2017 DFAST Annual Stress Test Disclosure

For Synchrony Financial, a Savings and

Loan Holding Company

June 27, 2017

2

Disclaimers

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,”

“plans,” “believes,” “seeks,” “targets,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements.

Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include

global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have

identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our revenue in a small number of Retail Card partners, promotion and support of our

products by our partners, and financial performance of our partners; cyber-attacks or other security breaches; higher borrowing costs and adverse financial market conditions impacting our

funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or

subservice our securitized loans, and lower payment rates on our securitized loans; our ability to grow our deposits in the future; changes in market interest rates and the impact of any

margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk,

the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in

retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or

enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; failure of third parties to provide various services

that are important to our operations; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with

international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our

reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; a material

indemnification obligation to GE under the tax sharing and separation agreement with GE if we cause the split-off from GE or certain preliminary transactions to fail to qualify for tax-free

treatment or in the case of certain significant transfers of our stock following the split-off; regulation, supervision, examination and enforcement of our business by governmental authorities,

the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the impact of the Consumer Financial Protection Bureau's regulation of our business; impact of capital

adequacy rules and liquidity requirements; restrictions that limit Synchrony Financial’s ability to pay dividends and repurchase our common stock, and restrictions that limit Synchrony Bank's

ability to pay dividends to Synchrony Financial; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business

relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws. Forward-looking statements in this presentation include projections of Synchrony Financial’s

and Synchrony Bank’s results of operations and financial condition, under hypothetical scenarios incorporating a set of assumed economic and financial conditions that are more adverse

than Synchrony Financial and Synchrony Bank expect, as prescribed by the Federal Reserve Board and the Office of the Comptroller of the Currency, respectively. The projections do not

represent forecasts of expected losses, revenue, net income, risk-weighted assets, capital or capital ratios, but rather reflect possible results under the prescribed hypothetical scenario.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are

included elsewhere in this presentation and in Synchrony Financial’s public filings, including under the heading “Risk Factors” in Synchrony Financial’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2016, as filed on February 23, 2017. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or

potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and

we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of

unanticipated events, except as otherwise may be required by law.

3

Overview

• The 2017 Annual Stress Test Disclosure presents the results of the annual stress tests conducted by Synchrony

Financial (“Synchrony”) and Synchrony Bank (the “Bank”), a wholly-owned subsidiary of Synchrony, in accordance with

the Dodd-Frank Act Company-Run Stress Test requirements.

• The stress tests reflect the potential impact of hypothetical macroeconomic scenarios on certain financial measures of

Synchrony and the Bank over a nine-quarter planning horizon from 1Q 2017 through 1Q 2019. Synchrony is required to

publicly disclose a summary of the results for the Supervisory Severely Adverse scenario for both Synchrony and the

Bank.

• The results represent hypothetical estimates consistent with the requirements prescribed by the Board of Governors of

the Federal Reserve System (the “FRB”) and the Office of the Comptroller of the Currency (the “OCC”) and do not

represent Synchrony’s and the Bank’s forecast of expected losses, revenue, net income, risk-weighted assets, capital,

or capital ratios.

• The results presented are based on capital action assumptions that would be consistent with the Supervisory Severely

Adverse scenario and required methodologies and internal practices:

Synchrony Financial:

• Actual dividend payments and share repurchases executed in 1Q17.

• Dividend payments in 2Q17 through 1Q19 are consistent with internal capital needs and projections. As a savings

and loan holding company, Synchrony is not required to include an average of the prior four quarters of dividends.

• No additional share repurchases and no additional capital issuances or redemptions are contemplated except for

issuances related to employee compensation.

Synchrony Bank:

• Dividend payments from the Bank to Synchrony Financial are limited to no more than the prior quarter’s

earnings. As a federal savings association, the Bank is not required to include an average of the prior four quarters

of dividends.

• No additional capital issuances or redemptions are contemplated.

4

Supervisory Severely Adverse Scenario Description

• The Supervisory Severely Adverse scenario is not a forecast, but rather a

hypothetical sequence of events designed to assess the strength of banking

organizations and their resilience to a severely adverse economic environment.

• The Supervisory Severely Adverse scenario features the following macroeconomic

assumptions:

• A severe global recession, accompanied by a period of heightened stress in corporate loan

markets and commercial real estate markets;

• The unemployment rate increases by 530 bps from its level in 4Q 2016, peaking at 10.0% in

the third quarter of 2018;

• A decline in house prices by approximately 25% during the scenario period relative to their

level in 4Q 2016; and

• A reduction in the level of real GDP by approximately 660 bps from 4Q 2016 to the first half

of 2018, with a recovery beginning thereafter.

5

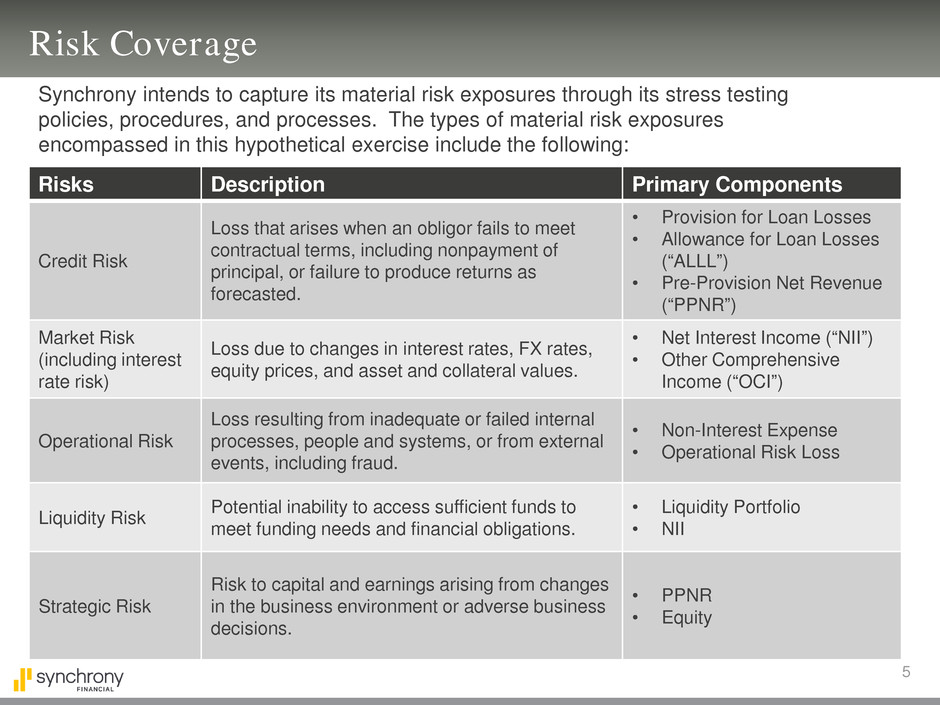

Risk Coverage

Synchrony intends to capture its material risk exposures through its stress testing

policies, procedures, and processes. The types of material risk exposures

encompassed in this hypothetical exercise include the following:

Risks Description Primary Components

Credit Risk

Loss that arises when an obligor fails to meet

contractual terms, including nonpayment of

principal, or failure to produce returns as

forecasted.

• Provision for Loan Losses

• Allowance for Loan Losses

(“ALLL”)

• Pre-Provision Net Revenue

(“PPNR”)

Market Risk

(including interest

rate risk)

Loss due to changes in interest rates, FX rates,

equity prices, and asset and collateral values.

• Net Interest Income (“NII”)

• Other Comprehensive

Income (“OCI”)

Operational Risk

Loss resulting from inadequate or failed internal

processes, people and systems, or from external

events, including fraud.

• Non-Interest Expense

• Operational Risk Loss

Liquidity Risk Potential inability to access sufficient funds to meet funding needs and financial obligations.

• Liquidity Portfolio

• NII

Strategic Risk

Risk to capital and earnings arising from changes

in the business environment or adverse business

decisions.

• PPNR

• Equity

6

Stress Test Methodology: Overview

• Synchrony considers a broad range of potential stresses to its balance sheet,

capital levels, PPNR, and provision for loan losses.

• Synchrony uses both qualitative and quantitative methods to translate risk

measures, including proprietary econometric forecasting models coupled with

management judgment, to estimate the financial impact to PPNR, provision for

loan losses, and risk-weighted assets (“RWAs”) by product for the nine-quarter

stress test horizon.

• PPNR includes net interest income, inclusive of retailer share arrangements

(“RSAs”), non-interest income, and non-interest expense.

• Provision for loan losses reflects net charge-offs of loans and changes to ALLL.

• Eligible capital, RWAs, and resulting capital ratios reflect a Basel III standardized

approach1 applied to balance sheet projections under the macroeconomic conditions

of the Supervisory Severely Adverse scenario.

1 Consistent with capital transition rules

7

Stress Test Methodology: PPNR

• Interest income is estimated across Synchrony’s lending products, using proprietary econometric

forecasting models. These models and other forecasting methodologies estimate the loan receivable

balances, interest and fees on loans, investment security balances, interest on investment securities,

and RSAs.

• RSAs are generally structured to share in the economic performance of retailer partner programs

above a negotiated threshold. Estimated payments to partners pursuant to these RSAs generally

decrease in a stress environment and therefore mitigate any adverse impact of macroeconomic

stress on Synchrony’s profitability over the projection horizon.

• Interest expense is estimated for all deposit and borrowing channels, using internally developed

forecasting methodologies to estimate expected funding balances multiplied by projected interest

rates.

• Non-interest income is generally estimated by forecasting the volume of transactions and the fees or

rates associated with that volume.

• Non-interest expense is estimated in several components including:

• Variable expenses that change with key drivers associated with business activities.

• Fixed expenses that reflect the company’s built-in infrastructure costs.

• Losses related to operational events that include credit card fraud losses using proprietary econometric

forecasting models, and other operational loss events using other forecasting methodologies including scenario

analysis.

8

Stress Test Methodology: Provision for Loan Losses

• Provision for loan losses is forecasted in two key components: Net Charge-offs of

Loans and changes in Allowance for Loan Losses (ALLL).

• Net charge-offs are a function of gross charge-offs net of reversals and recoveries.

• Gross charge-offs of loans are estimated using proprietary econometric forecasting models

that consider the statistical relationship between macroeconomic variables and credit losses

for Synchrony’s products based on historical experience.

• Recovery performance is modeled based on the statistical relationship between

macroeconomic variables and historical charge-offs available for collection.

• The key macroeconomic variables used are: Unemployment Rate, House Price Index,

Mortgage Rate, Gross Domestic Product, Disposable Income, and US Retail Sales.

• Reserves are estimated based on a forward view of net charge-offs impacted by

multiple factors using current ALLL reserving practices.

• The substantial majority of the reserve build over the planning horizon is estimated to occur

over the first 3 quarters of 2017 in anticipation of future net charge-offs as the economy

deteriorates.

9

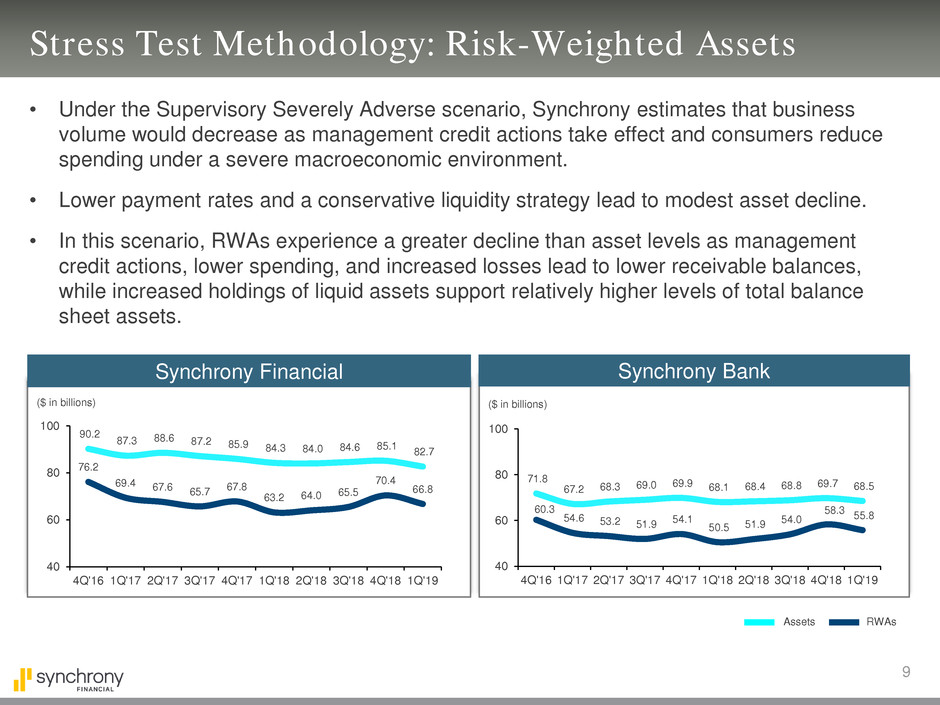

Stress Test Methodology: Risk-Weighted Assets

• Under the Supervisory Severely Adverse scenario, Synchrony estimates that business

volume would decrease as management credit actions take effect and consumers reduce

spending under a severe macroeconomic environment.

• Lower payment rates and a conservative liquidity strategy lead to modest asset decline.

• In this scenario, RWAs experience a greater decline than asset levels as management

credit actions, lower spending, and increased losses lead to lower receivable balances,

while increased holdings of liquid assets support relatively higher levels of total balance

sheet assets.

Synchrony Bank

60.3

54.6 53.2 51.9 54.1 50.5 51.9

54.0

58.3 55.8

71.8

67.2 68.3 69.0 69.9 68.1 68.4 68.8 69.7 68.5

40

60

80

100

4Q'16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19

($ in billions)

76.2

69.4 67.6 65.7 67.8 63.2 64.0 65.5

70.4

66.8

90.2

87.3 88.6 87.2 85.9 84.3 84.0 84.6 85.1 82.7

40

60

80

100

4Q'16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19

($ in billions)

Synchrony Financial

Assets RWAs

10

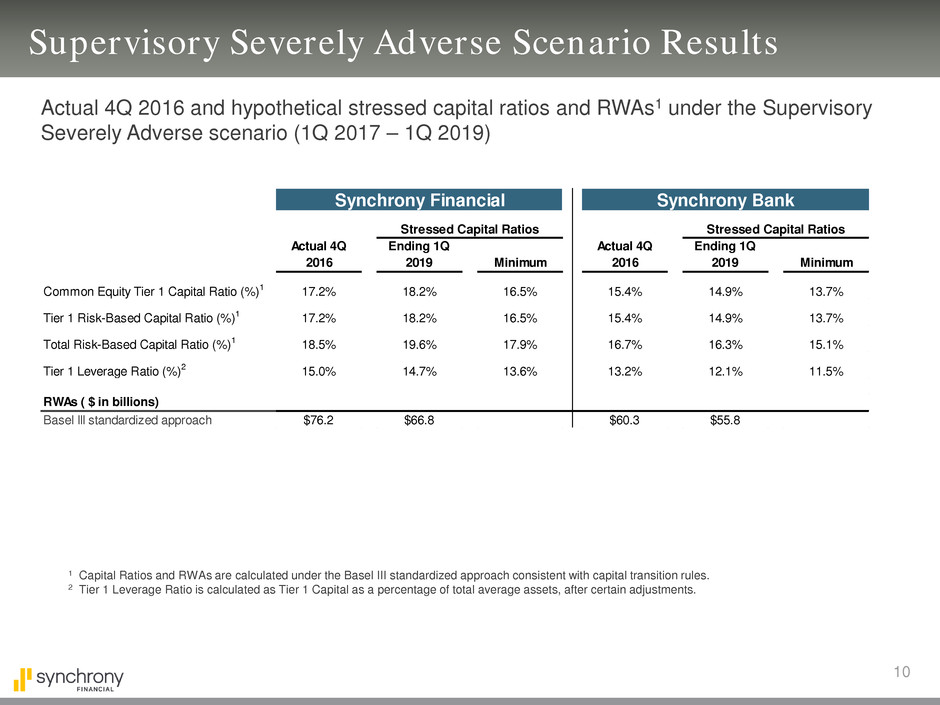

Supervisory Severely Adverse Scenario Results

1 Capital Ratios and RWAs are calculated under the Basel III standardized approach consistent with capital transition rules.

2 Tier 1 Leverage Ratio is calculated as Tier 1 Capital as a percentage of total average assets, after certain adjustments.

Actual 4Q 2016 and hypothetical stressed capital ratios and RWAs1 under the Supervisory

Severely Adverse scenario (1Q 2017 – 1Q 2019)

Actual 4Q

2016

Ending 1Q

2019 Minimum

Actual 4Q

2016

Ending 1Q

2019 Minimum

Common Equity Tier 1 Capital Ratio (%)1 17.2% 18.2% 16.5% 15.4% 14.9% 13.7%

Tier 1 Risk-Based Capital Ratio (%)1 17.2% 18.2% 16.5% 15.4% 14.9% 13.7%

Total Risk-Based Capital Ratio (%)1 18.5% 19.6% 17.9% 16.7% 16.3% 15.1%

Tier 1 Leverage Ratio (%)2 15.0% 14.7% 13.6% 13.2% 12.1% 11.5%

RWAs ( $ in billions)

Basel III standardized approach $76.2 $66.8 $60.3 $55.8

Synchrony Financial Synchrony Bank

Stressed Capital Ratios Stressed Capital Ratios

11

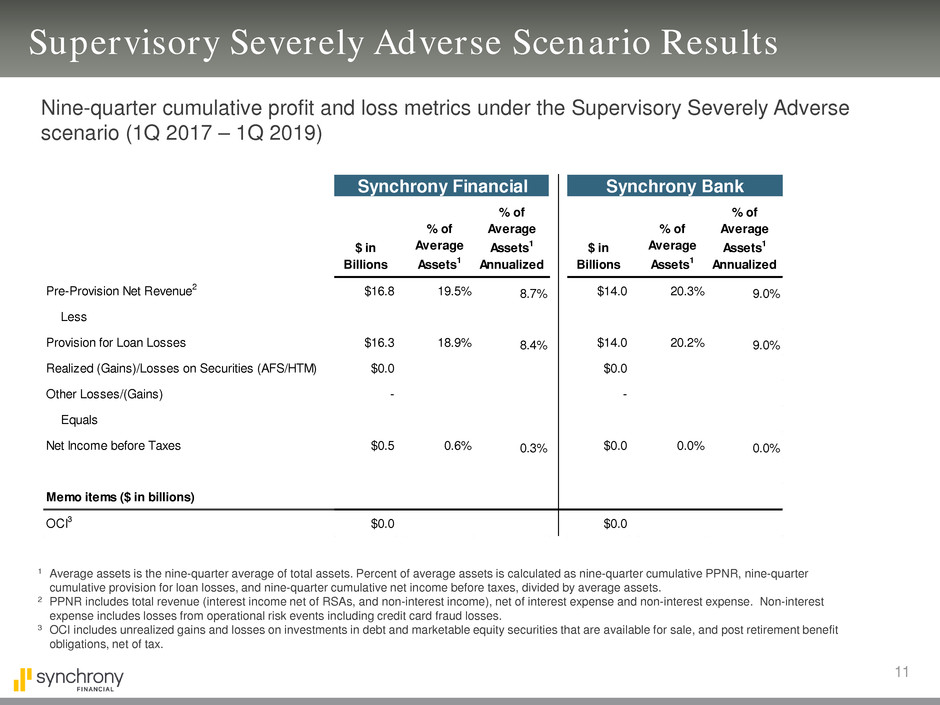

Supervisory Severely Adverse Scenario Results

Nine-quarter cumulative profit and loss metrics under the Supervisory Severely Adverse

scenario (1Q 2017 – 1Q 2019)

1 Average assets is the nine-quarter average of total assets. Percent of average assets is calculated as nine-quarter cumulative PPNR, nine-quarter

cumulative provision for loan losses, and nine-quarter cumulative net income before taxes, divided by average assets.

2 PPNR includes total revenue (interest income net of RSAs, and non-interest income), net of interest expense and non-interest expense. Non-interest

expense includes losses from operational risk events including credit card fraud losses.

3 OCI includes unrealized gains and losses on investments in debt and marketable equity securities that are available for sale, and post retirement benefit

obligations, net of tax.

$ in

Billions

% of

Average

Assets1

% of

Average

Assets1

Annualized

$ in

Billions

% of

Average

Assets1

% of

Average

Assets1

Annualized

Pre-Provision Net Revenue2 $16.8 19.5% 8.7% $14.0 20.3% 9.0%

Less

Provision for Loan Losses $16.3 18.9% 8.4% $14.0 20.2% 9.0%

Realized (Gains)/Losses on Securities (AFS/HTM) $0.0 $0.0

Other Losses/(Gains) - -

Equals

Net Income before Taxes $0.5 0.6% 0.3% $0.0 0.0% 0.0%

Memo items ($ in billions)

OCI3 $0.0 $0.0

Synchrony Financial Synchrony Bank

12

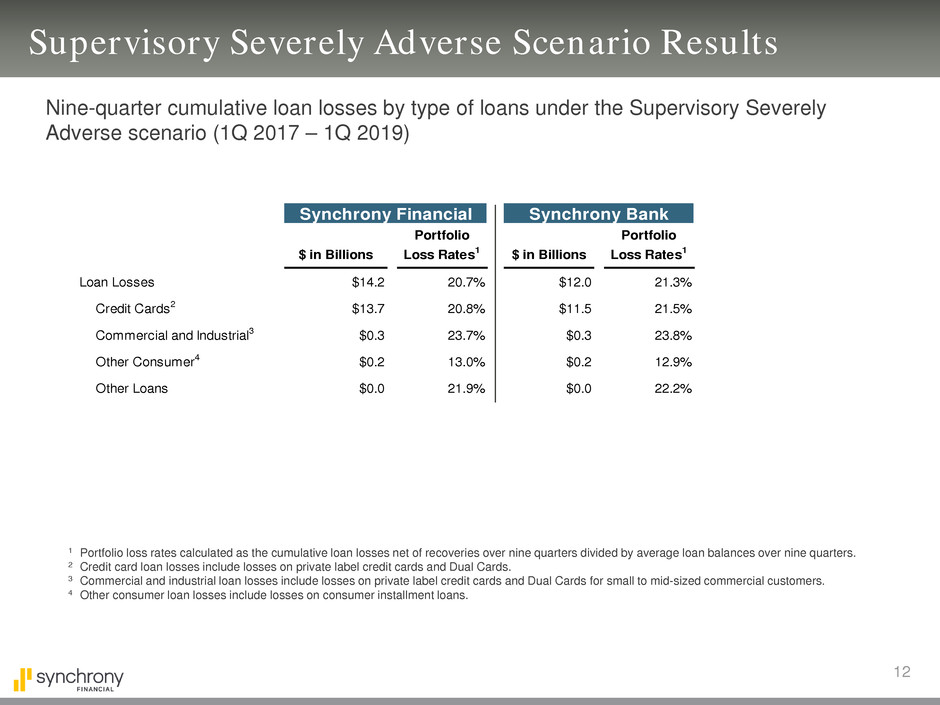

Supervisory Severely Adverse Scenario Results

Nine-quarter cumulative loan losses by type of loans under the Supervisory Severely

Adverse scenario (1Q 2017 – 1Q 2019)

1 Portfolio loss rates calculated as the cumulative loan losses net of recoveries over nine quarters divided by average loan balances over nine quarters.

2 Credit card loan losses include losses on private label credit cards and Dual Cards.

3 Commercial and industrial loan losses include losses on private label credit cards and Dual Cards for small to mid-sized commercial customers.

4 Other consumer loan losses include losses on consumer installment loans.

$ in Billions

Portfolio

Loss Rates1 $ in Billions

Portfolio

Loss Rates1

Loan Losses $14.2 20.7% $12.0 21.3%

Credit Cards2 $13.7 20.8% $11.5 21.5%

Commercial and Industrial3 $0.3 23.7% $0.3 23.8%

Other Consumer4 $0.2 13.0% $0.2 12.9%

Other Loans $0.0 21.9% $0.0 22.2%

Synchrony Financial Synchrony Bank

13

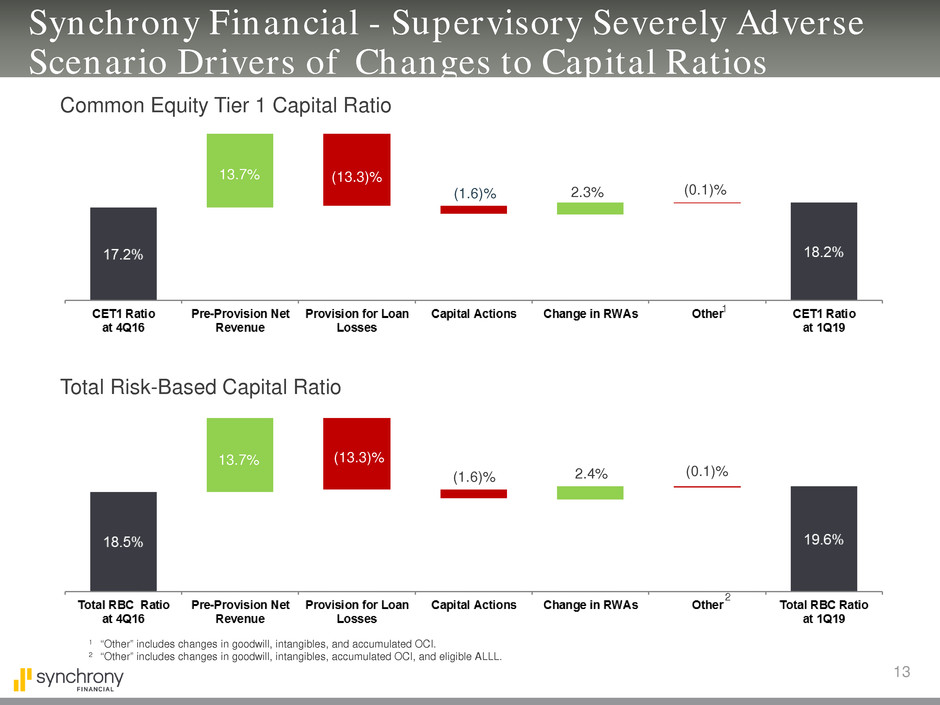

Synchrony Financial - Supervisory Severely Adverse

Scenario Drivers of Changes to Capital Ratios

Total Risk-Based Capital Ratio

1 “Other” includes changes in goodwill, intangibles, and accumulated OCI.

2 “Other” includes changes in goodwill, intangibles, accumulated OCI, and eligible ALLL.

13.7% (13.3)%

(1.6)% 2.3% (0.1)%

13.7% (13.3)%

(1.6)% 2.4% (0.1)%

1

2

Common Equity Tier 1 Capital Ratio

14

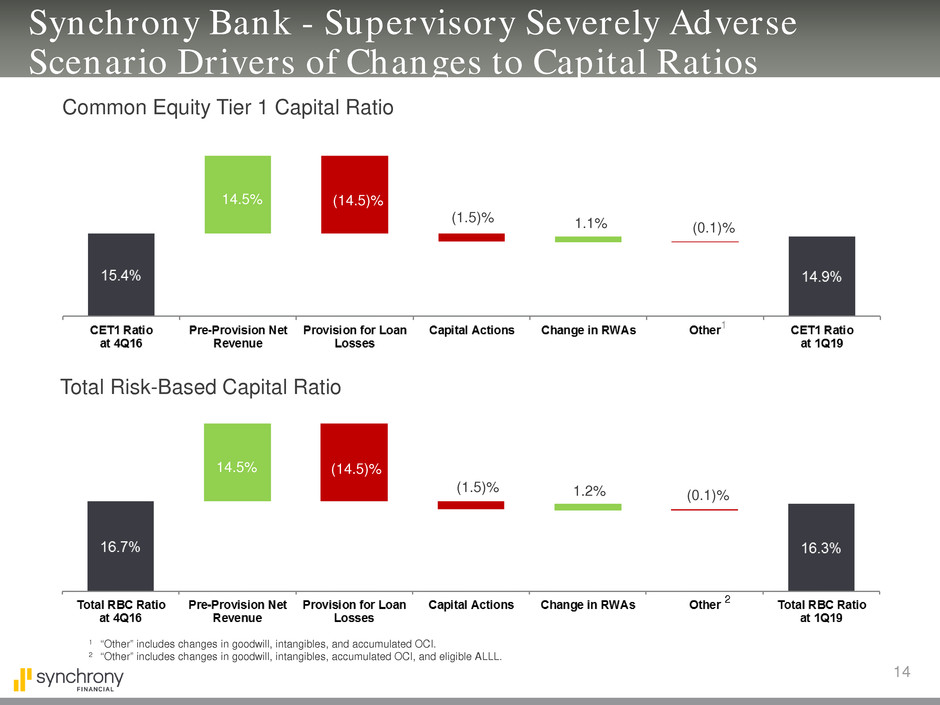

Synchrony Bank - Supervisory Severely Adverse

Scenario Drivers of Changes to Capital Ratios

Common Equity Tier 1 Capital Ratio

Total Risk-Based Capital Ratio

1 “Other” includes changes in goodwill, intangibles, and accumulated OCI.

2 “Other” includes changes in goodwill, intangibles, accumulated OCI, and eligible ALLL.

14.5% (14.5)%

(1.5)% 1.1% (0.1)%

14.5% (14.5)%

(1.5)% 1.2% (0.1)%

1

2

Engage with us.