| | 19 |

| | (13 | ) | | 3 |

| | 53 |

|

Other | 2 |

| | — |

| | — |

| | — |

| | $ | 2 |

|

Total | $ | 3,620 |

| | $ | 1,021 |

| | $ | (969 | ) | | $ | 222 |

| | $ | 3,894 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

($ in millions) | Balance at January 1, 2017 |

| | Provision charged to operations |

| | Gross charge-offs |

| | Recoveries |

| | Balance at

June 30, 2017 |

|

| |

Credit cards | $ | 4,254 |

| | $ | 2,579 |

| | $ | (2,378 | ) | | $ | 451 |

| | $ | 4,906 |

|

Consumer installment loans | 37 |

| | 14 |

| | (25 | ) | | 8 |

| | 34 |

|

Commercial credit products | 52 |

| | 39 |

| | (34 | ) | | 3 |

| | 60 |

|

Other | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Total | $ | 4,344 |

| | $ | 2,632 |

| | $ | (2,437 | ) | | $ | 462 |

| | $ | 5,001 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Balance at January 1, 2016 |

| | Provision charged to operations |

| | Gross charge- offs |

| | Recoveries |

| | Balance at June 30, 2016 |

|

($ in millions) | |

Credit cards | $ | 3,420 |

| | $ | 1,872 |

| | $ | (1,901 | ) | | $ | 409 |

| | $ | 3,800 |

|

Consumer installment loans | 26 |

| | 27 |

| | (20 | ) | | 6 |

| | 39 |

|

Commercial credit products | 50 |

| | 24 |

| | (26 | ) | | 5 |

| | 53 |

|

Other | 1 |

| | 1 |

| | — |

| | — |

| | 2 |

|

Total | $ | 3,497 |

| | $ | 1,924 |

| | $ | (1,947 | ) | | $ | 420 |

| | $ | 3,894 |

|

Funding, Liquidity and Capital Resources

____________________________________________________________________________________________

We maintain a strong focus on liquidity and capital. Our funding, liquidity and capital policies are designed to ensure that our business has the liquidity and capital resources to support our daily operations, our business growth, our credit ratings and our regulatory and policy requirements, in a cost effective and prudent manner through expected and unexpected market environments.

Funding Sources

Our primary funding sources include cash from operations, deposits (direct and brokered deposits), securitized financings and third-party debt.

The following table summarizes information concerning our funding sources during the periods indicated:

|

| | | | | | | | | | | | | | | | | | | |

| 2017 | | 2016 |

Three months ended June 30 ($ in millions) | Average Balance | | % | | Average Rate | | Average Balance | | % | | Average Rate |

Deposits(1) | $ | 51,836 |

| | 72.0 | % | | 1.6 | % | | $ | 45,523 |

| | 70.4 | % | | 1.6 | % |

Securitized financings | 12,213 |

| | 17.0 |

| | 2.1 |

| | 12,211 |

| | 18.9 |

| | 1.9 |

|

Senior unsecured notes | 7,933 |

| | 11.0 |

| | 3.4 |

| | 6,861 |

| | 10.6 |

| | 3.4 |

|

Bank term loan | — |

| | — |

| | — |

| | 65 |

| | 0.1 |

| | NM |

|

Total | $ | 71,982 |

| | 100.0 | % | | 1.9 | % | | $ | 64,660 |

| | 100.0 | % | | 1.9 | % |

| |

(1) | Excludes $218 million and $208 million average balance of non-interest-bearing deposits for the three months ended June 30, 2017 and 2016, respectively. Non-interest-bearing deposits comprise less than 10% of total deposits for the three months ended June 30, 2017 and 2016. |

|

| | | | | | | | | | | | | | | | | | | |

| 2017 | | 2016 |

Six months ended June 30 ($ in millions) | Average Balance | | % | | Average Rate | | Average Balance | | % | | Average Rate |

Deposits(1) | $ | 51,833 |

| | 72.0 | % | | 1.5 | % | | $ | 44,914 |

| | 68.8 | % | | 1.6 | % |

Securitized financings | 12,267 |

| | 17.1 |

| | 2.1 |

| | 12,535 |

| | 19.2 |

| | 1.9 |

|

Senior unsecured notes | 7,847 |

| | 10.9 |

| | 3.5 |

| | 6,709 |

| | 10.3 |

| | 3.4 |

|

Bank term loan | — |

| | — |

| | — |

| | 1,118 |

| | 1.7 |

| | 5.6 |

|

Total | $ | 71,947 |

| | 100.0 | % | | 1.8 | % | | $ | 65,276 |

| | 100.0 | % | | 1.9 | % |

| |

(1) | Excludes $229 million and $221 million average balance of non-interest-bearing deposits for the six months ended June 30, 2017 and 2016, respectively. Non-interest-bearing deposits comprise less than 10% of total deposits for the three months ended June 30, 2017 and 2016. |

Deposits

We obtain deposits directly from retail and commercial customers (“direct deposits”) or through third-party brokerage firms that offer our deposits to their customers (“brokered deposits”). At June 30, 2017, we had $40.4 billion in direct deposits (which includes deposits from banks and financial institutions) and $12.5 billion in deposits originated through brokerage firms (including network deposit sweeps procured through a program arranger that channels brokerage account deposits to us). A key part of our liquidity plan and funding strategy is to continue to expand our direct deposits base as a source of stable and diversified low cost funding.

Our direct deposits include a range of FDIC-insured deposit products, including certificates of deposit, IRAs, money market accounts and savings accounts.

Brokered deposits are primarily from retail customers of large brokerage firms. We have relationships with 10 brokers that offer our deposits through their networks. Our brokered deposits consist primarily of certificates of deposit that bear interest at a fixed rate and at June 30, 2017, had a weighted average remaining life of 3.2 years. These deposits generally are not subject to early withdrawal.

Our ability to attract deposits is sensitive to, among other things, the interest rates we pay, and therefore, we bear funding risk if we fail to pay higher rates, or interest rate risk if we are required to pay higher rates, to retain existing deposits or attract new deposits. To mitigate these risks, our funding strategy includes a range of deposit products, and we seek to maintain access to multiple other funding sources, including securitized financings (including our undrawn committed capacity) and unsecured debt.

The following table summarizes certain information regarding our interest-bearing deposits by type (all of which constitute U.S. deposits) for the periods indicated:

|

| | | | | | | | | | | | | | | | | | | |

Three months ended June 30 ($ in millions) | 2017 | | 2016 |

Average Balance | | % of Total | | Average Rate | | Average Balance | | % of Total | | Average Rate |

Direct deposits: | | | | | | | | | | | |

Certificates of deposit (including IRA certificates of deposit) | $ | 21,825 |

| | 42.1 | % | | 1.6 | % | | $ | 19,393 |

| | 42.6 | % | | 1.5 | % |

Savings accounts (including money market accounts) | 17,607 |

| | 34.0 |

| | 1.1 |

| | 13,708 |

| | 30.1 |

| | 1.0 |

|

Brokered deposits | 12,404 |

| | 23.9 |

| | 2.3 |

| | 12,422 |

| | 27.3 |

| | 2.2 |

|

Total interest-bearing deposits | $ | 51,836 |

| | 100.0 | % | | 1.6 | % | | $ | 45,523 |

| | 100.0 | % | | 1.6 | % |

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Six months ended June 30 ($ in millions) | 2017 | | 2016 |

Average Balance | | % of Total | | Average Rate | | Average Balance | | % of Total | | Average Rate |

Direct deposits: | | | | | | | | | | | |

Certificates of deposit (including IRA certificates of deposit) | $ | 21,532 |

| | 41.6 | % | | 1.6 | % | | $ | 18,856 |

| | 42.0 | % | | 1.5 | % |

Savings accounts (including money market accounts) | 17,477 |

| | 33.7 |

| | 1.1 |

| | 13,168 |

| | 29.3 | % | | 1.0 |

|

Brokered deposits | 12,824 |

| | 24.7 |

| | 2.2 |

| | 12,890 |

| | 28.7 | % | | 2.2 |

|

Total interest-bearing deposits | $ | 51,833 |

| | 100.0 | % | | 1.5 | % | | $ | 44,914 |

| | 100.0 | % | | 1.6 | % |

Our deposit liabilities provide funding with maturities ranging from one day to ten years. At June 30, 2017, the weighted average maturity of our interest-bearing time deposits was 1.9 years. See Note 7. Deposits to our condensed consolidated financial statements for more information on their maturities.

The following table summarizes deposits by contractual maturity at June 30, 2017.

|