BancAnalysts Association of Boston Conference

November 3, 2016

Exhibit 99.1

2

This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are

subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “will,”

“should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and

assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking

statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic

conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our revenue in a small number of Retail Card partners, promotion

and support of our products by our partners, and financial performance of our partners; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit

ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans;

our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may

be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability

to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize

new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; cyber-attacks or other security breaches; failure of third parties to provide

various services that are important to our operations; our transition to a replacement third-party vendor to manage the technology platform for our online retail deposits; disruptions in the operations of our computer

systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect

our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and

state sales tax rules and regulations; a material indemnification obligation to GE under the tax sharing and separation agreement with GE if we cause the split-off from GE or certain preliminary transactions to fail to

qualify for tax-free treatment or in the case of certain significant transfers of our stock following the split-off; obligations associated with being an independent public company; regulation, supervision, examination and

enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the impact of the Consumer Financial Protection Bureau’s regulation of our

business; changes to our methods of offering our CareCredit products; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and

restrictions that limit Synchrony Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and

failure to comply with anti-money laundering and anti-terrorism financing laws.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this

presentation and in our public filings, including in Synchrony Financial’s (the “Company”) Quarterly Report on Form 10-Q for our most recently completed fiscal quarter and under the heading “Risk Factors” in the

Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed on February 25, 2016. You should not consider any list of such factors to be an exhaustive statement of all of the risks,

uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we

undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as

otherwise may be required by law.

Non-GAAP Measures

We present certain capital ratios. Our Basel III Tier 1 common ratio, calculated on a fully phased-in basis, is a preliminary estimate reflecting management’s interpretation of the final Basel III capital rules adopted in July

2013 by the Federal Reserve Board, which have not been fully implemented, and our estimate and interpretations are subject to, among other things, ongoing regulatory review and implementation guidance. This ratio is

not currently required by regulators to be disclosed, and therefore is considered a non-GAAP measure. We believe this capital ratio is a useful measure to investors because it is widely used by analysts and regulators to

assess the capital position of financial services companies, although this ratio may not be comparable to similarly titled measures reported by other companies. The reconciliation of our Basel III Tier 1 common ratio,

calculated on a fully phased-in basis, to the comparable GAAP component at September 30, 2016 is included at the end of this presentation in “Appendix-Non-GAAP Reconciliations.”

We also present a measure we refer to as “tangible common equity” in this presentation. Tangible common equity itself is not a measure presented in accordance with GAAP. We believe tangible common equity is a

more meaningful measure to investors of the net asset value of the Company. The reconciliation of tangible common equity, to total equity reported in accordance with GAAP is included at the end of this presentation in

“Appendix-Non-GAAP Reconciliations.”

We refer to “managed-basis” as presenting certain loan performance measures as if loans sold by us to our securitization trusts were never sold and derecognized in our GAAP financial statements. We believe it is

useful to consider these performance measures on a managed-basis for 2009 when comparing to similar GAAP measures in later years since we serviced the securitized and owned loans, and related accounts, in the

same manner without regard to ownership of the loans. The reconciliation of the managed-basis loan performance measures in this presentation to the comparable GAAP measures for the twelve months ended

December 31, 2009 is included at the end of this presentation in “Appendix-Non-GAAP Reconciliations.”

Disclaimers

Business Overview

4

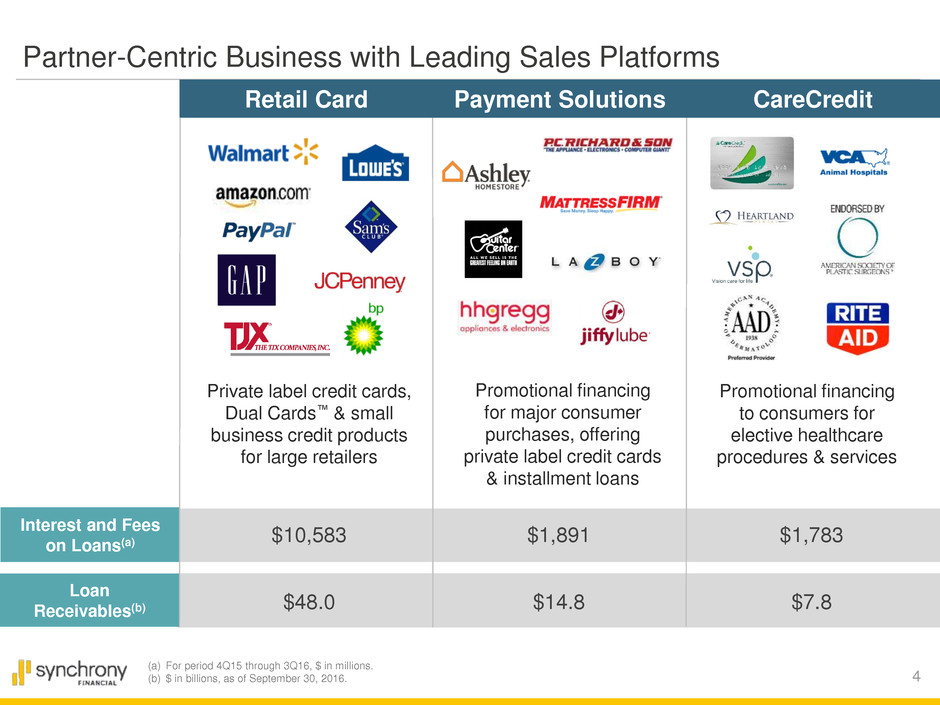

Partner-Centric Business with Leading Sales Platforms

(a) For period 4Q15 through 3Q16, $ in millions.

(b) $ in billions, as of September 30, 2016.

$10,583

$48.0

$1,891

$14.8

$1,783

$7.8

Payment Solutions Retail Card CareCredit

Interest and Fees

on Loans(a)

Loan

Receivables(b)

Private label credit cards,

Dual Cards™ & small

business credit products

for large retailers

Promotional financing

for major consumer

purchases, offering

private label credit cards

& installment loans

Promotional financing

to consumers for

elective healthcare

procedures & services

5

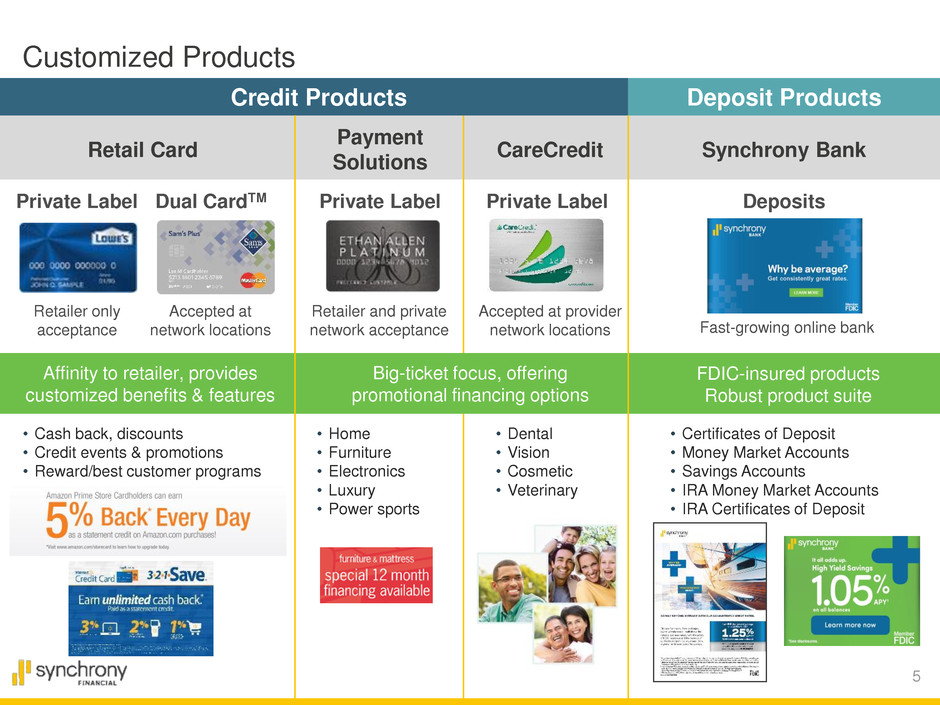

Customized Products

Credit Products

Retailer only

acceptance

Accepted at

network locations

Deposit Products

Retailer and private

network acceptance

Accepted at provider

network locations

Private Label Dual CardTM

Affinity to retailer, provides

customized benefits & features

Big-ticket focus, offering

promotional financing options

Retail Card

Private Label Private Label

• Dental

• Vision

• Cosmetic

• Veterinary

• Cash back, discounts

• Credit events & promotions

• Reward/best customer programs

• Home

• Furniture

• Electronics

• Luxury

• Power sports

Payment

Solutions

CareCredit

Fast-growing online bank

Deposits

FDIC-insured products

Robust product suite

Synchrony Bank

• Certificates of Deposit

• Money Market Accounts

• Savings Accounts

• IRA Money Market Accounts

• IRA Certificates of Deposit

6

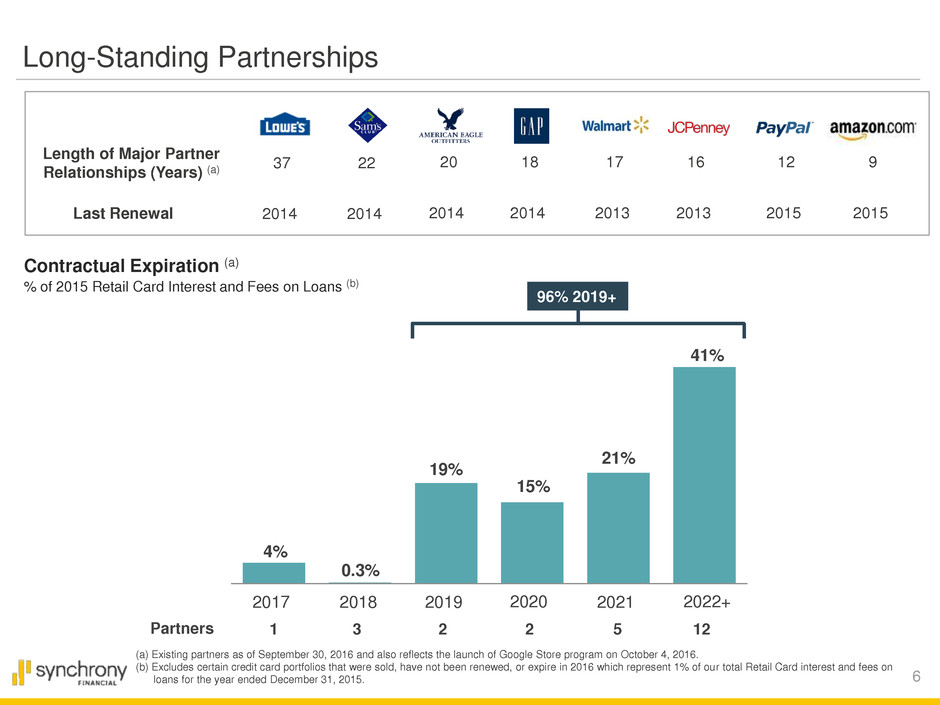

Long-Standing Partnerships

(a) Existing partners as of September 30, 2016 and also reflects the launch of Google Store program on October 4, 2016.

(b) Excludes certain credit card portfolios that were sold, have not been renewed, or expire in 2016 which represent 1% of our total Retail Card interest and fees on

loans for the year ended December 31, 2015.

4%

0.3%

19%

Partners

15%

21%

2019 2018 2017 2021

1 3 2 2

2020

41%

2022+

5 12

Length of Major Partner

Relationships (Years) (a)

Last Renewal

37

2014

22

2014

20

2014

18

2014

17

2013

16

2013

12

2015

9

2015

96% 2019+

Contractual Expiration (a)

% of 2015 Retail Card Interest and Fees on Loans (b)

7

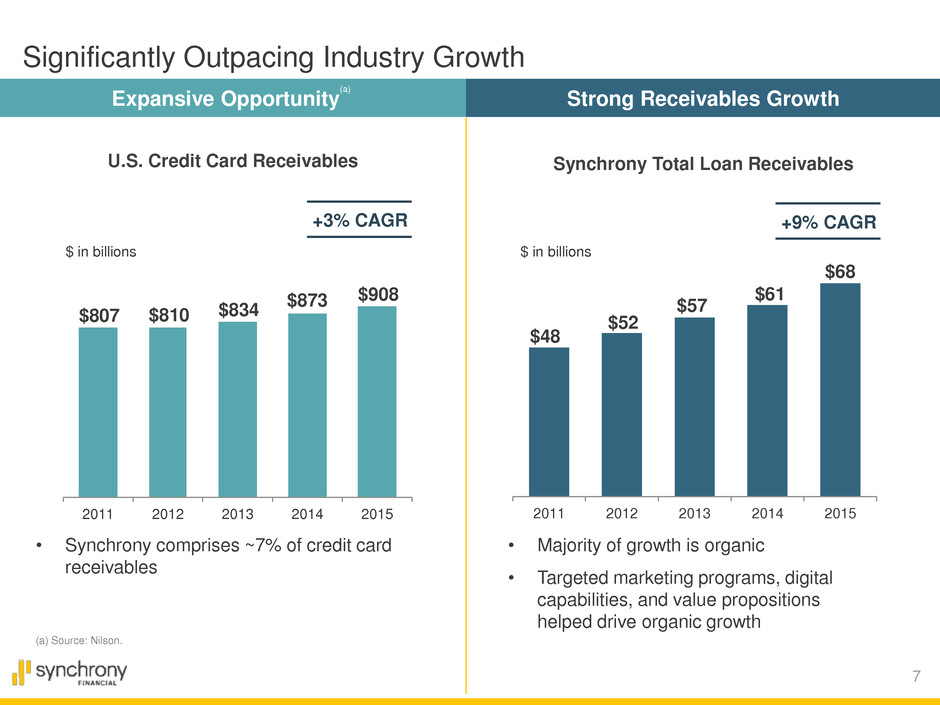

Expansive Opportunity

(a)

(a) Source: Nilson.

U.S. Credit Card Receivables

$48

$52

$57

$61

$68

2011 2012 2013 2014 2015

$ in billions

• Majority of growth is organic

• Targeted marketing programs, digital

capabilities, and value propositions

helped drive organic growth

Strong Receivables Growth

$807 $810 $834

$873 $908

2011 2012 2013 2014 2015

+3% CAGR

+9% CAGR

• Synchrony comprises ~7% of credit card

receivables

Significantly Outpacing Industry Growth

$ in billions

Synchrony Total Loan Receivables

8

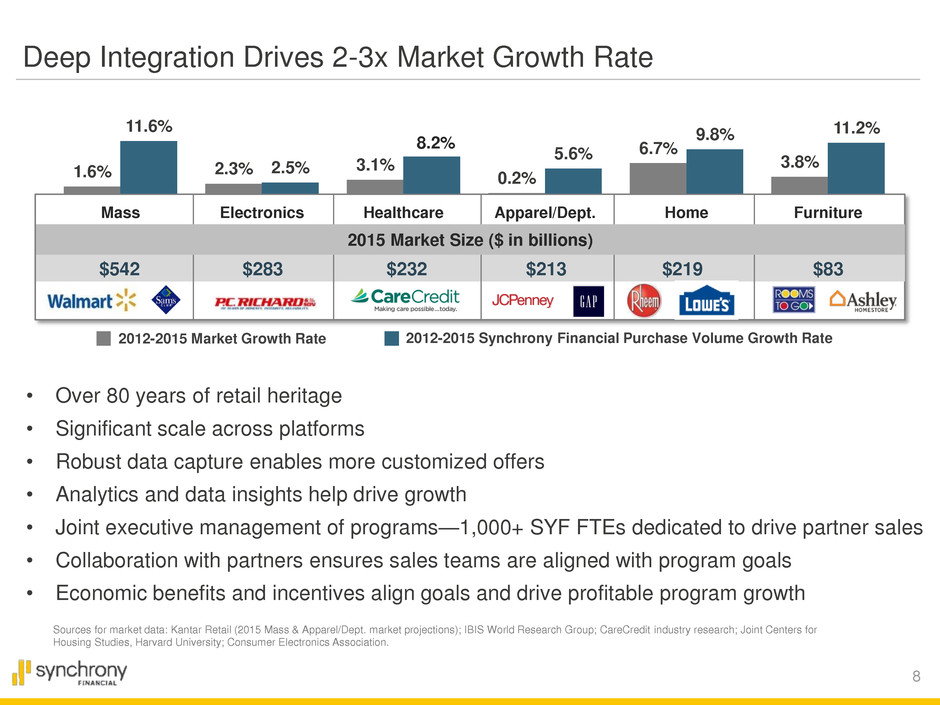

1.6% 2.3% 3.1% 0.2%

6.7%

3.8%

11.6%

2.5%

8.2%

5.6%

9.8% 11.2%

Mass Electronics Healthcare Apparel/Dept. Home Furniture

$542 $283 $232 $213 $219 $83

2012-2015 Market Growth Rate 2012-2015 Synchrony Financial Purchase Volume Growth Rate

2015 Market Size ($ in billions)

• Over 80 years of retail heritage

• Significant scale across platforms

• Robust data capture enables more customized offers

• Analytics and data insights help drive growth

• Joint executive management of programs—1,000+ SYF FTEs dedicated to drive partner sales

• Collaboration with partners ensures sales teams are aligned with program goals

• Economic benefits and incentives align goals and drive profitable program growth

Deep Integration Drives 2-3x Market Growth Rate

Sources for market data: Kantar Retail (2015 Mass & Apparel/Dept. market projections); IBIS World Research Group; CareCredit industry research; Joint Centers for

Housing Studies, Harvard University; Consumer Electronics Association.

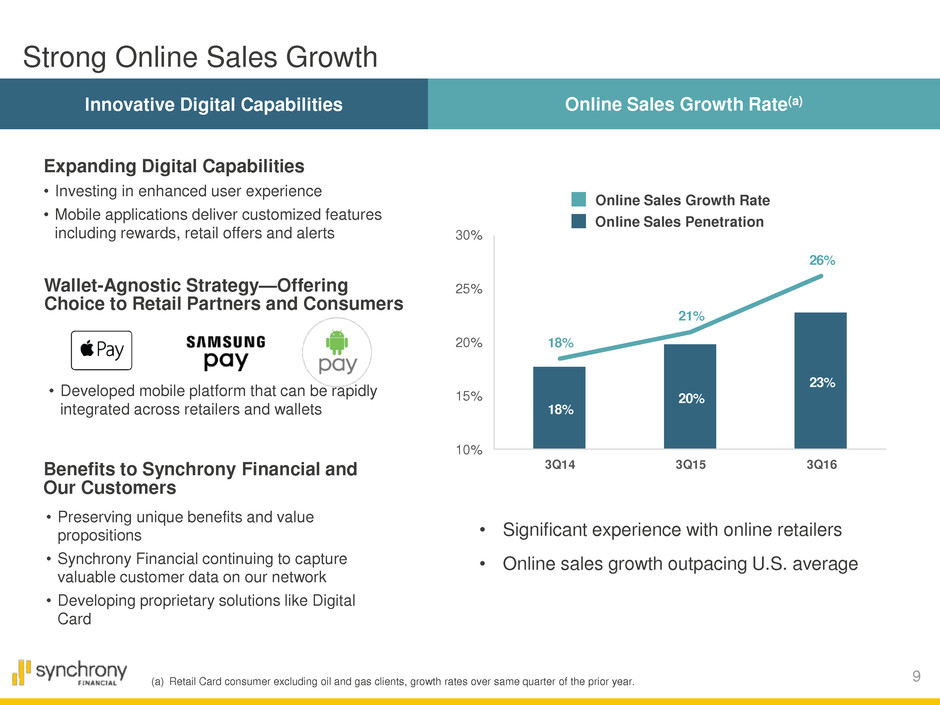

9 (a) Retail Card consumer excluding oil and gas clients, growth rates over same quarter of the prior year.

Strong Online Sales Growth

Innovative Digital Capabilities Online Sales Growth Rate(a)

• Significant experience with online retailers

• Online sales growth outpacing U.S. average

Online Sales Growth Rate

Online Sales Penetration

Expanding Digital Capabilities

• Investing in enhanced user experience

• Mobile applications deliver customized features

including rewards, retail offers and alerts

Wallet-Agnostic Strategy—Offering

Choice to Retail Partners and Consumers

Benefits to Synchrony Financial and

Our Customers

• Preserving unique benefits and value

propositions

• Synchrony Financial continuing to capture

valuable customer data on our network

• Developing proprietary solutions like Digital

Card

• Developed mobile platform that can be rapidly

integrated across retailers and wallets

18%

20%

23%

18%

21%

26%

10%

15%

20%

25%

30%

3Q14 3Q15 3Q16

10

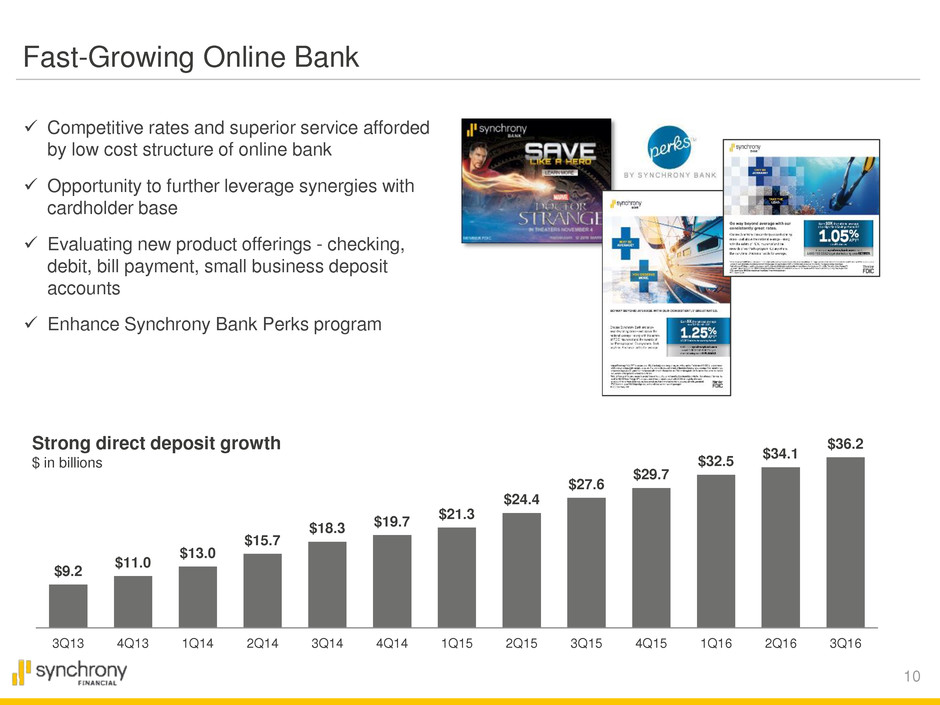

$9.2

$11.0

$13.0

$15.7

$18.3 $19.7

$21.3

$24.4

$27.6

$29.7

$32.5

$34.1

$36.2

3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Competitive rates and superior service afforded

by low cost structure of online bank

Opportunity to further leverage synergies with

cardholder base

Evaluating new product offerings - checking,

debit, bill payment, small business deposit

accounts

Enhance Synchrony Bank Perks program

Strong direct deposit growth

$ in billions

Fast-Growing Online Bank

Robust Data and Analytics Capabilities

12

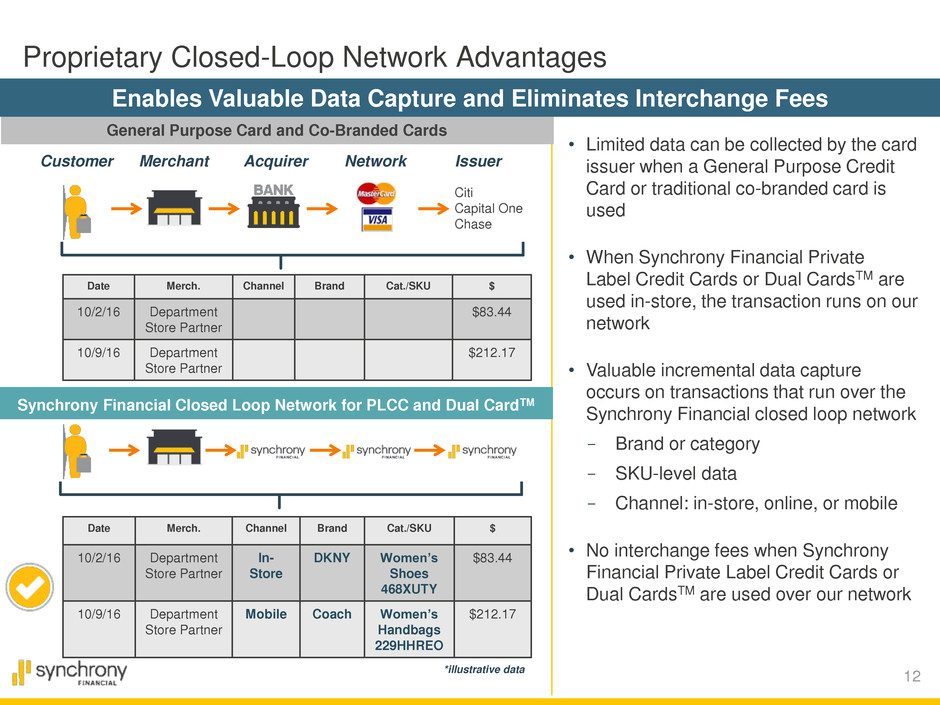

Proprietary Closed-Loop Network Advantages

Customer Merchant Acquirer Network Issuer

General Purpose Card and Co-Branded Cards

Synchrony Financial Closed Loop Network for PLCC and Dual CardTM

Citi

Capital One

Chase

Date Merch. Channel Brand Cat./SKU $

10/2/16 Department

Store Partner

In-

Store

DKNY Women’s

Shoes

468XUTY

$83.44

10/9/16 Department

Store Partner

Mobile Coach Women’s

Handbags

229HHREO

$212.17

Date Merch. Channel Brand Cat./SKU $

10/2/16 Department

Store Partner

$83.44

10/9/16 Department

Store Partner

$212.17

Enables Valuable Data Capture and Eliminates Interchange Fees

• Limited data can be collected by the card

issuer when a General Purpose Credit

Card or traditional co-branded card is

used

• When Synchrony Financial Private

Label Credit Cards or Dual CardsTM are

used in-store, the transaction runs on our

network

• Valuable incremental data capture

occurs on transactions that run over the

Synchrony Financial closed loop network

- Brand or category

- SKU-level data

- Channel: in-store, online, or mobile

• No interchange fees when Synchrony

Financial Private Label Credit Cards or

Dual CardsTM are used over our network

*illustrative data

13

Prior After Launch

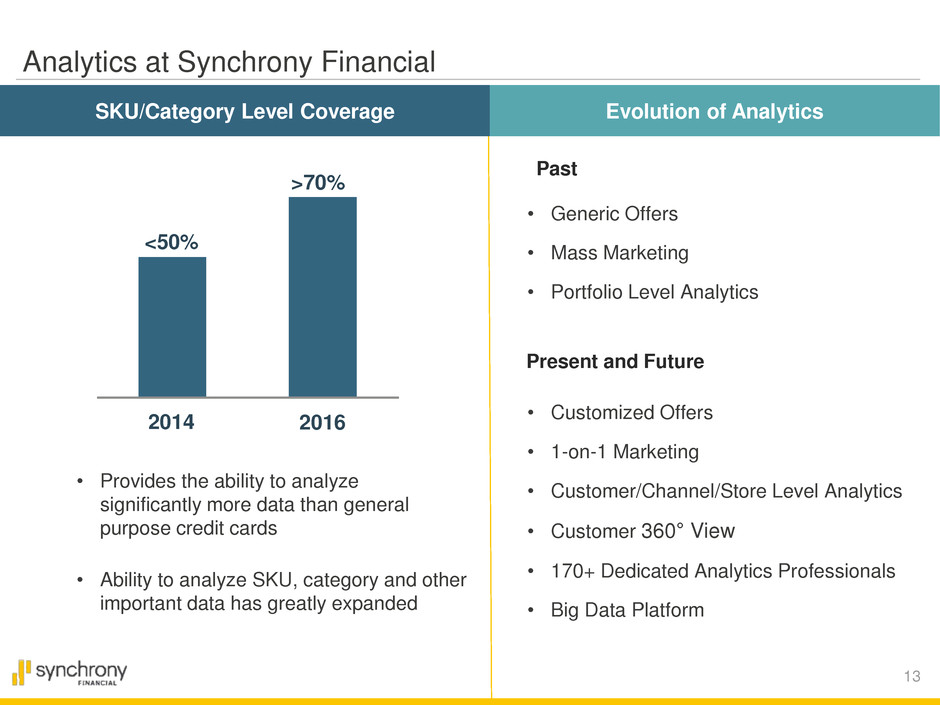

Analytics at Synchrony Financial

• Generic Offers

• Mass Marketing

• Portfolio Level Analytics

SKU/Category Level Coverage Evolution of Analytics

<50%

Present and Future

Past

>70%

2014

2016

• Provides the ability to analyze

significantly more data than general

purpose credit cards

• Ability to analyze SKU, category and other

important data has greatly expanded

• Customized Offers

• 1-on-1 Marketing

• Customer/Channel/Store Level Analytics

• Customer 360° View

• 170+ Dedicated Analytics Professionals

• Big Data Platform

14

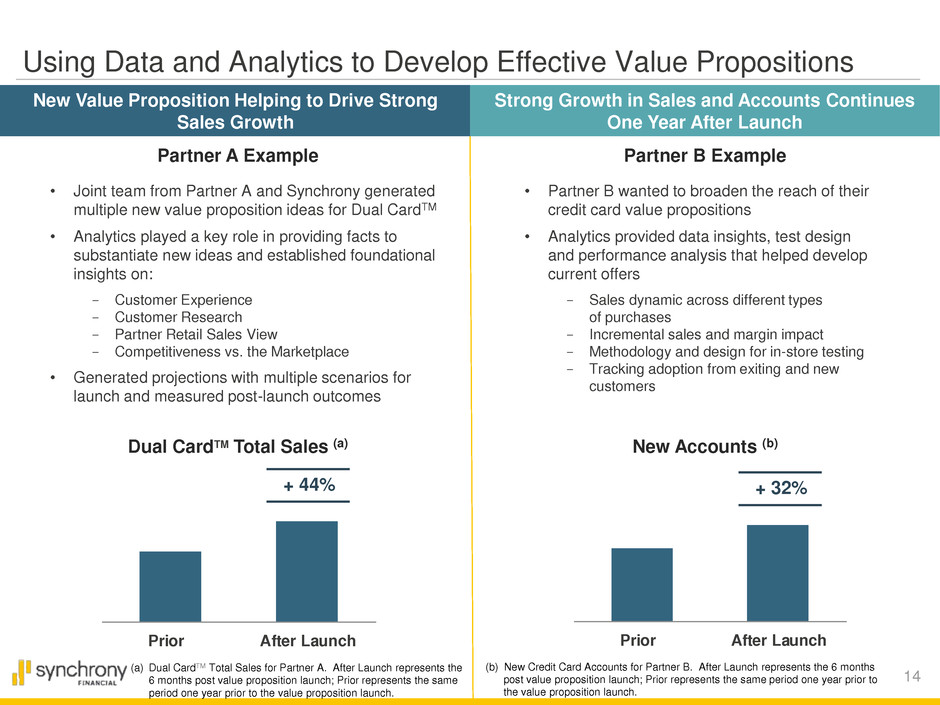

Using Data and Analytics to Develop Effective Value Propositions

• Joint team from Partner A and Synchrony generated

multiple new value proposition ideas for Dual CardTM

• Analytics played a key role in providing facts to

substantiate new ideas and established foundational

insights on:

- Customer Experience

- Customer Research

- Partner Retail Sales View

- Competitiveness vs. the Marketplace

• Generated projections with multiple scenarios for

launch and measured post-launch outcomes

• Partner B wanted to broaden the reach of their

credit card value propositions

• Analytics provided data insights, test design

and performance analysis that helped develop

current offers

- Sales dynamic across different types

of purchases

- Incremental sales and margin impact

- Methodology and design for in-store testing

- Tracking adoption from exiting and new

customers

New Value Proposition Helping to Drive Strong

Sales Growth

Strong Growth in Sales and Accounts Continues

One Year After Launch

Dual CardTM Total Sales (a)

+ 44%

(a) Dual CardTM Total Sales for Partner A. After Launch represents the

6 months post value proposition launch; Prior represents the same

period one year prior to the value proposition launch.

New Accounts (b)

+ 32%

Partner A Example Partner B Example

(b) New Credit Card Accounts for Partner B. After Launch represents the 6 months

post value proposition launch; Prior represents the same period one year prior to

the value proposition launch.

Prior After LaunchPrior After Launch

15

Channel Contribution

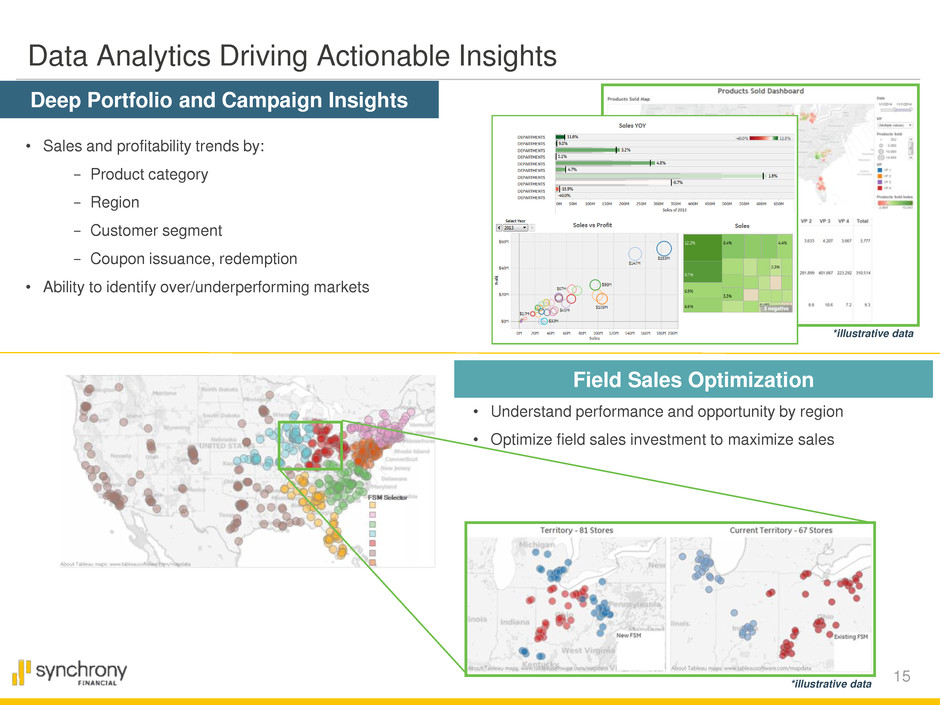

Data Analytics Driving Actionable Insights

• Understand performance and opportunity by region

• Optimize field sales investment to maximize sales

• Sales and profitability trends by:

- Product category

- Region

- Customer segment

- Coupon issuance, redemption

• Ability to identify over/underperforming markets

Deep Portfolio and Campaign Insights

Field Sales Optimization

*illustrative data

*illustrative data

Performance & Strategic Priorities

17

• Added several new partners, renewed existing

relationships, and launched new programs

• Online sales increased 26% year-over-year

outpacing U.S. online sales growth(d)

• Announced initial capital plan of $0.13

quarterly dividend and $952MM in share

repurchases

2016 Accomplishments

Financial Highlights Business Highlights

• Exceeded growth outlook(a)

Robust receivables growth of 11% exceeded

outlook of 7-9%

Program sales growth has outperformed

retailers’ sales growth by 2-3x

• Delivered strong financial results(b)

Return on assets of 2.7%, within outlook

range of 2.5%-3.0%

Net interest margin of 15.9% exceeded

outlook of ~15.5%

Efficiency ratio of 31% compared to outlook

of <34% (revised outlook of around 32%)

• Strengthened balance sheet(c)

Capital and liquidity levels well above peers

- CET1 Ratio, fully phased-in basis: 17.9%

- Liquid assets % of total assets: 18.8%

Strong deposit growth—increased $9.3B, or

23%, now 71% of funding

(a) SYF growth is 3Q16 vs. 3Q15. Outlook provided in January 22, 2016 earnings presentation.

(b) SYF financial results are 3Q16 YTD. Outlook provided in January 22, 2016 earnings presentation, revised efficiency ratio outlook provided October 21, 2016.

(c) SYF capital and liquidity ratios as of 3Q16 and deposit growth 3Q16 vs. 3Q15.

(d) SYF growth is for consumer accounts. Source for U.S. data is the U.S Census Bureau, Monthly & Annual Trade Report, Quarterly E-Commerce Report, Retail Indicators Branch,

U.S. Census Bureau - the growth is based on most current data available (3Q16 vs. 3Q15).

Note: Synchrony Financial does not affirm guidance during the year and is not doing so in this presentation.

18

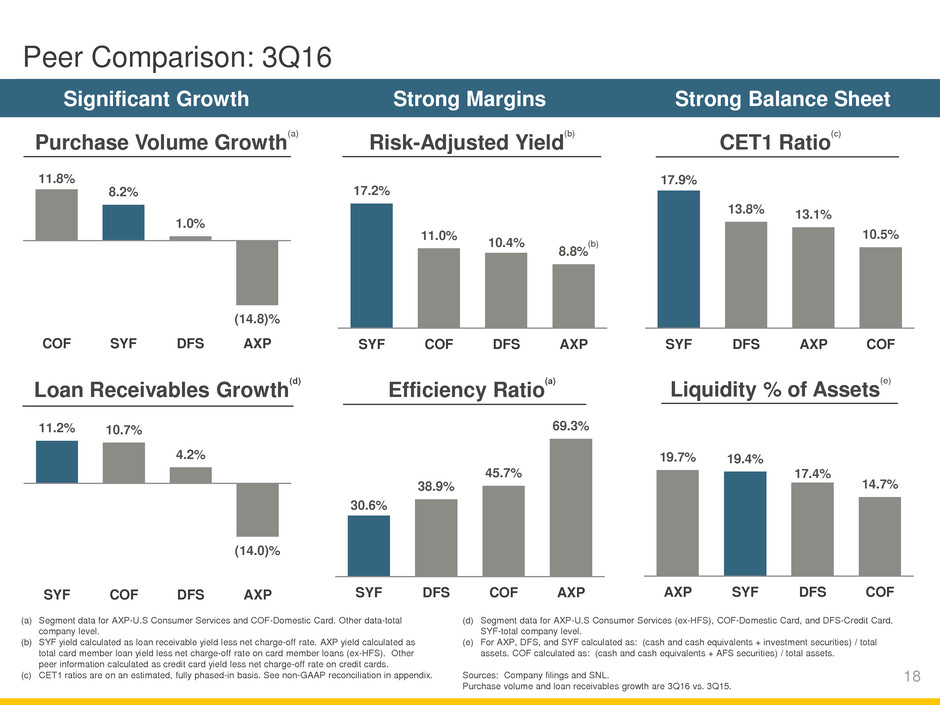

(a) Segment data for AXP-U.S Consumer Services and COF-Domestic Card. Other data-total

company level.

(b) SYF yield calculated as loan receivable yield less net charge-off rate. AXP yield calculated as

total card member loan yield less net charge-off rate on card member loans (ex-HFS). Other

peer information calculated as credit card yield less net charge-off rate on credit cards.

(c) CET1 ratios are on an estimated, fully phased-in basis. See non-GAAP reconciliation in appendix.

30.6%

38.9%

45.7%

69.3%

SYF DFS COF AXP

Efficiency Ratio

(a)

Risk-Adjusted Yield

(b)

17.2%

11.0%

10.4%

8.8%

SYF COF DFS AXP

11.8%

8.2%

1.0%

(14.8)%

COF SYF DFS AXP

Purchase Volume Growth

(a)

Liquidity % of Assets

(e)

19.7% 19.4%

17.4%

14.7%

AXP SYF DFS COF

17.9%

13.8% 13.1%

10.5%

SYF DFS AXP COF

CET1 Ratio

(c)

Strong Margins Significant Growth Strong Balance Sheet

Loan Receivables Growth

(d)

11.2% 10.7%

4.2%

(14.0)%

SYF COF DFS AXP

(d) Segment data for AXP-U.S Consumer Services (ex-HFS), COF-Domestic Card, and DFS-Credit Card.

SYF-total company level.

(e) For AXP, DFS, and SYF calculated as: (cash and cash equivalents + investment securities) / total

assets. COF calculated as: (cash and cash equivalents + AFS securities) / total assets.

Sources: Company filings and SNL.

Purchase volume and loan receivables growth are 3Q16 vs. 3Q15.

Peer Comparison: 3Q16

(b)

19

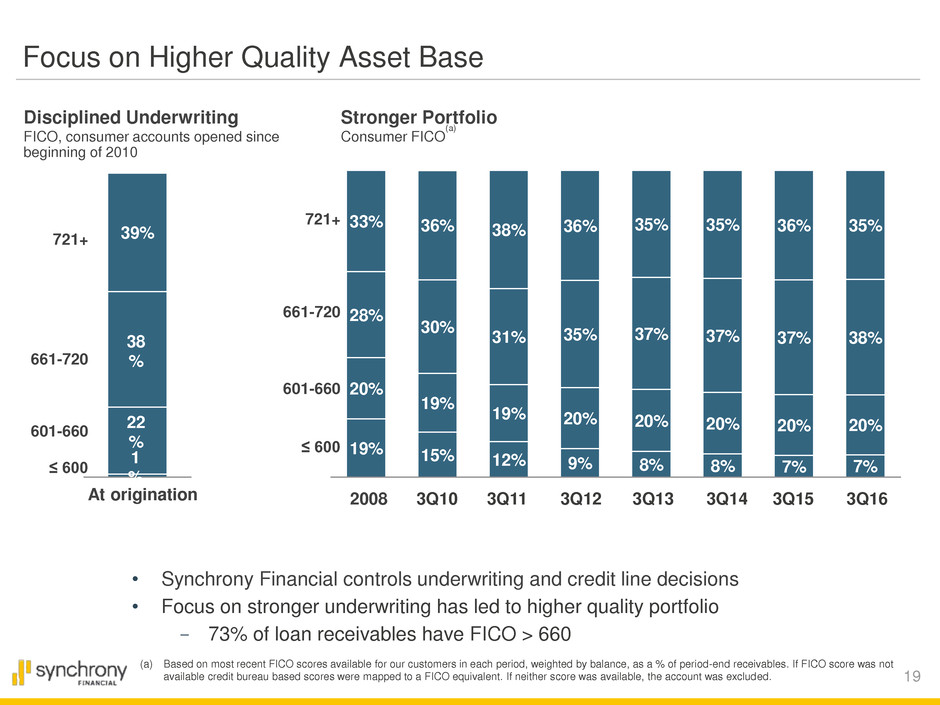

1

%

22

%

38

%

39%

19% 15% 12% 9% 8% 8% 7% 7%

20%

19%

19% 20% 20% 20% 20% 20%

28%

30%

31% 35% 37% 37% 37% 38%

33% 36% 38% 36% 35% 35% 36% 35%

• Synchrony Financial controls underwriting and credit line decisions

• Focus on stronger underwriting has led to higher quality portfolio

- 73% of loan receivables have FICO > 660

Stronger Portfolio

Consumer FICO

(a)

(a) Based on most recent FICO scores available for our customers in each period, weighted by balance, as a % of period-end receivables. If FICO score was not

available credit bureau based scores were mapped to a FICO equivalent. If neither score was available, the account was excluded.

601-660

2008 3Q16

≤ 600

≤ 600

601-660

661-720

721+

At origination

Disciplined Underwriting

FICO, consumer accounts opened since

beginning of 2010

Focus on Higher Quality Asset Base

3Q15 3Q14 3Q13 3Q12 3Q11 3Q10

661-720

721+

20

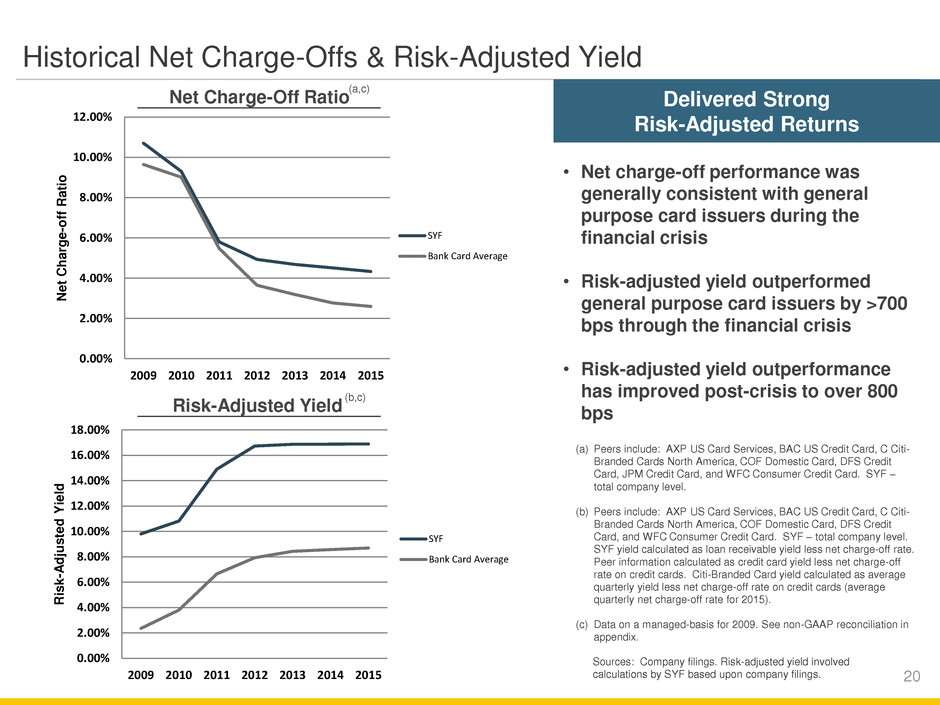

Net Charge-Off Ratio

Risk-Adjusted Yield

(a) Peers include: AXP US Card Services, BAC US Credit Card, C Citi-

Branded Cards North America, COF Domestic Card, DFS Credit

Card, JPM Credit Card, and WFC Consumer Credit Card. SYF –

total company level.

(b) Peers include: AXP US Card Services, BAC US Credit Card, C Citi-

Branded Cards North America, COF Domestic Card, DFS Credit

Card, and WFC Consumer Credit Card. SYF – total company level.

SYF yield calculated as loan receivable yield less net charge-off rate.

Peer information calculated as credit card yield less net charge-off

rate on credit cards. Citi-Branded Card yield calculated as average

quarterly yield less net charge-off rate on credit cards (average

quarterly net charge-off rate for 2015).

(c) Data on a managed-basis for 2009. See non-GAAP reconciliation in

appendix.

(a,c)

(b,c)

• Net charge-off performance was

generally consistent with general

purpose card issuers during the

financial crisis

• Risk-adjusted yield outperformed

general purpose card issuers by >700

bps through the financial crisis

• Risk-adjusted yield outperformance

has improved post-crisis to over 800

bps

Delivered Strong

Risk-Adjusted Returns

Historical Net Charge-Offs & Risk-Adjusted Yield

Sources: Company filings. Risk-adjusted yield involved

calculations by SYF based upon company filings.

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

2009 2010 2011 2012 2013 2014 2015

Ne

t C

h

a

rg

e

-o

ff

Ra

ti

o

SYF

Bank Card Average

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

2009 2010 2011 2012 2013 2014 2015

Ris

k

-A

d

jus

ted

Y

ie

ld

SYF

Bank Card Average

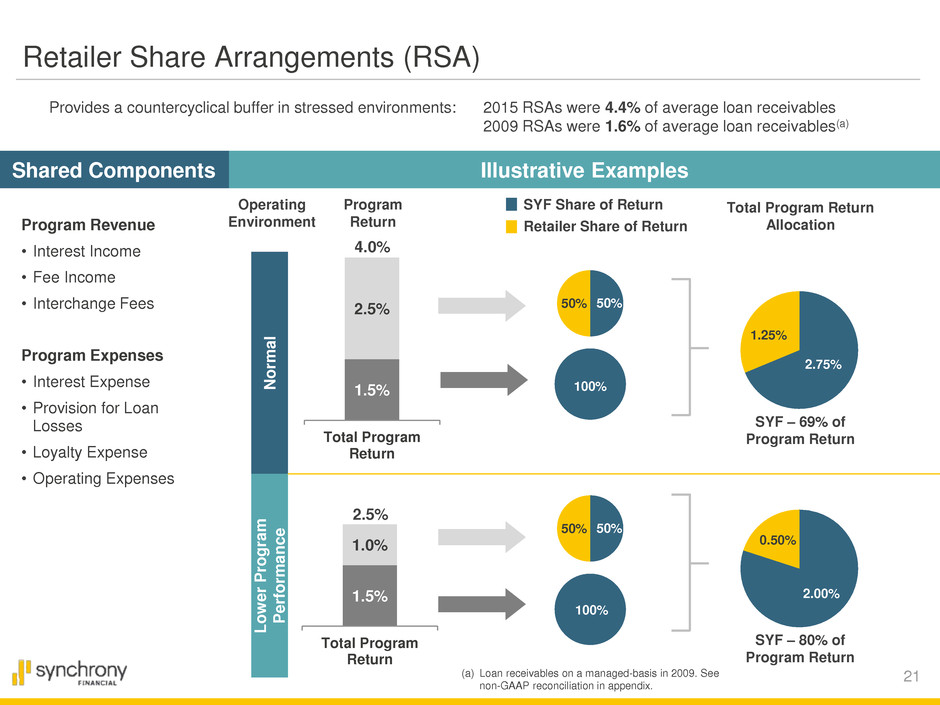

21

100%

50% 50%

1.5%

2.5%

Total Program

Return

Shared Components Illustrative Examples

Program Revenue

• Interest Income

• Fee Income

• Interchange Fees

Program Expenses

• Interest Expense

• Provision for Loan

Losses

• Loyalty Expense

• Operating Expenses

SYF Share of Return

Retailer Share of Return

2.75%

1.25%

4.0%

Total Program Return

Allocation

Provides a countercyclical buffer in stressed environments: 2015 RSAs were 4.4% of average loan receivables

2009 RSAs were 1.6% of average loan receivables(a)

100%

50% 50%

1.5%

1.0%

Total Program

Return

2.00%

0.50%

2.5%

N

orma

l

Lo

w

e

r

P

rogr

a

m

P

e

rf

o

rm

a

nc

e

Operating

Environment

Program

Return

(a) Loan receivables on a managed-basis in 2009. See

non-GAAP reconciliation in appendix.

Retailer Share Arrangements (RSA)

SYF – 69% of

Program Return

SYF – 80% of

Program Return

22

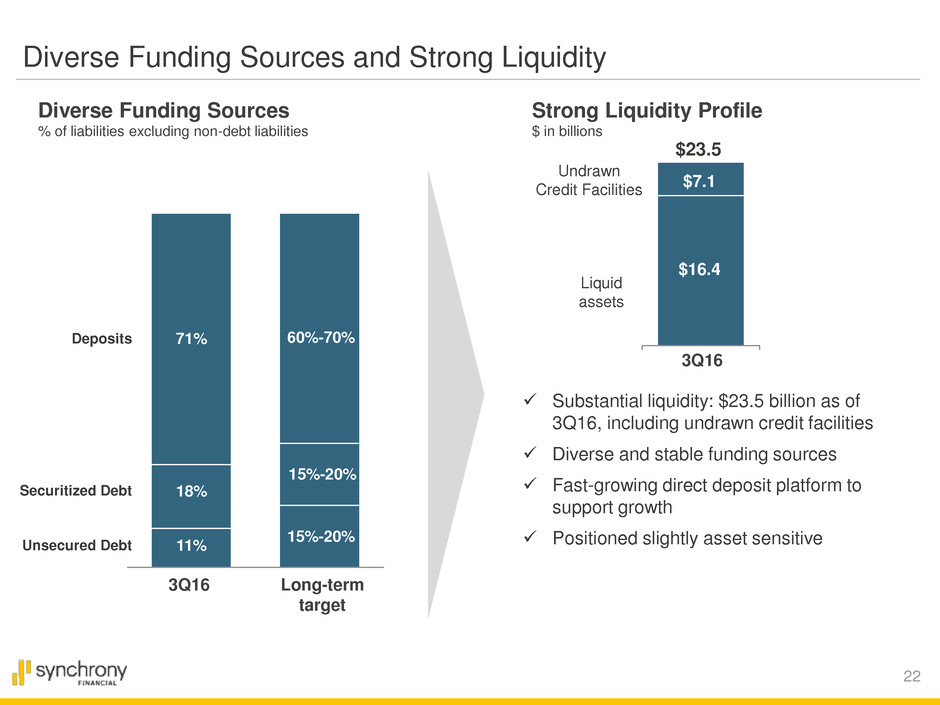

Diverse Funding Sources and Strong Liquidity

Deposits

Securitized Debt

Unsecured Debt

3Q16 Long-term

target

11%

71%

18%

15%-20%

60%-70%

15%-20%

Diverse Funding Sources

% of liabilities excluding non-debt liabilities

Strong Liquidity Profile

$ in billions

$23.5

Liquid

assets

Undrawn

Credit Facilities

$7.1

$16.4

Substantial liquidity: $23.5 billion as of

3Q16, including undrawn credit facilities

Diverse and stable funding sources

Fast-growing direct deposit platform to

support growth

Positioned slightly asset sensitive

3Q16

23

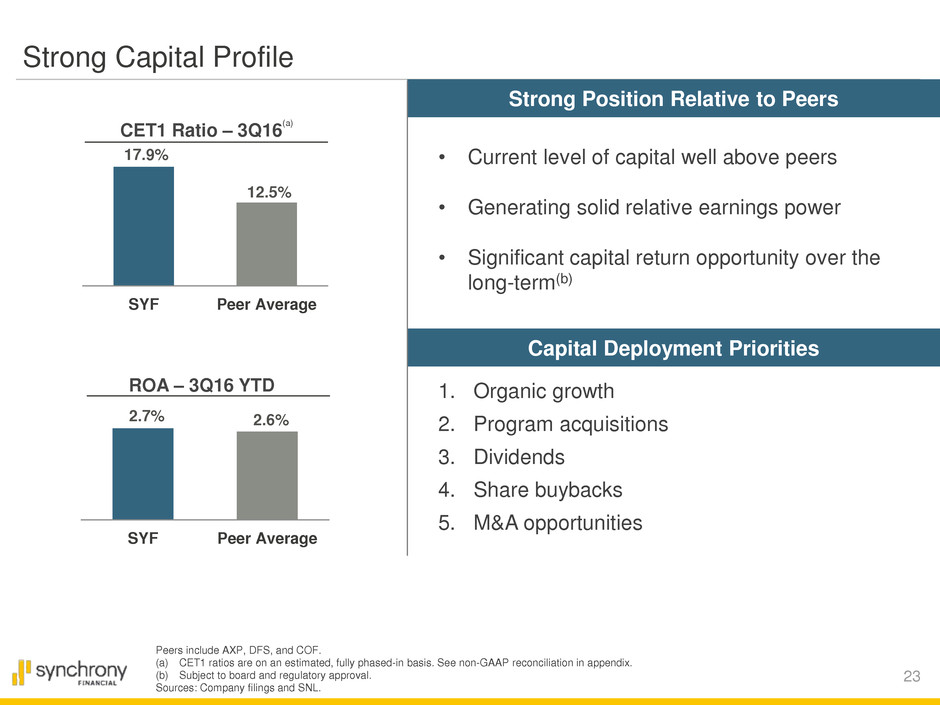

Strong Position Relative to Peers

Strong Capital Profile

Peers include AXP, DFS, and COF.

(a) CET1 ratios are on an estimated, fully phased-in basis. See non-GAAP reconciliation in appendix.

(b) Subject to board and regulatory approval.

Sources: Company filings and SNL.

2.7% 2.6%

SYF Peer Average

ROA – 3Q16 YTD

17.9%

12.5%

SYF Peer Average

CET1 Ratio – 3Q16

(a)

• Current level of capital well above peers

• Generating solid relative earnings power

• Significant capital return opportunity over the

long-term(b)

Capital Deployment Priorities

1. Organic growth

2. Program acquisitions

3. Dividends

4. Share buybacks

5. M&A opportunities

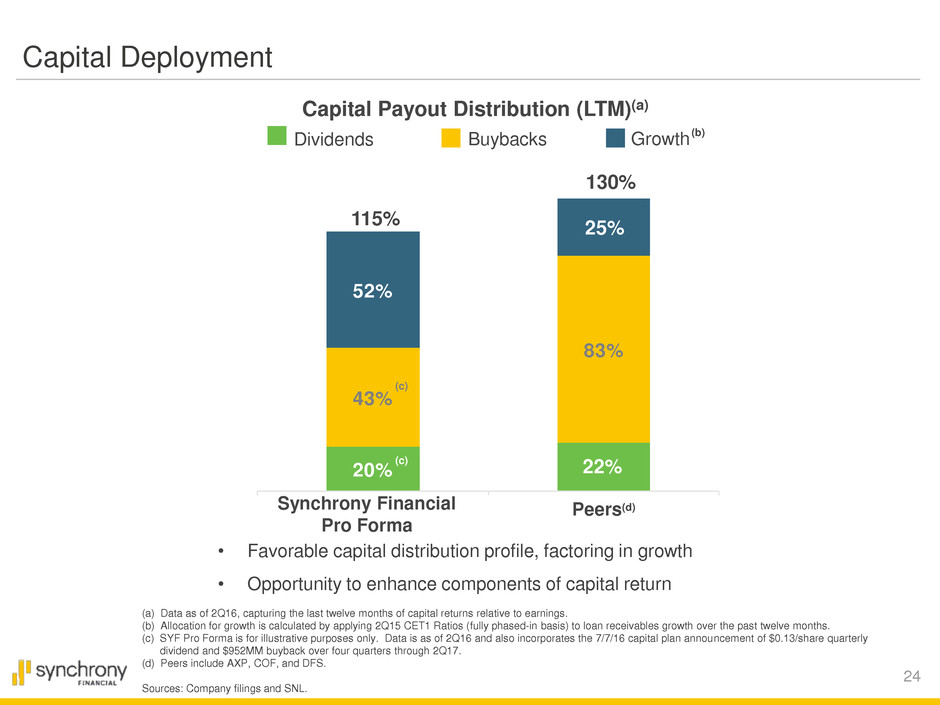

24

Growth Buybacks Dividends

Capital Deployment

(a) Data as of 2Q16, capturing the last twelve months of capital returns relative to earnings.

(b) Allocation for growth is calculated by applying 2Q15 CET1 Ratios (fully phased-in basis) to loan receivables growth over the past twelve months.

(c) SYF Pro Forma is for illustrative purposes only. Data is as of 2Q16 and also incorporates the 7/7/16 capital plan announcement of $0.13/share quarterly

dividend and $952MM buyback over four quarters through 2Q17.

(d) Peers include AXP, COF, and DFS.

Sources: Company filings and SNL.

Capital Payout Distribution (LTM)(a)

• Favorable capital distribution profile, factoring in growth

• Opportunity to enhance components of capital return

(b)

20% 21%

43%

83%

52%

26%

115%

130%

Synchrony Financial

Pro Forma

Peers(d)

(c)

(c)

25%

22%

25

Strategic Priorities

Grow our business through our three sales platforms

Position business for long-term growth

Operate with a strong balance sheet and financial profile

Leverage strong capital position

Expand robust data, analytics and digital capabilities

• Grow existing retailer penetration

• Continue to innovate and provide robust cardholder value propositions

• Add new partners and programs with attractive risk and return profiles

• Accelerate capabilities: marketing, analytics and loyalty

• Continue to leverage SKU level data and invest in CRM to differentiate marketing capabilities

• Deliver leading capabilities across digital and mobile technologies

• Explore opportunities to expand the core business (e.g., grow small business platform)

• Continue to grow Synchrony Bank — enhance offerings to increase loyalty, diversify funding and drive profitability

• Maintain strong capital and liquidity

• Deliver earnings growth at attractive returns

• Organic growth, program acquisitions, and start-up opportunities

• Continue capital plan execution through dividends and share repurchase program, subject to Board and regulatory approvals

• Invest in capability-enhancing technologies and businesses

Appendix

27

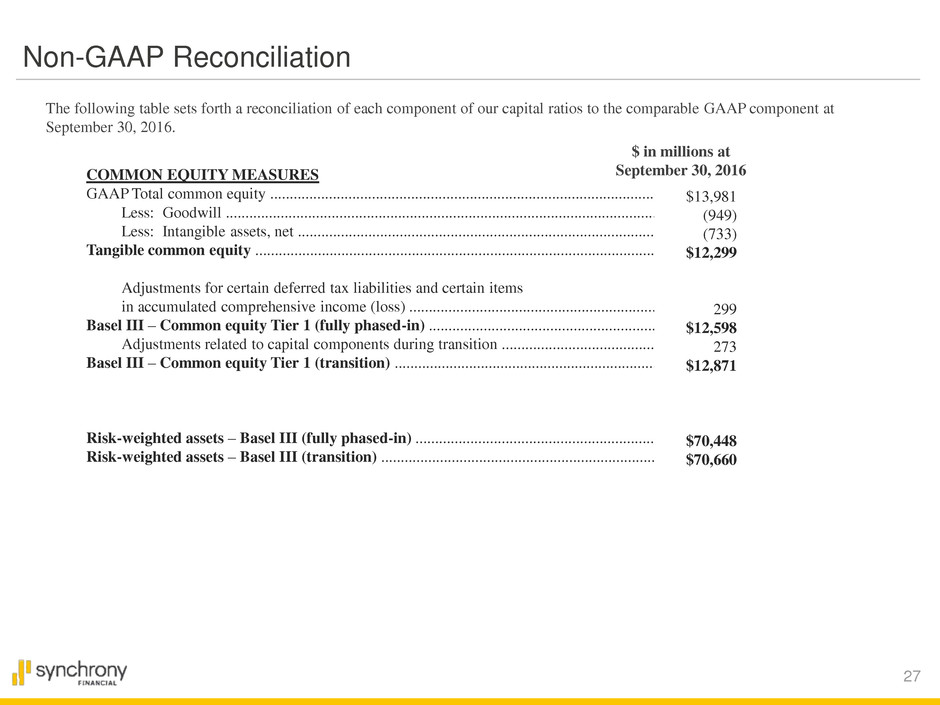

Non-GAAP Reconciliation

The following table sets forth a reconciliation of each component of our capital ratios to the comparable GAAP component at

September 30, 2016.

COMMON EQUITY MEASURES

GAAP Total common equity ....................................................................................................

Less: Goodwill ...............................................................................................................

Less: Intangible assets, net .............................................................................................

Tangible common equity ........................................................................................................

Adjustments for certain deferred tax liabilities and certain items

in accumulated comprehensive income (loss) ................................................................

Basel III – Common equity Tier 1 (fully phased-in) ............................................................

Adjustments related to capital components during transition ........................................

Basel III – Common equity Tier 1 (transition) ...................................................................

Risk-weighted assets – Basel III (fully phased-in) ..............................................................

Risk-weighted assets – Basel III (transition) .......................................................................

$13,981

(949)

(733)

$12,299

299

$12,598

273

$12,871

$70,448

$70,660

$ in millions at

September 30, 2016

28

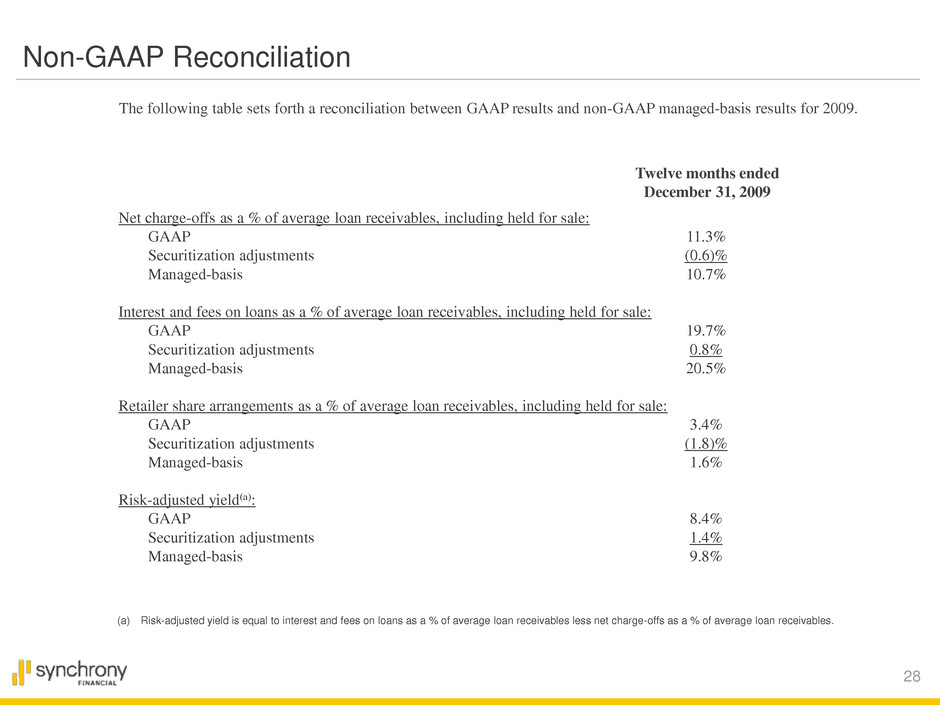

Non-GAAP Reconciliation

The following table sets forth a reconciliation between GAAP results and non-GAAP managed-basis results for 2009.

Net charge-offs as a % of average loan receivables, including held for sale:

GAAP 11.3%

Securitization adjustments (0.6)%

Managed-basis 10.7%

Interest and fees on loans as a % of average loan receivables, including held for sale:

GAAP 19.7%

Securitization adjustments 0.8%

Managed-basis 20.5%

Retailer share arrangements as a % of average loan receivables, including held for sale:

GAAP 3.4%

Securitization adjustments (1.8)%

Managed-basis 1.6%

Risk-adjusted yield(a):

GAAP 8.4%

Securitization adjustments 1.4%

Managed-basis 9.8%

Twelve months ended

December 31, 2009

(a) Risk-adjusted yield is equal to interest and fees on loans as a % of average loan receivables less net charge-offs as a % of average loan receivables.