OTHER BUSINESS

The Board has no knowledge of any other matter to be submitted at the Annual Meeting. If any other matter shall properly come before the Annual Meeting, including a question of adjourning or postponing the meeting, the persons named in this proxy statement will have discretionary authority to vote the shares thereby represented in accordance with their best judgment.

ANNUAL REPORT AND COMPANY INFORMATION

A copy of our 2022 Annual Report is being furnished to stockholders concurrently herewith. Our Annual Report and other reports we file with the SEC are available free of charge on our website as soon as reasonably practicable after they are electronically filed or furnished to the SEC at http://investors.synchrony.com under “SEC Filings.”

STOCKHOLDER PROPOSALS FOR THE 2024 ANNUAL MEETING

Proposals that stockholders wish to submit for inclusion in our proxy statement for our 2024 Annual Meeting of Stockholders pursuant to Rule 14a-8 under the Exchange Act must be received by our Corporate Secretary at Synchrony Financial, 777 Long Ridge Road, Stamford, Connecticut 06902 no later than December 5, 2023. Any stockholder proposal submitted for inclusion must be eligible for inclusion in our proxy statement in accordance with the rules and regulations promulgated by the SEC.

With respect to proposals submitted by a stockholder for consideration at our 2024 annual meeting but not for inclusion in our proxy statement for such annual meeting, timely notice of any stockholder proposal must be received by us in accordance with our Bylaws no earlier than January 19, 2024, nor later than February 18, 2024. Such notice must contain the information required by our laws.

Stockholders who intend to submit director nominees for inclusion in our proxy statement for the 2024 annual meeting must comply with the requirements of proxy access as set forth in our Bylaws. The stockholder or group of stockholders who wish to submit director nominees pursuant to proxy access must deliver the required materials to the Company not earlier than November 5, 2023, nor later than December 5, 2023. Stockholders who wish to propose director nominees at the 2024 annual meeting but not include such nominees in our proxy statement must deliver notice to the Company at its principal executive offices no earlier than January 19, 2024, nor later than February 18, 2024, and such notice must otherwise comply with our Bylaws. In addition, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 19, 2024.

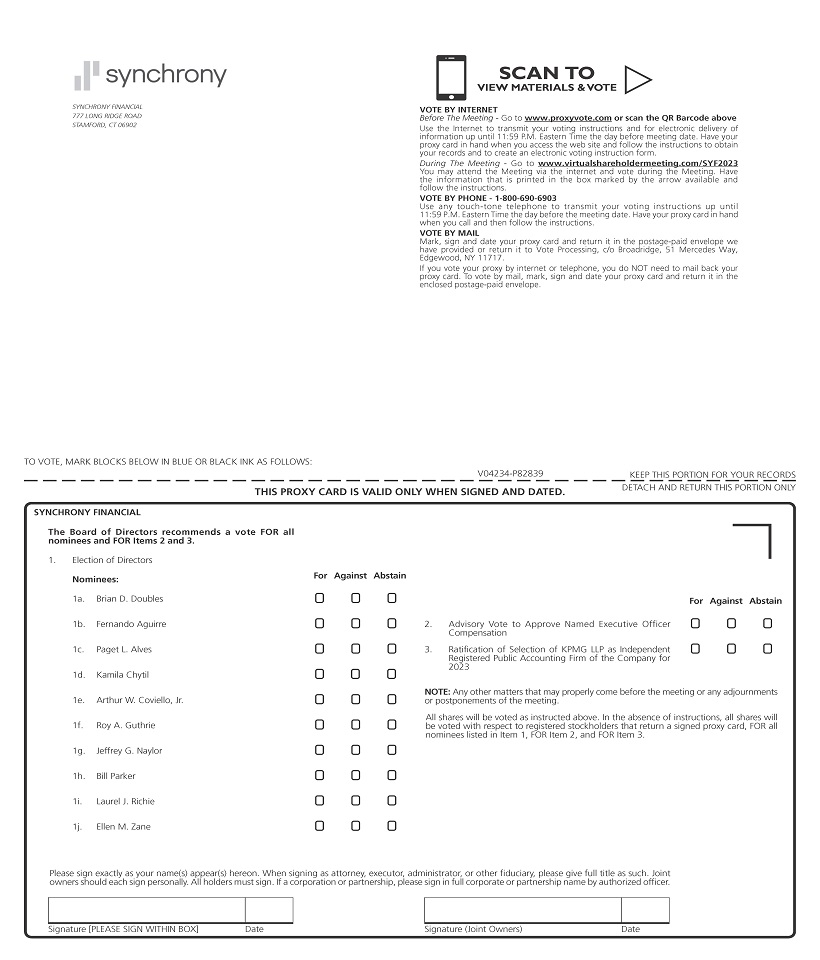

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING TO BE HELD ON MAY 18, 2023

Our proxy materials relating to our Annual Meeting (Notice, proxy statement and annual report) are available at www.proxyvote.com.

76 / 2023 ANNUAL MEETING AND PROXY STATEMENT