UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Notice of 2017

Annual Meeting

and Proxy Statement

TO BE HELD MAY 18, 2017

Synchrony FINANCIAL

NOTICE OF 2017 ANNUAL MEETING

OF STOCKHOLDERS

|

|

|

|

| |||

| Time | Date | Virtual Meeting Website Address | Record Date | |||

|

11:00 a.m. Eastern Time

|

May 18, 2017

|

www.virtualshareholdermeeting.com/SYF2017

|

March 23, 2017

|

Dear Stockholders:

You are invited to attend Synchrony Financial’s 2017 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 18, 2017 at 11:00 a.m., Eastern Time, for the following purposes:

| • | To elect the nine directors named in the proxy statement for the coming year; |

| • | To approve our named executive officers’ compensation in an advisory vote; |

| • | To approve the adoption of the amendment to the Synchrony Financial 2014 Long-Term Incentive Plan and re-approval of performance measures; |

| • | To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2017; and |

| • | To consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting. |

The meeting will again be held virtually to provide expanded access, improved communication and cost savings for our stockholders and Synchrony Financial. Hosting a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location. The website address for the virtual meeting is: www.virtualshareholdermeeting.com/SYF2017.

To participate in the meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials. The meeting will begin promptly at 11:00 a.m., Eastern Time. Online check-in will begin at 10:45 a.m., Eastern Time, and you should allow for time to complete the online check-in procedure. You are eligible to vote if you were a stockholder of record at the close of business on March 23, 2017. Proxy materials are being mailed or made available to stockholders on or about April 4, 2017. Whether or not you plan to attend the meeting, please submit your proxy by mail, internet or telephone to ensure that your shares are represented at the meeting.

Sincerely,

Jonathan S. Mothner

Executive Vice President,

General Counsel and Secretary

April 4, 2017

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE 2017 ANNUAL MEETING TO BE HELD ON MAY 18, 2017

Our proxy materials relating to our Annual Meeting (notice, proxy statement and annual report) are available at www.proxyvote.com.

2

3

3

TABLE OF CONTENTS, CONT.

4

|

|

This summary highlights certain information in this proxy statement in connection with our 2017 Annual Meeting of Stockholders (the “Annual Meeting”). As it is only a summary and does not contain all of the information you should consider, please review the complete proxy statement before you vote. In this proxy statement, references to the “Company” and to “Synchrony” are to Synchrony Financial. For answers to frequently asked questions regarding the Annual Meeting, please refer to the pages 60-63 of this proxy statement.

LOGISTICS

|

|

|

|

| |||

| Time | Date | Virtual Meeting Website Address | Record Date | |||

|

11:00 a.m. Eastern Time

|

May 18, 2017

|

www.virtualshareholdermeeting.com/SYF2017

|

March 23, 2017

|

ELIGIBILITY TO VOTE

You are eligible to vote if you were a stockholder of record at the close of business on March 23, 2017.

VOTING

|

BY MAIL | |

| You may date, sign and promptly return your proxy card by mail in a postage prepaid envelope (such proxy card must be received by May 17, 2017). | ||

|

BY TELEPHONE | |

| You may use the toll-free telephone number shown on your Notice of Internet Availability of Proxy Materials (the “Notice”) or proxy card up until 11:59 p.m., Eastern Time, on May 17, 2017. | ||

|

BY THE INTERNET | |

|

In Advance | ||

| You may visit the internet website indicated on your Notice or proxy card or scan the QR code indicated on your Notice or proxy card with your mobile device, and follow the on-screen instructions until 11:59 p.m., Eastern Time, on May 17, 2017. | ||

|

At the Annual Meeting | ||

| You may visit the internet website at the following address: www.virtualshareholdermeeting.com/SYF2017. | ||

AGENDA

|

Election of nine directors named in this proxy statement |

Advisory approval of our named executive officers’ compensation |

Approve the adoption of the amendment to the Synchrony Financial 2014 Long-Term Incentive Plan and re-approval of performance measures

|

Ratify the selection of KPMG LLP as our independent registered public accounting firm for 2017 | |||||||||

|

Majority of votes cast |

Majority of votes cast |

Majority of votes cast* |

Majority of votes cast | |||||||||

|

Page Reference — 12

|

Page Reference — 26 | Page Reference — 49 | Page Reference — 56 | |||||||||

|

|

|

|

| |||||||||

|

Board Recommendation |

Board Recommendation | Board Recommendation | Board Recommendation | |||||||||

| FOR | FOR | FOR | FOR |

*with abstentions counted as “votes cast” for this proposal only

5

5

|

PROXY SUMMARY |

||||

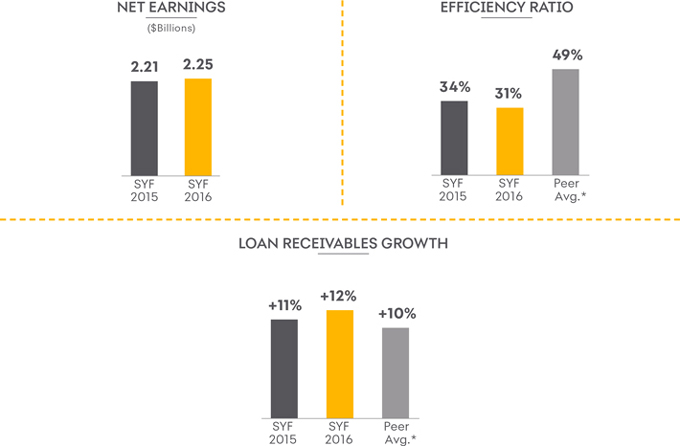

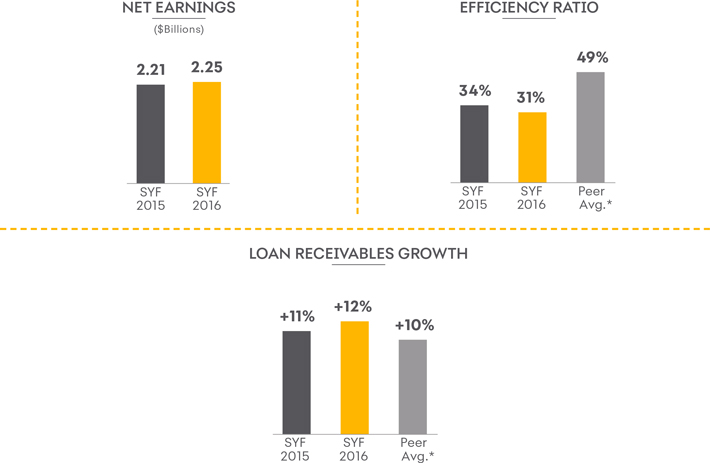

2016 PERFORMANCE HIGHLIGHTS

We performed very well in 2016 compared to goals established by the Management Development and Compensation Committee (the “MDCC”) of our Board of Directors (the “Board”) at the beginning of the year as well as to our direct peers (Discover Financial Services, Capital One, American Express). We generated strong financial performance, growing our core business through all three of our sales platforms (Retail Card, Payment Solutions and CareCredit). We grew loan receivables by 11.8% over 2015, increased net interest income and net earnings by 11.9% and 1.7%, respectively, over 2015 and achieved our target efficiency ratio of less than 34%. We forged new relationships with Cathay Pacific, Nissan and At Home; renewed programs with TJX Companies, Stein Mart, Ashley Furniture Homestore, La-Z-Boy, Nationwide Marketing Group and Suzuki; and launched programs with partners like Citgo, Marvel, GoogleStore, Fareportal, Mattress Firm and The Container Store. We maintained a strong balance sheet with robust capital and liquidity levels and diversified funding sources, growing deposits by 20.0% at December 31, 2016 as compared to deposits at December 31, 2015.

| Loan Receivables Grew |

Net Interest Income Increased |

Efficiency Ratio | Deposits Grew |

Online and Mobile Sales Grew | ||||

| 11.8% | 11.9% | 31% | 20% | 26% |

The following charts show our performance in 2016 compared to 2015 and in the case of Efficiency Ratio and Loan Receivables Growth our performance versus peers. For Synchrony, Efficiency Ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income.

* Peer Avg. = 2016 average for Discover Financial, Capital One and American Express, as publicly reported by such company.

6

|

|

PROXY SUMMARY |

||||

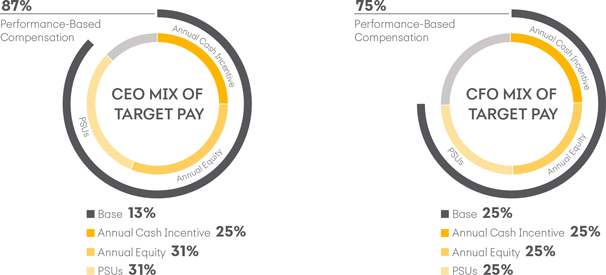

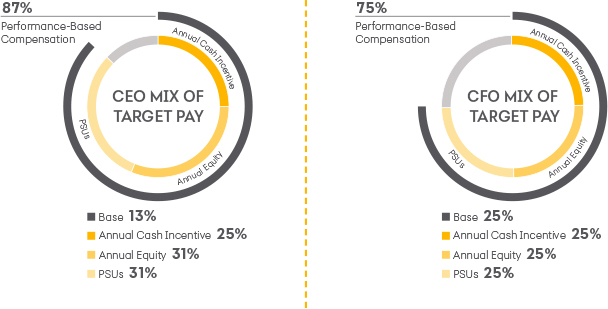

EXECUTIVE COMPENSATION

Target Pay

The MDCC reviews our compensation practices prior to making any decision on target pay and mix of pay, including (i) a detailed benchmarking study of peer compensation data, (ii) a pay for performance analysis comparing our compensation to our peers’ and to alignment with our performance, and (iii) a review of our executives’ stock ownership.

The chart below shows the target pay for our NEOs as of the end of 2016:

| Name | Position | Base Salary | Target Annual Cash Incentive Pay |

Target Annual Equity Award |

Target Long-Term Incentive Awards (PSUs) |

Target Total Pay | |||||||||||||||||||||

| Margaret Keane |

President and CEO | $1,100,000 | $2,200,000 | $2,750,000 | $2,750,000 | $8,800,000 | |||||||||||||||||||||

| Brian Doubles |

Executive Vice President, CFO | $ 685,000 | $ 685,000 | $ 685,000 | $ 685,000 | $2,740,000 | |||||||||||||||||||||

| Glenn Marino |

Executive Vice President, CEO— Payment Solutions and Chief Commercial Officer |

$ 750,000 | $ 600,000 | $ 600,000 | $ 600,000 | $2,550,000 | |||||||||||||||||||||

| Jonathan Mothner |

Executive Vice President, General Counsel and Secretary |

$ 700,000 | $ 560,000 | $ 560,000 | $ 560,000 | $2,380,000 | |||||||||||||||||||||

| Thomas Quindlen |

Executive Vice President and CEO—Retail Card |

$ 812,000 | $ 825,000 | $ 718,000 | $ 650,000 | $3,005,000 | |||||||||||||||||||||

Mix of Pay

The mix of target pay as of the end of 2016 for our CEO and CFO is shown below.

7

7

|

PROXY SUMMARY |

||||

COMPENSATION PRACTICES

The MDCC of the Board, which consists solely of independent directors, has implemented the following best practices with respect to executive compensation:

| What we do: | ||

| ✔ | Substantial portion of executive pay based on performance against goals set by the MDCC | |

| ✔ | Risk governance framework underlies compensation decisions | |

| ✔ | Stock ownership requirements for executive officers | |

| ✔ | Limited perquisites | |

| ✔ | Double-trigger vesting of equity and long-term incentive plan awards upon change in control | |

| ✔ | Compensation subject to claw-back in the event of misconduct | |

| ✔ | Independent compensation consultant advises the MDCC | |

| ✔ | Use of peer company benchmarking | |

| ✔ | One-year “Say-on-Pay” vote frequency | |

| What we don’t do: | ||

| Ò | No hedging or pledging of company stock | |

| Ò | No employment agreements for executive officers | |

| Ò | No tax gross-ups for executive officers | |

| Ò | No backdating or repricing of stock option awards | |

| Ò | No automatic or guaranteed annual salary increases | |

| Ò | No guaranteed bonuses or long-term incentive awards | |

CORPORATE GOVERNANCE

We believe that strong corporate governance is integral to building long-term value for our stockholders and enabling effective Board oversight. We are committed to governance policies and practices that serve the interests of the Company and its stockholders. The Board monitors emerging issues in the governance community and continually reviews our governance practices to incorporate evolving best practices and stockholder feedback.

2016 governance enhancements include:

Stockholder Engagement—We value our stockholders’ perspectives on our strategy and governance practices. We believe that maintaining a dialogue with our stockholders allows us to better understand and respond to their perspectives on matters of importance to them. In 2016, with input from members of our Board, we developed and implemented a plan to engage with a significant portion of our stockholders to proactively discuss strategy and governance matters such as board composition, diversity and compensation practices.

Majority Voting—To ensure that stockholders have a meaningful role in director elections, the Board changed the election standard in uncontested elections from a plurality vote standard to a majority vote standard in February 2016. Under a majority vote standard, a director nominee must receive an affirmative majority of votes cast in order to be elected, giving real meaning to withheld or negative votes and making directors more accountable to stockholders. The election standard in contested elections for directors remains a plurality standard.

Proxy Access—In October 2016, the Board amended and restated our bylaws (the “Bylaws”) to provide eligible stockholders the right to include their own director nominees in the Company’s proxy materials. As detailed in the Bylaws, the Board provided that a stockholder, or a group of up to 20 stockholders, owning 3% or more of our common stock continuously for at least three years may nominate up to the greater of two directors or 20% of the Board.

8

|

PROXY SUMMARY |

||||

CORPORATE GOVERNANCE PRACTICES

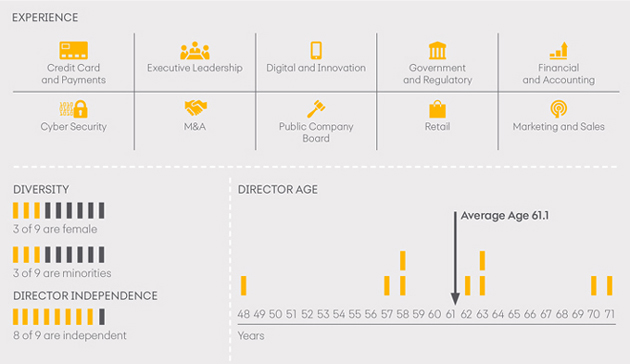

| Our governance highlights include: | ||

| ✔ | 8 out of 9 directors are independent | |

| ✔ | Experienced Board members with a diversity of skills and experiences | |

| ✔ | 3 out of 9 directors are women | |

| ✔ | Each Board committee is comprised exclusively of independent directors | |

| ✔ | Non-executive Chair of the Board | |

| ✔ | Regular meetings of independent directors in executive session without management | |

| ✔ | Annual election of all directors | |

| ✔ | Majority voting standard for directors in uncontested elections | |

| ✔ | Stockholder special meetings may be called upon the request of a majority of stockholders | |

| ✔ | Single-class voting structure (one share, one vote) | |

| ✔ | No stockholder rights plan | |

| ✔ | Nominating and Corporate Governance Committee regularly reviews overall corporate governance framework | |

| ✔ | Stock ownership requirements for our executive officers and directors | |

| ✔ | Stockholder proxy access | |

9

9

|

PROXY SUMMARY |

||||

BOARD OF DIRECTORS

We became a fully stand-alone public company after the completion of our split-off from General Electric Company (“GE”) in November 2015, a multi-step process that began in November 2013. At the time of our initial public offering (“IPO”) in July 2014, the first step toward GE’s exit from our business, we had three independent directors, each with deep industry knowledge and experience. In November 2015, when GE sold its remaining holdings in Synchrony through an exchange offer, GE’s designees on our Board resigned and we appointed five additional independent directors. We deliberately and thoughtfully formed an independent Board with diverse perspectives and experiences, which we believe is critical to effective corporate governance and to achieving our strategic goals. Today, eight of the nine directors on our Board are independent and three of the directors are women. The composition of the Board reflects distinct and varied professional experience and cognitive diversity.

Experience, Diversity and Independence

Third-Party Board Assessment

To enhance Board functioning and effectiveness, the Board engaged an independent, third-party facilitator in 2016 to perform the annual Board evaluation. This third-party expert interviewed each director to obtain his or her assessment of the effectiveness of the Board, including director performance and Board culture. The individual assessments were then summarized and presented to the Board for discussion. The results of the evaluation confirmed the Board’s view that the Company is performing well and that the Board is delivering effective oversight and governance of critically important business areas. Directors also expressed a high degree of confidence in the Company’s leadership team and the risk management processes in place.

10

|

PROXY SUMMARY |

||||

BOARD QUALIFICATIONS

| Name | Age | Director Since |

Independent | Committee Membership | ||||||

|

Margaret M. Keane President and Chief Executive Officer of Synchrony Financial |

57 |

2014 |

||||||||

|

Paget L. Alves Former Chief Sales Officer of Sprint Corporation |

62 |

2015 |

|

✔ |

|

Audit; Nominating and Corporate Governance | ||||

|

Arthur W. Coviello, Jr. Former Executive Vice President of EMC Corporation and Executive Chairman, RSA Security, Inc. |

63 |

2015 |

|

✔ |

|

Risk | ||||

|

William W. Graylin Global Co-General Manager of Samsung Pay, Samsung Electronics America, Inc. |

48 |

2015 |

|

✔ |

|

Risk | ||||

|

Roy A. Guthrie Former Executive Vice President and Chief Financial Officer of Discover Financial Services, Inc. |

63 |

2014 |

|

✔ |

|

Risk (Chair) | ||||

|

Richard C. Hartnack Former Vice Chairman and Head, Consumer and Small Business Banking of U.S. Bancorp |

71 |

2014 |

|

✔ |

|

Management Development and Compensation (Chair) | ||||

|

Jeffrey G. Naylor Former CFO and CAO of the TJX Companies, Inc. |

58 |

2014 |

|

✔ |

|

Audit (Chair); Management Development and Compensation | ||||

|

Laurel J. Richie Former President of The Women’s National Basketball Association, LLC |

58 |

2015 |

|

✔ |

|

Management Development and Compensation; Nominating and Corporate Governance | ||||

|

Olympia J. Snowe Chairman and CEO of Olympia Snowe, LLC U.S. Senator from 1995–2013 and Member of U.S. House of Representatives from 1979–1995 |

70 |

2015 |

|

✔ |

|

Audit; Nominating and Corporate Governance (Chair) | ||||

11

11

|

|

||

The Board currently consists of nine directors: our President and Chief Executive Officer (“CEO”), Margaret M. Keane, and eight directors who are “independent” under the listing standards of the New York Stock Exchange (“NYSE”) and our own independence standards set forth in our Governance Principles. The independent directors are Paget L. Alves, Arthur W. Coviello, Jr., William W. Graylin, Roy A. Guthrie, Richard C. Hartnack, Jeffrey G. Naylor, Laurel J. Richie and Senator Olympia J. Snowe (together, the “Independent Directors”). Under our Bylaws, our directors will be elected annually by a majority vote in uncontested elections. As discussed under “Committees of the Board of Directors” below, our Nominating and Corporate Governance Committee is responsible for recommending to our Board, for its approval, the director nominees to be presented for stockholder approval at the Annual Meeting.

Nominees for Election to the Board of Directors

Each of the nine director nominees listed below is currently a director of the Company.

The following biographies describe the business experience of each director nominee. Following the biographical information for each director nominee, we have listed specific qualifications that the Board considered in determining whether to recommend that the director be nominated for election at the Annual Meeting.

If elected, each of the director nominees is expected to serve for a term of one year or until their successors are duly elected and qualified. The Board expects that each of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board may nominate.

|

|

12

|

CORPORATE GOVERNANCE |

||||

BOARD QUALIFICATIONS

|

Name and present position,

|

Age, period served as a director and other business experience

| |

|

Margaret M. Keane President and Chief Executive Officer |

Ms. Keane, 57, has been our President and CEO since February 2014 and previously served as CEO and President of GE’s North American retail finance business since April 2011. She has also been a member of the Board since 2013 and a member of the board of directors of Synchrony Bank (the “Bank”) since 2009. From June 2004 to April 2011, Ms. Keane served as President and CEO of the Retail Card platform of GE’s North American retail finance business. From January 2002 to May 2004, Ms. Keane served as Senior Vice President of Operations of the Retail Card platform of GE’s North American retail finance business. From January 2000 to December 2001, Ms. Keane served as Chief Quality Leader of GE Capital Corporation (“GECC”). From October 1999 to December 1999, Ms. Keane served as Shared Services Leader for GECC’s Mid-Market Leasing Businesses. Prior to that, Ms. Keane served in various operations and quality leadership roles at GECC and Citibank. Ms. Keane received a B.A. in Government and Politics and an M.B.A. from St. John’s University. | |

| We believe that Ms. Keane should serve as a member of the Board due to her extensive experience in the retail finance business and the perspective she brings as our President and CEO.

| ||

|

Paget L. Alves |

Mr. Alves, 62, has been a director since November 2015 and was a non-voting Board observer from July 2015 to November 2015. He has also been a member of the board of directors of the Bank since January 2017. He served as Chief Sales Officer of Sprint Corporation, a wireless and wireline communications services provider, from January 2012 to September 2013 after serving as President of that company’s Business Markets Group since 2009. Prior thereto, Mr. Alves held various positions at Sprint Corporation, including President, Sales and Distribution, from 2008 to 2009; President, South Region, from 2006 to 2008; Senior Vice President, Enterprise Markets, from 2005 to 2006; and President, Strategic Markets, from 2003 to 2005. Between 2002 and 2003, he served as President and Chief Operating Officer of Centennial Communications Corporation and from 2000 to 2001 served as President and CEO of PointOne Telecommunications, Inc. Mr. Alves currently serves on the boards of directors of Yum! Brands, Inc., a company that develops, operates, franchises, and licenses a system of quick-service restaurants; International Game Technology PLC, a manufacturer and distributor of microprocessor-based gaming and video lottery products and software systems; and Ariel Investments LLC, an investment management company. He previously served on the boards of directors of GTECH Holdings Corporation from 2005 to 2006, Herman Miller, Inc. from 2008 to 2010 and International Game Technology Inc. from 2010 to 2015. Mr. Alves received a B.S. in Industrial and Labor Relations and a J.D. from Cornell University. | |

| We believe that Mr. Alves should serve as a member of the Board due to his executive management and leadership experience and his extensive background in sales.

| ||

13

13

|

CORPORATE GOVERNANCE |

||||

BOARD QUALIFICATIONS

|

Name and present position, if any, with the Company

|

Age, period served as a director and other business experience

| |

|

Arthur W. Coviello, Jr. |

Mr. Coviello, 63, has been a director since November 2015 and was a non-voting Board observer from July 2015 to November 2015. He has also been a member of the board of directors of the Bank since January 2017. He served as Executive Vice President, EMC Corporation, a cloud computing and information security company, and Executive Chairman, RSA, the Security Division of EMC Corporation and a provider of security, risk and compliance solutions, from 2011 to 2015, after serving as Executive Vice President and President of RSA from 2006 to 2011. Prior thereto, Mr. Coviello held various executive positions at RSA Security, Inc., including President and Chief Executive Officer from 2000 to 2006, and President from 1999 to 2000. Prior to RSA Security, Inc., he had extensive financial and operating management expertise in several technology companies. Mr. Coviello currently serves on the board of directors at EnerNOC, Inc. (ENOC), a provider of cloud-based energy intelligence software. He also serves on the boards of directors of two private companies, Cylance, Inc., which applies artificial intelligence, algorithmic science and machine learning to cyber security, and Bugcrowd, Inc., which uses tens of thousands of independent researchers to assist its customers in finding security vulnerabilities in their software. Mr. Coviello previously served on the boards of directors of AtHoc, RSA Security, Inc., and Sana Security, Inc. He received a B.B.A. in Accounting from the University of Massachusetts. | |

|

We believe that Mr. Coviello should serve as a member of the Board due to his leadership experience, his extensive financial and accounting background and his considerable experience in cyber security.

| ||

|

William W. Graylin |

Mr. Graylin, 48, has been a director since November 2015 and was a non-voting Board observer from July 2015 to November 2015. He is Global Co-General Manager of Samsung Pay, the mobile payment platform of Samsung Electronics America, Inc. Prior thereto, Mr. Graylin was CEO of LoopPay, Inc., a mobile payment company, from 2012 to 2015. Between 2007 and 2012, he was Founder and CEO of Roam Data, Inc., a developer of mobile point of sale software; from 2002 to 2007, he was Founder, Chairman and CEO of Way Systems, Inc.; and from 2000 to 2001, he was Founder and CEO of Entitlenet, Inc. Mr. Graylin served in the United States Navy as a Nuclear Submarine Officer from 1992 to 1998. He currently serves on the boards of directors of several privately held high-tech startups including: ONvocal, Inc., a wearable voice assistant solutions; Movylo, Inc., a SaaS-based mobile engagement solution for merchants; People Power, Inc., an IoT (internet of things) services company managed by artificial intelligence (“AI’”) for home automation, security and senior care; Myne/GeeVee, a universal communications app (phone/voip/messaging/video) for carriers and enterprises to better engage their customers; Feelter, crowd-sourced trusted reviews to improve eCommerce conversions; and PushPayments, real-time payment disbursements for businesses. Mr. Graylin is currently a Connection Science Fellow with MIT’s Media Lab, where he teaches part time on Innovation and Entrepreneurship. He received a B.S. in Electrical Engineering and Computer Science and a B.A. in Chinese Linguistics and Literature from the University of Washington; an M.B.A. from the Sloan School of Management, Massachusetts Institute of Technology; and an M.S. in Electrical Engineering and Computer Science from Massachusetts Institute of Technology. | |

| We believe that Mr. Graylin should serve as a member of the Board due to his executive management and leadership experience and his extensive background in technology.

| ||

14

|

CORPORATE GOVERNANCE |

||||

BOARD QUALIFICATIONS

|

Name and present position, if any, with the Company

|

Age, period served as a director and other business experience

| |

|

Roy A. Guthrie |

Mr. Guthrie, 63, joined our Board and the board of directors of the Bank in connection with the IPO in July 2014. From July 2005 to January 2012, Mr. Guthrie served as Executive Vice President, and from July 2005 to May 2011 as Chief Financial Officer (“CFO”) of Discover Financial Services, Inc., a direct banking and payments company. From September 2000 to July 2004, Mr. Guthrie served as President and CEO of various businesses of Citigroup Inc., including CitiFinancial International from 2000 to 2004 and CitiCapital from 2000 to 2001. From April 1978 to September 2000, Mr. Guthrie served in various roles of increasing responsibility at Associates First Capital Corporation. Mr. Guthrie serves on the boards of directors of Nationstar Mortgage Holdings, Inc., an originator and servicer of real estate mortgage loans, and OneMain Holdings, Inc., a financial services company. He previously served on the board of directors of LifeLock, Inc., a company offering identity theft protection and detection services, from 2012 to 2017. During his tenure with Discover Financial Services, Inc., he also served on the board of directors of Discover Bank. Mr. Guthrie received a B.A. in Economics from Hanover College and an M.B.A. from Drake University.

| |

| We believe that Mr. Guthrie should serve as a member of the Board due to his leadership experience and extensive background in consumer finance (including the private-label credit card industry), including more than 30 years of experience in finance and/or operating roles.

| ||

|

Richard C. Hartnack |

Mr. Hartnack, 71, joined our Board and the board of directors of the Bank in connection with the IPO in July 2014. From April 2005 to February 2013, Mr. Hartnack served as Vice Chairman and Head, Consumer and Small Business Banking of U.S. Bancorp, a financial services holding company. From June 1991 to March 2005, Mr. Hartnack served in various leadership roles at Union Bank, N.A. (formerly known as Union Bank of California, N.A.), including Vice Chairman, Director and Head, Community Banking and Investment Services from 1999 to 2005. From June 1982 to May 1991, Mr. Hartnack served in various leadership roles at First Chicago Corporation, including Executive Vice President and Head, Community Banking. Mr. Hartnack serves on the board of directors of Federal Home Loan Mortgage Corporation and has served on the boards of directors of MasterCard International, Inc. (U.S. Region) and UnionBanCal Corporation. Mr. Hartnack received a B.A. in Economics from the University of California, Los Angeles, and an M.B.A. from Stanford University.

| |

| We believe that Mr. Hartnack should serve as a member of the Board due to his leadership experience and extensive background in consumer finance and banking accumulated over the course of a 40-year career in the banking industry.

|

15

15

|

CORPORATE GOVERNANCE |

||||

BOARD QUALIFICATIONS

|

Name and present position, if any, with the Company

|

Age, period served as a director and other business experience

| |

|

Jeffrey G. Naylor |

Mr. Naylor, 58, joined our Board and the board of directors of the Bank in connection with the IPO in July 2014. From February 2013 to April 2014, Mr. Naylor served as Senior Corporate Advisor of the TJX Companies, Inc., a retail company of apparel and home fashions. From January 2012 to February 2013, Mr. Naylor served as Senior Executive Vice President and Chief Administrative Officer of the TJX Companies, Inc.; from February 2009 to January 2012, he served as its Senior Executive Vice President, Chief Financial and Administrative Officer; from June 2007 to February 2009, he served as its Senior Executive Vice President, Chief Administrative and Business Development Officer; from September 2006 to June 2007, he served as its Senior Executive Vice President, Chief Financial and Administrative Officer; and from February 2004 to September 2006, he served as its CFO. From September 2001 to January 2004, Mr. Naylor served as Senior Vice President and CFO of Big Lots, Inc. From September 2000 to September 2001, Mr. Naylor served as Senior Vice President, Chief Financial and Administrative Officer of Dade Behring, Inc. From November 1998 to September 2000, he served as Vice President, Controller of The Limited, Inc. Mr. Naylor also serves on the boards of directors of two privately held companies: Save-A-Lot, a grocery retailer, and Emerald Expositions, which conducts business and consumer trade shows. Mr. Naylor received a B.A. in Economics and Political Science and an M.B.A. from the J.L. Kellogg Graduate School of Management, Northwestern University.

| |

| We believe that Mr. Naylor should serve as a member of the Board due to his executive management and leadership experience, his extensive financial and accounting background and his considerable experience accumulated over the course of 25 years in the retail and consumer goods industries.

| ||

|

Laurel J. Richie |

Ms. Richie, 58, has been a director since November 2015 and was a non-voting Board observer from July 2015 to November 2015. Ms. Richie served as President of the Women’s National Basketball Association LLC, a professional basketball league, from 2011 to 2015. Prior to her appointment in 2011, she served as Chief Marketing Officer of Girl Scouts of the United States of America from 2008 to 2011. From 1984 to 2008, she held various positions at Ogilvy & Mather, including Senior Partner and Executive Group Director and founding member of its Diversity Advisory Board. She was named one of the 25 Most Influential Women in Business by The Network Journal and is a recipient of the YMCA Black Achievers in Industry award, Ebony magazine’s Outstanding Women in Marketing and Communications award, and Power 100 List. Most recently, Black Enterprise named her one of the Most Influential African Americans in Sports. Ms. Richie received a B.A. in Policy Studies from Dartmouth College. She was named as a Charter Trustee of her alma mater in 2012, and currently serves as board vice chair and chairman of the communications committee.

| |

| We believe that Ms. Richie should serve as a member of the Board due to her executive management and leadership experience and her considerable experience in communications and marketing.

|

16

|

CORPORATE GOVERNANCE |

||||

BOARD QUALIFICATIONS

|

Name and present position, if any, with the Company

|

Age, period served as a director and other business experience

| |

|

Olympia J. Snowe |

Senator Snowe, 70, has been a director since November 2015 and was a non-voting Board observer from January 2015 to November 2015. She has also been a member of the board of directors of the Bank since January 2017. She is currently chairman and CEO of Olympia Snowe, LLC, a policy and communications consulting firm, and a senior fellow at the Bipartisan Policy Center, a non-profit organization focused on national policy solutions, where she is a member of the board and co-chairs its Commission on Political Reform. Senator Snowe served in the U.S. Senate from 1995–2013, and as a member of the U.S. House of Representatives from 1979–1995. While in the U.S. Senate, she served as chair and was the ranking member of the Senate Committee on Small Business and Entrepreneurship, and served on the Senate Finance Committee, the Senate Intelligence Committee, and the Senate Commerce Science and Technology Committee. She also served as chair of the Subcommittee on Seapower for the Senate Armed Services Committee. Senator Snowe serves on the boards of directors of T. Rowe Price Group, Inc., a financial services company, and Aetna, Inc., a diversified healthcare benefits company. Senator Snowe received a B.A. in political science from the University of Maine and has received honorary doctorate degrees from many colleges and universities.

| |

| We believe that Senator Snowe should serve as a member of the Board due to her broad range of valuable leadership and public policy experience.

|

17

17

|

CORPORATE GOVERNANCE |

||||

Qualifications of Directors

Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the stockholders. They must also have an inquisitive and objective perspective, practical wisdom and mature judgment. The Company will endeavor to have a Board representing a range of experience at policy-making levels in areas that are relevant to the Company’s activities. Although the Board does not have a specific diversity policy, the Nominating and Corporate Governance Committee takes into account a candidate’s ability to contribute to the diversity on the Board. It considers the candidate’s and the existing Board members’ race, ethnicity, gender, age, cultural background and professional experience. Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serve on the Board for an extended period of time. Our Governance Principles maintain that directors who also serve as CEOs or in equivalent positions should not serve on more than two boards of public companies in addition to the Company’s Board, and other directors should not serve on more than four boards of public companies in addition to the Company’s Board.

Pursuant to our Company’s Governance Principles, when a director’s principal occupation or job responsibilities change significantly during his or her tenure as a director, that director shall tender his or her resignation for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will recommend to the Board the action, if any, to be taken with respect to the resignation. The Board does not believe that arbitrary term limits on directors’ service are appropriate, nor does it believe that directors should expect to be renominated annually until they reach the mandatory retirement age. The Nominating and Corporate Governance Committee will evaluate each director in connection with his or her renomination for election at each annual meeting of stockholders. Except in special circumstances, directors will not be nominated for election to the Board after their 75th birthday.

Process for Reviewing, Identifying and Evaluating Director Nominees

The Nominating and Corporate Governance Committee is responsible for reviewing, identifying, evaluating and recommending director nominees to the Board after considering the qualifications described above and set forth in the Company’s Governance Principles. Upon recommendation of the Nominating and Corporate Governance Committee, the Board proposes a slate of nominees to the stockholders for election to the Board. Between annual stockholder meetings, the Board may fill vacancies and newly created directorships on the Board with directors who will serve until the next annual meeting.

Other stockholders may also propose nominees for consideration by the Nominating and Corporate Governance Committee by submitting the names and other supporting information required under our Bylaws to: Corporate Secretary, Synchrony Financial, 777 Long Ridge Road, Stamford, Connecticut 06902. The Nominating and Corporate Governance Committee will apply the same standards in considering director candidates recommended by stockholders that it applies to other candidates. In addition to recommending director candidates to the Nominating and Corporate Governance Committee, stockholders may also, pursuant to procedures established in our Bylaws, directly nominate one or more director candidates to stand for election by the stockholders. For information on how to nominate a person for election as a director at the 2018 annual meeting of stockholders, including through the proxy access right to include such nominees in the Company’s proxy materials, please see the discussion under the heading “Additional Information—Stockholder Proposals for the 2018 Annual Meeting.”

18

|

CORPORATE GOVERNANCE |

||||

COMMITTEES OF THE BOARD OF DIRECTORS

The standing committees of the Board consist of the Audit Committee, the Nominating and Corporate Governance Committee, the MDCC, and the Risk Committee. The duties and responsibilities of these standing committees are set forth below. The Board may also establish various other committees to assist it in its responsibilities. Our Board has adopted charters for each of its standing committees. Copies of the committees’ charters are available on our website at http://investors.synchronyfinancial.com under “Corporate Governance.” Each of the standing committees reports to the Board as it deems appropriate and as the Board requests.

| Committees

|

Members

|

Primary Responsibilities

|

# of Meetings in 2016

| |||||

| Audit |

Mr. Naylor (Chair) Mr. Alves Senator Snowe |

• |

Selecting, evaluating, compensating and overseeing the independent registered public accounting firm | 12 | ||||

|

• |

Receiving reports from our internal audit, risk management and independent liquidity review functions on the results of risk management reviews and assessments, including the Company’s internal control system over operational and regulatory controls and of the adequacy of the processes for controlling the Company’s activities and managing its risk |

|||||||

|

• |

Reviewing the audit plan, changes in the audit plan, the nature, timing, scope and results of the audit, and any audit problems or difficulties and management’s response |

|||||||

|

• |

Overseeing our financial reporting activities, including our annual report, and accounting standards and principles followed (including any significant changes in such standards and principles) |

|||||||

|

• |

Reviewing and discussing with management and the independent auditor, as appropriate, the effectiveness of the Company’s internal control over financial reporting and the Company’s disclosure controls and procedures |

|||||||

|

• |

Reviewing our major financial risk exposures, the Company’s risk assessment and risk management practices and the guidelines, policies and processes for risk assessment and risk management |

|||||||

|

• |

In conjunction with the Risk Committee, overseeing our risk guidelines and policies relating to financial statements, financial systems, financial reporting processes, compliance and auditing, and allowance for loan losses |

|||||||

|

• |

Approving audit and non-audit services provided by the independent registered public accounting firm |

|||||||

|

• |

Meeting with management and the independent registered public accounting firm to review and discuss our financial statements and other matters required to be reviewed under applicable legal, regulatory or NYSE requirements |

|||||||

|

• |

Establishing and overseeing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters |

|||||||

|

• |

Overseeing our internal audit function, including reviewing its organization, performance and audit findings, and reviewing our disclosure and internal controls |

|||||||

|

• |

Overseeing the Company’s compliance with legal, ethical and regulatory requirements (other than those assigned to other committees of the Board) |

|||||||

19

19

|

CORPORATE GOVERNANCE |

||||

| Committees

|

Members

|

Primary Responsibilities

|

# of Meetings in 2016

| |||||

| Nominating and Corporate Governance |

Senator Snowe (Chair) Mr. Alves Ms. Richie |

• | Developing, and recommending to our Board for approval, qualifications for director candidates, taking into account applicable regulatory or legal requirements regarding experience, expertise or other qualifications for service on certain of our Board’s committees | 6 | ||||

| • | Considering potential director nominees properly recommended by the Company’s stockholders, leading the search for other individuals qualified to become members of the Board, recommending to our Board for approval the director nominees to be presented for stockholder approval at the annual meeting, and recommending to the Board nominations for any vacancies that may arise on the Board prior to the annual meeting | |||||||

| • | Reviewing and making recommendations to our Board with respect to the Board’s leadership structure and the size and composition of the Board and the Board committees | |||||||

| • | Developing and annually reviewing our corporate governance principles, including guidelines for determining the independence of directors | |||||||

| • | Annually reviewing director compensation and benefits | |||||||

| • | Developing and recommending to the Board for its approval an annual self-evaluation process of the Board and the Board’s committees and overseeing the annual self-evaluation of our Board and its committees | |||||||

| • | Reviewing and, if appropriate, approving or ratifying any “transaction” between the Company and a “related person” required to be disclosed under Securities and Exchange Commission (”SEC”) rules and annually reviewing the use and effectiveness of such policy | |||||||

| • | Reviewing our policies and procedures with respect to political spending | |||||||

| • | Reviewing actions in furtherance of our corporate social responsibility | |||||||

| • | Reviewing and resolving any conflicts of interest involving directors or executive officers | |||||||

| • | Overseeing the risks, if any, related to our corporate governance structure and practices | |||||||

| • | Identifying and discussing with management the risks, if any, related to our social responsibility actions and public policy initiatives | |||||||

20

|

CORPORATE GOVERNANCE |

||||

| Committees

|

Members

|

Primary Responsibilities

|

# of Meetings

| |||||

| Management Development and Compensation |

Mr. Hartnack (Chair) Mr. Naylor Ms. Richie |

• | Assisting our Board in developing and evaluating potential candidates for executive positions, including the CEO, and overseeing our management resources, structure, succession planning, development and selection process | 6 | ||||

| • | Evaluating the CEO’s performance and approving and, where required, recommending for approval by the independent members of our Board, the CEO’s annual compensation, including salary, bonus and equity and non-equity incentive compensation | |||||||

| • | Evaluating the performance of other senior executives and approving and, where required, recommending for approval by our Board, each senior executive’s annual compensation, including salary, bonus and equity and non-equity incentive compensation, in each case, based on initial recommendations from the CEO | |||||||

| • | Reviewing and overseeing incentive compensation arrangements with a view to appropriately balancing risk and financial results in a manner that does not encourage employees to expose us or any of our subsidiaries to imprudent risks, and are consistent with safety and soundness, and reviewing (with input from our Chief Risk Officer (“CRO”) and the CRO of the Bank) the relationship among risk management policies and practices, corporate strategies and senior executive compensation | |||||||

| • | Reviewing and overseeing equity incentive plans and other stock-based plans | |||||||

21

21

|

CORPORATE GOVERNANCE |

||||

| Committees

|

Members

|

Primary Responsibilities

|

# of Meetings

| |||||

| Risk |

Mr. Guthrie (Chair) Mr. Coviello Mr. Graylin |

• | Assisting our Board in its oversight of our enterprise-wide risk management framework, including as it relates to credit, investment, market, liquidity, operational, compliance and strategic risks | 10 | ||||

| • | Reviewing and, at least annually, approving our risk governance framework, and our risk assessment and risk management practices, guidelines and policies, including significant policies that management uses to manage credit and investment, market, liquidity, operational, compliance and strategic risks | |||||||

| • | Reviewing and, at least annually, recommending to our Board for approval, our enterprise-wide risk appetite, including our liquidity risk tolerance, and reviewing and approving our strategy relating to managing key risks and other policies on the establishment of risk limits as well as the guidelines and policies for monitoring and mitigating such risks | |||||||

| • | Meeting separately, at least quarterly, with our CRO and the Bank’s CRO to discuss the Company’s risk assessment and risk management practices and related guidelines and policies | |||||||

| • | Receiving periodic reports from management on the metrics used to measure, monitor and manage known and emerging risks, including management’s view on acceptable and appropriate levels of exposure | |||||||

| • | Receiving reports from our internal audit, risk management and independent liquidity review functions on the results of risk management reviews and assessments, including the Company’s internal control system over operational and regulatory controls and of the adequacy of the processes for controlling the Company’s activities and managing its risk | |||||||

| • | Reviewing and approving, at least annually, the Company’s enterprise-wide capital and liquidity framework (including our contingency funding plan) for addressing liquidity needs during liquidity stress events | |||||||

| • | Reviewing, at least quarterly, in coordination with the Bank’s Risk Committee, the Company’s allowance for loan losses methodology, liquidity, risk appetite, regulatory capital and ratios, and internal capital adequacy assessment processes | |||||||

| • | Reviewing, at least quarterly, information provided by senior management to determine whether we are operating within our established risk appetite | |||||||

| • | Reviewing the status of financial services regulatory examinations | |||||||

| • | Reviewing the independence, authority and effectiveness of our risk management function and independent liquidity review function | |||||||

| • | Approving the appointment of, evaluating and, when appropriate, approving the replacement of the CRO | |||||||

| • | Reviewing the disclosure regarding risk contained in our annual and quarterly reports filed with the SEC | |||||||

22

|

CORPORATE GOVERNANCE |

||||

Audit Committee

The Board has determined that Mr. Naylor qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K, and the Board is satisfied that all members of our Audit Committee have sufficient expertise and business and financial experience necessary to effectively perform their duties as members of the Audit Committee.

Management Development and Compensation Committee

Each of Mr. Hartnack, Mr. Naylor and Ms. Richie qualifies as “outside directors” within the meaning of Section 162(m) (“Section 162(m)”) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and as “non-employee directors” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

BOARD OF DIRECTORS’ LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Board is led by our non-executive Chair, Mr. Hartnack. We believe that having an independent director serve as the non-executive Chair of the Board is in the best interests of our stockholders. The separation of roles allows our Chair to focus on the organization and effectiveness of the Board. At the same time, it allows our CEO to focus on executing our strategy and managing our operations, performance and risks following our transition to being a fully stand-alone public company.

We manage our enterprise risk using an integrated framework that includes Board-level oversight, administration by a group of cross-functional management committees, and day-to-day implementation by a dedicated risk management team led by the CRO. The Board (with input from the Risk Committee) is responsible for approving the Company’s enterprise-wide risk appetite statement and framework, as well as certain other risk management policies, and oversees the Company’s strategic plan and enterprise-wide risk management program.

The Board regularly devotes time during its meetings to review and discuss the most significant risks facing the Company and management’s responses to those risks. During these discussions, the CEO, the CFO, the CRO, the General Counsel and other members of senior management present management’s assessment of risks, a description of the most significant risks facing the Company and any mitigating factors and plans or practices in place to address and monitor those risks. The Board has also delegated certain of its risk oversight responsibilities to its committees.

The Risk Committee of the Board has responsibility for the oversight of our risk management program, and the three other board committees have other oversight roles with respect to risk management within their respective oversight areas. Several management committees and subcommittees have important roles and responsibilities in administering our risk management program. This committee-focused governance structure provides a forum through which risk expertise is applied cross-functionally to all major decisions, including development of policies, processes and controls used by the CRO and risk management team to execute our risk management philosophy. Our enterprise risk management philosophy is to ensure that all relevant risks in our business activities are appropriately identified, measured, monitored and controlled. Our approach in executing this philosophy focuses on leveraging our strong credit risk culture to drive enterprise risk management using a strong governance framework, a comprehensive enterprise risk assessment program and an effective risk appetite framework.

Responsibility for risk management flows to individuals and entities throughout our Company, including our Board, various Board and management committees and senior management. We believe our corporate culture and values in conjunction with the risk management accountability incorporated into our integrated Risk Management Framework, which includes our governance structure and three distinct “Lines of Defense” (as further described below), has facilitated, and will continue to facilitate, the evolution of an effective risk management presence across the Company.

23

23

|

CORPORATE GOVERNANCE |

||||

The “First Line of Defense” is comprised of the business areas whose day-to-day business activities involve decision-making and associated risk-taking for the Company. As the business owner, the first line is responsible for identifying, assessing, managing and controlling that risk, and for mitigating our overall risk exposure. The first line formulates strategy and operates within the risk appetite and framework. The “Second Line of Defense,” which includes the independent risk management organization, provides oversight of first line risk taking and management. The second line assists in determining risk capacity, risk appetite, and the strategies, policies and structure for managing risks. The second line owns the risk framework. The “Third Line of Defense” is comprised of our Internal Audit function. The third line provides independent and objective assurance to senior management and to the Board of Directors that first and second line risk management and internal control systems and its governance processes are well-designed and working as intended.

It is our policy that each director is expected to dedicate sufficient time to the performance of his or her duties as a director, including by attending meetings of the stockholders, and meetings of the Board and Board committees of which he or she is a member.

In 2016, the Board held 12 meetings, including regularly scheduled and special meetings. All directors attended at least 75% of the aggregate of (i) the total number of meetings of the Board (held during the period for which he or she has been a director); and (ii) the total number of meetings held by all committees on which he or she served (during the periods for which he or she has served). All directors attended the 2016 Annual Meeting of Stockholders.

MEETINGS OF NON-MANAGEMENT AND INDEPENDENT DIRECTORS

In accordance with our Governance Principles, at the conclusion of every Board meeting, the independent directors have an executive session without any non-independent directors present. The Chair of the Board, Mr. Hartnack, presides at executive sessions. During executive sessions, the independent directors have complete access to Company personnel as they may request.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholders and any interested parties who would like to communicate with the Board or its committees may do so by writing to them via the Company’s Corporate Secretary by email at corporate.secretary@synchronyfinancial.com or by mail at Synchrony Financial, 777 Long Ridge Road, Stamford, Connecticut 06902 or by leaving a voicemail message at (800) 275-3301.

All communications directed to the Board, the Chair of the Board or any other members of the Board are initially reviewed by the Company’s Ombuds Leader. Any communications that allege or report fiscal improprieties or complaints about internal accounting controls or other accounting or auditing matters are immediately forwarded to the Chair of the Audit Committee, the General Counsel and Chief Audit Executive, and after consultation with the Chair of the Audit Committee, may be sent to the other members of the Audit Committee. Any communications that raise legal, ethical or compliance concerns about the Company’s policies or practices are immediately forwarded to the General Counsel and Chief Compliance Officer. The Chair of the Board is advised promptly of any such communication that alleges misconduct on the part of the Company’s management or raises legal, ethical or compliance concerns about the Company’s policies or practices and that the General Counsel or Chief Compliance Officer believes may be credible, and after consultation with the Chair of the Board, such communication may be reported to the other members of the Board or to a committee of the Board. On a quarterly basis, the Chair of the Board receives updates on other communications from stockholders that raise issues related to the affairs of the Company but do not fall into the two prior categories. The Chair of the Board determines which of these communications he would like to see.

Typically, the Ombuds Leader will not forward to the Company’s directors communications from stockholders or other communications that are of a personal nature or not related to the duties and responsibilities of the Board, including: junk mail and mass mailings; routine customer service complaints; human resources matters; service suggestions; resumes and other forms of job inquiries; opinion surveys and polls; business solicitations; or advertisements.

24

|

CORPORATE GOVERNANCE |

||||

We have adopted a Code of Conduct that applies to anyone who works for or represents Synchrony, including all directors, officers and employees. A copy of this code is available on our website at http://investors.synchronyfinancial.com under “Corporate Governance.” If we make any substantive amendments to this code or grant any waiver from a provision to our CEO, principal financial officer or principal accounting officer, we will disclose the nature of such amendment or waiver on our website or in a Current Report on Form 8-K.

Our Governance Principles provide the framework for the governance of the Company. The Nominating and Corporate Governance Committee is responsible for developing and implementing our Governance Principles, periodically reviewing such Governance Principles and recommending any proposed changes to the Board for approval. A copy of our Governance Principles is available on our website at http://investors.synchronyfinancial.com under “Corporate Governance.”

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based upon a review of our records, we believe that all reports required to be filed by our directors, officers and holders of more than 10% of our common stock pursuant to Section 16(a) of the Exchange Act during 2016 were filed on a timely basis.

MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Company’s MDCC are Mr. Hartnack, Mr. Naylor and Ms. Richie. None of Mr. Hartnack, Mr. Naylor and Ms. Richie was, during 2016 or previously, an officer or employee of the Company or any of its subsidiaries. During 2016, there were no compensation committee interlocks required to be disclosed. In addition, no member of the MDCC had any relationship requiring disclosure under Item 404 of Regulation S-K promulgated by the SEC.

25

25

|

|

ITEM 2—ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

In accordance with Section 14A of the Exchange Act, we are asking stockholders to approve the compensation paid to our named executive officers, as disclosed in this proxy statement on pages 29-48 (the “Say-on-Pay Vote”). Although the voting results are not binding, we value continuing and constructive feedback from our stockholders on compensation and other important matters, and the Company’s MDCC will consider the voting results when evaluating our executive compensation program. Consistent with the direction of our stockholders at our 2015 annual meeting, the Say-on-Pay Vote is held on an annual basis until the next non-binding stockholder vote on the frequency with which the Say-on-Pay Vote should be held in 2021.

We believe that our executive compensation program aligns the interests of the Company’s executives and other key employees with those of the Company and its stockholders. The program is intended to attract, retain and motivate high-caliber executive talent to enable the Company to maximize operational efficiency and long-term profitability. The program is also designed to differentiate compensation based upon individual contribution, performance and experience.

We ask for your advisory approval of the following resolution:

“RESOLVED, that the stockholders hereby approve, on an advisory basis, the compensation paid to Synchrony Financial’s named executive officers, as described in this proxy statement on pages 29-48.”

|

named executive officers, as disclosed in this proxy statement.

|

26

|

COMPENSATION MATTERS |

||||

The following table sets forth certain information concerning our executive officers (other than Ms. Keane).

For information concerning Ms. Keane, see “Corporate Governance—Election of Directors.”

| Name and present position with the Company

|

Age, period served in present position and other business experience

| |

|

Brian D. Doubles Executive Vice President and Chief Financial Officer |

Mr. Doubles, 41, has been our Executive Vice President and CFO since February 2014 and has served as CFO of GE’s North American retail finance business since January 2009 and a member of the board of directors of the Bank since 2009. From July 2008 to January 2009, Mr. Doubles served as Vice President of Financial Planning and Analysis of GE’s global consumer finance business. From March 2007 to July 2008, Mr. Doubles led the wind-down of GE’s U.S. mortgage business as CFO and subsequently as CEO. From May 2006 to March 2007, Mr. Doubles served as Vice President of Financial Planning and Analysis of GE’s North American retail finance business. From January 2001 to May 2006, Mr. Doubles served in roles of increasing responsibility for GE’s internal audit staff. From February 1998 to January 2001, Mr. Doubles held various roles as part of a GE management leadership program. Mr. Doubles received a B.S. in Engineering from Michigan State University.

| |

| Henry F. Greig Executive Vice President and Chief Risk Officer |

Mr. Greig, 54, has been our Executive Vice President and CRO since February 2014 and has served as CRO of GE’s North American retail finance business since October 2010 and the Bank since May 2011. He was also a member of the board of directors of the Bank from 2011 to January 2016. From June 2004 to October 2010, Mr. Greig served as CRO of the Retail Card platform of GE’s North American retail finance business. From December 2002 to June 2004, Mr. Greig served as Vice President of Risk for GE’s North American retail finance business. From June 2000 to December 2002, Mr. Greig served as Vice President of Information & Customer Marketing of GE’s North American retail finance business. Prior to that, Mr. Greig served in various business and risk positions with GE affiliates. Mr. Greig received an A.B. in Mathematics from Bowdoin College and an M.S. in Applied Mathematics from Rensselaer Polytechnic Institute.

| |

| Jonathan S. Mothner Executive Vice President, General Counsel and Secretary |

Mr. Mothner, 53, has been our Executive Vice President, General Counsel and Secretary since February 2014 and has served as General Counsel for GE’s North American retail finance business since January 2009 and the Bank since September 2011. From December 2005 to July 2009, Mr. Mothner served as Chief Litigation Counsel and Chief Compliance Officer of GE’s global consumer finance business. From June 2004 to December 2005, Mr. Mothner served as Chief Litigation Counsel and head of the Litigation Center of Excellence of GE Commercial Finance. From May 2000 to June 2004, Mr. Mothner served as Litigation Counsel of GE’s global consumer finance business. Prior to joining GECC, Mr. Mothner served in various legal roles in the U.S. Department of Justice and a private law firm. Mr. Mothner received a B.A. in Economics from Hobart College and a J.D. from New York University School of Law.

| |

| David P. Melito Senior Vice President, Chief Accounting Officer and Controller |

Mr. Melito, 51, has been our Senior Vice President, Chief Accounting Officer and Controller since February 2014 and has served as Controller for GE’s North American retail finance business since March 2009. From January 2008 to March 2009, Mr. Melito served as Global Controller, Technical Accounting for GE Capital Aviation Services. From January 2001 to January 2008, Mr. Melito served as Global Controller, Technical Accounting for GE Capital Commercial Finance. Prior to that, Mr. Melito worked in public accounting. Mr. Melito holds a B.A. in Accounting from Queens College, City University of New York, and is a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants.

| |

27

27

|

COMPENSATION MATTERS |

||||

| Name and present position with the Company

|

Age, period served in present position and other business experience

| |

|

Thomas M. Quindlen Executive Vice President and Chief Executive Officer— Retail Card |

Mr. Quindlen, 54, has been our Executive Vice President and CEO of our Retail Card platform since February 2014 and has served as Vice President of the Retail Card platform for GE’s North American retail finance business since December 2013. From January 2009 to December 2013, Mr. Quindlen served as Vice President and CEO of GECC Corporate Finance. From November 2005 to January 2009, Mr. Quindlen served as President of GECC Corporate Lending, North America. From March 2005 to November 2005, Mr. Quindlen served as Vice President and CEO of GECC Commercial Financial Services. From May 2002 to March 2005, Mr. Quindlen served as President and CEO of GECC Franchise Finance. From September 2001 to May 2002, Mr. Quindlen served as Senior Vice President of GECC Global Six Sigma for Commercial Equipment Financing. Prior to that, Mr. Quindlen served in various sales, marketing, business development and financial positions with GE affiliates. Mr. Quindlen received a B.S. in Accounting from Villanova University.

| |

|

Glenn P. Marino Executive Vice President, Chief Executive Officer— Payment Solutions and Chief Commercial Officer |

Mr. Marino, 60, has been our Executive Vice President and CEO of our Payment Solutions platform and our Chief Commercial Officer since February 2014 and has served as CEO of the Payment Solutions platform and as Chief Commercial Leader of GE’s North American retail finance business since December 2011. From July 2002 to December 2011 Mr. Marino served as CEO of the Sales Finance platform of GE’s North American retail finance business. From March 1999 to July 2002, Mr. Marino served as CEO of Monogram Credit Services, a joint venture between GE and BankOne (now JPMorgan Chase & Co.). From February 1996 to March 1999, Mr. Marino served as CRO of the Visa/MasterCard division of GE’s North American retail finance business. Prior to that, Mr. Marino served as Vice President of Risk within Citigroup’s U.S. retail banking business. Mr. Marino received a B.S. in Biology from Syracuse University and an M.B.A. from the University of Michigan.

| |

|

David Fasoli Executive Vice President and Chief Executive Officer— CareCredit |

Mr. Fasoli, 58, has been our Executive Vice President and CEO of our CareCredit platform since February 2014 and has served as President and CEO of the CareCredit platform of GE’s North American retail finance business since March 2008. From June 2003 to March 2008, he served as General Manager of the Home and Recreational Products Business of GE’s North American retail finance business. Prior to June 2003, Mr. Fasoli served as Vice President of Client Development of GE’s North American retail finance business and held several positions of increasing responsibility within GE and GE’s North American retail finance business in finance, client development, business integration and quality. Mr. Fasoli received a B.S. in Business and Economics from the State University of New York at Albany.

|

28

|

COMPENSATION MATTERS |

||||

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Our Named Executive Officers—The executive officers whose compensation we discuss in this Compensation Discussion and Analysis and whom we refer to as our named executive officers (“NEOs”) are Margaret M. Keane, President and CEO; Brian D. Doubles, Executive Vice President, CFO; Glenn P. Marino, Executive Vice President, CEO —Payment Solutions and Chief Commercial Officer; Jonathan S. Mothner, Executive Vice President, General Counsel and Secretary; and Thomas M. Quindlen, Executive Vice President and CEO—Retail Card.

2016 Performance—Synchrony performed very well in 2016 compared to goals established by the MDCC at the beginning of the year, as well as to our direct peers (Discover Financial Services, Capital One, American Express). We generated strong financial performance, growing our core business through all three sales platforms. We grew loan receivables by 11.8% over 2015, increased net interest income and net earnings by 11.9% and 1.7%, respectively, over 2015 and achieved our target efficiency ratio of less than 34%. We forged new relationships with Cathay Pacific, Nissan and At Home; renewed programs with TJX Companies, Stein Mart, Ashley Furniture Homestore, La-Z-Boy, Nationwide Marketing Group and Suzuki; and launched programs with partners like Citgo, Marvel, GoogleStore, Fareportal, Mattress Firm and The Container Store. We maintained a strong balance sheet with robust capital and liquidity levels and diversified funding sources, growing deposits by 20.0% at December 31, 2016 as compared to December 31, 2015.

The following charts show our performance in 2016 compared to 2015 and, in the case of Efficiency Ratio and Loan Receivables Growth, our performance versus peers. For Synchrony, Efficiency Ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income.

* Peer Avg. = 2016 average for Discover Financial, Capital One and American Express, as publicly reported by such company.

29

29 |

|

COMPENSATION MATTERS |

||||

Compensation Philosophy—One of the key principles guiding Synchrony’s executive compensation program is that compensation programs should measure business and individual performance against both qualitative and quantitative goals and objectives. Synchrony’s executive compensation program is intended to discourage excessive or imprudent risk-taking while at the same time promoting and supporting our key compensation principles—our performance, our values, market competitiveness, internal equity, fair customer treatment and employees’ ability to raise concerns. The program is also designed to be consistent with our safety and soundness and to identify, measure, monitor and control incentive compensation arrangements.

Major Compensation Programs—Since our IPO in 2014, our employees have been granted equity awards consisting of restricted stock units (RSUs) and stock options pursuant to the Synchrony Financial 2014 Long-Term Incentive Plan, in addition to salary and annual cash incentive awards. In 2014, our executives began to transition away from participation in GE compensation programs. In 2016, they were completely integrated into Synchrony compensation programs. In 2014, salary, annual incentives, and triennial grants of three-year long-term incentives for our executives were based on GE programs. In 2015, compensation programs for our executives were based on Synchrony programs except for the outstanding triennial grants of three-year long-term incentives, which were still part of a GE program. In 2016, we transitioned long-term incentives to a Synchrony program in the form of Performance Share Units (“PSUs”). The 2016 PSUs granted to our executives are linked to our financial performance over the 2016-2018 period, will not vest unless performance conditions are met, and are intended to comprise half of the value of each employee’s equity-based incentive compensation.

Our major compensation components and their objectives are:

| • | Base Salary—Provides market-based compensation based on experience, position and performance of the executives. |

| • | Annual Cash Incentive Awards—Focuses executives on short-term goals set by the fully independent MDCC through cash awards. |

| • | Annual Equity Awards—Aligns executives’ interests with stockholders through a combination of RSUs and stock options. |

| • | Long-Term Incentive Awards—Through the use of three-year vesting PSUs, focuses executives on long-term goals set by the MDCC. |

30

|

COMPENSATION MATTERS |

||||

Target Pay—The MDCC reviews our compensation practices prior to making any decision on target pay and mix of pay, including (i) a detailed benchmarking study of peer compensation data, (ii) a pay for performance analysis comparing our compensation to our peers and to alignment with our performance, and (iii) a review of our executives’ stock ownership.

The chart below shows the target pay for our NEOs as of the end of 2016:

| Name | Position | Base Salary | Target Annual Cash Incentive Pay |

Target Annual Equity Award |

Target Long-Term |

Target Total Pay | |||||||||||||||||||||

| Margaret Keane |

President and CEO | $ | 1,100,000 | $ | 2,200,000 | $ | 2,750,000 | $ | 2,750,000 | $ | 8,800,000 | ||||||||||||||||

| Brian Doubles |

Executive Vice President, CFO | $ | 685,000 | $ | 685,000 | $ | 685,000 | $ | 685,000 | $ | 2,740,000 | ||||||||||||||||

| Glenn Marino |

Executive Vice President, CEO— | $ | 750,000 | $ | 600,000 | $ | 600,000 | $ | 600,000 | $ | 2,550,000 | ||||||||||||||||

| Payment Solutions and Chief | |||||||||||||||||||||||||||

| Commercial Officer | |||||||||||||||||||||||||||

| Jonathan |

Executive Vice President, | $ | 700,000 | $ | 560,000 | $ | 560,000 | $ | 560,000 | $ | 2,380,000 | ||||||||||||||||

| Mothner |

General Counsel and Secretary | ||||||||||||||||||||||||||

| Thomas |

Executive Vice President | $ | 812,000 | $ | 825,000 | $ | 718,000 | $ | 650,000 | $ | 3,005,000 | ||||||||||||||||

| Quindlen |

and CEO—Retail Card | ||||||||||||||||||||||||||

Mix of Pay—The mix of target pay as of the end of 2016 for our CEO and CFO is shown below.

31

31

|

COMPENSATION MATTERS |

||||

Strong Governance—Our MDCC has implemented the following governance measures as part of our executive compensation programs:

| • | Substantial portion of executive pay based on performance against goals set by the MDCC; |

| • | Risk governance framework underlies compensation decisions; |

| • | Stock ownership requirements for executive officers; |

| • | No hedging or pledging of company stock; |

| • | No employment agreements for executive officers; |

| • | No tax gross-ups for executive officers; |

| • | Limited perquisites; |