As filed with the Securities and Exchange Commission on March 13, 2014

Registration No. 333 -

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SYNCHRONY FINANCIAL

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 6199 | 51-0483352 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

777 Long Ridge Road

Stamford, Connecticut 06902

(203) 585-2400

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jonathan S. Mothner, Esq.

Executive Vice President, General Counsel and Secretary Synchrony Financial

777 Long Ridge Road

Stamford, Connecticut 06902

(203) 585-2400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| David S. Lefkowitz, Esq. Corey R. Chivers, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 |

Stuart C. Stock, Esq. David B.H. Martin, Esq. Covington & Burling LLP 1201 Pennsylvania Avenue, NW Washington, DC 20004 (202) 662-6000 |

Richard J. Sandler, Esq. John B. Meade, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common stock, par value $0.001 per share |

$100,000,000 | $12,880 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. This amount represents the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the Registrant. |

| (2) | Includes shares of common stock which may be sold pursuant to the underwriters’ option to purchase additional shares. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Dated March 13, 2014

Shares

Common Stock

We are offering shares of our common stock in this offering. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price of the shares will be between $ and $ per share.

We have granted the underwriters the right to purchase up to an additional shares of our common stock at the initial public offering price less the underwriting discount.

We will apply to list our shares of common stock on the New York Stock Exchange under the symbol “SYF.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 19.

PRICE $ PER SHARE

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriters.” |

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock to purchasers on , 2014.

Joint Book-Running Managers

| Goldman, Sachs & Co. |

J.P. Morgan | Citigroup | Morgan Stanley |

| Barclays | BofA Merrill Lynch | Credit Suisse | Deutsche Bank Securities | |||

, 2014

| 1 | ||||

| 19 | ||||

| 55 | ||||

| 57 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 63 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

72 | |||

| 110 | ||||

| 111 | ||||

| 140 | ||||

| 151 | ||||

| 183 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

199 | |||

| 200 | ||||

| 208 | ||||

| 211 | ||||

| Certain U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders |

213 | |||

| 216 | ||||

| 223 | ||||

| 223 | ||||

| 223 | ||||

| F-1 |

Neither we nor any of the underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any free writing prospectus prepared by or on behalf of us or to which we may have referred you in connection with this offering. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

Neither we nor any of the underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since those dates.

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: Neither we nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

i

Certain Defined Terms

Except as the context may otherwise require in this prospectus, references to:

| • | “we,” “us,” “our,” and the “Company” are to SYNCHRONY FINANCIAL and its subsidiaries, which together represent the businesses that historically have conducted GE’s North American retail finance business; |

| • | “Synchrony” are to SYNCHRONY FINANCIAL only; |

| • | “GE” are to General Electric Company and its subsidiaries; |

| • | “GECC” are to General Electric Capital Corporation (a subsidiary of GE) and its subsidiaries; |

| • | “GECFI” are to GE Consumer Finance, Inc. (a subsidiary of GECC that currently owns Synchrony) and its subsidiaries; and |

| • | the “Bank” are to GE Capital Retail Bank (a subsidiary of Synchrony), which is to be renamed Synchrony Bank in connection with this offering. |

“FICO” score means a credit score developed by Fair Isaac & Co., which is widely used as a means of evaluating the likelihood that credit users will pay their obligations. For a description of certain other terms we use, including “active account,” “open account” and “purchase volume,” see the notes to “Prospectus Summary—Summary Historical and Pro Forma Financial Information—Other Financial and Statistical Data.” There is no standard industry definition for many of these terms, and other companies may define them differently than we do.

We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which, in our business and in this prospectus, we refer to as our “partners.” The terms of the programs all require cooperative efforts between us and our partners of varying natures and degrees to establish and operate the programs. Our use of the term “partners” to refer to these entities is not intended to, and does not, describe our legal relationship with them, imply that a legal partnership or other relationship exists between the parties or create any legal partnership or other relationship. The “average length of our relationship” with respect to a specified group of partners or programs is calculated on a loan receivables weighted average basis for those partners or for all partners participating in a program, based on the date each partner relationship or program, as applicable, started and the loan receivables attributable to each partner or all partners participating in a program, as applicable, as of a specified date.

“Synchrony” and its logos and other trademarks referred to in this prospectus, including, Optimizer+plus™, Optimizer+plus Perks™, CareCredit®, Quickscreen® and eQuickscreen™ belong to us. Solely for convenience, we refer to our trademarks in this prospectus without the ™ and ® symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

Industry and Market Data

This prospectus contains various historical and projected financial information concerning our industry and market. Some of this information is from industry publications and other third party sources, and other information is from our own data and market research that we commission. All of this information involves a variety of assumptions, limitations and methodologies and is inherently subject to uncertainties, and therefore you are cautioned not to give undue weight to it. Although we believe that those industry publications and other third party sources are reliable, we have not independently verified the accuracy or completeness of any of the data from those publications or sources. Statements in this prospectus that we are the largest provider of private label credit cards in the United States (based on purchase volume and receivables) are based on issue

ii

number 1,019 of “The Nilson Report,” a subscription-based industry newsletter, dated June 2013 (based on 2012 data), and references to “The Nilson Report (December 2012)” are to issue number 1,008 of The Nilson Report, dated December 2012.

Non-GAAP Measures

To assess and internally report the revenue performance of our three sales platforms, we use a measure we refer to as “platform revenue.” Platform revenue is the sum of three line items in our Combined Statements of Earnings prepared in accordance with U.S. generally accepted accounting principles (“GAAP”): “interest and fees on loans,” plus “other income,” less “retailer share arrangements.” Platform revenue itself is not a measure presented in accordance with GAAP. For a reconciliation of platform revenue to interest and fees on loans, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Platform Analysis.” We deduct retailer share arrangements but do not deduct other line item expenses, such as interest expense, provision for loan losses and other expense, because those items are managed for the business as a whole. We believe that platform revenue is a useful measure to investors because it represents management’s view of the net revenue contribution of each of our platforms. This measure should not be considered a substitute for interest and fees on loans or other measures of performance we have reported in accordance with GAAP.

We also present certain capital ratios for the Company calculated on a pro forma basis. As a new savings and loan holding company, the Company historically has not been required by regulators to disclose capital ratios, and therefore these capital ratios are non-GAAP measures. We believe these capital ratios are useful measures to investors because they are widely used by analysts and regulators to assess the capital position of financial services companies, although they may not be comparable to similarly titled measures reported by other companies. The pro forma Basel III Tier 1 common ratio presented herein is a preliminary estimate reflecting management’s interpretation of regulatory requirements, which have not been fully implemented. For a reconciliation of the components of these capital ratios to their nearest comparable GAAP component, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital.”

iii

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the information set forth in “Risk Factors,” our combined financial statements and the related notes thereto, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus, before making an investment decision.

Our Company

We are one of the premier consumer financial services companies in the United States. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” Through our partners’ 329,000 locations across the United States and Canada, and their websites and mobile applications, we offer their customers a variety of credit products to finance the purchase of goods and services. During 2013, we financed $93.9 billion of sales, and at December 31, 2013, we had $57.3 billion of loan receivables and 62.0 million active accounts. Our active accounts represent a geographically diverse group of both consumers and businesses, with an average FICO score of 714 for consumer active accounts. Our business has been profitable and resilient, including through the recent U.S. financial crisis and ensuing years. For the year ended December 31, 2013, we had net earnings of $2.0 billion, representing a return on assets of 3.5%.

Our business benefits from longstanding and collaborative relationships with our partners, including some of the nation’s leading retailers and manufacturers with well-known consumer brands, such as Lowe’s, Wal-Mart, Amazon and Ethan Allen. We believe our partner-centric business model has been successful because it aligns our interests with those of our partners and provides substantial value to both our partners and our customers. Our partners promote our credit products because they generate increased sales and strengthen customer loyalty. Our customers benefit from instant access to credit, discounts and promotional offers. We differentiate ourselves through deep partner integration and our extensive marketing expertise. We have omni-channel (in-store, online and mobile) technology and marketing capabilities, which allow us to offer and deliver our credit products instantly to customers across multiple channels. The purchase volume from our online and mobile channels increased 62% from 2010 to 2013.

We offer our credit products primarily through our wholly-owned subsidiary, GE Capital Retail Bank, which is to be renamed Synchrony Bank in connection with this offering (the “Bank”). Through the Bank, we offer a range of deposit products insured by the Federal Deposit Insurance Corporation (“FDIC”), including certificates of deposit, individual retirement accounts (“IRAs”), money market accounts and savings accounts, under our Optimizer+Plus brand, directly to retail and commercial customers. We also take deposits at the Bank through third-party securities brokerage firms that offer our FDIC-insured deposit products to their customers. We are expanding our online direct banking operations to increase our deposit base as a source of stable and diversified low cost funding for our credit activities. We had $25.7 billion in deposits at December 31, 2013.

1

Our Sales Platforms

We offer our credit products through three sales platforms: Retail Card, Payment Solutions and CareCredit. Set forth below is a summary of certain information relating to our Retail Card, Payment Solutions and CareCredit platforms at or for the year ended December 31, 2013:

| ($ in millions, except for average loan receivable balance) | Retail Card | Payment Solutions | CareCredit | |||||||||

| Partners |

24 | 61,000 | 149,000 | |||||||||

| Partner locations |

34,000 | 118,000 | 177,000 | |||||||||

| Purchase volume |

$ | 75,739 | $ | 11,360 | $ | 6,759 | ||||||

| Active accounts (in millions) |

50.8 | 6.8 | 4.4 | |||||||||

| Average loan receivable balance |

$ | 782 | $ | 1,654 | $ | 1,470 | ||||||

| Average FICO for consumer active accounts |

718 | 709 | 684 | |||||||||

| Period end loan receivables |

$ | 39,834 | $ | 10,893 | $ | 6,527 | ||||||

| Interest and fees on loans |

$ | 8,317 | $ | 1,506 | $ | 1,472 | ||||||

| Other income |

407 | 36 | 45 | |||||||||

| Retailer share arrangements(1) |

(2,320 | ) | (36 | ) | (6 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Platform revenue(2) |

$ | 6,404 | $ | 1,506 | $ | 1,511 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Most of our Retail Card program agreements contain retailer share arrangements that provide for payments to our partner if the economic performance of the program exceeds a contractually defined threshold. |

| (2) | Platform revenue is a non-GAAP measure. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Platform Analysis.” |

| • | Retail Card. Retail Card is a leading provider of private label credit cards, and also provides Dual Cards and small and medium-sized business credit products. We offer these products through programs with 24 national and regional retailers that collectively have 34,000 retail locations. The average length of our relationship with our Retail Card partners is 15 years. Our partners are diverse by industry and include Amazon, Belk, Brooks Brothers, Chevron, Dillard’s, Gap, JCPenney, Lowe’s, Sam’s Club, T.J.Maxx and Wal-Mart. Our Retail Card programs typically are exclusive with respect to the credit products we offer at that partner. Private label credit cards are partner-branded credit cards that are used for the purchase of goods and services from the partner. Our patented Dual Cards are credit cards that function as a private label credit card when used to purchase goods and services from our partners and as a general purpose credit card when used elsewhere. Substantially all of the credit extended in this platform is on standard (i.e., non-promotional) terms. |

| • | Payment Solutions. Payment Solutions is a leading provider of promotional financing for major consumer purchases, offering primarily private label credit cards and installment loans. We offer these products through 252 programs with national and regional retailers, manufacturers, buying groups and industry associations, and a total of 61,000 participating partners that collectively have 118,000 retail locations. Our partners operate in seven product markets: automotive (tires and repair), home furnishing/flooring, electronics/appliances, jewelry and other luxury items, power (motorcycles, ATVs and lawn and garden), home specialty (windows, doors, roofing, siding, HVAC and repair) and other retail. We have programs with a diverse group of retailers, manufacturers, buying groups and industry associations, such as Ashley HomeStores, Discount Tire, h.h.gregg, the North American Home Furnishings Association and P.C. Richard & Son. Substantially all of the credit extended in this platform is promotional financing for major purchases. We offer three types of promotional financing: deferred interest, no interest and reduced interest. In almost all cases, our partners compensate us for all or part of the cost of providing this promotional financing. |

2

| • | CareCredit. CareCredit is a leading provider of promotional financing to consumers for elective healthcare procedures or services, such as dental, veterinary, cosmetic, vision and audiology. We offer our products through a network we have developed of 149,000 healthcare partners that collectively have 177,000 locations. The vast majority of our partners are individual and small groups of independent healthcare providers, and the remainder are national and regional healthcare providers and manufacturers. Our national and regional healthcare and manufacturer partners include LCA-Vision, Heartland Dental, Starkey Laboratories and Veterinary Centers of America (VCA Antech). We also have relationships with more than 100 professional and other associations, including the American Dental Association and the American Animal Hospital Association, various state dental and veterinary associations, manufacturers and buying groups, which endorse and promote (in some cases for compensation) our credit products to their members. We offer customers a CareCredit-branded private label credit card that may be used across our network of CareCredit providers. Substantially all of the credit extended in this platform is promotional financing, and in almost all cases, our partners compensate us for all or part of the cost of providing this promotional financing. |

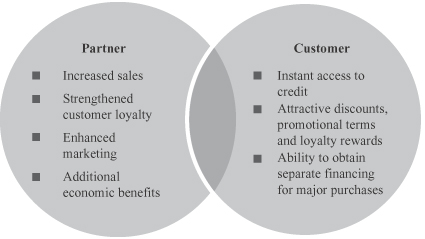

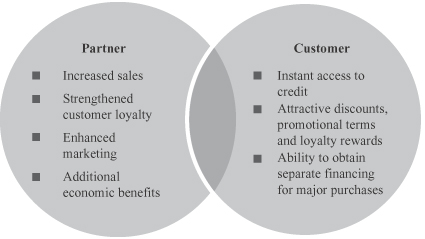

Our Value Proposition

We offer strong value propositions to both our partners and our customers.

Our Value Proposition

Value to Our Partners

Our consumer finance programs deliver the following benefits to our partners:

| • | Increased sales. Our programs drive increased sales for our partners by providing instant credit with an attractive value proposition (which may include discounts, promotional financing and customized loyalty rewards). Based on our research and experience in our Retail Card and Payment Solutions platforms, average sales per customer in these platforms are higher for customers who use our cards compared to consumers who do not. In Payment Solutions, the availability of promotional financing is important to the consumer’s decision to make purchases of “big-ticket” items and a driver of retailer selection. In CareCredit, the availability of credit can also have a substantial influence over consumer spending with a significant number of consumers indicating in our research that they would postpone or forego all or a portion of their desired healthcare procedures or services if credit was not available through their healthcare providers. |

3

| • | Strengthened customer loyalty. Our programs benefit our partners through strengthened customer loyalty. Our Retail Card customers have had their cards an average of 7.7 years at December 31, 2013. We believe customer loyalty drives repeat business and additional sales. In the year ended December 31, 2013, our 50.8 million active Retail Card accounts made an average of more than 12 purchases per account. Our CareCredit customers can use their card at any provider within our provider network, which we believe is an important source of new business to our providers, and 69% of CareCredit transactions in 2013 were from existing customers reusing their card at one or more providers. |

| • | Enhanced marketing. We have developed significant marketing expertise that we share with our partners through dedicated on-site teams, a national field sales force and experts who reside in our marketing centers of excellence. We believe this expertise is of substantial value to our partners in increasing sales and profitability. Our omni-channel capabilities allow us to market our credit products wherever our partners offer their products. Our customer relationship management (“CRM”) and data analytics capabilities allow us to track customer responsiveness to different marketing strategies, which helps us target marketing messages and promotional offers to our partners’ customers. In Payment Solutions, our dedicated industry-focused sales and marketing teams bring substantial retailer marketing expertise to our smaller retailer and merchant partners. These partners benefit from our research on how to increase store traffic with various promotional offerings. We also provide them with website and e-commerce capabilities that many could not afford to develop on their own. |

| • | Additional economic benefits. Our programs provide economic benefits to our partners in addition to increasing sales. Our Retail Card partners typically benefit from retailer share arrangements that provide for payments to them once the economic performance of the program exceeds a contractually-defined threshold. These shared economics enhance our partners’ engagement with us and provide an incentive for partners to support our programs. In addition, for most of our partners, our credit programs reduce costs by eliminating the interchange fees for in-store purchases that would otherwise be paid when general purpose credit cards or debit cards are used. Our programs also allow our partners to avoid the risks and administrative costs associated with carrying an accounts receivable balance for their customers, and this is particularly attractive to many of our CareCredit partners. |

Value to Our Customers

Our consumer finance programs deliver the following benefits to our customers:

| • | Instant access to credit. We offer qualified customers instant access to credit at the point of sale and across multiple channels. Annual applications for our credit products increased from 37.7 million applications in 2011 to 47.0 million in 2013. Our Retail Card programs provide financing for frequent purchases with attractive program benefits, including, in the case of our Dual Card, the convenience of a general purpose credit card. Payment Solutions and CareCredit offer promotional financing that enables qualified customers to make major purchases, including, in the case of CareCredit, elective healthcare procedures or services that typically are not covered by insurance. |

| • | Attractive discounts, promotional terms and loyalty rewards. We believe our programs provide substantial value to our customers through attractive discounts, promotional terms and loyalty rewards. Retail Card customers typically benefit from first purchase discounts (e.g., 10% or more off the purchase price when a new account is opened) and discounts or loyalty rewards when their card is used to make subsequent purchases from our partners. Our Retail Card customers typically earn rewards based on the amount of their purchases from our partners at a rate which is generally higher than the reward rate on general purpose credit cards. Our Payment Solutions and CareCredit customers typically benefit from promotional financing such as interest-free periods on purchases. These types of promotions typically are not available to consumers when they use a general purpose credit card outside of introductory offer periods. |

4

| • | Ability to obtain separate financing for major purchases. We believe many consumers prefer to obtain separate financing for major purchases or category expenditures rather than accessing available borrowing capacity under their general purpose credit cards or using cash. We believe our customers also value the ability to compartmentalize, budget and track their spending and borrowing through separate financing for a major purchase. |

Our Industry

We believe our business is well positioned to benefit from the following favorable industry trends:

| • | Improvements in consumer spending and credit utilization. Consumer spending has increased as U.S. economic conditions and consumer confidence continue to recover from the recent financial crisis. The U.S. consumer payments industry, which consists of credit, debit, cash, check and electronic payments, is projected to grow by 25% from 2011 to 2016 (from $8.3 trillion in 2011 to $10.4 trillion in 2016) according to The Nilson Report (December 2012). According to that report, credit card payments are expected to account for the majority of the growth of the U.S. consumer payments industry. Credit card payments accounted for $2.1 trillion or 25.6% of U.S. consumer payments volume in 2011 and are expected to grow to $3.5 trillion or 34.1% of U.S. consumer payments volume in 2016. Credit card spending is growing as a percentage of total consumer spending, driven in part by the growth of online and mobile purchases. |

| • | Improvements in U.S. household finances. U.S. household finances have recovered substantially since the financial crisis. According to the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”), the average U.S. household’s ratio of debt payments to disposable personal income (“debt service ratio”) is better than pre-crisis levels, having improved to 9.9% for the three months ended September 30, 2013 from 13.1% for the three months ended September 30, 2007. According to the Federal Reserve Board, aggregate U.S. household net worth also has increased, from $68.0 trillion at December 31, 2007 to $77.3 trillion at September 30, 2013. |

| • | Growth of direct banking and deposit balances. According to a 2012 American Bankers Association survey, the percentage of customers who prefer to do their banking via direct channels (internet, mail, phone and mobile) increased from 53% to 62% between 2010 and 2012, while those who prefer branch banking declined from 25% to 18% over the same period. This preference for direct banking has been evidenced by robust growth in direct deposits. |

Competitive Strengths

Our business has a number of competitive strengths, including the following:

| • | Large, diversified and well established consumer finance franchise. Our business is large and diversified with 62.0 million active accounts and a partner network with 329,000 locations across the United States and in Canada. At December 31, 2013, we had $57.3 billion in total loan receivables, and we are the largest provider of private label credit cards in the United States based on purchase volume and receivables according to The Nilson Report (June 2013). We have built large scale operations that support each of our sales platforms, and we believe our extensive partner network, with its broad geographic reach and diversity by industry, provides us with a distribution capability that is difficult to replicate. We believe the scale of our business and resulting operating efficiencies also contribute significantly to our success and profitability. In addition, we believe our partner-centric model, including our distribution capability, could lend itself to geographic expansion. |

| • | Partner-centric model with long-standing and stable relationships. Our business is based on a partner-centric, business-to-business model. Our ability to establish and maintain deep, collaborative relationships with our partners is a core skill that we have developed through decades of experience. |

5

| At December 31, 2013, the average length of our relationship for our 40 largest programs across all platforms (measured by platform revenue for the year ended December 31, 2013), which accounted in aggregate for 74.9% of our 2013 platform revenue, is 14 years. From these same 40 programs, 55.1% of our 2013 platform revenue is generated under programs with current contractual terms that continue through at least January 1, 2017. A diverse and growing group of more than 200,000 partners accounted for the remaining 25.1% of our 2013 platform revenue. |

| • | Deeply integrated technology across multiple channels. Our proprietary technology is deeply integrated with our partners’ systems and processes, which enables us to provide customized credit products to their customers at the point of sale across multiple channels. Our technologies enable customers to apply for credit at the point of sale in-store, online or on a mobile device and, if approved, purchase instantly. Our online and mobile technologies are capable of being seamlessly integrated into our partners’ systems to enable our customers to check their available credit line, manage their account, access our eChat online customer service and participate in many of our partners’ loyalty rewards programs online and using mobile devices. In addition, in CareCredit, we have developed what we believe is one of the largest healthcare provider locators of its kind, helping to connect customers to our 177,000 healthcare provider locations. This online locator received an average of 560,000 hits per month in 2013, helping to drive incremental business for our provider partners. We believe that our continued investment in technology and mobile offerings will help us deepen our relationships with our existing partners, as well as provide a competitive advantage when seeking to win new business. |

| • | Strong operating performance. Over the three years ended December 31, 2013, we have grown our purchase volume and loan receivables at 9.8% and 8.2% compound annual growth rates, respectively. For 2011, 2012 and 2013, our net earnings were $1.9 billion, $2.1 billion and $2.0 billion, respectively, and our return on assets was 4.1%, 4.2% and 3.5%, respectively. We were profitable throughout the recent U.S. financial crisis. We believe our ability to maintain profitability through various economic cycles is attributable to our rigorous underwriting process, strong pricing discipline, low cost to acquire new accounts, operational expertise and retailer share arrangements with our largest partners. |

| • | Strong balance sheet and capital base. We have a strong capital base and a diversified and stable funding profile with access to multiple sources of funding, including a growing deposit platform at the Bank, securitized financings under well-established programs, a new GECC term loan facility and a new bank term loan facility. In addition, following this offering, we intend to access the public unsecured debt markets as a source of funding. At December 31, 2013, pro forma for the Transactions (as defined under “—Summary Historical and Pro Forma Financial Information”), we would have had a fully phased-in Basel III Tier 1 common ratio of %, and our business would have been funded with $25.7 billion of deposits at the Bank, $15.4 billion of securitized financings, $ billion of transitional funding from the new GECC term loan facility, $ billion from the new bank term loan facility and $ billion of additional unsecured debt from a planned debt offering. At December 31, 2013, on a pro forma basis, we would have had $ billion of cash and short-term liquid investments (or % of total assets) and approximately $ billion of undrawn committed capacity under securitization facilities. We also had, at the same date and on the same basis, more than $25.0 billion of unencumbered assets in the Bank available to be used to generate additional liquidity through secured borrowings or asset sales. |

| • | Experienced and effective risk management. We have an experienced risk management team and an enterprise risk management infrastructure that we believe enable us to effectively manage our risk. Our enterprise risk management function is designed to identify, measure, monitor and control risk, including credit, market, liquidity, strategic and operational risks. Our focus on the credit process is evidenced by the success of our business through multiple economic cycles. We control the credit criteria for all of our |

6

| programs and issue credit only to consumers who qualify under those credit criteria. Our systems are integrated with our partners’ systems, and therefore we can use our proprietary credit approval processes to make credit decisions instantly at the point of sale and across all application channels in accordance with our underwriting guidelines and risk appetite. Our risk management strategies are customized by industry and partner, and we believe our proprietary decisioning systems and customized credit scores provide significant incremental predictive capabilities over standard credit bureau-based scores alone. In addition, we have a robust compliance program, and we have invested, and expect to continue to invest, in enhancing our regulatory compliance capabilities. |

| • | High quality and diverse asset base. The quality of our loan receivables portfolio is high. Our consumer active accounts had an average FICO score of 714, and our total loan receivables had a weighted average consumer FICO score of 696, in each case at December 31, 2013. In addition, 71.3% of our portfolio’s loan receivables are from consumers with a FICO score of greater than 660 at December 31, 2013. Our over-30 day delinquency rate at December 31, 2013 is below 2007 pre-financial crisis levels. We have a seasoned customer base with 32.7% of our loan receivables at December 31, 2013 associated with accounts that have been open for more than six years. Our portfolio is also diversified by geography, with receivables balances broadly reflecting the U.S. population distribution. |

| • | Experienced management team and business built on GE culture. Our senior management team, including key members who helped us successfully navigate the financial crisis, will continue to lead our company following this offering. We have operated as a largely standalone business within GECC, with our own sales, marketing, risk management, operations, collections, customer service and compliance functions. Our business has been built on GE’s culture and heritage, with a strong emphasis on our partners and customers, a rigorous use of metrics and analytics, a disciplined approach to risk management and compliance and a focus on continuous improvement and strong execution. |

Our Business and Growth Strategy

We intend to grow our business and increase our profitability by building on our financial and operating strengths and capitalizing on projected favorable industry trends, as well as by pursuing a number of important growth strategies for our business, including the following:

Increase customer penetration at our existing partners. We believe there is a significant opportunity to grow our business by increasing the usage of our cards in each of our sales platforms. In Retail Card, based on sales data provided by our partners, we have increased penetration of our partners’ aggregate sales in each of the last three years. For the year ended December 31, 2013, penetration of our Retail Card partners’ sales ranged from 1% to 49%, and the aggregate sales of all Retail Card partners were $555.6 billion, which we believe represents a significant opportunity for potential growth. We believe there is also a significant market opportunity for us to increase our penetration in Payment Solutions and CareCredit.

Attract new partners. We seek to attract new partners by both launching new programs and acquiring existing programs from our competitors. In Retail Card, which is typically characterized by longer-term, exclusive relationships, we added four new Retail Card partners from January 1, 2011 through December 31, 2013, which accounted for $2.3 billion of receivables at December 31, 2013. In Payment Solutions, where a significant portion of our programs include independent dealers and merchants that enter into separate arrangements with us, we established 37 new Payment Solutions programs from January 1, 2011 through December 31, 2013, which accounted for $1.2 billion of loan receivables at December 31, 2013, and increased our total partners from 57,000 at December 31, 2010 to 61,000 at December 31, 2013. In CareCredit, where we attract new healthcare provider partners largely by leveraging our endorsements from professional associations and healthcare consultants, we increased the number of partners with which we had agreements from 122,000 at December 31, 2010 to 149,000 at December 31, 2013. We believe there is a significant opportunity to attract new partners in each of our platforms, including by adding additional merchants, dealers and healthcare providers under existing programs.

7

Our strategies to both increase penetration among our current partners and attract new partners include the following elements:

| • | Leverage technology to support our partners. Our business model is focused on supporting our partners by offering credit wherever they offer their products and services (i.e., in-store, online and on mobile devices). We intend to continue to make significant investments in online and mobile technologies, which we believe will lead to new accounts, increased sales and deeper relationships with our existing partners and will give us an advantage when competing for new partners. We intend to continue to roll out the capability for consumers to apply for our products via their mobile devices, receive an instant credit decision and obtain immediate access to credit, and to deliver targeted rewards and promotions to our customers via their mobile devices for immediate use. |

| • | Capitalize on our strong data, analytics and customer relationship management capabilities. We believe that our ongoing efforts to expand our data and analytics capabilities help differentiate us from our competitors. We have access to a vast amount of data (such as our customers’ purchase patterns and payment histories) from our 108.9 million open accounts at December 31, 2013 and the hundreds of millions of transactions our customers make each year. Consistent with applicable privacy rules and regulations, we are developing new tools to assess this data to develop and deliver valuable insights and actionable analysis that can be used to improve the effectiveness of marketing strategies leading to incremental growth for both our partners and our business. Our recently enhanced CRM platform will utilize these insights and analysis to drive more relevant and timely offers to our customers via their preferred channels of communication. We believe the combination of our analytics expertise and extensive data access will drive greater partner engagement and increased sales, strengthen customer loyalty, and provide us a competitive advantage. |

| • | Launch our integrated multi-tender loyalty programs. We are leveraging our extensive data analytics, loyalty experience and broad retail presence to launch multi-tender loyalty programs that enable customers to earn rewards from a partner, regardless of how they pay for their purchases (e.g., cash, private label or general purpose credit cards). By expanding our loyalty program capabilities beyond credit payments we can provide deeper insights to our partners about their customers, including spending patterns and shopping behaviors. Multi-tender loyalty programs will also provide us with access to non-cardholders, giving us the opportunity to grow our customer base by marketing our credit products to them and delivering a more compelling value proposition. |

| • | Increase focus on small and mid-sized businesses. We currently offer private label credit cards and Dual Cards for small to mid-sized commercial customers that are similar to our consumer offerings. We are increasing our focus on marketing our commercial pay-in-full accounts receivable product to a wide range of business customers and are rolling out an improved customer experience for this product with enhanced functionality. Our loan receivables from business customers were $1.3 billion at December 31, 2013, and we believe our strategic focus on business customers will enable us to continue to attract new business customers and increase the diversity of our loan receivables. |

| • | Expand our direct banking activities. In January 2013, we acquired the deposit business of MetLife Bank, N.A. (“MetLife”), which is a direct banking platform that at the time of the acquisition had $6.0 billion in U.S. direct deposits and $0.4 billion in brokered deposits. Our U.S. direct deposits grew from $0.9 billion at December 31, 2012 to $10.9 billion at December 31, 2013 (including the MetLife acquisition). The acquisition of this banking platform is a key part of our strategy to increase our deposit base as a source of stable and diversified low cost funding. The platform is highly scalable, allowing us to expand without the overhead expenses of a traditional “brick and mortar” branch network. We believe we are well-positioned to benefit from the consumer-driven shift from branch banking to direct banking. According to a 2012 American Bankers Association survey, the percentage of customers who prefer to do their banking via direct channels (i.e., internet, mail, phone and mobile) increased from 53% to 62% between 2010 and 2012, while those who prefer branch banking declined from 25% to 18% over the same |

8

| period. To attract new deposits and retain existing ones, we are enhancing our loyalty program and expanding mobile banking offerings. We also intend to introduce new deposit products and enhancements to our existing products. These new and enhanced products include the introduction of checking accounts, overdraft protection lines of credit, a bill payment account feature and debit cards, as well as enhanced small business deposit accounts and expanded affinity offers. |

Formation and Regulation of Synchrony

Synchrony is a holding company for the legal entities that historically conducted GE’s North American retail finance business. Synchrony (previously named GE Capital Retail Finance Corporation) was incorporated in Delaware on September 12, 2003, but prior to April 1, 2013 conducted no business. During the period from April 1, 2013 to September 30, 2013, as part of a regulatory restructuring, substantially all of the assets and operations of GE’s North American retail finance business, including the Bank, were transferred to Synchrony. The remaining assets and operations of that business have been or will be transferred to Synchrony prior to the completion of this offering.

As a savings and loan holding company, Synchrony is subject to extensive regulation, supervision and examination by the Federal Reserve Board. In addition, as a large provider of consumer financial services, Synchrony is subject to extensive regulation, supervision and examination by the Consumer Financial Protection Bureau (the “CFPB”).

The Bank is a federally chartered savings association and therefore is subject to extensive regulation, supervision and examination by the Office of the Comptroller of the Currency of the U.S. Treasury (the “OCC”), which is its primary regulator, and by the CFPB. In addition, the Bank, as an insured depository institution, is supervised by the FDIC.

For a discussion of the regulation of our company and the Bank, see “Regulation.”

GE Ownership and Our Separation from GE

GE currently owns 100% of the common stock of GECC, GECC currently owns 100% of the common stock of GECFI and GECFI currently owns 100% of the common stock of Synchrony.

On November 15, 2013, GE announced that it planned a staged exit from our business, consistent with its strategy of reducing GECC’s percentage of GE’s total earnings and increasing GECC’s focus on its commercial lending and leasing businesses. This offering is the first step in that exit. After the completion of this offering, GE will beneficially own % of our outstanding common stock (or % if the underwriters’ option to purchase additional shares of common stock from us is exercised in full).

GE has indicated that after this offering it currently is targeting to complete its exit from our business in 2015 through a split-off transaction, by making a tax-free distribution of all of its remaining shares of our stock to electing GE stockholders in exchange for shares of GE’s common stock (the “Split-off”). GE may also decide to exit our business by selling or otherwise distributing or disposing of all or a portion of its shares of our stock. The Split-off or other transaction or transactions through which GE disposes of all of its remaining shares of our company are referred to as the “Separation.” The Separation would be subject to various conditions, including receipt of any necessary bank regulatory and other approvals, the existence of satisfactory market conditions, and, in the case of the Split-off, GE’s receipt of a private letter ruling from the Internal Revenue Service (“IRS”) as to certain issues relating to, and an opinion of counsel confirming, the tax-free treatment of the transaction to GE and its stockholders. The conditions to any transaction involved in the Separation may not be satisfied in 2015 or thereafter, or GE may decide for any reason not to consummate the Separation in 2015 or thereafter.

The final step in GE’s exit from our business will be complete only when the Federal Reserve Board determines that GE no longer controls us and releases GE from savings and loan holding company registration

9

(the “GE SLHC Deregistration”). Prior to the GE SLHC Deregistration, we will be required to file an application with, and receive approval from, the Federal Reserve Board to continue to be a savings and loan holding company and to retain ownership of the Bank following the GE SLHC Deregistration. The GE SLHC Deregistration may or may not coincide with the Separation, depending on whether GE is deemed to continue to control us for regulatory purposes as a result of ongoing transitional, contractual or other relationships. See “Risk Factors—Risks Relating to Our Separation from GE.”

Debt Financings

Prior to the completion of this offering, we will enter into a term loan facility (the “New Bank Term Loan Facility”) with third party lenders that will provide $ billion principal amount of unsecured term loans maturing in 2019. Prior to the completion of this offering, we will also enter into a term loan facility (the “New GECC Term Loan Facility”) with GECC that will provide $ billion principal amount of unsecured term loans maturing in 2019. We expect to borrow the full $ billion available under the New Bank Term Loan Facility and the New GECC Term Loan Facility concurrent with the closing of this offering. See “Use of Proceeds.”

Prior to the completion of this offering, we expect to enter into agreements providing us with an aggregate of approximately $ billion of undrawn committed capacity from private lenders under two of our existing securitization programs.

We also currently plan to issue approximately $ billion of senior unsecured debt securities in one or more series shortly after the completion of this offering (the “Planned Debt Offering”). We cannot assure you that the Planned Debt Offering will be completed or, if completed, on what terms it will be completed.

For a discussion of these financings, see “Description of Certain Indebtedness—New Bank Term Loan Facility,” “—New GECC Term Loan Facility,” “—Securitized Financings” and “—New Senior Notes.”

Risks Relating to Our Company

As part of your evaluation of our company, you should consider the risks associated with our business, regulation of our business, the Separation and this offering. These risks include:

| • | Risks relating to our business, including: (i) impact of macroeconomic conditions; (ii) retaining existing partners and attracting new partners, concentration of our platform revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; (iii) our need for additional financing, higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and reduction in our credit ratings; (iv) our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; (v) our reliance on dividends, distributions and other payments from the Bank; (vi) our ability to grow our deposits in the future; (vii) changes in market interest rates; (viii) effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses, and accuracy of the assumptions or estimates used in preparing our financial statements; (ix) our ability to offset increases in our costs in retailer share arrangements; (x) competition in the consumer finance industry; (xi) our concentration in the U.S. consumer credit market; (xii) our ability to successfully develop and commercialize new or enhanced products and services; (xiii) our ability to realize the value of strategic investments; (xiv) reductions in interchange fees; (xv) fraudulent activity; (xvi) cyber-attacks or other security breaches; (xvii) failure of third parties to provide various services that are important to our operations; (xviii) disruptions in the operations of our computer systems and data centers; (xix) international risks and compliance and regulatory risks and costs associated with international operations; (xx) catastrophic events; (xxi) alleged infringement of intellectual property rights of others and our ability to protect our |

10

| intellectual property; (xxii) litigation and regulatory actions; (xxiii) damage to our reputation; (xxiv) our ability to attract, retain and motivate key officers and employees; (xxv) tax legislation initiatives or challenges to our tax positions; and (xxvi) state sales tax rules and regulations; |

| • | Risks relating to regulation, including: (i) significant and extensive regulation, supervision and examination of, and enforcement relating to, our business by governmental authorities, impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and, the impact of the CFPB’s regulation of our business; (ii) changes to our methods of offering our CareCredit products; (iii) impact of capital adequacy rules; (iv) restrictions that limit our ability to pay dividends and repurchase our capital stock and that limit the Bank’s ability to pay dividends; (v) regulations relating to privacy, information security and data protection; (vi) use of third-party vendors and ongoing third-party business relationships; and (vii) as long as we are controlled by GECC for bank regulatory purposes, regulations pertaining to GECC; |

| • | Risks relating to the Separation, including: (i) GE not completing the Separation as planned or at all, and GE’s inability to obtain the GE SLHC Deregistration; (ii) Federal Reserve Board approval required for us to continue to be a savings and loan holding company, and Federal Reserve Board agreement required for us to be treated as a financial holding company after the GE SLHC Deregistration; (iii) need to significantly expand many aspects of our infrastructure; (iv) loss of association with GE’s strong brand and reputation; (v) limited right to use the GE brand name and logo and need to establish a new brand; (vi) terms of our arrangements with GE may be more favorable than we will be able to obtain from unaffiliated third parties, GE has significant control over us and reliance on exemptions from the corporate governance requirements of the NYSE available for a “controlled company”; (vii) our historical combined and pro forma financial results may not be a reliable indicator of what we would have achieved or will achieve as a standalone company; (viii) obligations associated with being a public company; (ix) GE could engage in businesses that compete with us, and conflicts of interest may arise between us and GE; and (x) failure caused by us of GE’s distribution of our common stock to its stockholders in exchange for its common stock to qualify for tax-free treatment, which may result in significant tax liabilities to GE for which we may be required to indemnify GE; and |

| • | Risks relating to this offering, including: (i) future sales of a substantial number of shares of our common stock; (ii) no prior public market for our common stock; (iii) volatility of the price of our common stock; (iv) our dividend policy may change at any time; (v) applicable laws and regulations, and provisions of our certificate of incorporation and by-laws may discourage takeover attempts and business combinations; and (vi) our common stock is and will be subordinate to all of our existing and future indebtedness and any preferred stock. |

For a discussion of these and other risks, see “Risk Factors.”

Additional Information

Our corporate headquarters and principal executive offices are located at 777 Long Ridge Road, Stamford, Connecticut 06902. Our telephone number at that address is (203) 585-2400. Our internet address is www.synchronyfinancial.com. Information on, or accessible through, our website is not part of this prospectus.

11

The Offering

| Issuer |

SYNCHRONY FINANCIAL |

| Common stock offered by us |

shares of common stock. |

| Option to purchase additional shares |

shares of common stock. |

| Common stock to be outstanding immediately after this offering |

shares of common stock. |

| Common stock listing |

We will apply to list our common stock on the New York Stock Exchange (“NYSE”) under the trading symbol “SYF.” |

| Use of proceeds |

Assuming an initial public offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus, we estimate that the net proceeds to us from the sale of our common stock in this offering will be $ (or $ if the underwriters exercise in full their option to purchase additional shares of common stock from us), after deducting estimated underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds from this offering, together with borrowings under the New Bank Term Loan Facility and the New GECC Term Loan Facility, to repay $ billion of the related party debt owed to GECC and its affiliates outstanding on the closing date of this offering ($ billion at December 31, 2013), to increase our capital, to invest in liquid assets to increase the size of our liquidity portfolio and for such additional uses as we may determine in the future. See “Use of Proceeds” and “Description of Certain Indebtedness.” |

| Voting rights |

One vote per share for all matters on which stockholders are entitled to vote, except that, until the earlier to occur of: (i) the time immediately prior to the Split-off and (ii) the GE SLHC Deregistration, no stockholder or group (other than GE or its affiliates and certain other exempted persons) shall have the right to vote more than 4.99% of our voting stock outstanding following this offering. |

| Dividend policy |

Following the offering, our board of directors intends to consider our policy regarding the payment and amount of dividends. The declaration and amount of any future dividends to holders of our common stock will be at the discretion of our board of directors and will depend on many factors, including the financial condition, earnings, capital and liquidity requirements of us and the Bank, regulatory restrictions, corporate law restrictions and other factors that our board of directors deems relevant. See “Risk Factors—Risks Relating to This Offering—We may change our dividend policy at any time” and “Dividend Policy.” |

12

| Risk factors |

See the section entitled “Risk Factors” beginning on page 19 for a discussion of some of the factors you should consider before investing in our common stock. |

| Debt financings |

Prior to the completion of this offering, we will enter into the New Bank Term Loan Facility with third party lenders that will provide $ billion principal amount of unsecured term loans maturing in 2019. Prior to the completion of this offering, we will also enter into the New GECC Term Loan Facility with GECC that will provide $ billion principal amount of unsecured term loans maturing in 2019. |

| We also currently intend to issue approximately $ billion of senior unsecured debt securities in the Planned Debt Offering shortly after the completion of this offering. |

| Prior to the completion of this offering, we expect to enter into agreements providing us with an aggregate of approximately $ billion of undrawn committed capacity from private lenders under two of our existing securitization programs. |

| For a discussion of these financings, see “Description of Certain Indebtedness—New Bank Term Loan Facility,” “—New GECC Term Loan Facility,” “—New Senior Notes” and “—Securitized Financings.” |

Unless otherwise indicated, all information in this prospectus, including information regarding the number of shares of our common stock outstanding:

| • | is based on an assumption of shares of common stock outstanding at December 31, 2013, which reflects the consummation of a stock split expected to occur immediately prior to this offering pursuant to which shares of common stock will be issued to the holder of common stock for each share held; |

| • | assumes an initial public offering price of $ per share (the midpoint of the price range set forth on the front cover of this prospectus); |

| • | assumes the underwriters’ option to purchase additional shares of common stock from us has not been exercised; and |

| • | does not include the shares of common stock underlying unvested restricted stock units and stock options issued to certain employees pursuant to “founders’ grants” under the Synchrony 2014 Long-Term Incentive Plan or the remaining shares of common stock reserved for issuance under the Synchrony 2014 Long-Term Incentive Plan, as described under “Management—Compensation Plans Following This Offering—Synchrony 2014 Long-Term Incentive Plan.” |

13

Summary Historical and Pro Forma Financial Information

The following table sets forth summary historical combined and unaudited pro forma financial information. You should read this information in conjunction with the information under “Selected Historical and Pro Forma Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our combined financial statements and the related notes included elsewhere in this prospectus.

Synchrony is a holding company for the legal entities that historically conducted GE’s North American retail finance business. Synchrony was incorporated in Delaware on September 12, 2003, but prior to April 1, 2013, conducted no business. During the period from April 1, 2013 to September 30, 2013, as part of a regulatory restructuring, substantially all of the assets and operations of GE’s North American retail finance business, including the Bank, were transferred to Synchrony. The remaining assets and operations of that business have been or will be transferred to Synchrony prior to the completion of this offering.

We have prepared our historical combined financial statements as if Synchrony had conducted GE’s North American retail finance business throughout all relevant periods. Our historical combined financial information and statements include the assets, liabilities and operations of GE’s North American retail finance business.

The unaudited pro forma information set forth below reflects our historical combined financial information, as adjusted to give effect to the following transactions (the “Transactions”) as if each had occurred as of January 1, 2013, in the case of statements of earnings information, and December 31, 2013, in the case of statements of financial position information:

| • | issuance of million shares of our common stock at an estimated offering price of $ per share (the midpoint of the price range set forth on the front cover of this prospectus); |

| • | repayment of $ billion of the Outstanding Related Party Debt (as defined under “Use of Proceeds”); |

| • | entering into of, and costs associated with, the New Bank Term Loan Facility and the New GECC Term Loan Facility; |

| • | completion of, and costs associated with, the Planned Debt Offering; |

| • | investment in liquid assets to further increase the size of our liquidity portfolio consistent with our liquidity and funding policies; and |

| • | issuance of a founders’ grant of restricted stock units and stock options to certain employees under the Synchrony 2014 Long-Term Incentive Plan. |

The unaudited pro forma information below is based upon available information and assumptions that we believe are reasonable. The unaudited pro forma financial information is for illustrative and informational purposes only and is not intended to represent what our financial condition or results of operations would have been had the Transactions occurred on the dates indicated. The unaudited pro forma information also should not be considered representative of our future financial condition or results of operations.

In addition to the pro forma adjustments to our historical combined financial statements, various other factors will have an effect on our financial condition and results of operations after the completion of this offering, including those discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” For a discussion of the pro forma adjustments, see “Selected Historical and Pro Forma Financial Information.”

14

Condensed Combined Statements of Earnings Information

| Pro Forma | Historical | |||||||||||||||

| Year Ended December 31, |

Years Ended December 31, | |||||||||||||||

| ($ in millions, except share and per share data) | 2013 | 2013 | 2012 | 2011 | ||||||||||||

| Interest income |

$ | $ | 11,313 | $ | 10,309 | $ | 9,141 | |||||||||

| Interest expense |

742 | 745 | 932 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income |

10,571 | 9,564 | 8,209 | |||||||||||||

| Retailer share arrangements |

(2,362 | ) | (1,975 | ) | (1,430 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income, after retailer share arrangements |

8,209 | 7,589 | 6,779 | |||||||||||||

| Provision for loan losses |

3,072 | 2,565 | 2,258 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income, after retailer share arrangements and provision for loan losses |

5,137 | 5,024 | 4,521 | |||||||||||||

| Other income |

488 | 473 | 498 | |||||||||||||

| Other expense |

2,483 | 2,121 | 2,009 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings before provision for income taxes |

3,142 | 3,376 | 3,010 | |||||||||||||

| Provision for income taxes |

(1,163 | ) | (1,257 | ) | (1,120 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net earnings |

$ | $ | 1,979 | $ | 2,119 | $ | 1,890 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding (in thousands) |

||||||||||||||||

| Basic |

||||||||||||||||

| Diluted |

||||||||||||||||

| Earnings per share |

||||||||||||||||

| Basic |

||||||||||||||||

| Diluted |

||||||||||||||||

15

Condensed Combined Statements of Financial Position Information

| Pro Forma | Historical | |||||||||||

| At December 31, |

At December 31, |

|||||||||||

| ($ in millions) | 2013 | 2013 | 2012 | |||||||||

| Assets: |

||||||||||||

| Cash and equivalents |

$ | $ | 2,319 | $ | 1,334 | |||||||

| Investment securities |

236 | 193 | ||||||||||

| Loan receivables |

57,254 | 52,313 | ||||||||||

| Allowance for loan losses |

(2,892 | ) | (2,274 | ) | ||||||||

| Goodwill |

949 | 936 | ||||||||||

| Intangible assets, net |

300 | 255 | ||||||||||

| Other assets |

919 | 705 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | $ | 59,085 | $ | 53,462 | |||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and Equity: |

||||||||||||

| Total deposits |

25,719 | 18,804 | ||||||||||

| Total borrowings |

24,321 | 27,815 | ||||||||||

| Accrued expenses and other liabilities |

3,085 | 2,261 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

53,125 | 48,880 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total equity |

5,960 | 4,582 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and equity |

$ | $ | 59,085 | $ | 53,462 | |||||||

|

|

|

|

|

|

|

|||||||

16

Other Financial and Statistical Data

| Pro Forma(1) | Historical | |||||||||||||||

| Year Ended December 31, |

Years Ended December 31, | |||||||||||||||

| ($ in millions, except per account data) | 2013 | 2013 | 2012 | 2011 | ||||||||||||

| Financial Position Data (Average): |

||||||||||||||||

| Loan receivables |

$ | $ | 52,407 | $ | 47,549 | $ | 44,131 | |||||||||

| Total assets |

$ | $ | 56,184 | $ | 49,905 | $ | 46,218 | |||||||||

| Deposits |

$ | $ | 22,911 | $ | 17,514 | $ | 15,442 | |||||||||

| Borrowings |

$ | $ | 25,209 | $ | 25,304 | $ | 24,687 | |||||||||

| Total equity |

$ | $ | 5,121 | $ | 4,764 | $ | 4,009 | |||||||||

| Selected Performance Metrics: |

||||||||||||||||

| Purchase volume(2) |

$ | 93,858 | $ | 93,858 | $ | 85,901 | $ | 77,883 | ||||||||

| Average active accounts (in thousands)(3) |

56,253 | 56,253 | 53,021 | 51,313 | ||||||||||||

| Average purchase volume per active account |

$ | 1,668 | $ | 1,668 | $ | 1,620 | $ | 1,518 | ||||||||

| Average loan receivables balance per active account |

$ | 932 | $ | 932 | $ | 897 | $ | 860 | ||||||||

| Net interest margin(4) |

% | 18.8 | % | 19.7 | % | 18.4 | % | |||||||||

| Net charge-offs |

$ | 2,454 | $ | 2,454 | $ | 2,343 | $ | 2,560 | ||||||||

| Net charge-offs as a % of average loan receivables |

4.7 | % | 4.7 | % | 4.9 | % | 5.8 | % | ||||||||

| Allowance coverage ratio(5) |

5.1 | % | 5.1 | % | 4.3 | % | 4.3 | % | ||||||||

| Return on assets(6) |

% | 3.5 | % | 4.2 | % | 4.1 | % | |||||||||

| Return on equity(7) |

% | 38.6 | % | 44.5 | % | 47.1 | % | |||||||||

| Equity to assets(8) |

% | 9.1 | % | 9.5 | % | 8.7 | % | |||||||||

| Other expense as a % of average loan receivables |

% | 4.7 | % | 4.5 | % | 4.6 | % | |||||||||

| Efficiency ratio(9) |

% | 28.6 | % | 26.3 | % | 27.6 | % | |||||||||

| Effective income tax rate |

% | 37.0 | % | 37.2 | % | 37.2 | % | |||||||||

| Capital Ratios for the Bank(10): |

||||||||||||||||

| Tier 1 risk-based capital ratio |

% | 16.0 | % | 13.8 | % | 13.3 | % | |||||||||

| Total risk-based capital ratio |

% | 17.3 | % | 15.1 | % | 14.5 | % | |||||||||

| Tier 1 leverage ratio |

% | 14.9 | % | 17.2 | % | 16.0 | % | |||||||||

| Capital Ratios for the Company(11): |

||||||||||||||||

| Tier 1 common ratio |

% | — | — | — | ||||||||||||

| Tier 1 risk-based capital ratio |

% | — | — | — | ||||||||||||

| Total risk-based capital ratio |

% | — | — | — | ||||||||||||

| Tier 1 leverage ratio |

% | — | — | — | ||||||||||||

| Selected Period End Data: |

||||||||||||||||

| Total loan receivables |

$ | 57,254 | $ | 57,254 | $ | 52,313 | $ | 47,741 | ||||||||

| Allowance for loan losses |

$ | 2,892 | $ | 2,892 | $ | 2,274 | $ | 2,052 | ||||||||

| 30+ days past due as a % of loan receivables |

4.3 | % | 4.3 | % | 4.6 | % | 4.9 | % | ||||||||

| 90+ days past due as a % of loan receivables |

2.0 | % | 2.0 | % | 2.0 | % | 2.2 | % | ||||||||

| Total active accounts (in thousands)(3) |

61,957 | 61,957 | 57,099 | 56,605 | ||||||||||||

| Other Information: |

||||||||||||||||

| Full time employees |

9,333 | 9,333 | 8,447 | 8,203 | ||||||||||||

| Interest and fees on loans |

$ | 11,295 | $ | 11,295 | $ | 10,300 | $ | 9,134 | ||||||||

| Other income |

488 | 488 | 473 | 498 | ||||||||||||

| Retailer share arrangements |

(2,362 | ) | (2,362 | ) | (1,975 | ) | (1,430 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Platform revenue(12) |

$ | 9,421 | $ | 9,421 | $ | 8,798 | $ | 8,202 | ||||||||

17

| (1) | The unaudited pro forma financial information for Financial Position Data (Average) and Selected Performance Metrics give effect to the Transactions as if they had occurred as of January 1, 2013 for amounts calculated using average financial position data. |

| (2) | Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. |

| (3) | Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. Open accounts represent credit card or installment loan accounts that are not closed, blocked or more than 60 days delinquent. |

| (4) | Net interest margin represents net interest income divided by average interest earning assets. |

| (5) | Allowance coverage ratio represents allowance for loan losses divided by total end-of-period loan receivables. |

| (6) | Return on assets represents net earnings as a percentage of average total assets. |

| (7) | Return on equity represents net earnings as a percentage of average total equity. |

| (8) | Equity to assets represents average equity as a percentage of average total assets. |

| (9) | Efficiency ratio represents (i) other expense, divided by (ii) net interest income, after retailer share arrangements, plus other income. |

| (10) | Represent Basel I capital ratios calculated for the Bank. |

| (11) | Represent Basel I capital ratios calculated for the Company on a pro forma basis. At December 31, 2013, pro forma for the Transactions, the Company had a fully phased-in Basel III Tier 1 common ratio of %. The Company’s pro forma capital ratios are non-GAAP measures. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital.” |

| (12) | Platform revenue is a non-GAAP measure. The table sets forth each component of our platform revenue for the periods presented. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Platform Analysis.” |

18

You should carefully consider the following risks before investing in our common stock. These risks could materially affect our business, results of operations or financial condition and cause the trading price of our common stock to decline. You could lose part or all of your investment.