3Q’16 Financial Results

October 21, 2016

Exhibit 99.3

2

Cautionary Statement Regarding Forward-Looking Statements

The following slides are part of a presentation by Synchrony Financial in connection with reporting quarterly financial results. No representation is made that the information in these slides is complete. For

additional information, see the earnings release and financial supplement included as exhibits to our Current Report on Form 8-K filed today and available on our website (www.synchronyfinancial.com) and

the SEC’s website (www.sec.gov). All references to net earnings and net income are intended to have the same meaning.

This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

which are subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,”

“targets,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on

management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ

materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory

and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners,

concentration of our revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; higher borrowing costs and

adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization

facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; our ability to grow our deposits in the future; changes in market interest rates and

the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk,

the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share

arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and

services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; cyber-attacks or other security breaches; failure of third parties to provide various services

that are important to our operations; our transition to a replacement third-party vendor to manage the technology platform for our online retail deposits; disruptions in the operations of our computer systems

and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to

protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our

tax positions and state sales tax rules and regulations; a material indemnification obligation to GE under the tax sharing and separation agreement with GE if we cause the split-off from GE or certain

preliminary transactions to fail to qualify for tax-free treatment or in the case of certain significant transfers of our stock following the split-off; obligations associated with being an independent public

company; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the impact

of the Consumer Financial Protection Bureau’s regulation of our business; changes to our methods of offering our CareCredit products; impact of capital adequacy rules and liquidity requirements;

restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit Synchrony Bank’s ability to pay dividends to us; regulations relating to privacy, information

security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included

elsewhere in this presentation and in our public filings, including under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed on

February 25, 2016. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current

expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement

to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Differences between this

presentation and the supplemental financials may occur due to rounding.

Non-GAAP Measures

The information provided herein includes certain capital ratios, which are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The reconciliations of such measures to

the most directly comparable GAAP measures are included in the appendix of this presentation.

Disclaimers

3

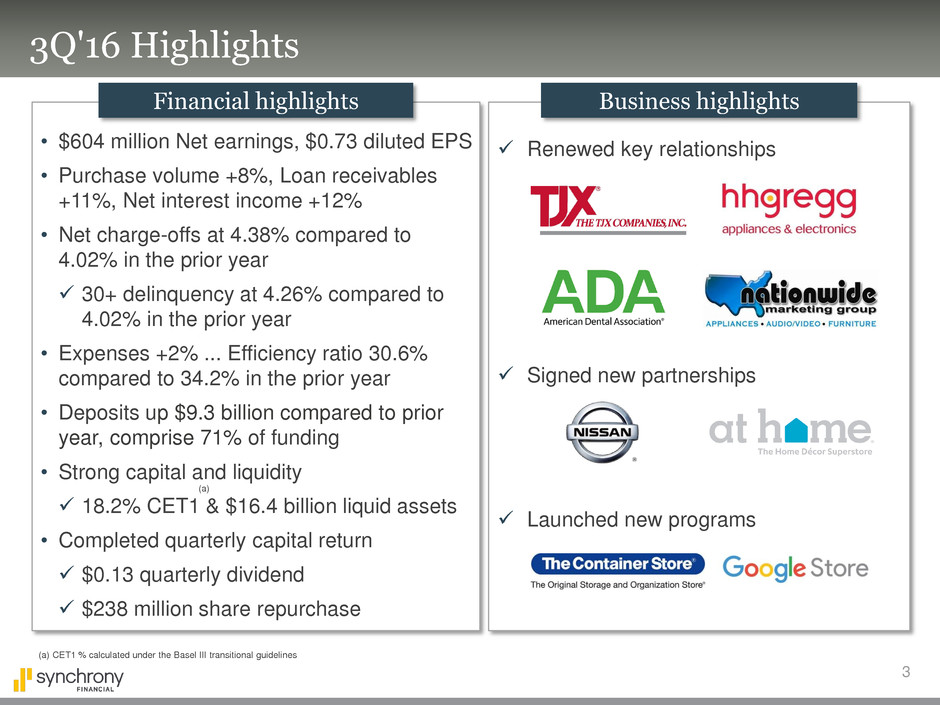

3Q'16 Highlights

Financial highlights

• $604 million Net earnings, $0.73 diluted EPS

• Purchase volume +8%, Loan receivables

+11%, Net interest income +12%

• Net charge-offs at 4.38% compared to

4.02% in the prior year

30+ delinquency at 4.26% compared to

4.02% in the prior year

• Expenses +2% ... Efficiency ratio 30.6%

compared to 34.2% in the prior year

• Deposits up $9.3 billion compared to prior

year, comprise 71% of funding

• Strong capital and liquidity

18.2% CET1 & $16.4 billion liquid assets

• Completed quarterly capital return

$0.13 quarterly dividend

$238 million share repurchase

(a)

(a) CET1 % calculated under the Basel III transitional guidelines

Business highlights

Renewed key relationships

Signed new partnerships

Launched new programs

4

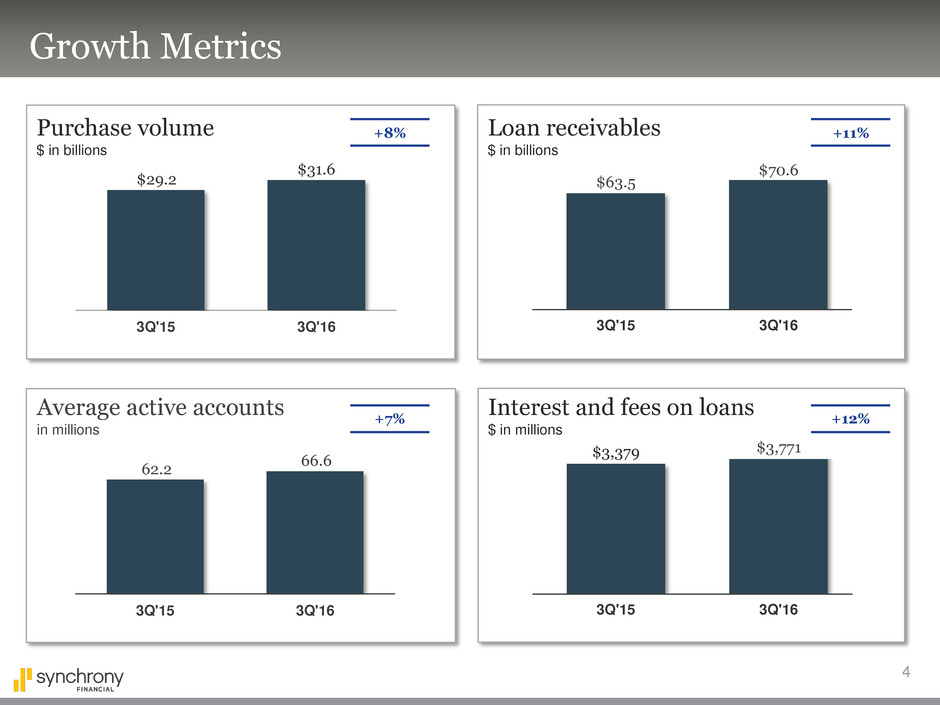

Growth Metrics

3Q'15 3Q'16

3Q'15 3Q'16

+8% Purchase volume

$ in billions

Loan receivables

$ in billions

Average active accounts

in millions

Interest and fees on loans

$ in millions

$29.2

$31.6

$63.5

$70.6

$3,771 $3,379

66.6

62.2

+7% +12%

+11%

3Q'15 3Q'16

3Q'15 3Q'16

5

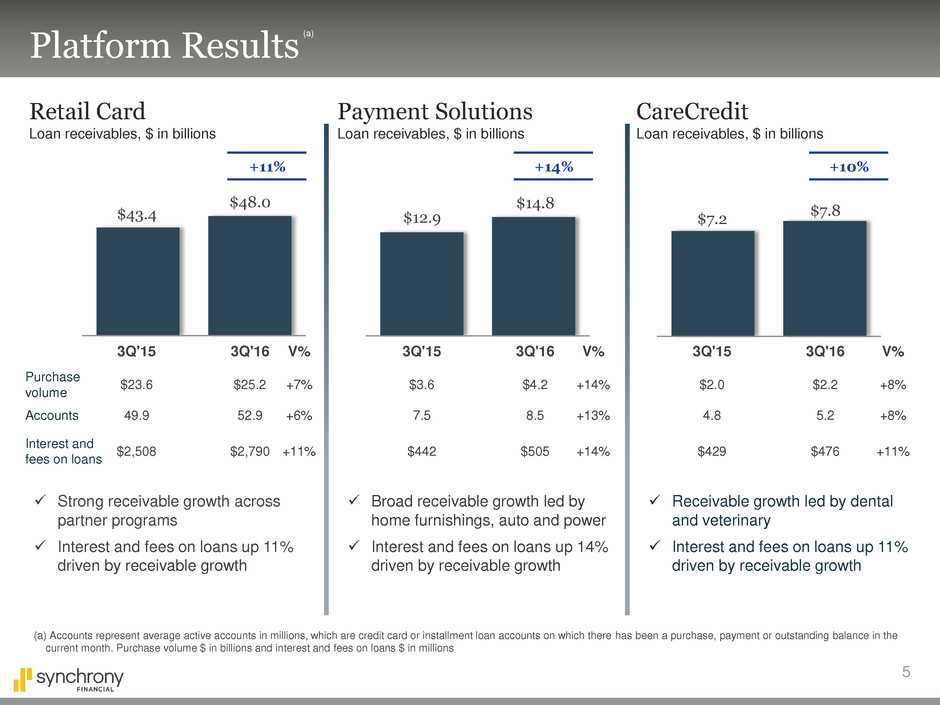

Platform Results

Retail Card

Loan receivables, $ in billions

$43.4

$48.0

3Q'15 3Q'16

Strong receivable growth across

partner programs

Interest and fees on loans up 11%

driven by receivable growth

Payment Solutions

Loan receivables, $ in billions

$12.9

$14.8

3Q'15 3Q'16

Broad receivable growth led by

home furnishings, auto and power

Interest and fees on loans up 14%

driven by receivable growth

CareCredit

Loan receivables, $ in billions

$7.2

$7.8

3Q'15 3Q'16

Receivable growth led by dental

and veterinary

Interest and fees on loans up 11%

driven by receivable growth

Purchase

volume

Accounts

$23.6

49.9

$25.2

52.9

+7%

+6%

$3.6

7.5

$4.2

8.5

+14%

+13%

$2.0

4.8

$2.2

5.2

+8%

+8%

Interest and

fees on loans

$2,508 $2,790 +11% $442 $505 +14% $429 $476 +11%

+11% +14% +10%

(a)

(a) Accounts represent average active accounts in millions, which are credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the

current month. Purchase volume $ in billions and interest and fees on loans $ in millions

V% V% V%

6

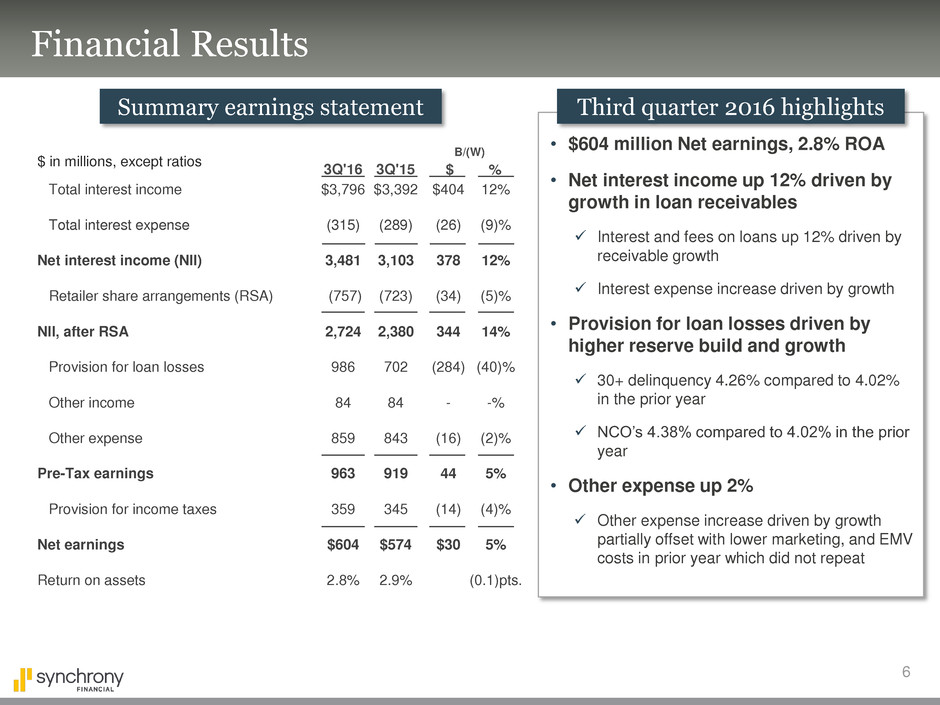

Financial Results

Summary earnings statement

Third quarter 2016 highlights

$ in millions, except ratios

Total interest income $3,796 $3,392 $404 12%

Total interest expense (315) (289) (26) (9)%

Net interest income (NII) 3,481 3,103 378 12%

Retailer share arrangements (RSA) (757) (723) (34) (5)%

NII, after RSA 2,724 2,380 344 14%

Provision for loan losses 986 702 (284) (40)%

Other income 84 84 - -%

Other expense 859 843 (16) (2)%

Pre-Tax earnings 963 919 44 5%

Provision for income taxes 359 345 (14) (4)%

Net earnings $604 $574 $30 5%

Return on assets 2.8% 2.9% (0.1)pts.

3Q'16 3Q'15 % $

B/(W)

• $604 million Net earnings, 2.8% ROA

• Net interest income up 12% driven by

growth in loan receivables

Interest and fees on loans up 12% driven by

receivable growth

Interest expense increase driven by growth

• Provision for loan losses driven by

higher reserve build and growth

30+ delinquency 4.26% compared to 4.02%

in the prior year

NCO’s 4.38% compared to 4.02% in the prior

year

• Other expense up 2%

Other expense increase driven by growth

partially offset with lower marketing, and EMV

costs in prior year which did not repeat

7

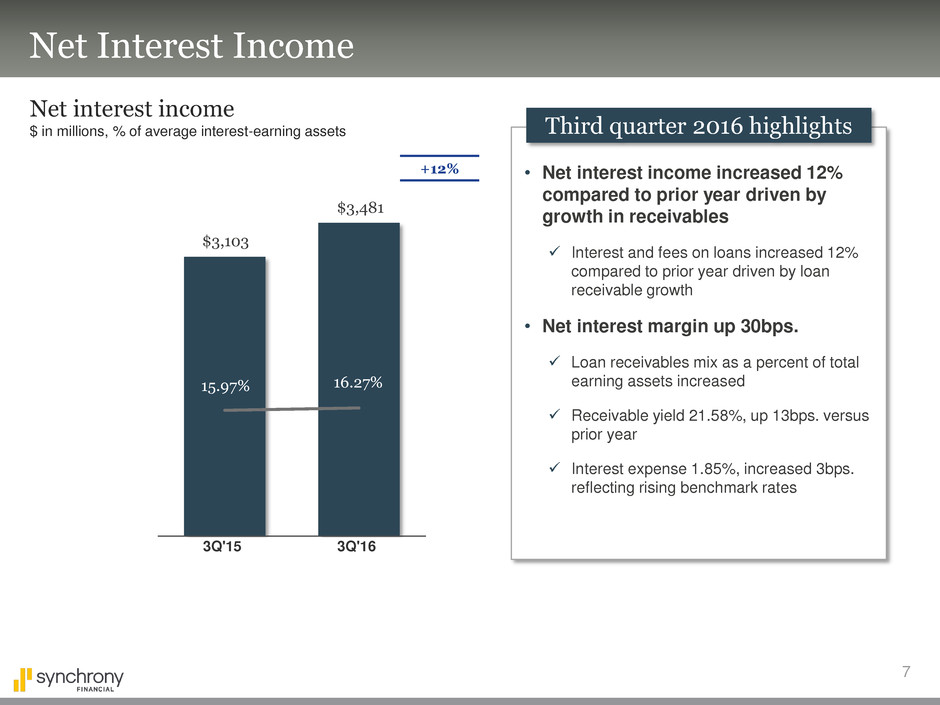

Net Interest Income

Third quarter 2016 highlights

• Net interest income increased 12%

compared to prior year driven by

growth in receivables

Interest and fees on loans increased 12%

compared to prior year driven by loan

receivable growth

• Net interest margin up 30bps.

Loan receivables mix as a percent of total

earning assets increased

Receivable yield 21.58%, up 13bps. versus

prior year

Interest expense 1.85%, increased 3bps.

reflecting rising benchmark rates

Net interest income

$ in millions, % of average interest-earning assets

15.97% 16.27%

3Q'15 3Q'16

+12%

$3,103

$3,481

8

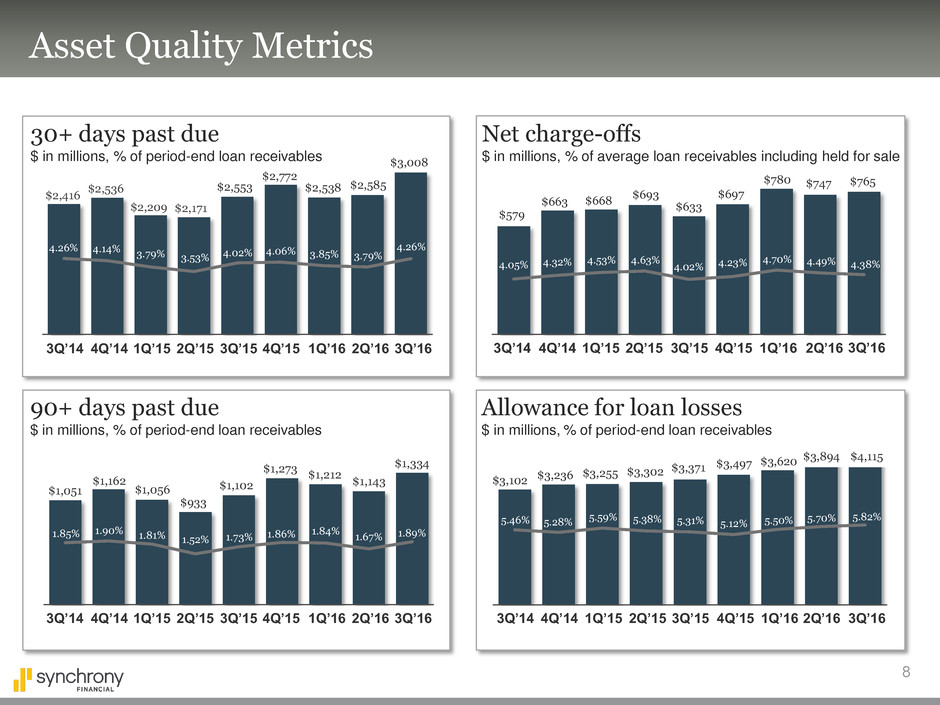

Asset Quality Metrics

Net charge-offs

$ in millions, % of average loan receivables including held for sale

30+ days past due

$ in millions, % of period-end loan receivables

$2,772

$2,416

$579

$2,536

$663 $2,209

$668

$2,171

$693

$633

$2,553

$697

4.05% 4.32% 4.53% 4.63% 4.02% 4.23%

Allowance for loan losses

$ in millions, % of period-end loan receivables

5.46%

$3,102

5.28%

$3,236

5.59%

$3,255

5.38%

$3,302

5.31%

$3,371

5.12%

$3,497

$2,538

$780

4.70%

5.50%

$3,620

$2,585

3Q’14 3Q’15 4Q’14 1Q’15 2Q’15 4Q’15 1Q’16 2Q’16

$747

4.49%

3Q’14 3Q’15 4Q’14 1Q’15 2Q’15 4Q’15 1Q’16 2Q’16

5.70%

$3,894

90+ days past due

$ in millions, % of period-end loan receivables

4.26%

$1,051

4.02%

1.85%

4.14%

$1,162

1.90%

3.79%

$1,056

1.81%

3.53%

$933

1.52%

$1,102

1.73%

4.06%

$1,273

1.86%

3.85%

$1,212

1.84%

3.79%

$1,143

1.67%

$3,008

4.26%

$765

4.38%

3Q’16

3Q’14 3Q’15 4Q’14 1Q’15 2Q’15 4Q’15 1Q’16 2Q’16 3Q’16

$1,334

1.89%

3Q’16

5.82%

$4,115

3Q’14 3Q’15 4Q’14 1Q’15 2Q’15 4Q’15 1Q’16 2Q’16 3Q’16

9

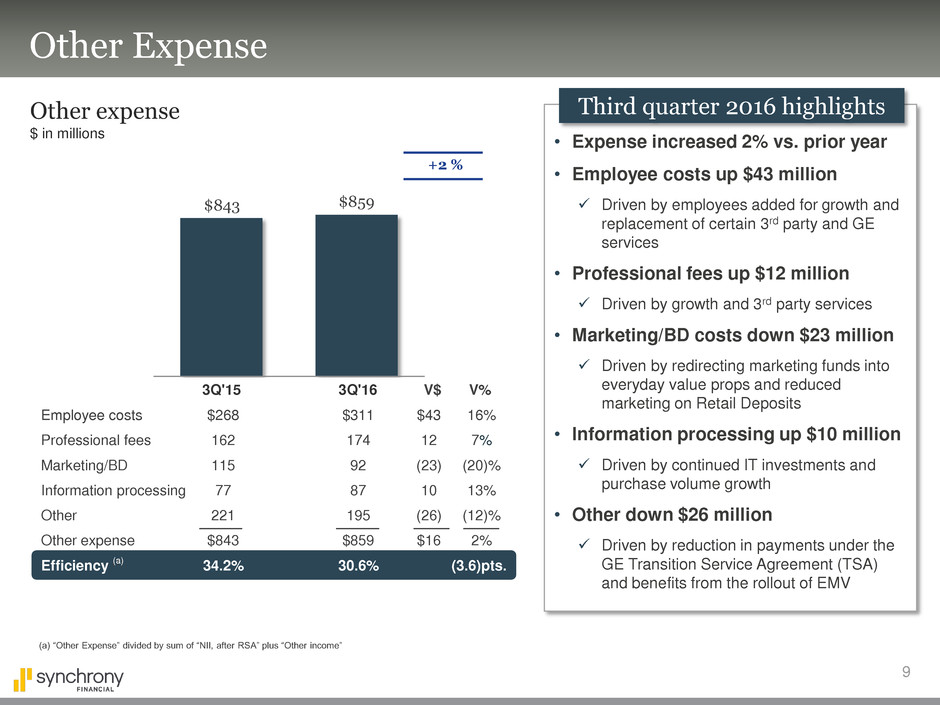

Other expense

$ in millions

Other Expense

Employee costs $268 $311 $43 16%

Professional fees 162 174 12 7%

Marketing/BD 115 92 (23) (20)%

Information processing 77 87 10 13%

Other 221 195 (26) (12)%

Other expense $843 $859 $16 2%

Efficiency 34.2% 30.6% (3.6)pts.

$843

(a) “Other Expense” divided by sum of “NII, after RSA” plus “Other income”

(1)

V$ V%

+2 %

(a)

$859

3Q'15 3Q'16

Third quarter 2016 highlights

• Expense increased 2% vs. prior year

• Employee costs up $43 million

Driven by employees added for growth and

replacement of certain 3rd party and GE

services

• Professional fees up $12 million

Driven by growth and 3rd party services

• Marketing/BD costs down $23 million

Driven by redirecting marketing funds into

everyday value props and reduced

marketing on Retail Deposits

• Information processing up $10 million

Driven by continued IT investments and

purchase volume growth

• Other down $26 million

Driven by reduction in payments under the

GE Transition Service Agreement (TSA)

and benefits from the rollout of EMV

10

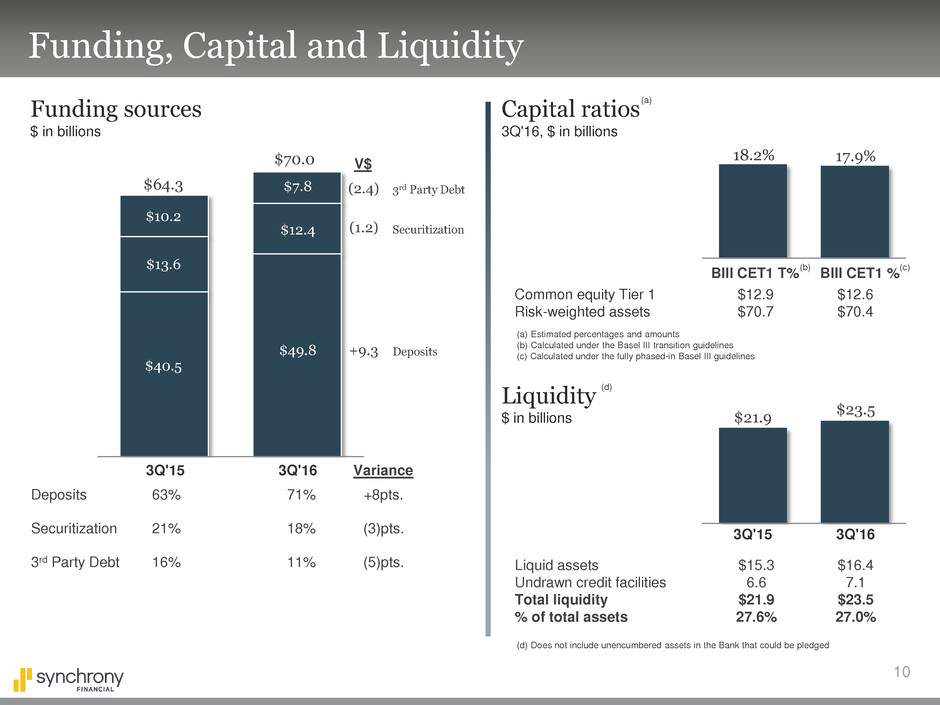

Funding, Capital and Liquidity

(c)

Liquid assets $15.3 $16.4

Undrawn credit facilities 6.6 7.1

Total liquidity $21.9 $23.5

% of total assets 27.6% 27.0%

Common equity Tier 1 $12.9 $12.6

Risk-weighted assets $70.7 $70.4

Liquidity

$ in billions

3Q'16

$23.5

$21.9

3Q'15

Capital ratios

3Q'16, $ in billions

BIII CET1 T%

(d) Does not include unencumbered assets in the Bank that could be pledged

(d)

BIII CET1 %

(a) Estimated percentages and amounts

(b) Calculated under the Basel III transition guidelines

(c) Calculated under the fully phased-in Basel III guidelines

18.2% 17.9%

Funding sources

$ in billions

3Q'15 3Q'16 Variance

Deposits 63% 71% +8pts.

Securitization 21% 18% (3)pts.

3rd Party Debt 16% 11% (5)pts.

$70.0

Deposits

Securitization

3rd Party Debt

V$

(a)

(b)

$40.5

$13.6

$10.2

$49.8

$12.4

$7.8 $64.3 (2.4)

(1.2)

+9.3

11

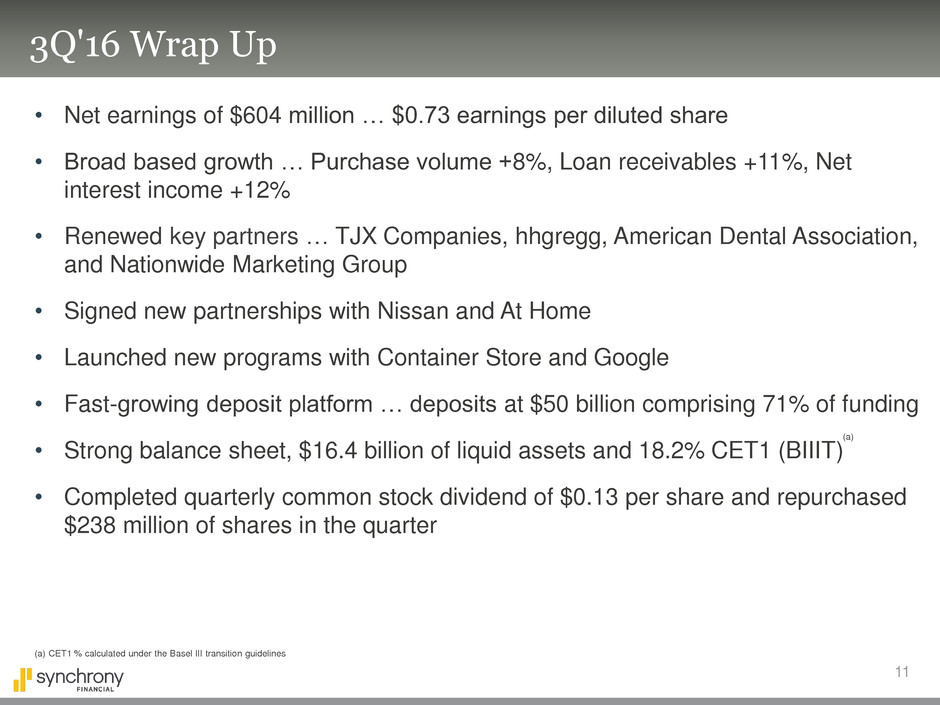

3Q'16 Wrap Up

• Net earnings of $604 million … $0.73 earnings per diluted share

• Broad based growth … Purchase volume +8%, Loan receivables +11%, Net

interest income +12%

• Renewed key partners … TJX Companies, hhgregg, American Dental Association,

and Nationwide Marketing Group

• Signed new partnerships with Nissan and At Home

• Launched new programs with Container Store and Google

• Fast-growing deposit platform … deposits at $50 billion comprising 71% of funding

• Strong balance sheet, $16.4 billion of liquid assets and 18.2% CET1 (BIIIT)

• Completed quarterly common stock dividend of $0.13 per share and repurchased

$238 million of shares in the quarter

(a)

(a) CET1 % calculated under the Basel III transition guidelines

Engage with us.

13

Appendix

14

Non-GAAP Reconciliation

We present certain capital ratios. Our Basel III Tier 1 common ratio, calculated on a fully phased-in basis, is a

preliminary estimate reflecting management’s interpretation of the final Basel III capital rules adopted in July 2013 by

the Federal Reserve Board, which have not been fully implemented, and our estimate and interpretations are subject to,

among other things, ongoing regulatory review and implementation guidance. This ratio is not currently required by

regulators to be disclosed, and therefore is considered a non-GAAP measure. We believe this capital ratio is a useful

measure to investors because it is widely used by analysts and regulators to assess the capital position of financial

services companies, although this ratio may not be comparable to similarly titled measures reported by other companies.

15

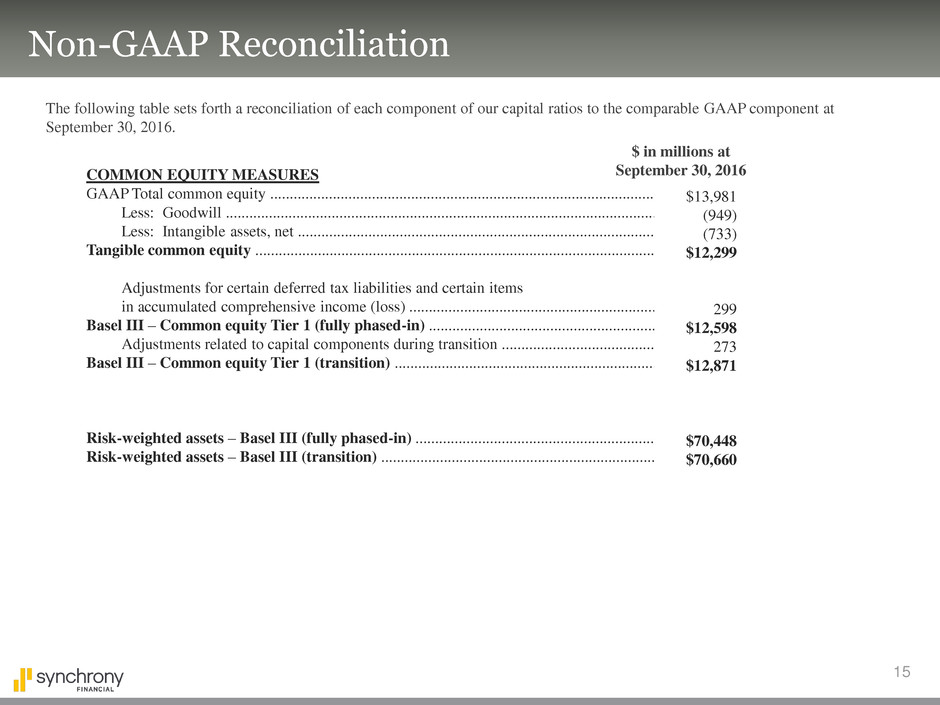

Non-GAAP Reconciliation

The following table sets forth a reconciliation of each component of our capital ratios to the comparable GAAP component at

September 30, 2016.

COMMON EQUITY MEASURES

GAAP Total common equity ....................................................................................................

Less: Goodwill ...............................................................................................................

Less: Intangible assets, net .............................................................................................

Tangible common equity ........................................................................................................

Adjustments for certain deferred tax liabilities and certain items

in accumulated comprehensive income (loss) ................................................................

Basel III – Common equity Tier 1 (fully phased-in) ............................................................

Adjustments related to capital components during transition ........................................

Basel III – Common equity Tier 1 (transition) ...................................................................

Risk-weighted assets – Basel III (fully phased-in) ..............................................................

Risk-weighted assets – Basel III (transition) .......................................................................

$13,981

(949)

(733)

$12,299

299

$12,598

273

$12,871

$70,448

$70,660

$ in millions at

September 30, 2016