2015

DFAST Annual Stress Test Disclosure For Synchrony Bank, a Wholly-Owned

Subsidiary of Synchrony Financial

June 26, 2015 Exhibit 99.1 |

2015

DFAST Annual Stress Test Disclosure For Synchrony Bank, a Wholly-Owned

Subsidiary of Synchrony Financial

June 26, 2015 Exhibit 99.1 |

2 Cautionary Statement Regarding Forward-Looking Statements Disclaimers This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, which are

subject to the “safe harbor” created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,”

“believes,” “seeks,” “targets,”

“estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on

management’s current expectations and assumptions, and are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include

global political, economic, business, competitive, market, regulatory and

other factors and risks, such as: the impact of macroeconomic conditions and

whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our platform revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and

financial performance of our partners; our need for additional financing,

higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early

amortization of our securitization facilities, loss of the right to service or

subservice our securitized loans, and lower payment rates on our securitized loans; our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures,

reliance on models which may be inaccurate or misinterpreted, our ability

to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases

in our costs in retailer share arrangements; competition in the consumer finance

industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity;

cyber-attacks or other security breaches; failure of third parties to

provide various services that are important to our operations; disruptions in the

operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our

intellectual property; litigation and regulatory actions; damage to our

reputation; our ability to attract, retain and motivate key officers and employees; tax

legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; significant and extensive regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Act and the

impact of the CFPB’s regulation of our business; changes to our

methods of offering our CareCredit products; impact of capital adequacy rules;

restrictions that limit Synchrony Bank’s ability to pay dividends; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; failure to comply with anti-money laundering

and anti-terrorism financing laws; effect of General Electric Capital

Corporation being subject to regulation by the Federal Reserve Board both as a savings

and loan holding company and as a systemically important financial institution; General Electric Company (GE) not completing the separation from Synchrony Financial as planned or at all, GE’s inability to obtain savings and loan holding company

deregistration (GE SLHC Deregistration) and GE continuing to have

significant control over us; completion by the Federal Reserve Board of a review (with

satisfactory results) of our preparedness to operate on a standalone basis, independently of GE, and Federal Reserve Board approval required for us to continue to be a savings and loan holding company, including the timing of the approval and the imposition of

any significant additional capital or liquidity requirements; our need to

establish and significantly expand many aspects of our operations and infrastructure; delays in receiving or failure to receive Federal Reserve Board agreement required for us to be treated as a

financial holding company after the GE SLHC Deregistration; loss of association with

GE’s strong brand and reputation; limited right to use the GE brand name and logo and need to establish a new brand; GE has significant control over us; terms of our arrangements with GE may be more favorable than what we will be able to obtain from unaffiliated

third parties; obligations associated with being a public company; our

incremental cost of operating as a standalone public company could be substantially more than anticipated; GE could engage in businesses that compete with us, and conflicts of interest may

arise between us and GE; and failure caused by us of GE’s distribution of our

common stock to its stockholders in exchange for its common stock to qualify for tax-free treatment, which may result in significant tax liabilities to GE for which we may be required to indemnify GE. Forward-looking statements in this presentation include

projections of Synchrony Bank’s results of operations and financial

condition, under a hypothetical scenario incorporating a set of assumed economic and

financial conditions that are more adverse than Synchrony Bank expects, as prescribed by the Office of the Comptroller of the Currency. The projections do not represent forecasts of expected losses, revenue, net income, risk-weighted assets, capital or capital

ratios, but rather reflect possible results under the prescribed

hypothetical scenario.

For the reasons described above, we caution you against relying on any

forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in Synchrony Financial’s public filings, including under the heading “Risk Factors” in

Synchrony Financial’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed on February 23, 2015. You should not consider any list of such factors to be an exhaustive statement of all of

the risks, uncertainties, or potentially inaccurate assumptions that

could cause our current expectations or beliefs to change. Further, any

forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of

unanticipated events, except as otherwise may be required by law. |

3 Overview • The 2015 Annual Stress Test Disclosure presents the results of the annual stress tests conducted by

Synchrony Bank (the “Bank”), a wholly-owned subsidiary of Synchrony

Financial, in accordance with the Dodd-Frank Act Company-Run

Stress Test requirements for Banking Organizations with Total

Consolidated Assets of more than $10 Billion but less than $50 Billion. The

stress tests indicate the potential impact on certain financial measures

of the Bank over a nine-quarter planning horizon from 4Q 2014 through

4Q 2016 for three macroeconomic scenarios: Supervisory Baseline, Supervisory Adverse, and Supervisory Severely Adverse. • The results for all three scenarios are reported to the Office of the Comptroller of the Currency

(“OCC”), and the Bank is also required to publicly disclose a summary of the

results for the Supervisory Severely Adverse Scenario.

• The results presented are based on capital action assumptions that would be consistent with the

Supervisory Severely Adverse Scenario and the Bank’s internal

practices: •

Dividend payments are limited to no more than the prior quarter earnings. As a

federal savings association with assets less than $50 billion, the Bank

is not required to include an average of the prior four quarters of

dividends. •

No additional capital issuances or redemptions are contemplated.

• The results represent hypothetical estimates consistent with the requirements prescribed by the OCC

and do not represent the Bank’s forecast of expected losses, revenue, net income,

risk-weighted assets, capital or capital ratios.

• Note that Bank assets comprise approximately 63% of total Synchrony Financial assets at 3Q 2014

and therefore, results may not be representative of consolidated stress results.

• Overall results were reviewed with the Bank’s Enterprise Risk Management Committee, Risk

Committee, and Board of Directors. |

4 Supervisory Severely Adverse Description • The Supervisory Severely Adverse scenario is not a forecast, but rather a hypothetical sequence of events designed to assess the strength of banking organizations and their resilience to a severely adverse economic environment. • The Supervisory Severely Adverse scenario features the following macroeconomic assumptions: • A substantial weakening in global economic activity, accompanied by large reductions in asset prices; • A deep and prolonged U.S. recession in which the unemployment rate increases by 400 bps from its level in 3Q 2014, peaking at 10.1% in the middle of 2016; • A decline in house prices by approximately 25% during the scenario period relative to their level in 3Q 2014; and • A reduction in the level of real GDP by approximately 450 bps from 3Q 2014 to the end of 2015, with recovery beginning thereafter. |

5 Risk Coverage Synchrony Bank intends to capture its material risk exposures through its stress testing

policies, procedures, and processes. The types of material risk exposures

encompassed in this hypothetical exercise include the following:

Risks Description Primary Components Credit Risk Loss that arises when an obligor fails to meet contractual terms, including nonpayment of receivables, or failure to produce returns as forecasted. • Allowance for Loan Losses (“ALLL”) • Pre-Provision Net Revenue (“PPNR”) • Provision for Loan Losses Market Risk (including interest rate risk) Loss due to changes in interest rates, FX rates, equity prices, and asset and collateral values. • Net Interest Income (“NII”) • Other Comprehensive Income (“OCI”) Operational Risk Loss resulting from inadequate or failed internal processes, people and systems, or from external events, including fraud. • Non-interest Expense • Operational Risk Losses Liquidity Risk Potential inability to access sufficient funds to meet funding needs and financial obligations. • Liquidity Portfolio • NII Strategic Risk Risk to capital and earnings resulting from changes in the business environment or adverse business decisions. • PPNR • Equity |

6 Stress Test Methodology: Overview • The Bank considers a broad range of potential stresses to its balance sheet, capital levels, PPNR, and provision for loan losses. • The Bank uses both qualitative and quantitative methods to translate risk measures including proprietary econometric forecasting models coupled with management judgment to estimate the financial impact to PPNR, provision for loan losses and risk-weighted assets (“RWAs”) by product, for

the nine-quarter stress test horizon.

• PPNR includes net interest income, inclusive of retailer share arrangements (“RSAs”), non-interest income, and non-interest expense. • Provision for loan losses reflects net charge-offs of loans and changes in the

ALLL. • The Tier 1 Common ratio is calculated using a Basel I approach for all periods.

• All other capital ratios and RWAs reflect a Basel I approach for 2014 and a Basel III standardized approach 1 for 2015 and 2016 applied to balance sheet projections under the macroeconomic conditions of the Supervisory Severely

Adverse Scenario. 1 Consistent with the OCC’s capital transition rules |

7 Stress Test Methodology: PPNR • Interest income is estimated across the Bank’s lending products, using proprietary

econometric forecasting models. These models and other forecasting methodologies

estimate loan receivable balances, interest and fees on loans, and

RSAs. •

RSAs are generally structured to share in the economic performance of retailer partner

programs above a negotiated threshold. Estimated payments to partners

pursuant to these RSAs generally decrease in a stress environment and

therefore mitigate (benefit) the impact on the Bank’s profitability

over the planning horizon. •

Interest expense is estimated for all deposit and borrowings channels, using

internally developed forecasting methodologies to estimate expected

funding balances multiplied by projected interest rates.

• Non-interest income is generally estimated by forecasting the volume of transactions and the

fees or rates associated with that volume.

• Non-interest expense is estimated in several components including: • Volume-driven expenses that vary based on changes in business sales. • Fixed expenses that reflect the company’s built-in infrastructure costs.

• Losses related to operational events that include credit card fraud losses using proprietary

econometric forecasting models, and other operational loss events, using other

forecasting methodologies including scenario analysis.

|

8 Stress Test Methodology: Provision for Loan Losses • Provision for loan losses is forecasted in two key components: net charge- offs of loans and changes in the ALLL. • Net charge-offs are a function of gross charge-offs net of recoveries. • Gross charge-offs of loans are estimated using proprietary econometric forecasting models that consider the statistical relationship between macroeconomic variables and credit loss for the Bank’s products based on historical experience. • Recovery performance is modeled at the product level based on the statistical relationship between macroeconomic variables and historical charge-offs available for collection. • The key macroeconomic variables considered are unemployment rate, gross domestic product, disposable income, home price index, and consumer price index. • Reserves are estimated based on a forward view of net charge-offs impacted by multiple factors using current ALLL practices. • The substantial majority of the reserve build over the planning horizon is estimated to occur in 4Q 2014 in anticipation of future net charge-offs as the

economy rapidly deteriorates. |

9 Stress Test Methodology: Risk-Weighted Assets • Under the Supervisory Severely Adverse Scenario, the Bank estimates that business volume would grow, albeit at a much slower rate than under a base case set of economic conditions as consumers reduce spending under a severe macroeconomic environment. • Lower payment rates would lead to modest asset growth. • In this scenario, RWAs would move in line with asset levels over the nine- quarter stress test, ranging between 79% and 85% of total assets through the time horizon. $38.4 $38.8 $38.3 $38.6 $39.7 $40.8 $40.0 $40.0 $41.2 $42.2 $46.1 $48.1 $48.0 $47.4 $48.1 $48.7 $50.4 $49.1 $49.6 $49.8 $35.0 $40.0 $45.0 $50.0 $55.0 3Q'14 4Q'14 1Q'15 2Q'15 3Q'15 4Q'15 1Q'16 2Q'16 3Q'16 4Q'16 Assets RWAs ($s in billions) |

10 Supervisory Severely Adverse Scenario Results Actual 3Q 2014 and hypothetical stressed capital ratios and RWAs 1 from 4Q 2014 through 4Q 2016 under the Supervisory Severely Adverse Scenario Stressed Capital Ratios Actual 3Q 2014 Ending 4Q 2016 Minimum Tier 1 Common Ratio (%) 2 15.7% 16.4% 14.6% Common Equity Tier 1 Capital Ratio (%) N/A 16.6% 15.7% Tier 1 Risk-Based Capital Ratio (%) 15.7% 16.6% 14.6% Total Risk-Based Capital Ratio (%) 17.0% 17.9% 16.0% Tier 1 Leverage Ratio (%) 3 13.2% 14.2% 12.0% Tangible Capital Ratio (%) 4 13.9% 14.2% 12.2% RWAs ( $ in billions) General approach (Basel I) $38.4 $41.5 Basel III standardized approach $42.2 1 For each quarter in 2014 RWAs are calculated using the Basel I general risk-based capital approach. For each quarter in 2015 and 2016, RWAs

are calculated under the Basel III standardized approach

consistent with the OCC’s capital transition rules.

2 Tier 1 Common Ratio uses the Basel I general risk-based capital approach for 2014 through 2016.

3 In 2014 the Tier 1 Leverage ratio is calculated as Tier 1 Capital divided by adjusted end of period assets. In 2015 and 2016 the Tier 1 Leverage

Ratio is calculated as Tier 1 Capital divided by adjusted average

assets. 4 Calculated in accordance with 12 CFR Part 3. |

11 Supervisory Severely Adverse Scenario Results Nine-quarter cumulative profit and loss metrics under the Supervisory Severely Adverse

Scenario (4Q 2014 – 4Q 2016) $ in Billions % of Average Assets 1 Pre-Provision Net Revenue 2 $10.5 21.7% Less Provision for Loan Losses $8.8 Realized (Gains)/Losses on Securities (AFS/HTM) $0.0 Other Losses/(Gains) $0.0 Equals Net Income before Taxes $1.7 3.5% Memo items ($ in billions) OCI 3 $0.0 1 Average assets is the nine-quarter average of total assets. Percent of Average Assets is calculated as nine-quarter cumulative PPNR and

nine-quarter cumulative net income before tax divided by Average

Assets. 2 PPNR includes total revenue (interest and non-interest income), net of interest expense and non-interest expense. Non-interest

expense includes losses from operational risk events including credit

card fraud losses. 3

OCI includes unrealized gains and losses on investments in debt and marketable equity securities held by the Bank that are available for sale, net of tax. |

12 Supervisory Severely Adverse Scenario Results Nine-quarter cumulative loan losses by type of loans under the Supervisory Severely

Adverse Scenario (4Q 2014 – 4Q 2016) 1 Portfolio loss rates calculated as the cumulative loan losses net of recoveries over nine quarters divided by average loan balances over nine

quarters. Loan balances include held for sale

balances. 2

Credit card loan losses include losses on private label credit cards and Dual

Cards. 3 Commercial and industrial loan losses include losses on private label credit cards and Dual Cards for small to mid-sized commercial

customers. 4

Other consumer loan losses include losses on consumer installment loans. $ in Billions Portfolio Loss Rates 1 Loan Losses $7.8 19.7% Credit Cards 2 $7.5 19.8% Commercial and Industrial 3 $0.3 25.5% Other Consumer 4 $0.0 4.4% Other Loans $0.0 0.0% |

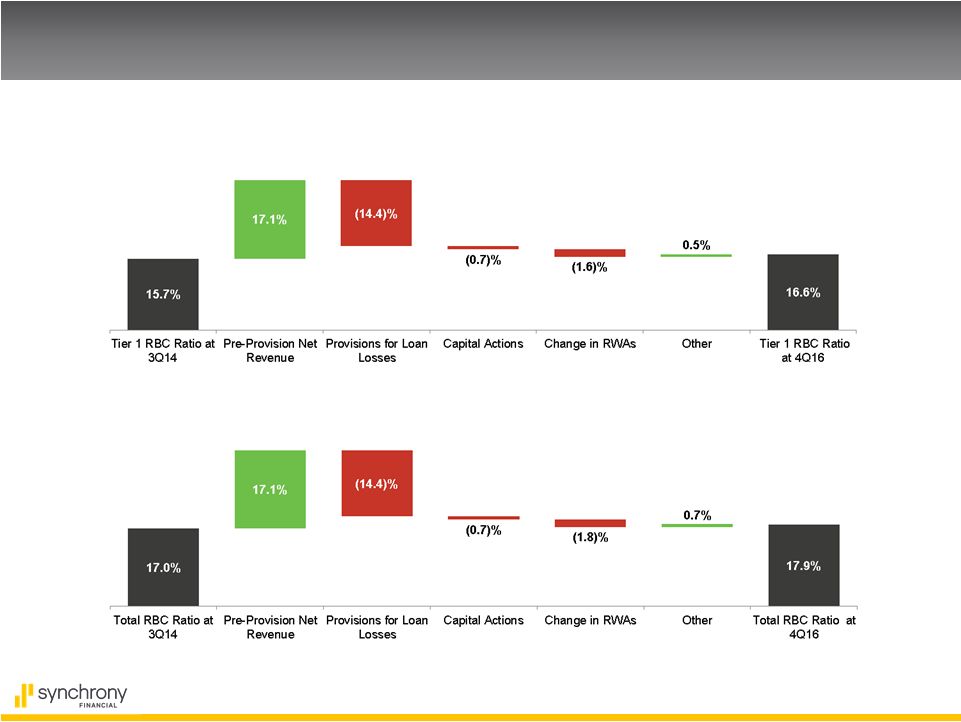

13 Supervisory Severely Adverse Scenario Drivers of Pro Forma Capital Ratios Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio 2 1 “Other” includes changes in goodwill, intangibles, and accumulated OCI.

2 “Other” includes changes in goodwill, intangibles, accumulated OCI, and eligible ALLL.

1 |

Engage with us. |